EX-99.2

Published on November 15, 2023

| THIS DISCLOSURE STATEMENT (AS MAY BE AMENDED) WILL BE SUBMITTED FOR APPROVAL BUT HAS NOT YET BEEN APPROVED BY THE BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF TEXAS, HOUSTON DIVISION. THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THE INFORMATION IN THIS DISCLOSURE STATEMENT IS SUBJECT TO CHANGE. THIS DISCLOSURE STATEMENT IS NOT AN OFFER TO SELL ANY SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY ANY SECURITIES. |

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE SOUTHERN DISTRICT OF TEXAS

HOUSTON DIVISION

| § | ||||

| In re: | § | Chapter 11 | ||

| § | ||||

| CORE SCIENTIFIC, INC., et al., | § | Case No. 22-90341 (CML) | ||

| § | ||||

| § | (Jointly Administered) | |||

| Debtors.1 |

§ |

DISCLOSURE STATEMENT FOR THIRD AMENDED JOINT

CHAPTER 11 PLAN OF CORE SCIENTIFIC, INC. AND ITS AFFILIATED DEBTORS

| WEIL, GOTSHAL & MANGES LLP Alfredo R. Pérez (15776275) Clifford W. Carlson (24090024) 700 Louisiana Street, Suite 1700 Houston, Texas 77002 Telephone: (713) 546-5000 Facsimile: (713) 224-9511 |

WEIL, GOTSHAL & MANGES LLP Ray C. Schrock, (admitted pro hac vice) Ronit J. Berkovich (admitted pro hac vice) 767 Fifth Avenue New York, New York 10153 Telephone: (212) 310-8000 Facsimile: (212) 310-8007 |

|

| Attorneys for Debtors and Debtors in Possession |

||

| Dated: November 14, 2023 Houston, Texas |

||

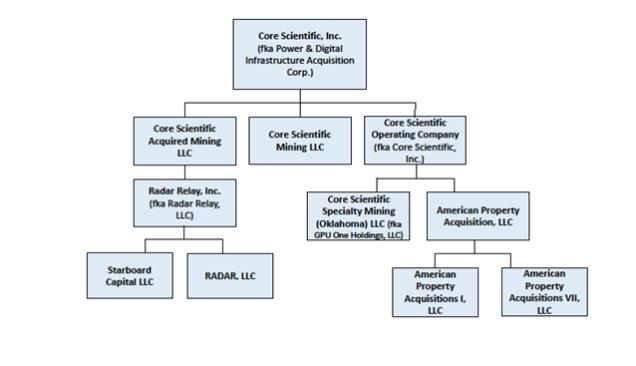

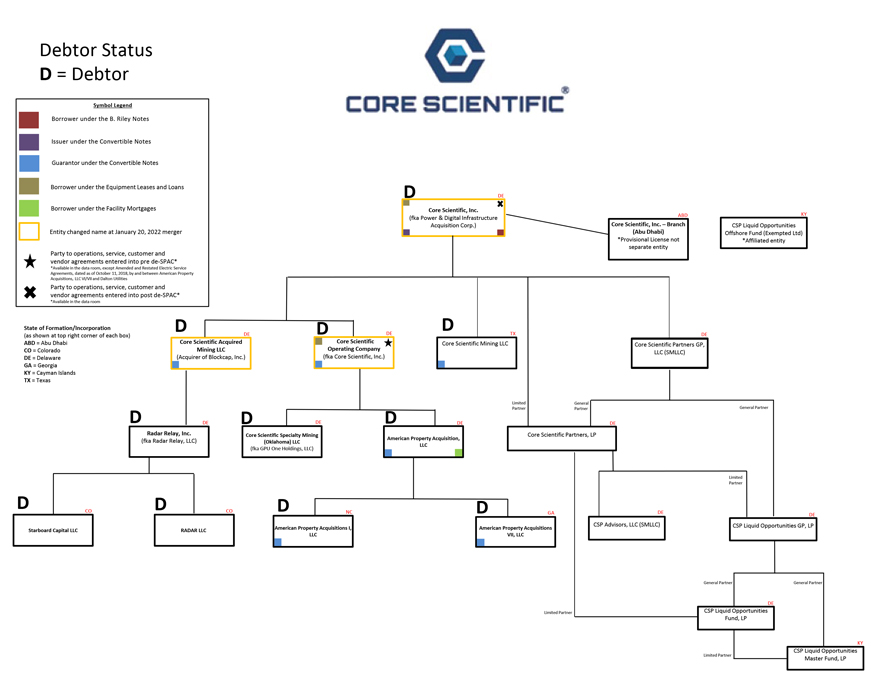

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of each Debtors federal tax identification number, are as follows: Core Scientific Mining LLC (6971); Core Scientific, Inc. (3837); Core Scientific Acquired Mining LLC (6074); Core Scientific Operating Company (5526); Radar Relay, Inc. (0496); Core Scientific Specialty Mining (Oklahoma) LLC (4327); American Property Acquisition, LLC (0825); Starboard Capital LLC (6677); RADAR LLC (5106); American Property Acquisitions I, LLC (9717); and American Property Acquisitions VII, LLC (3198). The Debtors corporate headquarters is 210 Barton Springs Road, Suite 300, Austin, Texas 78704. The Debtors service address is 2407 S. Congress Ave, Suite E-101, Austin, TX 78704. |

1

DISCLOSURE STATEMENT, DATED NOVEMBER 14, 2023

Solicitation of Votes on the Plan of

CORE SCIENTIFIC, INC., ET AL.

THIS SOLICITATION OF VOTES (THE SOLICITATION) IS BEING CONDUCTED TO OBTAIN SUFFICIENT VOTES TO ACCEPT THE THIRD AMENDED JOINT CHAPTER 11 PLAN OF CORE SCIENTIFIC, INC. AND ITS DEBTOR AFFILIATES IN THE ABOVE-CAPTIONED CHAPTER 11 CASES (COLLECTIVELY, THE DEBTORS), ATTACHED HERETO AS EXHIBIT A (THE PLAN).

THE VOTING DEADLINE TO ACCEPT OR REJECT THE PLAN IS 5:00 (PREVAILING CENTRAL TIME) ON DECEMBER 13, 2023 UNLESS EXTENDED BY THE DEBTORS IN WRITING, WITH THE CONSENT OF THE REQUISITE CONSENTING CREDITORS.

THE RECORD DATE FOR DETERMINING WHICH HOLDERS OF CLAIMS OR INTERESTS MAY VOTE ON THE PLAN IS NOVEMBER 9, 2023 (THE RECORD DATE).

|

RECOMMENDATION BY THE DEBTORS

The Special Committee (as defined below) has unanimously approved the transactions contemplated by the Plan. The Debtors believe the Plan is in the best interests of all stakeholders and recommend that all creditors and equity holders whose votes are being solicited submit ballots to accept the Plan.

The Ad Hoc Noteholder Group and the Equity Committee (each as defined below) support the Plan, and the members of such groups who are signatories to the RSA have agreed to vote in favor of the Plan, in each case, subject to the terms of the Restructuring Support Agreement (as defined below). The Settling Equipment Lenders (as defined below) also support the Plan and have agreed to vote in favor of the Plan. |

HOLDERS OF CLAIMS OR INTERESTS SHOULD NOT CONSTRUE THE CONTENTS OF THIS DISCLOSURE STATEMENT AS PROVIDING ANY LEGAL, BUSINESS, FINANCIAL, OR TAX ADVICE AND SHOULD CONSULT WITH THEIR OWN ADVISORS BEFORE CASTING A VOTE WITH RESPECT TO THE PLAN.

NEITHER THIS DISCLOSURE STATEMENT NOR THE MOTION SEEKING APPROVAL THEREOF CONSTITUTES AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY SECURITIES IN ANY STATE OR JURISDICTION IN WHICH SUCH OFFER OR SOLICITATION IS UNLAWFUL.

THE OFFER, ISSUANCE, AND DISTRIBUTION UNDER THE PLAN OF THE NEW COMMON INTERESTS AND THE NEW WARRANTS (AND THE NEW COMMON INTERESTS ISSUED UPON EXERCISE THEREOF, IF APPLICABLE), (I) TO, AS APPLICABLE, THE HOLDERS OF ALLOWED APRIL CONVERTIBLE NOTES SECURED CLAIMS, ALLOWED AUGUST CONVERTIBLE NOTES SECURED CLAIMS, ALLOWED GENERAL UNSECURED CLAIMS, ALLOWED SECTION 510(B) CLAIMS, AND EXISTING COMMON INTERESTS AND (II) IF APPLICABLE, CONSTITUTING THE BACKSTOP COMMITMENT PREMIUM WILL, IN EACH CASE, BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE SECURITIES ACT) AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE.

2

THE OFFER, SALE, ISSUANCE, AND DISTRIBUTION UNDER THE PLAN OF THE RIGHTS OFFERING SHARES TO BE ISSUED PURSUANT TO THE RIGHTS OFFERING, AND THE BACKSTOP PREMIUM, WILL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE.

THE OFFER, ISSUANCE, AND DISTRIBUTION UNDER THE PLAN OF THE NEW SECURED NOTES AND THE NEW SECURED CONVERTIBLE NOTES (AND THE NEW COMMON INTERESTS ISSUED UPON CONVERSION THEREOF, IF ANY), WILL, IN EACH CASE, BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE.

THE OFFER, ISSUANCE, AND DISTRIBUTION UNDER THE PLAN OF CONTINGENT PAYMENT OBLIGATIONS AND THE NEW COMMON INTERESTS ISSUED ON ACCOUNT THEREOF IF ANY, WILL, IN EACH CASE, BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 1145 OF THE BANKRUPTCY CODE.

THE OFFER, ISSUANCE, AND DISTRIBUTION OF THE BACKSTOP SHARES TO BE ISSUED UNDER THE PLAN IN CONNECTION WITH THE BACKSTOP COMMITMENTS WILL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND ANY OTHER APPLICABLE SECURITIES LAWS PURSUANT TO SECTION 4(A)(2) OF THE SECURITIES ACT AND REGULATION D THEREUNDER.

WITH RESPECT TO THE SECURITIES ISSUED PURSUANT TO THE EXEMPTION UNDER SECTION 1145 OF THE BANKRUPTCY CODE, SUCH SECURITIES MAY BE RESOLD WITHOUT REGISTRATION UNDER THE SECURITIES ACT OR OTHER FEDERAL SECURITIES LAWS PURSUANT TO THE EXEMPTION PROVIDED BY SECTION 4(A)(1) OF THE SECURITIES ACT, UNLESS THE HOLDER IS AN UNDERWRITER WITH RESPECT TO SUCH SECURITIES, AS THAT TERM IS DEFINED IN SECTION 1145(B) OF THE BANKRUPTCY CODE. IN ADDITION, SUCH SECURITIES GENERALLY MAY BE RESOLD WITHOUT REGISTRATION UNDER STATE SECURITIES LAWS PURSUANT TO VARIOUS EXEMPTIONS PROVIDED BY THE RESPECTIVE LAWS OF THE SEVERAL STATES.

WITH RESPECT TO ANY SECURITIES ISSUED IN RELIANCE ON THE EXEMPTION FROM REGISTRATION SET FORTH IN SECTION 4(A)(2) OF THE SECURITIES ACT AND REGULATION D THEREUNDER, SUCH SECURITIES WILL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT AND CONSIDERED RESTRICTED SECURITIES (WITHIN THE MEANING OF RULE 144 UNDER THE SECURITIES ACT) AND MAY NOT BE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR UNDER AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT.

THE AVAILABILITY OF THE EXEMPTION UNDER SECTION 1145 OF THE BANKRUPTCY CODE OR ANY OTHER APPLICABLE SECURITIES LAWS WILL NOT BE A CONDITION TO THE OCCURRENCE OF THE EFFECTIVE DATE.

THE SECURITIES ISSUED PURSUANT TO THE PLAN HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE SEC) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION (SUCH AS THAT REFERRED TO UNDER THE CAPTION FINANCIAL PROJECTIONS ELSEWHERE IN THIS DISCLOSURE STATEMENT), THE LIQUIDATION ANALYSIS (AS DEFINED HEREIN), THE VALUATION ANALYSIS (AS DEFINED HEREIN), AND OTHER FORWARD-LOOKING STATEMENTS,

3

ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS SHOULD BE EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHERMORE, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN, INCLUDING ANY PROJECTIONS, ARE SUBJECT TO A NUMBER OF ASSUMPTIONS, RISKS, AND UNCERTAINTIES, MANY OF WHICH ARE BEYOND THE CONTROL OF THE DEBTORS, INCLUDING THE IMPLEMENTATION OF THE PLAN. IMPORTANT ASSUMPTIONS AND OTHER IMPORTANT FACTORS THAT COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY INCLUDE, BUT ARE NOT LIMITED TO, THOSE FACTORS, RISKS AND UNCERTAINTIES DESCRIBED IN MORE DETAIL UNDER THE HEADING CERTAIN RISK FACTORS TO BE CONSIDERED BELOW, AS WELL AS CERTAIN RISKS INHERENT IN THE DEBTORS BUSINESS AND OTHER FACTORS LISTED IN THE DEBTORS SEC FILINGS. PARTIES ARE CAUTIONED THAT THE FORWARD-LOOKING STATEMENTS ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED, ARE BASED ON THE DEBTORS CURRENT BELIEFS, INTENTIONS AND EXPECTATIONS, AND ARE NOT GUARANTEES OF FUTURE PERFORMANCE. ACTUAL RESULTS OR DEVELOPMENTS MAY DIFFER MATERIALLY FROM THE EXPECTATIONS EXPRESSED OR IMPLIED IN THE FORWARD-LOOKING STATEMENTS, AND THE DEBTORS UNDERTAKE NO OBLIGATION TO UPDATE ANY SUCH STATEMENTS. THE DEBTORS AND REORGANIZED DEBTORS, AS APPLICABLE, DO NOT INTEND AND UNDERTAKE NO OBLIGATION TO UPDATE OR OTHERWISE REVISE ANY FORWARD-LOOKING STATEMENTS, INCLUDING ANY PROJECTIONS CONTAINED HEREIN, TO REFLECT EVENTS OR CIRCUMSTANCES EXISTING OR ARISING AFTER THE DATE HEREOF OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

NO INDEPENDENT AUDITOR OR ACCOUNTANT HAS REVIEWED OR APPROVED THE FINANCIAL PROJECTIONS OR THE LIQUIDATION ANALYSIS HEREIN.

THE DEBTORS HAVE NOT AUTHORIZED ANY PERSON TO GIVE ANY INFORMATION OR ADVICE, OR TO MAKE ANY REPRESENTATION, IN CONNECTION WITH THE PLAN OR THIS DISCLOSURE STATEMENT.

THE STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT ARE MADE AS OF THE DATE HEREOF UNLESS OTHERWISE SPECIFIED. THE TERMS OF THE PLAN GOVERN IN THE EVENT OF ANY INCONSISTENCY WITH THE SUMMARIES IN THIS DISCLOSURE STATEMENT.

THE INFORMATION IN THIS DISCLOSURE STATEMENT IS BEING PROVIDED SOLELY FOR PURPOSES OF VOTING TO ACCEPT OR REJECT THE PLAN OR OBJECTING TO CONFIRMATION. NOTHING IN THIS DISCLOSURE STATEMENT MAY BE USED BY ANY PARTY FOR ANY OTHER PURPOSE.

NOTHING IN THIS DISCLOSURE STATEMENT SHALL PREJUDICE OR WAIVE THE RIGHTS OF ANY PARTY WITH RESPECT TO THE CLASSIFICATION, TREATMENT, OR IMPAIRMENT OF ANY CLAIMS SHOULD THIS PLAN NOT BE CONFIRMED.

ALL EXHIBITS TO THIS DISCLOSURE STATEMENT ARE INCORPORATED INTO AND ARE A PART OF THIS DISCLOSURE STATEMENT AS IF SET FORTH IN FULL HEREIN.

THE PLAN PROVIDES THAT THE FOLLOWING PARTIES ARE DEEMED TO GRANT THE RELEASES PROVIDED FOR THEREIN: (A) THE DEBTORS; (B) THE REORGANIZED DEBTORS; (C) WITH RESPECT TO EACH OF THE FOREGOING PERSONS IN CLAUSES (A) THROUGH (B), ALL RELATED PARTIES; (D) THE HOLDERS OF ALL CLAIMS OR INTERESTS THAT VOTE TO ACCEPT THE PLAN; (E) THE HOLDERS OF ALL CLAIMS OR INTERESTS WHOSE VOTE TO ACCEPT OR REJECT THE PLAN IS SOLICITED BUT THAT DO NOT VOTE EITHER TO ACCEPT OR TO REJECT THE PLAN AND DO NOT OPT OUT OF GRANTING THE RELEASES SET FORTH IN ARTICLE X OF

4

THE PLAN; (F) THE HOLDERS OF ALL CLAIMS OR INTERESTS THAT VOTE, OR ARE DEEMED, TO REJECT THE PLAN OR THAT ARE PRESUMED TO ACCEPT THE PLAN BUT DO NOT OPT OUT OF GRANTING THE RELEASES SET FORTH IN ARTICLE X OF THE PLAN; (G) THE HOLDERS OF ALL CLAIMS AND INTERESTS AND ALL OTHER BENEFICIAL OWNERS THAT WERE GIVEN NOTICE OF THE OPPORTUNITY TO OPT OUT OF GRANTING THE RELEASES SET FORTH IN SECTION 10.6(b) OF THE PLAN BUT DID NOT OPT OUT.

HOLDERS OF CLAIMS OR INTERESTS IN VOTING CLASSES (APRIL CONVERTIBLE NOTES SECURED CLAIMS, AUGUST CONVERTIBLE NOTES SECURED CLAIMS, MINER EQUIPMENT LENDER SECURED CLAIMS, M&M LIEN SECURED CLAIMS, SECURED MORTGAGE CLAIMS, GENERAL UNSECURED CLAIMS, SECTION 510(B) CLAIMS, AND EXISTING COMMON INTERESTS) HAVE RECEIVED A BALLOT THAT INCLUDES THE OPTION TO OPT OUT OF THE RELEASES CONTAINED IN SECTION 10.6(b) OF THE PLAN. HOLDERS OF CLAIMS AND INTERESTS IN CERTAIN NON-VOTING CLASSES (OTHER SECURED CLAIMS AND PRIORITY NON-TAX CLAIMS) HAVE RECEIVED A NOTICE OF NON-VOTING STATUS THAT (I) NOTIFIES SUCH HOLDERS OF THEIR RIGHT TO OPT OUT OF THE RELEASES CONTAINED IN SECTION 10.6(b) OF THE PLAN AND (II) INCLUDES A FORM PURSUANT TO WHICH SUCH HOLDERS CAN OPT OUT OF THE RELEASES CONTAINED IN SECTION 10.6(b) OF THE PLAN. OTHER BENEFICIAL OWNERS HAVE ALSO RECEIVED A RELEASE OPT OUT FORM. SEE EXHIBIT B FOR A DESCRIPTION OF THE RELEASES AND RELATED PROVISIONS.

| PLEASE BE ADVISED THAT ARTICLE X OF THE PLAN CONTAINS RELEASE, EXCULPATION, AND INJUNCTION PROVISIONS. YOU SHOULD REVIEW AND CONSIDER THE PLAN CAREFULLY BECAUSE YOUR RIGHTS MAY BE AFFECTED

|

5

Table of Contents

| I. INTRODUCTION |

1 | |||||

| A. |

Background and Overview of the Plan and Restructuring | 1 | ||||

| i. Overview of Restructuring |

2 | |||||

| ii. Summary of Exit Capital |

3 | |||||

| iii. Summary of Plan Treatment |

5 | |||||

| iv. Other Plan Concepts and Provisions |

21 | |||||

| B. |

Debtors Recommendation | 22 | ||||

| C. |

Equity Committees Recommendation | 23 | ||||

| D. |

Creditors Committees Recommendation | 23 | ||||

| E. |

Debtors Response to Creditors Committee Statement and Recommendation | 24 | ||||

| F. |

Confirmation Timeline | 25 | ||||

| G. |

Inquiries | 26 | ||||

| II. SUMMARY OF PLAN CLASSIFICATION AND TREATMENT OF CLAIMS |

26 | |||||

| A. |

Voting Classes | 26 | ||||

| B. |

Treatment of Claims | 27 | ||||

| C. |

Post-Petition Capital Structure and Pro Forma Equity Chart | 36 | ||||

| III. THE DEBTORS BUSINESS |

38 | |||||

| A. |

General Overview | 38 | ||||

| B. |

Digital Asset Mining | 38 | ||||

| C. |

Debtors History | 38 | ||||

| D. |

Business Operations and Properties | 39 | ||||

| i. Business Model |

39 | |||||

| ii. Data Centers |

40 | |||||

| IV. DEBTORS CORPORATE AND CAPITAL STRUCTURE |

41 | |||||

| A. |

Corporate Structure | 41 | ||||

| B. |

Corporate Governance and Management | 42 | ||||

| C. |

Prepetition Capital Structure | 42 | ||||

| i. April Secured Convertible Notes: |

42 | |||||

| ii. August Convertible Notes: |

43 | |||||

| iii. Secured Mining Equipment Financings and Leases |

44 | |||||

| iv. Secured Non-Mining Financings and Leases |

45 | |||||

| v. M&M Liens |

47 | |||||

| vi. Unsecured Bridge Notes: |

48 | |||||

i

| vii. General Unsecured Claims: |

48 | |||||

| viii. Common Stock |

50 | |||||

| V. SIGNIFICANT EVENTS LEADING TO THE CHAPTER 11 FILINGS |

51 | |||||

| A. |

The Decline in the Price of Bitcoin and Increase in Bitcoin Network Difficulty | 51 | ||||

| B. |

Increased Energy Costs | 51 | ||||

| C. |

Celsiuss Chapter 11 Filing and PPT Dispute | 52 | ||||

| D. |

Prepetition Initiatives | 53 | ||||

| E. |

Appointment of New Independent Director and Formation of Special Committee to Consider Strategic Options and Engage with Creditors | 53 | ||||

| F. |

Retention of Restructuring Professionals and Prepetition Stakeholder Engagement | 53 | ||||

| VI. OVERVIEW OF CHAPTER 11 CASES |

54 | |||||

| A. |

Commencement of Chapter 11 Cases | 54 | ||||

| i. First/Second Day Relief |

54 | |||||

| ii. Other Procedural and Administrative Motions |

55 | |||||

| B. |

DIP Financing | 55 | ||||

| i. Original DIP Financing |

55 | |||||

| ii. Replacement DIP Financing |

56 | |||||

| C. |

Rejection of Celsius Hosting Contract | 57 | ||||

| D. |

Appointment of Creditors Committee | 57 | ||||

| E. |

Appointment of Equity Committee | 57 | ||||

| F. |

Debtors Key Employee Retention Program and Proposed Amendment to CFOs Employment Agreement | 58 | ||||

| G. |

Sale Process for Certain of the Debtors Facilities | 59 | ||||

| H. |

Sale of Bitmain Coupons | 59 | ||||

| I. |

Settlements/Agreements with Creditors | 60 | ||||

| i. NYDIG Stipulation and Agreed Order |

60 | |||||

| ii. Priority Power Management Settlement |

60 | |||||

| iii. Atalaya Settlement |

60 | |||||

| iv. Denton Agreement |

61 | |||||

| v. M&M Lien Settlements |

61 | |||||

| vi. Celsius Settlement |

64 | |||||

| vii. Celsiuss Proofs of Claim |

64 | |||||

| viii. Celsiuss Administrative Claim Motion |

64 | |||||

| ix. Foundry Settlement |

66 | |||||

| x. Miner Equipment Lender Settlement |

66 | |||||

| xi. Maddox Settlement |

67 | |||||

| xii. Bitmain Purchase Agreement |

67 | |||||

ii

| J. |

Claims | 68 | ||||

| i. Schedules of Assets and Liabilities and Statements of Financial Affairs |

68 | |||||

| ii. Claims Bar Dates |

68 | |||||

| iii. Claims Reconciliation Process |

68 | |||||

| K. |

Entry Into Cottonwood II Lease | 71 | ||||

| L. |

Exclusivity | 71 | ||||

| M. |

Internal Investigation | 72 | ||||

| N. |

Formulation of the Business Plan | 72 | ||||

| O. |

Postpetition Stakeholder Discussions and Plan Mediation | 73 | ||||

| P. |

Exit Capital Marketing Process | 75 | ||||

| i. Rights Offering and Backstop |

75 | |||||

| ii. The Exit Facility |

76 | |||||

| VII. TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES LAWS |

76 | |||||

| A. |

Section 1145 of the Bankruptcy Code Exemption and Subsequent Transfers | 77 | ||||

| B. |

Section 4(a)(2) and Regulation D of the Securities Act Exemption and Subsequent Transfers | 77 | ||||

| VIII. CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF PLAN |

79 | |||||

| A. |

Consequences to the Debtors | 80 | ||||

| i. Cancellation of Debt |

80 | |||||

| ii. Limitation of NOL Carryforwards and Other Tax Attributes |

81 | |||||

| iii. Potential Limitations on Interest Deductions |

82 | |||||

| B. |

Consequences to Holders of Certain Allowed Claims | 82 | ||||

| i. Taxable Exchange |

83 | |||||

| ii. Distributions in Discharge of Accrued Interest or OID |

84 | |||||

| iii. Character of Gain or Loss |

85 | |||||

| iv. Ownership and Disposition of New Debt |

85 | |||||

| v. Disposition of New Common Interests by U.S. Holders |

88 | |||||

| vi. Ownership and Disposition of Contingent Payment Obligations |

89 | |||||

| C. |

Consequences to Holders of Section 510(b) Claims | 90 | ||||

| D. |

Consequences to Holders of Existing Common Interests | 90 | ||||

| i. Tax Treatment of Exchange |

90 | |||||

| ii. Treatment of Right to Participate in Rights Offering |

91 | |||||

| iii. Ownership and Disposition of New Warrants |

91 | |||||

| IX. CERTAIN RISK FACTORS TO BE CONSIDERED |

92 | |||||

| A. |

Certain Bankruptcy Law Considerations | 93 | ||||

| i. Parties in Interest May Object to Plans Classification of Claims and Interests |

93 | |||||

iii

| ii. Risks Related to Possible Bankruptcy Court Determination that Federal Judgement Rate is not the Appropriate Rate of Postpetition Interest for Unsecured and Undersecured Claim |

93 | |||||

| iii. Distributions to Allowed Existing Common Interests and Allowed Section 510(b) Claims (if any) May Change |

93 | |||||

| iv. The Plan Provides Class 3 Multiple Options Regarding the Manner of their Distributions; A Particular Election by One Claimant Will Affect the Allocation of New Common Interests Received by Other Classes and the Overall Capital Structure of the Reorganized Debtors |

94 | |||||

| v. The Amount of Allowed Claims in Classes 8 and 11 Will Affect the Allocation of New Common Interests |

94 | |||||

| vi. Debtors May Require and May Not Obtain Additional Financing |

94 | |||||

| vii. Risks Related to Possible Objections to the Plan |

94 | |||||

| viii. Risk of Additional Rejection Damages Claims Being Filed |

94 | |||||

| ix. Risk of Non-Confirmation of the Plan |

94 | |||||

| x. Risk of Non-Consensual Confirmation |

95 | |||||

| xi. Conversion into Chapter 7 Cases |

95 | |||||

| xii. Risk of Non-Occurrence of the Effective Date |

95 | |||||

| xiii. DIP Facility |

95 | |||||

| xiv. Releases, Injunctions, and Exculpations Provisions May Not Be Approved |

95 | |||||

| B. |

Additional Factors Affecting the Value of Reorganized Debtors | 96 | ||||

| i. Projections and Other Forward-Looking Statements Are Not Assured, and Actual Results May Vary |

96 | |||||

| ii. Risks Associated with the Debtors Business and Industry |

96 | |||||

| iii. Post-Effective Date Indebtedness |

99 | |||||

| C. |

Risks Relating to the New Common Interests to be Issued Under the Plan | 99 | ||||

| i. Market for Equity of Reorganized Parent Debtor |

99 | |||||

| ii. Potential Dilution |

99 | |||||

| iii. New Common Interests Subordinated to Reorganized Debtors Indebtedness |

99 | |||||

| iv. Valuation of Debtors Not Intended to Represent Trading Value of New Common Interests of Debtors |

100 | |||||

| v. Changes to New Common Interests Affect Holders of New Secured Convertible Notes, New Warrants and Contingent Payment Obligations |

100 | |||||

| D. |

Risks Relating to the New Debt | 100 | ||||

| i. Insufficient Cash Flow to Meet Debt Obligations |

100 | |||||

| ii. Rating of New Debt |

100 | |||||

| iii. Defects in Guarantees and Collateral Securing the New Debt |

101 | |||||

| iv. Failure to Perfect Security Interests in New Debt Collateral |

101 | |||||

| v. There May Not be an Active Trading Market for the New Debt |

102 | |||||

iv

| vi. Risks Relating to M&M Lien Takeback Debt |

102 | |||||

| vii. Risk of Recharacterization of New Secured Notes and New Secured Convertible Notes |

102 | |||||

| Risks Related to the Rights Offering |

102 | |||||

| i. Debtors Could Modify the Rights Offering Procedures |

102 | |||||

| ii. The Backstop Commitment Letter Could Be Terminated or the Parties Thereto Could Fail to Live Up to Their Commitment |

102 | |||||

| iii. The Amount of New Common Interests Issued to Holders of Existing Common Interests On Account of Exercising Their Subscription Rights May Be Adjusted |

102 | |||||

| E. |

Risks Related to the Contingent Payment Obligations | 103 | ||||

| F. |

Risks Related to the Exit Facility | 103 | ||||

| G. |

Additional Factors | 103 | ||||

| i. Debtors Could Withdraw Plan |

103 | |||||

| ii. Debtors Have No Duty to Update |

103 | |||||

| iii. No Representations Outside the Disclosure Statement Are Authorized |

103 | |||||

| iv. No Legal or Tax Advice Is Provided by the Disclosure Statement |

103 | |||||

| v. No Admission Made |

103 | |||||

| vi. Certain Tax Consequences |

104 | |||||

| X. VOTING PROCEDURES AND REQUIREMENTS |

104 | |||||

| A. |

Voting Deadline | 104 | ||||

| B. |

Voting Procedures | 104 | ||||

| C. |

Parties Entitled to Vote | 105 | ||||

| i. Fiduciaries and Other Representatives |

106 | |||||

| ii. Agreements Upon Furnishing Ballots |

106 | |||||

| iii. Change of Vote |

106 | |||||

| D. |

Waivers of Defects, Irregularities, etc. | 106 | ||||

| E. |

Opt Out Form | 106 | ||||

| F. |

Further Information, Additional Copies | 107 | ||||

| XI. CONFIRMATION OF PLAN |

107 | |||||

| A. |

Confirmation Hearing | 107 | ||||

| B. |

Objections to Confirmation | 107 | ||||

| C. |

Requirements for Confirmation of Plan | 110 | ||||

| i. Acceptance of Plan |

110 | |||||

| ii. Best Interests Test |

111 | |||||

| iii. Feasibility |

111 | |||||

| XII. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF PLAN |

112 | |||||

| A. |

Alternative Plan of Reorganization | 112 | ||||

v

| B. |

Sale under Section 363 of the Bankruptcy Code | 112 | ||||

| C. |

Liquidation Under Chapter 7 of Bankruptcy Code | 112 | ||||

| XIII. CONCLUSION AND RECOMMENDATION |

112 | |||||

EXHIBITS

| EXHIBIT A | Plan (Filed Separately) | |

| EXHIBIT B | Plan Release, Exculpation, and Injunction Provisions | |

| EXHIBIT C | Liquidation Analysis | |

| EXHIBIT D | Valuation Analysis | |

| EXHIBIT E | Financial Projections | |

| EXHIBIT F | Organizational Chart | |

| EXHIBIT G | Schedule of Other Secured Claims | |

vi

I.

INTRODUCTION

| A. | Background and Overview of the Plan and Restructuring |

Core Scientific, Inc. and its direct and indirect subsidiaries that are debtors and debtors in possession in the above-captioned chapter 11 cases (collectively, the Debtors and, on or after the Effective Date, the Reorganized Debtors) submit this disclosure statement (as may be amended, supplemented, or modified from time to time, the Disclosure Statement) in connection with the solicitation of votes (the Solicitation) on the Third Amended Joint Chapter 11 Plan of Core Scientific, Inc. and its Affiliated Debtors, dated November 14, 2023 (including all exhibits, annexes, and schedules thereto, the Plan), attached hereto as Exhibit A.2 The Debtors commenced chapter 11 cases (the Chapter 11 Cases) in the United States Bankruptcy Court for the Southern District of Texas (the Bankruptcy Court) on December 21, 2022 (the Petition Date).

The purpose of this Disclosure Statement is to provide information of a kind, and in sufficient detail, to enable Holders of Claims and Existing Common Interests that are entitled to vote on the Plan to make an informed decision on whether to vote to accept or reject the Plan. This Disclosure Statement contains summaries of the Plan, certain statutory provisions, events in the Chapter 11 Cases, and certain documents related to the Plan. This Disclosure Statement and the Solicitation and Voting Procedures3 provide information on the process for voting on the Plan.

The Voting Classes (as defined below) include the following Claims: April Convertible Notes Secured Claims, August Convertible Notes Secured Claims, Miner Equipment Lender Secured Claims, M&M Lien Secured Claims, Secured Mortgage Claims, General Unsecured Claims, and Section 510(b) Claims. Holders of existing common stock issued by Core Scientific, Inc. (Existing Common Interests) are also entitled to vote.

During the Chapter 11 Cases, the Debtors and their restructuring advisors, including Weil, Gotshal & Manges LLP (Weil), PJT Partners, LP (PJT), and AlixPartners, LLP (Alix and, collectively with Weil and PJT, the Advisors), engaged in discussions with the Debtors five key stakeholder groups, including:

| i. | the ad hoc group of the Debtors Convertible Noteholders (the Ad Hoc Noteholder Group), |

| ii. | B. Riley Commercial Capital, LLC (the DIP Lender and, together with its affiliated entities, B. Riley), which is also the largest holder of General Unsecured Claims, |

| iii. | certain secured miner equipment lenders (the Settling Miner Equipment Lenders), |

| iv. | the official committee of unsecured creditors (the Creditors Committee), and |

| v. | the official committee of equity holders (the Equity Committee and, collectively with the Ad Hoc Noteholder Group, the DIP Lender, the Creditors Committee, and the Settling Miner Equipment Lenders, the Key Stakeholder Groups). |

| 2 | Capitalized terms used in this Disclosure Statement, but not defined herein, have the meanings ascribed to them in the Plan as applicable. To the extent any inconsistencies exist between this Disclosure Statement and the Plan, the Plan will govern. |

| 3 | The Solicitation and Voting Procedures are attached as Exhibit 2 to the Order (I) Scheduling Combined Hearing on (A) Adequacy of Disclosure Statement and (B) Confirmation of Plan; (II) Conditionally Approving Disclosure Statement and Form and Manner of Notice of Conditional Disclosure Statement Hearing; (III) Establishing Solicitation and Voting Procedures; (IV) Establishing Notice and Objection Procedures For Confirmation of Proposed Plan; (V) Approving Notice Procedures for Assumption or Rejection of Executory Contracts and Unexpired Leases; (VI) Approving Notice Procedures for Reinstatement of Claims; (VII) Establishing Rights Offering Procedures; And (VIII) Granting Related Relief (Docket No. []) (the Disclosure Statement Order). |

1

The Debtors goal was to design a Plan that ensures the continuation of the Debtors businesses as a going concern, preserves jobs, maximizes value, treats all stakeholders fairly, and enjoys widespread support. The Debtors believe that the Plan achieves such goal.

The Plan is the result of a mediation (the Mediation) before the Honorable Marvin Isgur, which commenced on July 17, 2023 pursuant to the Mediation Order.4 Following several months of good faith and hard-fought negotiations, on [November 14, 2023], the Debtors entered into that certain Restructuring Support Agreement (as amended, restated, amended and restated, supplemented or otherwise modified from time to time in accordance with the terms thereof, and including all exhibits, annexes, and schedules thereto, the Restructuring Support Agreement or RSA) with (i) the Convertible Noteholders that are members of the Ad Hoc Noteholder Group and comprise (a) 93% of the Holders of the April Convertible Notes Secured Claims and (b) 80% of the Holders of the August Convertible Notes Secured Claims (collectively, the foregoing (a) and (b), the Consenting Creditors) and (ii) the members of the Equity Committee, excluding Foundry Digital LLC (collectively, the RSA Parties).5 The settlements embodied in the RSA are a global settlement of issues between the Debtors and the RSA Parties (the RSA Settlement), (including, among other issues, the Enterprise Value of the Reorganized Debtors, the size of the Convertible Noteholders Allowed Claims and resolution of the dispute on the validity of the 2X Amounts, the treatment of the Convertible Notes Secured Claims, the treatment of Existing Common Interests, and the terms of exit capital to fund the Plan). The Restructuring Support Agreement sets forth the principal terms of the Debtors restructuring, which are incorporated into the Plan and described herein.

As of the date hereof, the Plan is supported by three of the five Key Stakeholder Groups: (i) the Ad Hoc Noteholder Group, (ii) the Equity Committee, and (iii) the Settling Miner Equipment Lenders. The Debtors have also reached final settlements or settlements in principle with several other key creditors, including the Holders of a majority of the M&M Lien Claims, the Holders of Secured Mortgage Claims, and Celsius (the Debtors largest litigation claimant), each as described further herein. The Plan currently does not have the support of B. Riley or the Creditors Committee, but the Debtors intend to continue negotiations with such parties and work towards reaching a global settlement. In any event, regardless of whether a global settlement is reached, the Debtors believe the optimal path towards emergence is to move forward with the Plan so that they may proceed to exit these Chapter 11 Cases and make distributions to stakeholders expeditiously. Therefore, to the extent any Class votes to reject the Plan (including Holders of General Unsecured Claims in Class 8), the Debtors will seek confirmation of the Plan over such rejection under the cramdown provisions of the Bankruptcy Code.

| i. | Overview of Restructuring |

The Plan, which incorporates the RSA Settlement and is premised on a $1.5 billion total enterprise value of the Reorganized Debtors (the Enterprise Value), provides for a comprehensive restructuring of the Debtors balance sheet and will strengthen the Debtors by substantially reducing their debt and preserving in excess of 240 jobs. The Debtors believe the Plan provides a full recovery (100% of the Claim plus postpetition interest) to all creditors (other than Holders of Section 510(b) Claims and creditors that have agreed to take lesser treatment) and a meaningful recovery to their shareholders.

Specifically, as described in greater detail below, the Plan provides, among other things:

| | 100% recoveries, including postpetition interest, to all Classes of creditors (other than Section 510(b) Claims and creditors that have agreed to accept lesser treatment) in the form of one or more of the following: (i) Cash, (ii) new common equity (New Common Interests) in Core Scientific, Inc. (on or after the Effective Date, the Reorganized Parent) and/or certain Contingent Payment Obligations (as defined below) relating thereto, (iii) take-back debt issued and/or guaranteed by one or more of the Reorganized Debtors, and/or (iv) reinstatement of Claims. |

| 4 | Agreed Mediation Order Appointing Judge Marvin Isgur as Mediator Regarding Debtors Chapter 11 Plan, entered on July 12, 2023 (Docket No. 1052) (the Mediation Order). |

| 5 | See Notice of Debtors Entry Into Restructuring Support Agreement With (I) the Ad Hoc Noteholder Group and (II) the Equity Committee, dated November [], 2023 (Docket No. []). |

2

| | Distributions to Holders of Existing Common Interests in the form of (i) New Common Interests from the Residual Equity Pool,6 (ii) New Warrants, and (iii) Subscription Rights in connection with the Rights Offering (each as defined below). |

| | Distributions to the Holders of Allowed Section 510(b) Claims (if any) in the form of (i) New Common Interests from the Residual Equity Pool, (ii) New Warrants, and (iii) in lieu of the right to participate in the Rights Offering, either Cash, New Common Interests, or some combination thereof, at the Companys option, in an amount equal to the value of the Subscription Rights. |

| | Certain of the Convertible Noteholders (the Exit Lenders) will provide the Reorganized Debtors with $40 million in new available capital through the $80 million Exit Facility (as defined below), as discussed in detail below. |

| | The Debtors will conduct a $55 million Rights Offering, of which $37.1 million is backstopped by the Backstop Parties. |

| | Numerous settlements with various parties in interest, including, but not limited to, (i) the RSA Settlement, (ii) the Miner Equipment Lender Settlement, (iii) the Brown Settlement, and (iv) the Holliwood Settlement, in addition to other settlements consummated outside of the Plan, including the Celsius Settlement and the M&M Lien Settlements. |

| | The assumption of the vast majority of Executory Contracts and Unexpired Leases of the Debtors. |

| | A reduction of current debt on the Debtors balance sheet by approximately $245 million and a reduction in the Debtors annual debt service by approximately $60 million, each depending upon the Settling Miner Equipment Lenders elections under the Plan (as described in section (I)(A)(iii) below). |

Upon the Effective Date, the Reorganized Debtors anticipate that they will continue to be a reporting company under the Exchange Act, 15 U.S.C. §§ 78(a)78(pp). The Reorganized Debtors will use commercially reasonable efforts to have the New Common Interests and New Warrants listed on the NASDAQ, NYSE, or another nationally recognized exchange, as soon as reasonably practicable, subject to meeting applicable listing requirements following the Effective Date. In connection with the contemplated listing of New Common Interests, the Debtors have submitted an initial listing application to Nasdaq Global Select Market.

| ii. | Summary of Exit Capital |

The Plan will be funded by the Debtors existing Cash, proceeds from the Rights Offering, and the Exit Facility.

| 6 | As described in greater detail below, the Residual Equity Pool refers to the New Common Interests, comprising all residual New Common Interests after any and all New Common Interests issued to, or reserved for, as applicable, (i) the Holders of Claims, (ii) the Holders of Existing Common Interests that participate in the Rights Offering and purchase Rights Offering Shares (as defined below), (iii) the Backstop Parties on account of the Backstop Commitment Premium (each as defined below), (iv) the Exit Lenders on account of the Exit Facility in the event of an ERO Shortfall (each as defined below), (v) Bitmain in connection with the Bitmain Transaction (as defined below), and (vi) the issuance and reservation as treasury stock New Common Interests in an amount sufficient to issue to Holders of Unvested RSUs and Stock Options assuming that all Unvested RSUs will vest and all Stock Options are exercised. |

3

| (a) | Exit Facility |

As further detailed in the Exit Facility Term Sheet, the Exit Lenders will provide the Company with an $80 million exit facility (the Exit Facility), comprised of (i) $40 million in new money delayed draw term loan commitments7, including up to $20 million available upon emergence and (ii) $40 million of Convertible Notes Claims held by the Exit Lenders. The Exit Facility will, among other things, (x) accrue interest at nine percent (9%) per annum Cash, with a one percent (1%) per annum Cash fee for amounts undrawn, (y) mature three (3) years following the Effective Date, and (z) be secured by (a) first-priority Liens on substantially all of the Reorganized Debtors assets, subject to exclusions to be agreed, including all bitcoin Miners acquired subsequent to the first $52.5 million of unencumbered bitcoin Miners purchased after the Effective Date, and (b) second-priority Liens on the first $52.5 million of unencumbered bitcoin Miners purchased after the Effective Date, Miners secured by the Miner Equipment Lender Agreements, real estate mortgages, and M&M Liens.

| (b) | Rights Offering |

As contemplated by the Plan and the RSA, the Debtors will conduct a $55 million equity rights offering (the Rights Offering), which will be implemented, pursuant to subscription procedures approved by the Bankruptcy Court (the Rights Offering Procedures).8 The Holders of Existing Common Interests will have the right to participate in the Rights Offering (Subscription Rights) and, in accordance with the Rights Offering Procedures, exercise such Subscription Rights to purchase New Common Interests (the Rights Offering Shares) at a price per share that represents a thirty percent (30%) discount to Plan Equity Value,9 as implied by the $1.5 billion Enterprise Value (the Per Share Price). The Debtors estimate that the Plan Equity Value will be approximately $795 million. Holders of Existing Common Interests are permitted to purchase Rights Offering Shares in excess of each Holders Subscription Rights at the same Per Share Price in the event that less than $55 million in Rights Offering Shares are timely, duly, and validly subscribed and paid for (such rights Oversubscription Rights).

Pursuant to a backstop commitment letter and related term sheet annexed thereto (together, the Backstop Commitment Letter), certain Holders of Existing Common Interests (the Backstop Parties) have committed to backstop $37.1 million of the Rights Offering (such commitment, the Backstop Commitment).

In exchange therefor, the Backstop Parties will receive a backstop premium equal to twenty percent (20%) of the Backstop Commitment, which will be paid in the form of New Common Interests on the Effective Date at the Per Share Price (the Backstop Commitment Premium). If the Backstop Commitment Letter is terminated under certain circumstances described therein, the Backstop Parties will receive a Cash payment equal to five percent (5%) of the Backstop Commitment in lieu of the Backstop Commitment Premium, unless such termination is the result of a breach by the Backstop Parties, among other exceptions. On November 3, 2023, the Debtors filed a motion seeking, among other things, the Bankruptcy Courts approval of its entry into the Backstop Commitment Letter.10 The form of Backstop Commitment Letter and related term sheet are attached as Exhibit A to the Backstop Motion. On November 14, 2023, the Debtors filed a supplement to the Backstop Motion (Docket No. 1415), reporting that the Debtors obtained $37.1 million in Backstop Commitments and describing certain modifications to the form of Backstop Commitment Letter and Rights Offering Procedures. Following a hearing held on November 14, 2023, the Bankruptcy Court entered an order approving the Backstop Motion.

| 7 | The $40 million will be immediately available to pay the Allowed DIP Claims in Cash in full subject to a three percent (3%) premium payable in Cash or added to the principal amount of the Exit Facility, non-refundable payment in the form of New Common Interests in an amount equal to the lesser of the quotient of (a) the ERO Shortfall (if any) multiplied by 1.2 (Line 1) and (b) Line 1 divided by 0.7 and two-percent (2%) of Plan Equity Value |

| 8 | The Rights Offering Procedures are attached as Exhibit 15 to the Disclosure Statement Order |

| 9 | The term Plan Equity Value means and shall be calculated as (a) the $1.5 billion Plan Enterprise Value minus (b) the sum of the debt incurred pursuant to (i) the Exit Facility (amount drawn as of the Effective Date), (ii) the New Secured Notes, (iii) the New Secured Convertible Notes, (iv) Miner Equipment Lender Takeback Debt (Default), (v) Miner Equipment Lender Takeback Debt (Election 2), (vi) Reinstated Other Secured Claims Agreements, (vii) M&M Lien Takeback Debt, (viii) the M&M Lien Settlements, and (ix) the Mortgage Takeback Debt. |

| 10 | See Emergency Motion of Debtors for Order (I) Authorizing Entry Into Backstop Commitment Letter, (II) Approving Performance Obligations Thereunder, and (III) Granting Related Relief, dated November 3, 2023 (Docket No. 1383) (the Backstop Motion). |

4

| iii. | Summary of Plan Treatment |

The following summary is qualified in its entirety by reference to the full text of the Plan.

YOU SHOULD READ THE PLAN IN ITS ENTIRETY BEFORE VOTING TO ACCEPT OR REJECT THE PLAN.

The proposed restructuring embodied in the Plan contemplates, among other things, the following treatment of Holders of Claims and Interests:

DIP Claims

The Allowed DIP Claims will be (i) paid in cash in full on the Effective Date or (ii) receive such other treatment as to which the Debtors and the Holder of such Allowed DIP Claims will have agreed upon in writing, with the consent of the Requisite Consenting Creditors. The Debtors expect the Allowed DIP Claims to total approximately $20 million, accounting for principal plus fees and interest and assuming a projected Effective Date of December 31, 2023.

Administrative Expense Claims

The Plan provides that each holder of an Allowed Administrative Expense Claim (other than Professional Fee Claim or Restructuring Fees and Expenses) will receive Cash in full on, or as soon as reasonably practicable thereafter, the later of (i) the Effective Date and (ii) the first Business Day after the date that is thirty (30) days after the date such Administrative Expense Claim becomes an Allowed Administrative Expense Claim or such other treatment consistent with section 1129(a)(9) of the Bankruptcy Court; provided, that Allowed Administrative Expense Claims representing liabilities incurred in the ordinary course of business will be paid by the Debtors or Reorganized Debtors, as applicable, in the ordinary course of business, consistent with past practice and in accordance with the terms and subject to the conditions of any orders, course of dealing or agreements governing, instruments evidencing, or other documents relating to such transactions.

Priority Tax Claims

The Plan provides that each holder of an Allowed Priority Tax Claim will receive, at the sole option of the Debtors or Reorganized Debtors, as applicable, (i) Cash in full on, or as soon as reasonably practicable thereafter, the later of (a) the Effective Date, (b) the first Business Day after the date that is thirty (30) days after the date such Priority Tax Claim becomes an Allowed Priority Tax Claim, and (c) the date such Allowed Priority Tax Claim is due and payable in the ordinary course, or (ii) such other treatment reasonably acceptable to the Debtors or Reorganized Debtors (as applicable with the consent of the Requisite Consenting Creditors) and consistent with the provisions of section 1129(a)(9) of the Bankruptcy Code.

Convertible Notes Secured Claims (Classes 1 and 2)

Claims arising under or related to the April NPA (the April Convertible Notes Secured Claims) (Class 1) and Claims arising under or related to the August NPA (the August Convertible Notes Secured Claims) (Class 2) have been separately classified under the Plan.

5

| 1. | April Convertible Notes Secured Claims (Class 1) |

Allowance

Pursuant to the RSA Settlement, Bankruptcy Rule 9019 and section 1123 of the Bankruptcy Code, the RSA Parties have agreed to settle the Allowed amount of the April Convertible Notes Secured Claims (including postpetition interest and the accreted portion of the April 2X Amounts) in an amount equal to the sum of:

| (i) | $350 million; |

| (ii) | if the Effective Date occurs after January 15, 2024,11 any accrued interest at the rate provided under the April NPA from January 15, 2024 through the Effective Date; |

| (iii) | the aggregate Pro Rata Total Convertible Notes Share12 on account of the April Convertible Notes Secured Claims of any ERO Shortfall Equity Distribution Amount (as defined below); and |

| (iv) | the aggregate Pro Rata Total Convertible Notes Share on account of the April Convertible Notes Secured Claims of any Incremental Convertible Noteholders Equity Distribution Amount. |

Treatment

Except to the extent that a Holder of an April Convertible Notes Secured Claim agrees to a less favorable treatment of such Claim, each Holder of an April Convertible Notes Secured Claim will receive, on the Effective Date or as soon as reasonably practicable thereafter, such Holders:

| (i) | Pro Rata Share of $150 million in New Secured Notes; |

| (ii) | Pro Rata Reduced Convertible Notes Share13 of |

| a. | $260 million in New Secured Convertible Notes; |

| b. | New Common Interests with an aggregate value, based on Plan Value, equal to $300 million (the Convertible Noteholders Equity Distribution);14 and |

| (iii) | Pro Rata Total Convertible Notes Equity Distribution15 of up to $130 million in Contingent Payment Obligations, payable by the Reorganized Parent; |

| 11 | The RSA Parties have agreed to use reasonable efforts to emerge from chapter 11 on or before January 15, 2024. |

| 12 | As set forth in the Plan, the term Pro Rata Total Convertible Notes Share means the proportion that a Holder of an Allowed Convertible Notes Claim bears to the aggregate amount of Allowed Claims in Class 1 and Class 2. |

| 13 | As set forth in the Plan, the term Pro Rata Reduced Convertible Notes Share means the proportion that a Holder of an Allowed Convertible Notes Claim bears to the aggregate amount of Allowed Claims in Class 1 and Class 2, after (i) reducing such Holders Claim amount, for purposes of the calculation, by the principal amount of New Secured Notes allocated to such Holder and (ii) reducing the aggregate amount of Allowed Claims in Class 1 and Class 2 by the aggregate principal amount of New Secured Notes to be issued under the Plan. |

| 14 | The actual amount of New Common Interests provided to Holders of Allowed Convertible Notes Claims on account of the Convertible Noteholders Equity Distribution will be $260 million, not $300 million, as $40 million of such amount will be deemed to have been exchanged by certain Holders for a portion of the Exit Facility, as set forth in the Plan. |

| 15 | As set forth in the Plan, Pro Rata Convertible Notes Equity Distribution means the proportion of New Common Interests that a Holder of an Allowed Convertible Notes Claim will receive on account of the Convertible Noteholders Equity Distribution in relation to the New Common Interests that all Holders of Allowed Convertible Notes Claims will receive on account of the Convertible Noteholders Equity Distribution, in each case, after the taking into account the reduction of the Exit Lenders distribution of New Common Interests pursuant to the Convertible Noteholders Equity Distribution on account of the Designated Amount that will become obligations under the Exit Facility pursuant to sections 4.1 and 4.2 of the Plan. |

6

| (iv) | Pro Rata Total Convertible Notes Share of: |

| a. | the ERO Shortfall Equity Distribution (if any); and |

| b. | the Incremental Convertible Noteholders Equity Distribution (if any). |

To the extent that a Holder of Allowed April Convertible Notes Secured Claims is an Exit Lender, such Holder shall have its distribution of New Common Interests pursuant to the Convertible Noteholders Equity Distribution, reduced in the amount of its respective share of the Designated Amount,16 on a dollar-for-dollar basis, for first-lien delayed draw term loans under the Exit Facility.

SUMMARY DESCRIPTIONS AND ILLUSTRATIVE EXAMPLES (IF APPLICABLE) OF EACH OF THE FOREGOING FORMS OF PLAN CONSIDERATION ARE SET FORTH BELOW.

| 2. | August Convertible Notes Secured Claims (Class 2) |

Allowance

Pursuant to the RSA Settlement, Bankruptcy Rule 9019 and section 1123 of the Bankruptcy Code, the RSA Parties have agreed to settle the allowed amount of the August Convertible Notes Claims (including postpetition interest and the accreted portion of the August 2X Amounts) in an amount equal to the sum of:

| (i) | $360 million; |

| (ii) | if the Effective Date occurs after January 15, 2024,17 any accrued interest at the rate provided under the August NPA from January 15, 2024 through the Effective Date; |

| (iii) | the aggregate Pro Rata Total Convertible Notes Share on account of the August Convertible Notes of any ERO Shortfall Equity Distribution Amount; and |

| (iv) | the aggregate Pro Rata Total Convertible Notes Share on account of the August Convertible Notes of any Incremental Convertible Noteholders Equity Distribution Amount. |

Treatment

Except to the extent that a Holder of an August Convertible Notes Secured Claim agrees to a less favorable treatment of such Claim, each Holder of an August Convertible Notes Secured Claim will receive, on the Effective Date or as soon as reasonably practicable thereafter:

| (i) | such Holders Pro Rata Reduced Convertible Notes Share of |

| a. | $260 million in the New Secured Convertible Notes; |

| 16 | As set forth in the Plan, the term Designated Amount means $40 million, which reflects the amount of Convertible Notes become obligations under the Exit Facility. |

| 17 | The RSA Parties have agreed to use reasonable efforts to emerge from chapter 11 on or before January 15, 2024. |

7

| b. | the Convertible Noteholders Equity Distribution; and |

| (ii) | Pro Rata Total Convertible Notes Equity Distribution of up to $130 million in Contingent Payment Obligations, payable by the Reorganized Parent; |

| (iii) | Pro Rata Total Convertible Notes Share of: |

| a. | the ERO Shortfall Equity Distribution (if any); and |

| b. | the Incremental Convertible Noteholders Equity Distribution (if any) |

To the extent that a Holder of Allowed August Convertible Notes Secured Claims is an Exit Lender, such Holder shall have its distribution of New Common Interests pursuant to the Convertible Noteholders Equity Distribution reduced in the amount of its respective share of the Designated Amount,19 on a dollar-for-dollar basis, for first-lien delayed draw term loans under the Exit Facility:

SUMMARY DESCRIPTIONS AND ILLUSTRATIVE EXAMPLES (IF APPLICABLE) OF EACH OF THE FOREGOING FORMS OF PLAN CONSIDERATION ARE SET FORTH BELOW.

Description of Plan Consideration for Class 1 and Class 2

New Secured Notes (Class 1 Only)

As further detailed in the New Secured Notes Term Sheet attached to the Plan as Exhibit B, the Reorganized Parent will issue freely-tradeable new secured notes in the principal amount of $150 million, which will, among other things, (i) accrue interest at twelve and one-half percent (12.5%) Cash, (ii) mature four (4) years after the Effective Date, and (iii) be secured by Liens on substantially all of the Reorganized Debtors assets that are only junior to the Liens securing the Exit Facility (the New Secured Notes).

New Secured Convertible Notes (Class 1 and Class 2)

As further detailed in the New Secured Convertible Notes Term Sheet attached to the Plan as Exhibit C, the Reorganized Parent will issue freely-tradeable new secured convertible notes in the principal amount of $260 million, which will, among other things, (i) accrue interest, in the Reorganized Parents election, at either (a) six percent (6.0%) per annum in Cash and (b) six percent (6.0%) per annum in payment-in-kind New Common Interests (PIK) or (b) ten percent (10%) per annum in Cash, (ii) mature five (5) years after the Effective Date, (iii) be secured by Liens on substantially all of the Reorganized Debtors assets and property that are junior only to the Liens securing the New Secured Notes and Exit Facility, (iv) permit conversion to New Common Interests (or a combination of Cash and New Common Interests, at the Reorganized Parents election) at the election of the Holders at any time prior to maturity at the then applicable Conversion Price (as defined in the New Secured Convertible Notes Term Sheet) and (v) require conversion to New Common Interests if the Reorganized Debtors Enterprise Value equals or exceeds $2.1 billion (the New Secured Convertible Notes).

Contingent Payment Obligations (Class 1 and Class 2)

As further detailed in the Contingent Payment Obligations Term Sheet attached to the Plan as Exhibit D, Reorganized Parents issuance of certain freely assignable and publicly tradeable contingent payment obligations in the aggregate amount of up to $130 million (the Contingent Payment Obligations), which may become payable at the end of each year during the three-year period following the Effective Date, depending on the fair market value of the Convertible Noteholders Equity Distribution, in accordance with the following:

| 18 | Amount subject to status as an Exit Lender as described below. |

| 19 | As set forth in the Plan, the term Designated Amount means $40 million, which reflects the amount of Convertible Notes become obligations under the Exit Facility. |

8

| | Year 1: Beginning on the Effective Date through the first anniversary thereof (such anniversary, the First Testing Date and, such period, the First Testing Period), Reorganized Parent will pay the applicable payee its pro rata share of Cash (the Year 1 Contingent Payment Obligation) equal to the lesser of (i) $43.33 million and (ii) the difference between (a) $260 million and (b) the fair market value of the Convertible Noteholders Equity Distribution (the First Anniversary Payment Amount); provided, that, the Year 1 Contingent Payment Obligation will be extinguished if the fair market value of the Convertible Noteholders Equity Distribution is equal to or in excess of $260 million with respect to the First Testing Date. With respect to the First Testing Period, the fair market value of the Convertible Noteholders Equity Distribution is calculated by the product of (i) the volume weighted average closing price (the VWAP) in the consecutive sixty (60) calendar day period immediately prior to the First Testing Date multiplied by (ii) the number of New Common Interests that comprise the Convertible Noteholders Equity Distribution. The below table describes four illustrative scenarios. |

| Select Year 1 Contingent Payment Obligation Illustrations | ||||

| Scenario 1 | Assumption(s): | $240 million fair market value of Convertible Noteholders Equity Distribution on First Testing Date

|

||

| Calculation: | Lesser of (i) $43.33 million and (ii) $260 million minus $240 million

|

|||

| Result: | $20 million First Anniversary Payment Amount, payable in Cash |

|||

| Scenario 2 | Assumption(s): | $160 million fair market value of Convertible Noteholders Equity Distribution on First Testing Date

|

||

| Calculation: | Lesser of (i) $43.33 million and (ii) $260 million minus $160 million

|

|||

| Result: | $43.33 million First Anniversary Payment Amount payable in Cash

|

|||

| Scenario 3 | Assumption(s): | $260 million or greater fair market value of Convertible Noteholders Equity Distribution on First Testing Date |

||

| Calculation: | Lesser of (i) $43.33 million and (ii) $260 million minus $260 million

|

|||

| Result: | No payment on account First Testing Period.

|

|||

| | Year 2: Beginning on the First Testing Date through the second anniversary of the Effective Date (such anniversary, the Second Testing Date and, such period, the Second Testing Period), Reorganized Parent will pay the applicable payee its pro rata share of Cash or New Common Interests, in the Reorganized Parents sole discretion (the Year 2 Contingent Payment Obligation), equal to the lesser of (i) $43.33 million and (ii) the difference between (a) $260 million minus the First Anniversary Payment Amount, if any, and (b) the fair market value of the Convertible Noteholders Equity Distribution (the Second Anniversary Payment Amount); provided that the Year 2 Contingent Payment Obligation will be extinguished if the fair market value of the Convertible Noteholders Equity Distribution is equal to or in excess of $260 million minus the First Anniversary Payment Amount, if any, with respect to the Second Testing Date. With respect to the Second Testing Period, the fair market value of the Convertible Noteholders Equity Distribution is calculated by the product of (i) the VWAP in the consecutive sixty (60) calendar day period immediately prior to the Second Testing Date multiplied by (ii) the number of New Common Interests that comprise the Convertible Noteholders Equity Distribution. The below table describes three illustrative scenarios. |

9

| Select Year 2 Contingent Payment Obligation Illustrations | ||||

| Scenario 1 | Assumption(s): | $200 million fair market value of Convertible Noteholders Equity Distribution on Second Testing Date

$20 million First Anniversary Payment Amount |

||

| Calculation: |

Lesser of: (i) $43.33 million; and

(ii) ($260 million $20 million) $200 million |

|||

| Result: |

$40 million Second Anniversary Payment Amount, payable in Cash or New Common Interests at Companys election

|

|||

| Scenario 2 | Assumption(s): | $200 million fair market value of Convertible Noteholders Equity Distribution on Second Testing Date

No payment on account of First Testing Period |

||

| Calculation: |

Lesser of: (i) $43.33 million; and

(ii) ($260 million $0) $200 million |

|||

| Result: |

$43.33 million Second Anniversary Payment Amount, payable in Cash or New Common Interests at Companys election |

|||

| Scenario 3 | Assumption(s): | $250 million fair market value of Convertible Noteholders Equity Distribution on Second Testing Date

$10 million First Anniversary Payment Amount |

||

| Calculation: |

Lesser of: (i) $43.33 million; and

(ii) ($260 million $10 million) $250 million |

|||

| Result: | No payment on account of Second Testing Period |

|||

| | Year 3: Beginning on the Second Testing Date through the third anniversary of the Effective Date (such anniversary, the Third Testing Date and, such period, the Third Testing Period), the Reorganized Parent will pay the applicable payee its pro rata share of Cash or New Common Interests, in the Reorganized Parents sole discretion (the Year 3 Contingent Payment Obligation), equal to the lesser of (i) $43.33 million and (ii) the difference between (a) $260 million minus the sum of (y) the First Anniversary Payment Amount, if any, and (z) the Second Anniversary Payment Amount, if any, and (b) the fair market value of the Convertible Noteholders Equity Distribution (the Third Anniversary Payment Amount); provided that the Year 3 Contingent Payment Obligation will be extinguished if the fair market value of the Convertible Noteholders Equity Distribution is equal to or in excess of $260 million minus the (1) First Anniversary Payment Amount, if any, and (2) the Second Anniversary Payment Amount, if any, with respect to the Third Testing Date. With respect to the Third Testing Period, the fair market value of the Convertible Noteholders Equity Distribution is calculated by the product of (i) the VWAP in the consecutive sixty (60) calendar day period immediately prior to the Third Testing Date multiplied by (ii) the number of New Common Interests that comprise the Convertible Noteholders Equity Distribution. The below table describes three illustrative scenarios. |

| Select Year 3 Contingent Payment Obligation Illustrations | ||||

| Scenario 1 | Assumption(s): | $180 million fair market value of Convertible Noteholders Equity Distribution on Third Testing Date

$35 million First Anniversary Payment Amount

$25 million Second Anniversary Payment Amount |

||

10

| Select Year 3 Contingent Payment Obligation Illustrations | ||||

| Calculation: | Lesser of: (i) $43.33 million; and

(ii) (($260 million ($35 million + $25 million)) $180 million |

|||

| Result: |

$20 million Third Anniversary Payment Amount, payable in Cash or New Common Interests at Companys election |

|||

| Scenario 2 | Assumption(s): |

$160 million fair market value of Convertible Noteholders Equity Distribution on Third Testing Date

$20 million First Anniversary Payment Amount

$10 million Second Anniversary Payment Amount |

||

| Calculation: | Lesser of: (i) $43.33 million; and

(ii) (($260 million ($20 million + $10 million)) $160 million |

|||

| Result: |

$43.33 million Third Anniversary Payment Amount, payable in Cash or New Common Interests at Companys election |

|||

| Scenario 3 | Assumption(s): |

$200 million fair market value of Convertible Noteholders Equity Distribution on Third Testing Date

No payment on account of First Testing Period

$30 million Second Anniversary Payment Amount |

||

| Calculation: | Lesser of: (i) $43.33 million; and

(ii) (($260 million ($0 + $30 million)) $200 million |

|||

| Result: |

$30 million Third Anniversary Payment Amount, payable in Cash or New Common Interests at Companys election |

|||

| Scenario 4 | Assumption(s): |

$220 million fair market value of Convertible Noteholders Equity Distribution on Third Testing Date

$10 million First Anniversary Payment Amount

$30 million Second Anniversary Payment Amount |

||

| Calculation: |

Lesser of: (i) $43.33 million; and

(ii) (($260 million ($10 million + $30 million)) $220 million |

|||

| Result: |

No payment on account of Third Testing Period |

|||

ERO Shortfall Equity Distribution (Class 1 and Class 2)

To the extent the Rights Offering does not yield proceeds of $55 million, there will be shortfall, calculated as the dollar amount equal to the difference of $55 million minus the total amount of proceeds raised in the Rights Offering (the ERO Shortfall). In accordance with the Plan, including the RSA Settlement, any ERO Shortfall will trigger a sliding scale mechanism (the ERO Shortfall Mechanism) whereby New Common Interests with a value of up to approximately five and four/tenths percent (5.4%) will be distributed to the Exit Lenders (i.e. the first 2% of the New Common Interests) and the Holders of Allowed Convertible Notes Claims (only to the extent the ERO Shortfall mechanism results in more than two percent (2%) of New Common Interests being reallocated) (such distribution to Holders of Allowed Convertible Notes Claims, an ERO Shortfall Equity Distribution). Any ERO Shortfall Equity Distribution Amount will be paid in New Common Interests to the Convertible Noteholders. Specifically, the ERO Shortfall Equity Distribution will (i) increase the Allowed Settled April Convertible Notes Secured Claims Amount and Allowed Settled August Convertible Notes Secured Claims Amount and (ii) increase such Holders recoveries in New Common Interests by providing them with a larger quantity of the aggregate distributable New Common Interests. The New Common Interests being distributed to Holders of Allowed Convertibles Notes Claims in connection with the Incremental Convertible Noteholders Equity Distribution are New Common Interests that would have otherwise been distributed to Holders of Existing Common Interests and Allowed Section 510(b) Claims.

11

The amount of the ERO Shortfall Equity Distribution to be distributed to the Holders of Allowed Convertible Notes Claims will equal the dollar amount arising from the following formula (the ERO Shortfall Equity Distribution Amount):

(a) the ERO Shortfall multiplied by 1.2 (Line 1);

(b) Line 1 divided by 0.7 (Line 2); and

(c) Line 2 minus the number that is two percent (2%) of the Plan Equity Value.

provided, that if such dollar amount is less than $0, then the ERO Shortfall Equity Distribution Amount shall be $0.

The below table describes four illustrative scenarios.

| Select ERO Shortfall Illustrations | ||||

| Scenario 1 | Assumption(s): | $30 million in proceeds from Rights Offering

$795 million Plan Equity Value

|

||

| ERO Shortfall: | $55 million $30 million = $25 million

|

|||

| ERO Shortfall Equity Distribution Amount: | Line 1: $25 million × 1.2 = $30 million

Line 2: $30 million ÷ 0.7 = $42,857,142.90

Line 3: $42,857,142.90 ($795 million × 0.02) = $26,957,142.90

|

|||

| Result: | $15,900,000 (2% of the New Common Interests) to Exit Lenders

$26,957,142.90 (3.5 % of the New Common Interests) to Convertible Noteholders:

$13,288,732.42 to Holders of April Convertible Notes Secured Claims

$13,668,410.48 to Holders of August Convertible Notes Secured Claims |

|||

| Scenario 2 | Assumption(s): | $40 million in proceeds from Rights Offering

$795 million Plan Equity Value

|

||

| ERO Shortfall: | $55 million $40 million = $15 million

|

|||

| ERO Shortfall Equity Distribution Amount: | Line 1: $15 million × 1.2 = $18 million

Line 2: $18 million ÷ 0.7 = $25,714,285.70

Line 3: $25,714,285.70 ($795 million × 0.02) = $9,814,285.71

|

|||

| Result: | $15,900,000 (2% of the New Common Shares) to Exit Lenders

$9,814,285.71 (1.2% of the New Common Shares) to Convertible Noteholders:

$4,838,028.17 to Holders of April Convertible Notes Secured Claims

$4,976,257.54 to Holders of August Convertible Notes Secured Claims

|

|||

| Scenario 3 | Assumption(s): | $55 million in proceeds from Rights Offering

$795 Plan Equity Value |

||

12

| Select ERO Shortfall Illustrations | ||||

| ERO Shortfall: | $55 million $55 million = $0 |

|||

| ERO Shortfall Equity Distribution Amount: | None |

|||

| Result: | No ERO Shortfall Equity Distribution |

|||

| Scenario 4 | Assumption(s): | $50 million in proceeds from Rights Offering

$795 Plan Equity Value |

||

| ERO Shortfall:

|

$55 million $50 million = $5

|

|||

| ERO Shortfall Equity Distribution Amount: | Line 1: $5 million × 1.2 = $6 million

Line 2: $6 million ÷ 0.7 = $8,571,428.57

Line 3: $8,571,428.57 ($795 million × 0.02) < 0 |

|||

| Result: | $8,571,428.57 to Exit Lenders

$0 to Convertible Noteholders: |

|||

Incremental Convertible Noteholders Equity Distribution (Class 1 and Class 2)

In accordance with the Plan and RSA Settlement, there are two circumstances where increased professional fees paid by the Reorganized Debtors on account of representatives of Holders of Existing Common Interests will (i) increase the Allowed Settled April Convertible Notes Secured Claims Amount and Allowed Settled August Convertible Notes Secured Claims Amount and (ii) thus result in the Holders of Allowed Convertible Notes Secured Claims receiving additional New Common Interests. The first is if the final Allowed amount of professional fees of the Equity Committee (the Final Equity Committee Fees Amount) exceeds $6.75 million. The second is on account of any Allowed Claim of the ad hoc group of equity security holders (Ad Hoc Equity Group) for the reasonable and documented fees and expenses of Skadden, Arps, Slate, Meagher & Flom LLP, in its capacity as counsel to the Ad Hoc Equity Group, pursuant to section 503(b)(3)(D) of the Bankruptcy Code in an amount not to exceed $1.5 million (the Ad Hoc Equity Group Substantial Contribution Claim).

Specifically, the Convertible Noteholders will receive New Common Interests with an aggregate value, based on Plan Value, equal to the sum of (the Incremental Convertible Noteholders Equity Distribution): (i) the Final Equity Committee Fees Amount in excess of $6.75 million and (ii) the Ad Hoc Equity Group Substantial Contribution Claim that is Allowed (together, the Incremental Convertible Noteholders Equity Distribution Amount). The New Common Interests being distributed to Holders of Allowed Convertibles Notes Claims in connection with the Incremental Convertible Noteholders Equity Distribution are New Common Interests that would have otherwise been distributed to Holders of Existing Common Interests and Allowed Section 510(b) Claims.

| Select Incremental Convertible Noteholders Equity Distribution Illustrations

|

||||

| Scenario 1 | Assumption(s): | Final Approval of Equity Committee Fees Amount of $8.75 million

$1.5 million Allowed Ad Hoc Equity Group Substantial Contribution Claim

|

||

| Calculation:

|

($8.75 million $6.75 million) + $1.5 million = $3.5 million

|

|||

| Result: | Incremental Convertible Noteholders Equity Distribution Amount of $3.5 million

Residual Equity Pool reduced by $3.5 million |

|||

13

| Select Incremental Convertible Noteholders Equity Distribution Illustrations | ||||

| Scenario 2 | Assumption(s): | Final Equity Committee Fees Amount of $6.75 million

$1.5 million Ad Hoc Equity Group Substantial Contribution Claim |

||

| Calculation | ($6.75 million $6.75 million) + $1.5 million = $1.5 million |

|||

| Result | Incremental Convertible Noteholders Equity Distribution Amount of $1.5 million

Residual Equity Pool reduced by $1.5 million |

|||

| Scenario 3 | Assumption(s): | Final Equity Committee Fees Amount of $6.75 million

$0 Ad Hoc Equity Group Substantial Contribution Claim |

||

| Calculation: | ($6.75 million $6.75 million) + $0 = $0 |

|||

| Result: | No Incremental Convertible Noteholders Distribution

No reduction to Residual Equity Pool |

|||

Miner Equipment Lender Claims (Class 3)

Bifurcation and Allowance

Pursuant to the Plan, Claims held by each Equipment Lender (collectively the Miner Equipment Lender Claims) will be bifurcated into (i) a secured Claim equal to the value of the collateral securing the Miner Equipment Lender Claim (collectively, the Miner Equipment Lender Secured Claims) and (ii) an unsecured Claim for amounts in excess of the applicable collateral value (collectively the Miner Equipment Lender Deficiency Claims). Miner Equipment Lender Deficiency Claims shall be treated as General Unsecured Claims and shall vote in Class 8.

Pursuant to the Plan, the Debtors seek allowance of Miner Equipment Lender Secured Claims and Miner Equipment Lender Deficiency Claims held by each Equipment Lender as set forth on Exhibit L attached to the Plan (the Miner Equipment Lender Claims Schedule). Any interest accruing on Allowed Miner Equipment Lender Claims from the Petition Date through the Effective Date shall accrue at 4.64% per annum, which is the federal judgment rate as provided under 28 U.S.C. § 1961(a), calculated as of the Petition Date (the Federal Judgment Rate), and shall be added to the Miner Equipment Lender Deficiency Claim. Each Claim that is expressly Disallowed as set forth on the Miner Equipment Lender Claims Schedule shall be Disallowed and expunged as of the Effective Date.

Treatment

Each holder of a Miner Equipment Lender Secured Claim will have three options for treatment of its Claim. To receive any option other than the Default Miner Equipment Lender Treatment (described below), Holders of Miner Equipment Lender Secured Claims must elect such option on a timely submitted Ballot. Any holder of a Miner Equipment Lender Secured Claim that does not properly elect an option will receive the Default Miner Equipment Lender Treatment.

Default Treatment

Except to the extent that a Holder of a Miner Equipment Lender Secured Claim timely elects on its Ballot one of the treatment election options described below, each Holder of an Allowed Miner Equipment Lender Secured Claim will receive, on the Effective Date or as soon as reasonably practicable thereafter, the following treatment (the Default Miner Equipment Lender Treatment):

| | Miner Equipment Lender Takeback Debt secured debt to be issued by the Debtor that is party to the applicable Miner Equipment Lender Agreement in the principal amount of each applicable Holders Miner Equipment Lender Secured Claim, on the terms and conditions set forth in the term sheet attached as Exhibit H to the Plan (the New Equipment Lender Debt Term Sheet (Default)); and |

14

| | Deficiency Claim Treatment Any Allowed Miner Equipment Lender Deficiency Claim (in accordance with the Miner Equipment Lender Claims Schedule) shall be treated in Class 8 as a General Unsecured Claim. |

Potential Treatment Elections

In lieu of the Default Miner Equipment Lender Treatment above, each Holder of an Allowed Miner Equipment Lender Secured Claim may elect one of the following settlement options:

| | Miner Equipment Lender Treatment Election 1 Such Holder may elect to receive New Common Interests with a value, based on Plan Value, equal to one hundred percent (100%) of such Holders Allowed Miner Equipment Lender Secured Claim. Such Holders Miner Equipment Lender Deficiency Claim will be treated in Class 8 as a General Unsecured Claim in accordance with the terms and provisions set forth in section 4.8 of the Plan. |

| | Miner Equipment Lender Treatment Election 2 Any Holder that is a Settling Miner Equipment Lender may elect to receive secured debt to be issued by the Debtor that is party to the applicable Miner Equipment Lender Agreement in the principal amount of eighty percent (80%) of each applicable Holders Allowed Miner Equipment Lender Claim, on the terms and conditions set forth in the term sheet attached as Exhibit I to the Plan (the New Equipment Lender Debt Term Sheet (Election 2)). Each Holders applicable Miner Equipment Lender Takeback Debt (Election 2) will be secured by such Holders prepetition collateral and such Holders pro rata share of the Settling Miner Equipment Lender Additional Collateral (as defined below). By electing this treatment, such Holder will have agreed to waive any additional recovery on account of its Miner Equipment Lender Deficiency Claim in Class 8. |