EX-99.2

Published on October 30, 2023

Exhibit 99.2 Core Scientific RESTRUCTURING TERM SHEET October 30, 2023

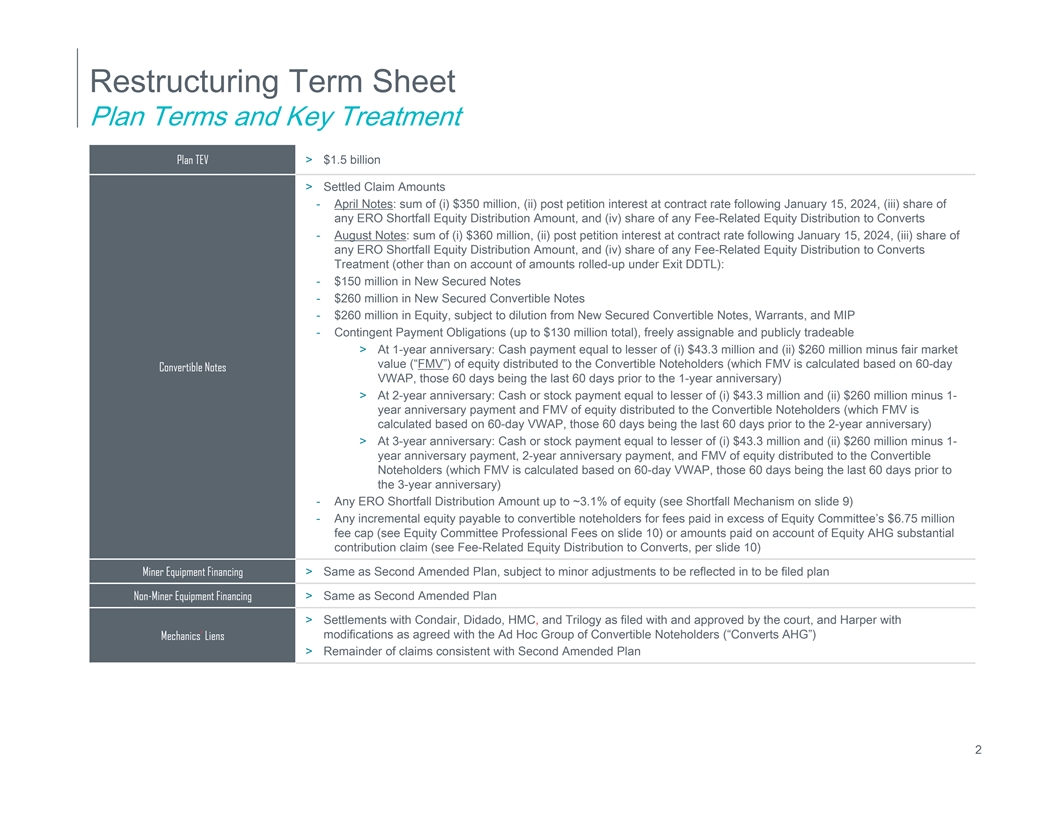

Restructuring Term Sheet Plan Terms and Key Treatment Plan TEV > $1.5 billion > Settled Claim Amounts - April Notes: sum of (i) $350 million, (ii) post petition interest at contract rate following January 15, 2024, (iii) share of any ERO Shortfall Equity Distribution Amount, and (iv) share of any Fee-Related Equity Distribution to Converts - August Notes: sum of (i) $360 million, (ii) post petition interest at contract rate following January 15, 2024, (iii) share of any ERO Shortfall Equity Distribution Amount, and (iv) share of any Fee-Related Equity Distribution to Converts Treatment (other than on account of amounts rolled-up under Exit DDTL): - $150 million in New Secured Notes - $260 million in New Secured Convertible Notes - $260 million in Equity, subject to dilution from New Secured Convertible Notes, Warrants, and MIP - Contingent Payment Obligations (up to $130 million total), freely assignable and publicly tradeable > At 1-year anniversary: Cash payment equal to lesser of (i) $43.3 million and (ii) $260 million minus fair market value (“FMV”) of equity distributed to the Convertible Noteholders (which FMV is calculated based on 60-day Convertible Notes VWAP, those 60 days being the last 60 days prior to the 1-year anniversary) > At 2-year anniversary: Cash or stock payment equal to lesser of (i) $43.3 million and (ii) $260 million minus 1- year anniversary payment and FMV of equity distributed to the Convertible Noteholders (which FMV is calculated based on 60-day VWAP, those 60 days being the last 60 days prior to the 2-year anniversary) > At 3-year anniversary: Cash or stock payment equal to lesser of (i) $43.3 million and (ii) $260 million minus 1- year anniversary payment, 2-year anniversary payment, and FMV of equity distributed to the Convertible Noteholders (which FMV is calculated based on 60-day VWAP, those 60 days being the last 60 days prior to the 3-year anniversary) - Any ERO Shortfall Distribution Amount up to ~3.1% of equity (see Shortfall Mechanism on slide 9) - Any incremental equity payable to convertible noteholders for fees paid in excess of Equity Committee’s $6.75 million fee cap (see Equity Committee Professional Fees on slide 10) or amounts paid on account of Equity AHG substantial contribution claim (see Fee-Related Equity Distribution to Converts, per slide 10) Miner Equipment Financing > Same as Second Amended Plan, subject to minor adjustments to be reflected in to be filed plan Non-Miner Equipment Financing > Same as Second Amended Plan > Settlements with Condair, Didado, HMC, and Trilogy as filed with and approved by the court, and Harper with modifications as agreed with the Ad Hoc Group of Convertible Noteholders (“Converts AHG”) Mechanics’ Liens > Remainder of claims consistent with Second Amended Plan 2

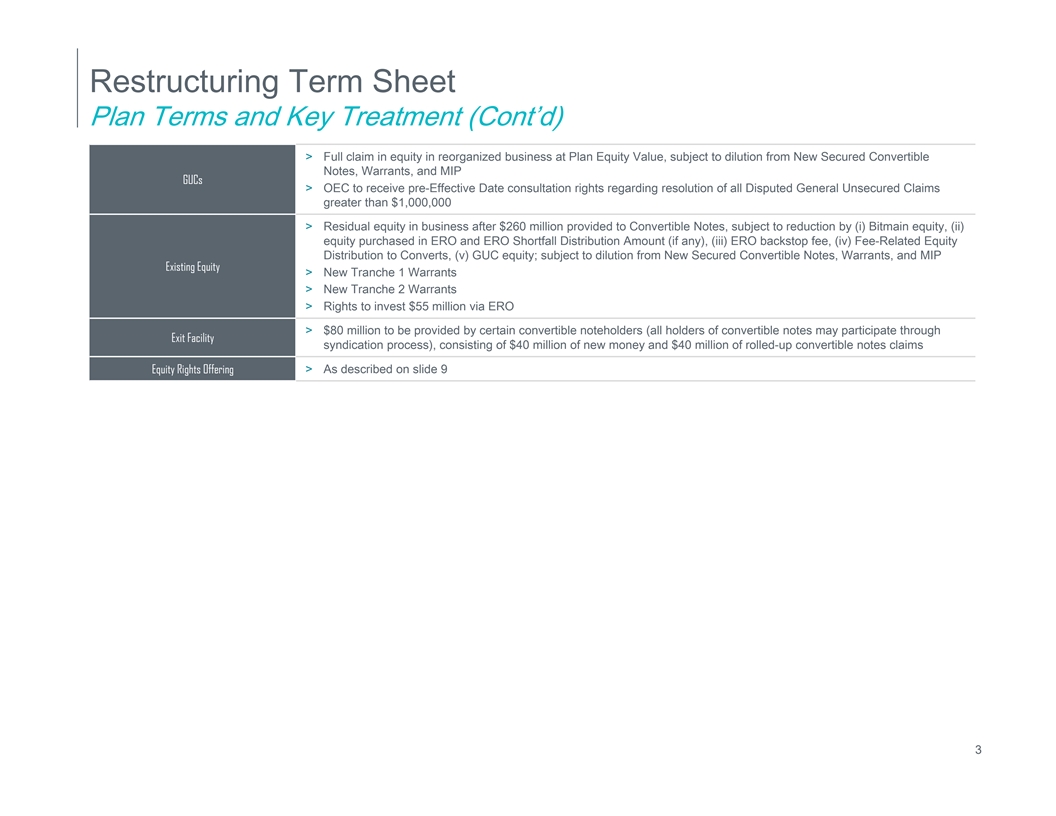

Restructuring Term Sheet Plan Terms and Key Treatment (Cont’d) > Full claim in equity in reorganized business at Plan Equity Value, subject to dilution from New Secured Convertible Notes, Warrants, and MIP GUCs > OEC to receive pre-Effective Date consultation rights regarding resolution of all Disputed General Unsecured Claims greater than $1,000,000 > Residual equity in business after $260 million provided to Convertible Notes, subject to reduction by (i) Bitmain equity, (ii) equity purchased in ERO and ERO Shortfall Distribution Amount (if any), (iii) ERO backstop fee, (iv) Fee-Related Equity Distribution to Converts, (v) GUC equity; subject to dilution from New Secured Convertible Notes, Warrants, and MIP Existing Equity > New Tranche 1 Warrants > New Tranche 2 Warrants > Rights to invest $55 million via ERO > $80 million to be provided by certain convertible noteholders (all holders of convertible notes may participate through Exit Facility syndication process), consisting of $40 million of new money and $40 million of rolled-up convertible notes claims Equity Rights Offering > As described on slide 9 3

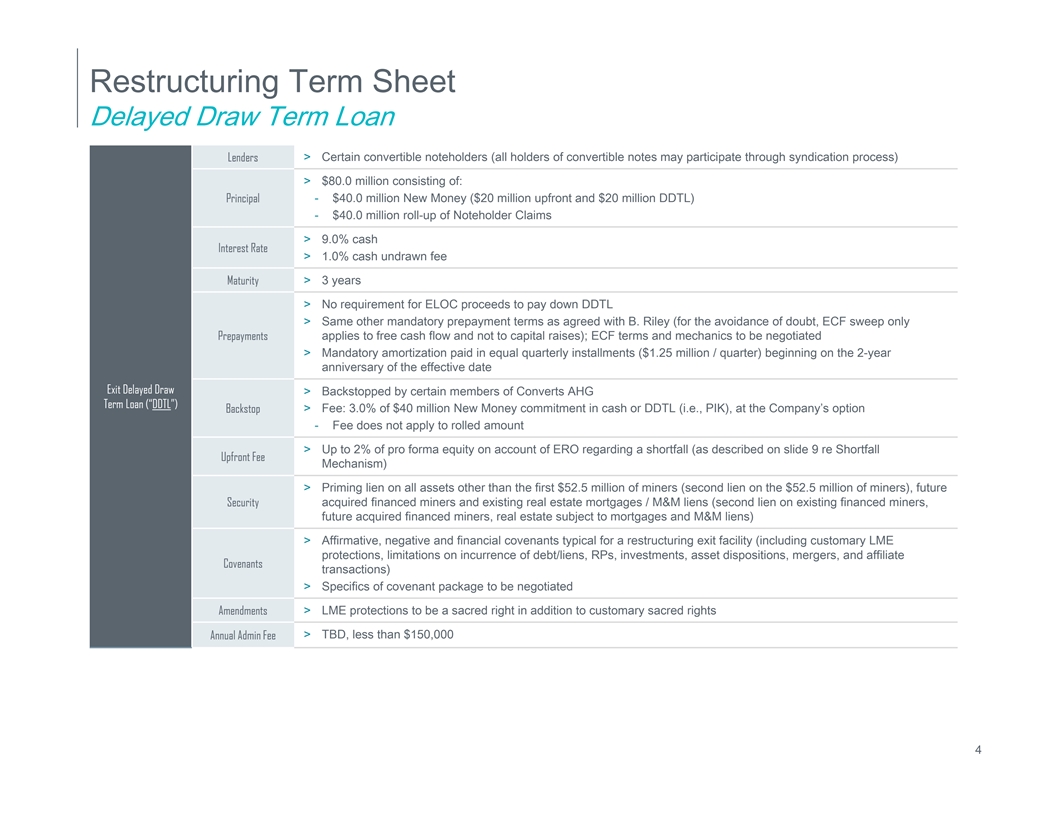

Restructuring Term Sheet Delayed Draw Term Loan Lenders > Certain convertible noteholders (all holders of convertible notes may participate through syndication process) > $80.0 million consisting of: Principal - $40.0 million New Money ($20 million upfront and $20 million DDTL) - $40.0 million roll-up of Noteholder Claims > 9.0% cash Interest Rate > 1.0% cash undrawn fee > 3 years Maturity > No requirement for ELOC proceeds to pay down DDTL > Same other mandatory prepayment terms as agreed with B. Riley (for the avoidance of doubt, ECF sweep only Prepayments applies to free cash flow and not to capital raises); ECF terms and mechanics to be negotiated > Mandatory amortization paid in equal quarterly installments ($1.25 million / quarter) beginning on the 2-year anniversary of the effective date Exit Delayed Draw > Backstopped by certain members of Converts AHG Term Loan (“DDTL”) > Fee: 3.0% of $40 million New Money commitment in cash or DDTL (i.e., PIK), at the Company’s option Backstop - Fee does not apply to rolled amount > Up to 2% of pro forma equity on account of ERO regarding a shortfall (as described on slide 9 re Shortfall Upfront Fee Mechanism) > Priming lien on all assets other than the first $52.5 million of miners (second lien on the $52.5 million of miners), future Security acquired financed miners and existing real estate mortgages / M&M liens (second lien on existing financed miners, future acquired financed miners, real estate subject to mortgages and M&M liens) > Affirmative, negative and financial covenants typical for a restructuring exit facility (including customary LME protections, limitations on incurrence of debt/liens, RPs, investments, asset dispositions, mergers, and affiliate Covenants transactions) > Specifics of covenant package to be negotiated Amendments > LME protections to be a sacred right in addition to customary sacred rights > TBD, less than $150,000 Annual Admin Fee 4

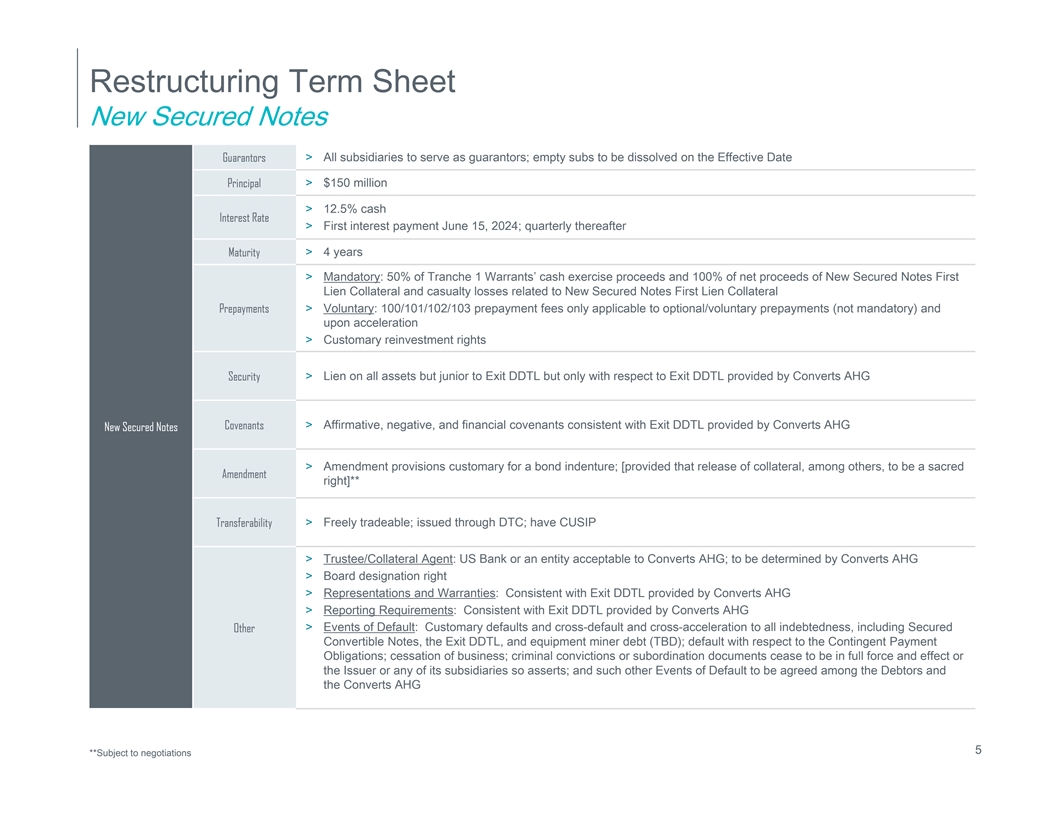

Restructuring Term Sheet New Secured Notes Guarantors > All subsidiaries to serve as guarantors; empty subs to be dissolved on the Effective Date > $150 million Principal > 12.5% cash Interest Rate > First interest payment June 15, 2024; quarterly thereafter Maturity > 4 years > Mandatory: 50% of Tranche 1 Warrants’ cash exercise proceeds and 100% of net proceeds of New Secured Notes First Lien Collateral and casualty losses related to New Secured Notes First Lien Collateral > Voluntary: 100/101/102/103 prepayment fees only applicable to optional/voluntary prepayments (not mandatory) and Prepayments upon acceleration > Customary reinvestment rights > Lien on all assets but junior to Exit DDTL but only with respect to Exit DDTL provided by Converts AHG Security Covenants > Affirmative, negative, and financial covenants consistent with Exit DDTL provided by Converts AHG New Secured Notes > Amendment provisions customary for a bond indenture; [provided that release of collateral, among others, to be a sacred Amendment right]** Transferability > Freely tradeable; issued through DTC; have CUSIP > Trustee/Collateral Agent: US Bank or an entity acceptable to Converts AHG; to be determined by Converts AHG > Board designation right > Representations and Warranties: Consistent with Exit DDTL provided by Converts AHG > Reporting Requirements: Consistent with Exit DDTL provided by Converts AHG Other > Events of Default: Customary defaults and cross-default and cross-acceleration to all indebtedness, including Secured Convertible Notes, the Exit DDTL, and equipment miner debt (TBD); default with respect to the Contingent Payment Obligations; cessation of business; criminal convictions or subordination documents cease to be in full force and effect or the Issuer or any of its subsidiaries so asserts; and such other Events of Default to be agreed among the Debtors and the Converts AHG 5 **Subject to negotiations

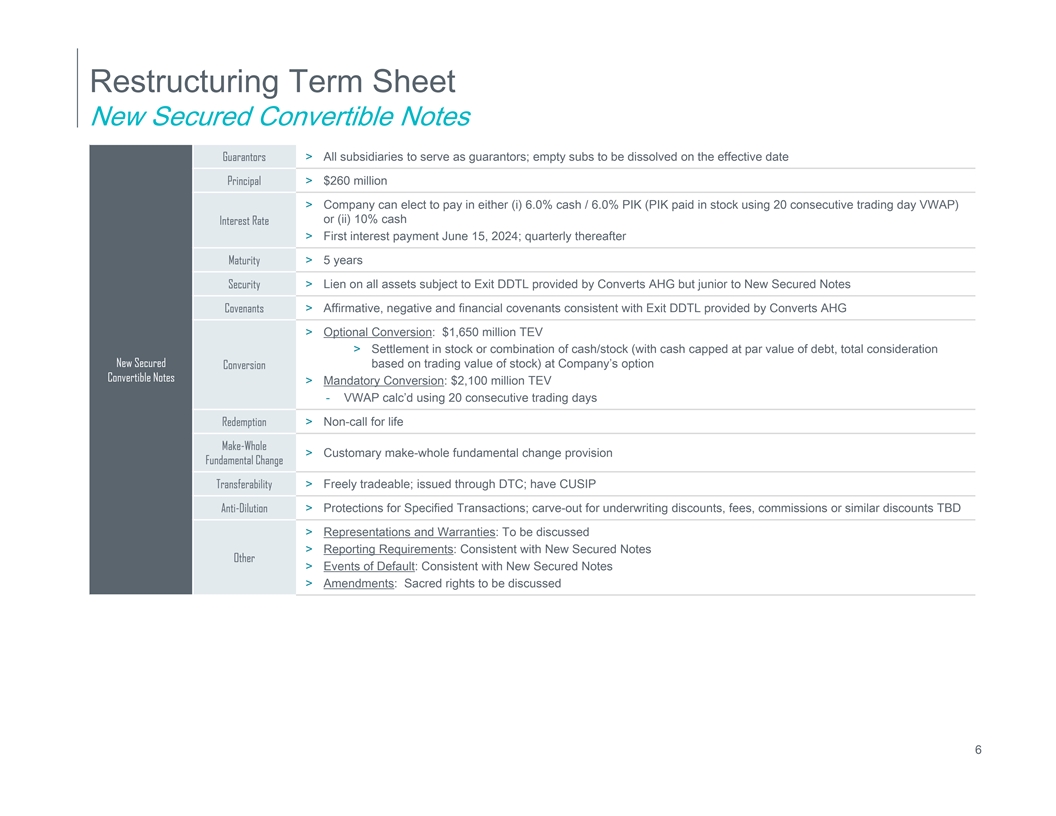

Restructuring Term Sheet New Secured Convertible Notes Guarantors > All subsidiaries to serve as guarantors; empty subs to be dissolved on the effective date Principal > $260 million > Company can elect to pay in either (i) 6.0% cash / 6.0% PIK (PIK paid in stock using 20 consecutive trading day VWAP) or (ii) 10% cash Interest Rate > First interest payment June 15, 2024; quarterly thereafter > 5 years Maturity > Lien on all assets subject to Exit DDTL provided by Converts AHG but junior to New Secured Notes Security > Affirmative, negative and financial covenants consistent with Exit DDTL provided by Converts AHG Covenants > Optional Conversion: $1,650 million TEV > Settlement in stock or combination of cash/stock (with cash capped at par value of debt, total consideration New Secured based on trading value of stock) at Company’s option Conversion Convertible Notes > Mandatory Conversion: $2,100 million TEV - VWAP calc’d using 20 consecutive trading days > Non-call for life Redemption Make-Whole > Customary make-whole fundamental change provision Fundamental Change > Freely tradeable; issued through DTC; have CUSIP Transferability > Protections for Specified Transactions; carve-out for underwriting discounts, fees, commissions or similar discounts TBD Anti-Dilution > Representations and Warranties: To be discussed > Reporting Requirements: Consistent with New Secured Notes Other > Events of Default: Consistent with New Secured Notes > Amendments: Sacred rights to be discussed 6

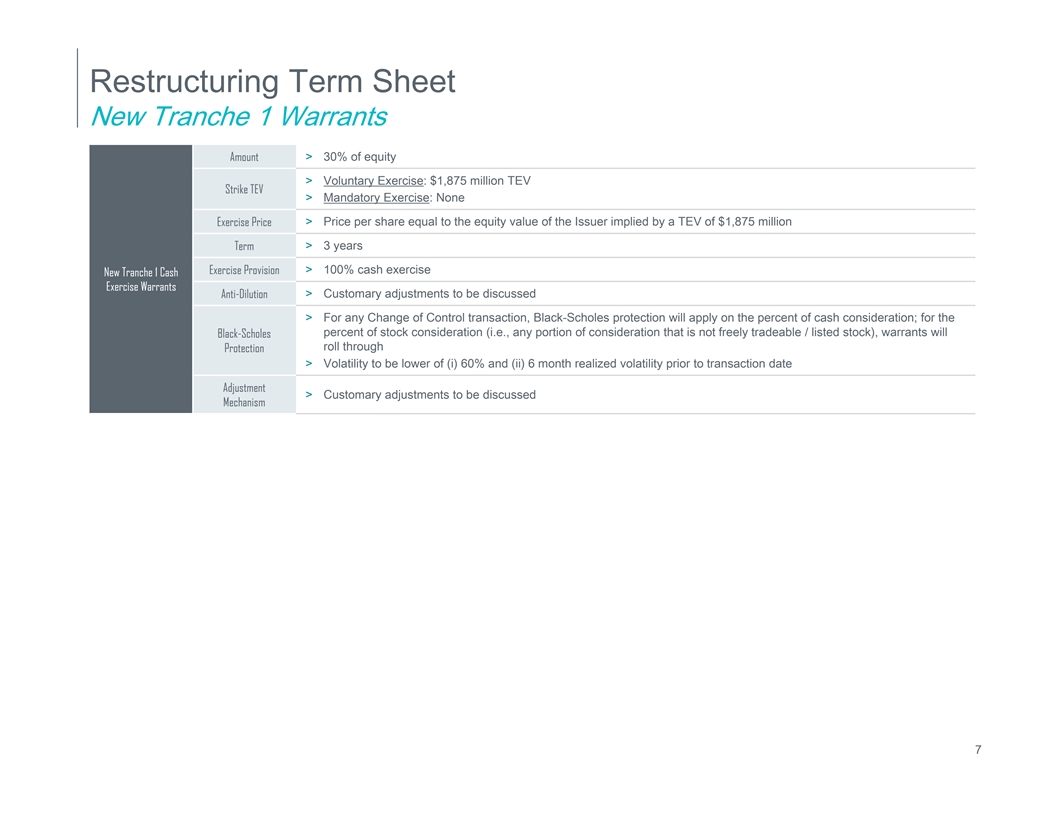

Restructuring Term Sheet New Tranche 1 Warrants Amount > 30% of equity > Voluntary Exercise: $1,875 million TEV Strike TEV > Mandatory Exercise: None > Price per share equal to the equity value of the Issuer implied by a TEV of $1,875 million Exercise Price > 3 years Term > 100% cash exercise Exercise Provision New Tranche 1 Cash Exercise Warrants > Customary adjustments to be discussed Anti-Dilution > For any Change of Control transaction, Black-Scholes protection will apply on the percent of cash consideration; for the percent of stock consideration (i.e., any portion of consideration that is not freely tradeable / listed stock), warrants will Black-Scholes roll through Protection > Volatility to be lower of (i) 60% and (ii) 6 month realized volatility prior to transaction date Adjustment > Customary adjustments to be discussed Mechanism 7

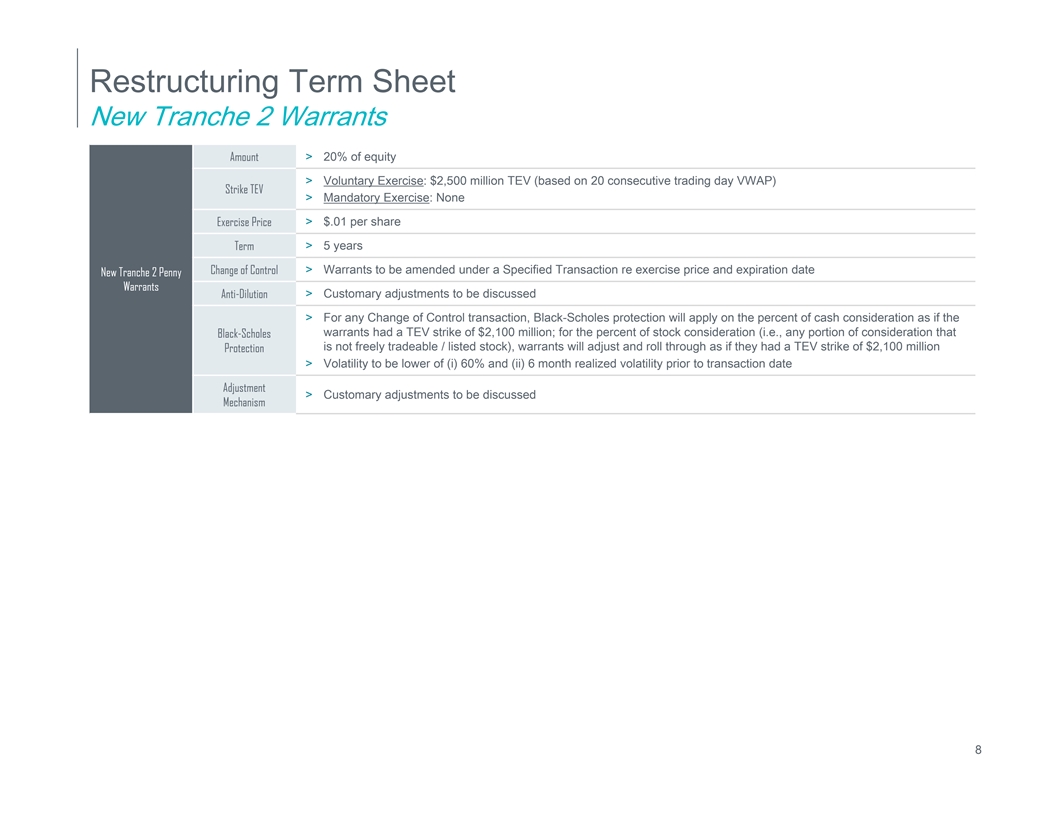

Restructuring Term Sheet New Tranche 2 Warrants Amount > 20% of equity > Voluntary Exercise: $2,500 million TEV (based on 20 consecutive trading day VWAP) Strike TEV > Mandatory Exercise: None > $.01 per share Exercise Price > 5 years Term > Warrants to be amended under a Specified Transaction re exercise price and expiration date Change of Control New Tranche 2 Penny Warrants > Customary adjustments to be discussed Anti-Dilution > For any Change of Control transaction, Black-Scholes protection will apply on the percent of cash consideration as if the warrants had a TEV strike of $2,100 million; for the percent of stock consideration (i.e., any portion of consideration that Black-Scholes is not freely tradeable / listed stock), warrants will adjust and roll through as if they had a TEV strike of $2,100 million Protection > Volatility to be lower of (i) 60% and (ii) 6 month realized volatility prior to transaction date Adjustment > Customary adjustments to be discussed Mechanism 8

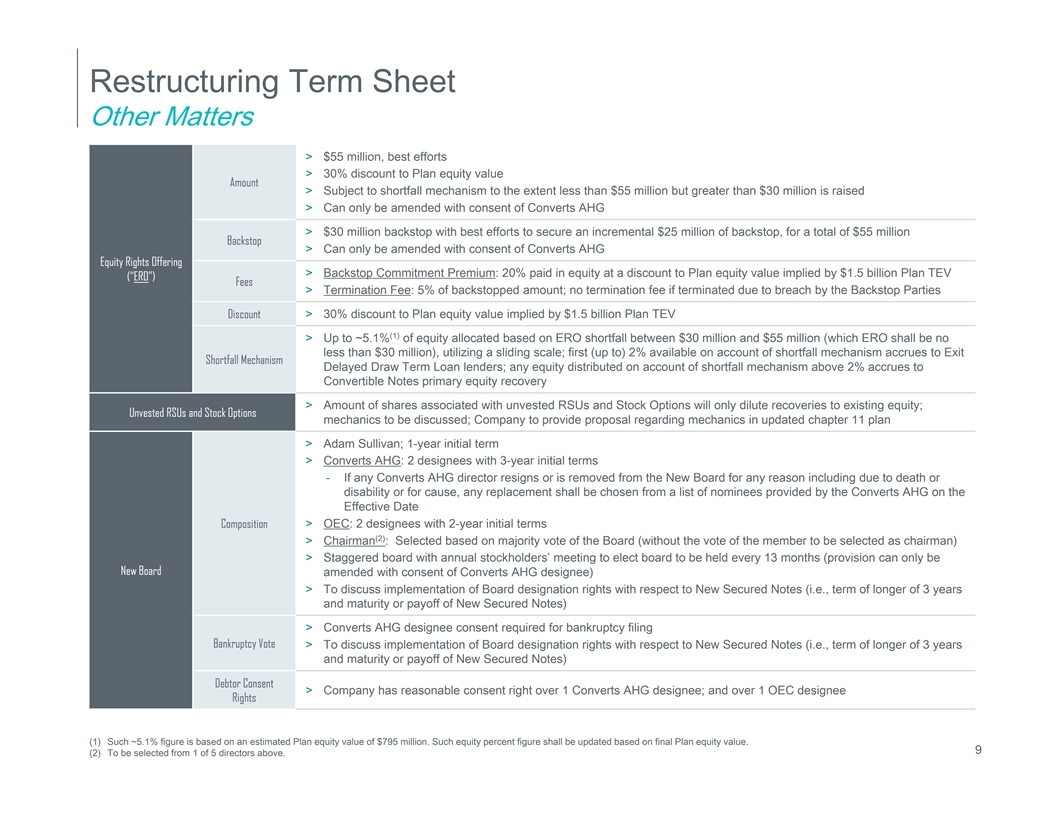

Restructuring Term Sheet Other Matters > $55 million, best efforts > 30% discount to Plan equity value Amount > Subject to shortfall mechanism to the extent less than $55 million but greater than $30 million is raised > Can only be amended with consent of Converts AHG > $30 million backstop with best efforts to secure an incremental $25 million of backstop, for a total of $55 million Backstop > Can only be amended with consent of Converts AHG Equity Rights Offering > Backstop Commitment Premium: 20% paid in equity at a discount to Plan equity value implied by $1.5 billion Plan TEV (“ERO”) Fees > Termination Fee: 5% of backstopped amount; no termination fee if terminated due to breach by the Backstop Parties Discount > 30% discount to Plan equity value implied by $1.5 billion Plan TEV (1) > Up to ~5.1% of equity allocated based on ERO shortfall between $30 million and $55 million (which ERO shall be no less than $30 million), utilizing a sliding scale; first (up to) 2% available on account of shortfall mechanism accrues to Exit Shortfall Mechanism Delayed Draw Term Loan lenders; any equity distributed on account of shortfall mechanism above 2% accrues to Convertible Notes primary equity recovery > Amount of shares associated with unvested RSUs and Stock Options will only dilute recoveries to existing equity; Unvested RSUs and Stock Options mechanics to be discussed; Company to provide proposal regarding mechanics in updated chapter 11 plan > Adam Sullivan; 1-year initial term > Converts AHG: 2 designees with 3-year initial terms - If any Converts AHG director resigns or is removed from the New Board for any reason including due to death or disability or for cause, any replacement shall be chosen from a list of nominees provided by the Converts AHG on the Effective Date Composition > OEC: 2 designees with 2-year initial terms (2) > Chairman : Selected based on majority vote of the Board (without the vote of the member to be selected as chairman) > Staggered board with annual stockholders’ meeting to elect board to be held every 13 months (provision can only be New Board amended with consent of Converts AHG designee) > To discuss implementation of Board designation rights with respect to New Secured Notes (i.e., term of longer of 3 years and maturity or payoff of New Secured Notes) > Converts AHG designee consent required for bankruptcy filing Bankruptcy Vote > To discuss implementation of Board designation rights with respect to New Secured Notes (i.e., term of longer of 3 years and maturity or payoff of New Secured Notes) Debtor Consent > Company has reasonable consent right over 1 Converts AHG designee; and over 1 OEC designee Rights (1) Such ~5.1% figure is based on an estimated Plan equity value of $795 million. Such equity percent figure shall be updated based on final Plan equity value. 9 (2) To be selected from 1 of 5 directors above.

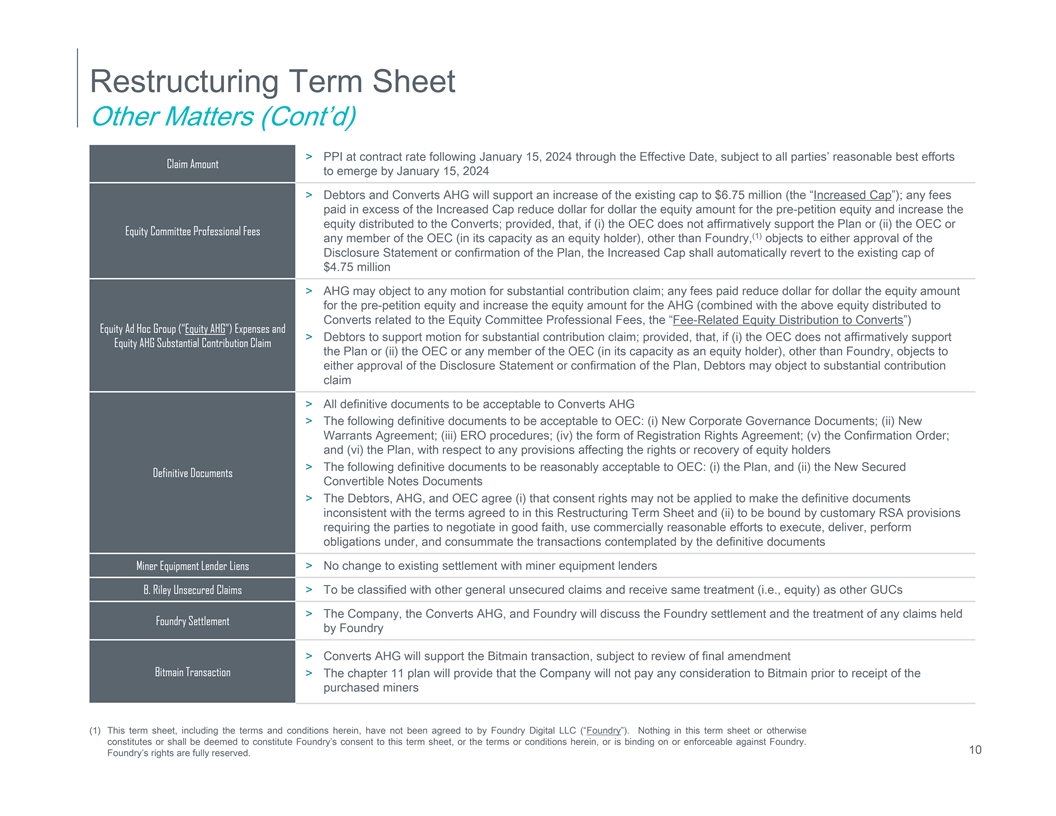

Restructuring Term Sheet Other Matters (Cont’d) > PPI at contract rate following January 15, 2024 through the Effective Date, subject to all parties’ reasonable best efforts Claim Amount to emerge by January 15, 2024 > Debtors and Converts AHG will support an increase of the existing cap to $6.75 million (the “Increased Cap”); any fees paid in excess of the Increased Cap reduce dollar for dollar the equity amount for the pre-petition equity and increase the equity distributed to the Converts; provided, that, if (i) the OEC does not affirmatively support the Plan or (ii) the OEC or Equity Committee Professional Fees (1) any member of the OEC (in its capacity as an equity holder), other than Foundry, objects to either approval of the Disclosure Statement or confirmation of the Plan, the Increased Cap shall automatically revert to the existing cap of $4.75 million > AHG may object to any motion for substantial contribution claim; any fees paid reduce dollar for dollar the equity amount for the pre-petition equity and increase the equity amount for the AHG (combined with the above equity distributed to Converts related to the Equity Committee Professional Fees, the “Fee-Related Equity Distribution to Converts”) Equity Ad Hoc Group (“Equity AHG”) Expenses and > Debtors to support motion for substantial contribution claim; provided, that, if (i) the OEC does not affirmatively support Equity AHG Substantial Contribution Claim the Plan or (ii) the OEC or any member of the OEC (in its capacity as an equity holder), other than Foundry, objects to either approval of the Disclosure Statement or confirmation of the Plan, Debtors may object to substantial contribution claim > All definitive documents to be acceptable to Converts AHG > The following definitive documents to be acceptable to OEC: (i) New Corporate Governance Documents; (ii) New Warrants Agreement; (iii) ERO procedures; (iv) the form of Registration Rights Agreement; (v) the Confirmation Order; and (vi) the Plan, with respect to any provisions affecting the rights or recovery of equity holders > The following definitive documents to be reasonably acceptable to OEC: (i) the Plan, and (ii) the New Secured Definitive Documents Convertible Notes Documents > The Debtors, AHG, and OEC agree (i) that consent rights may not be applied to make the definitive documents inconsistent with the terms agreed to in this Restructuring Term Sheet and (ii) to be bound by customary RSA provisions requiring the parties to negotiate in good faith, use commercially reasonable efforts to execute, deliver, perform obligations under, and consummate the transactions contemplated by the definitive documents > No change to existing settlement with miner equipment lenders Miner Equipment Lender Liens > To be classified with other general unsecured claims and receive same treatment (i.e., equity) as other GUCs B. Riley Unsecured Claims > The Company, the Converts AHG, and Foundry will discuss the Foundry settlement and the treatment of any claims held Foundry Settlement by Foundry > Converts AHG will support the Bitmain transaction, subject to review of final amendment Bitmain Transaction > The chapter 11 plan will provide that the Company will not pay any consideration to Bitmain prior to receipt of the purchased miners (1) This term sheet, including the terms and conditions herein, have not been agreed to by Foundry Digital LLC (“Foundry”). Nothing in this term sheet or otherwise constitutes or shall be deemed to constitute Foundry’s consent to this term sheet, or the terms or conditions herein, or is binding on or enforceable against Foundry. 10 Foundry’s rights are fully reserved.

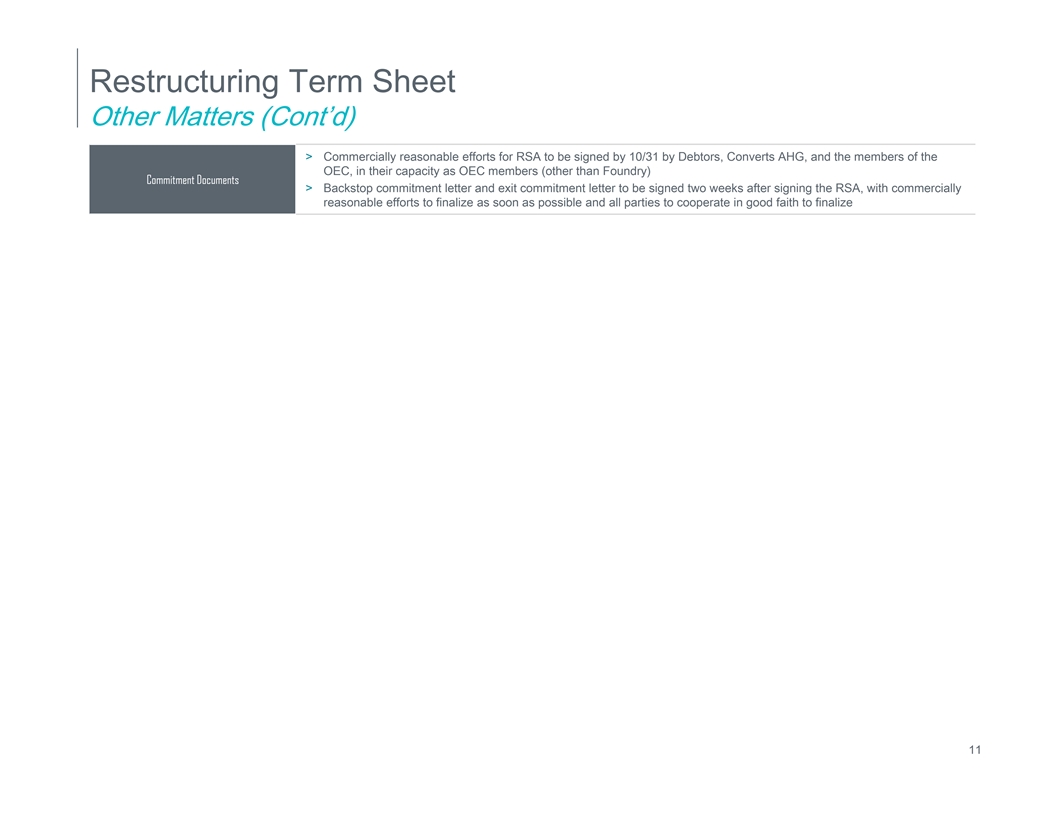

Restructuring Term Sheet Other Matters (Cont’d) > Commercially reasonable efforts for RSA to be signed by 10/31 by Debtors, Converts AHG, and the members of the OEC, in their capacity as OEC members (other than Foundry) Commitment Documents > Backstop commitment letter and exit commitment letter to be signed two weeks after signing the RSA, with commercially reasonable efforts to finalize as soon as possible and all parties to cooperate in good faith to finalize 11