EX-99.3

Published on June 21, 2023

Exhibit 99.3 Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Core Scientific Cleansing Materials June 2023 Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change PROPRIETARY & CONFIDENTIAL 1

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Experienced Management Team MIKE LEVITT ADAM SULLIVAN TODD DUCHENE CEO President Chief Administrative Officer MATT BROWN RUSSELL CANN DENISE STERLING EVP, Data Center Operations EVP, Client Services CFO MICHAEL BROS KATHARINE HALL JEFF TAYLOR SVP, Capital Markets and General Counsel SVP, Chief Information Acquisitions Security Officer Aaron McCreery Sangeeta Campos Puri Cline Kezar SVP, Platform Engineering VP, People Operations VP, Data Center Services PROPRIETARY & CONFIDENTIAL 2

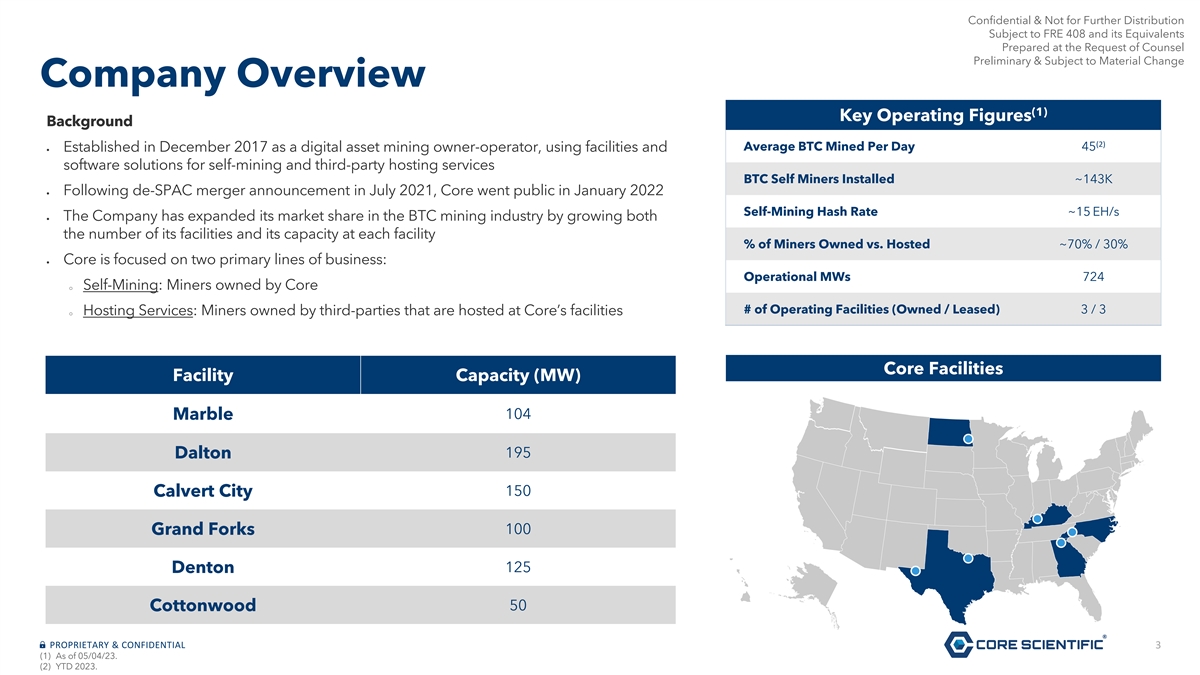

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Company Overview (1) Key Operating Figures Background (2) Average BTC Mined Per Day 45 • Established in December 2017 as a digital asset mining owner-operator, using facilities and software solutions for self-mining and third-party hosting services BTC Self Miners Installed ~143K • Following de-SPAC merger announcement in July 2021, Core went public in January 2022 Self-Mining Hash Rate ~15 EH/s • The Company has expanded its market share in the BTC mining industry by growing both the number of its facilities and its capacity at each facility % of Miners Owned vs. Hosted ~70% / 30% • Core is focused on two primary lines of business: Operational MWs 724 o Self-Mining: Miners owned by Core # of Operating Facilities (Owned / Leased) 3 / 3 o Hosting Services: Miners owned by third-parties that are hosted at Core’s facilities Core Facilities Facility Capacity (MW) 104 Marble 195 Dalton 150 Calvert City 100 Grand Forks 125 Denton 50 Cottonwood PROPRIETARY & CONFIDENTIAL 3 (1) As of 05/04/23. (2) YTD 2023.

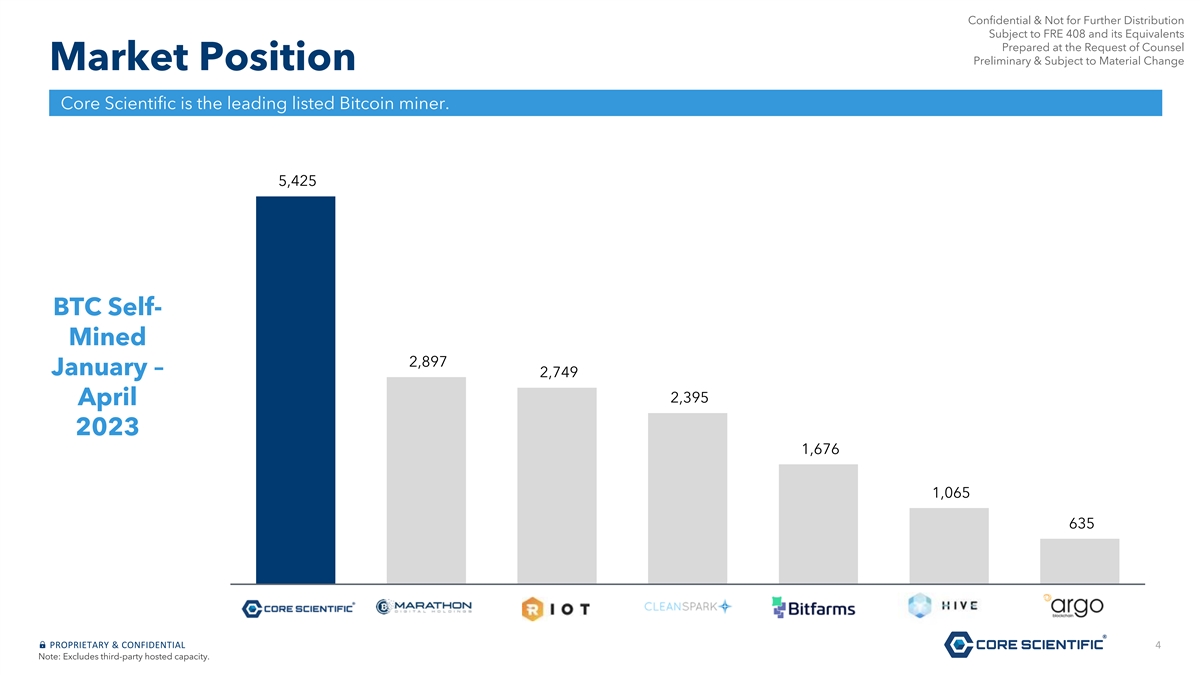

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Market Position Core Scientific is the leading listed Bitcoin miner. 5,425 BTC Self- Mined 2,897 January – 2,749 2,395 April 2023 1,676 1,065 635 Core Scientific Marathon Riot Clean Spark BitFarms Hive Argo PROPRIETARY & CONFIDENTIAL 4 Note: Excludes third-party hosted capacity.

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change PROPRIETARY & CONFIDENTIAL 5

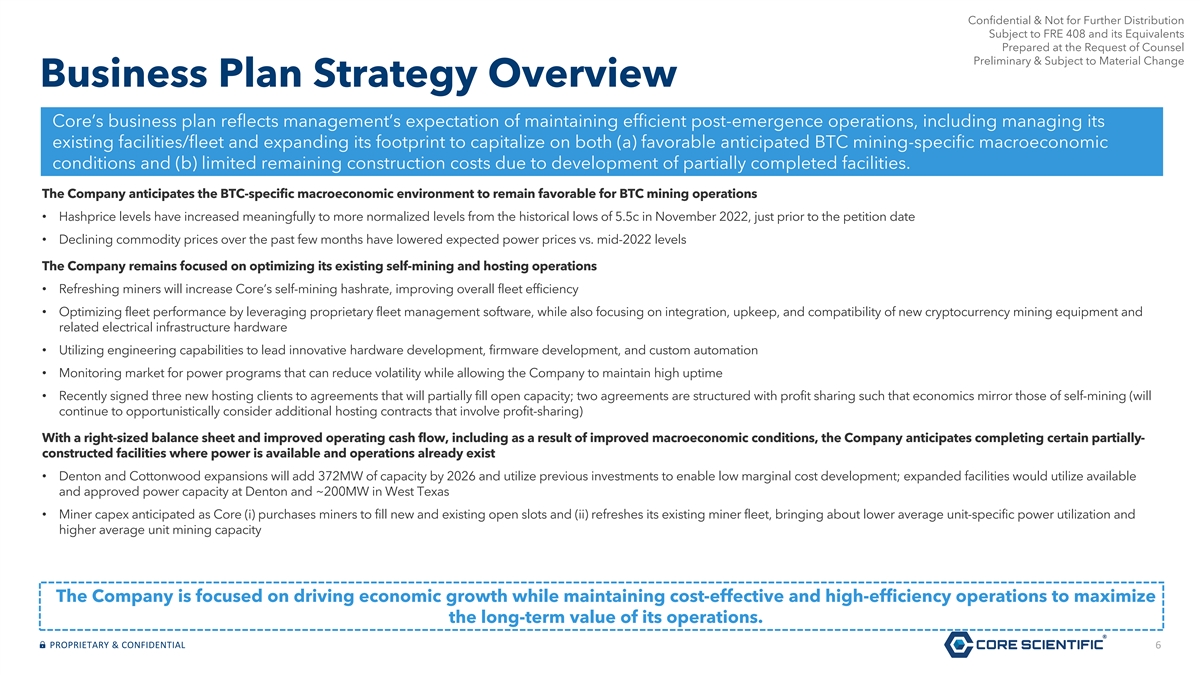

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Strategy Overview Core’s business plan reflects management’s expectation of maintaining efficient post-emergence operations, including managing its existing facilities/fleet and expanding its footprint to capitalize on both (a) favorable anticipated BTC mining-specific macroeconomic conditions and (b) limited remaining construction costs due to development of partially completed facilities. The Company anticipates the BTC-specific macroeconomic environment to remain favorable for BTC mining operations • Hashprice levels have increased meaningfully to more normalized levels from the historical lows of 5.5c in November 2022, just prior to the petition date • Declining commodity prices over the past few months have lowered expected power prices vs. mid-2022 levels The Company remains focused on optimizing its existing self-mining and hosting operations • Refreshing miners will increase Core’s self-mining hashrate, improving overall fleet efficiency • Optimizing fleet performance by leveraging proprietary fleet management software, while also focusing on integration, upkeep, and compatibility of new cryptocurrency mining equipment and related electrical infrastructure hardware • Utilizing engineering capabilities to lead innovative hardware development, firmware development, and custom automation • Monitoring market for power programs that can reduce volatility while allowing the Company to maintain high uptime • Recently signed three new hosting clients to agreements that will partially fill open capacity; two agreements are structured with profit sharing such that economics mirror those of self-mining (will continue to opportunistically consider additional hosting contracts that involve profit-sharing) With a right-sized balance sheet and improved operating cash flow, including as a result of improved macroeconomic conditions, the Company anticipates completing certain partially- constructed facilities where power is available and operations already exist • Denton and Cottonwood expansions will add 372MW of capacity by 2026 and utilize previous investments to enable low marginal cost development; expanded facilities would utilize available and approved power capacity at Denton and ~200MW in West Texas • Miner capex anticipated as Core (i) purchases miners to fill new and existing open slots and (ii) refreshes its existing miner fleet, bringing about lower average unit-specific power utilization and higher average unit mining capacity The Company is focused on driving economic growth while maintaining cost-effective and high-efficiency operations to maximize the long-term value of its operations. PROPRIETARY & CONFIDENTIAL 6

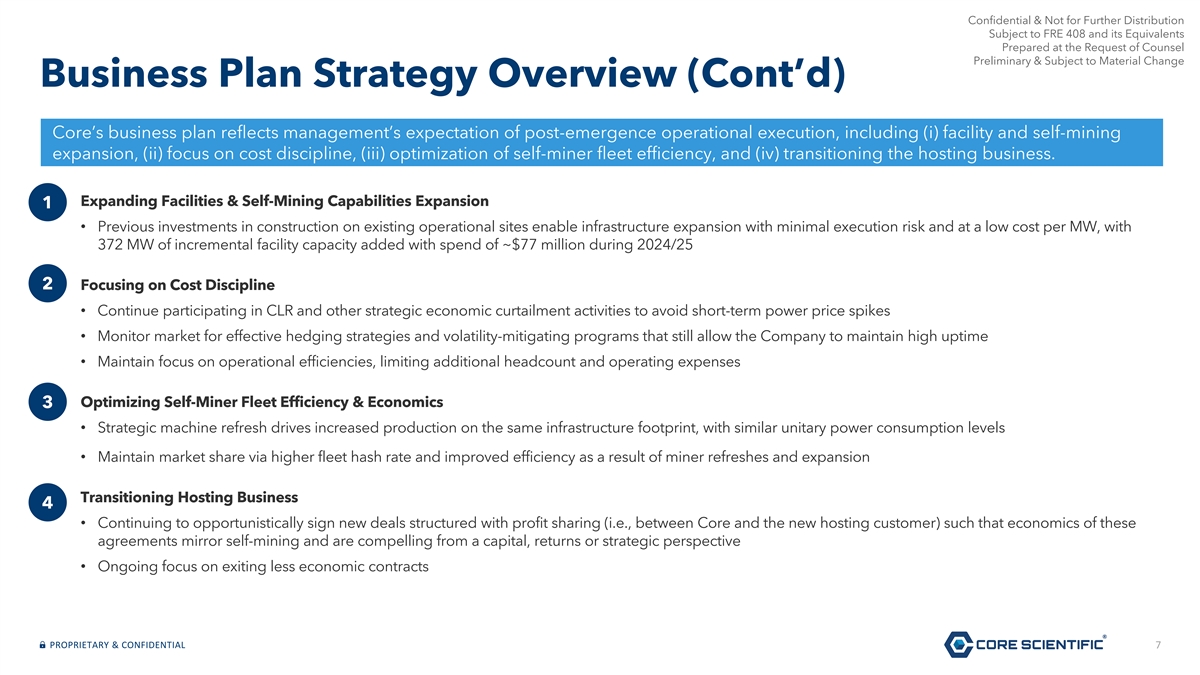

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Strategy Overview (Cont’d) Core’s business plan reflects management’s expectation of post-emergence operational execution, including (i) facility and self-mining expansion, (ii) focus on cost discipline, (iii) optimization of self-miner fleet efficiency, and (iv) transitioning the hosting business. Expanding Facilities & Self-Mining Capabilities Expansion 1 • Previous investments in construction on existing operational sites enable infrastructure expansion with minimal execution risk and at a low cost per MW, with 372 MW of incremental facility capacity added with spend of ~$77 million during 2024/25 2 Focusing on Cost Discipline • Continue participating in CLR and other strategic economic curtailment activities to avoid short-term power price spikes • Monitor market for effective hedging strategies and volatility-mitigating programs that still allow the Company to maintain high uptime • Maintain focus on operational efficiencies, limiting additional headcount and operating expenses Optimizing Self-Miner Fleet Efficiency & Economics 3 • Strategic machine refresh drives increased production on the same infrastructure footprint, with similar unitary power consumption levels • Maintain market share via higher fleet hash rate and improved efficiency as a result of miner refreshes and expansion Transitioning Hosting Business 4 • Continuing to opportunistically sign new deals structured with profit sharing (i.e., between Core and the new hosting customer) such that economics of these agreements mirror self-mining and are compelling from a capital, returns or strategic perspective • Ongoing focus on exiting less economic contracts PROPRIETARY & CONFIDENTIAL 7

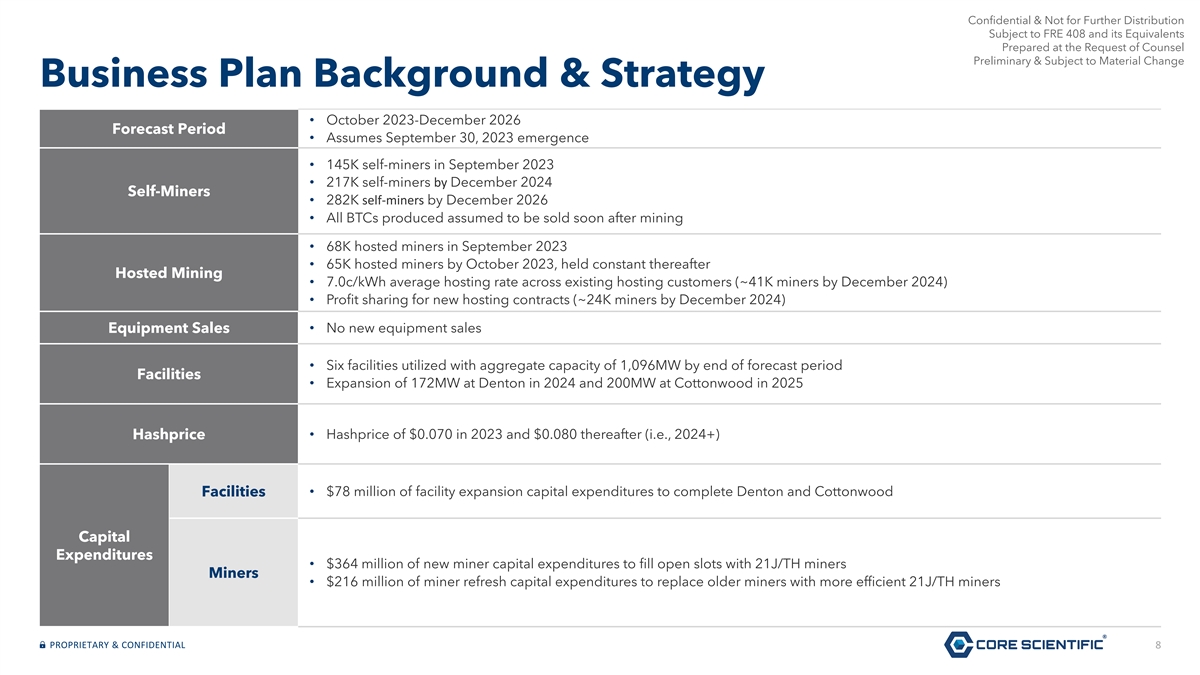

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Background & Strategy • October 2023-December 2026 Forecast Period • Assumes September 30, 2023 emergence • 145K self-miners in September 2023 • 217K self-miners by December 2024 Self-Miners • 282K self-miners by December 2026 • All BTCs produced assumed to be sold soon after mining • 68K hosted miners in September 2023 • 65K hosted miners by October 2023, held constant thereafter Hosted Mining • 7.0c/kWh average hosting rate across existing hosting customers (~41K miners by December 2024) • Profit sharing for new hosting contracts (~24K miners by December 2024) Equipment Sales• No new equipment sales • Six facilities utilized with aggregate capacity of 1,096MW by end of forecast period Facilities • Expansion of 172MW at Denton in 2024 and 200MW at Cottonwood in 2025 • Hashprice of $0.070 in 2023 and $0.080 thereafter (i.e., 2024+) Hashprice • $78 million of facility expansion capital expenditures to complete Denton and Cottonwood Facilities Capital Expenditures • $364 million of new miner capital expenditures to fill open slots with 21J/TH miners Miners • $216 million of miner refresh capital expenditures to replace older miners with more efficient 21J/TH miners PROPRIETARY & CONFIDENTIAL 8

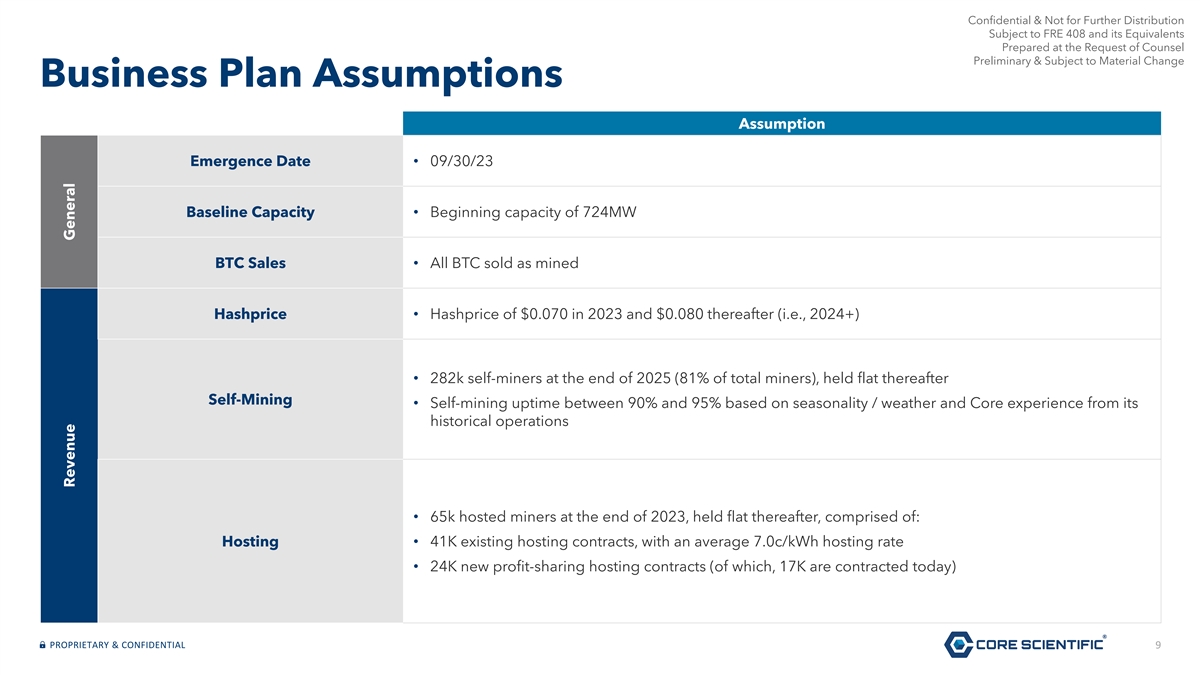

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Assumptions Assumption Emergence Date• 09/30/23 Baseline Capacity• Beginning capacity of 724MW BTC Sales• All BTC sold as mined Hashprice• Hashprice of $0.070 in 2023 and $0.080 thereafter (i.e., 2024+) • 282k self-miners at the end of 2025 (81% of total miners), held flat thereafter Self-Mining • Self-mining uptime between 90% and 95% based on seasonality / weather and Core experience from its historical operations • 65k hosted miners at the end of 2023, held flat thereafter, comprised of: Hosting• 41K existing hosting contracts, with an average 7.0c/kWh hosting rate • 24K new profit-sharing hosting contracts (of which, 17K are contracted today) PROPRIETARY & CONFIDENTIAL 9 Revenue General

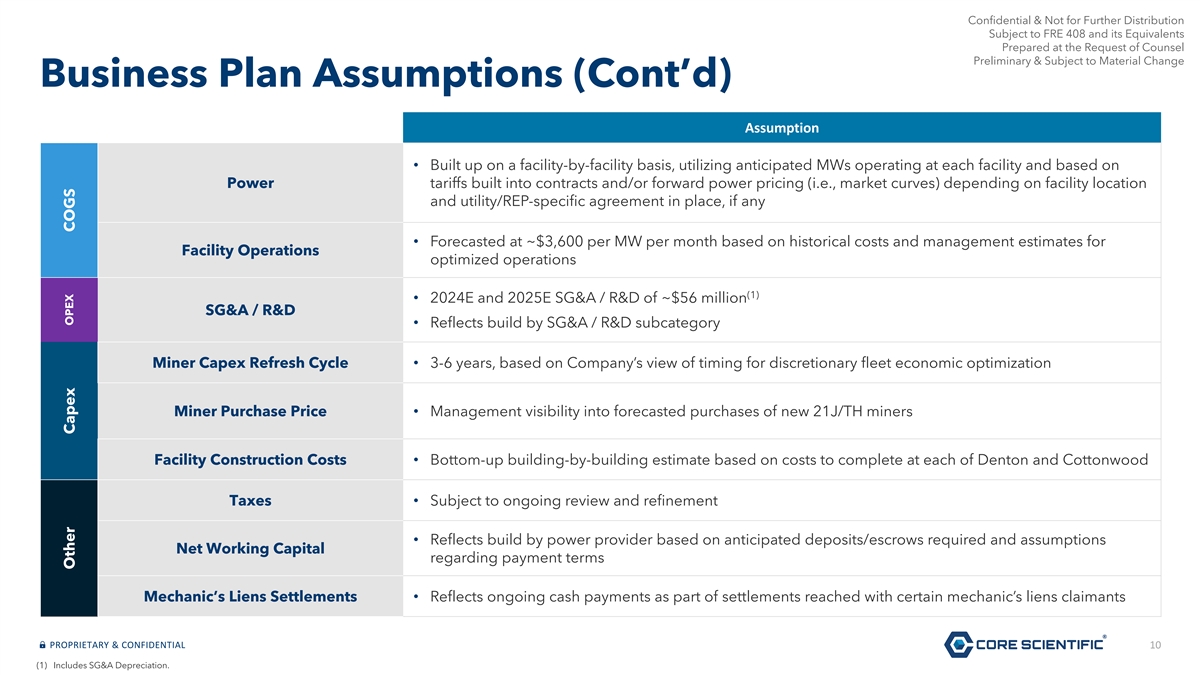

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Assumptions (Cont’d) Assumption • Built up on a facility-by-facility basis, utilizing anticipated MWs operating at each facility and based on Power tariffs built into contracts and/or forward power pricing (i.e., market curves) depending on facility location and utility/REP-specific agreement in place, if any • Forecasted at ~$3,600 per MW per month based on historical costs and management estimates for Facility Operations optimized operations (1) • 2024E and 2025E SG&A / R&D of ~$56 million SG&A / R&D • Reflects build by SG&A / R&D subcategory Miner Capex Refresh Cycle• 3-6 years, based on Company’s view of timing for discretionary fleet economic optimization Miner Purchase Price• Management visibility into forecasted purchases of new 21J/TH miners Facility Construction Costs• Bottom-up building-by-building estimate based on costs to complete at each of Denton and Cottonwood Taxes• Subject to ongoing review and refinement • Reflects build by power provider based on anticipated deposits/escrows required and assumptions Net Working Capital regarding payment terms Mechanic’s Liens Settlements• Reflects ongoing cash payments as part of settlements reached with certain mechanic’s liens claimants PROPRIETARY & CONFIDENTIAL 10 (1) Includes SG&A Depreciation. OPEX Other Capex COGS

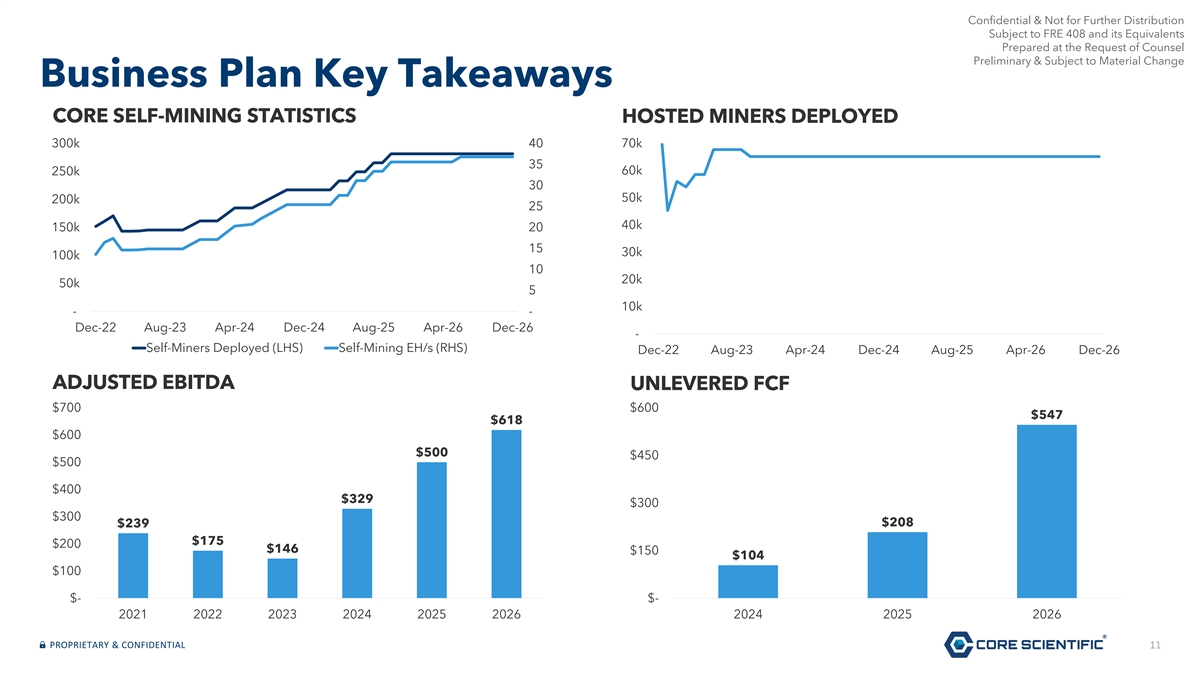

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Key Takeaways CORE SELF-MINING STATISTICS HOSTED MINERS DEPLOYED 300k 40 70k 35 60k 250k 30 50k 200k 25 40k 150k 20 15 30k 100k 10 20k 50k 5 10k - - Dec-22 Aug-23 Apr-24 Dec-24 Aug-25 Apr-26 Dec-26 - Self-Miners Deployed (LHS) Self-Mining EH/s (RHS) Dec-22 Aug-23 Apr-24 Dec-24 Aug-25 Apr-26 Dec-26 ADJUSTED EBITDA UNLEVERED FCF $700 $600 $547 $618 $600 $500 $450 $500 $400 $329 $300 $300 $208 $239 $175 $200 $146 $150 $104 $100 $- $- 2021 2022 2023 2024 2025 2026 2024 2025 2026 PROPRIETARY & CONFIDENTIAL 11

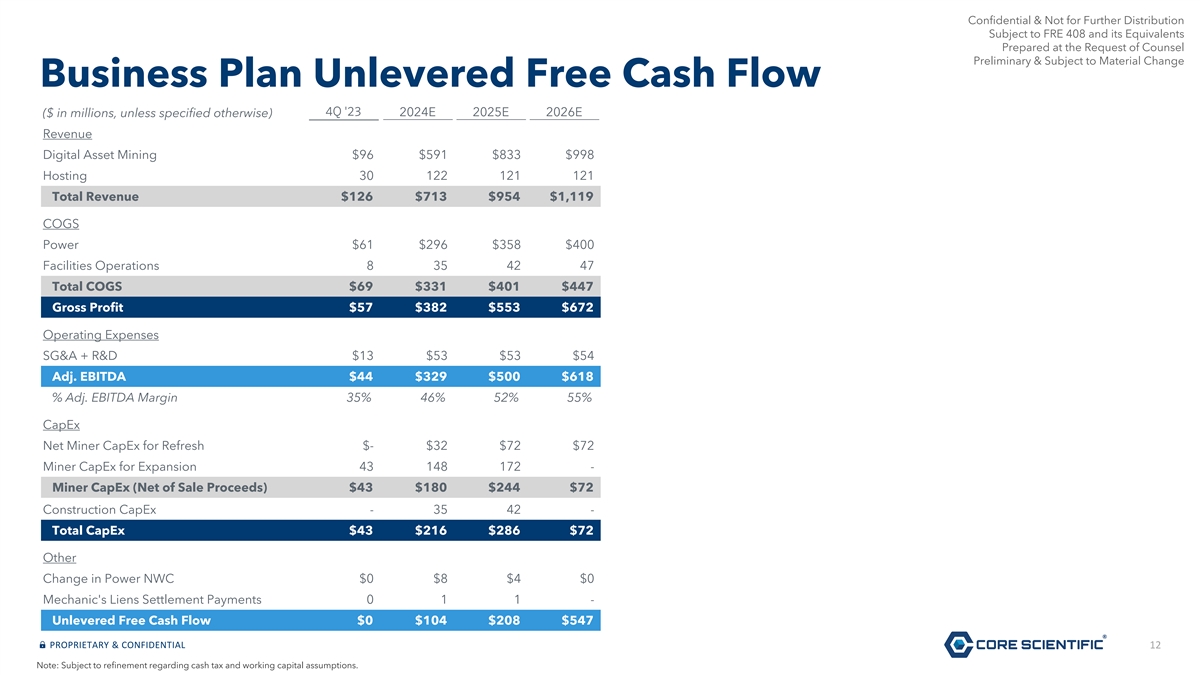

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Business Plan Unlevered Free Cash Flow 4Q '23 2023E 2024E 2025E 2026E ($ in millions, unless specified otherwise) Revenue Digital Asset Mining $366 $96 $591 $833 $998 Hosting 108 30 122 121 121 Total Revenue $126 $474 $713 $954 $1,119 COGS Power $243 $61 $296 $358 $400 Facilities Operations 32 8 35 42 47 Total COGS $275 $69 $331 $401 $447 Gross Profit $199 $57 $382 $553 $672 Operating Expenses SG&A + R&D $13 $53 $53 $53 $54 Adj. EBITDA $146 $44 $329 $500 $618 % Adj. EBITDA Margin 35% 31% 46% 52% 55% CapEx Net Miner CapEx for Refresh $- $- $32 $72 $72 Miner CapEx for Expansion 43 43 148 172 - Miner CapEx (Net of Sale Proceeds) $43 $43 $180 $244 $72 Construction CapEx - - 35 42 - Total CapEx $43 $43 $216 $286 $72 Other Change in Power NWC $0 $3 $8 $4 $0 Mechanic's Liens Settlement Payments 0 6 1 1 - Unlevered Free Cash Flow $94 $0 $104 $208 $547 PROPRIETARY & CONFIDENTIAL 12 Note: Subject to refinement regarding cash tax and working capital assumptions.

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Power Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change PROPRIETARY & CONFIDENTIAL 13

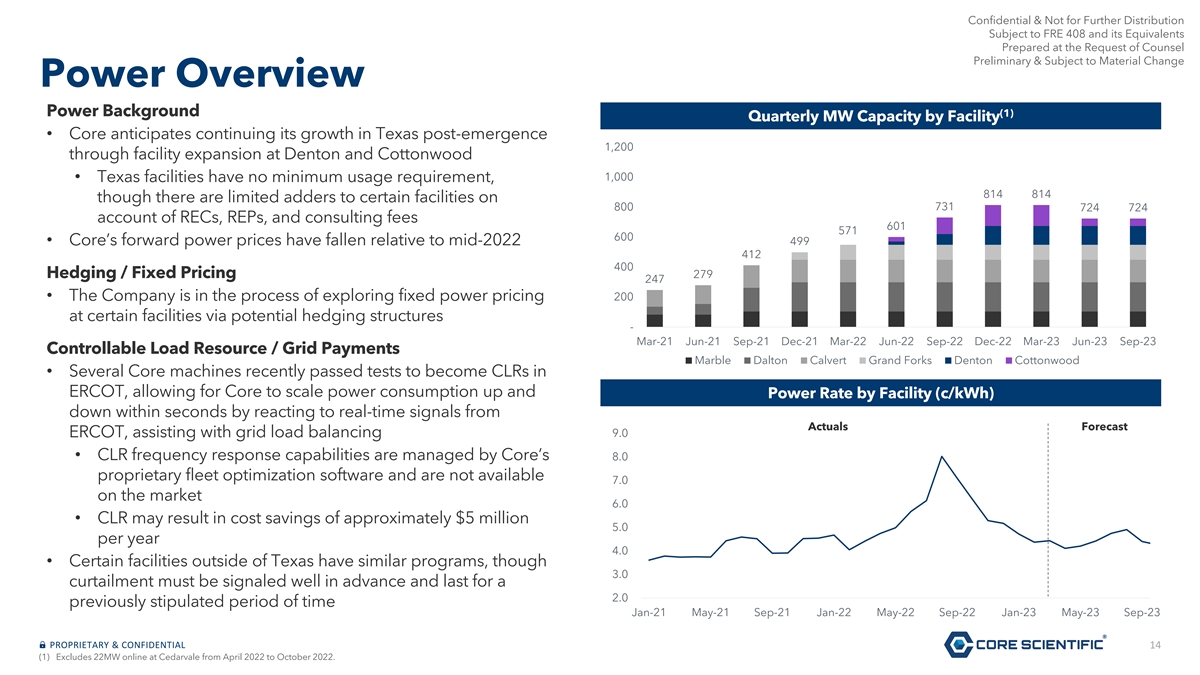

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Power Overview Power Background (1) Quarterly MW Capacity by Facility • Core anticipates continuing its growth in Texas post-emergence 1,200 through facility expansion at Denton and Cottonwood 1,000 • Texas facilities have no minimum usage requirement, 814 814 though there are limited adders to certain facilities on 731 800 724 724 account of RECs, REPs, and consulting fees 601 571 600 • Core’s forward power prices have fallen relative to mid-2022 499 412 400 Hedging / Fixed Pricing 279 247 • The Company is in the process of exploring fixed power pricing 200 at certain facilities via potential hedging structures - Mar-21 Jun-21 Sep-21 Dec-21 Mar-22 Jun-22 Sep-22 Dec-22 Mar-23 Jun-23 Sep-23 Controllable Load Resource / Grid Payments Marble Dalton Calvert Grand Forks Denton Cottonwood • Several Core machines recently passed tests to become CLRs in ERCOT, allowing for Core to scale power consumption up and Power Rate by Facility (c/kWh) down within seconds by reacting to real-time signals from Actuals Forecast ERCOT, assisting with grid load balancing 9.0 • CLR frequency response capabilities are managed by Core’s 8.0 proprietary fleet optimization software and are not available 7.0 on the market 6.0 • CLR may result in cost savings of approximately $5 million 5.0 per year 4.0 • Certain facilities outside of Texas have similar programs, though 3.0 curtailment must be signaled well in advance and last for a 2.0 previously stipulated period of time Jan-21 May-21 Sep-21 Jan-22 May-22 Sep-22 Jan-23 May-23 Sep-23 PROPRIETARY & CONFIDENTIAL 14 (1) Excludes 22MW online at Cedarvale from April 2022 to October 2022.

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Power Background by Facility Current Operational Capacity Facility Location Total Available Capacity (MW) Power Company (MW) Marble 1 Marble, NC 35 35 TVA-Murphy Power Marble 2 Marble, NC 69 69 Duke Carolinas Dalton Brown Dalton, GA 53 53 Dalton Utilities Dalton Green Dalton, GA 142 142 Dalton Utilities TVA Calvert Calvert City, KY 150 150 TVA Direct Grand Forks Grand Forks, ND 100 100 Minnkota / NoDak Denton Denton, TX 125 297 ERCOT (Supplier: City of Denton) Cottonwood Pecos, TX 50 234 ERCOT (Supplier: ENGIE) PROPRIETARY & CONFIDENTIAL 15

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Facility / Infrastructure CapEx Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change PROPRIETARY & CONFIDENTIAL 16

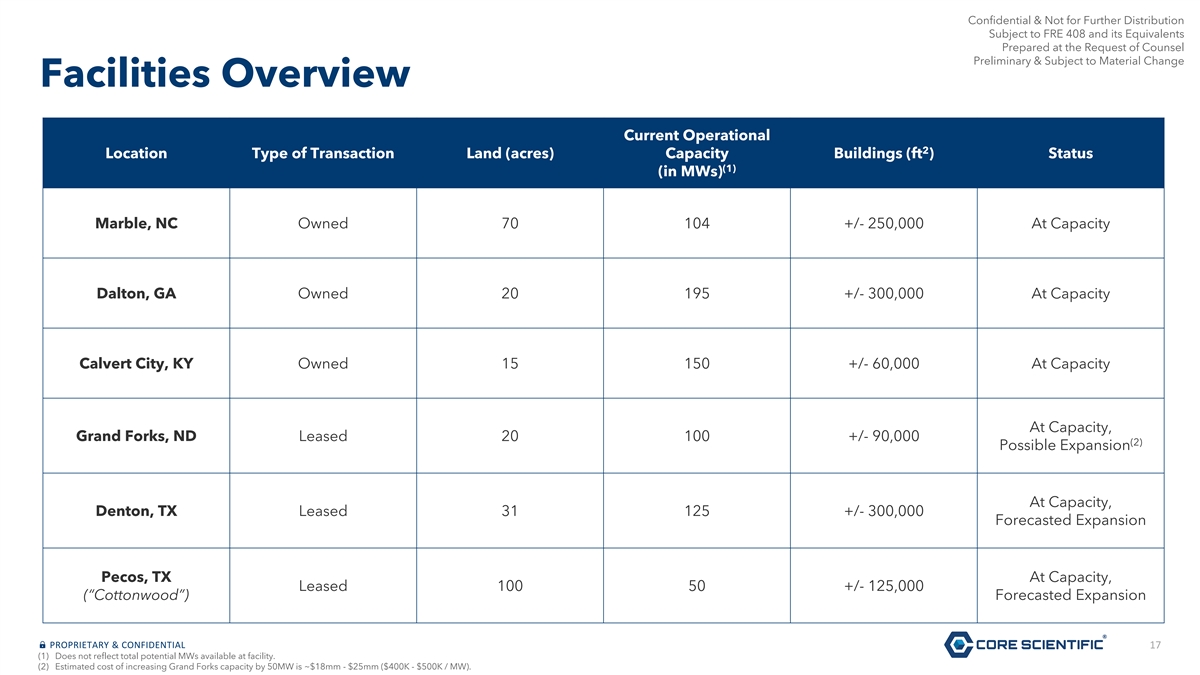

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Facilities Overview Current Operational 2 Location Type of Transaction Land (acres) Capacity Buildings (ft ) Status (1) (in MWs) Marble, NC Owned 70 104 +/- 250,000 At Capacity Dalton, GA Owned 20 195 +/- 300,000 At Capacity Calvert City, KY Owned 15 150 +/- 60,000 At Capacity At Capacity, Grand Forks, ND Leased 20 100 +/- 90,000 (2) Possible Expansion At Capacity, Denton, TX Leased 31 125 +/- 300,000 Forecasted Expansion Pecos, TX At Capacity, Leased 100 50 +/- 125,000 (“Cottonwood”) Forecasted Expansion PROPRIETARY & CONFIDENTIAL 17 (1) Does not reflect total potential MWs available at facility. (2) Estimated cost of increasing Grand Forks capacity by 50MW is ~$18mm - $25mm ($400K - $500K / MW).

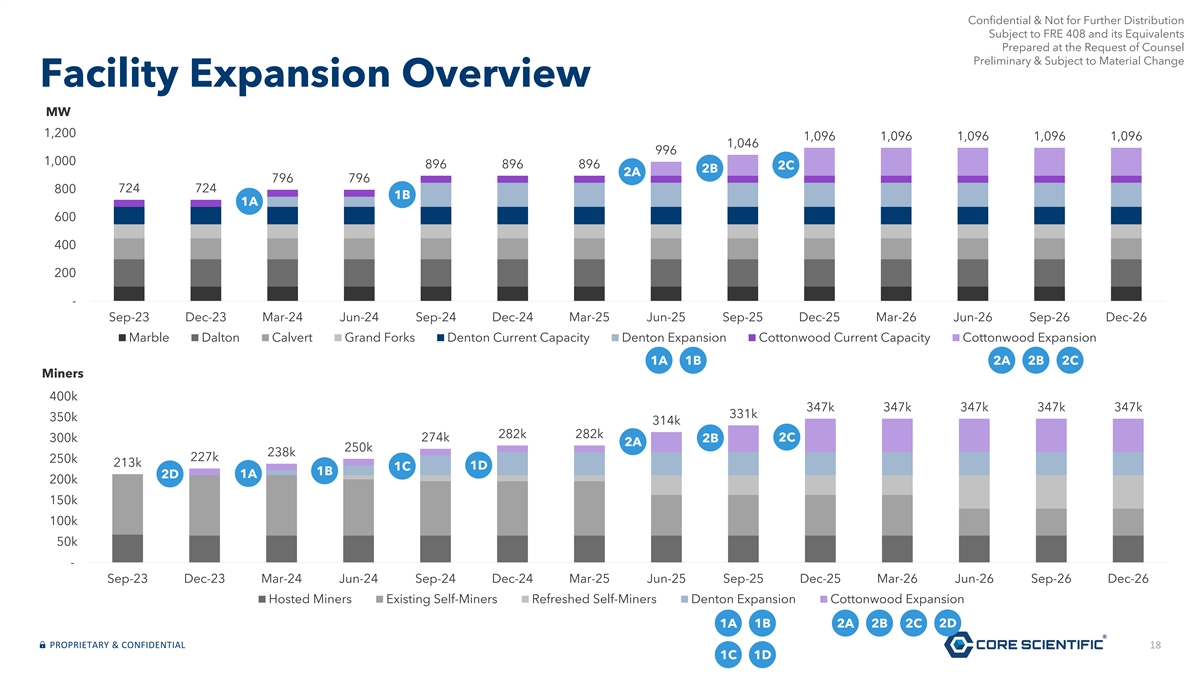

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Facility Expansion Overview MW 1,200 1,096 1,096 1,096 1,096 1,096 1,046 996 1,000 896 896 896 2C 2B 2A 796 796 724 724 800 1B 1A 600 400 200 - Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Mar-26 Jun-26 Sep-26 Dec-26 Marble Dalton Calvert Grand Forks Denton Current Capacity Denton Expansion Cottonwood Current Capacity Cottonwood Expansion 1A 1B 2A 2B 2C Miners 400k 347k 347k 347k 347k 347k 331k 350k 314k 282k 282k 274k 2C 300k 2B 2A 250k 238k 227k 250k 213k 1D 1C 1B 2D 1A 200k 150k 100k 50k - Sep-23 Dec-23 Mar-24 Jun-24 Sep-24 Dec-24 Mar-25 Jun-25 Sep-25 Dec-25 Mar-26 Jun-26 Sep-26 Dec-26 Hosted Miners Existing Self-Miners Refreshed Self-Miners Denton Expansion Cottonwood Expansion 1A 1B 2A 2B 2C 2D PROPRIETARY & CONFIDENTIAL 18 1C 1D

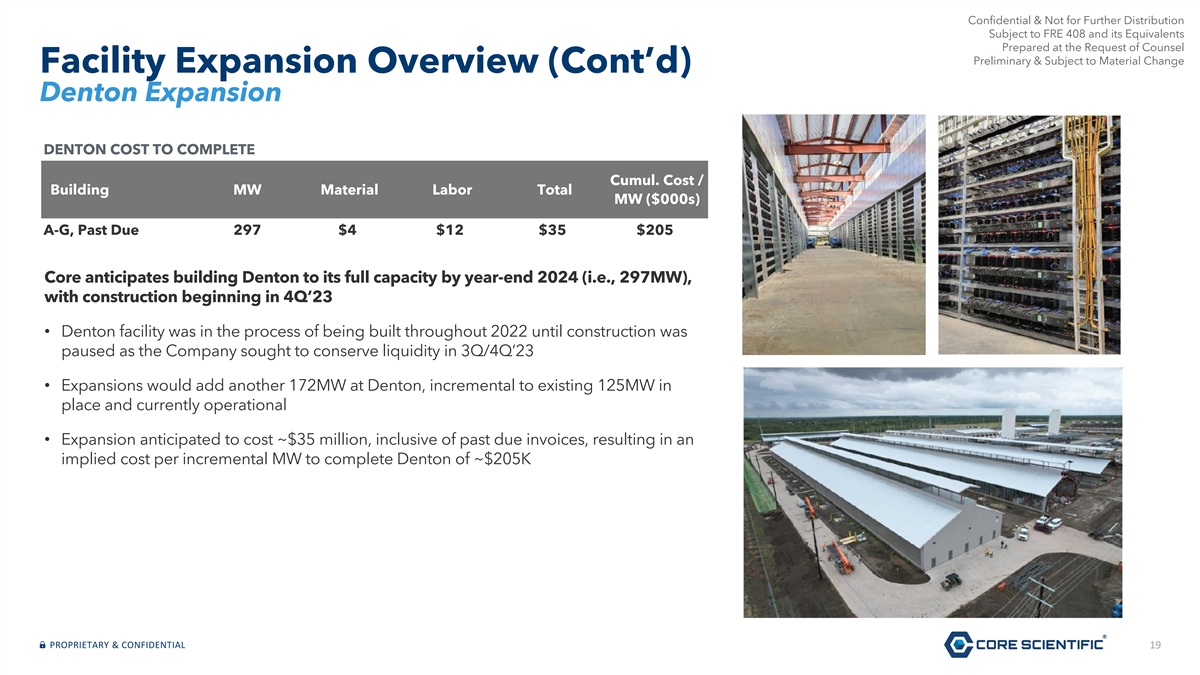

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Facility Expansion Overview (Cont’d) Denton Expansion DENTON COST TO COMPLETE % Cumul. Cost / Building MW Material Labor Total Complete MW ($000s) A-G, Past Due 297 $4 $12 $35 $205 Core anticipates building Denton to its full capacity by year-end 2024 (i.e., 297MW), with construction beginning in 4Q’23 • Denton facility was in the process of being built throughout 2022 until construction was paused as the Company sought to conserve liquidity in 3Q/4Q’23 • Expansions would add another 172MW at Denton, incremental to existing 125MW in place and currently operational • Expansion anticipated to cost ~$35 million, inclusive of past due invoices, resulting in an implied cost per incremental MW to complete Denton of ~$205K PROPRIETARY & CONFIDENTIAL 19

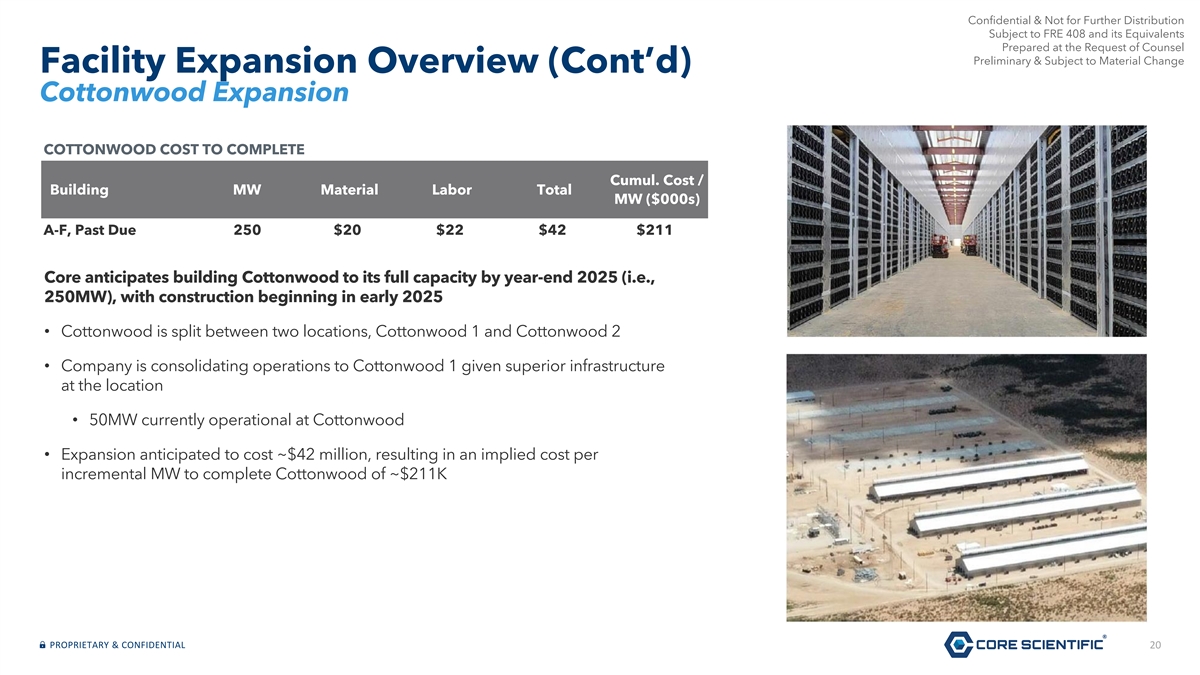

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Facility Expansion Overview (Cont’d) Cottonwood Expansion COTTONWOOD COST TO COMPLETE % Cumul. Cost / Building MW Material Labor Total Complete MW ($000s) A-F, Past Due 250 $20 $22 $42 $211 Core anticipates building Cottonwood to its full capacity by year-end 2025 (i.e., 250MW), with construction beginning in early 2025 • Cottonwood is split between two locations, Cottonwood 1 and Cottonwood 2 • Company is consolidating operations to Cottonwood 1 given superior infrastructure at the location • 50MW currently operational at Cottonwood • Expansion anticipated to cost ~$42 million, resulting in an implied cost per incremental MW to complete Cottonwood of ~$211K PROPRIETARY & CONFIDENTIAL 20

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Miner CapEx Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change PROPRIETARY & CONFIDENTIAL 21

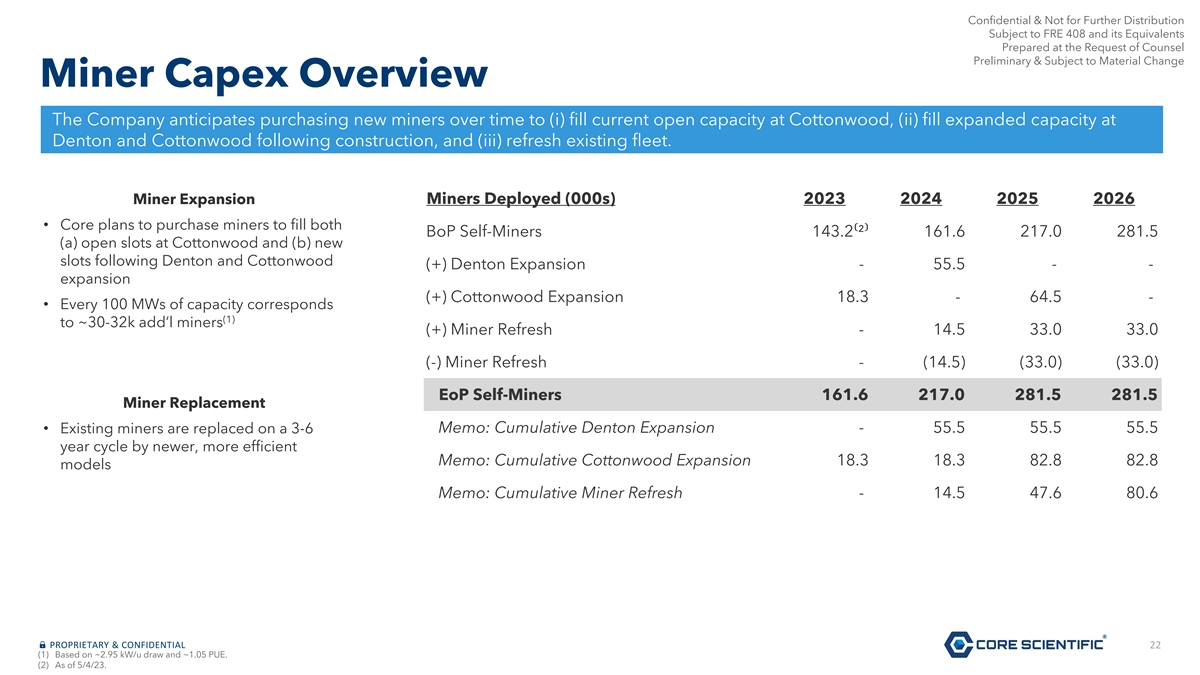

Confidential & Not for Further Distribution Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change Miner Capex Overview The Company anticipates purchasing new miners over time to (i) fill current open capacity at Cottonwood, (ii) fill expanded capacity at Denton and Cottonwood following construction, and (iii) refresh existing fleet. Miner Expansion Miners Deployed (000s) 2023 2024 2025 2026 • Core plans to purchase miners to fill both BoP Self-Miners 143.2⁽²⁾ 161.6 217.0 281.5 (a) open slots at Cottonwood and (b) new slots following Denton and Cottonwood (+) Denton Expansion - 55.5 - - expansion (+) Cottonwood Expansion 18.3 - 64.5 - • Every 100 MWs of capacity corresponds (1) to ~30-32k add’l miners (+) Miner Refresh - 14.5 33.0 33.0 (-) Miner Refresh - (14.5) (33.0) (33.0) EoP Self-Miners 161.6 217.0 281.5 281.5 Miner Replacement Memo: Cumulative Denton Expansion - 55.5 55.5 55.5 • Existing miners are replaced on a 3-6 year cycle by newer, more efficient Memo: Cumulative Cottonwood Expansion 18.3 18.3 82.8 82.8 models Memo: Cumulative Miner Refresh - 14.5 47.6 80.6 PROPRIETARY & CONFIDENTIAL 22 (1) Based on ~2.95 kW/u draw and ~1.05 PUE. (2) As of 5/4/23.

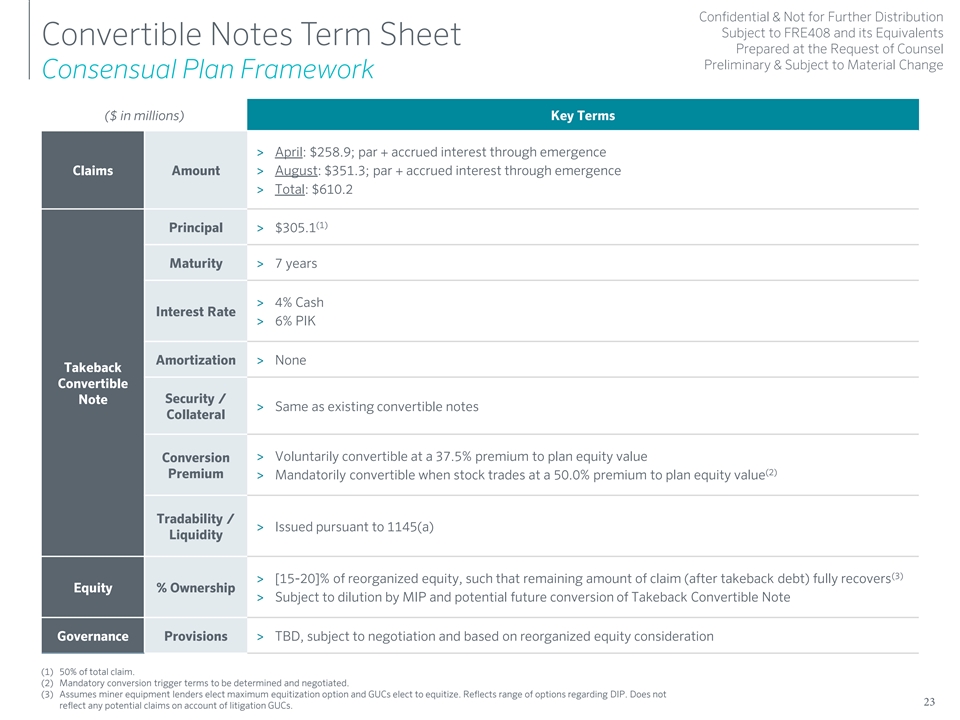

Confidential & Not for Further Distribution Subject to FRE408 and its Equivalents Convertible Notes Term Sheet Prepared at the Request of Counsel Preliminary & Subject to Material Change Consensual Plan Framework ($ in millions) Key Terms > April: $258.9; par + accrued interest through emergence > August: $351.3; par + accrued interest through emergence Claims Amount > Total: $610.2 (1) Principal > $305.1 Maturity > 7 years > 4% Cash Interest Rate > 6% PIK Amortization > None Takeback Convertible Security / Note > Same as existing convertible notes Collateral > Voluntarily convertible at a 37.5% premium to plan equity value Conversion (2) Premium > Mandatorily convertible when stock trades at a 50.0% premium to plan equity value Tradability / > Issued pursuant to 1145(a) Liquidity (3) > [15-20]% of reorganized equity, such that remaining amount of claim (after takeback debt) fully recovers Equity % Ownership > Subject to dilution by MIP and potential future conversion of Takeback Convertible Note Governance Provisions > TBD, subject to negotiation and based on reorganized equity consideration (1) 50% of total claim. (2) Mandatory conversion trigger terms to be determined and negotiated. (3) Assumes miner equipment lenders elect maximum equitization option and GUCs elect to equitize. Reflects range of options regarding DIP. Does not 23 reflect any potential claims on account of litigation GUCs.