INVESTOR PRESENTATION

Published on October 10, 2025

Exhibit 1

© All rights reserved. Two Seas Capital LP A FLAWED PROCESS, A DEFICIENT STRUCTURE AND AN INADEQUATE PRICE INVESTOR PRESENTATION TWO SEAS CAPITAL LP OCTOBER 2025 STOCKHOLDERS SHOULD VOTE AGAINST THE PROPOSED ACQUISITION OF CORE SCIENTIFIC

© All rights reserved. Two Seas Capital LP TABLE OF CONTENTS INVESTOR PRESENTATION PAGE 3 Executive Summary 01 PAGE 14 The Board’s Deal Process and Negotiations Were Egregious 02 PAGE 25 The Transaction Structure Is Deficient 03 PAGE 35 The Merger Significantly Undervalues Core Scientific 04 PAGE 50 Core Scientific Has Tremendous Value as an Independent Company 05 PAGE 65 Conclusion 06 PAGE 71 Appendices 07

© All rights reserved. Two Seas Capital LP EXECUTIVE SUMMARY SECTION 01

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION About Two Seas Capital SECTION 01: EXECUTIVE SUMMARY 4 ▪ Two Seas Capital (“Two Seas Capital”, “we” or “us”) is an alternative investment management firm based in Rye, New York ▪ We seek to generate outsized, uncorrelated returns by investing in securities that we believe are mispriced ▪ We have been a committed investor in, and staunch advocate of, Core Scientific, Inc. (“Core Scientific” or the “Company”) sin ce 2022 — We were early members of the ad hoc equity committee, supported the Company's emergence from bankruptcy by joining in the rig hts offering in early 2024, participated in both convertible note issuances, and have grown our equity stake over the past 18 mon ths ▪ Today, we beneficially own approximately 6.5% of Core Scientific’s outstanding shares, making us one of the Company’s largest st ockholders — We also own a meaningful position in CoreWeave, Inc. (“CoreWeave”) — We are confident that both Core Scientific and CoreWeave have an opportunity to create long - term value for stockholders ▪ We are not an activist fund and prefer to engage constructively and privately with the companies we own ▪ However, because we believe strongly that the proposed merger with CoreWeave (the “Merger” or the “Proposed Merger”) signific ant ly undervalues Core Scientific, we are compelled to bring our concerns directly to our fellow stockholders and publicly advocate ag ainst this suboptimal transaction

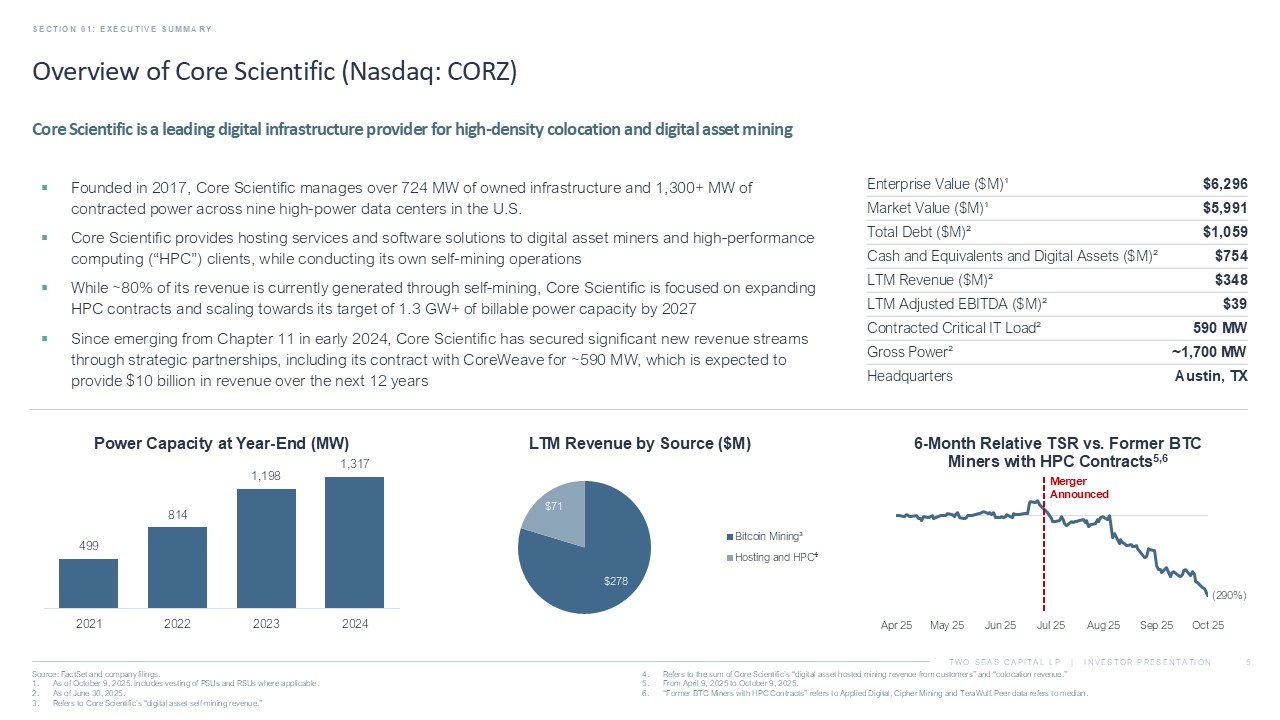

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Overview of Core Scientific (Nasdaq: CORZ) SECTION 01: EXECUTIVE SUMMARY 5 Source: FactSet and company filings. 1. As of October 9, 2025. 2. As of June 30, 2025. 3. Refers to Core Scientific’s “digital asset self - mining revenue.” 4. Refers to the sum of Core Scientific’s “digital asset hosted mining revenue from customers” and “colocation revenue.” 5. From April 9, 2025 to October 9, 2025. 6. “Former BTC Miners with HPC Contracts” refers to Applied Digital, Cipher Mining and TeraWulf . Peer data refers to median. ▪ Founded in 2017, Core Scientific manages over 724 MW of owned infrastructure and 1,300+ MW of contracted power across nine high - power data centers in the U.S. ▪ Core Scientific provides hosting services and software solutions to digital asset miners and high - performance computing (“HPC”) clients, while conducting its own self - mining operations ▪ While ~80% of its revenue is currently generated through self - mining, Core Scientific is focused on expanding HPC contracts and scaling towards its target of 1.3 GW+ of billable power capacity by 2027 ▪ Since emerging from Chapter 11 in early 2024, Core Scientific has secured significant new revenue streams through strategic partnerships, including its contract with CoreWeave for ~590 MW, which is expected to provide $10 billion in revenue over the next 12 years Core Scientific is a leading digital infrastructure provider for high - density colocation and digital asset mining $6,296 Enterprise Value ($M)¹ $5,991 Market Value ($M)¹ $1,059 Total Debt ($M)² $754 Cash and Equivalents and Digital Assets ($M)² $348 LTM Revenue ($M)² $39 LTM Adjusted EBITDA ($M)² 875 MW Billable Power Load² 1,335 MW Gross Power² Austin, TX Headquarters $278 $71 LTM Revenue by Source ($M) Bitcoin Mining³ Hosting and HPC ⁴ 499 814 1,198 1,317 2021 2022 2023 2024 Power Capacity at Year - End (MW) (290%) Apr 25 May 25 Jun 25 Jul 25 Aug 25 Sep 25 Oct 25 6 - Month Relative TSR vs. Former BTC Miners with HPC Contracts 5,6 Merger Announced

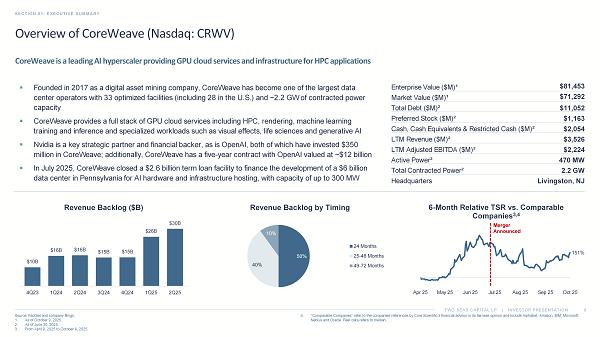

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Overview of CoreWeave (Nasdaq: CRWV) SECTION 01: EXECUTIVE SUMMARY 6 Source: FactSet and company filings. 1. As of October 9, 2025. 2. As of June 30, 2025. 3. From April 9, 2025 to October 9, 2025. 4. “Comparable Companies” refer to the companies references by Core Scientific’s financial advisor in its fairness opinion and i ncl ude Alphabet, Amazon, IBM, Microsoft, Nebius and Oracle. Peer data refers to median. CoreWeave is a leading AI hyperscaler providing GPU cloud services and infrastructure for HPC applications ▪ Founded in 2017 as a digital asset mining company, CoreWeave has become one of the largest data center operators with 33 optimized facilities (including 28 in the U.S.) and ~2.2 GW of contracted power capacity ▪ CoreWeave provides a full stack of GPU cloud services including HPC, rendering, machine learning training and inference and specialized workloads such as visual effects, life sciences and generative AI ▪ Nvidia is a key strategic partner and financial backer, as is OpenAI, both of which have invested $350 million in CoreWeave; additionally, CoreWeave has a five - year contract with OpenAI valued at ~$12 billion ▪ In July 2025, CoreWeave closed a $2.6 billion term loan facility to finance the development of a $6 billion data center in Pennsylvania for AI hardware and infrastructure hosting, with capacity of up to 300 MW $81,453 Enterprise Value ($M)¹ $71,292 Market Value ($M)¹ $11,052 Total Debt ($M)² $1,163 Preferred Stock ($M)² $2,054 Cash, Cash Equivalents & Restricted Cash ($M)² $3,526 LTM Revenue ($M)² $2,224 LTM Adjusted EBITDA ($M)² 470 MW Active Power² 2.2 GW Total Contracted Power² Livingston, NJ Headquarters $10B $16B $16B $15B $15B $26B $30B 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 Revenue Backlog ($B) 50% 40% 10% Revenue Backlog by Timing 24 Months 25-48 Months 49-72 Months 151% Apr 25 May 25 Jun 25 Jul 25 Aug 25 Sep 25 Oct 25 6 - Month Relative TSR vs. Comparable Companies 3,4 Merger Announced

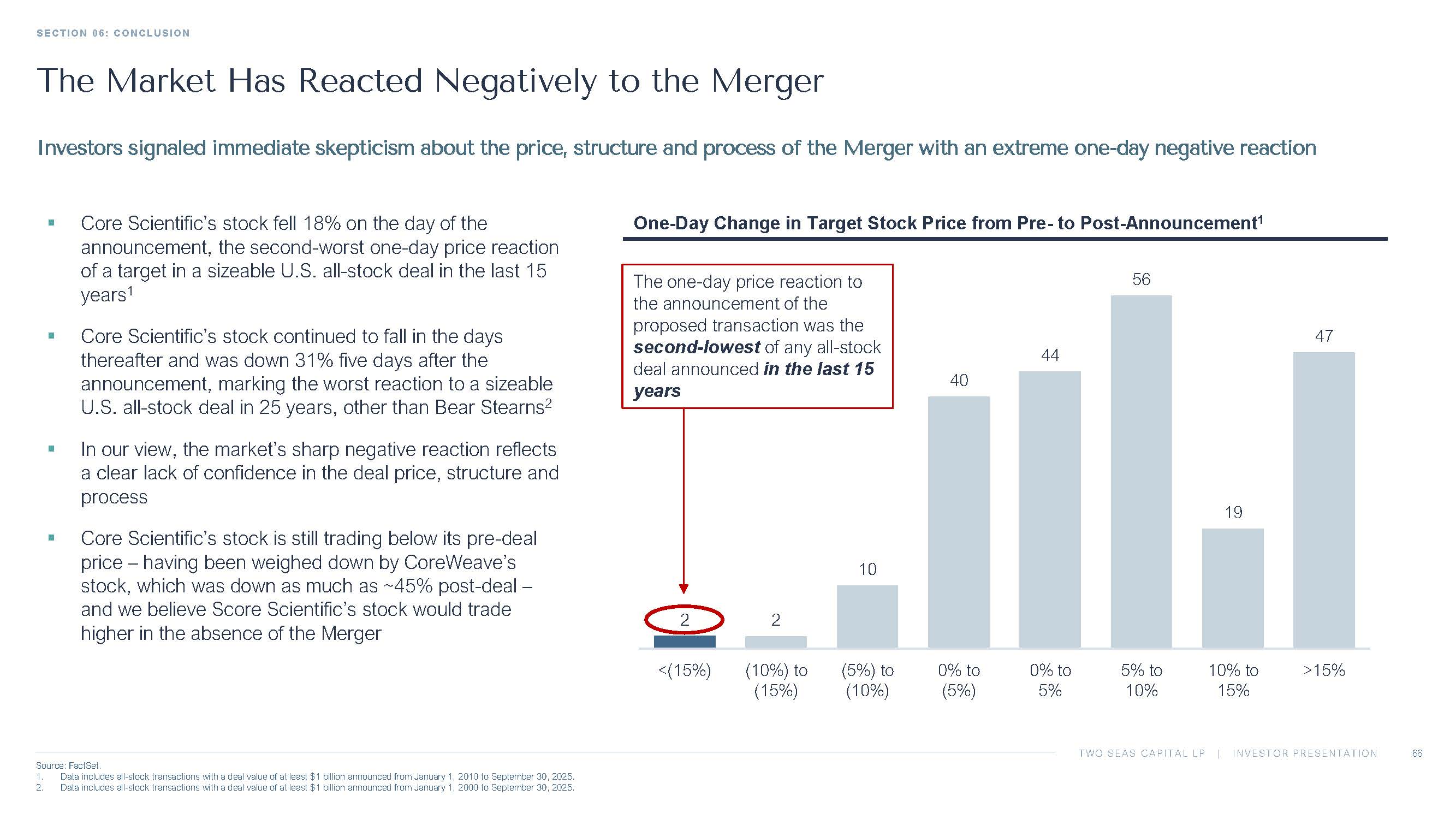

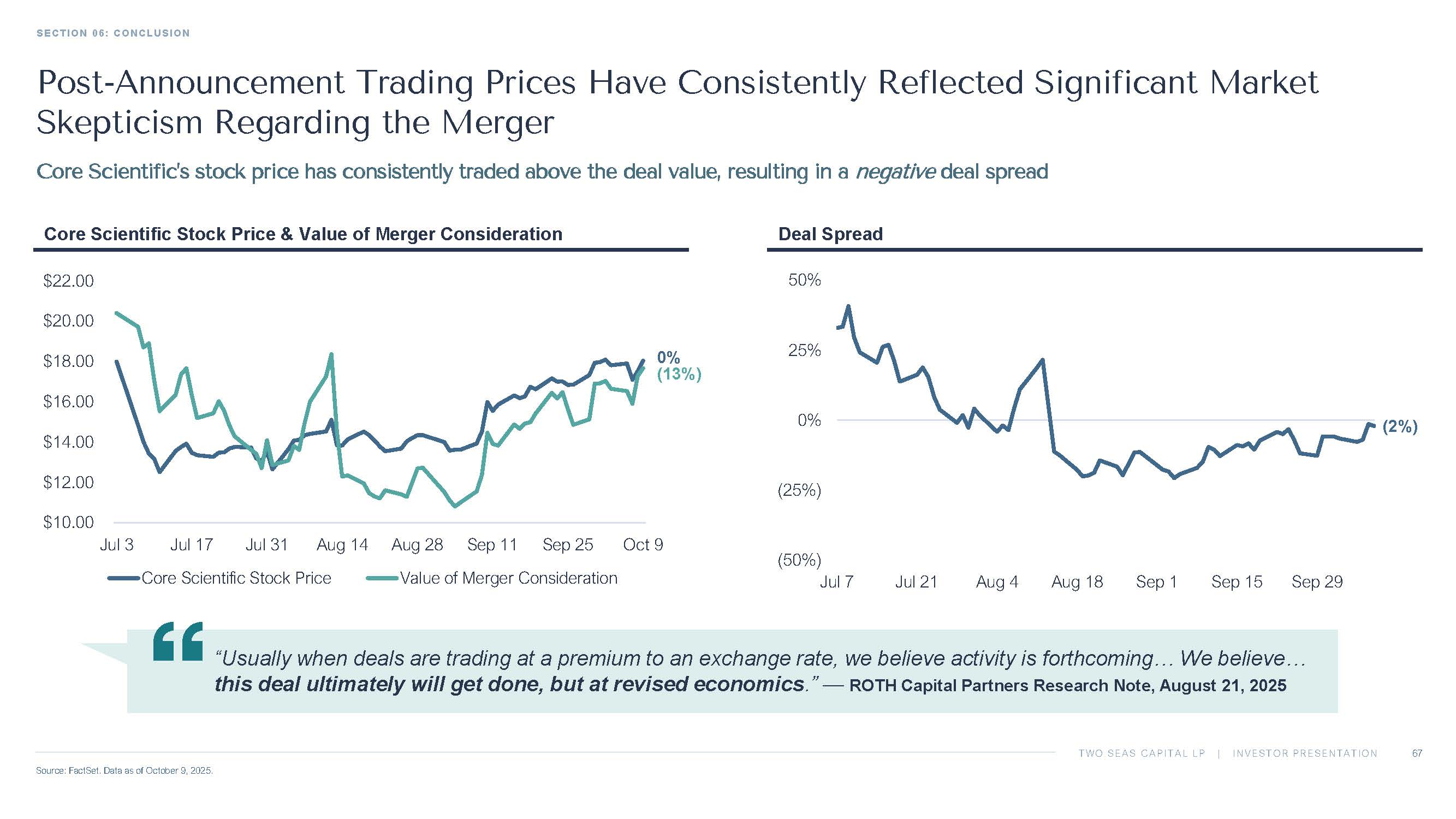

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Overview of the Merger SECTION 01: EXECUTIVE SUMMARY 7 Source: FactSet and Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 1. As of July 3, 2025, the last trading day prior to the announcement of the Merger. 2. As of October 9, 2025. July 7, 2025 Announcement Date October 30, 2025 Special Meeting Date 0.1235 shares of CoreWeave common stock for each share of Core Scientific common stock All - Stock Consideration Today 2 : $17.67 per share At Announcement 1 : $20.40 per share Value of Consideration Closing Price Day Prior to Rumors: 44% Closing Price Day Prior to Announcement: (2%) 52 - Week High Prior to Rumors: (3%) Transaction Premia / Discount Based on Current Value of Consideration 2 30 Days After: (22%) 45 Days After: (23%) Today 2 : 0% Day After Announcement: (18%) Five Days After: (31%) 15 Days After: (25%) Change in Core Scientific Stock Price None Price Protection (Collar, Floating Ratio, etc.) Minimum: (21%) (September 4, 2025) 30 - Day Average: (8%) Today 2 : (2%) Deal Spread (Value of Consideration divided by Core Scientific Stock Price) Majority of the outstanding shares of Core Scientific Common Stock Required Approvals

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Merger as Proposed Should Not Be Supported SECTION 01: EXECUTIVE SUMMARY 8 1. Core Scientific Press Release, July 7, 2025. 2. As of October 9, 2025. We urge Core Scientific stockholders to vote the GOLD proxy card AGAINST the Merger Proposals The Price Is Inadequate The Structure Is Deficient The Process Was Flawed ▪ The initial headline deal price of $20.40 per share 1 undervalued Core Scientific’s intrinsic value and strategic value to CoreWeave ▪ After the Merger announcement, CoreWeave’s stock price tumbled by as much as ~45% and remains down ~15% today, following one of the worst post - deal drawdowns in an acquirer’s stock price since 2020; the current deal value of less than $18 per share 2 reflects a take - under of Core Scientific ▪ Valuation multiples of peer companies and precedent transactions imply a ~30 - 100% higher value for Core Scientific than the current deal value ▪ Core Scientific’s stock has consistently traded meaningfully higher than the deal value and could trade significantly higher still, in our view, if the Merger is rejected, as recent HPC transactions have led to a dramatic increase in valuations across the sector ▪ Despite CoreWeave's stock being extremely volatile and appreciating by more than 300% between CoreWeave’s March 2025 IPO and the deal announcement, the Core Scientific Board agreed to an all - stock, fixed exchange ratio structure, with no downside protection ▪ This structure left Core Scientific stockholders fully exposed to one of the most volatile stocks in the market, with a then - looming lock - up expiration that was expected to weigh on CoreWeave’s stock ▪ The Board should have insisted on appropriate protections against one of the most volatile merger currencies ever used in an M&A transaction, but instead caused Core Scientific stockholders to suffer through the extreme fluctuations and value erosion in CoreWeave’s stock that have ensued since the Merger was announced ▪ Core Scientific’s Board of Directors (the “Board”) dealt exclusively with CoreWeave, forgoing any proactive outreach or a competitive process, and agreed to a “no - shop” provision despite Core Scientific’s highly attractive assets and strategic value ▪ Deal negotiations consisted of a single counter before the Board accepted a modest 1% bump in the exchange ratio, with the entire process lasting little more than a month ▪ The Board reversed its policy on accelerated vesting of executive equity awards and tax gross - ups worth $180 million, potentially incentivizing management to close a deal over maximizing stockholder value ▪ The Board relied on a flawed fairness opinion, predicated on an excessive discount rate, overly conservative projections of future growth and inappropriate assumptions – lowering the value reference range by ~35% GOLD

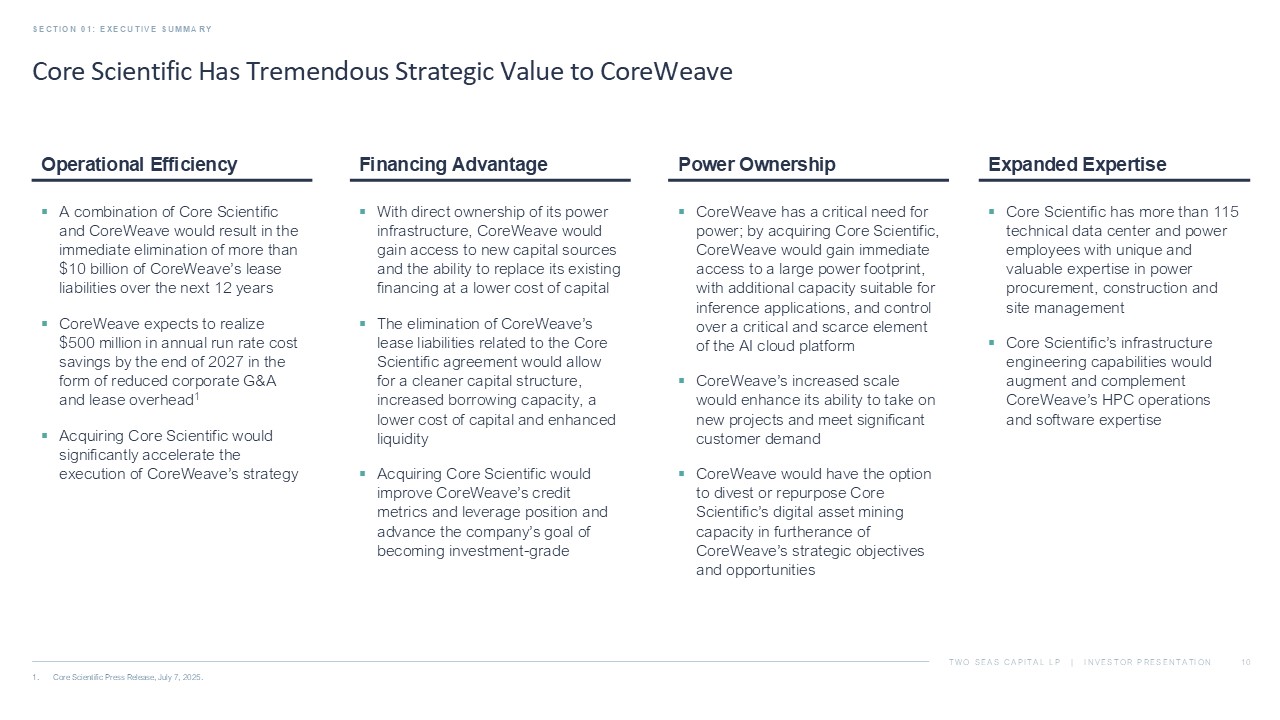

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific Has Tremendous Strategic Value to CoreWeave SECTION 01: EXECUTIVE SUMMARY 9 1. Core Scientific Press Release, July 7, 2025. Expanded Expertise Power Ownership Financing Advantage Operational Efficiency ▪ Core Scientific has more than 115 technical data center and power employees with unique and valuable expertise in power procurement, construction and site management ▪ Core Scientific’s infrastructure engineering capabilities would augment and complement CoreWeave’s HPC operations and software expertise ▪ CoreWeave has a critical need for power; by acquiring Core Scientific, CoreWeave would gain immediate access to a large power footprint, with additional capacity suitable for inference applications, and control over a critical and scarce element of the AI cloud platform ▪ CoreWeave’s increased scale would enhance its ability to take on new projects and meet significant customer demand ▪ CoreWeave would have the option to divest or repurpose Core Scientific’s digital asset mining capacity in furtherance of CoreWeave’s strategic objectives and opportunities ▪ With direct ownership of its power infrastructure, CoreWeave would gain access to new capital sources and the ability to replace its existing financing at a lower cost of capital ▪ The elimination of CoreWeave’s lease liabilities related to the Core Scientific agreement would allow for a cleaner capital structure, increased borrowing capacity, a lower cost of capital and enhanced liquidity ▪ Acquiring Core Scientific would improve CoreWeave’s credit metrics and leverage position and advance the company’s goal of becoming investment - grade ▪ A combination of Core Scientific and CoreWeave would result in the immediate elimination of more than $10 billion of CoreWeave’s lease liabilities over the next 12 years ▪ CoreWeave expects to realize $500 million in annual run rate cost savings by the end of 2027 in the form of reduced corporate G&A and lease overhead 1 ▪ Acquiring Core Scientific would significantly accelerate the execution of CoreWeave’s strategy

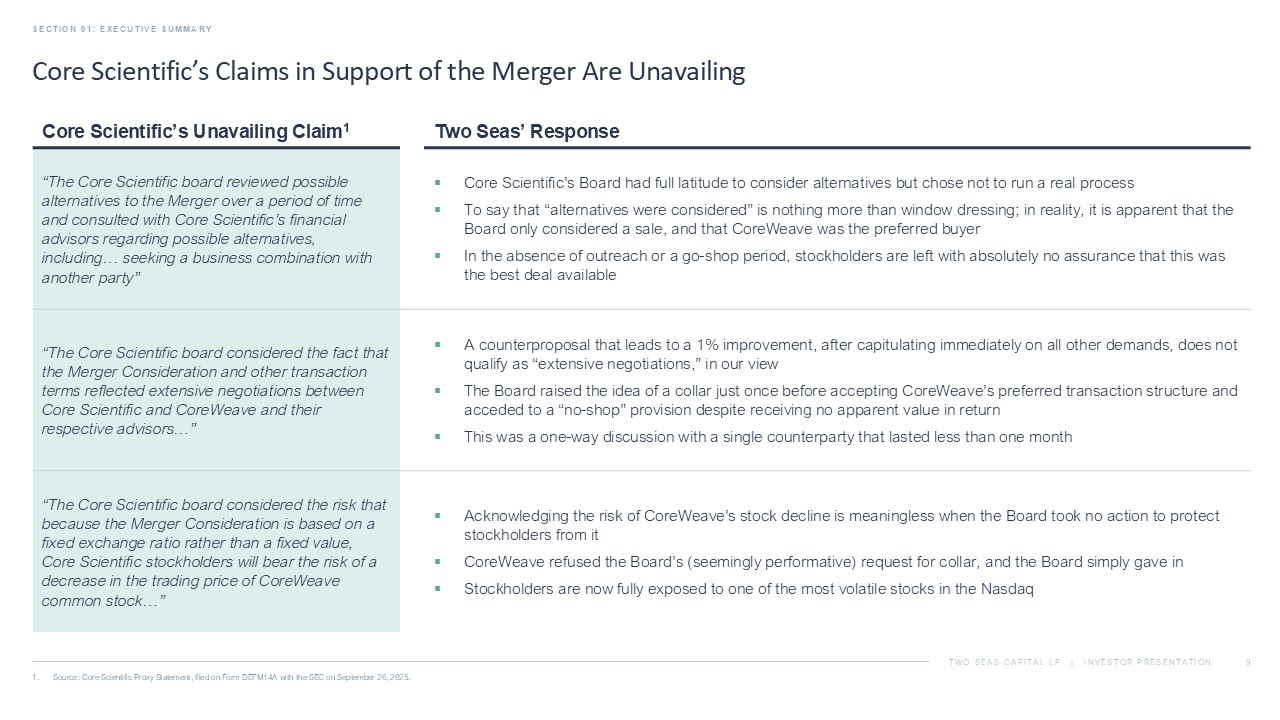

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific’s Claims in Support of the Merger Are Unavailing SECTION 01: EXECUTIVE SUMMARY 10 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. Two Seas’ Response Core Scientific’s Unavailing Claim 1 ▪ Core Scientific’s Board had full latitude to consider alternatives but chose not to run a real process ▪ To say that “alternatives were considered” is nothing more than window dressing; in reality, it is apparent that the Board only considered a sale, and that CoreWeave was the preferred buyer ▪ In the absence of outreach or a go - shop period, stockholders are left with absolutely no assurance that this was the best deal available “The Core Scientific board reviewed possible alternatives to the Merger over a period of time and consulted with Core Scientific’s financial advisors regarding possible alternatives, including… seeking a business combination with another party” ▪ A counterproposal that leads to a 1% improvement, after capitulating immediately on all other demands, does not qualify as “extensive negotiations,” in our view ▪ The Board raised the idea of a collar just once before accepting CoreWeave’s preferred transaction structure and acceded to a “no - shop” provision despite receiving no apparent value in return ▪ This was a one - way discussion with a single counterparty that lasted less than one month “The Core Scientific board considered the fact that the Merger Consideration and other transaction terms reflected extensive negotiations between Core Scientific and CoreWeave and their respective advisors…” ▪ Acknowledging the risk of CoreWeave’s stock decline is meaningless when the Board took no action to protect stockholders from it ▪ CoreWeave refused the Board’s (seemingly performative) request for collar, and the Board simply gave in ▪ Stockholders are now fully exposed to one of the most volatile stocks in the Nasdaq “The Core Scientific board considered the risk that because the Merger Consideration is based on a fixed exchange ratio rather than a fixed value, Core Scientific stockholders will bear the risk of a decrease in the trading price of CoreWeave common stock…”

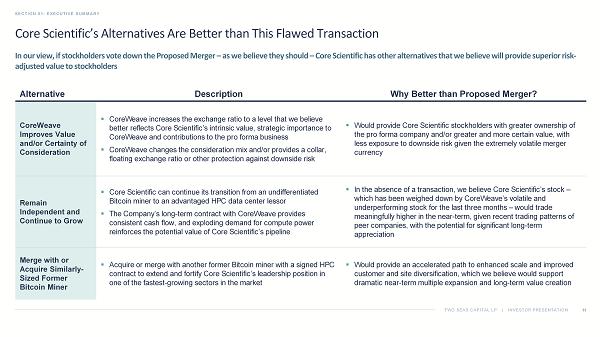

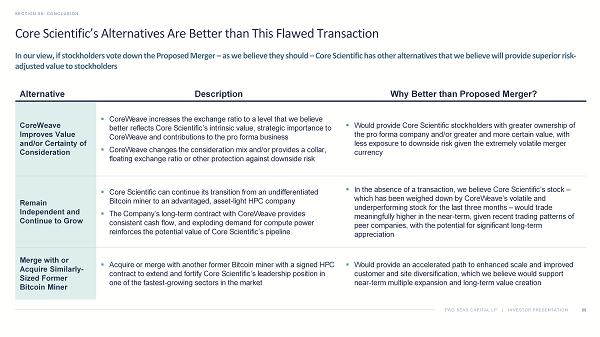

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific’s Alternatives Are Better than This Flawed Transaction SECTION 01: EXECUTIVE SUMMARY 11 In our view, if stockholders vote down the Proposed Merger – as we believe they should – Core Scientific has other alternatives that we believe will provide superior risk - adjusted value to stockholders Why Better than Proposed Merger? Description Alternative ▪ Would provide Core Scientific stockholders with greater ownership of the pro forma company and/or greater and more certain value, with less exposure to downside risk given the extremely volatile merger currency ▪ CoreWeave increases the exchange ratio to a level that we believe better reflects Core Scientific’s intrinsic value, strategic importance to CoreWeave and contributions to the pro forma business ▪ CoreWeave changes the consideration mix and/or provides a collar, floating exchange ratio or other protection against downside risk CoreWeave Improves Value and/or Certainty of Consideration ▪ In the absence of a transaction, we believe Core Scientific’s stock – which has been weighed down by CoreWeave’s volatile and underperforming stock for the last three months – would trade meaningfully higher in the near - term, given recent trading patterns of peer companies, with the potential for significant long - term appreciation ▪ Core Scientific can continue its transition from an undifferentiated Bitcoin miner to an advantaged HPC data center lessor ▪ The Company’s long - term contract with CoreWeave provides consistent cash flow, and exploding demand for compute power reinforces the potential value of Core Scientific’s pipeline Remain Independent and Continue to Grow ▪ Would provide an accelerated path to enhanced scale and improved customer and site diversification, which we believe would support dramatic near - term multiple expansion and long - term value creation ▪ Acquire or merge with another former Bitcoin miner with a signed HPC contract to extend and fortify Core Scientific’s leadership position in one of the fastest - growing sectors in the market Merge with or Acquire Similarly - Sized Former Bitcoin Miner

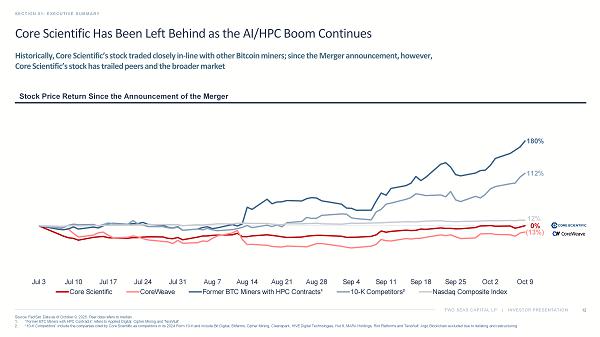

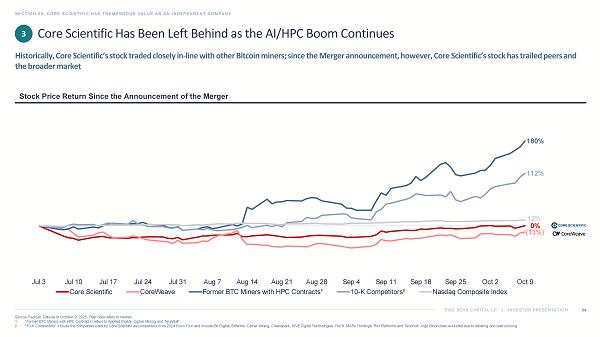

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific Has Been Left Behind as the AI/ HPC Boom Continues SECTION 01: EXECUTIVE SUMMARY 12 Source: FactSet. Data as of October 9, 2025. Peer data refers to median. 1. “Former BTC Miners with HPC Contracts” refers to Applied Digital, Cipher Mining and TeraWulf . 2. “10 - K Competitors” include the companies cited by Core Scientific as competitors in its 2024 Form 10 - K and include Bit Digital, Bitfarms, Cipher Mining, Cleanspark , HIVE Digital Technologies, Hut 8, MARA Holdings, Riot Platforms and TeraWulf . Argo Blockchain excluded due to delisting and restructuring. Historically, Core Scientific’s stock traded closely in - line with other Bitcoin miners; since the Merger announcement, however, Core Scientific’s stock has trailed peers and the broader market Stock Price Return Since the Announcement of the Merger 0% (13%) 180% 112% 12% Jul 3 Jul 10 Jul 17 Jul 24 Jul 31 Aug 7 Aug 14 Aug 21 Aug 28 Sep 4 Sep 11 Sep 18 Sep 25 Oct 2 Oct 9 Core Scientific CoreWeave Former BTC Miners with HPC Contracts¹ 10-K Competitors² Nasdaq Composite Index

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 01: EXECUTIVE SUMMARY 13 Source: FactSet. Data as of October 9, 2025. Stock price data assumes Core Scientific trades in - line with the peer group median. 1. “Former BTC Miners with HPC Contracts” refers to Applied Digital, Cipher Mining and TeraWulf . 2. “10 - K Competitors” include the companies cited by Core Scientific as competitors in its 2024 Form 10 - K and include Bit Digital, Bitfarms, Cipher Mining, Cleanspark , HIVE Digital Technologies, Hut 8, MARA Holdings, Riot Platforms and TeraWulf . Argo Blockchain excluded due to delisting and restructuring. We Believe Core Scientific Will Trade Higher If the Merger Is Rejected Core Scientific Illustrative Stock Price Based on Stock Price Appreciation of Benchmarks Implied Upside +166% +112% +258% +180% From Current Stock Price +171% +116% +264% +186% From Current Value of Merger Consideration In the absence of a transaction, we believe Core Scientific’s stock would trade meaningfully higher, in - line with peers, with wh ich its returns have historically been strongly correlated $50.45 $38.10 $17.67 $18.04 $64.37 $47.82 Implied Value of Merger Consideration Core Scientific Stock Price Today Former BTC Miners with HPC Contracts¹ 10-K Competitors² Since Merger Announcement Since Unaffected Date

© All rights reserved. Two Seas Capital LP THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS SECTION 02

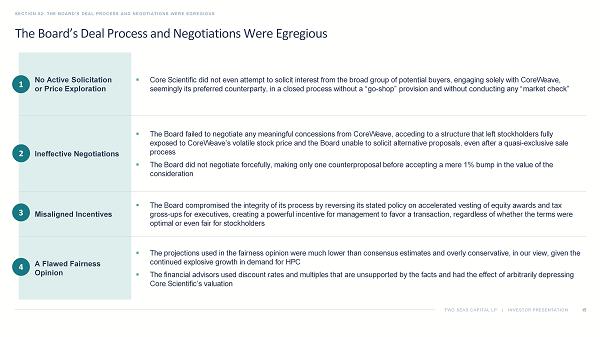

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Board’s Deal Process and Negotiations Were Egregious SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 15 ▪ Core Scientific did not even attempt to solicit interest from the broad group of potential buyers, engaging solely with CoreW eav e, seemingly its preferred counterparty, in a closed process without a “go - shop” provision and without conducting any “market check ” No Active Solicitation or Price Exploration ▪ The Board failed to negotiate any meaningful concessions from CoreWeave, acceding to a structure that left stockholders fully exposed to CoreWeave’s volatile stock price and the Board unable to solicit alternative proposals, even after a quasi - exclusive sale process ▪ The Board did not negotiate forcefully, making only one counterproposal before accepting a mere 1% bump in the value of the consideration Ineffective Negotiations ▪ The Board compromised the integrity of its process by reversing its stated policy on accelerated vesting of equity awards and ta x gross - ups for executives, creating a powerful incentive for management to favor a transaction, regardless of whether the terms w ere optimal or even fair for stockholders Misaligned Incentives ▪ The projections used in the fairness opinion were much lower than consensus estimates and overly conservative, in our view, g ive n the continued explosive growth in demand for HPC ▪ The financial advisors used discount rates and multiples that are unsupported by the facts and had the effect of arbitrarily dep ressing Core Scientific’s valuation A Flawed Fairness Opinion 1 2 4 3

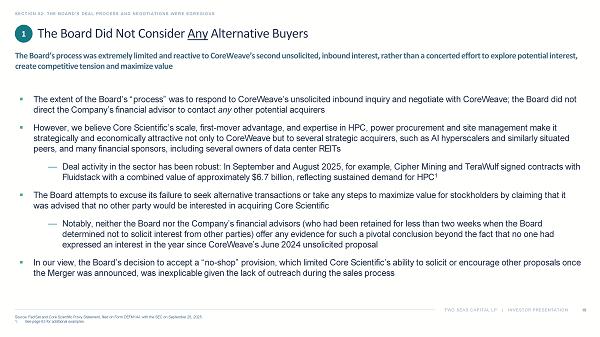

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Board Did Not Consider Any Alternative Buyers SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 16 Source: FactSet and Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 1. See page 63 for additional examples. ▪ The extent of the Board’s “process” was to respond to CoreWeave’s unsolicited inbound inquiry and negotiate with CoreWeave; t he Board did not direct the Company’s financial advisor to contact any other potential acquirers ▪ However, we believe Core Scientific’s scale, first - mover advantage, and expertise in HPC, power procurement and site management make it strategically and economically attractive not only to CoreWeave but to several strategic acquirers, such as AI hyperscalers and similarly situated peers, and many financial sponsors, including several owners of data center REITs — Deal activity in the sector has been robust: In September and August 2025, for example, Cipher Mining and TeraWulf signed contracts with Fluidstack with a combined value of approximately $6.7 billion, reflecting sustained demand for HPC 1 ▪ The Board attempts to excuse its failure to seek alternative transactions or take any steps to maximize value for stockholder s b y claiming that it was advised that no other party would be interested in acquiring Core Scientific — Notably, neither the Board nor the Company’s financial advisors (who had been retained for less than two weeks when the Board determined not to solicit interest from other parties) offer any evidence for such a pivotal conclusion beyond the fact that no one had expressed an interest in the year since CoreWeave’s June 2024 unsolicited proposal ▪ In our view, the Board’s decision to accept a “no - shop” provision, which limited Core Scientific’s ability to solicit or encoura ge other proposals once the Merger was announced, was inexplicable given the lack of outreach during the sales process The Board’s process was extremely limited and reactive to CoreWeave’s second unsolicited, inbound interest, rather than a con cer ted effort to explore potential interest, create competitive tension and maximize value 1

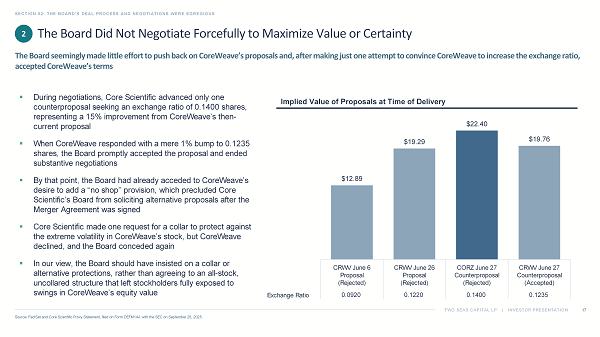

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Board Did Not Negotiate Forcefully to Maximize Value or Certainty SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 17 Source: FactSet and Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. The Board seemingly made little effort to push back on CoreWeave’s proposals and, after making just one attempt to convince C ore Weave to increase the exchange ratio, accepted CoreWeave’s terms ▪ During negotiations, Core Scientific advanced only one counterproposal seeking an exchange ratio of 0.1400 shares, representing a 15% improvement from CoreWeave’s then - current proposal ▪ When CoreWeave responded with a mere 1% bump to 0.1235 shares, the Board promptly accepted the proposal and ended substantive negotiations ▪ By that point, the Board had already acceded to CoreWeave’s desire to add a “no shop” provision, which precluded Core Scientific’s Board from soliciting alternative proposals after the Merger Agreement was signed ▪ Core Scientific made one request for a collar to protect against the extreme volatility in CoreWeave’s stock, but CoreWeave declined, and the Board conceded again ▪ In our view, the Board should have insisted on a collar or alternative protections, rather than agreeing to an all - stock, uncollared structure that left stockholders fully exposed to swings in CoreWeave’s equity value Implied Value of Proposals at Time of Delivery Exchange Ratio $12.89 $19.29 $22.40 $19.76 CRWV June 6 Proposal (Rejected) CRWV June 26 Proposal (Rejected) CORZ June 27 Counterproposal (Rejected) CRWV June 27 Counterproposal (Accepted) 0.0920 0.1220 0.1400 0.1235 2

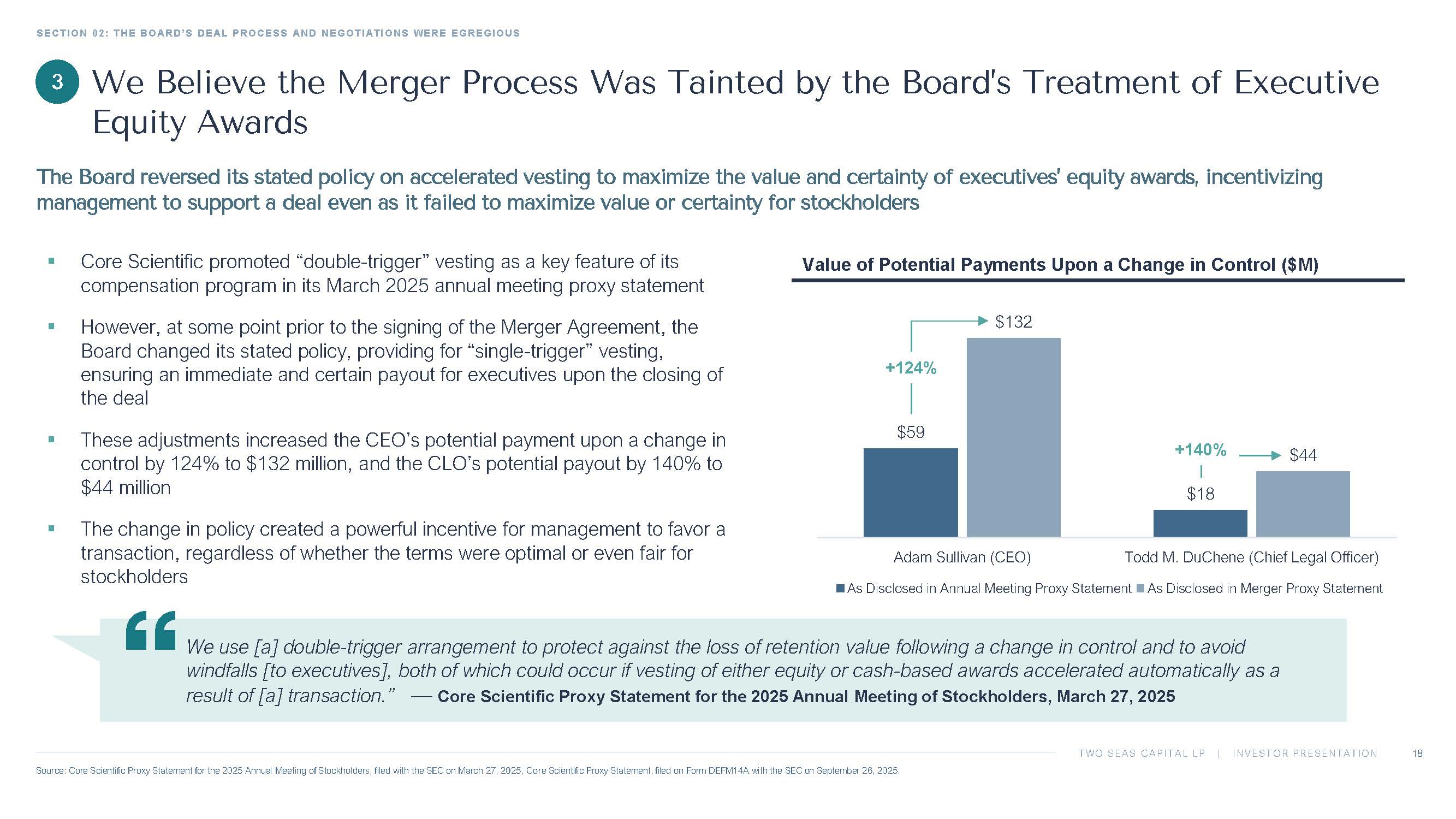

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 18 Source: Core Scientific Proxy Statement for the 2025 Annual Meeting of Stockholders, filed with the SEC on March 27, 2025, Co re Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. We Believe the Merger Process Was Tainted by the Board’s Treatment of Executive Equity Awards The Board reversed its stated policy on accelerated vesting to maximize the value and certainty of executives’ equity awards, in centivizing management to support a deal even as it failed to maximize value or certainty for stockholders ▪ Core Scientific promoted “double - trigger” vesting as a key feature of its compensation program in its March 2025 annual meeting proxy statement ▪ However, at some point prior to the signing of the Merger Agreement, the Board changed its stated policy, providing for “single - trigger” vesting, ensuring an immediate and certain payout for executives upon the closing of the deal ▪ These adjustments increased the CEO’s potential payment upon a change in control by 124% to $132 million, and the CLO’s potential payout by 140% to $44 million ▪ The change in policy created a powerful incentive for management to favor a transaction, regardless of whether the terms were optimal or even fair for stockholders Value of Potential Payments Upon a Change in Control ($M) $59 $18 $132 $44 Adam Sullivan (CEO) Todd M. DuChene (Chief Legal Officer) As Disclosed in Annual Meeting Proxy Statement As Disclosed in Merger Proxy Statement +124% +140% 3 We use [a] double - trigger arrangement to protect against the loss of retention value following a change in control and to avoid windfalls [to executives], both of which could occur if vesting of either equity or cash - based awards accelerated automatically as a result of [a] transaction.” — Core Scientific Proxy Statement for the 2025 Annual Meeting of Stockholders, March 27, 2025

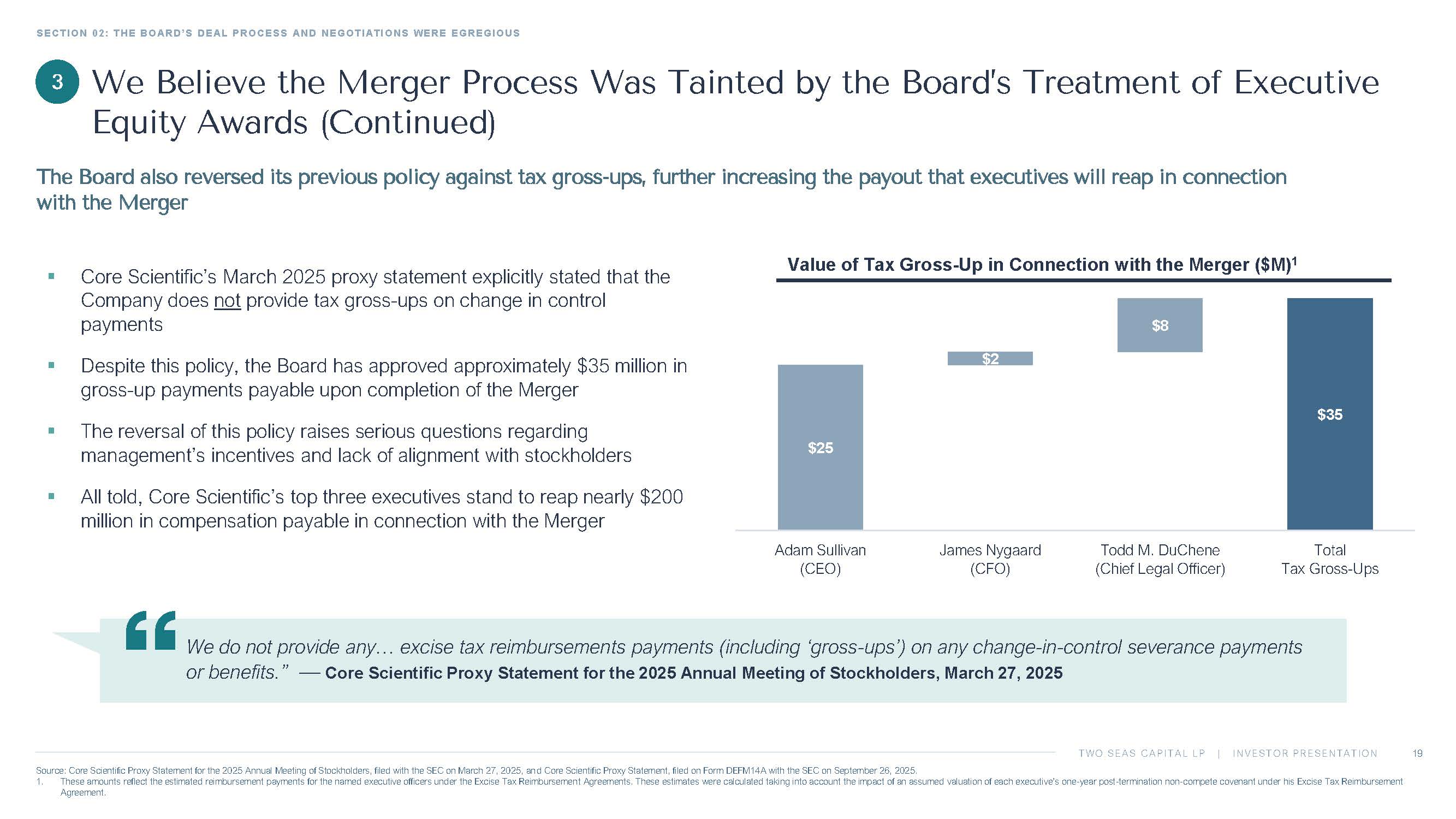

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 19 Source: Core Scientific Proxy Statement for the 2025 Annual Meeting of Stockholders, filed with the SEC on March 27, 2025, an d C ore Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 1. These amounts reflect the estimated reimbursement payments for the named executive officers under the Excise Tax Reimbursemen t A greements. These estimates were calculated taking into account the impact of an assumed valuation of each executive’s one - year p ost - termination non - compete covenant under his Excise Tax Reimbursement Agreement. We Believe the Merger Process Was Tainted by the Board’s Treatment of Executive Equity Awards (Continued) The Board also reversed its previous policy against tax gross - ups, further increasing the payout that executives will reap in co nnection with the Merger 3 We do not provide any… excise tax reimbursements payments (including ‘gross - ups’) on any change - in - control severance payments or benefits.” — Core Scientific Proxy Statement for the 2025 Annual Meeting of Stockholders, March 27, 2025 Value of Tax Gross - Up in Connection with the Merger ($M) 1 $25 $2 $8 $35 Adam Sullivan (CEO) James Nygaard (CFO) Todd M. DuChene (Chief Legal Officer) Total Tax Gross-Ups ▪ Core Scientific’s March 2025 proxy statement explicitly stated that the Company does not provide tax gross - ups on change in control payments ▪ Despite this policy, the Board has approved approximately $35 million in gross - up payments payable upon completion of the Merger ▪ The reversal of this policy raises serious questions regarding management’s incentives and lack of alignment with stockholders ▪ All told, Core Scientific’s top three executives stand to reap nearly $200 million in compensation payable in connection with the Merger

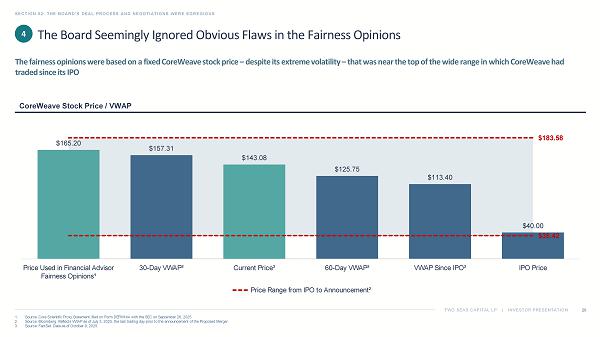

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 20 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 2. Source: Bloomberg. Reflects VWAP as of July 3, 2025, the last trading day prior to the announcement of the Proposed Merger 3. Source: FactSet. Data as of October 9, 2025. The Board Seemingly Ignored Obvious Flaws in the Fairness Opinions CoreWeave Stock Price / VWAP The fairness opinions were based on a fixed CoreWeave stock price – despite its extreme volatility – that was near the top of th e wide range in which CoreWeave had traded since its IPO 4 $165.20 $157.31 $143.08 $125.75 $113.40 $40.00 $35.42 $183.58 Price Used in Financial Advisor Fairness Opinions¹ 30-Day VWAP² Current Price³ 60-Day VWAP² VWAP Since IPO² IPO Price Price Range from IPO to Announcement²

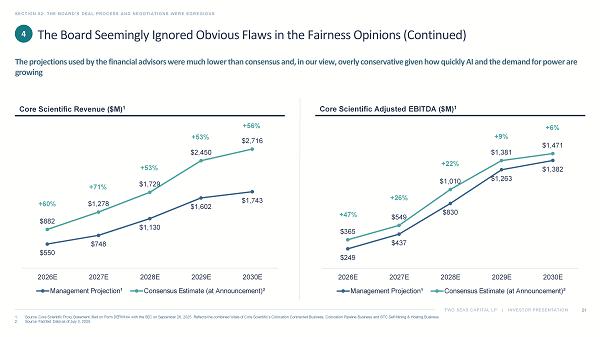

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 21 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. Reflects the combined tota ls of Core Scientific’s Colocation Contracted Business, Colocation Pipeline Business and BTC Self Mining & Hosting Business. 2. Source: FactSet. Data as of July 3, 2025. Core Scientific Adjusted EBITDA ($M) 1 Core Scientific Revenue ($M) 1 4 The Board Seemingly Ignored Obvious Flaws in the Fairness Opinions (Continued) The projections used by the financial advisors were much lower than consensus and, in our view, overly conservative given how qu ickly AI and the demand for power are growing $249 $437 $830 $1,263 $1,382 $365 $549 $1,010 $1,381 $1,471 2026E 2027E 2028E 2029E 2030E Management Projection¹ Consensus Estimate (at Announcement)² $550 $748 $1,130 $1,602 $1,743 $882 $1,278 $1,729 $2,450 $2,716 2026E 2027E 2028E 2029E 2030E Management Projection¹ Consensus Estimate (at Announcement)² +60% +71% +53% +53% +56% +47% +26% +22% +9% +6%

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION 24% 38% 34% 4% 1% 2% 3% 3% 3% 4% 2027E 2028E 2029E 2030E 2031E 2032E 2033E 2034E 2035E 2036E YoY Revenue Growth Rate for Colocation Contracted Business 3 SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 22 1. Source: Core Scientific Investor Day Presentation, June 12, 2024. 2. Source: Core Scientific Investor Presentation, May 7, 2025. 3. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 4 Management indicated in June 2024 that its HPC power would be fully energized by 2027 1 … …and reaffirmed this expectation in its Q1 2025 earnings presentation 2 … …but is now seemingly projecting that it will not reach steady - state revenue until 2030 Ramp Up Steady - State I’m even more confident than I was just two months ago in our ability to hit 590 megawatts by early 2027 .” — Adam Sullivan , CEO; May 7, 2025 The Board Seemingly Ignored Obvious Flaws in the Fairness Opinions (Continued) Core Scientific’s financial projections appear to indicate a much slower power delivery and revenue ramp from the CoreWeave c ont racted business than the Company repeatedly communicated to investors

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 23 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 2. Source: Bloomberg. Data as of October 9, 2025. Based on the weighted average of the midpoints of the yield to convention bid/ ask spread on the two issuances. 3. Estimated based on average blended yield of Compass Data Centers, EdgeCore and eStructure ABS issuances in July 2025. CoreWeave Cost of Debt / Discount Rate for Core Scientific Colocation Contracted Business 4 ▪ Core Scientific’s Colocation Contracted Business ( i.e. , its hosting contract with CoreWeave) has a very low risk profile and could be regarded as a debt - like cash flow stream to Core Scientific — In a sense, the hosting contract carries even less risk than CoreWeave’s debt; Core Scientific’s data center capacity is integral to CoreWeave’s business, and CoreWeave is unlikely to “default” on the contract and risk being unable to fulfill its obligations to its customers ▪ Therefore, we see no reason why this contracted revenue stream should be regarded as riskier than CoreWeave’s debt, especially given that the ultimate counterparties – CoreWeave’s customers, like Microsoft, Meta and IBM – are among the most credit - worthy companies in the world — Accordingly, we believe it is reasonable to assume a discount rate for this business that is equivalent to the cost of CoreWeave’s secured debt if CoreWeave were able to raise debt against the data centers it is building for Core Scientific; we estimate that cost of debt to be approximately 5.6% based on the yield of comparable recent data center backed issuances 2 ▪ However, to be conservative, we use a discount rate in our analyses that reflects the yield on CoreWeave’s unsecured debt (approximately 8.3%) 3 ▪ In all events, we do not believe there is any justification for using a discount rate of 10% or more on what is essentially a CoreWeave debt obligation The Board Seemingly Ignored Obvious Flaws in the Fairness Opinions (Continued) The financial advisors assumed an excessive discount rate for Core Scientific’s Colocation Contracted Business that was much hig her than CoreWeave’s cost of debt, lowering Core Scientific’s DCF value 8.5% to 13% 10% to 12% ~8.3% ~5.6% Moelis Discount Rate¹ PJT Discount Rate¹ Yield on CoreWeave Unsecured Debt² Yield on CoreWeave Secured Debt³

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 02: THE BOARD’S DEAL PROCESS AND NEGOTIATIONS WERE EGREGIOUS 24 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 4 High End of Moelis’ Valuation Reference Range 1 Low End of Moelis’ Valuation Reference Range 1 17.8x 16.0x 14.0x 12.0x 2026E 2027E Lowest Valuation Multiple Low End of Moelis' Valuation Reference Range 20.7x 19.6x 20.0x 18.0x 2026E 2027E Highest Valuation Multiple High End of Moelis' Valuation Reference Range - 21% - 25% - 3% - 8% The Board Seemingly Ignored Obvious Flaws in the Fairness Opinions (Continued) Moelis arbitrarily lowered the valuation reference range for its comparable companies analysis, making the value of the Merge r c onsideration look better than it was

© All rights reserved. Two Seas Capital LP THE TRANSACTION STRUCTURE IS DEFICIENT SECTION 03

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Transaction Structure Is Deficient SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 26 ▪ The all - stock transaction and fixed exchange ratio have left Core Scientific stockholders fully exposed to fluctuations in CoreWeave’s stock, which has been one of the most volatile of any Nasdaq - listed company since its IPO and one of the most volatile merger currencies of the last 25 years ▪ The volatility of CoreWeave’s stock is an order of magnitude higher than that of a typical acquirer using its stock as curren cy, reinforcing the need for greater certainty and stockholder protection No Value Certainty ▪ In addition to the extreme volatility of CoreWeave’s stock price, the elevated levels at which the stock traded during deal negotiations, the heavy short interest in the stock and the then - looming lock - up expiration all supported the inclusion of reaso nable protections for Core Scientific’s stockholders ▪ A floating exchange ratio, collar or cash component should have been non - negotiable for Core Scientific if the Board was focused on maximizing value and certainty No Downside Protection ▪ The risk of a material decline in the value of the Merger consideration was evident and seemingly well understood by the Core Scientific Board, as well as sell - side analysts ▪ However, the Board made little effort to mitigate these risks and agreed to a transaction structure that predictably harmed C ore Scientific stockholders No Risk Mitigation 1 2 3

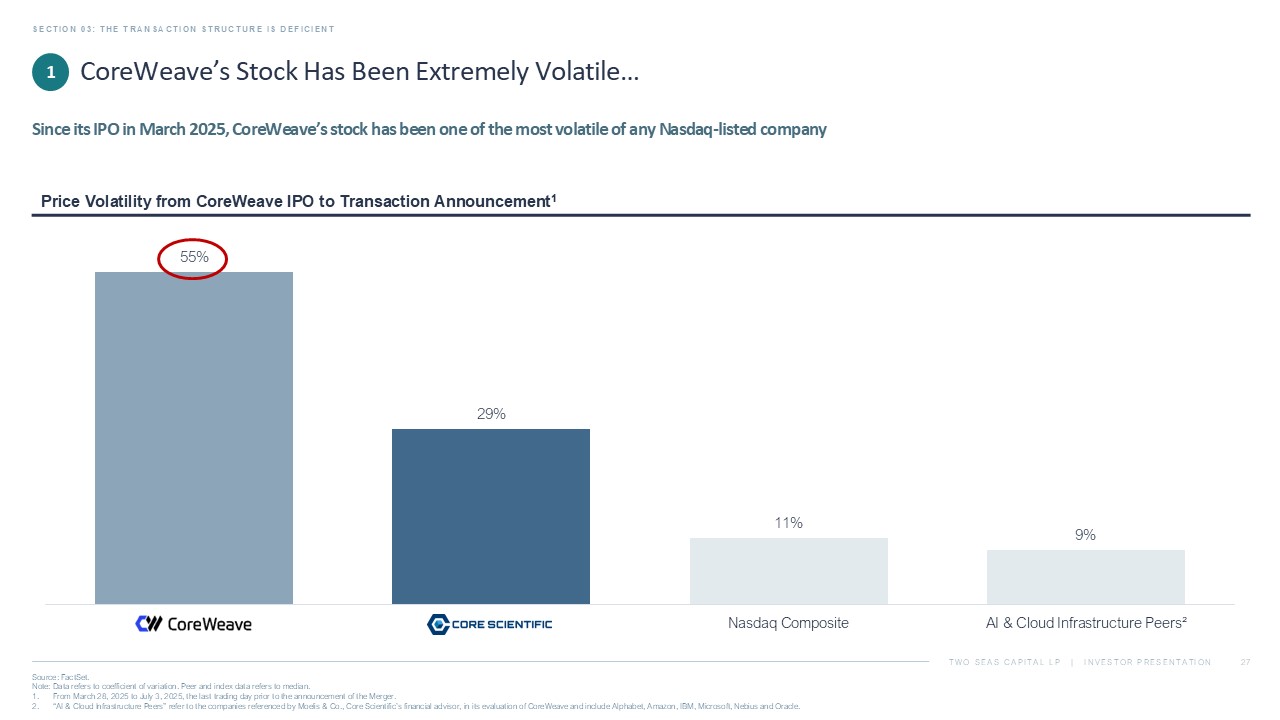

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION CoreWeave’s Stock Has Been Extremely Volatile… SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 27 Source: FactSet. Note: Peer and index data refers to median. 1. From March 28, 2025 to July 3, 2025, the last trading day prior to the announcement of the Merger. 2. “AI & Cloud Infrastructure Peers” refer to the companies referenced by Moelis & Co., Core Scientific’s financial advisor, in its evaluation of CoreWeave and include Alphabet, Amazon, IBM, Microsoft, Nebius and Oracle. Since its IPO in March 2025, CoreWeave’s stock has been one of the most volatile of any Nasdaq - listed company Annualized Price Volatility from CoreWeave IPO to Transaction Announcement 1 1 55% 29% 11% 9% Nasdaq Composite AI & Cloud Infrastructure Peers²

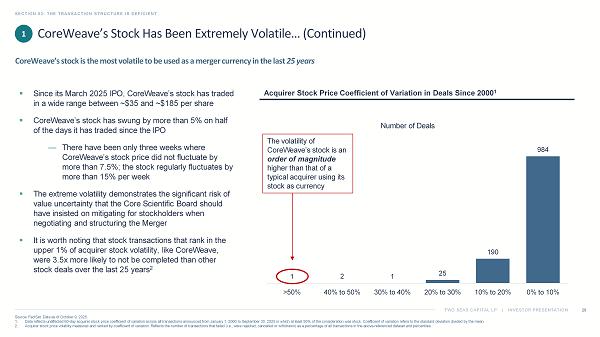

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION CoreWeave’s Stock Has Been Extremely Volatile… (Continued) SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 28 CoreWeave’s stock is the most volatile to be used as a merger currency in the last 25 years ▪ Since its March 2025 IPO, CoreWeave’s stock has traded in a wide range between ~$35 and ~$185 per share ▪ CoreWeave’s stock has swung by more than 5% on half of the days it has traded since the IPO — There have been only three weeks where CoreWeave’s stock price did not fluctuate by more than 7.5%; the stock regularly fluctuates by more than 15% per week ▪ The extreme volatility demonstrates the significant risk of value uncertainty that the Core Scientific Board should have insisted on mitigating for stockholders when negotiating and structuring the Merger ▪ It is worth noting that stock transactions that rank in the upper 1% of acquirer stock volatility, like CoreWeave, were 3.5x more likely to not be completed than other stock deals over the last 25 years 2 Acquirer Stock Price Coefficient of Variation in Deals Since 2000 1 1 2 1 25 190 984 >50% 40% to 50% 30% to 40% 20% to 30% 10% to 20% 0% to 10% Number of Deals The volatility of CoreWeave’s stock is an order of magnitude higher than that of a typical acquirer using its stock as currency Source: FactSet. Data as of October 9, 2025. 1. Data reflects unaffected 60 - day acquirer stock price coefficient of variation across all transactions announced from January 1, 2000 to September 30, 2025 in which at least 50% of the consideration was stock. Coefficient of variation refers to the stand ard deviation divided by the mean. 2. Acquirer stock price volatility measured and ranked by coefficient of variation. Reflects the number of transactions that fai led (i.e., were rejected, cancelled or withdrawn) as a percentage of all transactions in the above - referenced dataset and percentil es. 1

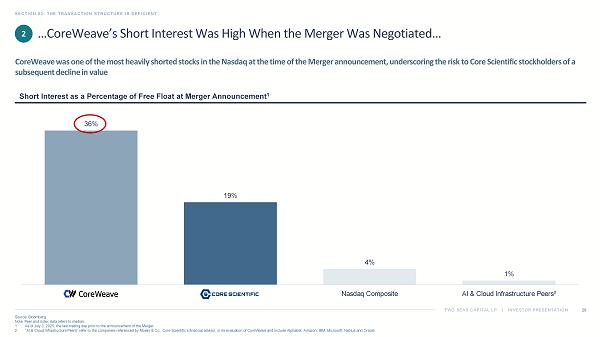

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION …CoreWeave’s Short Interest Was High When the Merger Was Negotiated… SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 29 Source: Bloomberg. Note: Peer and index data refers to median. 1. As of July 3, 2025, the last trading day prior to the announcement of the Merger. 2. “AI & Cloud Infrastructure Peers” refer to the companies referenced by Moelis & Co., Core Scientific’s financial advisor, in its evaluation of CoreWeave and include Alphabet, Amazon, IBM, Microsoft, Nebius and Oracle. CoreWeave was one of the most heavily shorted stocks in the Nasdaq at the time of the Merger announcement, underscoring the r isk to Core Scientific stockholders of a subsequent decline in value Short Interest as a Percentage of Free Float at Merger Announcement 1 2 36% 19% 4% 1% Nasdaq Composite AI & Cloud Infrastructure Peers²

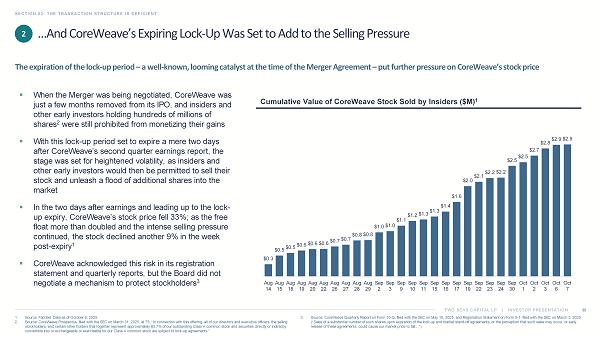

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 30 1. Source: FactSet. Data as of October 9, 2025. 2. Source: CoreWeave Prospectus, filed with the SEC on March 31, 2025, at 75: “In connection with this offering, all of our dire cto rs and executive officers, the selling stockholders, and certain other holders that together represent approximately 83.7% of our outstanding Class A common stock a nd securities directly or indirectly convertible into or exchangeable or exercisable for our Class A common stock are subject to lock - up agreements.” 3. Source: CoreWeave Quarterly Report on Form 10 - Q, filed with the SEC on May 15, 2025, and Registration Statement on Form S - 1, fil ed with the SEC on March 3, 2025 (“Sales of a substantial number of such shares upon expiration of the lock - up and market stand - off agreements, or the perception that such sales may occur, or early release of these agreements, could cause our market price to fall…”). The expiration of the lock - up period – a well - known, looming catalyst at the time of the Merger Agreement – put further pressure on CoreWeave’s stock price ▪ When the Merger was being negotiated, CoreWeave was just a few months removed from its IPO, and insiders and other early investors holding hundreds of millions of shares 2 were still prohibited from monetizing their gains ▪ With this lock - up period set to expire a mere two days after CoreWeave’s second quarter earnings report, the stage was set for heightened volatility, as insiders and other early investors would then be permitted to sell their stock and unleash a flood of additional shares into the market ▪ In the two days after earnings and leading up to the lock - up expiry, CoreWeave’s stock price fell 33%; as the free float more than doubled and the intense selling pressure continued, the stock declined another 9% in the week post - expiry 1 ▪ CoreWeave acknowledged this risk in its registration statement and quarterly reports, but the Board did not negotiate a mechanism to protect stockholders 3 Cumulative Value of CoreWeave Stock Sold by Insiders ($M) 1 …And CoreWeave’s Expiring Lock - Up Was Set to Add to the Selling Pressure 2 $0.3 $0.5 $0.5 $0.6 $0.6 $0.6 $0.7 $0.7 $0.8 $0.8 $1.0 $1.0 $1.1 $1.2 $1.3 $1.3 $1.4 $1.6 $2.0 $2.1 $2.2 $2.2 $2.5 $2.5 $2.7 $2.8 $2.9 $2.9 Aug 14 Aug 15 Aug 18 Aug 19 Aug 20 Aug 22 Aug 26 Aug 27 Aug 28 Aug 29 Sep 2 Sep 3 Sep 9 Sep 10 Sep 11 Sep 15 Sep 16 Sep 17 Sep 19 Sep 22 Sep 23 Sep 24 Sep 30 Oct 1 Oct 2 Oct 3 Oct 6 Oct 7

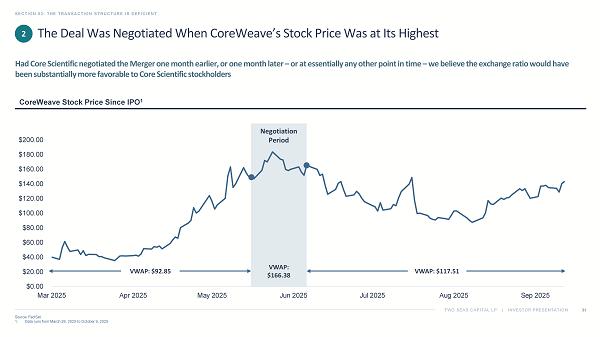

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 31 Source: FactSet. 1. Data runs from March 28, 2025 to October 9, 2025. CoreWeave Stock Price Since IPO 1 Negotiation Period The Deal Was Negotiated When CoreWeave’s Stock Price Was at Its Highest Had Core Scientific negotiated the Merger one month earlier, or one month later – or at essentially any other point in time – we believe the exchange ratio would have been substantially more favorable to Core Scientific stockholders 2 $0.00 $20.00 $40.00 $60.00 $80.00 $100.00 $120.00 $140.00 $160.00 $180.00 $200.00 Mar 2025 Apr 2025 May 2025 Jun 2025 Jul 2025 Aug 2025 Sep 2025 VWAP: $92.85 VWAP: $166.38 VWAP: $117.51

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 32 “We continue to think shares could see some pressure from the expiration of the lock - up period.” August 13, 2025 “[W]e note the dilutive impact that will come as a greater supply of shares enters the market from lock - up expirations.” July 7, 2025 “[We] expect shares to start their descent as we approach the expiration of the IPO lock up.” July 7, 2025 “[N]ear - term focus will more - so center on the coming lock - up… as well as nearer - term developments related to the proposed CORZ merger… [W]e think shares could see some pressure near - term...” August 12, 2025 “[T]he… lock - up conclusion [signals] imminent equity liquidity and potential dilution . We… caution against unknown, unforeseen headline risks… [for] a stock that has already moved north so strongly in such a short period.” June 25, 2025 “CRWV's IPO lock - up period is expected to expire following the company's 2Q earnings results (2 days post - print)... Should increased share supply cause variation in share price , the ultimate value of the transaction could vary significantly.” July 16, 2025 Analysts Expected the Lock - Up Expiration to Weigh on CoreWeave’s Stock 2

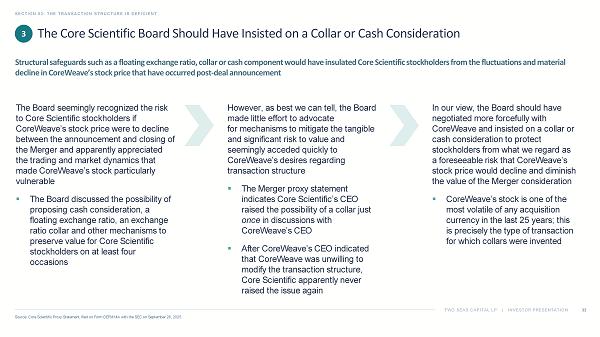

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 33 Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. The Board seemingly recognized the risk to Core Scientific stockholders if CoreWeave’s stock price were to decline between the announcement and closing of the Merger and apparently appreciated the trading and market dynamics that made CoreWeave’s stock particularly vulnerable ▪ The Board discussed the possibility of proposing cash consideration, a floating exchange ratio, an exchange ratio collar and other mechanisms to preserve value for Core Scientific stockholders on at least four occasions The Core Scientific Board Should Have Insisted on a Collar or Cash Consideration Structural safeguards such as a floating exchange ratio, collar or cash component would have insulated Core Scientific stockh old ers from the fluctuations and material decline in CoreWeave’s stock price that have occurred post - deal announcement 3 However, as best we can tell, the Board made little effort to advocate for mechanisms to mitigate the tangible and significant risk to value and seemingly acceded quickly to CoreWeave’s desires regarding transaction structure ▪ The Merger proxy statement indicates Core Scientific’s CEO raised the possibility of a collar just once in discussions with CoreWeave’s CEO ▪ After CoreWeave’s CEO indicated that CoreWeave was unwilling to modify the transaction structure, Core Scientific apparently never raised the issue again In our view, the Board should have negotiated more forcefully with CoreWeave and insisted on a collar or cash consideration to protect stockholders from what we regard as a foreseeable risk that CoreWeave’s stock price would decline and diminish the value of the Merger consideration ▪ CoreWeave’s stock is one of the most volatile of any acquisition currency in the last 25 years; this is precisely the type of transaction for which collars were invented

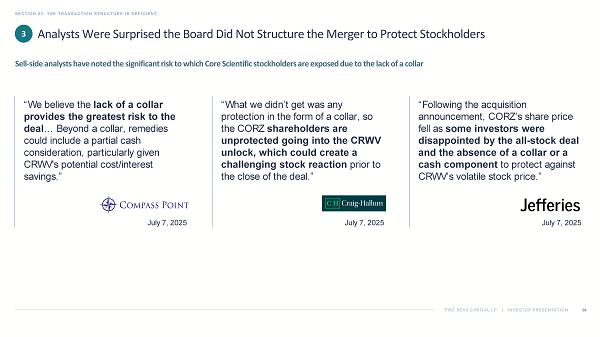

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 03: THE TRANSACTION STRUCTURE IS DEFICIENT 34 “Following the acquisition announcement, CORZ’s share price fell as some investors were disappointed by the all - stock deal and the absence of a collar or a cash component to protect against CRWV’s volatile stock price.” July 7, 2025 “What we didn’t get was any protection in the form of a collar, so the CORZ shareholders are unprotected going into the CRWV unlock, which could create a challenging stock reaction prior to the close of the deal.” July 7, 2025 “We believe the lack of a collar provides the greatest risk to the deal … Beyond a collar, remedies could include a partial cash consideration, particularly given CRWV's potential cost/interest savings.” July 7, 2025 Analysts Were Surprised the Board Did Not Structure the Merger to Protect Stockholders Sell - side analysts have noted the significant risk to which Core Scientific stockholders are exposed due to the lack of a collar 3

© All rights reserved. Two Seas Capital LP THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC SECTION 04

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Merger Significantly Undervalues Core Scientific SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 36 1. As further described on pages 40 - 47 of this presentation. 2. As further described on page 64 of this presentation. ▪ The acquisition of Core Scientific would address several near - term challenges for CoreWeave, providing ready access to substanti al power and significant infrastructure expertise Core Scientific’s Importance to CoreWeave Warrants a Premium Valuation ▪ After the announcement of the Merger, CoreWeave’s stock price and the value of the Merger consideration declined by as much a s ~45%, and they remain ~15% lower today following one of the worst post - deal drawdowns since the pandemic - driven market turmoil of 2020 ▪ The current value of the Merger consideration reflects a take - under of Core Scientific relative to both its stock price on the d ay before the announcement and its stock price today ▪ Various valuation methodologies support a substantially higher valuation for Core Scientific than both the current value of t he Merger consideration and the headline value at announcement 1 The Merger Significantly Undervalues Core Scientific ▪ New hosting contracts announced over the last two months have lifted equity valuations of virtually all Bitcoin miners, but e spe cially those that are actively converting capacity to AI and HPC, which are up approximately 180% 2 since the Merger was announced ▪ We believe Core Scientific would have joined them in trading meaningfully higher absent the Merger, supporting a significantl y higher valuation and exchange ratio Recent Activity Supports a Materially Higher Valuation for Core Scientific 1 2 3

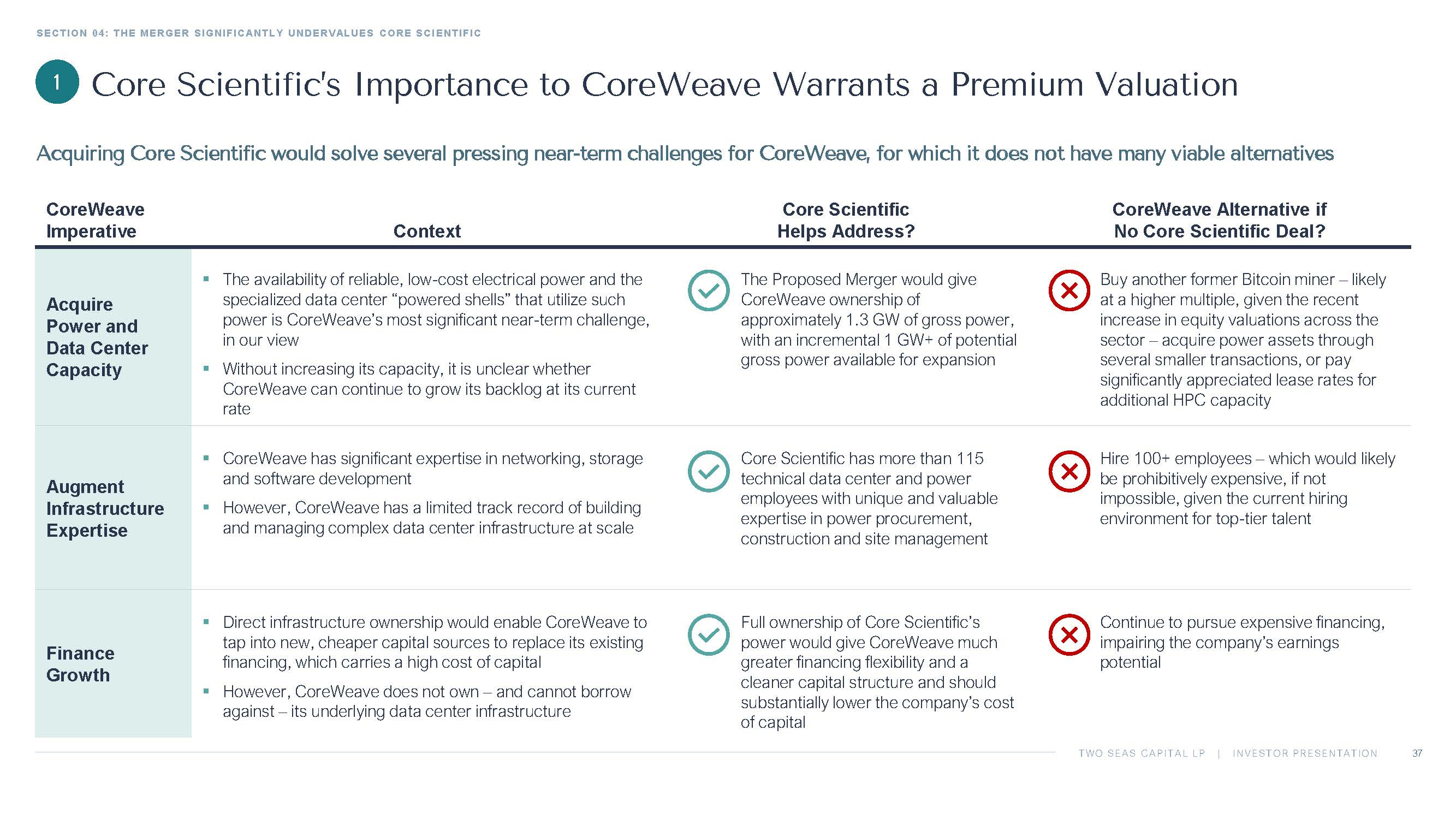

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 37 CoreWeave Alternative if No Core Scientific Deal? Core Scientific Helps Address? Context CoreWeave Imperative Buy another former Bitcoin miner – likely at a higher multiple, given the recent increase in equity valuations across the sector – acquire power assets through several smaller transactions, or pay significantly appreciated lease rates for additional HPC capacity The Proposed Merger would give CoreWeave ownership of approximately 1.3 GW of gross power, with an incremental 1 GW+ of potential gross power available for expansion ▪ The availability of reliable, low - cost electrical power and the specialized data center “powered shells” that utilize such power is CoreWeave’s most significant near - term challenge, in our view ▪ Without increasing its capacity, it is unclear whether CoreWeave can continue to grow its backlog at its current rate Acquire Power and Data Center Capacity Hire 100+ employees – which would likely be prohibitively expensive, if not impossible, given the current hiring environment for top - tier talent Core Scientific has more than 115 technical data center and power employees with unique and valuable expertise in power procurement, construction and site management ▪ CoreWeave has significant expertise in networking, storage and software development ▪ However, CoreWeave has a limited track record of building and managing complex data center infrastructure at scale Augment Infrastructure Expertise Continue to pursue expensive financing, impairing the company’s earnings potential Full ownership of Core Scientific’s power would give CoreWeave much greater financing flexibility and a cleaner capital structure and should substantially lower the company’s cost of capital ▪ Direct infrastructure ownership would enable CoreWeave to tap into new, cheaper capital sources to replace its existing financing, which carries a high cost of capital ▪ However, CoreWeave does not own – and cannot borrow against – its underlying data center infrastructure Finance Growth 1 Core Scientific’s Importance to CoreWeave Warrants a Premium Valuation Acquiring Core Scientific would solve several pressing near - term challenges for CoreWeave, for which it does not have many viabl e alternatives

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 38 1. Source: CoreWeave Quarterly Earnings Presentations and Registration Statement, filed with the SEC on March 31, 2025, as amend ed. 2. Source: CoreWeave Registration Statement, filed with the SEC on March 31, 2025, as amended. 3. Source: Loop Capital Markets Research Note, September 18, 2025. 4. Source: Needham & Co. Research Note, August 13, 2025. CoreWeave Revenue Backlog ($B) 1 Core Scientific’s Importance to CoreWeave Warrants a Premium Valuation (Continued) CoreWeave’s continued growth is dependent on readily available, owned and online power $9.9B $15.9B $16.2B $15.0B $15.1B $25.9B $30.1B 4Q23 1Q24 2Q24 3Q24 4Q24 1Q25 2Q25 ▪ CoreWeave’s revenue backlog has increased significantly, and the company’s continued growth depends on its ability to secure power for its data centers in a cost - effective manner 2 ▪ While CoreWeave has secured contracted power capacity of 2.2 GW, it does not own any of its power, and the industry generally faces a widespread shortfall of both power and suitable real estate for high - density AI data centers 3 — That situation does not appear likely to resolve itself in the near - term; wait times for approval for 10+ MW power projects are over five years in the U.S. 4 ▪ In our view, the acquisition of Core Scientific represents CoreWeave’s quickest path to owned power and data center capacity, making Core Scientific tremendously strategically valuable 1 [W] e're still in a chronically supply - constrained environment where capacity constraints, especially around powered shell capacity, [are] the biggest [constraint] for our growth…” — Nitin Agrawal, CoreWeave CFO, August 27, 2025 Verticalizing the ownership of Core Scientific’s high - performance data center infrastructure enables CoreWeave to significantly enhance operating efficiency and de - risk our future expansion, solidifying our growth trajectory.” — Michael Intrator , CoreWeave CEO, July 7, 2025

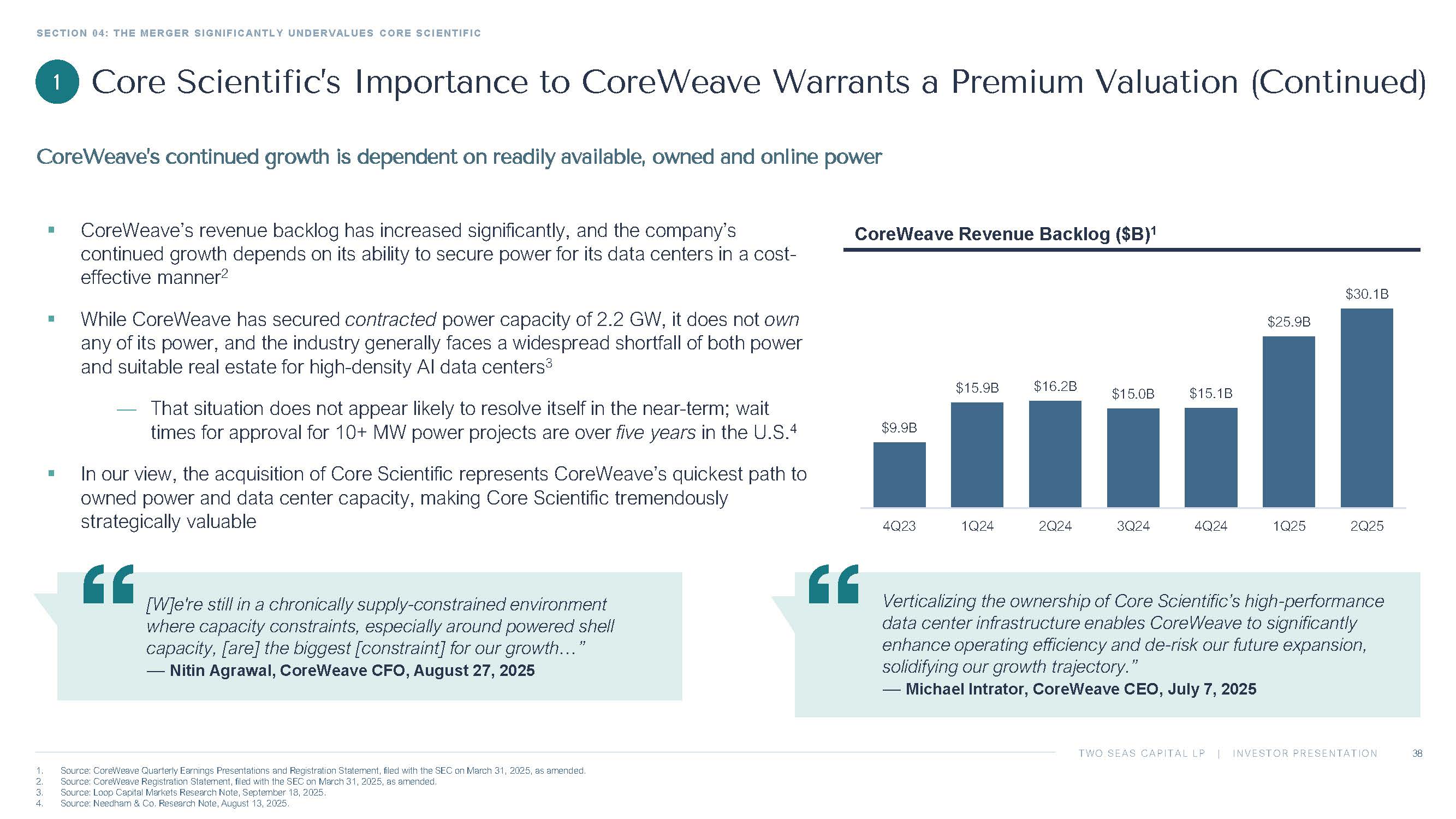

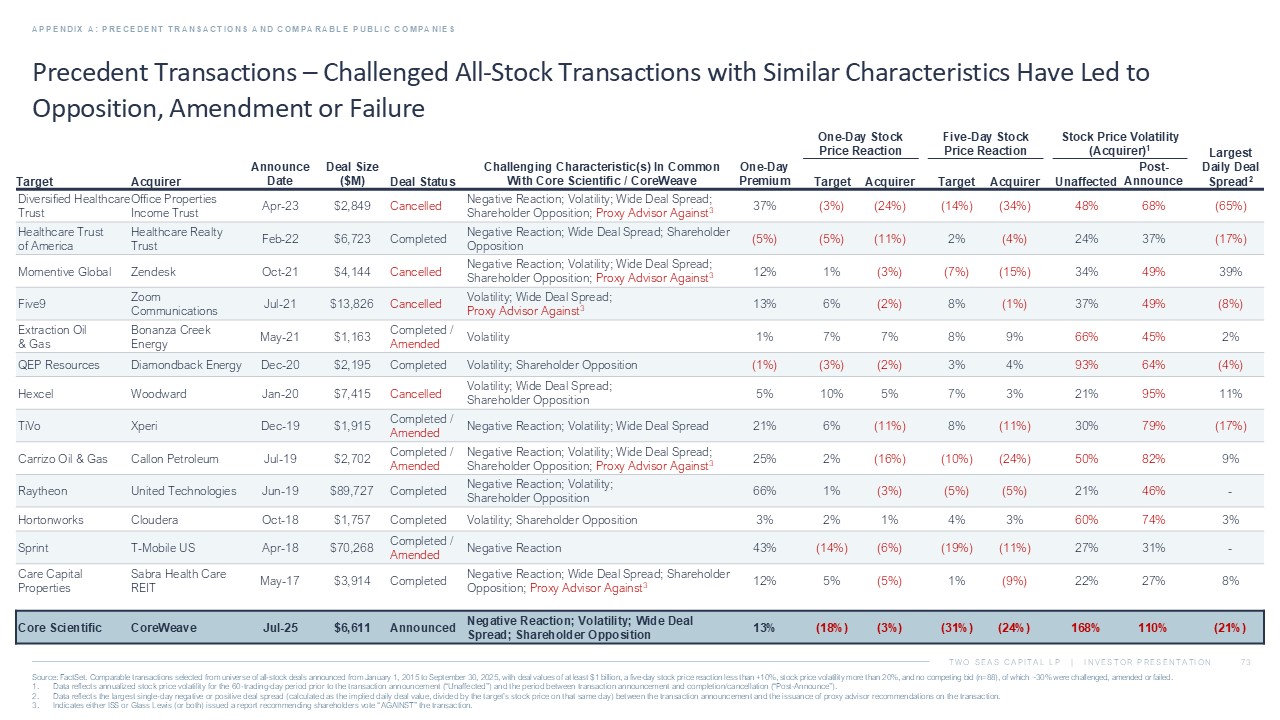

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION The Value of the Consideration Has Declined Significantly SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 39 Source: FactSet. 1. Data includes all - stock transactions with a deal value of at least $1 billion announced from January 1, 2020 to September 30, 20 25. 2. Data as of October 9, 2025. 3. Data includes all - stock transactions with a deal value of at least $1 billion announced from January 1, 2020 to September 30, 20 25. See Appendix A for more detail on challenged transactions. After the Merger announcement, CoreWeave’s stock price tumbled by as much as ~45% and remains down ~15% today, following one of the worst post - deal drawdowns in an acquirer’s stock price since 2020 1 Change in Value of Consideration Since Merger Announcement 2 ▪ Uncollared all - stock deals are fraught with risk for the target company’s stockholders, primarily with respect to potential value erosion between deal signing and closing ▪ The substantial decline in CoreWeave’s stock price since the deal announcement is among the deepest post - deal declines a target company’s stockholders have suffered since the Covid - driven market turmoil in early 2020 1 ▪ When an acquirer’s stock price falls by more than 25% post - announcement during the pendency of the transaction, the deal often faces substantial challenges, is amended, or fails 3 ; recent examples include: — Office Properties / Diversified Healthcare in 2023 (failed) — Zendesk / Momentive in 2021 (failed) — Zoom Communications / Five9 in 2021 (failed) 2 (13%) (50%) (40%) (30%) (20%) (10%) 0% Jul 3 Jul 17 Jul 31 Aug 14 Aug 28 Sep 11 Sep 25 Oct 9

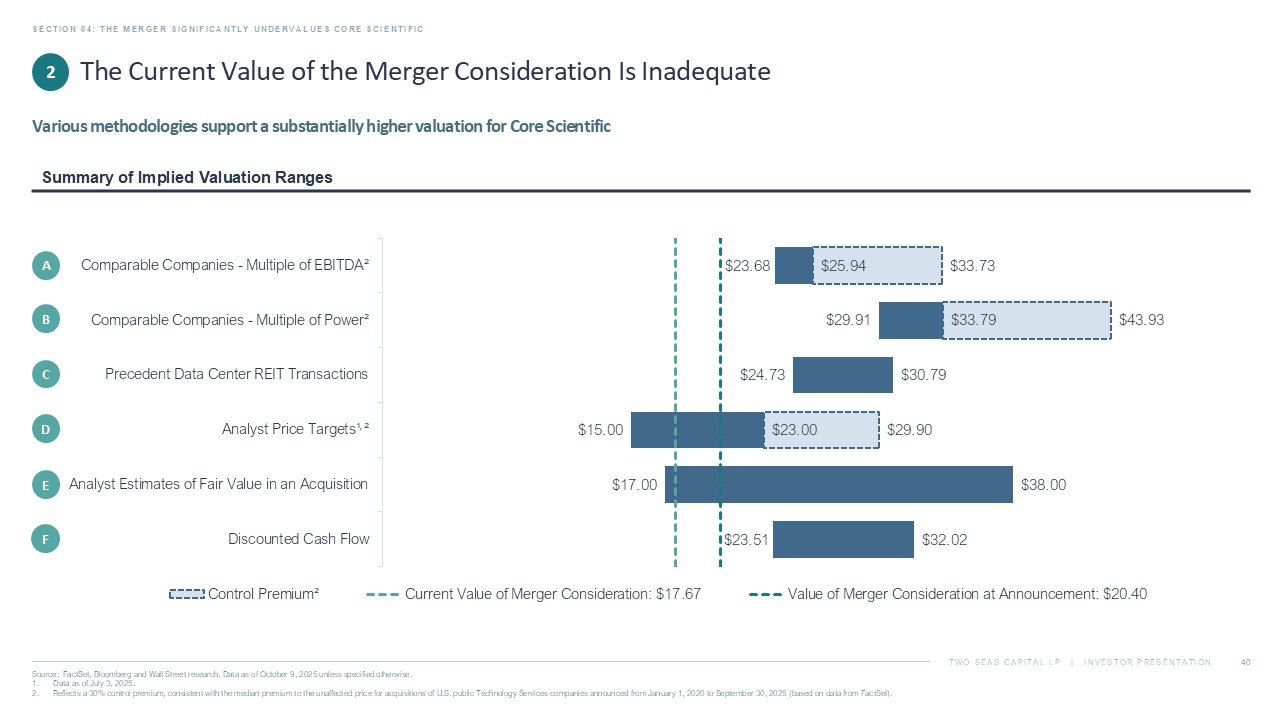

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE TRANSACTION SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 40 Source: FactSet, Bloomberg and Wall Street research. Data as of October 9, 2025 unless specified otherwise. 1. Data as of July 3, 2025. 2. Reflects a 30% control premium, consistent with the median premium to the unaffected price for acquisitions of U.S. public Te chn ology Services companies announced from January 1, 2020 to September 30, 2025 (based on data from FactSet). Summary of Implied Valuation Ranges The Current Value of the Merger Consideration Is Inadequate Various methodologies support a substantially higher valuation for Core Scientific 2 A B C D E F , $23.63 $29.91 $24.73 $15.00 $17.00 $23.51 $25.93 $33.79 $30.79 $23.00 $38.00 $32.02 $33.71 $43.93 $29.90 $0.00 $10.00 $20.00 $30.00 $40.00 $50.00 Comparable Companies - Multiple of EBITDA² Comparable Companies - Multiple of Power² Precedent Data Center REIT Transactions Analyst Price Targets¹ ² Analyst Estimates of Fair Value in an Acquisition Discounted Cash Flow Control Premium² Current Value of Merger Consideration: $17.67 Value of Merger Consideration at Announcement: $20.40

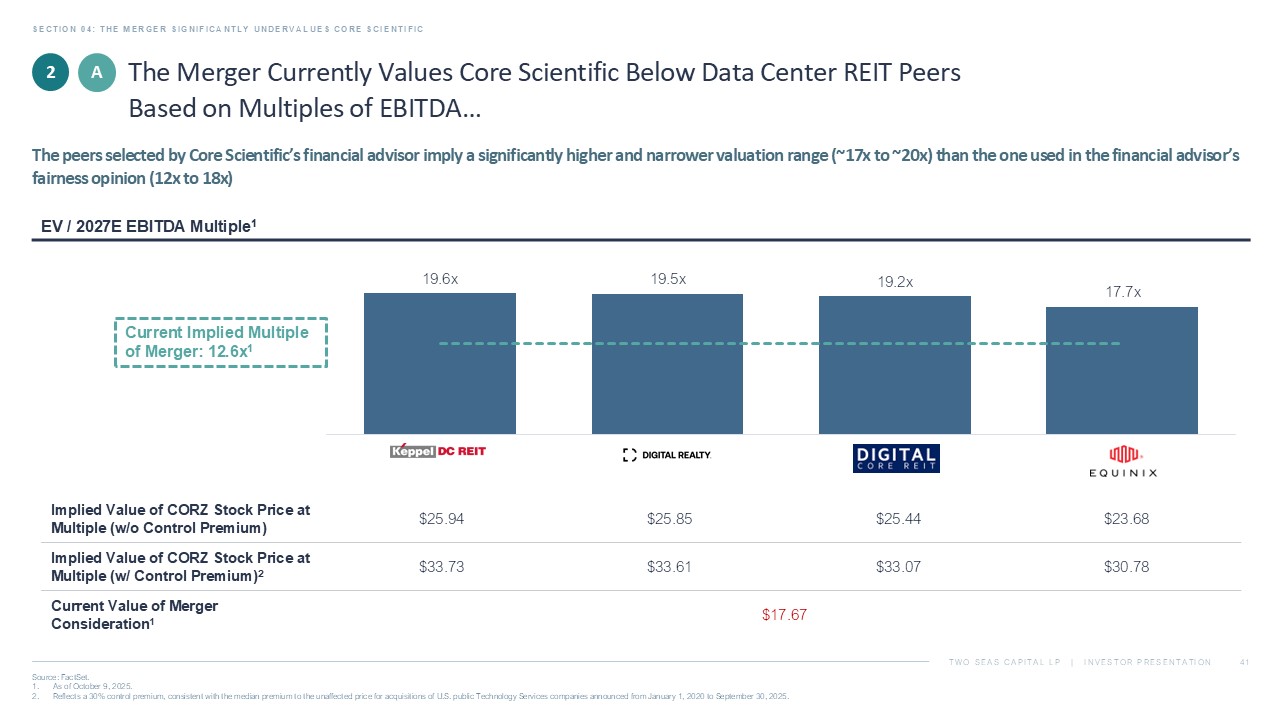

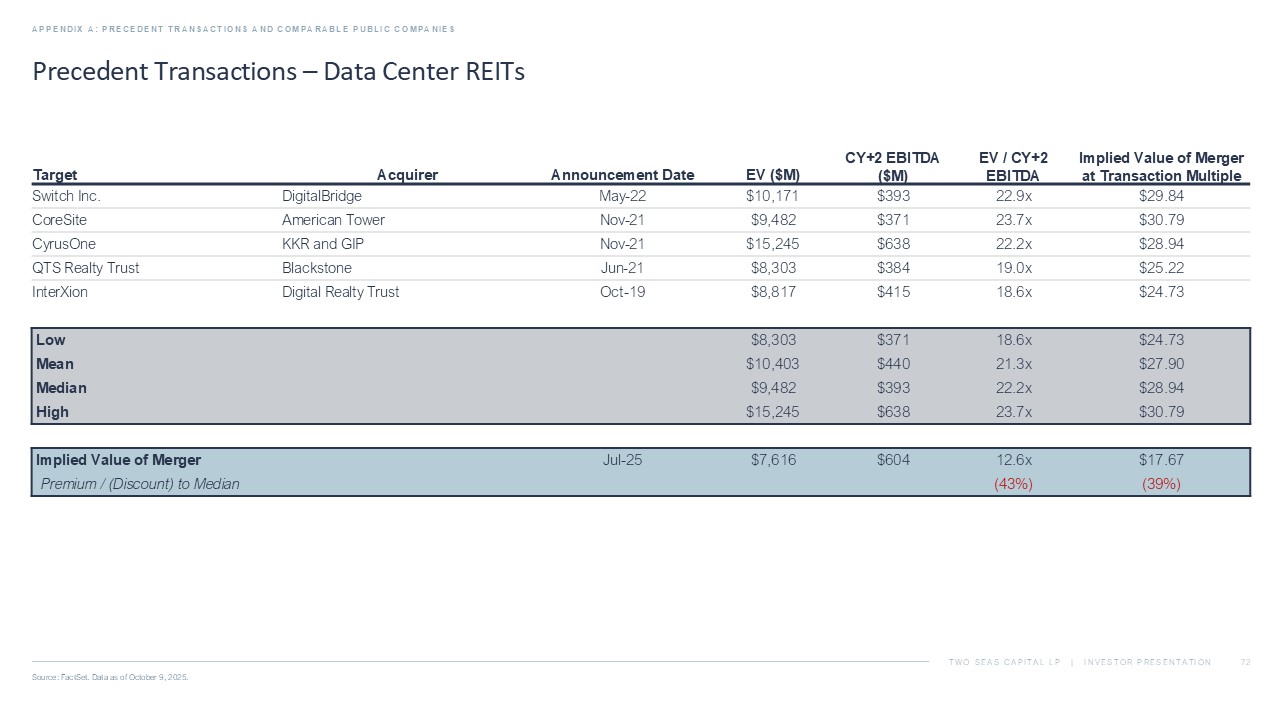

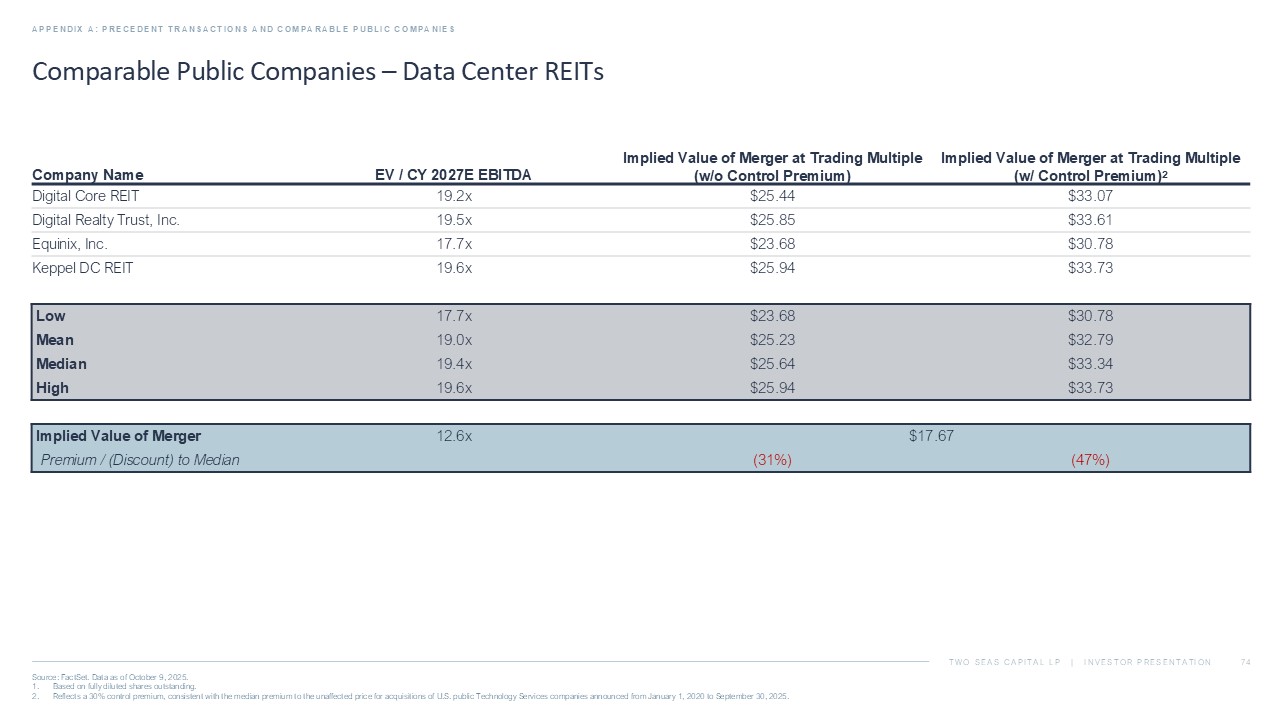

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION $23.63 $25.44 $25.77 $25.93 Implied Value of CORZ Stock Price at Multiple (w/o Control Premium) $30.72 $33.07 $33.50 $33.71 Implied Value of CORZ Stock Price at Multiple (w/ Control Premium) 2 $17.67 Current Value of Merger Consideration 1 Current Implied Multiple of Merger: 12.6x 1 SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC Source: FactSet. 1. As of October 9, 2025. 2. Reflects a 30% control premium, consistent with the median premium to the unaffected price for acquisitions of U.S. public Te chn ology Services companies announced from January 1, 2020 to September 30, 2025. EV / 2027E EBITDA Multiple 1 41 2 A The Merger Currently Values Core Scientific Below Data Center REIT Peers Based on Multiples of EBITDA… The peers selected by Core Scientific’s financial advisor imply a significantly higher and narrower valuation range (~17x to ~20 x) than the one used in the financial advisor’s fairness opinion (12x to 18x) 19.6x 19.5x 19.2x 17.7x KPDCF-US DLR-US DGTCF-US EQIX-US

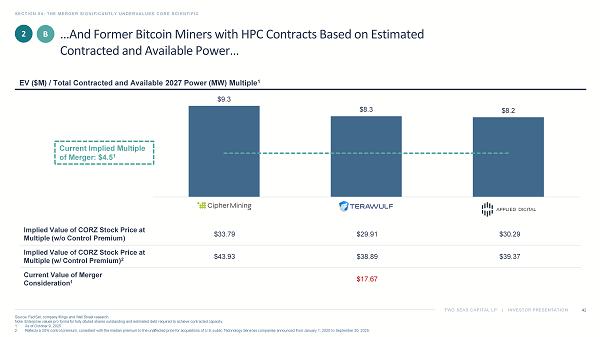

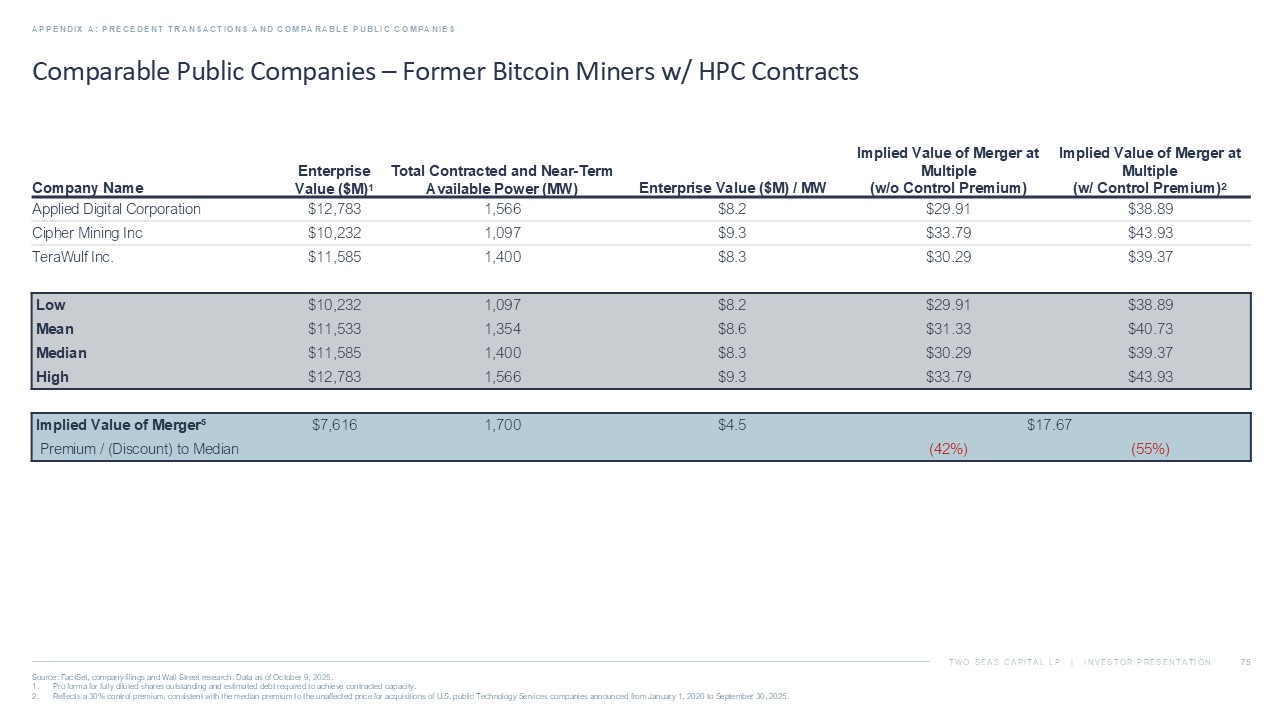

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 42 Source: FactSet, company filings and Wall Street research. Note: Enterprise values pro forma for fully diluted shares outstanding and estimated debt required to achieve contracted capa cit y. 1. As of October 9, 2025. 2. Reflects a 30% control premium, consistent with the median premium to the unaffected price for acquisitions of U.S. public Te chn ology Services companies announced from January 1, 2020 to September 30, 2025. 2 B EV ($M) / Total Contracted and Available 2027 Power (MW) Multiple 1 $30.29 $29.91 $33.79 Implied Value of CORZ Stock Price at Multiple (w/o Control Premium) $39.37 $38.89 $43.93 Implied Value of CORZ Stock Price at Multiple (w/ Control Premium) 2 $17.67 Current Value of Merger Consideration 1 …And Former Bitcoin Miners with HPC Contracts Based on Estimated Contracted and Available Power… Current Implied Multiple of Merger: $4.5 1 $9.3 $8.3 $8.2 CIFR WULF APLD

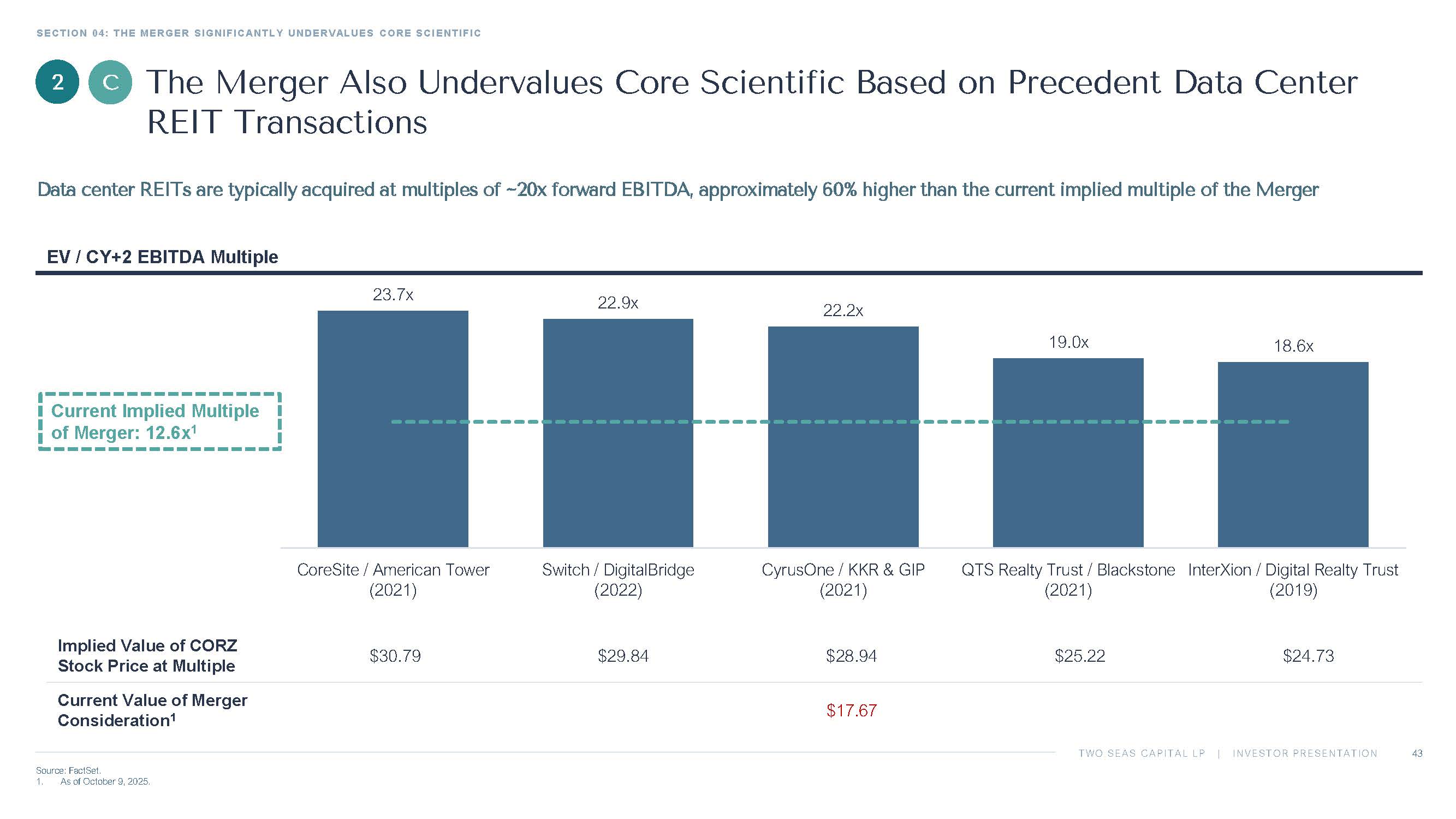

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 43 Source: FactSet. 1. As of October 9, 2025. EV / CY+2 EBITDA Multiple $24.73 $25.22 $28.94 $29.84 $30.79 Implied Value of CORZ Stock Price at Multiple $17.67 Current Value of Merger Consideration 1 2 The Merger Also Undervalues Core Scientific Based on Precedent Data Center REIT Transactions Data center REITs are typically acquired at multiples of ~20x forward EBITDA, approximately 60% higher than the current impli ed multiple of the Merger Current Implied Multiple of Merger: 12.6x 1 C 23.7x 22.9x 22.2x 19.0x 18.6x CoreSite / American Tower (2021) Switch / DigitalBridge (2022) CyrusOne / KKR & GIP (2021) QTS Realty Trust / Blackstone (2021) InterXion / Digital Realty Trust (2019)

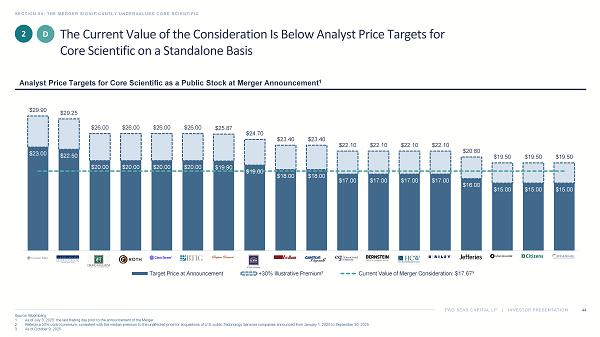

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 44 Source: Bloomberg. 1. As of July 3, 2025, the last trading day prior to the announcement of the Merger. 2. Reflects a 30% control premium, consistent with the median premium to the unaffected price for acquisitions of U.S. public Te chn ology Services companies announced from January 1, 2020 to September 30, 2025. 3. As of October 9, 2025. Analyst Price Targets for Core Scientific as a Public Stock at Merger Announcement 1 C The Current Value of the Consideration Is Below Analyst Price Targets for Core Scientific on a Standalone Basis 2 D $23.00 $22.50 $20.00 $20.00 $20.00 $20.00 $19.90 $19.00 $18.00 $18.00 $17.00 $17.00 $17.00 $17.00 $16.00 $15.00 $15.00 $15.00 $29.90 $29.25 $26.00 $26.00 $26.00 $26.00 $25.87 $24.70 $23.40 $23.40 $22.10 $22.10 $22.10 $22.10 $20.80 $19.50 $19.50 $19.50 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Target Price at Announcement +30% Illustrative Premium² Current Value of Merger Consideration: $17.67³

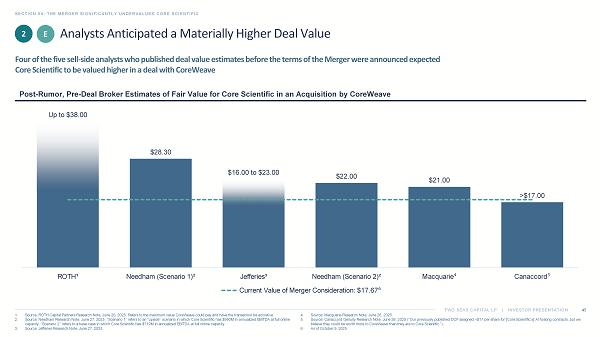

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Analysts Anticipated a Materially Higher Deal Value SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 45 1. Source: ROTH Capital Partners Research Note, June 26, 2025. Refers to the maximum value CoreWeave could pay and have the tran sac tion be accretive. 2. Source: Needham Research Note, June 27, 2025. “Scenario 1” refers to an “upside” scenario in which Core Scientific has $990M in annualized EBITDA at full online capacity; “Scenario 2” refers to a base case in which Core Scientific has $719M in annualized EBITDA at full online capacity. 3. Source: Jefferies Research Note, June 27, 2025. 4. Source: Macquarie Research Note, June 26, 2025. 5. Source: Canaccord Genuity Research Note, June 26, 2025 (“Our previously published DCF assigned ~$17 per share for [Core Scien tif ic’s] AI hosting contracts, but we believe they could be worth more to CoreWeave than they are to Core Scientific.”). 6. As of October 9, 2025. Post - Rumor, Pre - Deal Broker Estimates of Fair Value for Core Scientific in an Acquisition by CoreWeave Four of the five sell - side analysts who published deal value estimates before the terms of the Merger were announced expected Core Scientific to be valued higher in a deal with CoreWeave 2 E Up to $38.00 $28.30 $16.00 to $23.00 $22.00 $21.00 >$17.00 ROTH¹ Needham (Scenario 1)² Jefferies³ Needham (Scenario 2)² Macquarie ⁴ Canaccord ⁵ Current Value of Merger Consideration: $17.67 ⁶

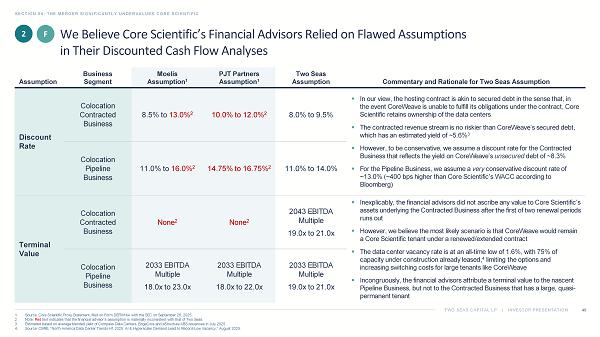

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 2. Note: Red text indicates that the financial advisor’s assumption is materially inconsistent with that of Two Seas. 3. Estimated based on average blended yield of Compass Data Centers, EdgeCore and eStructure ABS issuances in July 2025. 4. Source: CBRE, “North America Data Center Trends H1 2025: AI & Hyperscaler Demand Lead to Record - Low Vacancy,” August 2025. 46 2 We Believe Core Scientific’s Financial Advisors Relied on Flawed Assumptions in Their Discounted Cash Flow Analyses F Commentary and Rationale for Two Seas Assumption Two Seas Assumption PJT Partners Assumption 1 Moelis Assumption 1 Business Segment Assumption ▪ In our view, the hosting contract is akin to secured debt in the sense that, in the event CoreWeave is unable to fulfill its obligations under the contract, Core Scientific retains ownership of the data centers ▪ The contracted revenue stream is no riskier than CoreWeave’s secured debt, which has an estimated yield of ~5.6% 3 ▪ However, to be conservative, we assume a discount rate for the Contracted Business that reflects the yield on CoreWeave’s unsecured debt of ~8.3% ▪ For the Pipeline Business, we assume a very conservative discount rate of ~13.0% (~400 bps higher than Core Scientific’s WACC according to Bloomberg) 8.0% to 9.5% 10.0% to 12.0% 2 8.5% to 13.0% 2 Colocation Contracted Business Discount Rate 11.0% to 14.0% 14.75% to 16.75% 2 11.0% to 16.0% 2 Colocation Pipeline Business ▪ Inexplicably, the financial advisors did not ascribe any value to Core Scientific’s assets underlying the Contracted Business after the first of two renewal periods runs out ▪ However, we believe the most likely scenario is that CoreWeave would remain a Core Scientific tenant under a renewed/extended contract ▪ The data center vacancy rate is at an all - time low of 1.6%, with 75% of capacity under construction already leased, 4 limiting the options and increasing switching costs for large tenants like CoreWeave ▪ Incongruously, the financial advisors attribute a terminal value to the nascent Pipeline Business, but not to the Contracted Business that has a large, quasi - permanent tenant 2043 EBITDA Multiple 19.0x to 21.0x None 2 None 2 Colocation Contracted Business Terminal Value 2033 EBITDA Multiple 19.0x to 21.0x 2033 EBITDA Multiple 18.0x to 22.0x 2033 EBITDA Multiple 18.0x to 23.0x Colocation Pipeline Business

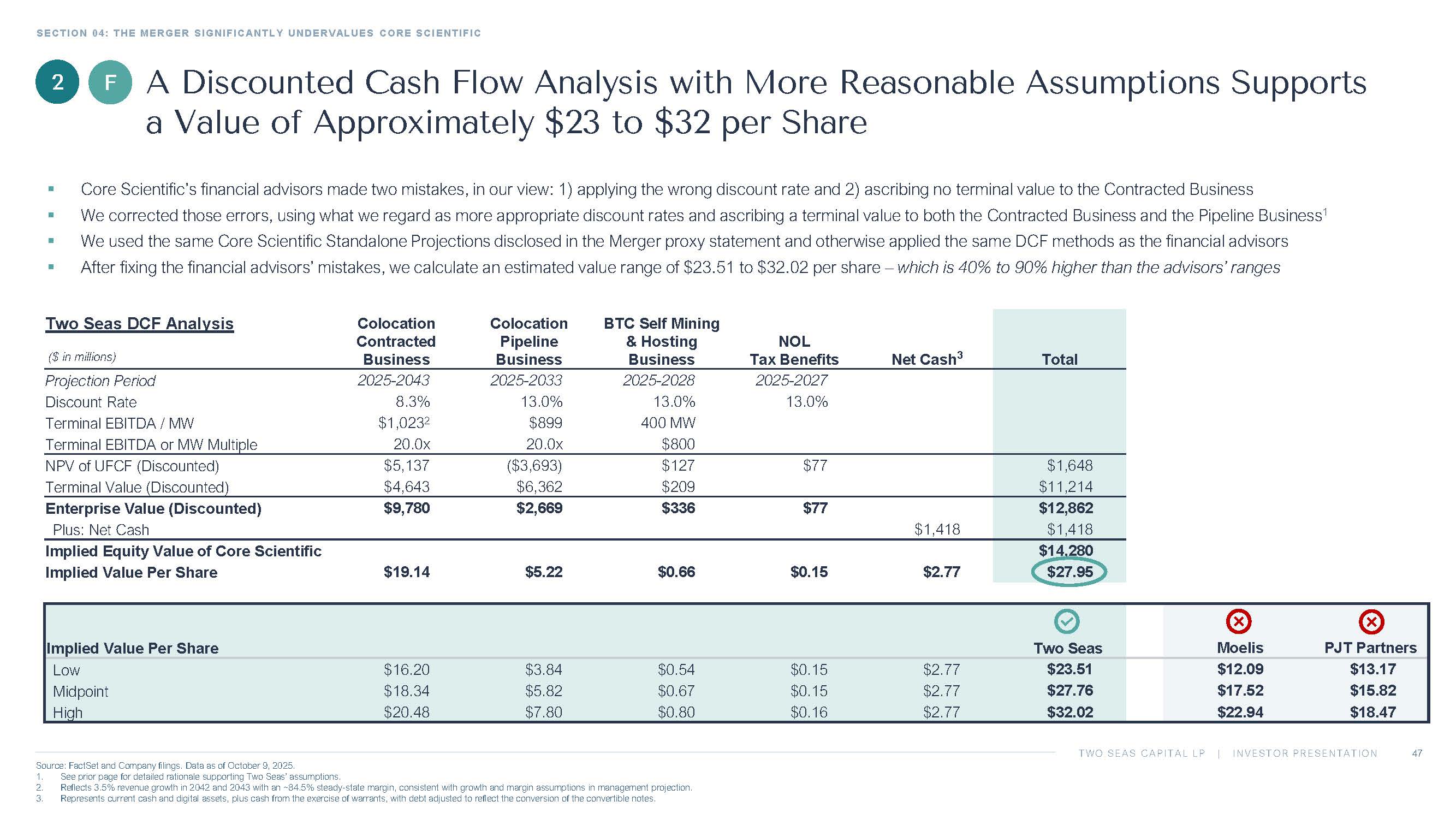

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC Source: FactSet and Company filings. Data as of October 9, 2025. 1. See prior page for detailed rationale supporting Two Seas’ assumptions. 2. Reflects 3.5% revenue growth in 2042 and 2043 with an ~84.5% steady - state margin, consistent with growth and margin assumptions in management projection. 3. Represents current cash and digital assets, plus cash from the exercise of warrants, with debt adjusted to reflect the conver sio n of the convertible notes. 47 2 A Discounted Cash Flow Analysis with More Reasonable Assumptions Supports a Value of Approximately $23 to $32 per Share Total Net Cash 3 NOL Tax Benefits BTC Self Mining & Hosting Business Colocation Pipeline Business Colocation Contracted Business Two Seas DCF Analysis ($ in millions) 2025 - 2027 2025 - 2028 2025 - 2033 2025 - 2043 Projection Period 13.0% 13.0% 13.0% 8.3% Discount Rate 400 MW $899 $1,023 2 Terminal EBITDA / MW $800 20.0x 20.0x Terminal EBITDA or MW Multiple $1,648 $77 $127 ($3,693) $5,137 NPV of UFCF (Discounted) $11,214 $209 $6,362 $4,643 Terminal Value (Discounted) $12,862 $77 $336 $2,669 $9,780 Enterprise Value (Discounted) $1,418 $1,418 Plus: Net Cash $14,280 Implied Equity Value of Core Scientific $27.95 $2.77 $0.15 $0.66 $5.22 $19.14 Implied Value Per Share PJT Partners Moelis Two Seas Implied Value Per Share $13.17 $12.09 $23.51 $2.77 $0.15 $0.54 $3.84 $16.20 Low $15.82 $17.52 $27.76 $2.77 $0.15 $0.67 $5.82 $18.34 Midpoint $18.47 $22.94 $32.02 $2.77 $0.16 $0.80 $7.80 $20.48 High F ▪ Core Scientific’s financial advisors made two mistakes, in our view: 1) applying the wrong discount rate and 2) ascribing no ter minal value to the Contracted Business ▪ We corrected those errors, using what we regard as more appropriate discount rates and ascribing a terminal value to both the Co ntracted Business and the Pipeline Business 1 ▪ We used the same Core Scientific Standalone Projections disclosed in the Merger proxy statement and otherwise applied the sam e D CF methods as the financial advisors ▪ After fixing the financial advisors’ mistakes, we calculate an estimated value range of $23.51 to $32.02 per share – which is 40% to 90% higher than the advisors’ ranges

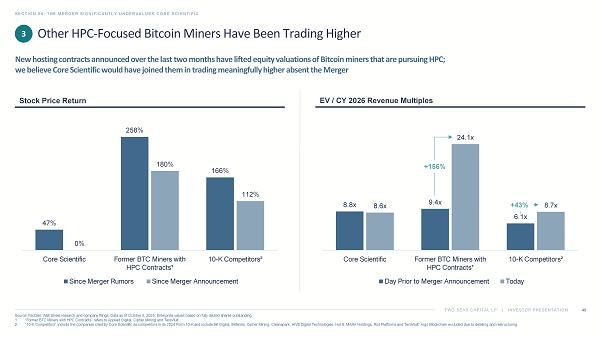

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC 48 Source: FactSet, Wall Street research and company filings. Data as of October 9, 2025. Enterprise values based on fully dilut ed shares outstanding. 1. “Former BTC Miners with HPC Contracts” refers to Applied Digital, Cipher Mining and TeraWulf . 2. “10 - K Competitors” include the companies cited by Core Scientific as competitors in its 2024 Form 10 - K and include Bit Digital, Bitfarms, Cipher Mining, Cleanspark , HIVE Digital Technologies, Hut 8, MARA Holdings, Riot Platforms and TeraWulf . Argo Blockchain excluded due to delisting and restructuring. Other HPC - Focused Bitcoin Miners Have Been Trading Higher New hosting contracts announced over the last two months have lifted equity valuations of Bitcoin miners that are pursuing HP C; we believe Core Scientific would have joined them in trading meaningfully higher absent the Merger EV / CY 2026 Revenue Multiples Stock Price Return 3 47% 258% 166% 0% 180% 112% Core Scientific Former BTC Miners with HPC Contracts¹ 10-K Competitors² Since Merger Rumors Since Merger Announcement 8.8x 9.4x 6.1x 8.6x 24.1x 8.7x Core Scientific Former BTC Miners with HPC Contracts¹ 10-K Competitors² Day Prior to Merger Announcement Today +156% +43%

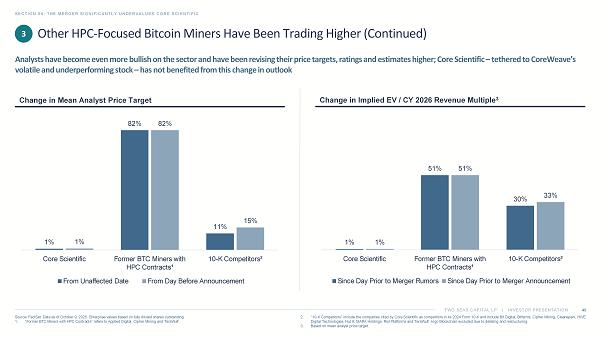

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 04: THE MERGER SIGNIFICANTLY UNDERVALUES CORE SCIENTIFIC Source: FactSet. Data as of October 9, 2025. Enterprise values based on fully diluted shares outstanding. 1. “Former BTC Miners with HPC Contracts” refers to Applied Digital, Cipher Mining and TeraWulf . 2. “10 - K Competitors” include the companies cited by Core Scientific as competitors in its 2024 Form 10 - K and include Bit Digital, Bitfarms, Cipher Mining, Cleanspark , HIVE Digital Technologies, Hut 8, MARA Holdings, Riot Platforms and TeraWulf . Argo Blockchain excluded due to delisting and restructuring. 3. Based on mean analyst price target. Other HPC - Focused Bitcoin Miners Have Been Trading Higher (Continued) Analysts have become even more bullish on the sector and have been revising their price targets, ratings and estimates higher ; C ore Scientific – tethered to CoreWeave’s volatile and underperforming stock – has not benefited from this change in outlook Change in Implied EV / CY 2026 Revenue Multiple 3 Change in Mean Analyst Price Target 3 49 1% 82% 11% 1% 82% 15% Core Scientific Former BTC Miners with HPC Contracts¹ 10-K Competitors² From Unaffected Date From Day Before Announcement 1% 51% 30% 1% 51% 33% Core Scientific Former BTC Miners with HPC Contracts¹ 10-K Competitors² Since Day Prior to Merger Rumors Since Day Prior to Merger Announcement

© All rights reserved. Two Seas Capital LP CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY SECTION 05

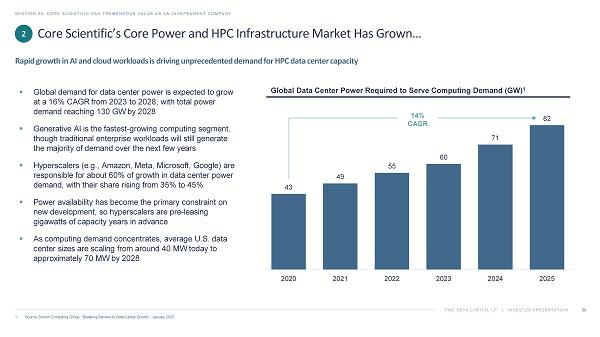

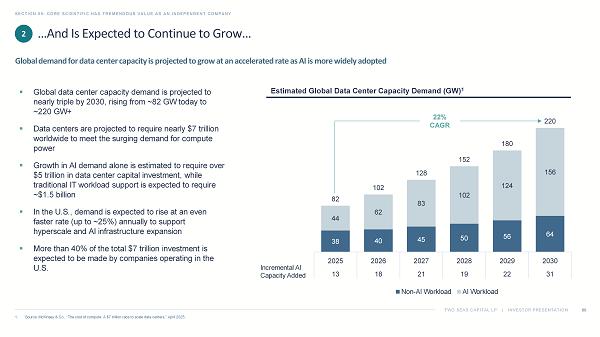

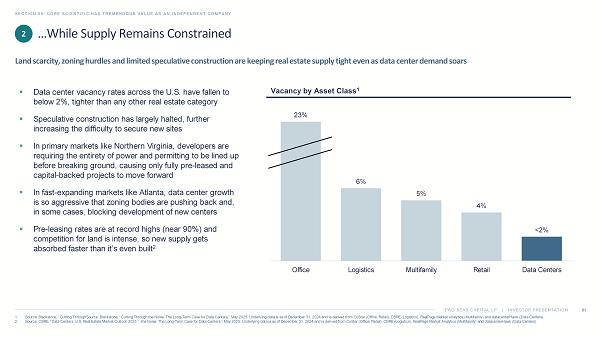

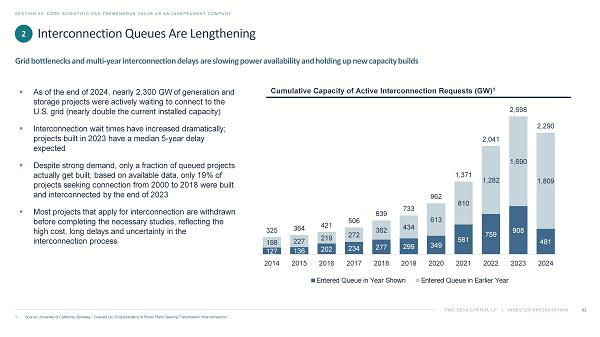

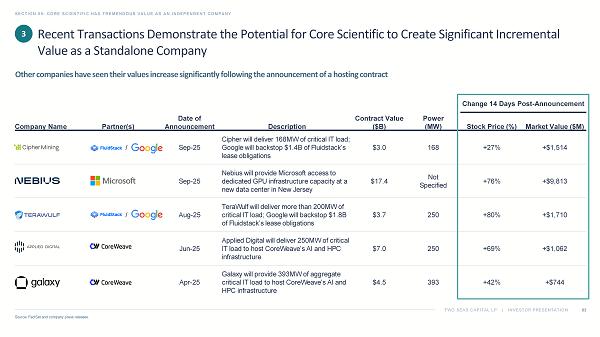

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific Has Tremendous Value as an Independent Company SECTION 05: CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY 51 ▪ Core Scientific is positioned for significant revenue and EBITDA growth, highlighting the Company’s ability to convert scale int o sustained profitability ▪ Both management and sell - side analysts believe that Core Scientific is in the early innings of an AI - fueled transformation that is poised to reshape its business and drive significant stockholder value Core Scientific Has Compelling Standalone Prospects ▪ Rapid growth in AI and cloud workloads is driving unprecedented demand for electrical power and HPC data center capacity, reinforcing the value of Core Scientific’s offerings ▪ Other former Bitcoin miners and neocloud companies have seen their values increase significantly following the announcement of a hosting contract, and we believe the announcement by Core Scientific of a new hosting contract would similarly serve as a cat aly st for a material increase in its valuation The Company Is Poised to Benefit from Significant Industry Tailwinds ▪ The stocks of Core Scientific’s closest peers have approximately doubled since the Merger was announced, reflecting the announcement of significant HPC contracts and the market’s continued enthusiasm for AI ▪ We believe Core Scientific would similarly be trading meaningfully higher were it not tethered to CoreWeave’s volatile and underperforming stock We Believe Core Scientific Will Trade Higher if the Merger Is Not Approved 1 2 3

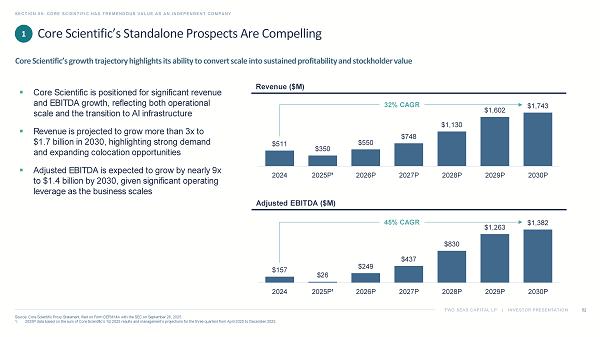

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific’s Standalone Prospects Are Compelling SECTION 05: CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY 52 Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 1. 2025P data based on the sum of Core Scientific’s 1Q 2025 results and management’s projections for the three quarters from Apr il 2025 to December 2025. Core Scientific’s growth trajectory highlights its ability to convert scale into sustained profitability and stockholder valu e Revenue ($M) ▪ Core Scientific is positioned for significant revenue and EBITDA growth, reflecting both operational scale and the transition to AI infrastructure ▪ Revenue is projected to grow more than 3x to $1.7 billion in 2030, highlighting strong demand and expanding colocation opportunities ▪ Adjusted EBITDA is expected to grow by nearly 9x to $1.4 billion by 2030, given significant operating leverage as the business scales Adjusted EBITDA ($M) $511 $350 $550 $748 $1,130 $1,602 $1,743 2024 2025P¹ 2026P 2027P 2028P 2029P 2030P $157 $26 $249 $437 $830 $1,263 $1,382 2024 2025P¹ 2026P 2027P 2028P 2029P 2030P 32% CAGR 45% CAGR 1

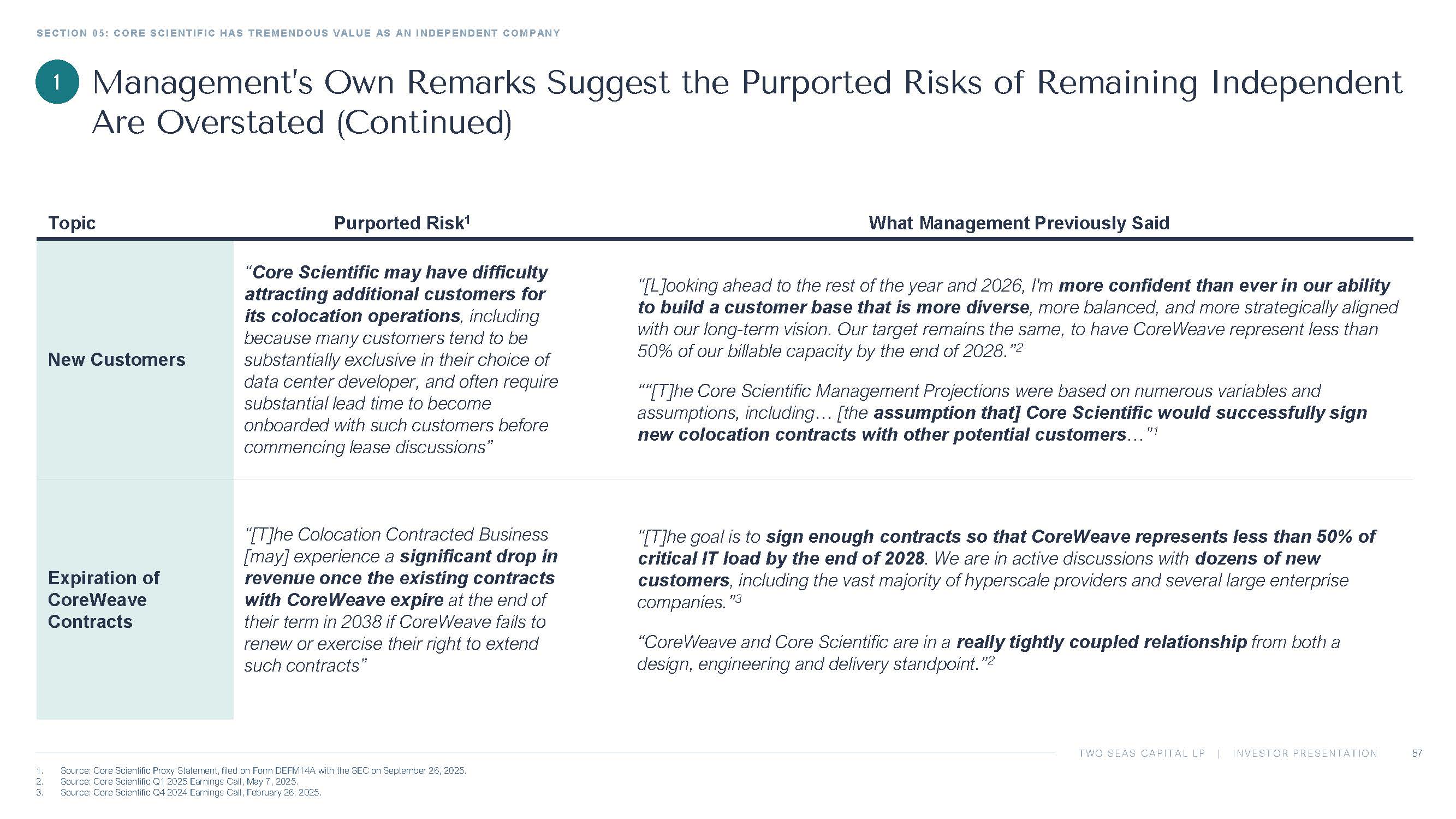

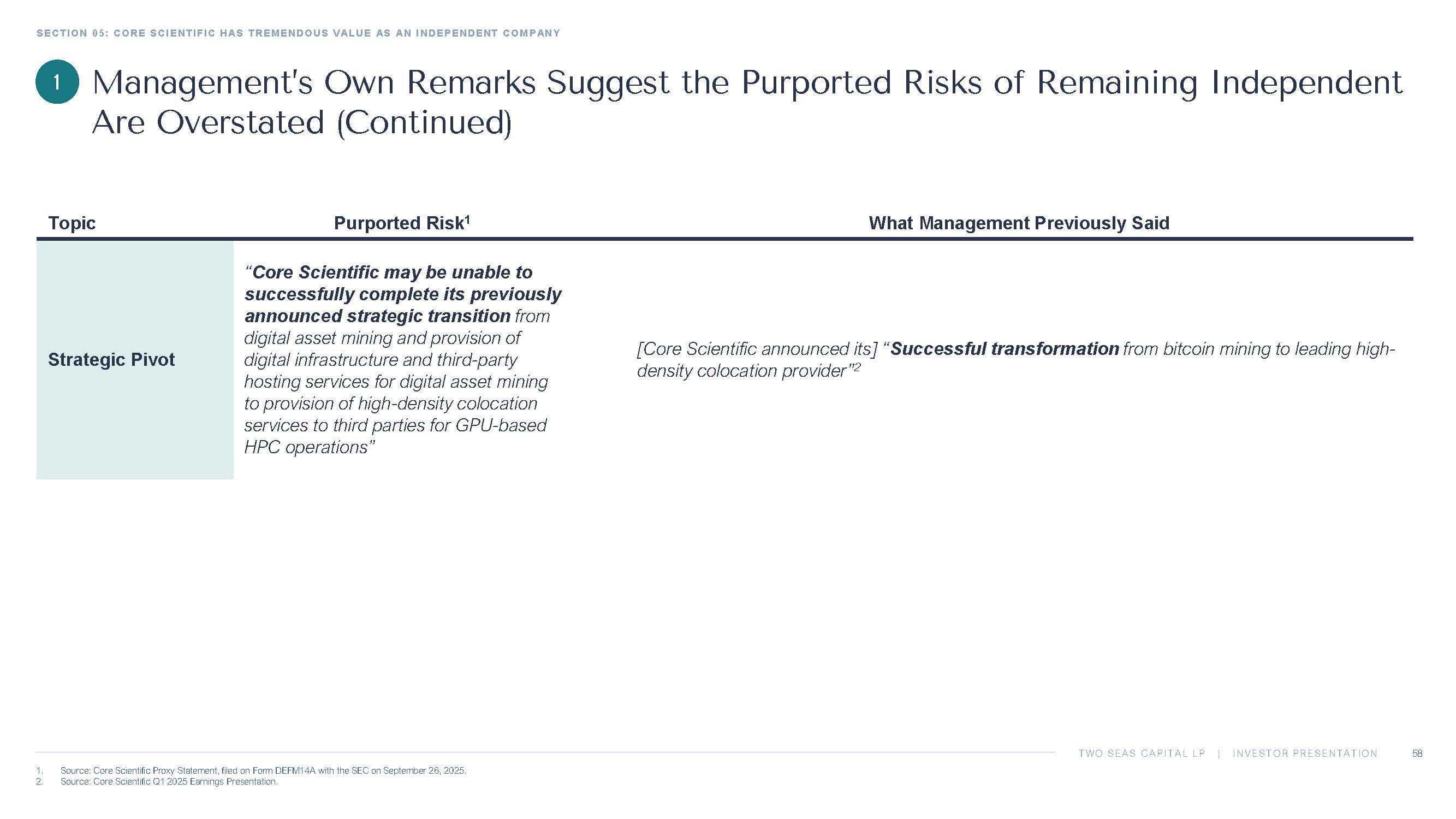

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION Core Scientific Management Is Enthusiastic About the Company’s Future… SECTION 05: CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY 53 Core Scientific is in the early innings of an industry - shaping transformation it is well positioned to capitalize upon “[W]e are building more than capacity. We are laying the foundation for what comes next for this company and for the growth of accelerated compute. And while [our GPU infrastructure agreement with] CoreWeave is a significant first step, it's just that, the first step of a long journey .” Adam Sullivan, CEO; May 7, 2025 “ AI is driving one of the biggest shifts we've seen in infrastructure in decades . It's not just about more demand. It's about a new kind of infrastructure purpose - built for high - performance, high - density workloads… [M]any large enterprises are just beginning to plan their AI strategies, and… [a]s those plans turn to action, Core Scientific is well positioned to be a major supplier of infrastructure that will power it.” Adam Sullivan, CEO; May 7, 2025 “[W]e want to build out a large scale data center platform that rivals that of Digital Realty and QTS. We believe given the transition that this industry is currently going through between low density to high density [colocation] we believe this is a very large opening for our business to grab a significant market share . And we have a very unique capital structure as well that's enabling that.” Adam Sullivan, CEO; May 29, 2025 “We're in a moment the broader datacenter industry hasn't experienced in years. AI - driven demand is fundamentally reshaping infrastructure needs around the world, and this company is extremely well positioned to lead in that shift.” Jim Nygaard, CFO; May 7, 2025 1

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION …As Are Wall Street Analysts SECTION 05: CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY 54 Prior to the deal announcement, 17 of 18 analysts who follow the Company had a “Buy” rating on Core Scientific’s stock “We think CORZ is well positioned to benefit from the fifth wave of compute as we move from general purpose, CPU - centric cloud computing to purpose - built, GPU - centric infrastructure.” May 14, 2025 “CORZ's strategic shift (and diversification) to HPC infrastructure, alongside ongoing BTC mining, provides a clear path to stable and predictable cash flow growth . With an improved capital structure, CORZ is well - positioned for future growth, customer diversification, and enhanced financial stability, driving profitability in a dynamic digital infrastructure market.” November 14, 2024 “ CORZ is the first mover (among bitcoin miners) in what we expect will be a fast growing, high demand environment for HPC data center capacity.” September 4, 2024 “In a speculative space where viability of HPC/AI hosting diversification is on investors' minds, CORZ is the only one executing at scale so far… [T]his should mean consistent, lower risk revenues.” September 24, 2024 “ CORZ is uniquely well positioned to capture this moment of AI demand given the large amounts of available power and a data center development team with experience from Equinix, DataBank , and HP…” October 27,2024 1

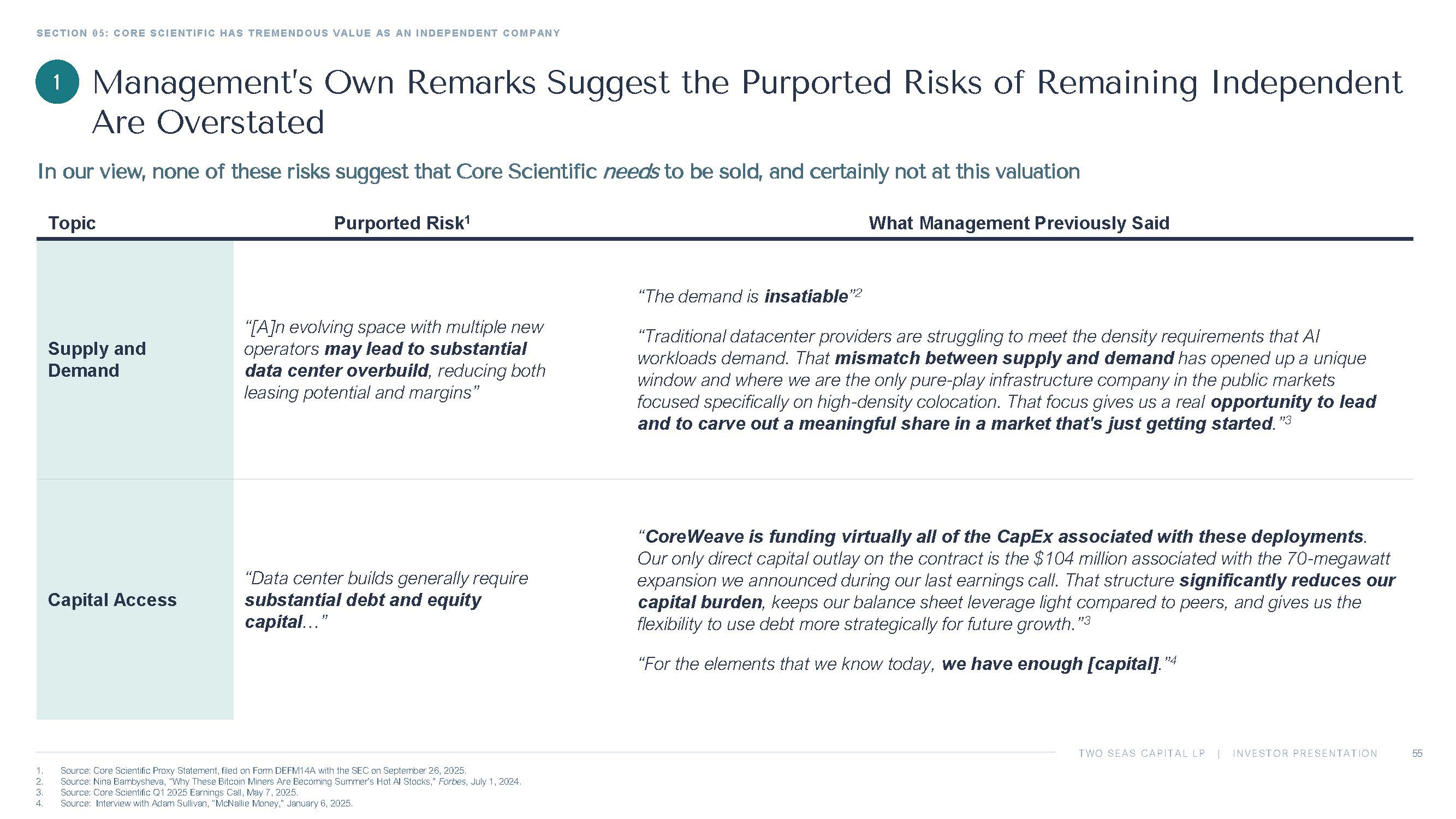

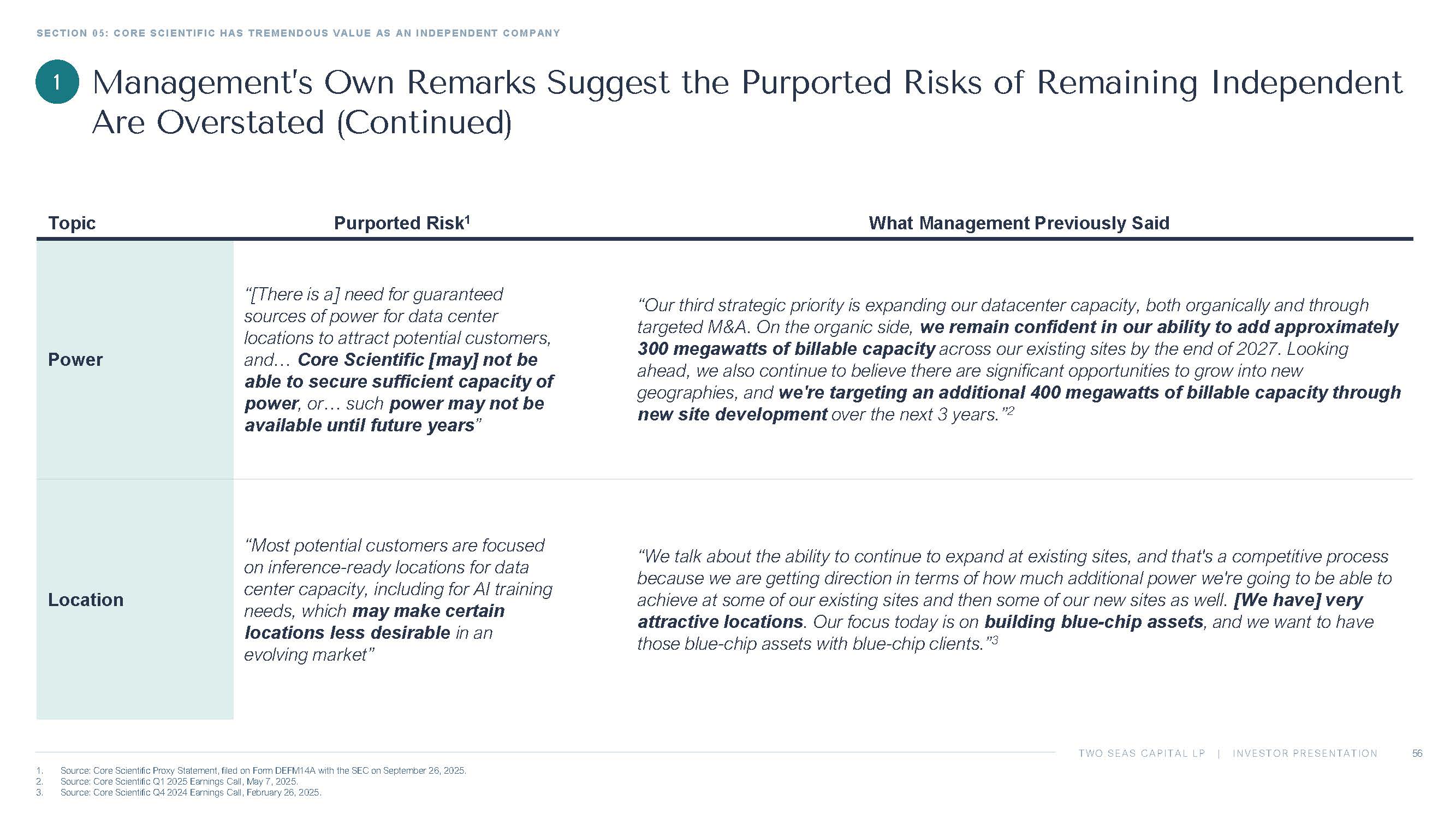

TWO SEAS CAPITAL LP | INVESTOR PRESENTATION SECTION 05: CORE SCIENTIFIC HAS TREMENDOUS VALUE AS AN INDEPENDENT COMPANY 55 1. Source: Core Scientific Proxy Statement, filed on Form DEFM14A with the SEC on September 26, 2025. 2. Source: Nina Bambysheva , “Why These Bitcoin Miners Are Becoming Summer’s Hot AI Stocks,” Forbes , July 1, 2024. 3. Source: Core Scientific Q1 2025 Earnings Call, May 7, 2025. 4. Source: Interview with Adam Sullivan, “ McNallie Money,” January 6, 2025. In our view, none of these risks suggest that Core Scientific needs to be sold, and certainly not at this valuation What Management Previously Said Purported Risk 1 Topic “The demand is insatiable ” 2 “Traditional datacenter providers are struggling to meet the density requirements that AI workloads demand. That mismatch between supply and demand has opened up a unique window and where we are the only pure - play infrastructure company in the public markets focused specifically on high - density colocation. That focus gives us a real opportunity to lead and to carve out a meaningful share in a market that's just getting started .” 3 “[A]n evolving space with multiple new operators may lead to substantial data center overbuild , reducing both leasing potential and margins” Supply and Demand “ CoreWeave is funding virtually all of the CapEx associated with these deployments . Our only direct capital outlay on the contract is the $104 million associated with the 70 - megawatt expansion we announced during our last earnings call. That structure significantly reduces our capital burden , keeps our balance sheet leverage light compared to peers, and gives us the flexibility to use debt more strategically for future growth.” 3 “For the elements that we know today, we have enough [capital] .” 4 “Data center builds generally require substantial debt and equity capital …” Capital Access Management’s Own Remarks Suggest the Purported Risks of Remaining Independent Are Overstated 1