EX-99.2

Published on November 6, 2024

Third Quarter Fiscal 2024 Earnings Presentation Adam Sullivan, CEO Denise Sterling, CFO November 6, 2024

2 FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the Company’s ability to scale, and grow its business and execute on its growth plans and hosting contracts, source clean and renewable energy, the advantages, and expected growth, and anticipated future revenue of the Company, and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to earn digital assets profitably and to attract customers for our digital asset and high performance compute hosting capabilities; our ability to perform under our existing colocation agreements, our ability to maintain our competitive position in our existing operating segments, the impact of increases in total network hash rate; our ability to raise additional capital to continue our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential failure in our critical systems, facilities or services we provide; the physical risks and regulatory changes relating to climate change; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting high performance computing, the blockchain industry and the blockchain hosting market; the identification of material weaknesses in our internal control over financial reporting; price volatility of digital assets and bitcoin in particular; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the increasing likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; increasing scrutiny and changing expectations with respect to our ESG policies; the effectiveness of our compliance and risk management methods. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. Year over year comparisons are based on the combined results of Core Scientific and its acquired entities. Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law. NON-GAAP FINANCIAL MEASURES This presentation also contains non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA and adjusted earnings (loss) per diluted share. The Company believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non-GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company urges investors not to rely on any single financial measure to evaluate its business.

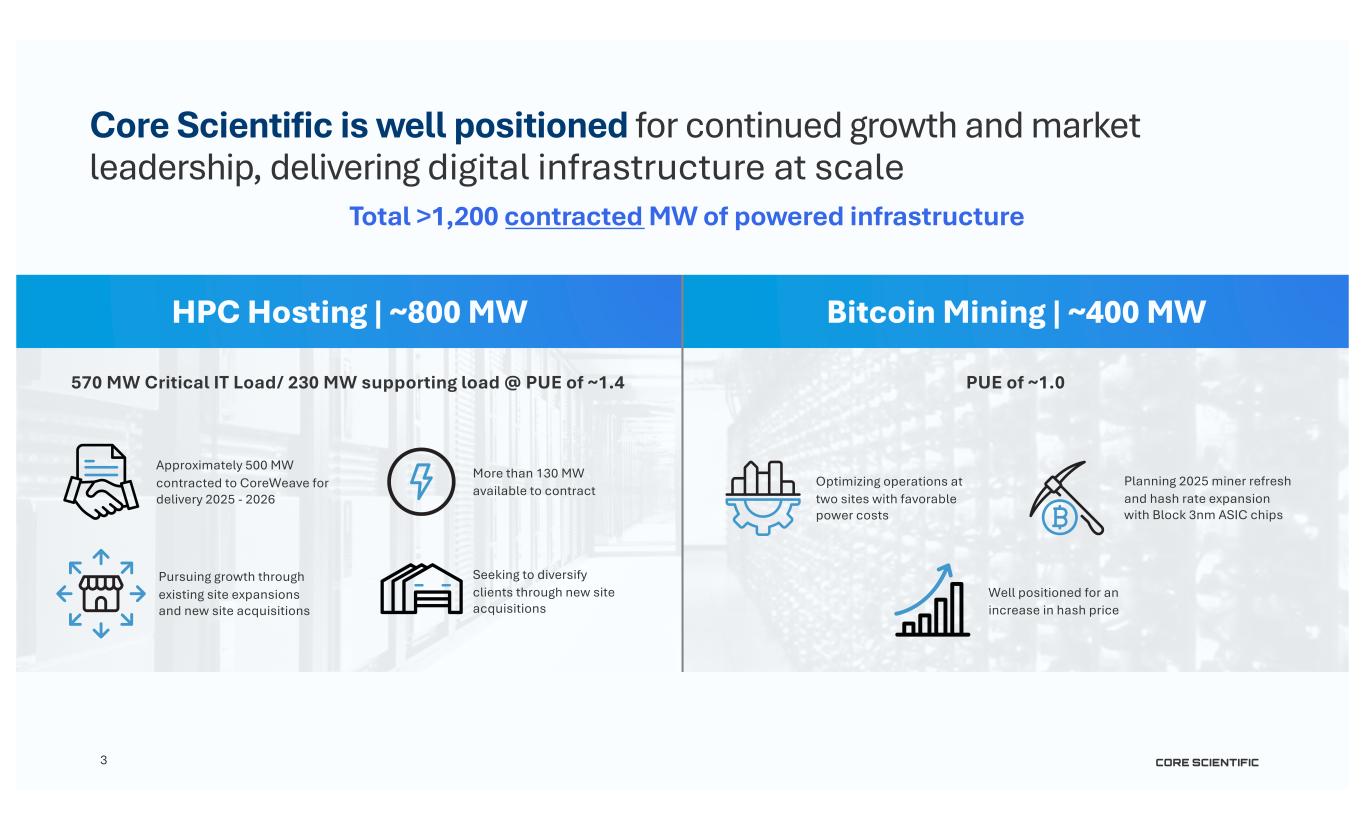

3 Total >1,200 contracted MW of powered infrastructure 570 MW Critical IT Load/ 230 MW supporting load @ PUE of ~1.4 PUE of ~1.0 Core Scientific is well positioned for continued growth and market leadership, delivering digital infrastructure at scale HPC Hosting | ~800 MW Bitcoin Mining | ~400 MW Planning 2025 miner refresh and hash rate expansion with Block 3nm ASIC chips Optimizing operations at two sites with favorable power costs More than 130 MW available to contract Pursuing growth through existing site expansions and new site acquisitions Approximately 500 MW contracted to CoreWeave for delivery 2025 - 2026 Well positioned for an increase in hash price Seeking to diversify clients through new site acquisitions

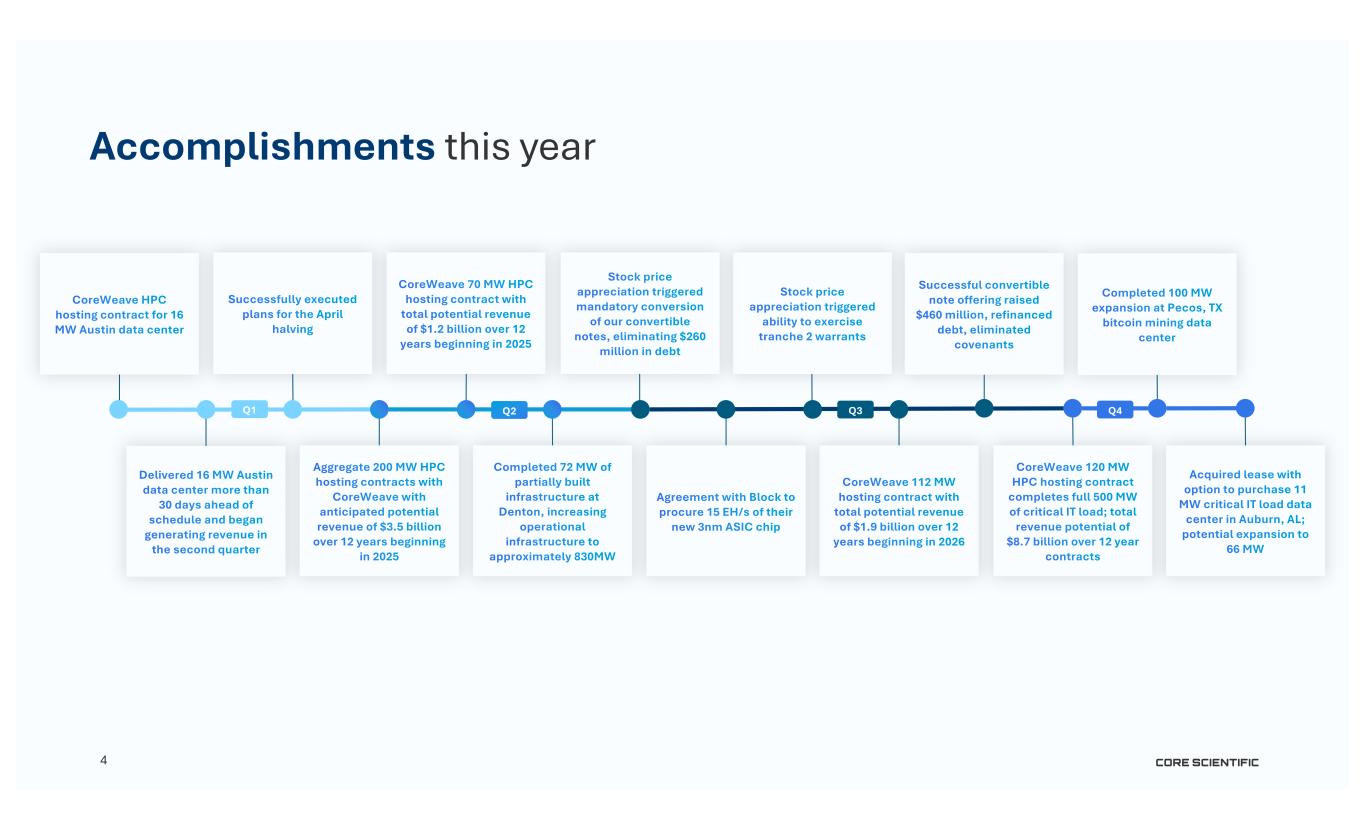

4 Accomplishments this year Q2Q1 Q3 Q4

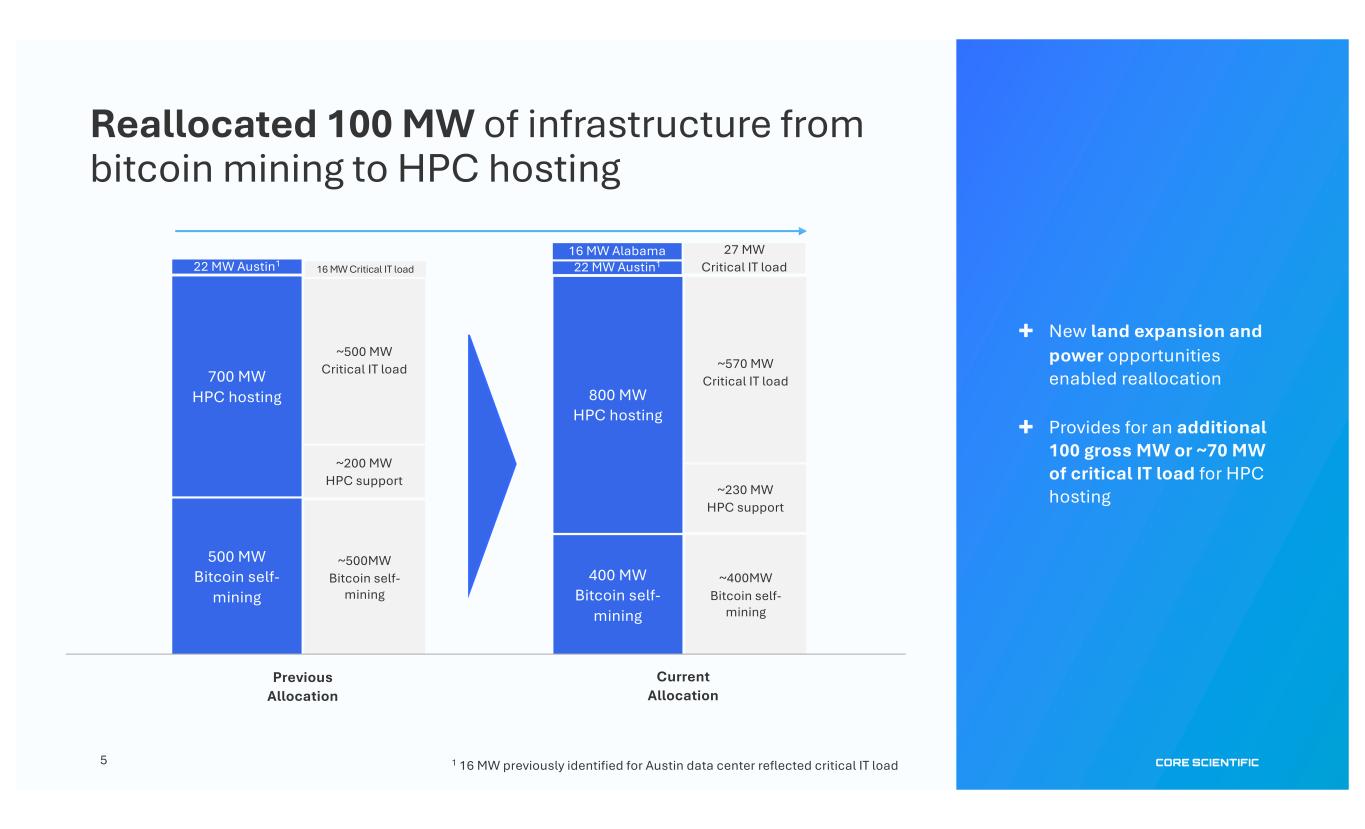

5 ~400MW Bitcoin self- mining ~570 MW Critical IT load ~230 MW HPC support Current Allocation 700 MW HPC hosting Previous Allocation ✚ New land expansion and power opportunities enabled reallocation ✚ Provides for an additional 100 gross MW or ~70 MW of critical IT load for HPC hosting 22 MW Austin1 800 MW HPC hosting 400 MW Bitcoin self- mining 22 MW Austin1 500 MW Bitcoin self- mining ~500MW Bitcoin self- mining ~500 MW Critical IT load ~200 MW HPC support 16 MW Alabama Reallocated 100 MW of infrastructure from bitcoin mining to HPC hosting 1 16 MW previously identified for Austin data center reflected critical IT load 27 MW Critical IT load16 MW Critical IT load

6 2024 snapshot Financial (Q3) • $95 million revenue • $455.3 million net loss, mainly driven by non-cash adjustments • $10 million adjusted EBITDA • $253 million in cash • Reduced interest rate from as high as 12.5% to 3% for new convertible notes Operational (Q3) • Earned 1,115 bitcoin • Operated 20.4 EH/s self-mining hash rate • Migrated all miners from two data centers designated for HPC hosting • Continued sunset of hosted mining to 11% of total fleet • Signed aggregate ~500 MW HPC hosting contracts with anticipated potential revenue of $8.7 billion over 12-year contracts • Refinanced debt, added cash to balance sheet and eliminated covenants with $460 million convertible note offering • Added 100 MW of infrastructure at Pecos, TX bitcoin mining data center Strategic (YTD)

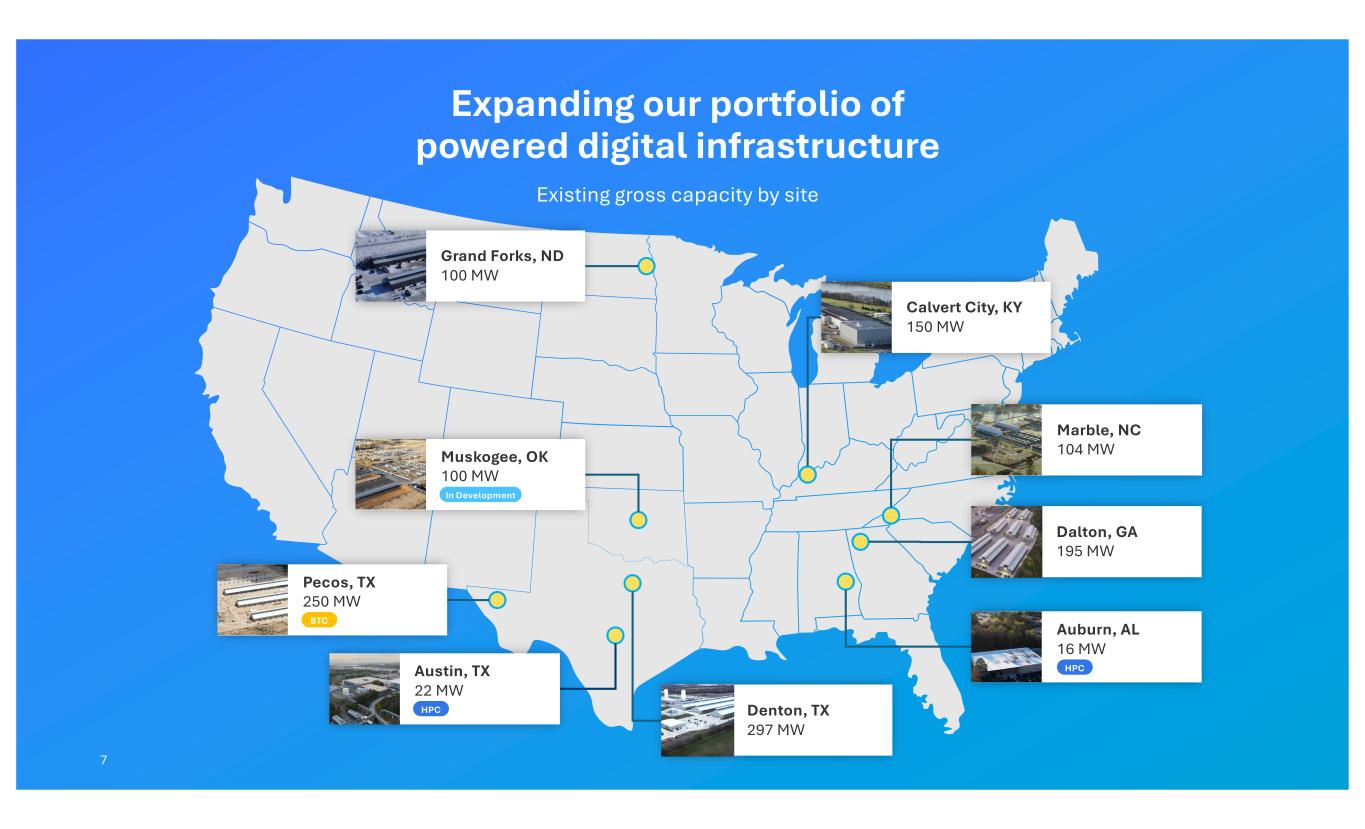

7 Expanding our portfolio of powered digital infrastructure Existing gross capacity by site Grand Forks, ND 100 MW Muskogee, OK 100 MW In Development Pecos, TX PROPRIETARY & CONFIDENTIAL 56 Commentary Cottonwood 56 Trailing 12 Month Performance(1) CapEx Investment Pecos, TX 250MW (Cottonwood 1 & 2) • Greenfield Buildout in 2022 • Campus has (2) phases – COT1 and COT2 • Core Scientific Leased • COT1 - (1) Operational Building totaling 50MW of energized capacity (~15k miners) with expansion capacity of additional 200MW • COT2 - (50) Operational containers totaling 21MW of energized capacity (~7.8k miners) • COT2 MW usage counts against total power allocation of 250MW from ERCOT • COT1 – 53k sq/ft production area • 7 Mining Ops FTEs • Utility Provider: TNMP Lease Information COT1 • Initial term expires Nov 2031; optional three, 10-year extensions (through Nov 2061) • Rent of $10k/acre ($600k) per 10-year term; rent escalates 20% per extension COT2 • Leased for 99 years (through 2122) • Paid full lease rent of $1m in 2023 88% Uptime 87% Hashrate Utilization 1.9 EH 97% Self-Mining Potential CapEx Projects • ~$500k CapEx for tech building • ~$250k CapEx for COT2 container field weatherization project • Complete COT1 200MW capacity expansion 250 MW BTC Austin, TX 22 MW HPC Denton, TX 297 MW Calvert City, KY 150 MW Marble, NC 104 MW Dalton, GA 195 MW Auburn, AL 16 MW HPC

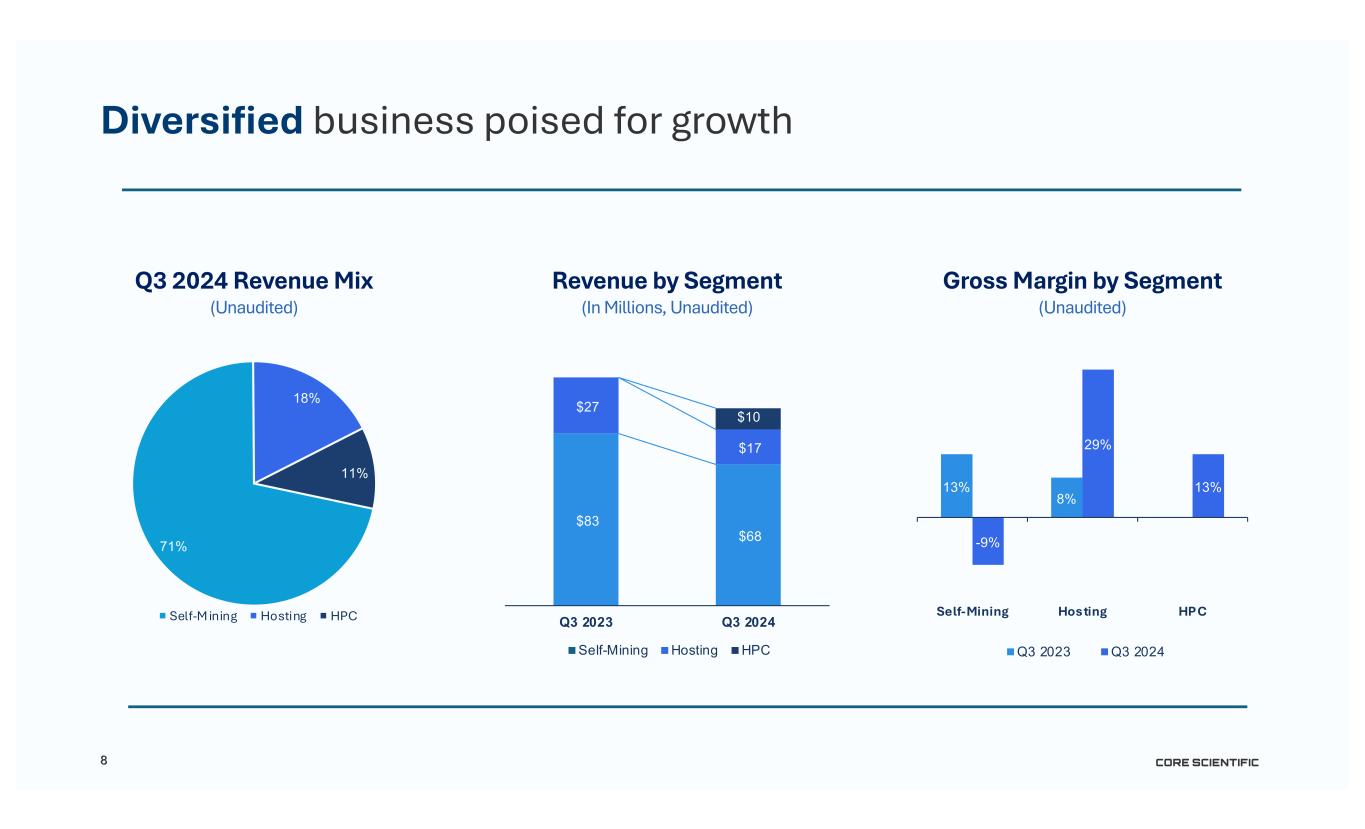

8 (Unaudited) Q3 2024 Revenue Mix (In Millions, Unaudited) Revenue by Segment Diversified business poised for growth 71% 18% 11% Self-M ining Hosting HPC $83 $68 $27 $17 $10 Q3 2023 Q3 2024 Self-Mining Hosting HPC (Unaudited) Gross Margin by Segment 13% 8% 0% -9% 29% 13% Self-Mining Hosting HPC Q3 2023 Q3 2024

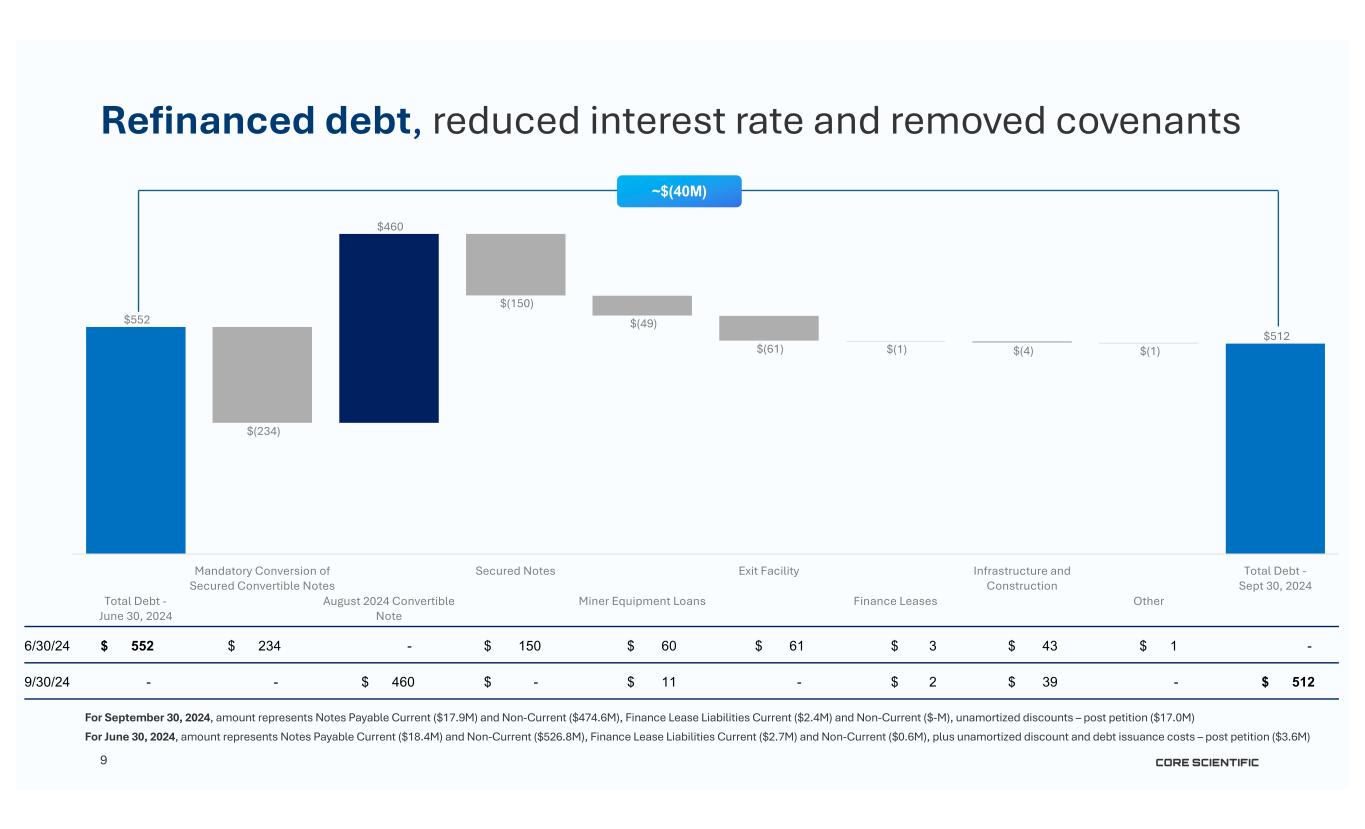

9 $552 $(234) $460 $(150) $(49) $(61) $(1) $(4) $(1) $512 Total Debt - June 30, 2024 Mandatory Conversion of Secured Convertible Notes August 2024 Convertible Note Secured Notes Miner Equipment Loans Exit Facility Finance Leases Infrastructure and Construction Other Total Debt - Sept 30, 2024 6/30/24 $ 552 $ 234 - $ 150 $ 60 $ 61 $ 3 $ 43 $ 1 - 9/30/24 - - $ 460 $ - $ 11 - $ 2 $ 39 - $ 512 ~$(40M) For September 30, 2024, amount represents Notes Payable Current ($17.9M) and Non-Current ($474.6M), Finance Lease Liabilities Current ($2.4M) and Non-Current ($-M), unamortized discounts – post petition ($17.0M) For June 30, 2024, amount represents Notes Payable Current ($18.4M) and Non-Current ($526.8M), Finance Lease Liabilities Current ($2.7M) and Non-Current ($0.6M), plus unamortized discount and debt issuance costs – post petition ($3.6M) Refinanced debt, reduced interest rate and removed covenants

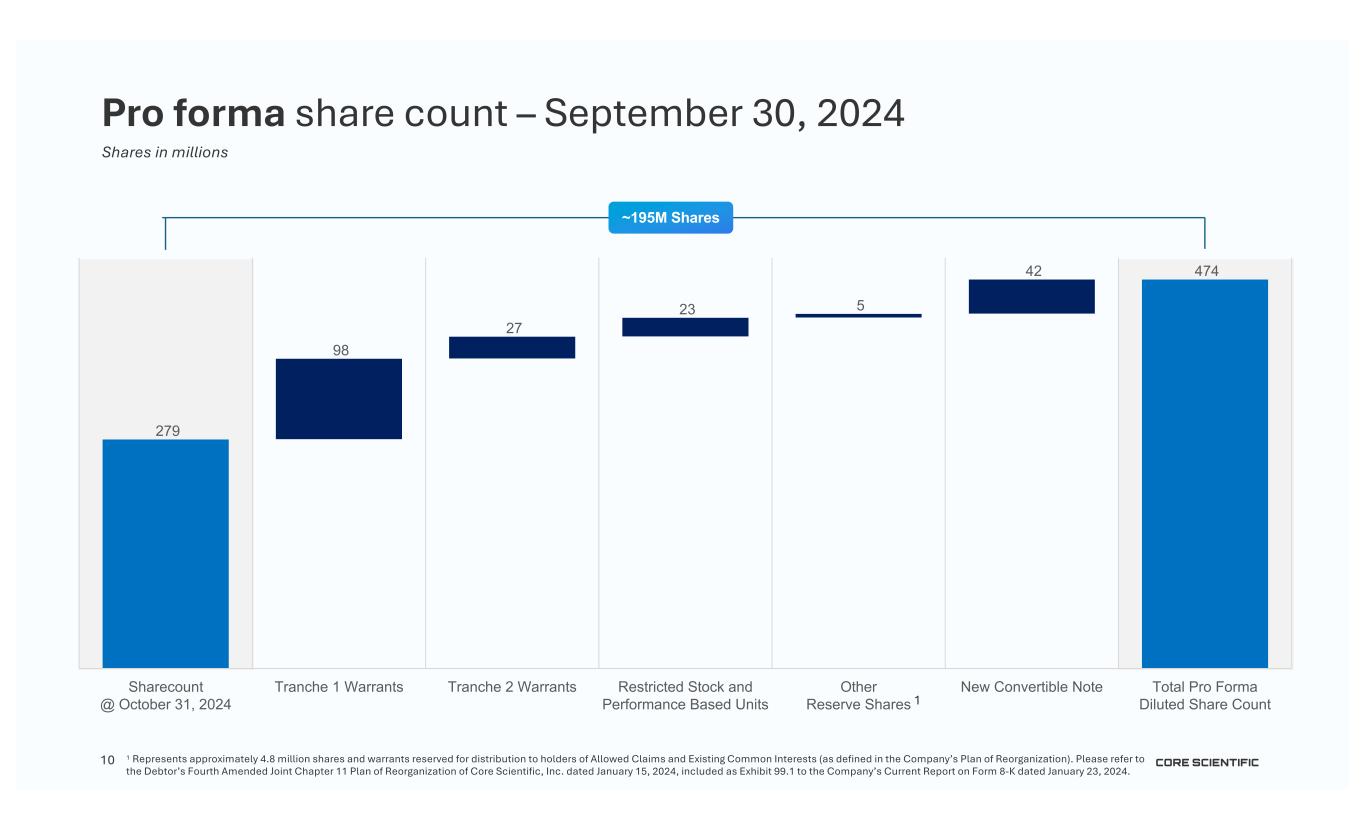

10 279 98 27 23 5 42 474 Sharecount @ October 31, 2024 Tranche 1 Warrants Tranche 2 Warrants Restricted Stock and Performance Based Units Other Reserve Shares New Convertible Note Total Pro Forma Diluted Share Count Pro forma share count – September 30, 2024 Shares in millions ~195M Shares 1 1 Represents approximately 4.8 million shares and warrants reserved for distribution to holders of Allowed Claims and Existing Common Interests (as defined in the Company’s Plan of Reorganization). Please refer to the Debtor’s Fourth Amended Joint Chapter 11 Plan of Reorganization of Core Scientific, Inc. dated January 15, 2024, included as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated January 23, 2024.

11 Cash Cost to self-mine a bitcoin in third quarter 2024 1 Represents our direct, cash costs of power and facilities operations based on our self-mining/hosting mix as of 9/30/24 divided by total bitcoin self-mined in 2024 Q3 of 1,115. Future changes in power cost, operational cost or self-mining/hosting mix could change the cash cost to mine 2 Represents our direct, cash costs of power and facilities operations divided by our self-mining fleet hash rate, in terahash, per day 3 Includes personnel and related costs, software, telecommunications, security, etc. Excludes stock-based compensation and depreciation Third Quarter 2024 Cash Cost Per Bitcoin1 $33,946 Third Quarter 2024 Cash-Based Hash Cost2 2.5¢ $8,405 0.6¢ $42,351 3.1¢ Direct Power Cost Operational Cost3 Total Direct Cash Cost

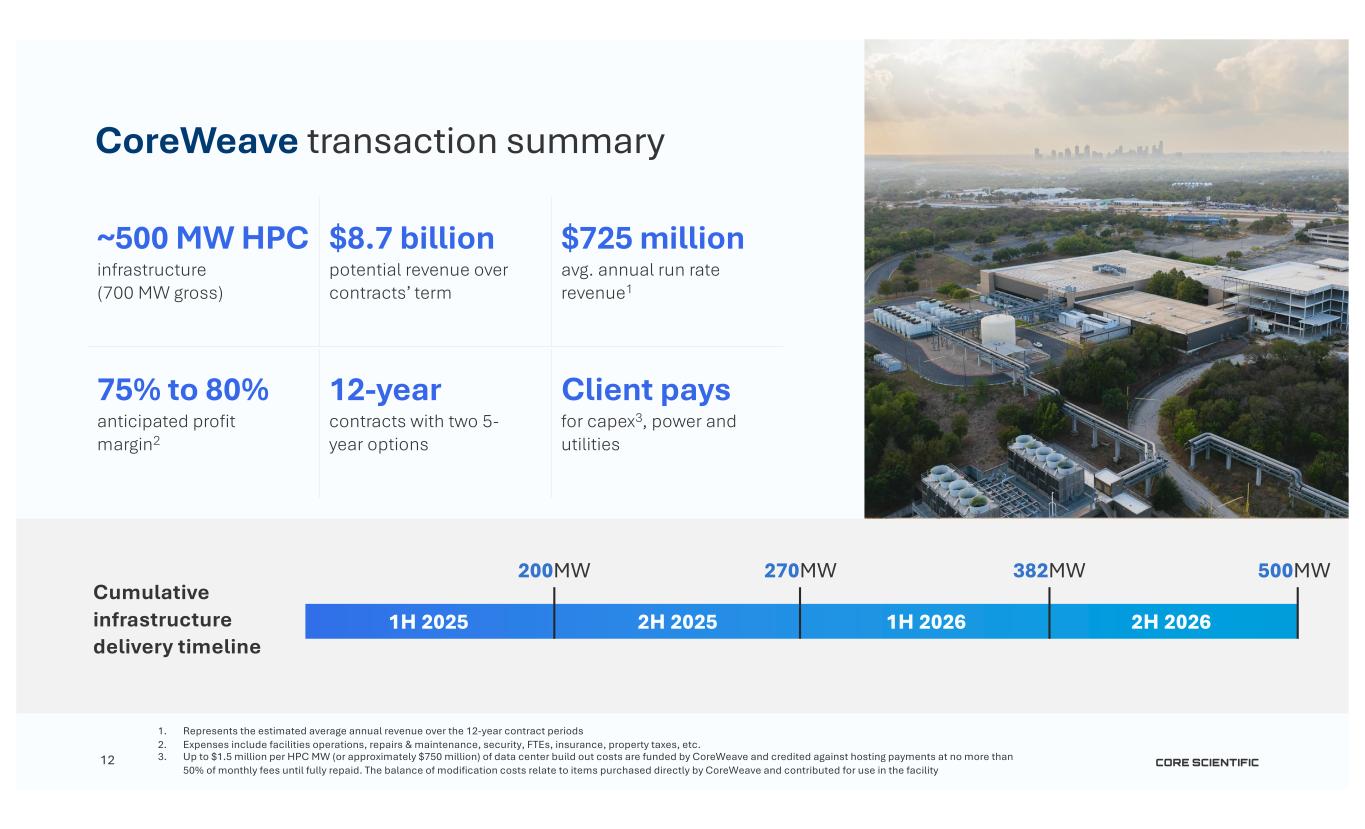

12 CoreWeave transaction summary 1. Represents the estimated average annual revenue over the 12-year contract periods 2. Expenses include facilities operations, repairs & maintenance, security, FTEs, insurance, property taxes, etc. 3. Up to $1.5 million per HPC MW (or approximately $750 million) of data center build out costs are funded by CoreWeave and credited against hosting payments at no more than 50% of monthly fees until fully repaid. The balance of modification costs relate to items purchased directly by CoreWeave and contributed for use in the facility ~500 MW HPC infrastructure (700 MW gross) $8.7 billion potential revenue over contracts’ term $725 million avg. annual run rate revenue1 1H 2025 2H 2025 1H 2026 2H 2026 200MW 270MW 382MW 500MW Cumulative infrastructure delivery timeline 75% to 80% anticipated profit margin2 12-year contracts with two 5- year options Client pays for capex3, power and utilities

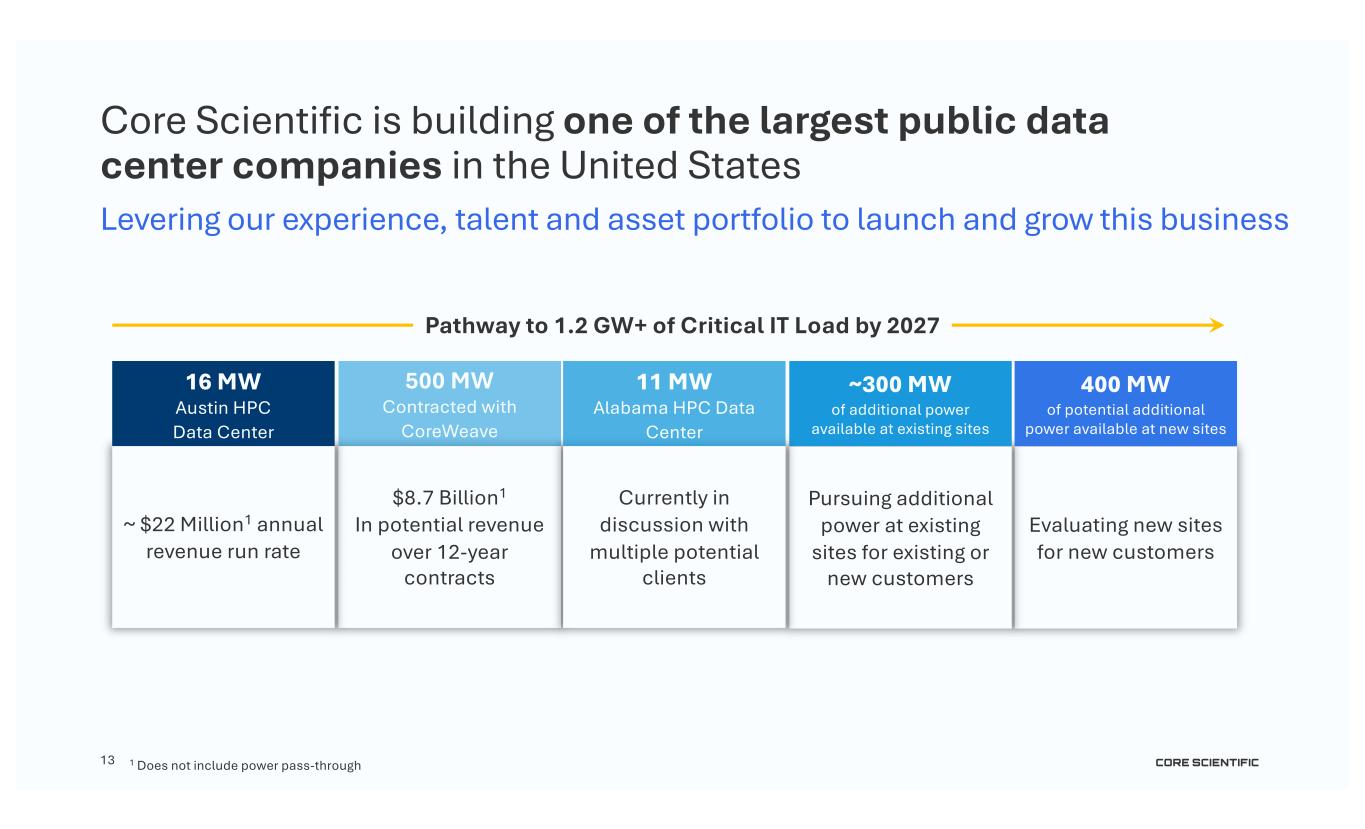

13 Core Scientific is building one of the largest public data center companies in the United States Levering our experience, talent and asset portfolio to launch and grow this business Evaluating new sites for new customers Pursuing additional power at existing sites for existing or new customers $8.7 Billion1 In potential revenue over 12-year contracts 500 MW Contracted with CoreWeave ~300 MW of additional power available at existing sites 400 MW of potential additional power available at new sites ~ $22 Million1 annual revenue run rate 16 MW Austin HPC Data Center Currently in discussion with multiple potential clients 11 MW Alabama HPC Data Center 1 Does not include power pass-through Pathway to 1.2 GW+ of Critical IT Load by 2027

14 2024 goals and targets MW HPC critical IT load 16 Bitcoin mining fleet average power price (cents/kWh) 4.2 - 4.4

CORE SCIENTIFIC15 2024 catalysts Contract remaining 118 MW of infrastructure available for HPC hosting Execute on pipeline of opportunities to increase our infrastructure capacity Diversify HPC hosting clients 1 2 3

16 Summary Executing on our diversification strategy to create long term shareholder value | Capturing AI compute market growth | Fortifying our strong bitcoin mining franchise Expanding our platform for accelerated growth Building on our assets and our team Strengthening our earnings power Balancing our business Leading a new category in digital infrastructure

Appendix

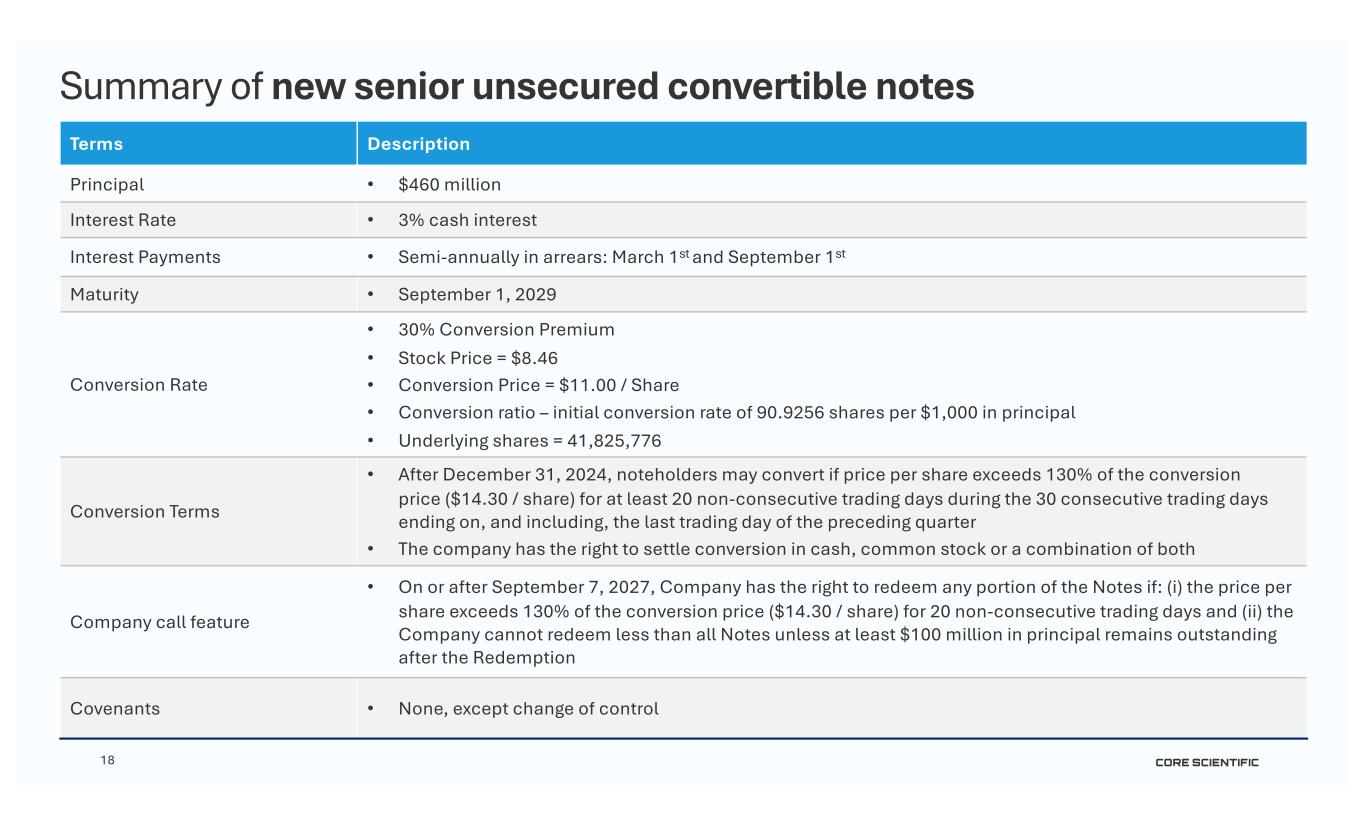

18 Summary of new senior unsecured convertible notes Terms Description Principal • $460 million Interest Rate • 3% cash interest Interest Payments • Semi-annually in arrears: March 1st and September 1st Maturity • September 1, 2029 Conversion Rate • 30% Conversion Premium • Stock Price = $8.46 • Conversion Price = $11.00 / Share • Conversion ratio – initial conversion rate of 90.9256 shares per $1,000 in principal • Underlying shares = 41,825,776 Conversion Terms • After December 31, 2024, noteholders may convert if price per share exceeds 130% of the conversion price ($14.30 / share) for at least 20 non-consecutive trading days during the 30 consecutive trading days ending on, and including, the last trading day of the preceding quarter • The company has the right to settle conversion in cash, common stock or a combination of both Company call feature • On or after September 7, 2027, Company has the right to redeem any portion of the Notes if: (i) the price per share exceeds 130% of the conversion price ($14.30 / share) for 20 non-consecutive trading days and (ii) the Company cannot redeem less than all Notes unless at least $100 million in principal remains outstanding after the Redemption Covenants • None, except change of control

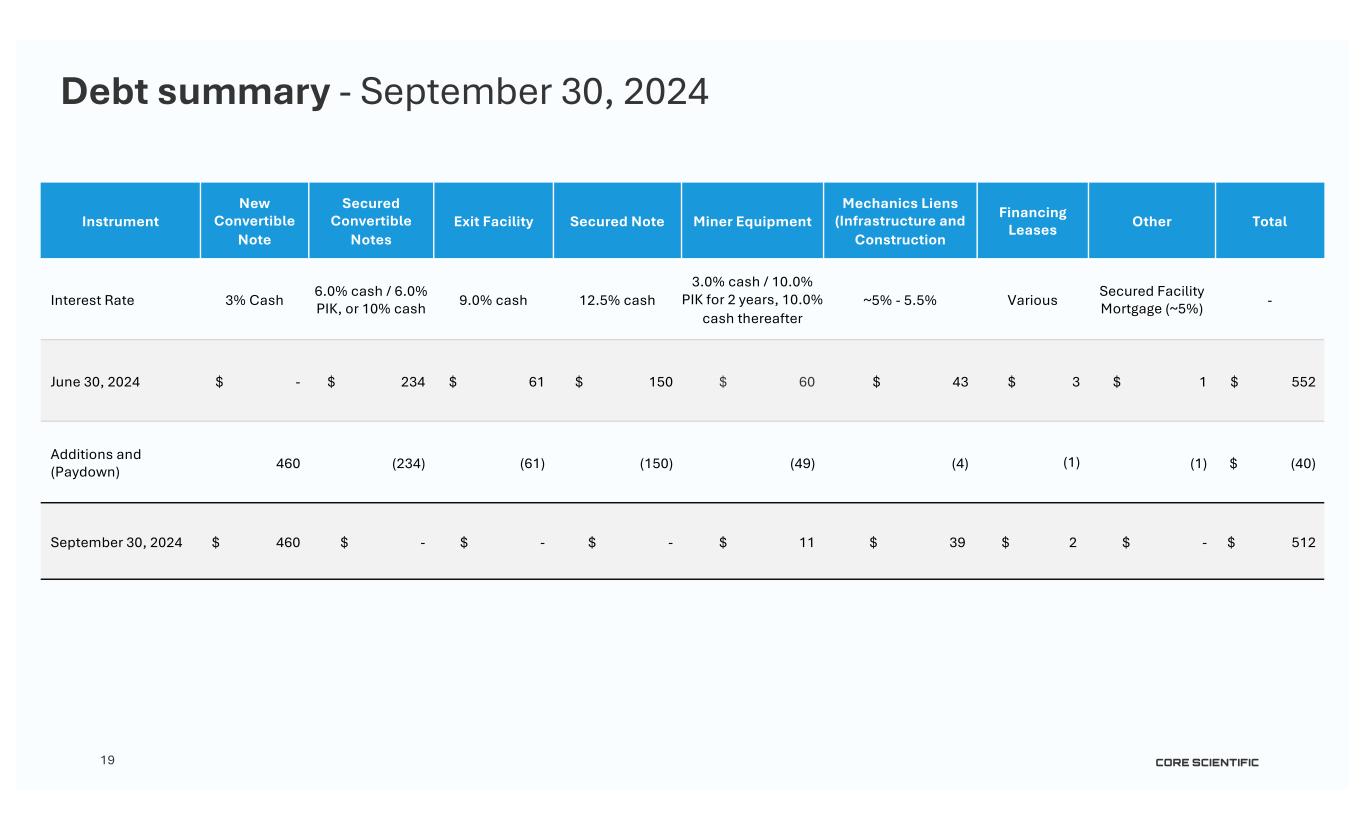

19 Debt summary - September 30, 2024 Instrument New Convertible Note Secured Convertible Notes Exit Facility Secured Note Miner Equipment Mechanics Liens (Infrastructure and Construction Financing Leases Other Total Interest Rate 3% Cash 6.0% cash / 6.0% PIK, or 10% cash 9.0% cash 12.5% cash 3.0% cash / 10.0% PIK for 2 years, 10.0% cash thereafter ~5% - 5.5% Various Secured Facility Mortgage (~5%) - June 30, 2024 $ - $ 234 $ 61 $ 150 $ 60 $ 43 $ 3 $ 1 $ 552 Additions and (Paydown) 460 (234) (61) (150) (49) (4) (1) (1) $ (40) September 30, 2024 $ 460 $ - $ - $ - $ 11 $ 39 $ 2 $ - $ 512

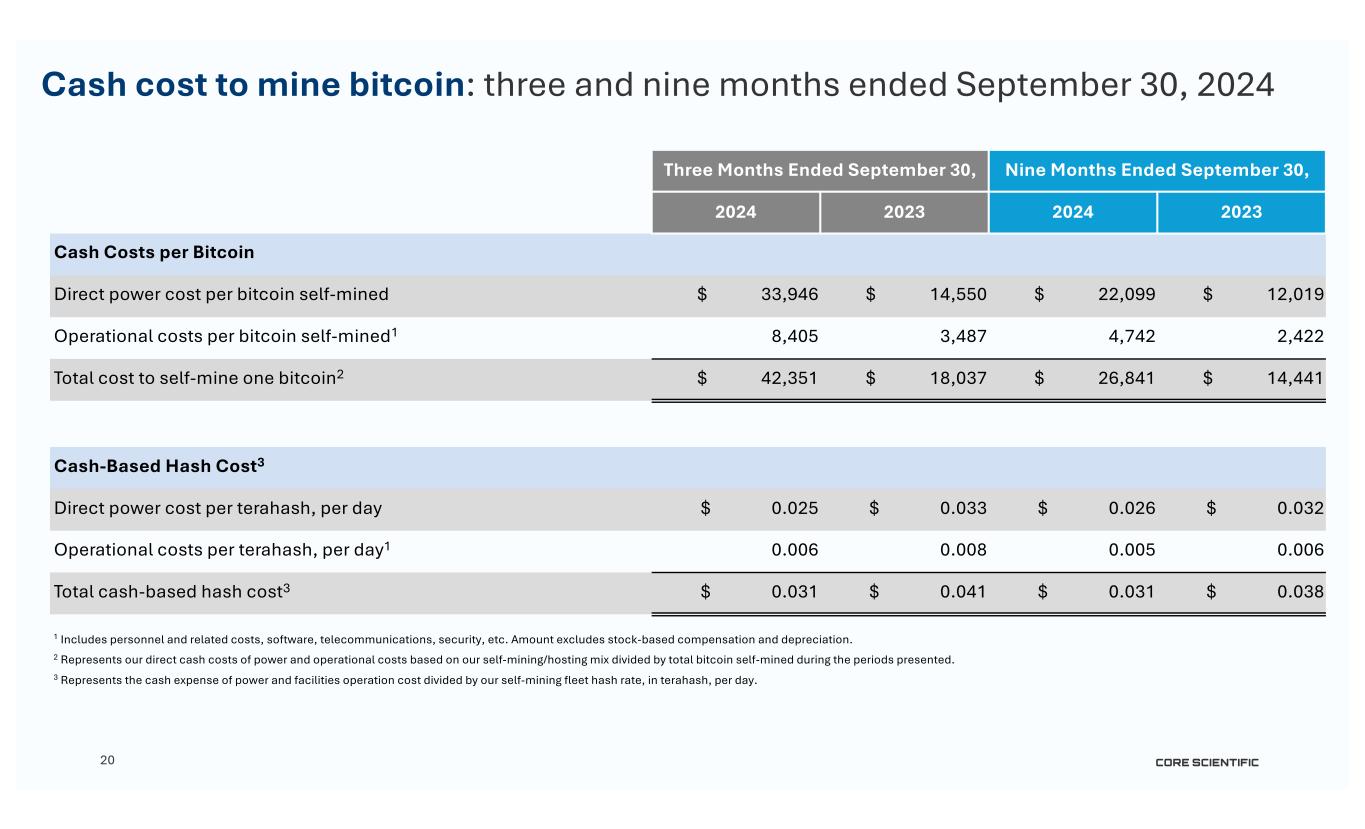

20 Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Cash Costs per Bitcoin Direct power cost per bitcoin self-mined $ 33,946 $ 14,550 $ 22,099 $ 12,019 Operational costs per bitcoin self-mined1 8,405 3,487 4,742 2,422 Total cost to self-mine one bitcoin2 $ 42,351 $ 18,037 $ 26,841 $ 14,441 Cash-Based Hash Cost3 Direct power cost per terahash, per day $ 0.025 $ 0.033 $ 0.026 $ 0.032 Operational costs per terahash, per day1 0.006 0.008 0.005 0.006 Total cash-based hash cost3 $ 0.031 $ 0.041 $ 0.031 $ 0.038 Cash cost to mine bitcoin: three and nine months ended September 30, 2024 1 Includes personnel and related costs, software, telecommunications, security, etc. Amount excludes stock-based compensation and depreciation. 2 Represents our direct cash costs of power and operational costs based on our self-mining/hosting mix divided by total bitcoin self-mined during the periods presented. 3 Represents the cash expense of power and facilities operation cost divided by our self-mining fleet hash rate, in terahash, per day.

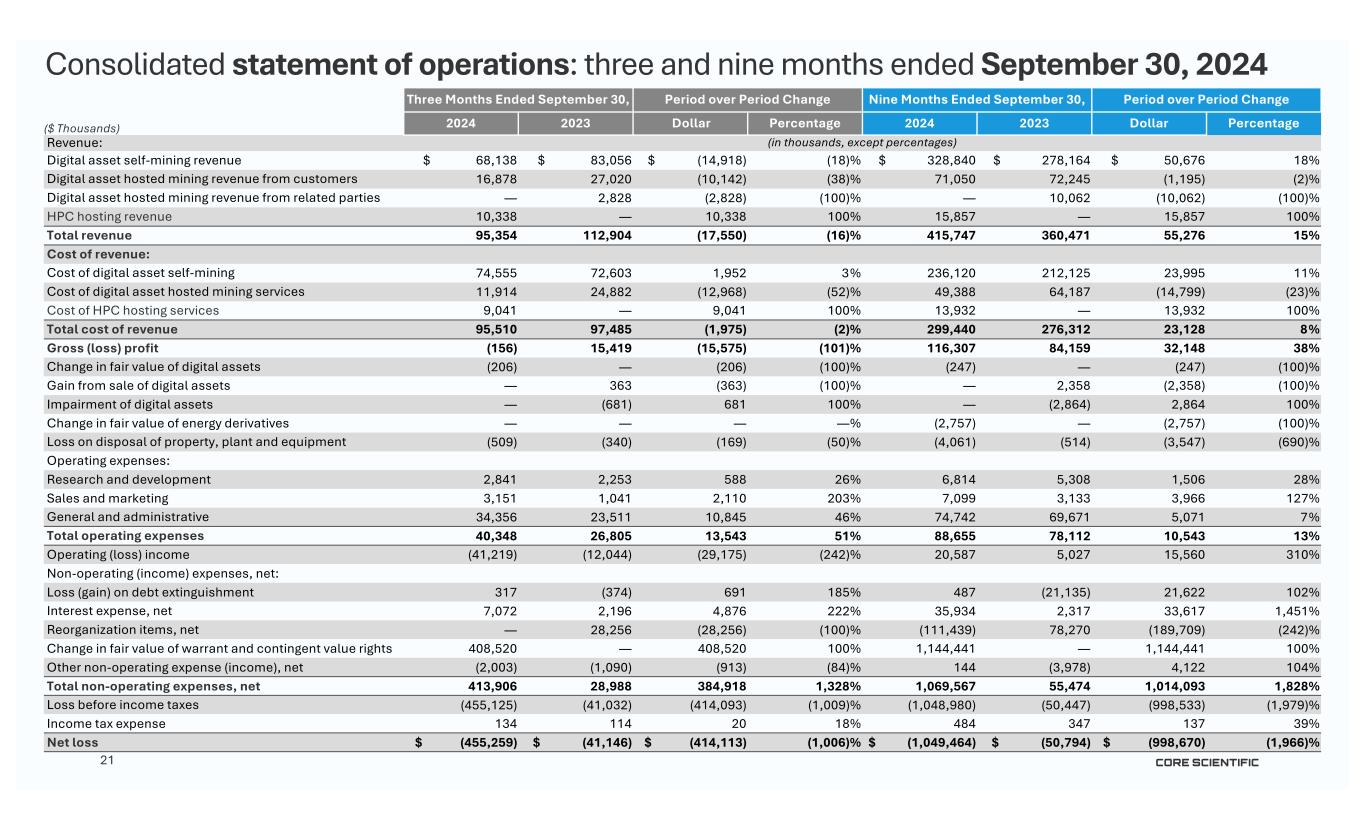

21 Consolidated statement of operations: three and nine months ended September 30, 2024 Three Months Ended September 30, Period over Period Change Nine Months Ended September 30, Period over Period Change 2024 2023 Dollar Percentage 2024 2023 Dollar Percentage Revenue: (in thousands, except percentages) Digital asset self-mining revenue $ 68,138 $ 83,056 $ (14,918) (18)% $ 328,840 $ 278,164 $ 50,676 18% Digital asset hosted mining revenue from customers 16,878 27,020 (10,142) (38)% 71,050 72,245 (1,195) (2)% Digital asset hosted mining revenue from related parties — 2,828 (2,828) (100)% — 10,062 (10,062) (100)% HPC hosting revenue 10,338 — 10,338 100% 15,857 — 15,857 100% Total revenue 95,354 112,904 (17,550) (16)% 415,747 360,471 55,276 15% Cost of revenue: Cost of digital asset self-mining 74,555 72,603 1,952 3% 236,120 212,125 23,995 11% Cost of digital asset hosted mining services 11,914 24,882 (12,968) (52)% 49,388 64,187 (14,799) (23)% Cost of HPC hosting services 9,041 — 9,041 100% 13,932 — 13,932 100% Total cost of revenue 95,510 97,485 (1,975) (2)% 299,440 276,312 23,128 8% Gross (loss) profit (156) 15,419 (15,575) (101)% 116,307 84,159 32,148 38% Change in fair value of digital assets (206) — (206) (100)% (247) — (247) (100)% Gain from sale of digital assets — 363 (363) (100)% — 2,358 (2,358) (100)% Impairment of digital assets — (681) 681 100% — (2,864) 2,864 100% Change in fair value of energy derivatives — — — —% (2,757) — (2,757) (100)% Loss on disposal of property, plant and equipment (509) (340) (169) (50)% (4,061) (514) (3,547) (690)% Operating expenses: Research and development 2,841 2,253 588 26% 6,814 5,308 1,506 28% Sales and marketing 3,151 1,041 2,110 203% 7,099 3,133 3,966 127% General and administrative 34,356 23,511 10,845 46% 74,742 69,671 5,071 7% Total operating expenses 40,348 26,805 13,543 51% 88,655 78,112 10,543 13% Operating (loss) income (41,219) (12,044) (29,175) (242)% 20,587 5,027 15,560 310% Non-operating (income) expenses, net: Loss (gain) on debt extinguishment 317 (374) 691 185% 487 (21,135) 21,622 102% Interest expense, net 7,072 2,196 4,876 222% 35,934 2,317 33,617 1,451% Reorganization items, net — 28,256 (28,256) (100)% (111,439) 78,270 (189,709) (242)% Change in fair value of warrant and contingent value rights 408,520 — 408,520 100% 1,144,441 — 1,144,441 100% Other non-operating expense (income), net (2,003) (1,090) (913) (84)% 144 (3,978) 4,122 104% Total non-operating expenses, net 413,906 28,988 384,918 1,328% 1,069,567 55,474 1,014,093 1,828% Loss before income taxes (455,125) (41,032) (414,093) (1,009)% (1,048,980) (50,447) (998,533) (1,979)% Income tax expense 134 114 20 18% 484 347 137 39% Net loss $ (455,259) $ (41,146) $ (414,113) (1,006)% $ (1,049,464) $ (50,794) $ (998,670) (1,966)% ($ Thousands)

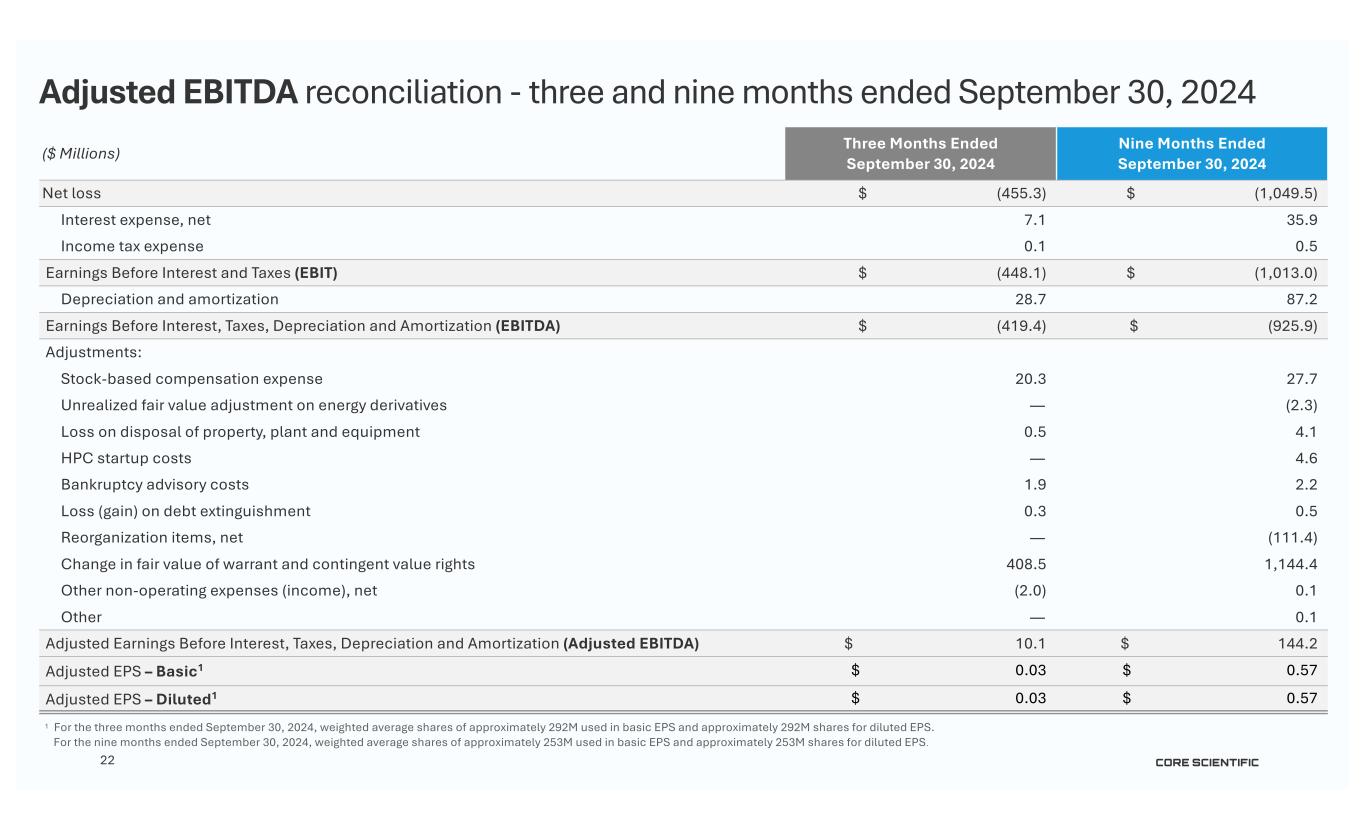

22 Adjusted EBITDA reconciliation - three and nine months ended September 30, 2024 ($ Millions) Three Months Ended September 30, 2024 Nine Months Ended September 30, 2024 Net loss $ (455.3) $ (1,049.5) Interest expense, net 7.1 35.9 Income tax expense 0.1 0.5 Earnings Before Interest and Taxes (EBIT) $ (448.1) $ (1,013.0) Depreciation and amortization 28.7 87.2 Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) $ (419.4) $ (925.9) Adjustments: Stock-based compensation expense 20.3 27.7 Unrealized fair value adjustment on energy derivatives — (2.3) Loss on disposal of property, plant and equipment 0.5 4.1 HPC startup costs — 4.6 Bankruptcy advisory costs 1.9 2.2 Loss (gain) on debt extinguishment 0.3 0.5 Reorganization items, net — (111.4) Change in fair value of warrant and contingent value rights 408.5 1,144.4 Other non-operating expenses (income), net (2.0) 0.1 Other — 0.1 Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA) $ 10.1 $ 144.2 Adjusted EPS – Basic1 $ 0.03 $ 0.57 Adjusted EPS – Diluted1 $ 0.03 $ 0.57 1 For the three months ended September 30, 2024, weighted average shares of approximately 292M used in basic EPS and approximately 292M shares for diluted EPS. For the nine months ended September 30, 2024, weighted average shares of approximately 253M used in basic EPS and approximately 253M shares for diluted EPS.

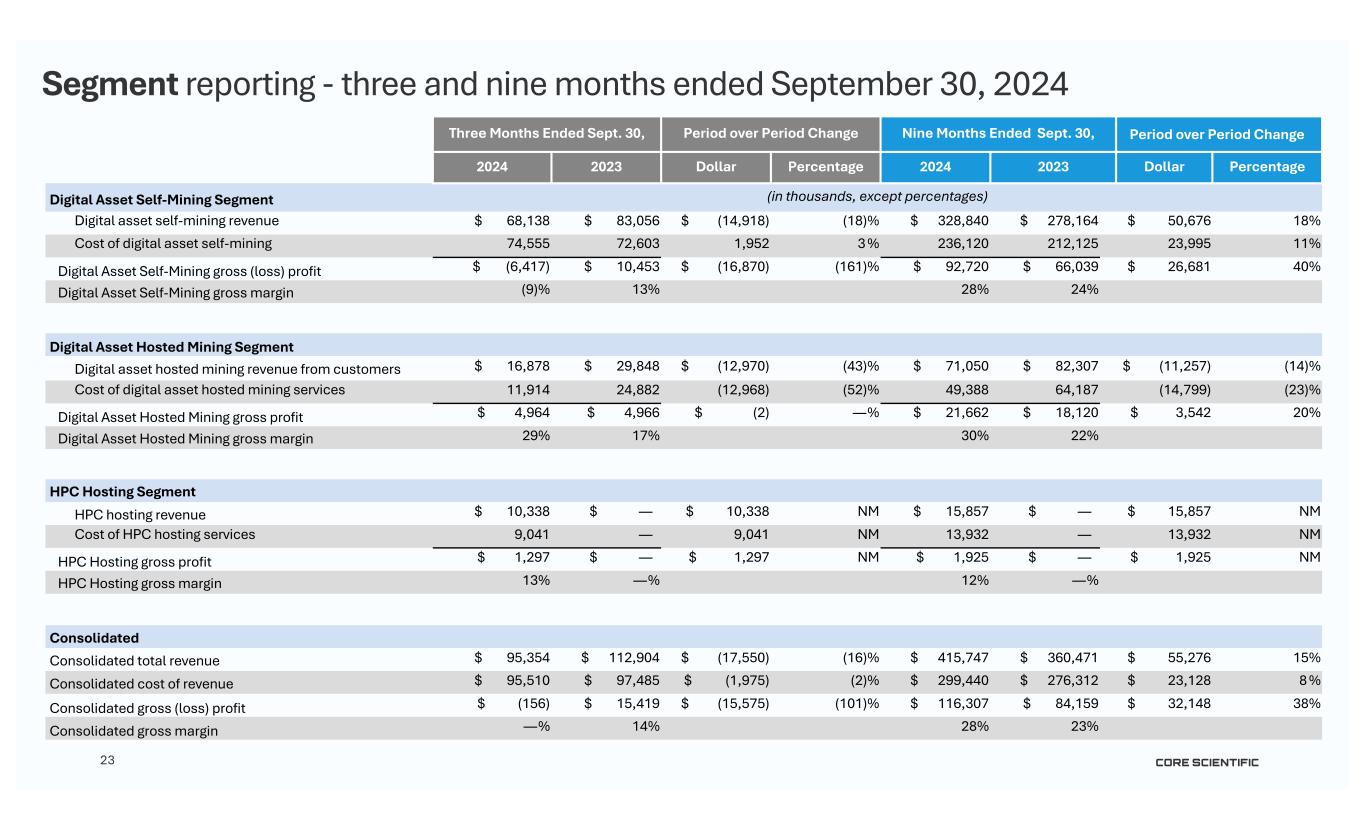

23 Three Months Ended Sept. 30, Period over Period Change Nine Months Ended Sept. 30, Period over Period Change 2024 2023 Dollar Percentage 2024 2023 Dollar Percentage Digital Asset Self-Mining Segment (in thousands, except percentages) Digital asset self-mining revenue $ 68,138 $ 83,056 $ (14,918) (18) % $ 328,840 $ 278,164 $ 50,676 18 % Cost of digital asset self-mining 74,555 72,603 1,952 3 % 236,120 212,125 23,995 11 % Digital Asset Self-Mining gross (loss) profit $ (6,417) $ 10,453 $ (16,870) (161) % $ 92,720 $ 66,039 $ 26,681 40 % Digital Asset Self-Mining gross margin (9) % 13 % 28 % 24 % Digital Asset Hosted Mining Segment Digital asset hosted mining revenue from customers $ 16,878 $ 29,848 $ (12,970) (43) % $ 71,050 $ 82,307 $ (11,257) (14) % Cost of digital asset hosted mining services 11,914 24,882 (12,968) (52) % 49,388 64,187 (14,799) (23) % Digital Asset Hosted Mining gross profit $ 4,964 $ 4,966 $ (2) — % $ 21,662 $ 18,120 $ 3,542 20 % Digital Asset Hosted Mining gross margin 29 % 17 % 30 % 22 % HPC Hosting Segment HPC hosting revenue $ 10,338 $ — $ 10,338 NM $ 15,857 $ — $ 15,857 NM Cost of HPC hosting services 9,041 — 9,041 NM 13,932 — 13,932 NM HPC Hosting gross profit $ 1,297 $ — $ 1,297 NM $ 1,925 $ — $ 1,925 NM HPC Hosting gross margin 13 % — % 12 % — % Consolidated Consolidated total revenue $ 95,354 $ 112,904 $ (17,550) (16) % $ 415,747 $ 360,471 $ 55,276 15 % Consolidated cost of revenue $ 95,510 $ 97,485 $ (1,975) (2) % $ 299,440 $ 276,312 $ 23,128 8 % Consolidated gross (loss) profit $ (156) $ 15,419 $ (15,575) (101) % $ 116,307 $ 84,159 $ 32,148 38 % Consolidated gross margin — % 14 % 28 % 23 % Segment reporting - three and nine months ended September 30, 2024

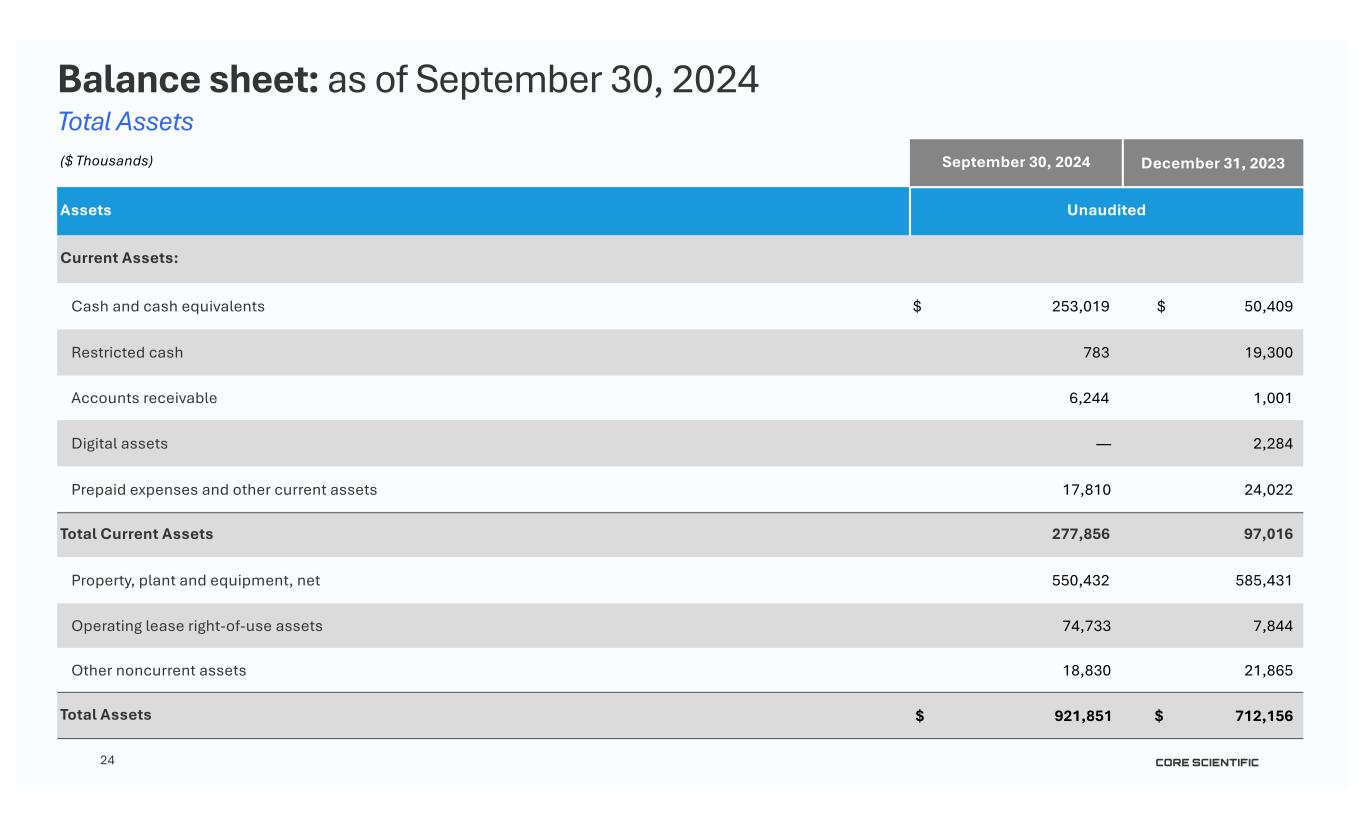

24 Balance sheet: as of September 30, 2024 Total Assets ($ Thousands) September 30, 2024 December 31, 2023 Assets Unaudited Current Assets: Cash and cash equivalents $ 253,019 $ 50,409 Restricted cash 783 19,300 Accounts receivable 6,244 1,001 Digital assets — 2,284 Prepaid expenses and other current assets 17,810 24,022 Total Current Assets 277,856 97,016 Property, plant and equipment, net 550,432 585,431 Operating lease right-of-use assets 74,733 7,844 Other noncurrent assets 18,830 21,865 Total Assets $ 921,851 $ 712,156

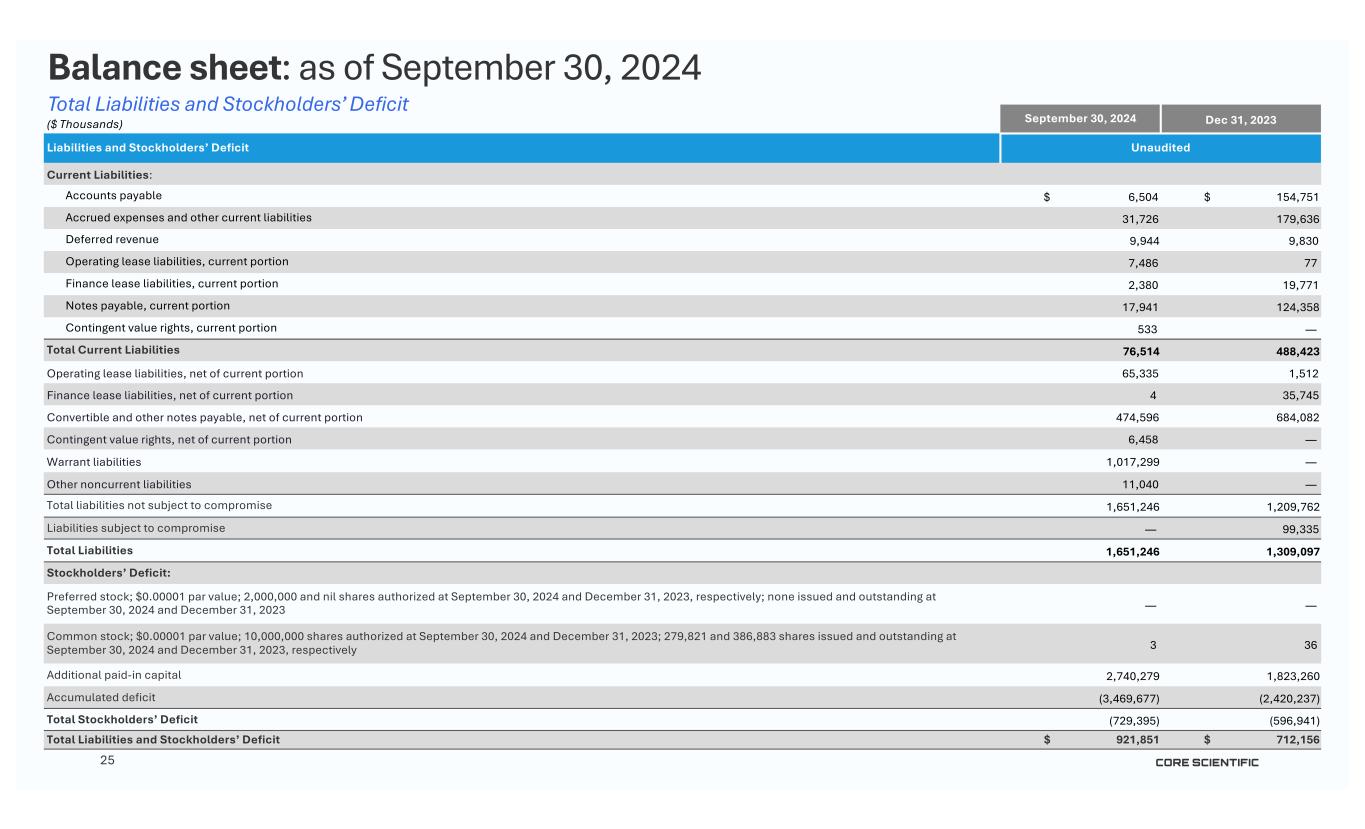

25 Balance sheet: as of September 30, 2024 Total Liabilities and Stockholders’ Deficit ($ Thousands) September 30, 2024 Dec 31, 2023 Liabilities and Stockholders’ Deficit Unaudited Current Liabilities: Accounts payable $ 6,504 $ 154,751 Accrued expenses and other current liabilities 31,726 179,636 Deferred revenue 9,944 9,830 Operating lease liabilities, current portion 7,486 77 Finance lease liabilities, current portion 2,380 19,771 Notes payable, current portion 17,941 124,358 Contingent value rights, current portion 533 — Total Current Liabilities 76,514 488,423 Operating lease liabilities, net of current portion 65,335 1,512 Finance lease liabilities, net of current portion 4 35,745 Convertible and other notes payable, net of current portion 474,596 684,082 Contingent value rights, net of current portion 6,458 — Warrant liabilities 1,017,299 — Other noncurrent liabilities 11,040 — Total liabilities not subject to compromise 1,651,246 1,209,762 Liabilities subject to compromise — 99,335 Total Liabilities 1,651,246 1,309,097 Stockholders’ Deficit: Preferred stock; $0.00001 par value; 2,000,000 and nil shares authorized at September 30, 2024 and December 31, 2023, respectively; none issued and outstanding at September 30, 2024 and December 31, 2023 — — Common stock; $0.00001 par value; 10,000,000 shares authorized at September 30, 2024 and December 31, 2023; 279,821 and 386,883 shares issued and outstanding at September 30, 2024 and December 31, 2023, respectively 3 36 Additional paid-in capital 2,740,279 1,823,260 Accumulated deficit (3,469,677) (2,420,237) Total Stockholders’ Deficit (729,395) (596,941) Total Liabilities and Stockholders’ Deficit $ 921,851 $ 712,156