EX-99.1

Published on June 12, 2024

INVESTOR AND ANALYST DAY June 12, 2024 Denton, TX

2 FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the Company’s ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the Company and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. All forward looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to earn digital assets profitably and to attract customers for our hosting capabilities; our ability to maintain our competitive position as digital asset networks experience increases in total network hash rate; our ability to raise additional capital to continue our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential failure in our critical systems, facilities or services we provide; the physical risks and regulatory changes relating to climate change; potential significant changes to the method of validating blockchain transactions; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting the blockchain industry and the blockchain hosting market; the identification of material weaknesses in our internal control over financial reporting; price volatility of digital assets and bitcoin in particular; the “halving” of rewards available on the Bitcoin network, or the reduction of rewards on other networks, affecting our ability to generate revenue as our customers may not have an adequate incentive to continue mining and customers may cease mining operations altogether; the potential that insufficient awards from digital asset mining could disincentivize transaction processors from expending processing power on a particular network, which could negatively impact the utility of the network and further reduce the value of its digital assets; the requirements of our existing debt agreements for us to sell our digital assets earned from mining as they are received, preventing us from recognizing any gain from appreciation in the value of the digital assets we hold; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the increasing likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; increasing scrutiny and changing expectations with respect to our ESG policies; the effectiveness of our compliance and risk management methods; the adequacy of our sources of recovery if the digital assets held by us are lost, stolen or destroyed due to third-party digital asset services; the effects of our emergence from bankruptcy on our financial results, business and business relationships; and our substantial level of indebtedness and our current liquidity constraints affecting our financial condition and ability to service our indebtedness. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this presentation. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. Year over year comparisons are based on the combined results of Core Scientific and its acquired entities. Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law. NON-GAAP FINANCIAL MEASURES This presentation also contains non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA and adjusted earnings (loss) per diluted share. The Company believes that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non-GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company urges investors not to rely on any single financial measure to evaluate its business.

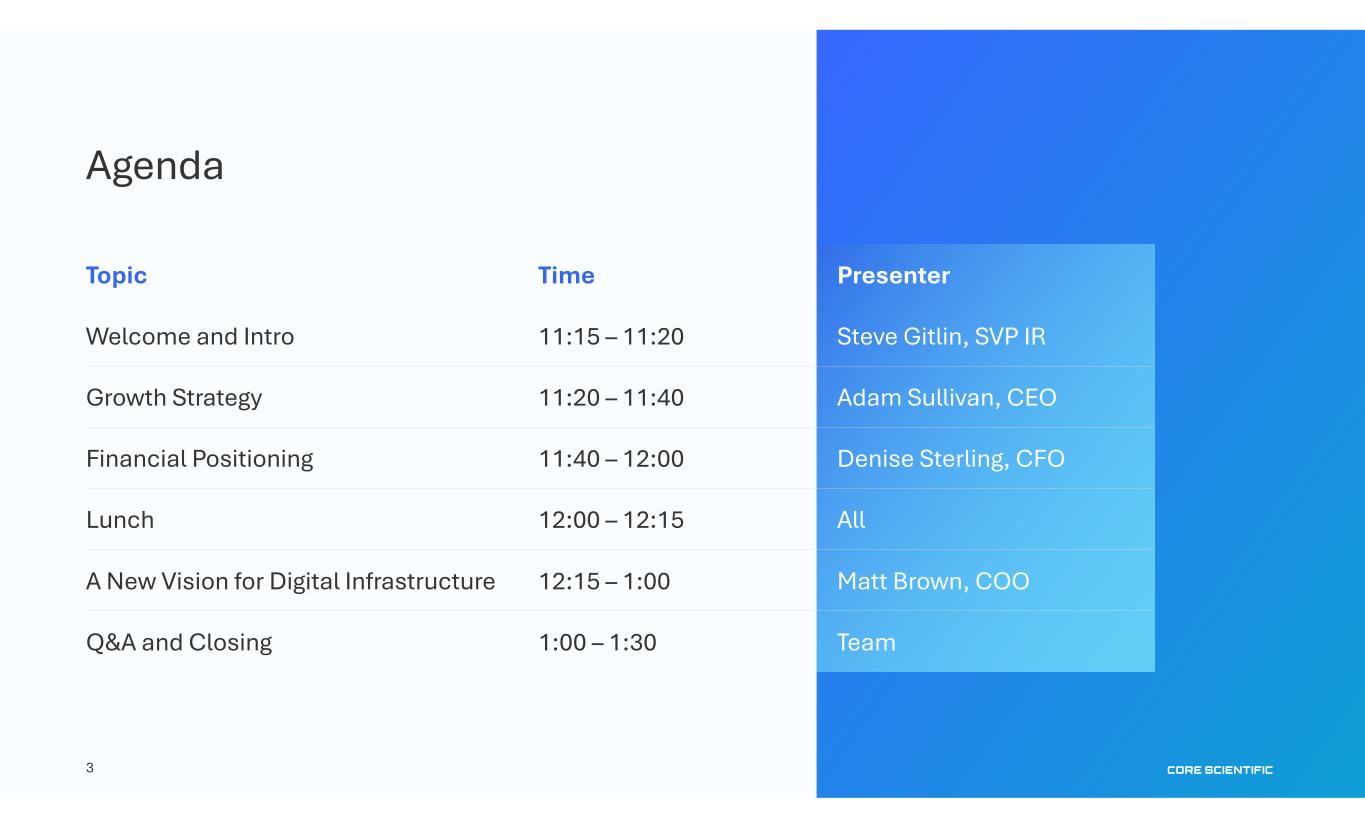

3 Agenda Topic Time Presenter Welcome and Intro 11:15 – 11:20 Steve Gitlin, SVP IR Growth Strategy 11:20 – 11:40 Adam Sullivan, CEO Financial Positioning 11:40 – 12:00 Denise Sterling, CFO Lunch 12:00 – 12:15 All A New Vision for Digital Infrastructure 12:15 – 1:00 Matt Brown, COO Q&A and Closing 1:00 – 1:30 Team

4 Today’s Speakers Adam Sullivan CEO Denise Sterling CFO Matt Brown COO

5 Our Objectives For Today Explain mechanics and key terms of our 200 MW CoreWeave agreements Communicate broader market opportunity for HPC and value of our remaining 300MW Demonstrate how we are executing our HPC build-out and strategy Outline our clear path for near- and long-term value creation

6 GROWTH STRATEGY Joined in 2023 Previously Managing Director and Head of Digital Assets and Infrastructure at XMS Capital Partners Oversaw more than $5 billion of transactions, including Core Scientific’s business combination with XPDI in 2021 Adam Sullivan | Chief Executive Officer

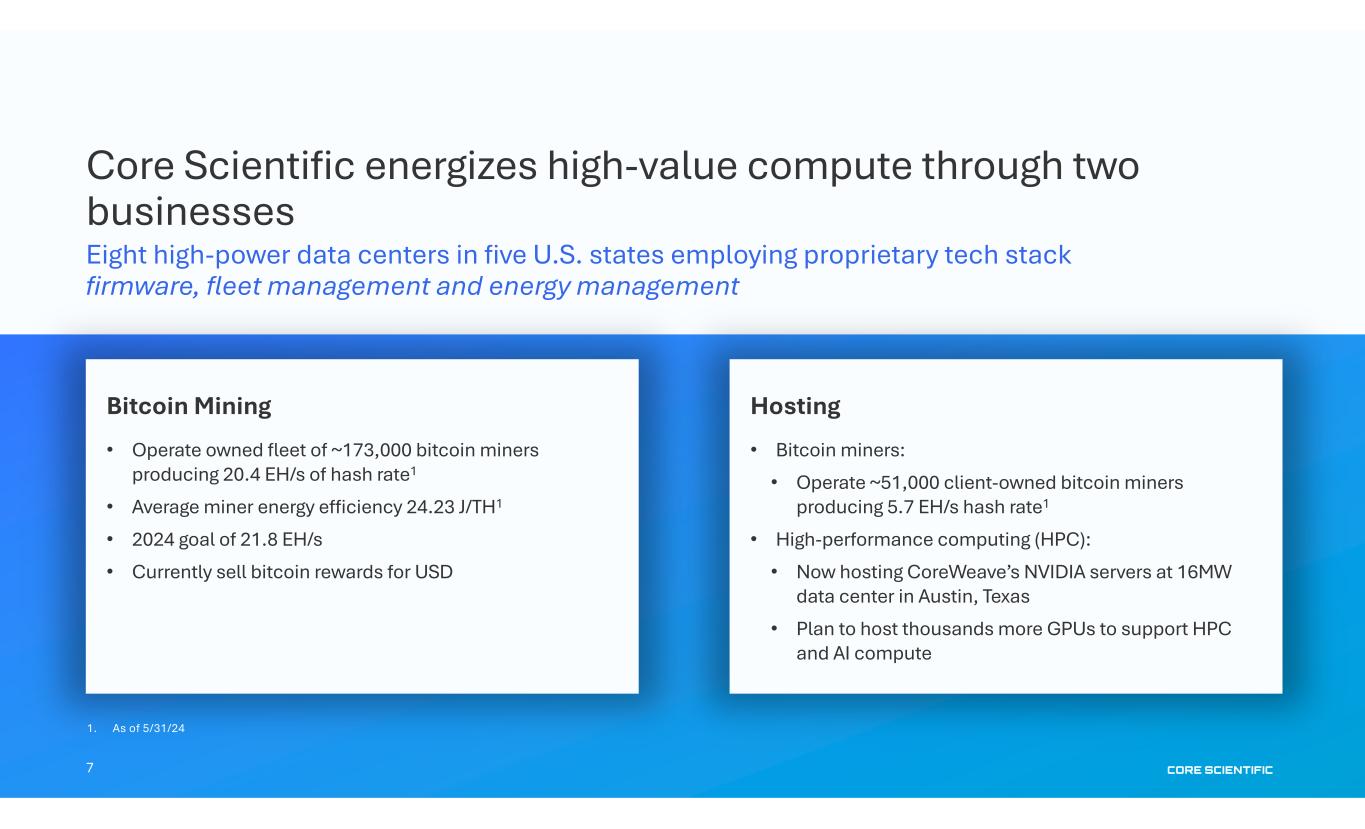

7 Core Scientific energizes high-value compute through two businesses Eight high-power data centers in five U.S. states employing proprietary tech stack firmware, fleet management and energy management Bitcoin Mining • Operate owned fleet of ~173,000 bitcoin miners producing 20.4 EH/s of hash rate1 • Average miner energy efficiency 24.23 J/TH1 • 2024 goal of 21.8 EH/s • Currently sell bitcoin rewards for USD Hosting • Bitcoin miners: • Operate ~51,000 client-owned bitcoin miners producing 5.7 EH/s hash rate1 • High-performance computing (HPC): • Now hosting CoreWeave’s NVIDIA servers at 16MW data center in Austin, Texas • Plan to host thousands more GPUs to support HPC and AI compute 1. As of 5/31/24

CORE SCIENTIFIC8 The Beginning Founders began small scale mining in 2012 Sought sites with abundant reliable & affordable power, connectivity, vacant land or existing buildings, economic incentives, water Purchased Marble, NC site in 2017 Over-designed our powered shells for BTC mining infrastructure and fiber connections based on data center requirements Rented excess capacity to hosting clients 0 100 200 300 400 500 600 700 800 2018 2019 2020 2021 2022 2023 2024 Mar ble Da lton Calvert City Grand For ks Den ton Peco s Austin Infrastructure Growth Operational MW Milestones • First industrial crypto miner to reach 100MW, 200MW, 500MW, 700 MW • 2019 to 2022 — Hosted CoreWeave GPUs • 2019 — built Tier 3 data center within Dalton 1 to house and operate NVDIA DGX systems • 2021 — significantly expanded self-mining fleet

9 PROPRIETARY & CONFIDENTIAL 56 Commentary Cottonwood 56 Trailing 12 Month Performance(1) CapEx Investment Pecos, TX 250MW (Cottonwood 1 & 2) • Greenfield Buildout in 2022 • Campus has (2) phases – COT1 and COT2 • Core Scientific Leased • COT1 - (1) Operational Building totaling 50MW of energized capacity (~15k miners) with expansion capacity of additional 200MW • COT2 - (50) Operational containers totaling 21MW of energized capacity (~7.8k miners) • COT2 MW usage counts against total power allocation of 250MW from ERCOT • COT1 – 53k sq/ft production area • 7 Mining Ops FTEs • Utility Provider: TNMP Lease Information COT1 • Initial term expires Nov 2031; optional three, 10-year extensions (through Nov 2061) • Rent of $10k/acre ($600k) per 10-year term; rent escalates 20% per extension COT2 • Leased for 99 years (through 2122) • Paid full lease rent of $1m in 2023 88% Uptime 87% Hashrate Utilization 1.9 EH 97% Self-Mining Potential CapEx Projects • ~$500k CapEx for tech building • ~$250k CapEx for COT2 container field weatherization project • Complete COT1 200MW capacity expansion We design and build application-specific digital infrastructure 760 Operational Megawatts Pecos, TX 71 MW2 Austin, TX 16 MW Denton, TX 125 MW1 Calvert City, KY 150 MW Grand Forks, ND 100 MW Dalton 3, GA 145 MW Dalton 1, GA 50 MW Marble, NC 104 MW 1 72 MW expansion underway 2 200 MW expansion planned for 2025-2027; includes 21MW for opportunistic mining using prior generation miners

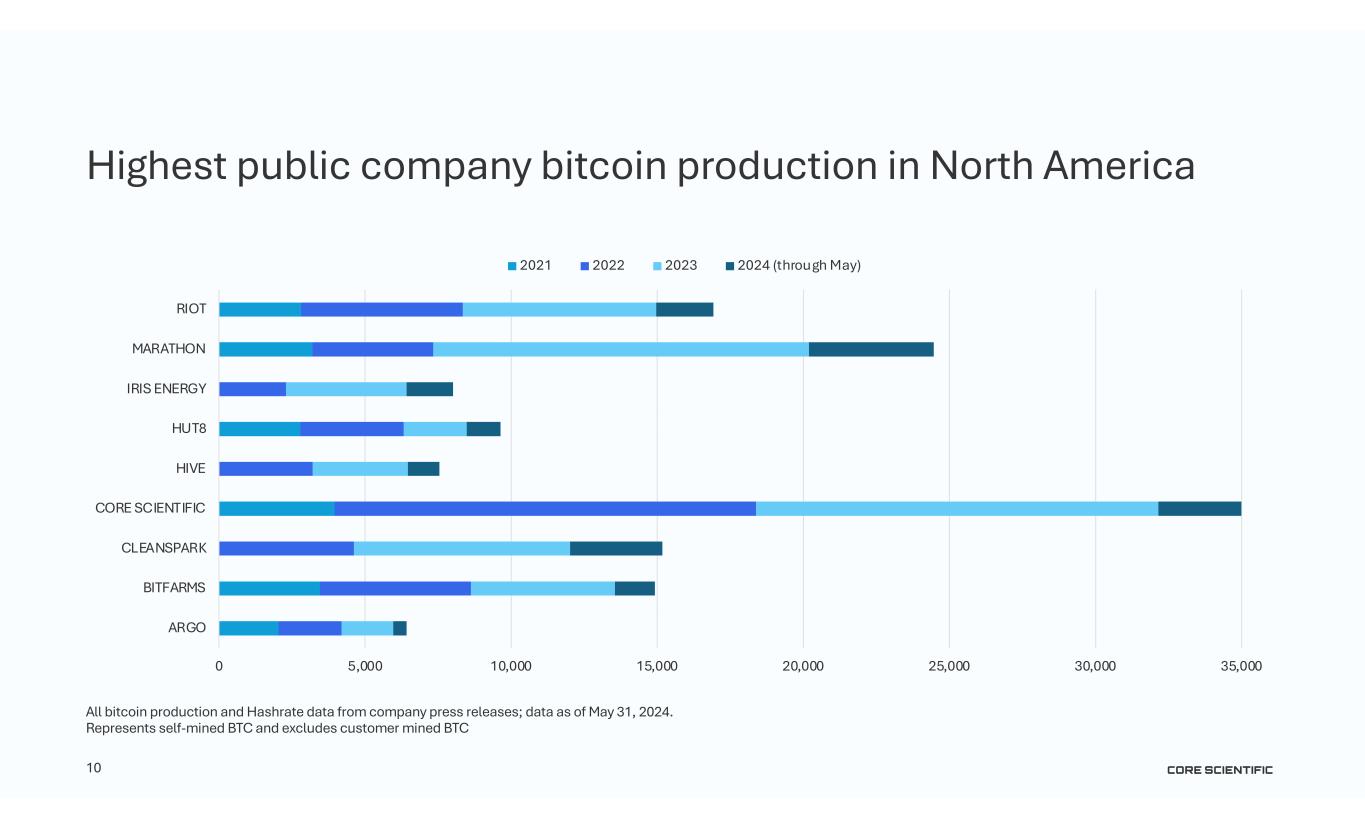

10 All bitcoin production and Hashrate data from company press releases; data as of May 31, 2024. Represents self-mined BTC and excludes customer mined BTC Highest public company bitcoin production in North America 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 ARGO BITFARMS CLEANSPARK CORE SCIENTIFIC HIVE HUT8 IRIS ENERGY MARATHON RIOT 2021 2022 2023 2024 (through May)

11 Core Scientific transforms energy into high- value compute with superior efficiency at scale

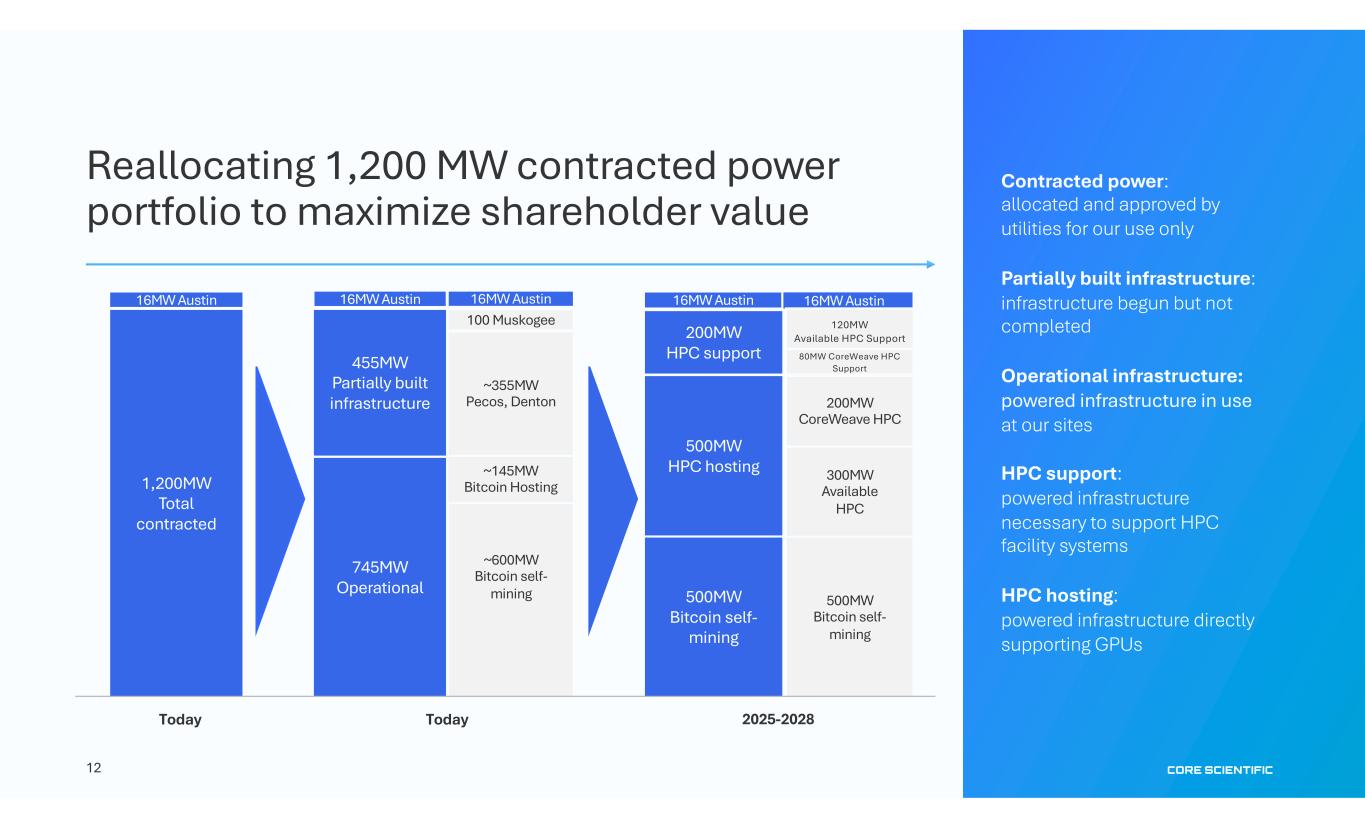

12 16MW Austin Reallocating 1,200 MW contracted power portfolio to maximize shareholder value ~600MW Bitcoin self- mining ~145MW Bitcoin Hosting ~355MW Pecos, Denton 100 Muskogee 455MW Partially built infrastructure 745MW Operational Today 500MW Bitcoin self- mining 200MW HPC support 500MW HPC hosting 2025-2028 500MW Bitcoin self- mining 200MW CoreWeave HPC 80MW CoreWeave HPC Support 300MW Available HPC 120MW Available HPC Support 1,200MW Total contracted Today Contracted power: allocated and approved by utilities for our use only Partially built infrastructure: infrastructure begun but not completed Operational infrastructure: powered infrastructure in use at our sites HPC support: powered infrastructure necessary to support HPC facility systems HPC hosting: powered infrastructure directly supporting GPUs 16MW Austin 16MW Austin 16MW Austin 16MW Austin

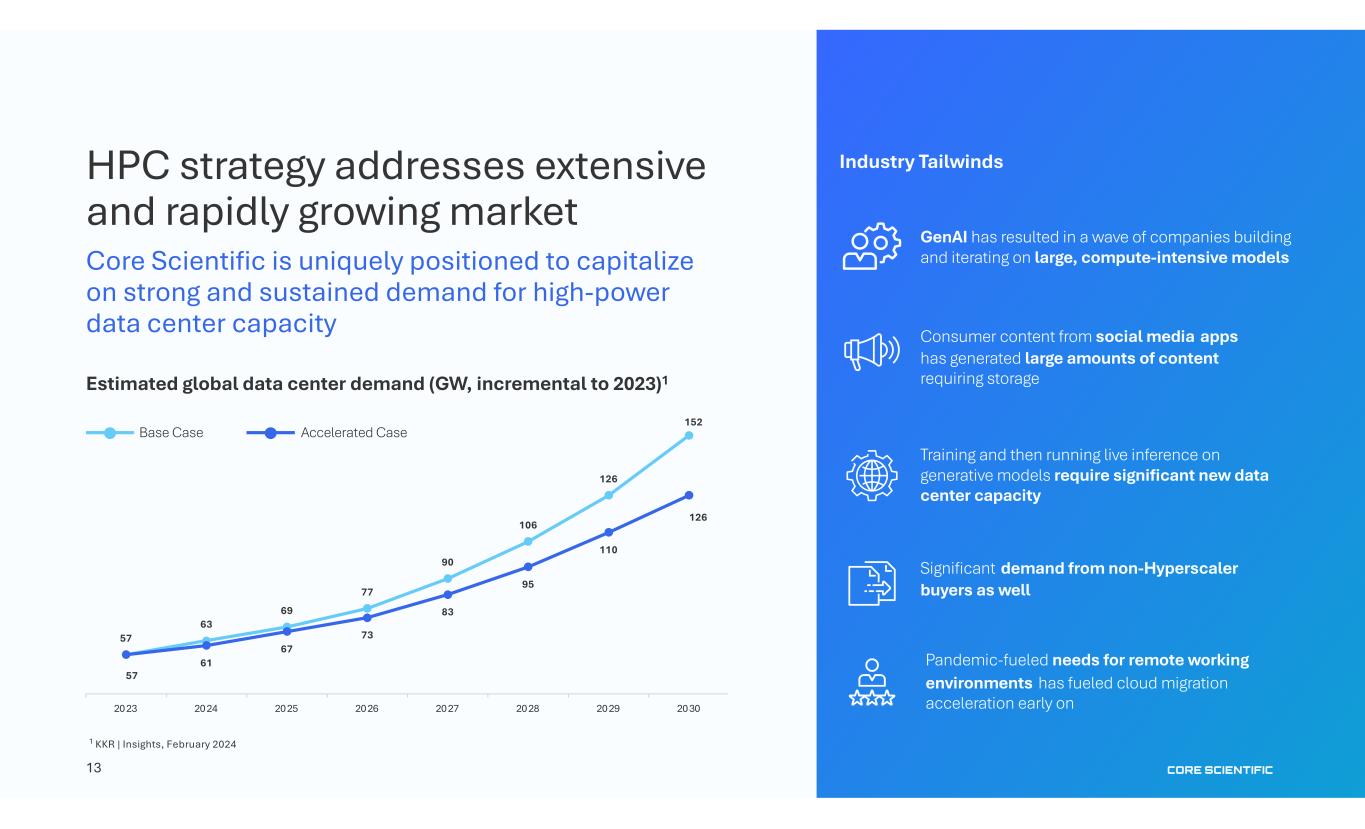

13 HPC strategy addresses extensive and rapidly growing market Core Scientific is uniquely positioned to capitalize on strong and sustained demand for high-power data center capacity 57 63 69 77 90 106 126 152 57 61 67 73 83 95 110 126 2023 2024 2025 2026 2027 2028 2029 2030 Estimated global data center demand (GW, incremental to 2023)1 Base Case Accelerated Case Industry Tailwinds Pandemic-fueled needs for remote working environments has fueled cloud migration acceleration early on Training and then running live inference on generative models require significant new data center capacity GenAI has resulted in a wave of companies building and iterating on large, compute-intensive models Significant demand from non-Hyperscaler buyers as well Consumer content from social media apps has generated large amounts of content requiring storage 1 KKR | Insights, February 2024

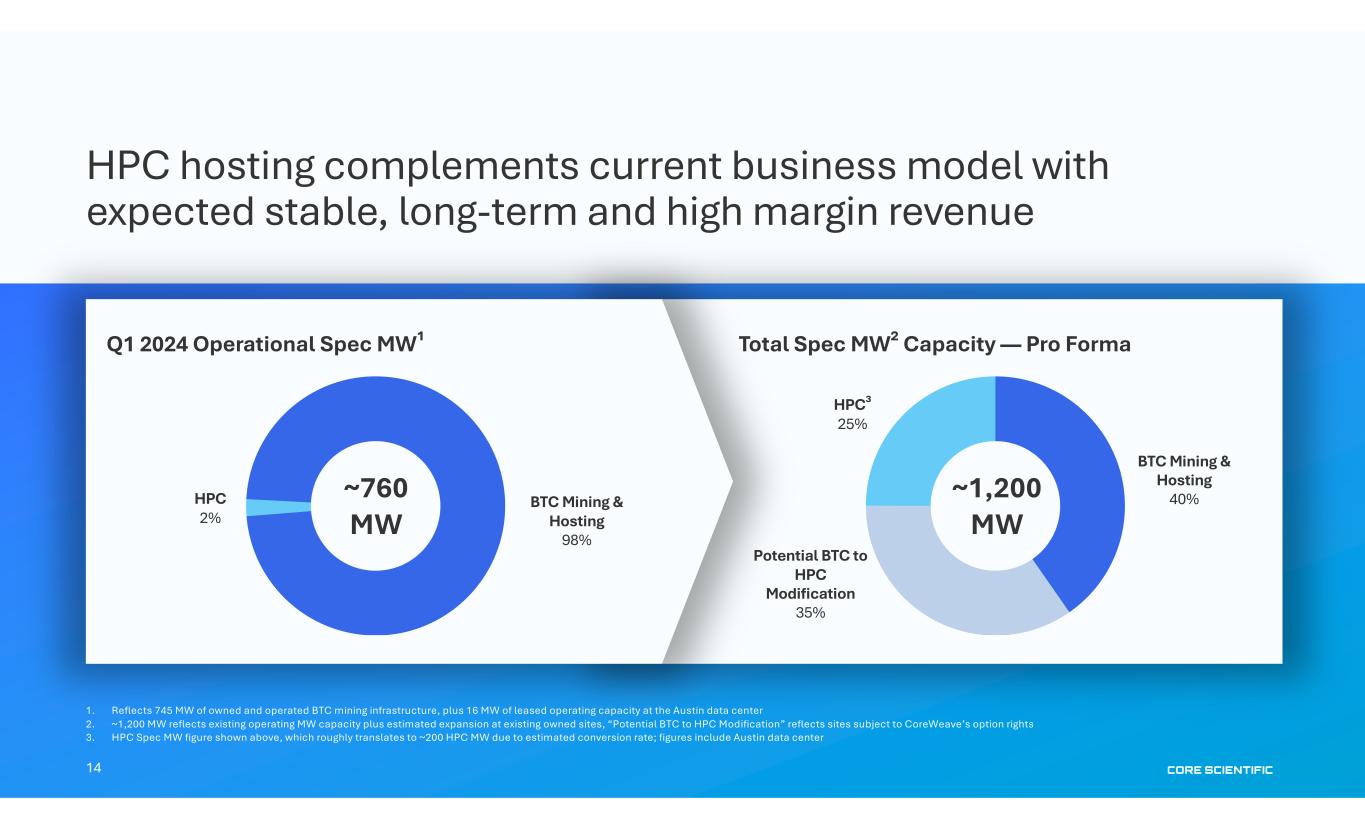

14 HPC hosting complements current business model with expected stable, long-term and high margin revenue 1. Reflects 745 MW of owned and operated BTC mining infrastructure, plus 16 MW of leased operating capacity at the Austin data center 2. ~1,200 MW reflects existing operating MW capacity plus estimated expansion at existing owned sites, “Potential BTC to HPC Modification” reflects sites subject to CoreWeave’s option rights 3. HPC Spec MW figure shown above, which roughly translates to ~200 HPC MW due to estimated conversion rate; figures include Austin data center Total Spec MW² Capacity — Pro FormaQ1 2024 Operational Spec MW¹ BTC Mining & Hosting 40% Potential BTC to HPC Modification 35% HPC³ 25% ~1,200 MW BTC Mining & Hosting 98% HPC 2% ~760 MW

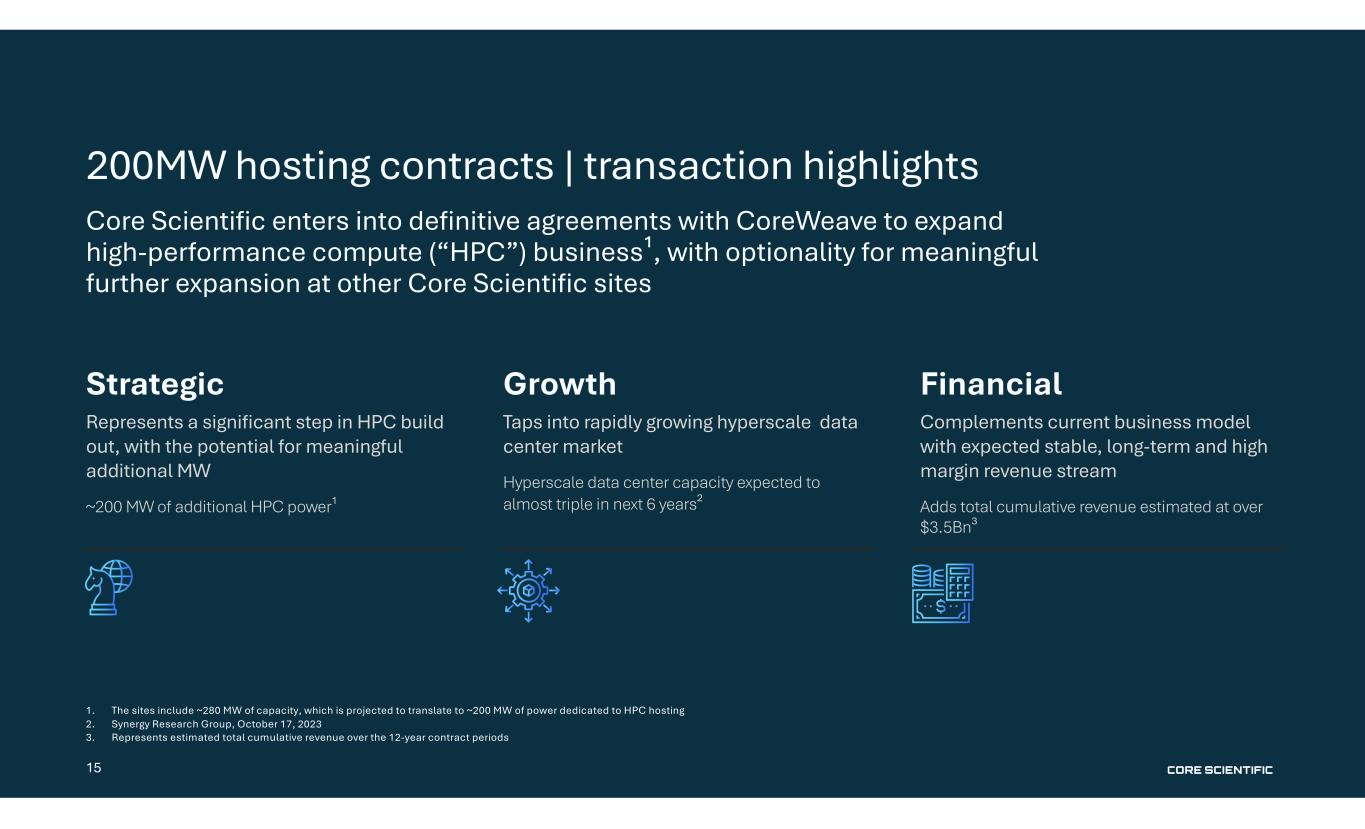

15 200MW hosting contracts | transaction highlights Core Scientific enters into definitive agreements with CoreWeave to expand high-performance compute (“HPC”) business¹, with optionality for meaningful further expansion at other Core Scientific sites 1. The sites include ~280 MW of capacity, which is projected to translate to ~200 MW of power dedicated to HPC hosting 2. Synergy Research Group, October 17, 2023 3. Represents estimated total cumulative revenue over the 12-year contract periods Strategic Represents a significant step in HPC build out, with the potential for meaningful additional MW ~200 MW of additional HPC power¹ Growth Taps into rapidly growing hyperscale data center market Hyperscale data center capacity expected to almost triple in next 6 years² Financial Complements current business model with expected stable, long-term and high margin revenue stream Adds total cumulative revenue estimated at over $3.5Bn³

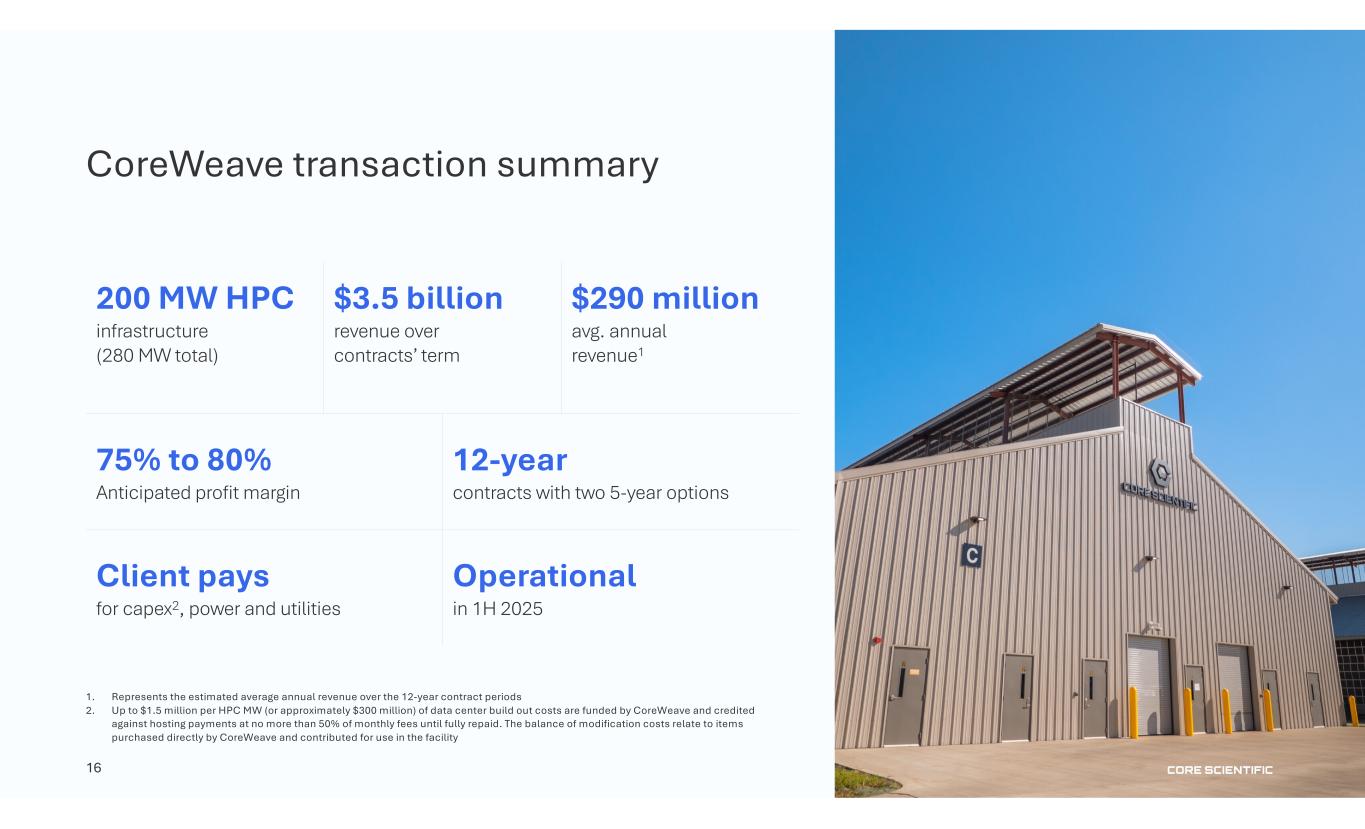

16 CoreWeave transaction summary 1. Represents the estimated average annual revenue over the 12-year contract periods 2. Up to $1.5 million per HPC MW (or approximately $300 million) of data center build out costs are funded by CoreWeave and credited against hosting payments at no more than 50% of monthly fees until fully repaid. The balance of modification costs relate to items purchased directly by CoreWeave and contributed for use in the facility 200 MW HPC infrastructure (280 MW total) $3.5 billion revenue over contracts’ term $290 million avg. annual revenue1 75% to 80% Anticipated profit margin 12-year contracts with two 5-year options Client pays for capex2, power and utilities Operational in 1H 2025

17 Summary Diversifying our hosting business to create long term shareholder value | Capturing explosive AI compute market growth | Fortifying our strong bitcoin mining franchise Balancing our business Strengthening our earnings power Leveraging our core competencies Changing the equation in data centers Expanding our platform for accelerated growth

18 FINANCIAL POSITIONING Joined in 2021 Previously Senior Vice President, Finance, and FP&A at Oportun, Inc. Senior financial executive at Visa for 23 years Denise Sterling | Chief Financial Officer

19 Well positioned for continued growth and market leadership Largest owned infrastructure capacity (MW) for bitcoin mining and hosting in North America Top producer of bitcoin among public self-mining peers since 2021 Executing on de- leveraging strategy to manage down debt Effectively managing Halving impact through first two months Diversifying hosting customer base into high- performance computing Operating cash flow supporting organic growth plans Strong Gross Margins and Expense management vs. industry peers

20 Superior profitability and operating expense management CORZ produced highest gross margin and lowest operating expenses as a % of revenue among large peers Source: Public filings Gross Margin Operating Expenses as a % of Revenue 25% -4% 9% -27% 43% -2% 41% 41% CORZ MARA RIOT CLSK 2023 2024 Q1 22% 25% 36% 46% 9% 46% 73% 23% CORZ MARA RIOT CLSK 2023 2024 Q1

21 CoreWeave transaction benefits Continues build-out of HPC capabilities Amplifies access to fast-growing, extensive hyperscale data center market Raises revenue visibility Moderates revenue volatility linked to bitcoin price Upgrades business model with stable, long- term and high margin revenue stream Improves asset quality and balance sheet flexibility Expands exposure to dollar-denominated and contracted revenue

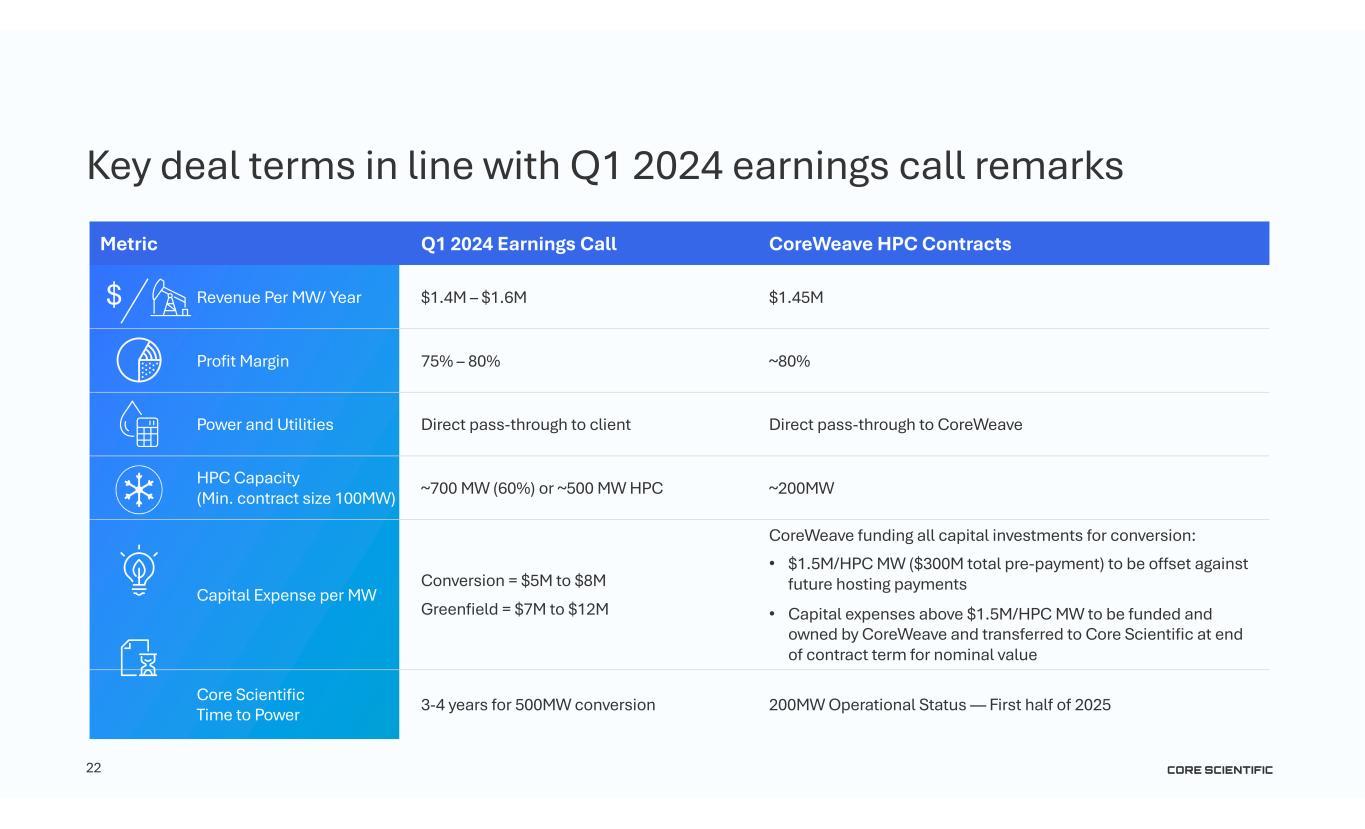

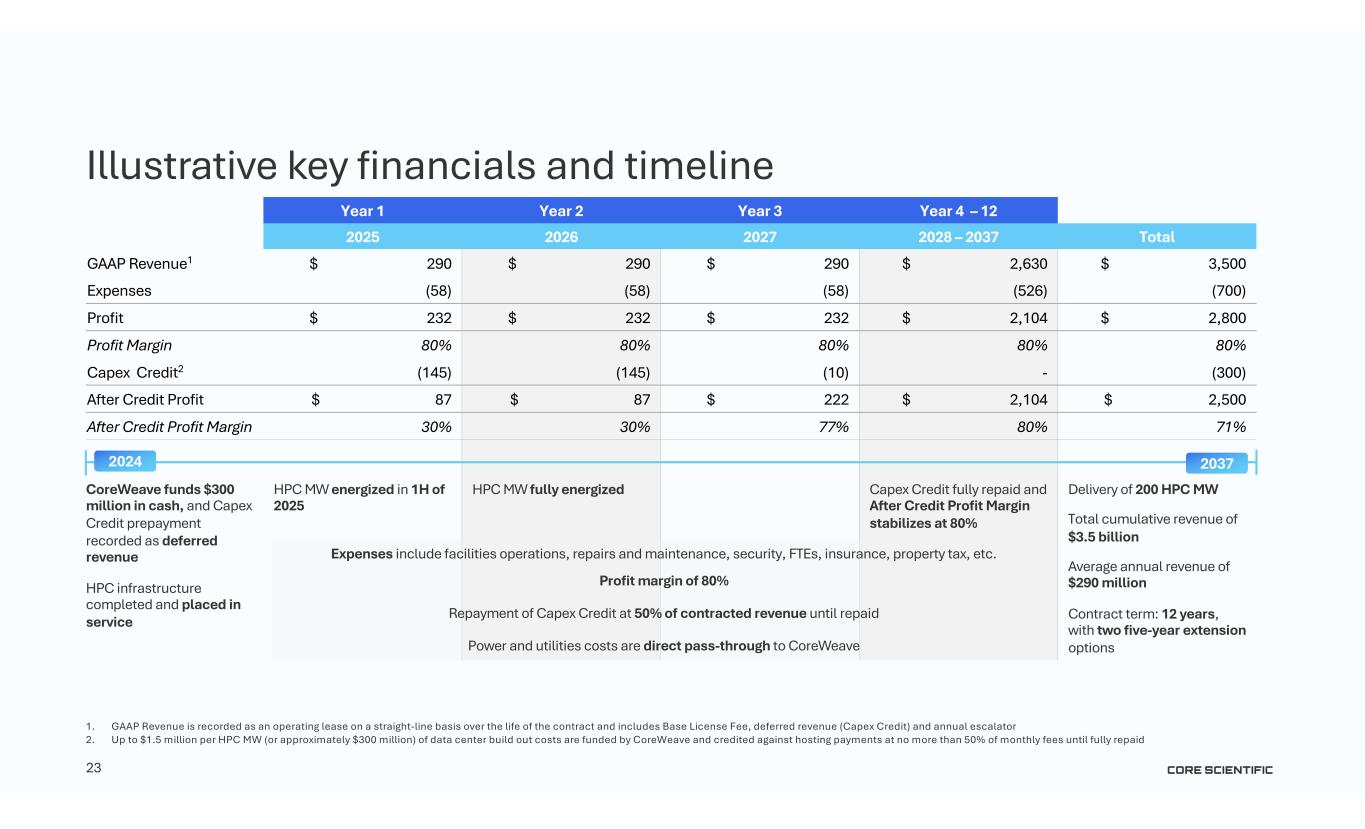

22 Metric Q1 2024 Earnings Call CoreWeave HPC Contracts Revenue Per MW/ Year $1.4M – $1.6M $1.45M Profit Margin 75% – 80% ~80% Power and Utilities Direct pass-through to client Direct pass-through to CoreWeave HPC Capacity (Min. contract size 100MW) ~700 MW (60%) or ~500 MW HPC ~200MW Capital Expense per MW Conversion = $5M to $8M Greenfield = $7M to $12M CoreWeave funding all capital investments for conversion: • $1.5M/HPC MW ($300M total pre-payment) to be offset against future hosting payments • Capital expenses above $1.5M/HPC MW to be funded and owned by CoreWeave and transferred to Core Scientific at end of contract term for nominal value Core Scientific Time to Power 3-4 years for 500MW conversion 200MW Operational Status — First half of 2025 $ Key deal terms in line with Q1 2024 earnings call remarks

23 1. GAAP Revenue is recorded as an operating lease on a straight-line basis over the life of the contract and includes Base License Fee, deferred revenue (Capex Credit) and annual escalator 2. Up to $1.5 million per HPC MW (or approximately $300 million) of data center build out costs are funded by CoreWeave and credited against hosting payments at no more than 50% of monthly fees until fully repaid Year 1 Year 2 Year 3 Year 4 – 12 2025 2026 2027 2028 – 2037 Total GAAP Revenue1 $ 290 $ 290 $ 290 $ 2,630 $ 3,500 Expenses (58) (58) (58) (526) (700) Profit $ 232 $ 232 $ 232 $ 2,104 $ 2,800 Profit Margin 80% 80% 80% 80% 80% Capex Credit2 (145) (145) (10) - (300) After Credit Profit $ 87 $ 87 $ 222 $ 2,104 $ 2,500 After Credit Profit Margin 30% 30% 77% 80% 71% CoreWeave funds $300 million in cash, and Capex Credit prepayment recorded as deferred revenue HPC infrastructure completed and placed in service HPC MW energized in 1H of 2025 HPC MW fully energized Capex Credit fully repaid and After Credit Profit Margin stabilizes at 80% Delivery of 200 HPC MW Total cumulative revenue of $3.5 billion Average annual revenue of $290 million Contract term: 12 years, with two five-year extension options Illustrative key financials and timeline 2024 2037 Expenses include facilities operations, repairs and maintenance, security, FTEs, insurance, property tax, etc. Profit margin of 80% Repayment of Capex Credit at 50% of contracted revenue until repaid Power and utilities costs are direct pass-through to CoreWeave

24 Lunch

25 A NEW VISION FOR DIGITAL INFRASTRUCTURE Joined in 2021 Previously Senior Director — Americas IBX Operations at Equinix, responsible for 200 data centers, 380,000 cabinets and 1,000MW of critical infrastructure Senior executive at Hewlett Packard, responsible for end-to-end data center infrastructure services Matt Brown | Chief Operating Officer

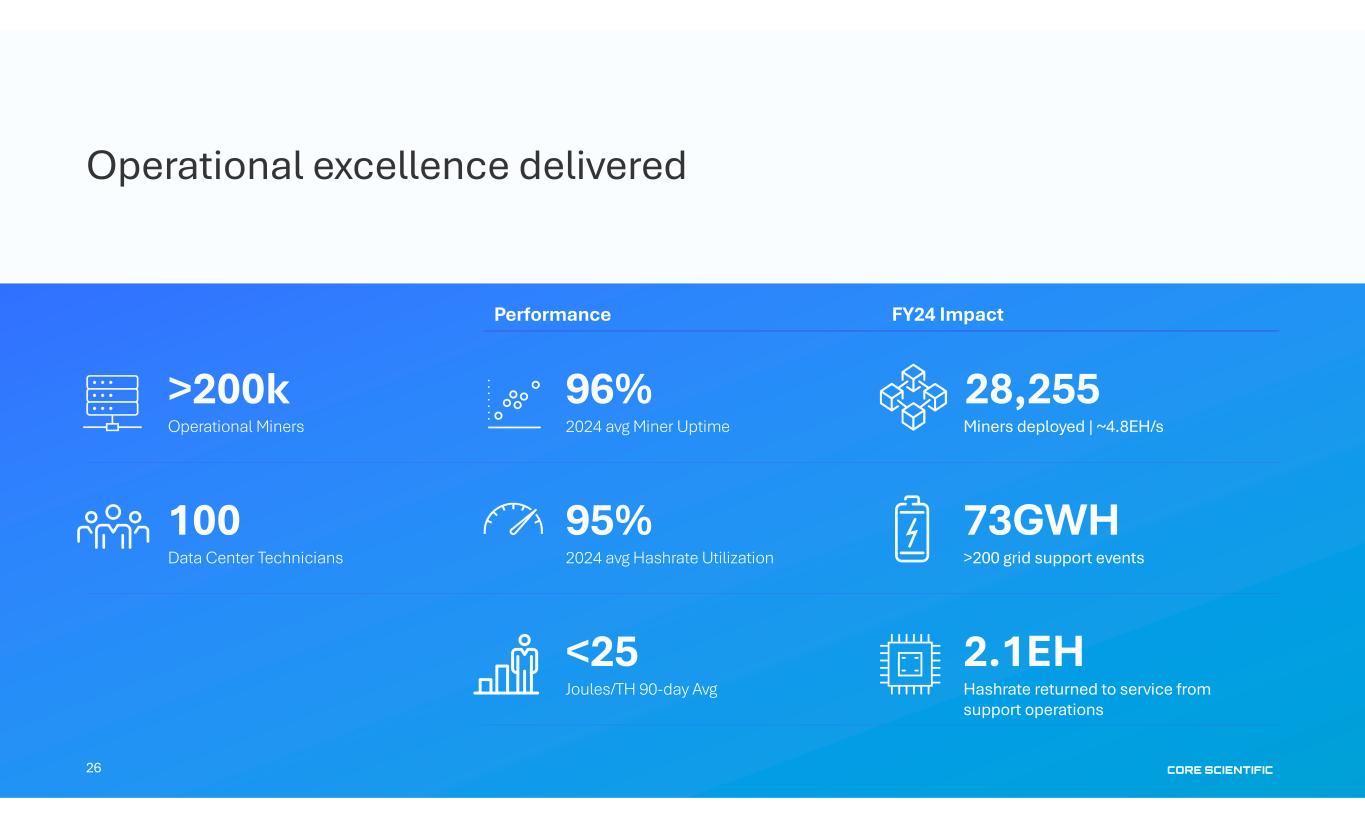

26 Operational excellence delivered Performance FY24 Impact >200k Operational Miners 96% 2024 avg Miner Uptime 28,255 Miners deployed | ~4.8EH/s 100 Data Center Technicians 95% 2024 avg Hashrate Utilization 73GWH >200 grid support events <25 Joules/TH 90-day Avg 2.1EH Hashrate returned to service from support operations

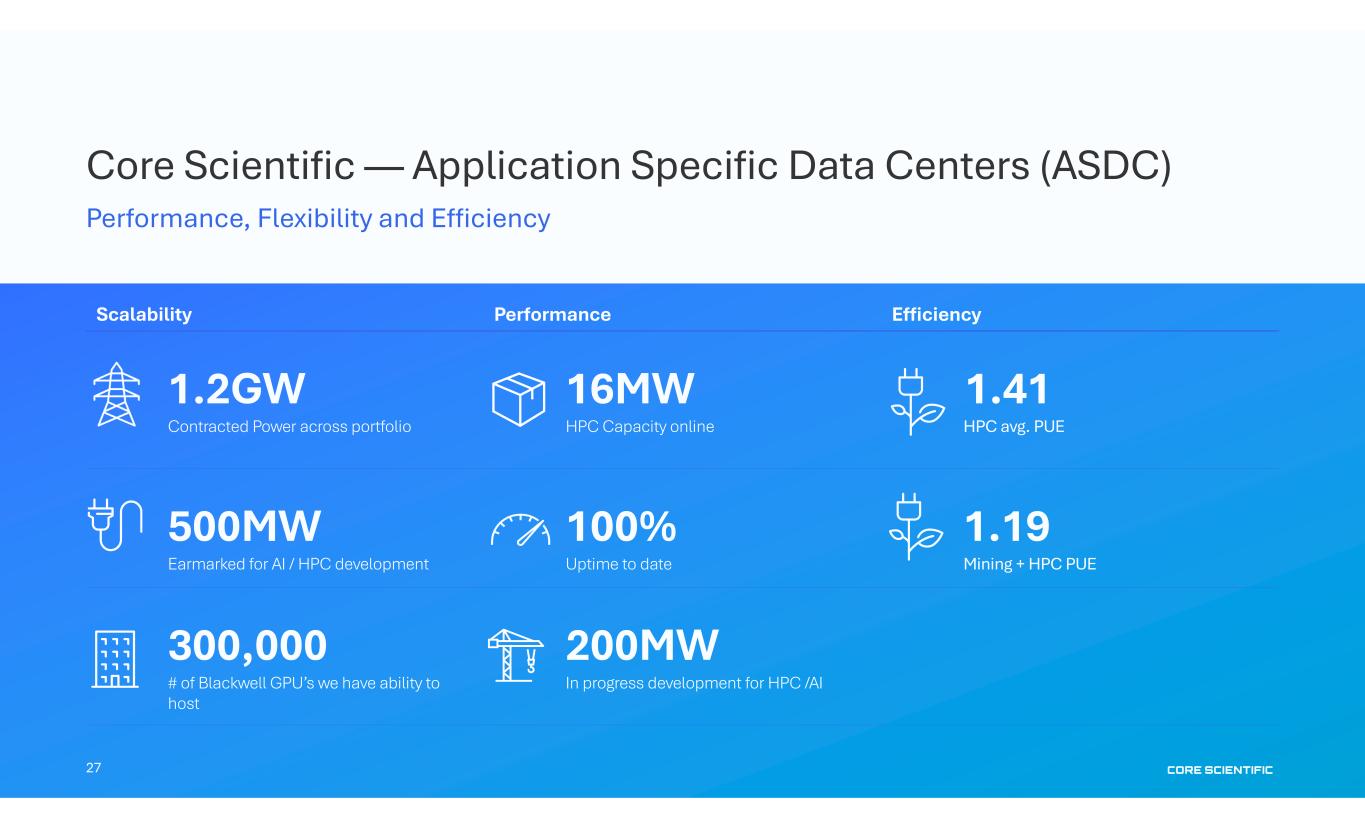

27 Core Scientific — Application Specific Data Centers (ASDC) Performance, Flexibility and Efficiency Scalability Performance Efficiency 1.2GW Contracted Power across portfolio 16MW HPC Capacity online 1.41 HPC avg. PUE 500MW Earmarked for AI / HPC development 100% Uptime to date 1.19 Mining + HPC PUE 300,000 # of Blackwell GPU’s we have ability to host 200MW In progress development for HPC /AI

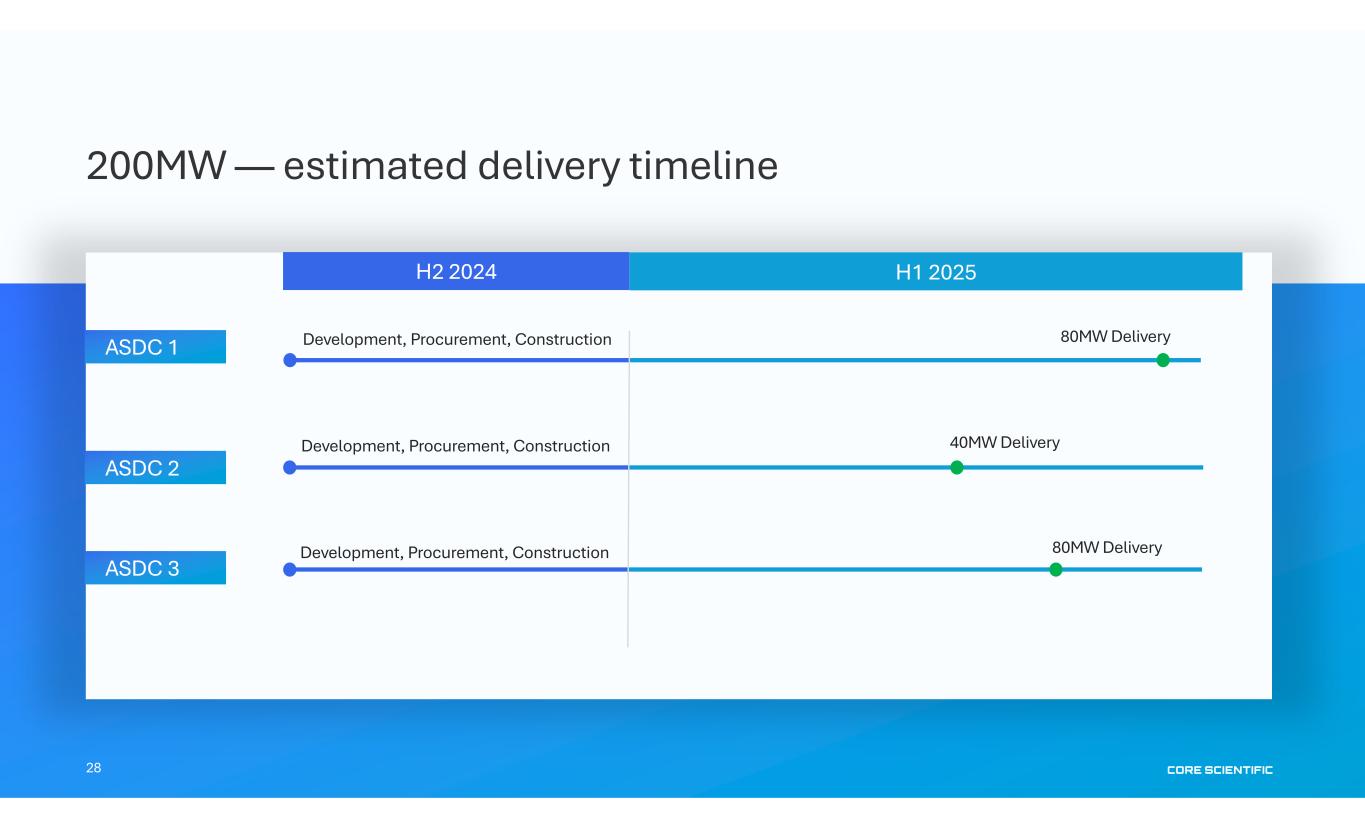

28 200MW — estimated delivery timeline Development, Procurement, Construction H2 2024 80MW Delivery 40MW Delivery 80MW Delivery ASDC 1 ASDC 2 ASDC 3 Development, Procurement, Construction Development, Procurement, Construction H1 2025

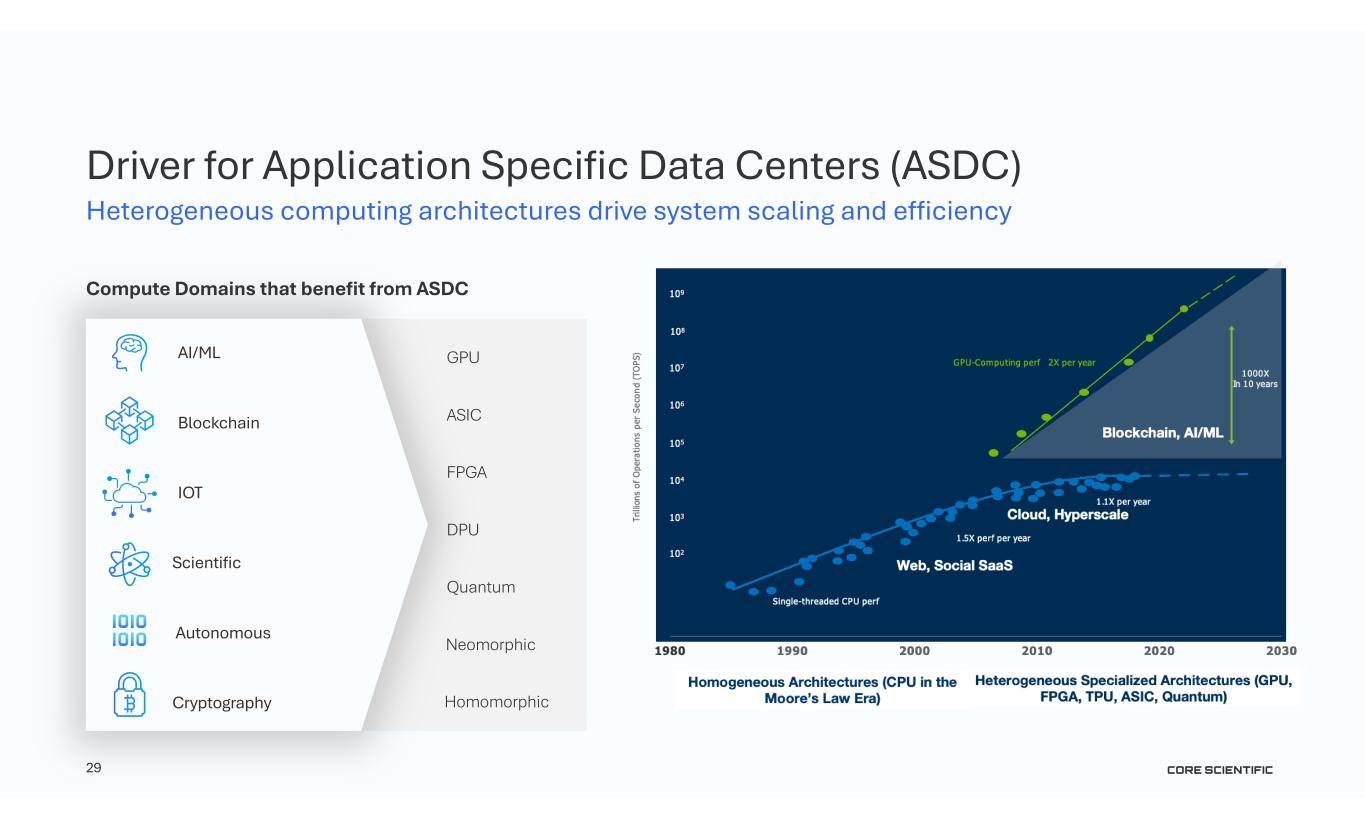

29 Quantum IOT AI/ML Blockchain GPU ASIC FPGA Autonomous Neomorphic DPU Scientific HomomorphicCryptography Compute Domains that benefit from ASDC Driver for Application Specific Data Centers (ASDC) Heterogeneous computing architectures drive system scaling and efficiency

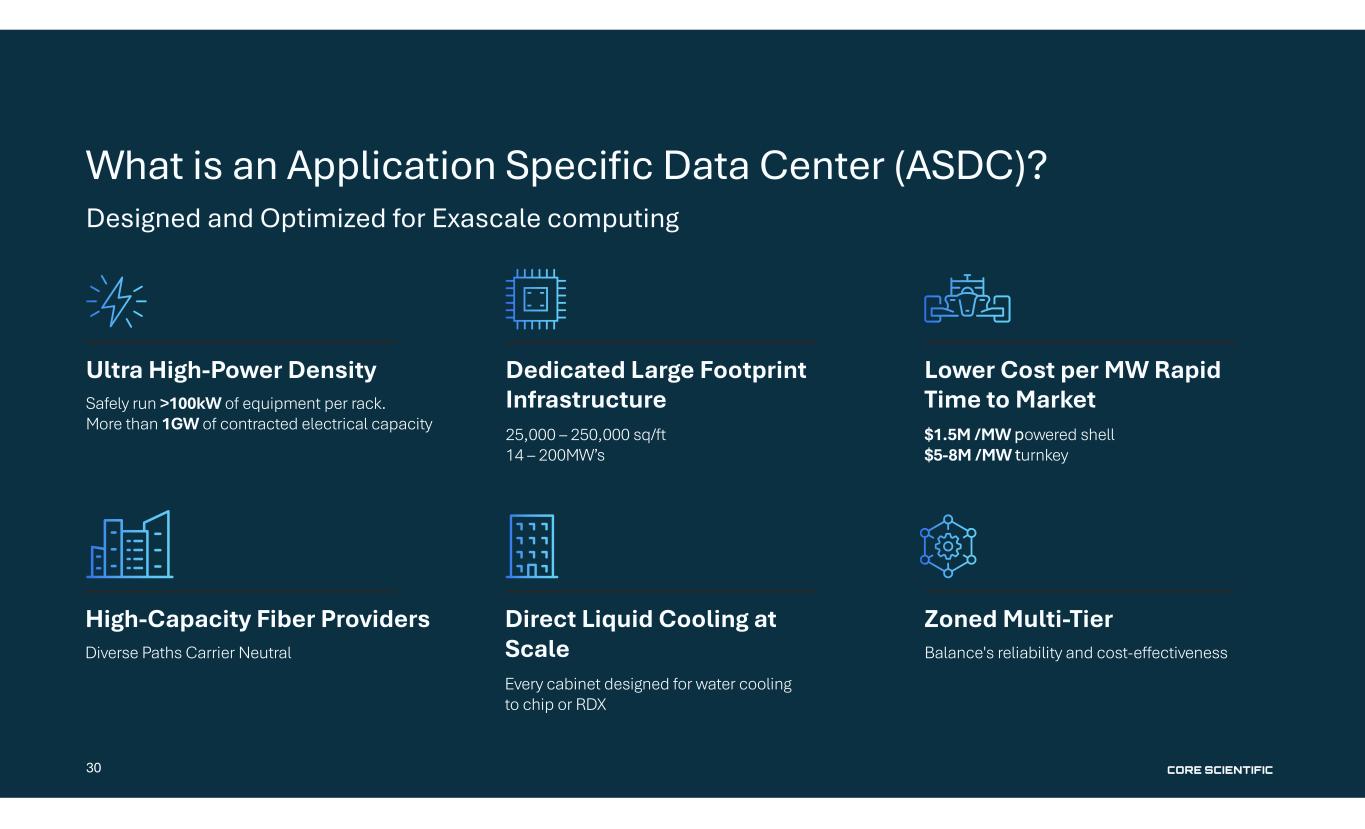

30 What is an Application Specific Data Center (ASDC)? Designed and Optimized for Exascale computing Ultra High-Power Density Safely run >100kW of equipment per rack. More than 1GW of contracted electrical capacity Dedicated Large Footprint Infrastructure 25,000 – 250,000 sq/ft 14 – 200MW’s Lower Cost per MW Rapid Time to Market $1.5M /MW powered shell $5-8M /MW turnkey High-Capacity Fiber Providers Diverse Paths Carrier Neutral Direct Liquid Cooling at Scale Every cabinet designed for water cooling to chip or RDX Zoned Multi-Tier Balance's reliability and cost-effectiveness

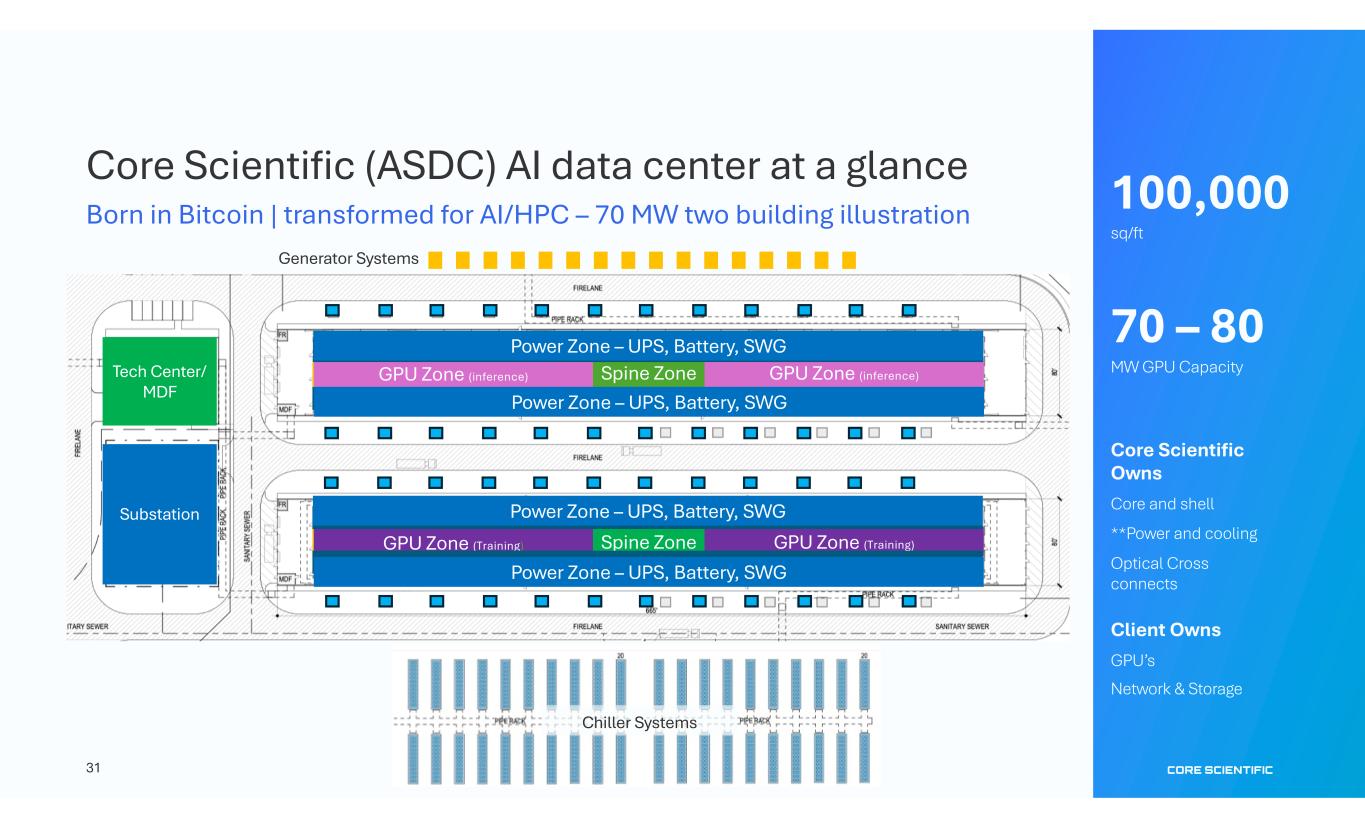

31 ASIC HOT AISLE ASIC HOT AISLE GPU Zone (inference)pine ZoneGPU Zone (inference) GPU Zone (Training)pine ZoneGPU Zone (Training) Tech Center/ MDF Substation Chiller Systems Core Scientific Owns Core and shell **Power and cooling Optical Cross connects Client Owns GPU’s Network & Storage Core Scientific (ASDC) AI data center at a glance Born in Bitcoin | transformed for AI/HPC – 70 MW two building illustration 100,000 sq/ft 70 – 80 MW GPU Capacity ASIC Miners ASIC Miners ASIC Miners ASIC Miners Power Zone – UPS, Battery, SWG Power Zone – UPS, Battery, SWG Power Zone – UPS, Battery, SWG Power Zone – UPS, Battery, SWG Generator Systems

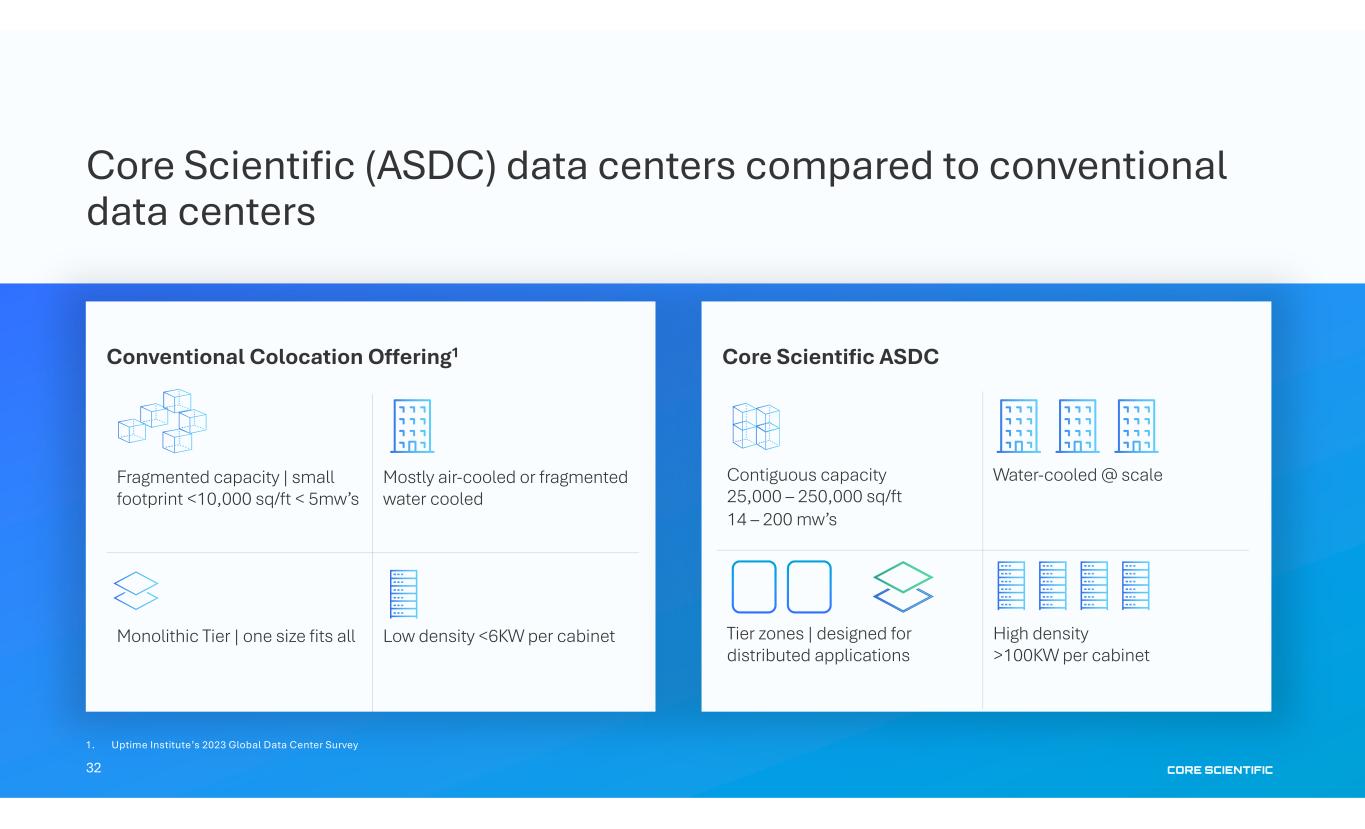

32 Core Scientific (ASDC) data centers compared to conventional data centers Conventional Colocation Offering1 Core Scientific ASDC Fragmented capacity | small footprint <10,000 sq/ft < 5mw’s Mostly air-cooled or fragmented water cooled Monolithic Tier | one size fits all Low density <6KW per cabinet Contiguous capacity 25,000 – 250,000 sq/ft 14 – 200 mw’s Water-cooled @ scale Tier zones | designed for distributed applications High density >100KW per cabinet 1. Uptime Institute’s 2023 Global Data Center Survey

33 Data center services Future-proof operations with world-class data center services Turnkey Rack and GPU Hardware Installation Our Field Services team can deploy hardware at scale with superior efficiency 24 x 7 On-site Maintenance & Operations Real-Time Monitoring Get on-demand access to environmental and operating information relevant to your GPU fleet Network Planning & Delivery Our Network Engineering can assist with all aspects of network delivery. ISP fiber build coordination, route diversity planning, last mile delivery, and managed bandwidth options. Managed Power Services Our power team can assist with power purchase agreements (PPA’s), utility account management, carbon offsets, utility planning and coordination. 24 x 7 Security Operations 24 x 7 remote monitoring Multi-layer security Robust access controls & biometrics

Experienced team of digital infrastructure experts Matt Brown EVP Data Center Services Cline K. SVP Operations Angie L. Senior Director HPC Operations Jay B. SVP Data Center Construction Kevin C. VP Field Services & Security Brent N. Senior Manager Hardware Implementation Colin S. Senior Manager Command Center Operations Ron W. Director Critical Facilities David J. VP Data Center Construction Projects

35 Q&A SESSION

36 Core Scientific Highlights Transforming our hosting business to capture significant growth opportunity in HPC with 200MW CoreWeave contracts In discussions to modify additional 300MW for HPC hosting Reinforcing our bitcoin mining business Focused on long-term shareholder value Investment Thesis Unique digital infrastructure-driven opportunity to benefit from explosive HPC and AI compute demand for high power data center capacity Efficient capital allocation Unmatched team from data center, technology industries Building balanced portfolio of HPC hosting and bitcoin mining

Nasdaq: CORZ ir@corescientific.com

38 Appendix

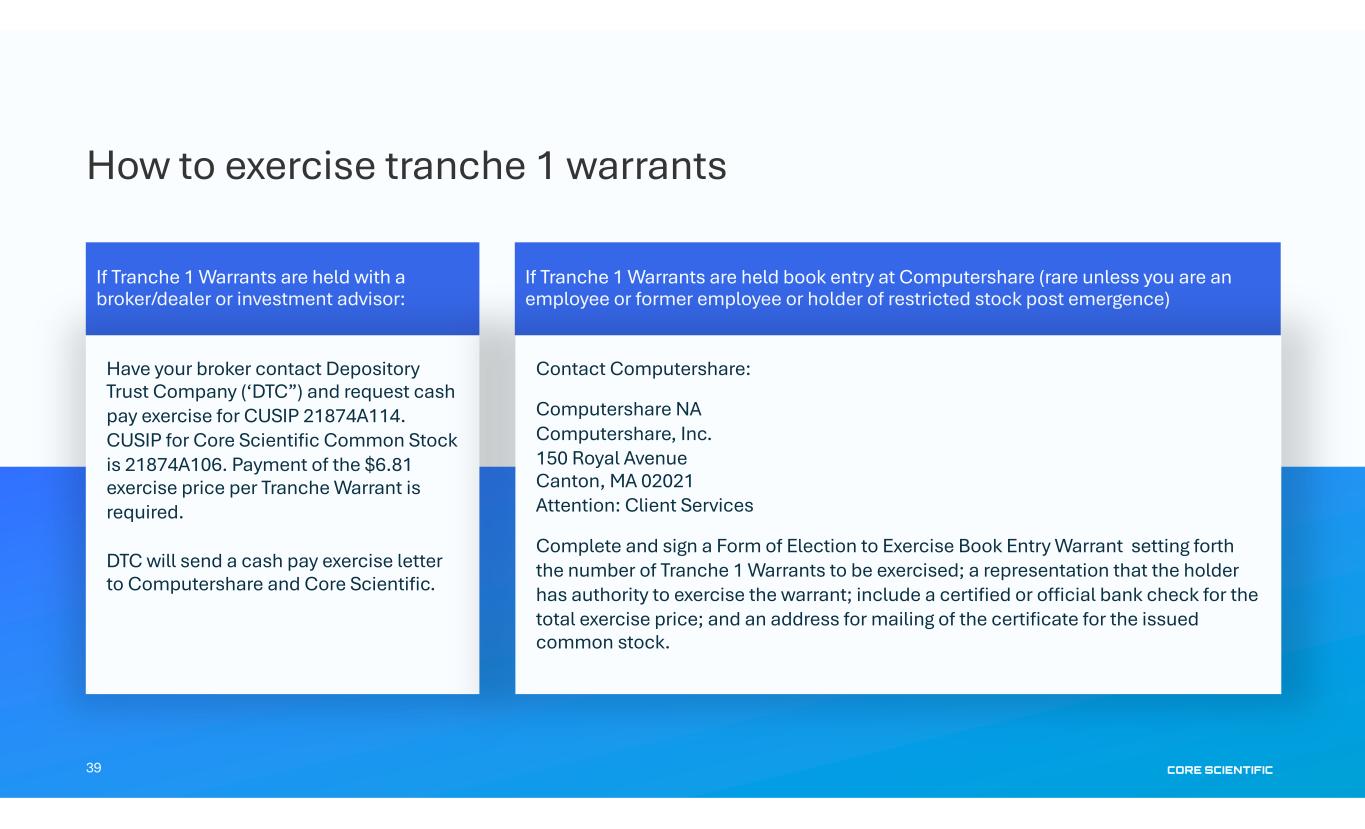

39 How to exercise tranche 1 warrants If Tranche 1 Warrants are held with a broker/dealer or investment advisor: If Tranche 1 Warrants are held book entry at Computershare (rare unless you are an employee or former employee or holder of restricted stock post emergence) Have your broker contact Depository Trust Company (‘DTC”) and request cash pay exercise for CUSIP 21874A114. CUSIP for Core Scientific Common Stock is 21874A106. Payment of the $6.81 exercise price per Tranche Warrant is required. DTC will send a cash pay exercise letter to Computershare and Core Scientific. Contact Computershare: Computershare NA Computershare, Inc. 150 Royal Avenue Canton, MA 02021 Attention: Client Services Complete and sign a Form of Election to Exercise Book Entry Warrant setting forth the number of Tranche 1 Warrants to be exercised; a representation that the holder has authority to exercise the warrant; include a certified or official bank check for the total exercise price; and an address for mailing of the certificate for the issued common stock.

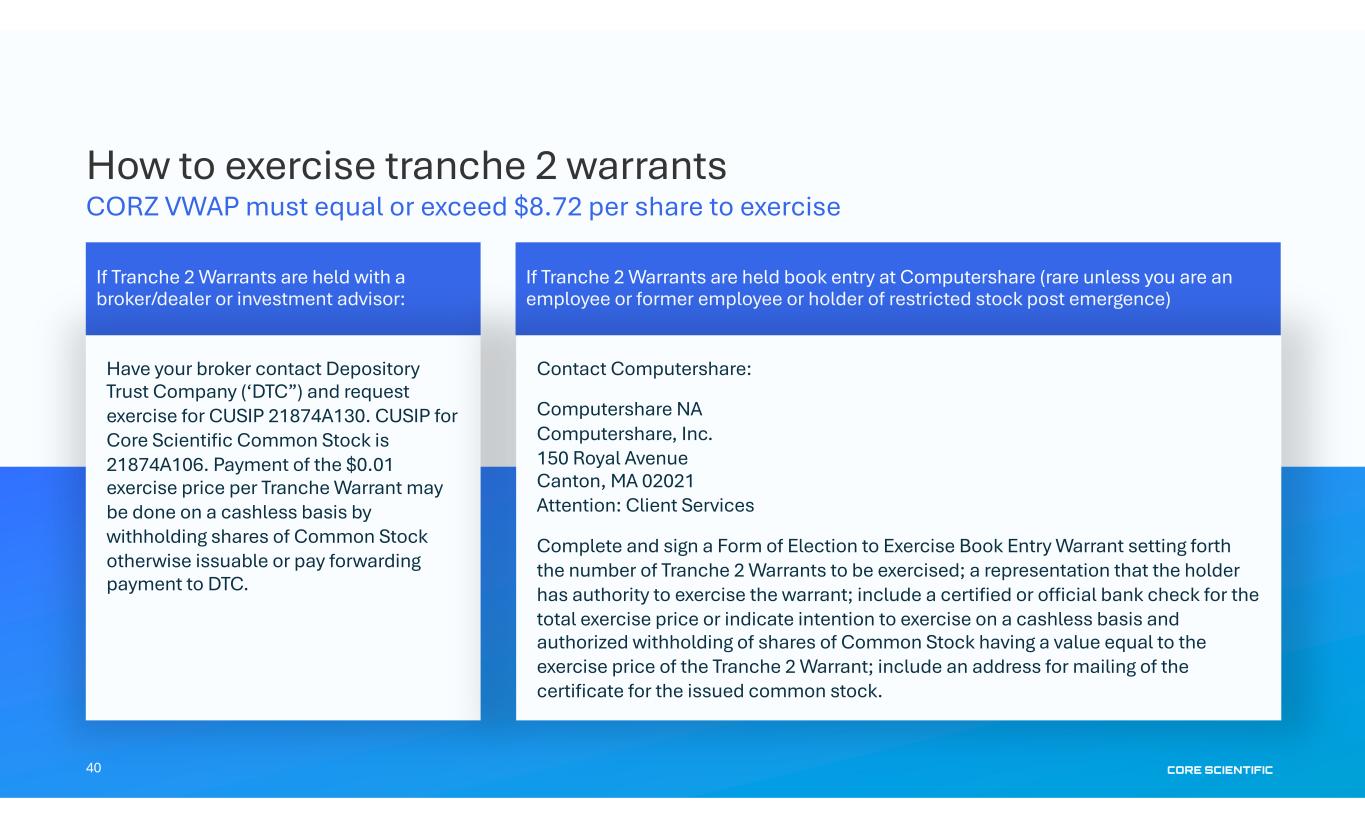

40 How to exercise tranche 2 warrants CORZ VWAP must equal or exceed $8.72 per share to exercise If Tranche 2 Warrants are held with a broker/dealer or investment advisor: If Tranche 2 Warrants are held book entry at Computershare (rare unless you are an employee or former employee or holder of restricted stock post emergence) Have your broker contact Depository Trust Company (‘DTC”) and request exercise for CUSIP 21874A130. CUSIP for Core Scientific Common Stock is 21874A106. Payment of the $0.01 exercise price per Tranche Warrant may be done on a cashless basis by withholding shares of Common Stock otherwise issuable or pay forwarding payment to DTC. Contact Computershare: Computershare NA Computershare, Inc. 150 Royal Avenue Canton, MA 02021 Attention: Client Services Complete and sign a Form of Election to Exercise Book Entry Warrant setting forth the number of Tranche 2 Warrants to be exercised; a representation that the holder has authority to exercise the warrant; include a certified or official bank check for the total exercise price or indicate intention to exercise on a cashless basis and authorized withholding of shares of Common Stock having a value equal to the exercise price of the Tranche 2 Warrant; include an address for mailing of the certificate for the issued common stock.

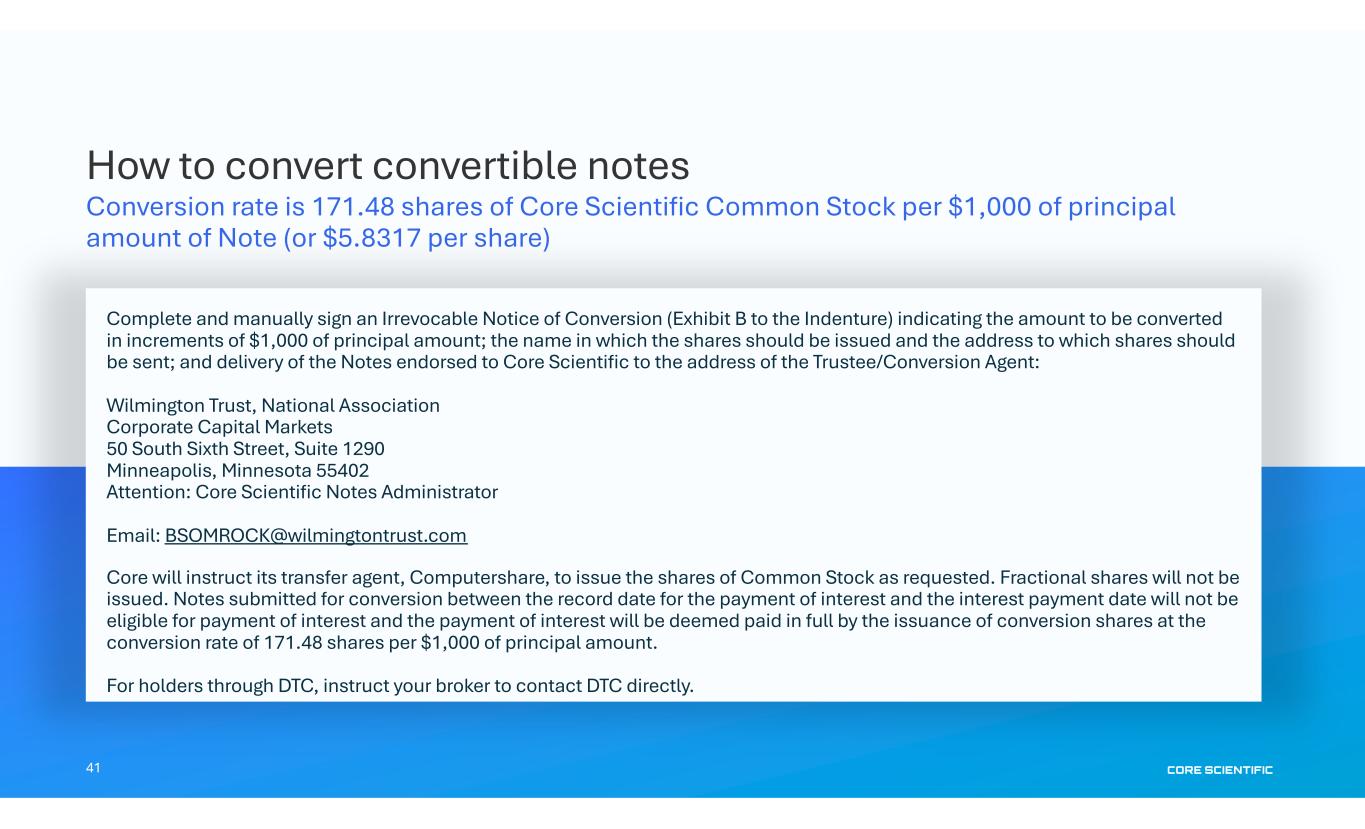

41 How to convert convertible notes Complete and manually sign an Irrevocable Notice of Conversion (Exhibit B to the Indenture) indicating the amount to be converted in increments of $1,000 of principal amount; the name in which the shares should be issued and the address to which shares should be sent; and delivery of the Notes endorsed to Core Scientific to the address of the Trustee/Conversion Agent: Wilmington Trust, National Association Corporate Capital Markets 50 South Sixth Street, Suite 1290 Minneapolis, Minnesota 55402 Attention: Core Scientific Notes Administrator Email: BSOMROCK@wilmingtontrust.com Core will instruct its transfer agent, Computershare, to issue the shares of Common Stock as requested. Fractional shares will not be issued. Notes submitted for conversion between the record date for the payment of interest and the interest payment date will not be eligible for payment of interest and the payment of interest will be deemed paid in full by the issuance of conversion shares at the conversion rate of 171.48 shares per $1,000 of principal amount. For holders through DTC, instruct your broker to contact DTC directly. Conversion rate is 171.48 shares of Core Scientific Common Stock per $1,000 of principal amount of Note (or $5.8317 per share)

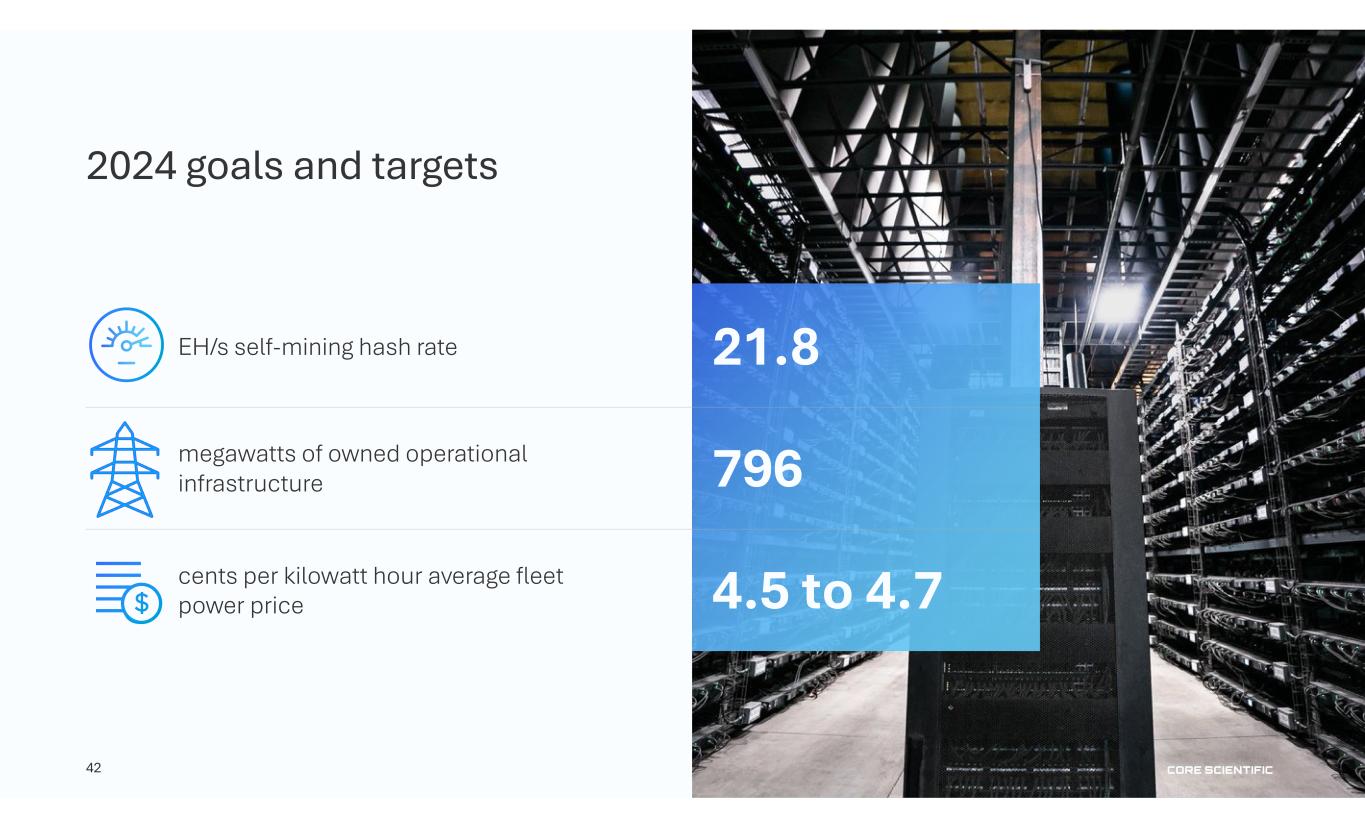

42 2024 goals and targets EH/s self-mining hash rate 21.8 megawatts of owned operational infrastructure 796 cents per kilowatt hour average fleet power price 4.5 to 4.7

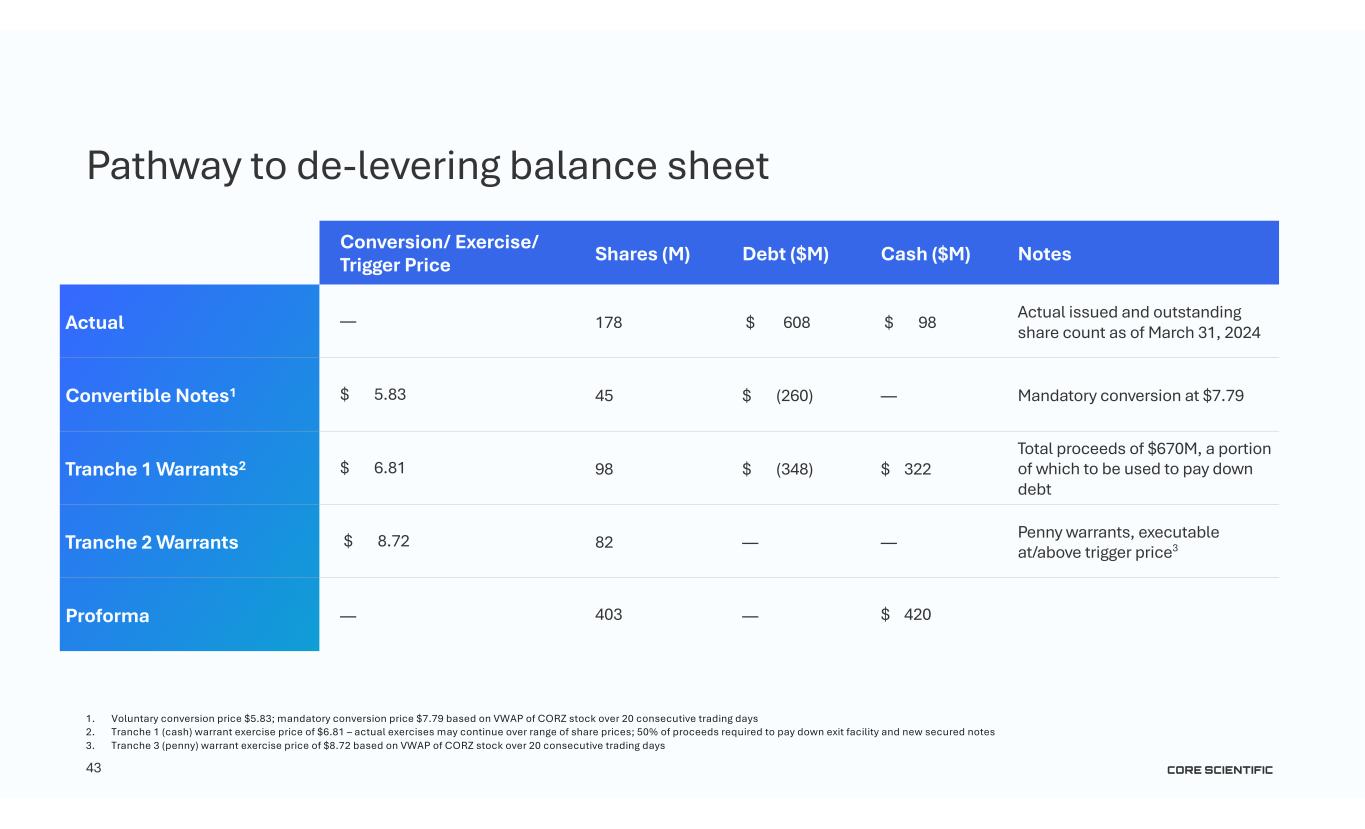

43 Conversion/ Exercise/ Trigger Price Shares (M) Debt ($M) Cash ($M) Notes Actual — 178 $ 608 $ 98 Actual issued and outstanding share count as of March 31, 2024 Convertible Notes1 $ 5.83 45 $ (260) — Mandatory conversion at $7.79 Tranche 1 Warrants2 $ 6.81 98 $ (348) $ 322 Total proceeds of $670M, a portion of which to be used to pay down debt Tranche 2 Warrants $ 8.72 82 — — Penny warrants, executable at/above trigger price3 Proforma — 403 — $ 420 Pathway to de-levering balance sheet 1. Voluntary conversion price $5.83; mandatory conversion price $7.79 based on VWAP of CORZ stock over 20 consecutive trading days 2. Tranche 1 (cash) warrant exercise price of $6.81 – actual exercises may continue over range of share prices; 50% of proceeds required to pay down exit facility and new secured notes 3. Tranche 3 (penny) warrant exercise price of $8.72 based on VWAP of CORZ stock over 20 consecutive trading days