EX-99.2

Published on June 4, 2024

1 JUNE 3, 2024 Core Scientific Announces Strategic Expansion of HPC Business with Multi-Year CoreWeave Hosting Agreements JUNE 3, 2024

2 JUNE 3, 2024 Forward-looking statements This presentation of Core Scientific, Inc. (the “Company”) includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward- looking statements may be identified by the use of words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “opportunity,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target,” “potential,” “hope” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These statements include, but are not limited, statements regarding potential benefits of or expectations regarding the strategic relationship, agreements and contemplated transactions with CoreWeave, Inc. (“CoreWeave”), impacts on the Company’s financial and operating results, completion and timing of certain events, impacts on the Company’s trading multiple and ability to deliver shareholder value, the Company’s intention and ability to capitalize on additional or related opportunities, and the Company’s plans, objectives, expectations and intentions. The Company’s actual results may differ materially from those anticipated in these forward-looking statements as a result of certain risks and other factors, which could include, but are not limited to, unanticipated difficulties or expenditures relating to the strategic relationship, agreements and contemplated transactions with CoreWeave; the possibility that the anticipated financial and operational benefits of the strategic relationship, agreements and contemplated transactions and additional opportunities are not realized when expected or at all; disruptions of current plans and operations caused by the announcement and execution of the strategic relationship, agreements and contemplated transactions; diversion of management’s attention from ongoing business operations and opportunities; potential adverse reactions or changes to business, regulatory or employee relationships, including those resulting from the announcement or execution of the strategic relationship, agreements and contemplated transactions; unexpected risks or the materialization of risks that are greater than anticipated; occurrence of any event, change or other circumstance that could give rise to the termination of the contracts with CoreWeave; delays in required approvals; the availability of government incentives; and legal proceedings, judgments or settlements in connection with the strategic relationship, agreements and contemplated transactions, as well as other risk factors set forth in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission. These statements are provided for illustrative purposes only and are based on various assumptions, whether or not identified in this presentation, and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the Securities and Exchange Commission, and if any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. The Company does not assume any duty or obligation (and does not undertake) to update or supplement any forward-looking statements. Non-GAAP Financial Measures Adjusted EBITDA, which is referred to in this presentation, is a non-GAAP financial measure. For further information regarding the Company’s definition of, and additional information related to, non-GAAP financial measures, see “Key Business Metrics and Non-GAAP Financial Measures” in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission.

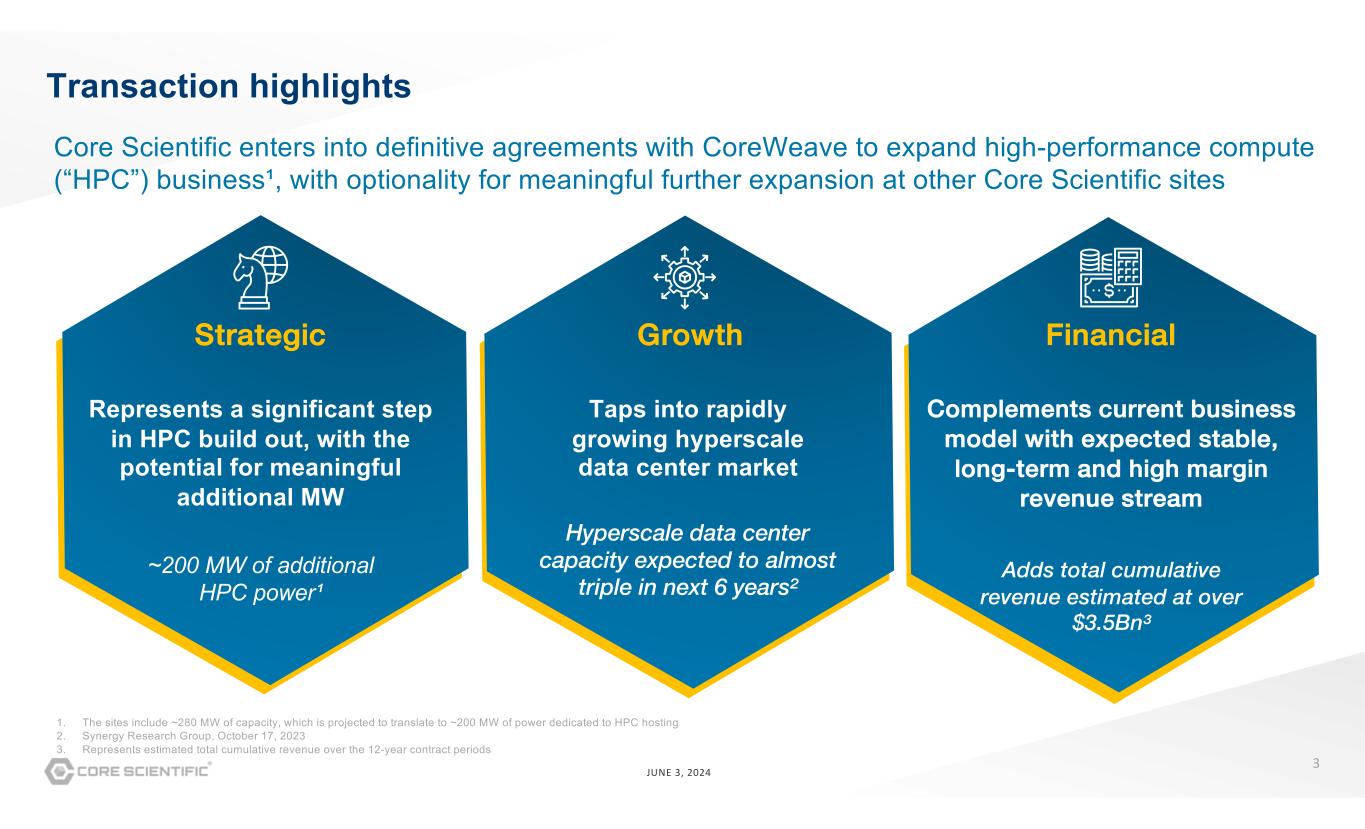

3 JUNE 3, 2024 Strategic Represents a significant step in HPC build out, with the potential for meaningful additional MW ~200 MW of additional HPC power¹ Growth Taps into rapidly growing hyperscale data center market Hyperscale data center capacity expected to almost triple in next 6 years² Financial Complements current business model with expected stable, long-term and high margin revenue stream Adds total cumulative revenue estimated at over $3.5Bn³ Transaction highlights 1. The sites include ~280 MW of capacity, which is projected to translate to ~200 MW of power dedicated to HPC hosting 2. Synergy Research Group, October 17, 2023 3. Represents estimated total cumulative revenue over the 12-year contract periods Core Scientific enters into definitive agreements with CoreWeave to expand high-performance compute (“HPC”) business¹, with optionality for meaningful further expansion at other Core Scientific sites

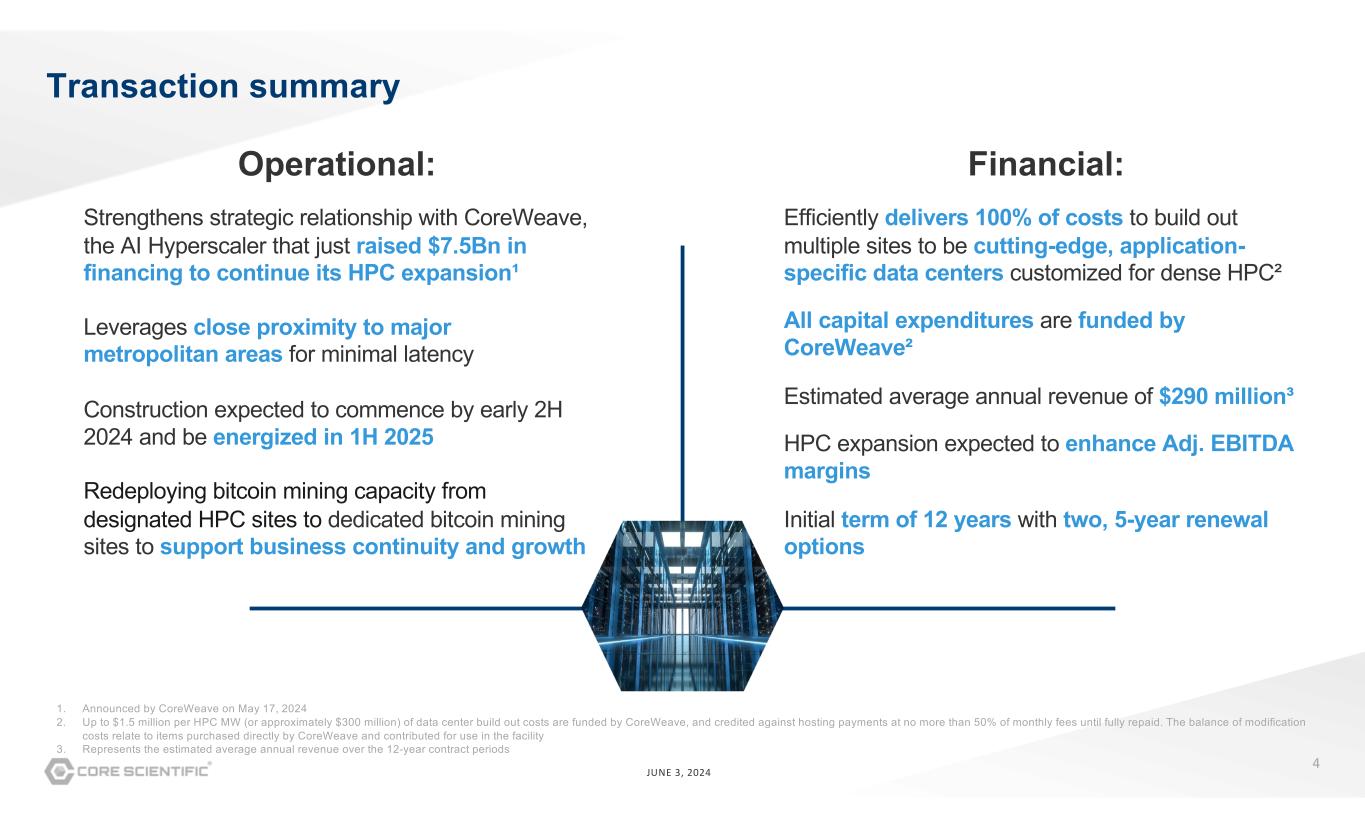

4 JUNE 3, 2024 Strengthens strategic relationship with CoreWeave, the AI Hyperscaler that just raised $7.5Bn in financing to continue its HPC expansion¹ Leverages close proximity to major metropolitan areas for minimal latency Construction expected to commence by early 2H 2024 and be energized in 1H 2025 Redeploying bitcoin mining capacity from designated HPC sites to dedicated bitcoin mining sites to support business continuity and growth Financial:Operational: Transaction summary Efficiently delivers 100% of costs to build out multiple sites to be cutting-edge, application- specific data centers customized for dense HPC² All capital expenditures are funded by CoreWeave² Estimated average annual revenue of $290 million³ HPC expansion expected to enhance Adj. EBITDA margins Initial term of 12 years with two, 5-year renewal options 1. Announced by CoreWeave on May 17, 2024 2. Up to $1.5 million per HPC MW (or approximately $300 million) of data center build out costs are funded by CoreWeave, and credited against hosting payments at no more than 50% of monthly fees until fully repaid. The balance of modification costs relate to items purchased directly by CoreWeave and contributed for use in the facility 3. Represents the estimated average annual revenue over the 12-year contract periods

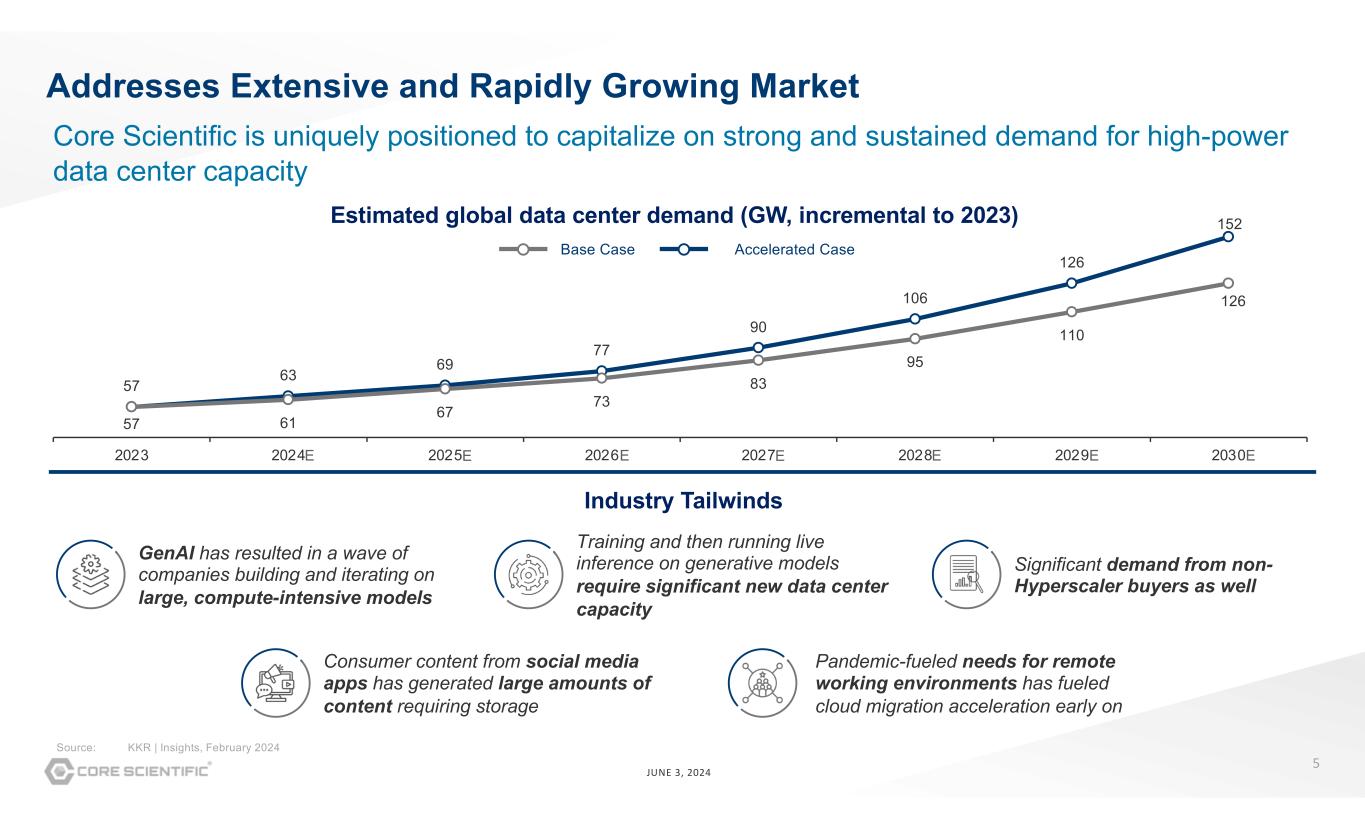

5 JUNE 3, 2024 Addresses Extensive and Rapidly Growing Market Source: KKR | Insights, February 2024 Pandemic-fueled needs for remote working environments has fueled cloud migration acceleration early on Training and then running live inference on generative models require significant new data center capacity GenAI has resulted in a wave of companies building and iterating on large, compute-intensive models Significant demand from non- Hyperscaler buyers as well Consumer content from social media apps has generated large amounts of content requiring storage Industry Tailwinds Core Scientific is uniquely positioned to capitalize on strong and sustained demand for high-power data center capacity Estimated global data center demand (GW, incremental to 2023) Base Case Accelerated Case 57 63 69 77 90 106 126 152 57 61 67 73 83 95 110 126 40 60 80 100 120 140 160 2023 2024 2025 2026 2027 2028 2029 2030E E E E E E E

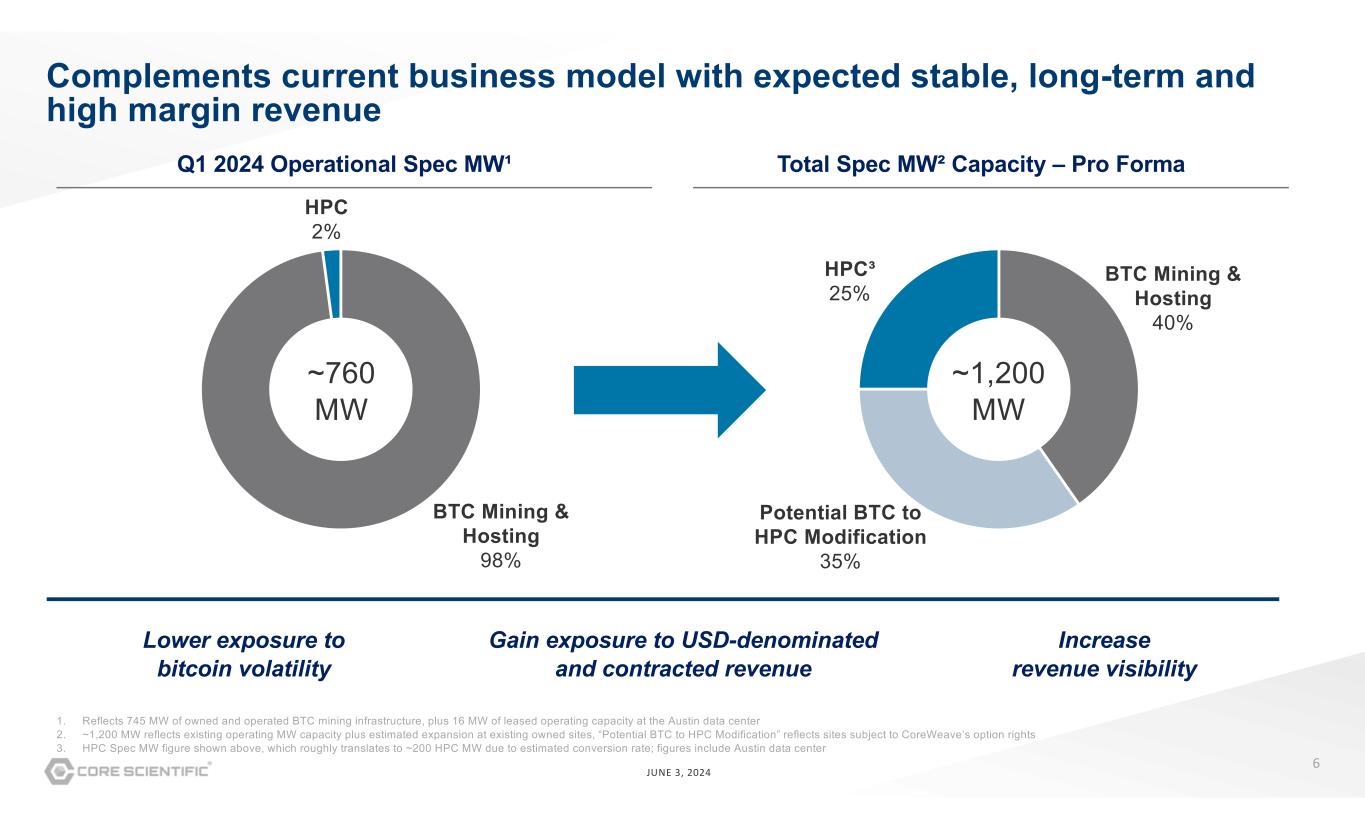

6 JUNE 3, 2024 Complements current business model with expected stable, long-term and high margin revenue 1. Reflects 745 MW of owned and operated BTC mining infrastructure, plus 16 MW of leased operating capacity at the Austin data center 2. ~1,200 MW reflects existing operating MW capacity plus estimated expansion at existing owned sites, “Potential BTC to HPC Modification” reflects sites subject to CoreWeave’s option rights 3. HPC Spec MW figure shown above, which roughly translates to ~200 HPC MW due to estimated conversion rate; figures include Austin data center Lower exposure to bitcoin volatility Gain exposure to USD-denominated and contracted revenue Increase revenue visibility Q1 2024 Operational Spec MW¹ Total Spec MW² Capacity – Pro Forma ~760 MW BTC Mining & Hosting 40% Potential BTC to HPC Modification 35% HPC³ 25% ~1,200 MW BTC Mining & Hosting 98% HPC 2%

7 JUNE 3, 2024 Key Expected Benefits Continues build- out of HPC capabilities Moderates revenue volatility linked to bitcoin price Amplifies access to fast-growing, extensive hyperscale data center market Upgrades business model with stable, long- term and high margin revenue stream Raises revenue visibility Improves asset quality and balance sheet flexibility Expands exposure to dollar- denominated and contracted revenue

Thank you! Investor Relations (737) 931-1351 ir@corescientific.com Corescientific.com