EX-99.2

Published on August 22, 2022

1AUG 22, 2022 Second Quarter Fiscal Year 2022 Earnings Presentation August 22, 2022

2AUG 22, 2022 Legal Disclaimer Forward-Looking Statements This presentation includes “forward-looking statements'' within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, those related to the Company’s ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the Company, future estimates of revenue, net income, adjusted EBITDA, liquidity and cash flow, and availability of capital, future estimates of computing capacity and operating power, future demand for hosting capacity, future estimate of hashrate (including mix of self-mining and hosting), operating gigawatts and power, future projects in construction or negotiation and future expectations of operation location, orders for miners and critical infrastructure, future estimates of self-mining capacity, the public float of the Company’s shares, future infrastructure additions and their operational capacity, and operating power and site features of the Company’s operations center in Denton, Texas. These statements are provided for illustrative purposes only and are based on various assumptions and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the U.S. Securities and Exchange Commission (”SEC”) from time to time, including the Company’s definitive proxy statement filed with the SEC on January 3, 2022, and other subsequent filings the Company files with the SEC from time to time, including its Annual Report on Form 10-K for the year ended December 31, 2021, and Current Report on Form 8-K filed on January 24, 2022, and Quarterly Report on form 10-Q for the second quarter ended June 30, 2022, to be filed with the SEC by August 22, 2022. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, the Company assumes no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Year over year comparisons are based on the combined results of Core Scientific and its acquired entities. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA and adjusted earnings (loss) per diluted share. The Company believes that these non- GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non-GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company urges investors not to rely on any single financial measure to evaluate its business.

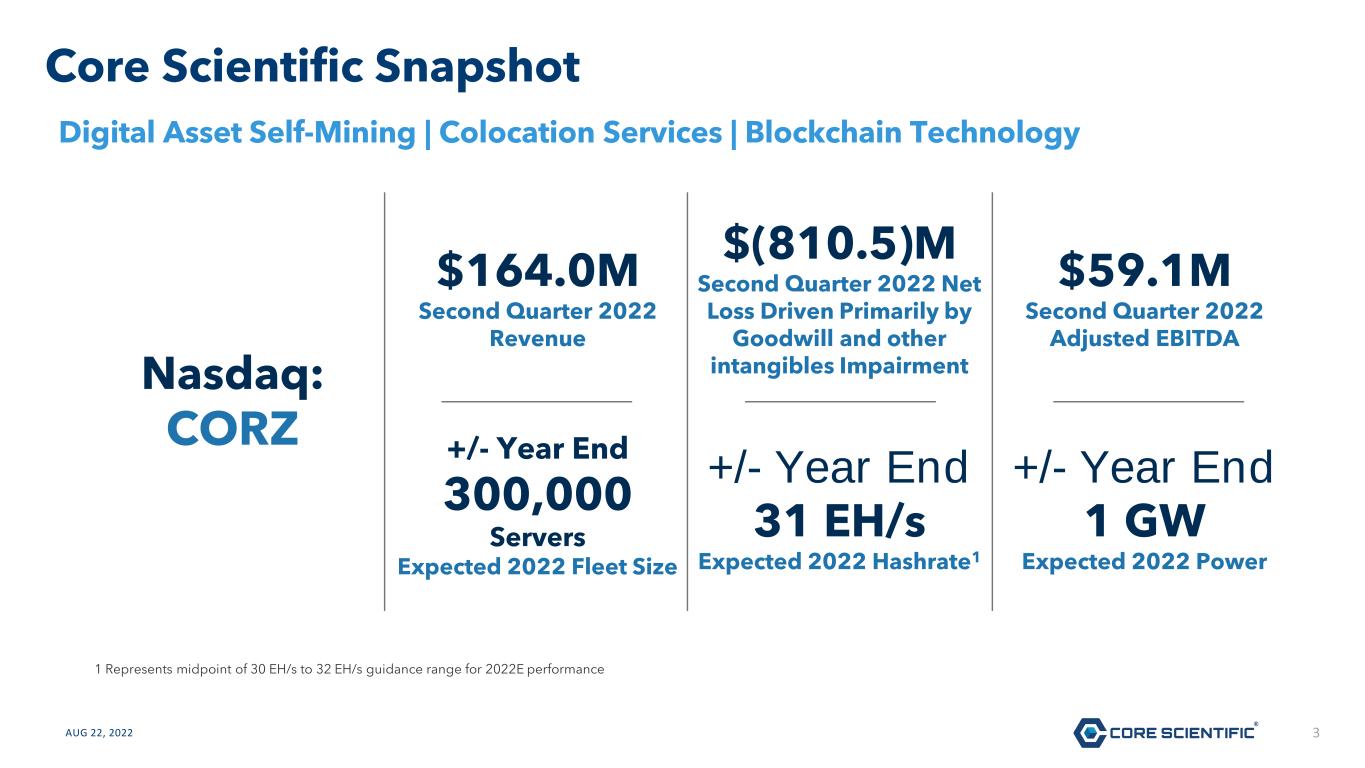

3AUG 22, 2022 Core Scientific Snapshot Digital Asset Self-Mining | Colocation Services | Blockchain Technology $164.0M Second Quarter 2022 Revenue +/- Year End 31 EH/s Expected 2022 Hashrate1 $(810.5)M Second Quarter 2022 Net Loss Driven Primarily by Goodwill and other intangibles Impairment +/- Year End 1 GW Expected 2022 Power $59.1M Second Quarter 2022 Adjusted EBITDA +/- Year End 300,000 Servers Expected 2022 Fleet Size Nasdaq: CORZ 1 Represents midpoint of 30 EH/s to 32 EH/s guidance range for 2022E performance

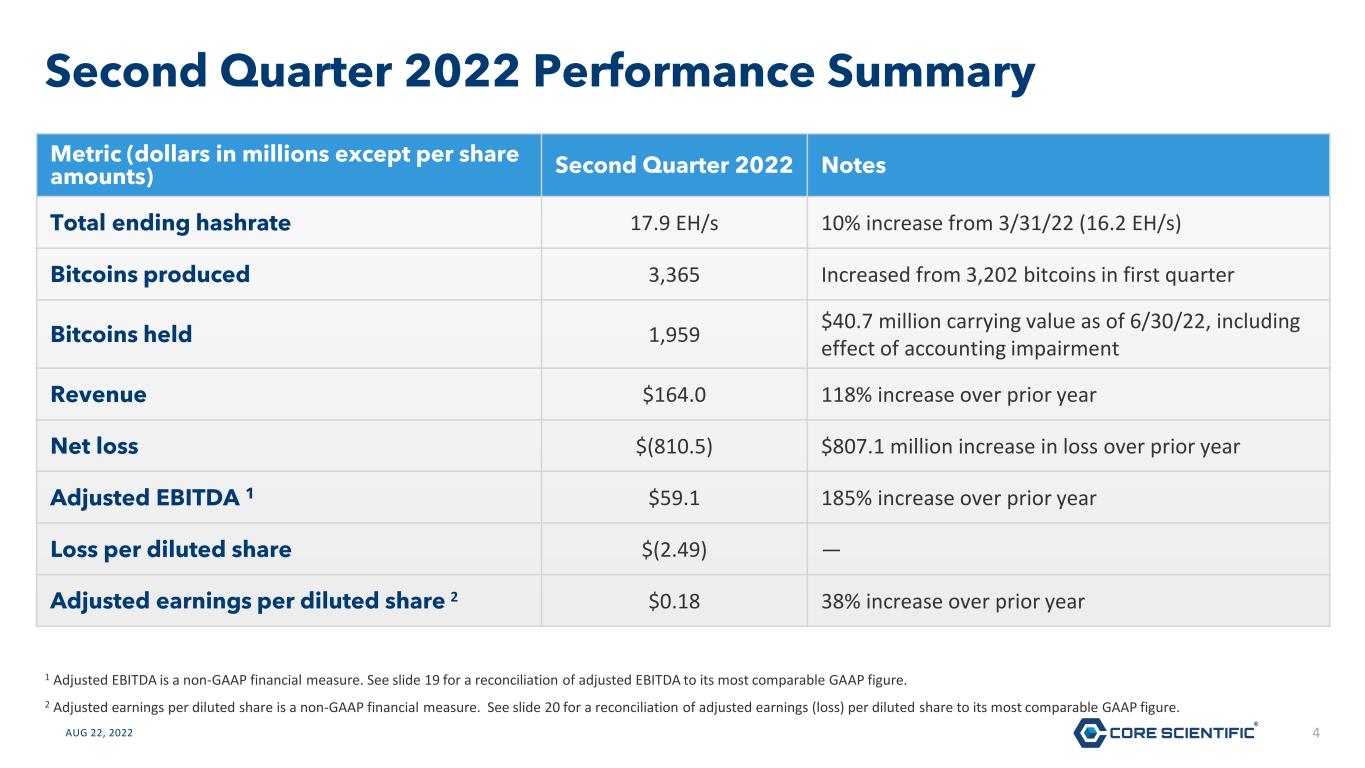

4AUG 22, 2022 Second Quarter 2022 Performance Summary 1 Adjusted EBITDA is a non-GAAP financial measure. See slide 19 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure. 2 Adjusted earnings per diluted share is a non-GAAP financial measure. See slide 20 for a reconciliation of adjusted earnings (loss) per diluted share to its most comparable GAAP figure. Metric (dollars in millions except per share amounts) Second Quarter 2022 Notes Total ending hashrate 17.9 EH/s 10% increase from 3/31/22 (16.2 EH/s) Bitcoins produced 3,365 Increased from 3,202 bitcoins in first quarter Bitcoins held 1,959 $40.7 million carrying value as of 6/30/22, including effect of accounting impairment Revenue $164.0 118% increase over prior year Net loss $(810.5) $807.1 million increase in loss over prior year Adjusted EBITDA 1 $59.1 185% increase over prior year Loss per diluted share $(2.49) — Adjusted earnings per diluted share 2 $0.18 38% increase over prior year

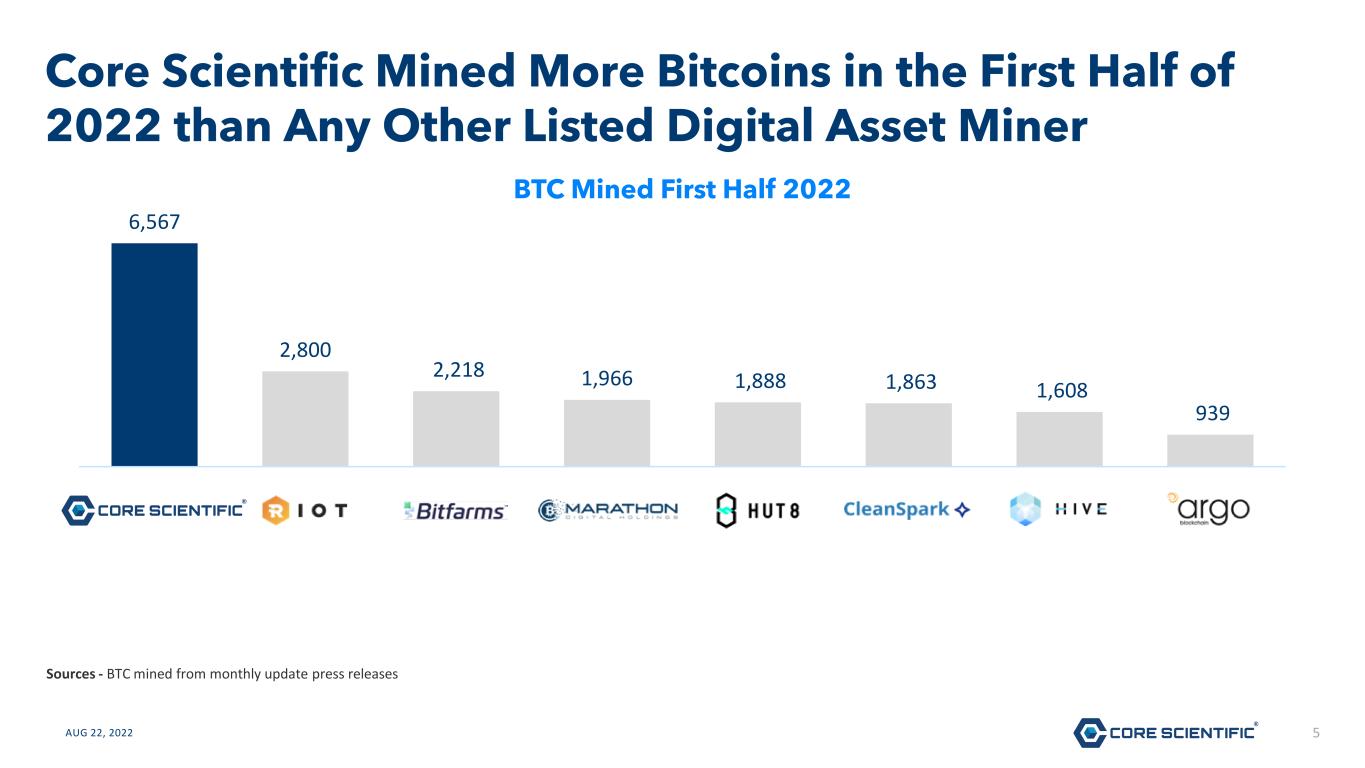

5AUG 22, 2022 Core Scientific Mined More Bitcoins in the First Half of 2022 than Any Other Listed Digital Asset Miner Sources - BTC mined from monthly update press releases 6,567 2,800 2,218 1,966 1,888 1,863 1,608 939 Core Scientific Riot Blockchain Bitfarms Marathon Digital Hut8 Cleanspark Hive Argo BTC Mined First Half 2022

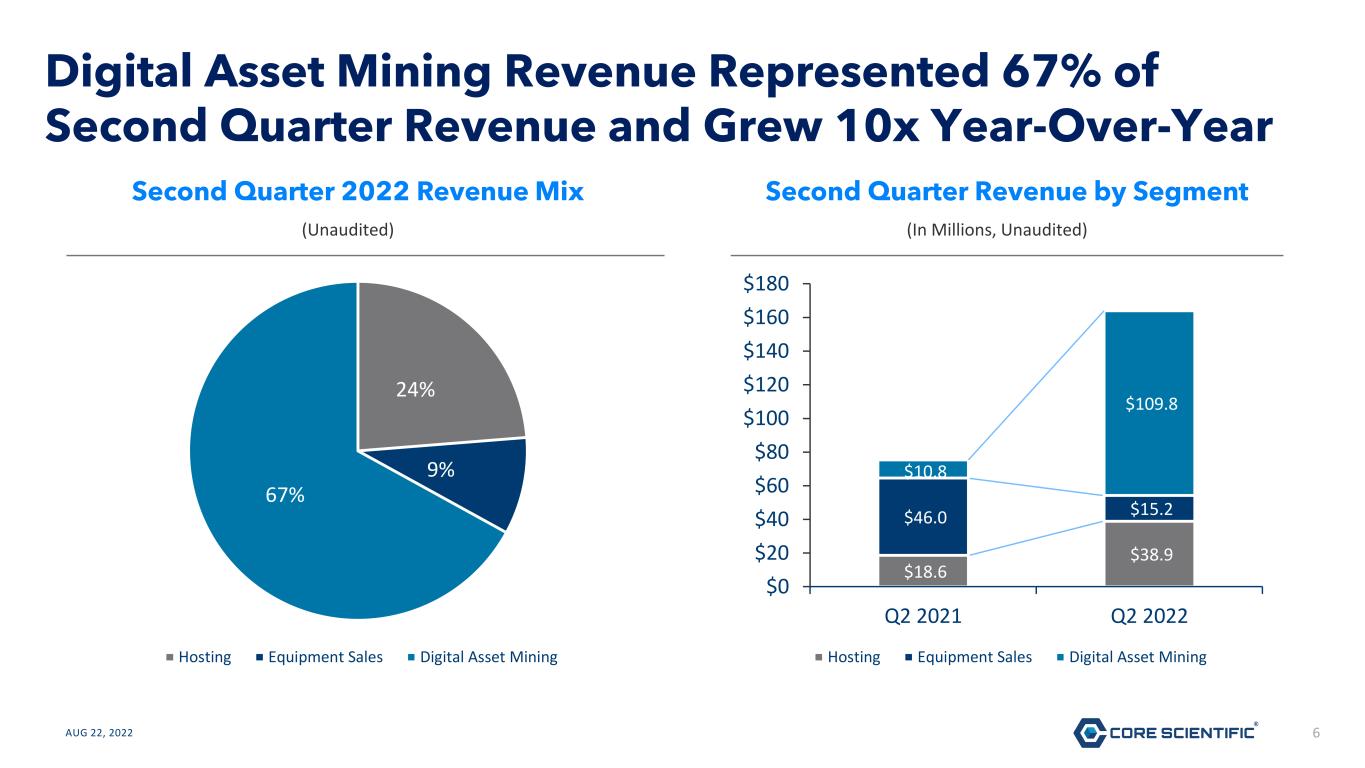

6AUG 22, 2022 Digital Asset Mining Revenue Represented 67% of Second Quarter Revenue and Grew 10x Year-Over-Year (Unaudited) 24% 9% 67% Hosting Equipment Sales Digital Asset Mining Second Quarter 2022 Revenue Mix (In Millions, Unaudited) $18.6 $38.9 $46.0 $15.2 $10.8 $109.8 $0 $20 $40 $60 $80 $100 $120 $140 $160 $180 Q2 2021 Q2 2022 Hosting Equipment Sales Digital Asset Mining Second Quarter Revenue by Segment

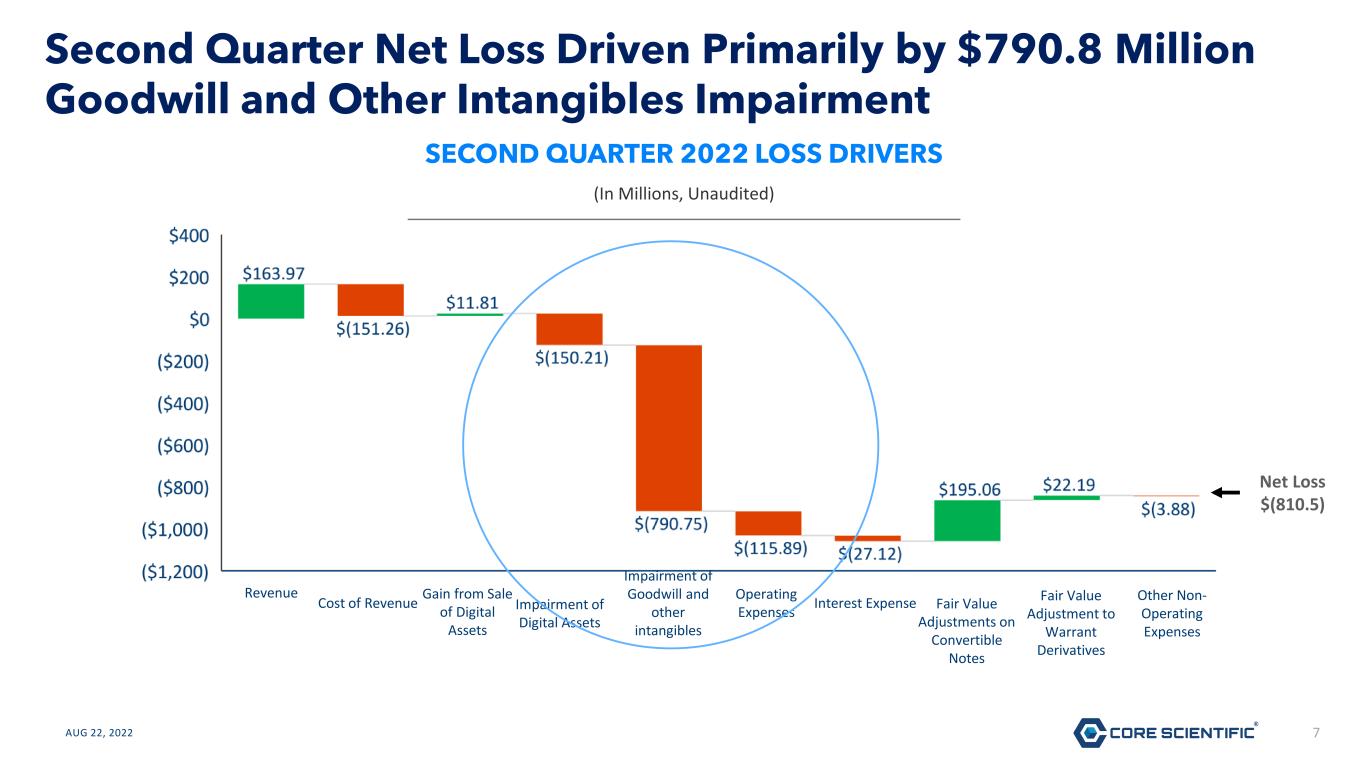

7AUG 22, 2022 Second Quarter Net Loss Driven Primarily by $790.8 Million Goodwill and Other Intangibles Impairment (In Millions, Unaudited) SECOND QUARTER 2022 LOSS DRIVERS Revenue Cost of Revenue Gain from Sale of Digital Assets Impairment of Digital Assets Operating Expenses Interest Expense Fair Value Adjustments on Convertible Notes Fair Value Adjustment to Warrant Derivatives Other Non- Operating Expenses Impairment of Goodwill and other intangibles Net Loss $(810.5)

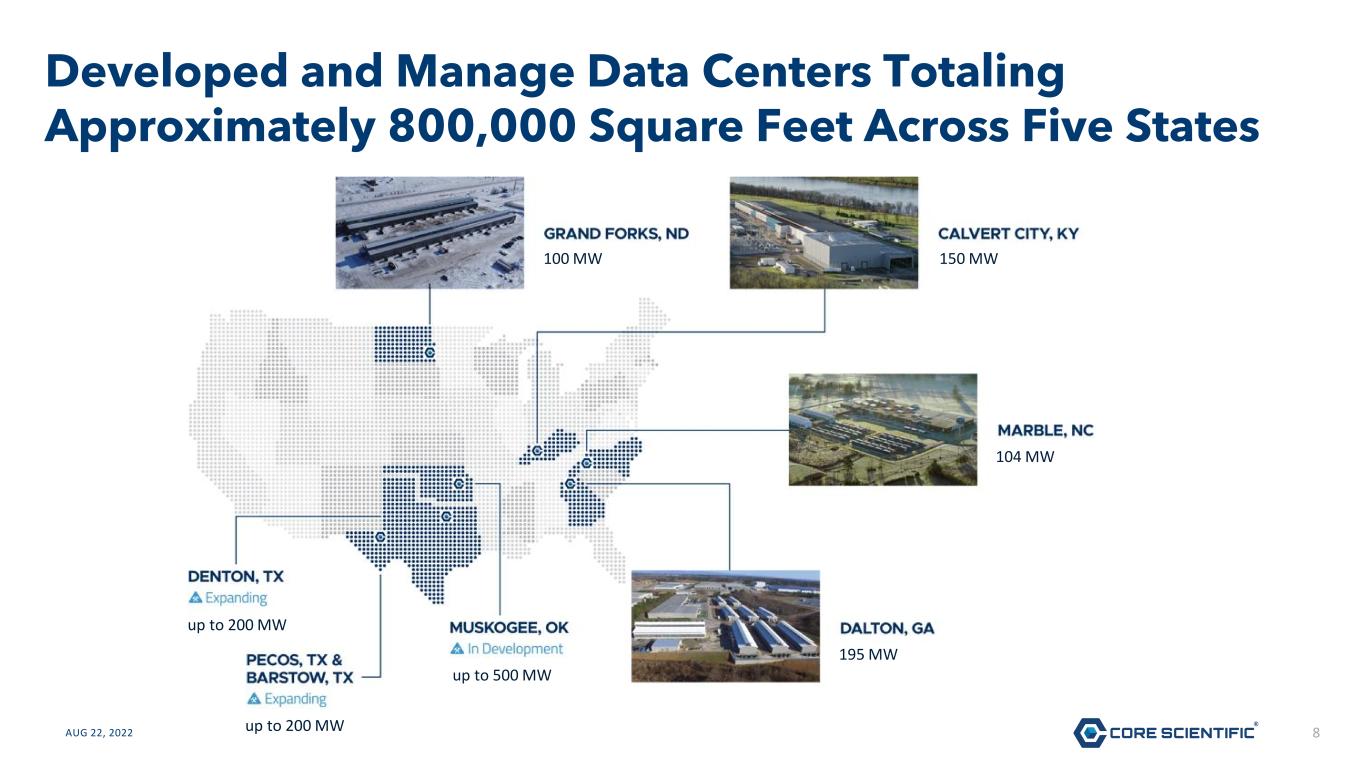

8AUG 22, 2022 Developed and Manage Data Centers Totaling Approximately 800,000 Square Feet Across Five States 100 MW 150 MW 104 MW 195 MW up to 500 MW up to 200 MW up to 200 MW

9AUG 22, 2022 Continued Progress on Three Texas Data Center Projects Barstow, TX Pecos, TXDenton, TX Denton, TX

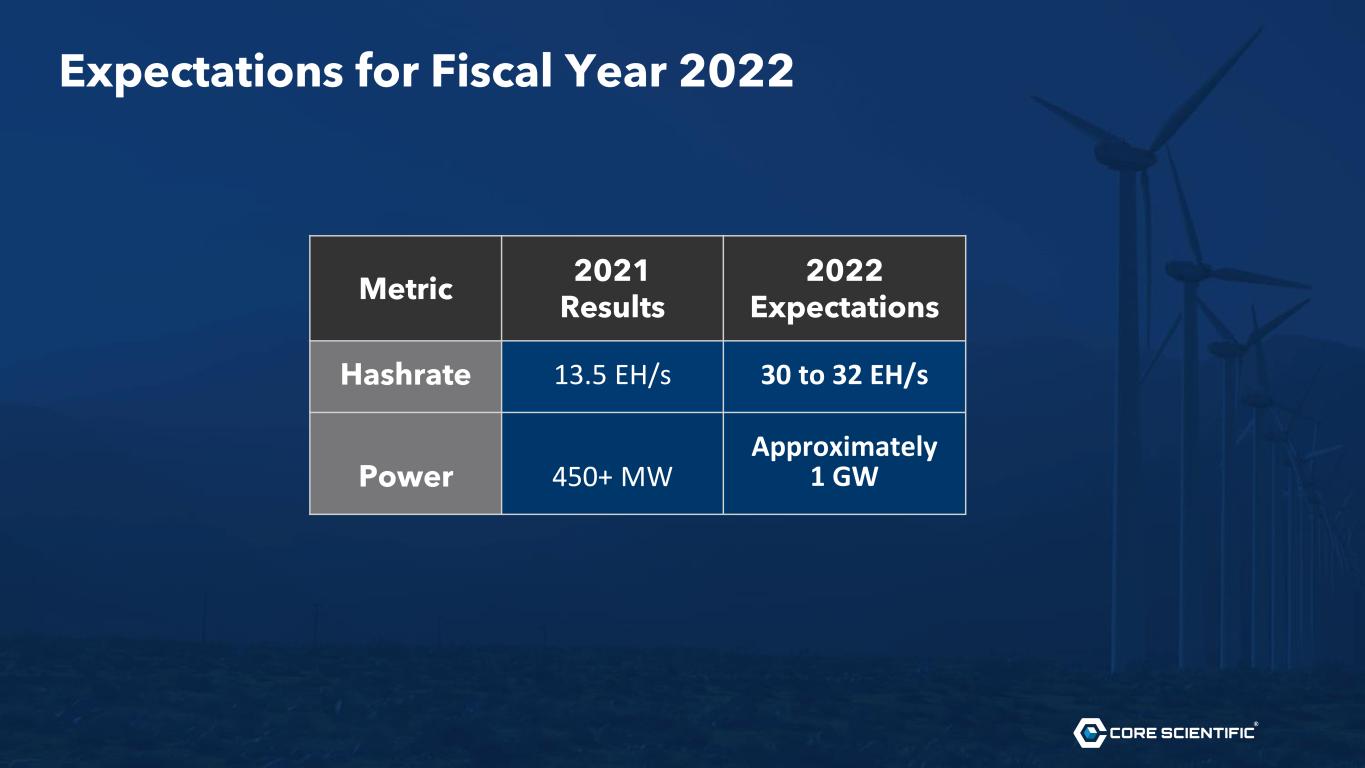

10AUG 22, 202211 Metric 2021 Results 2022 Expectations Hashrate 13.5 EH/s 30 to 32 EH/s Power 450+ MW Approximately 1 GW 1 Expectations for Fiscal Year 2022

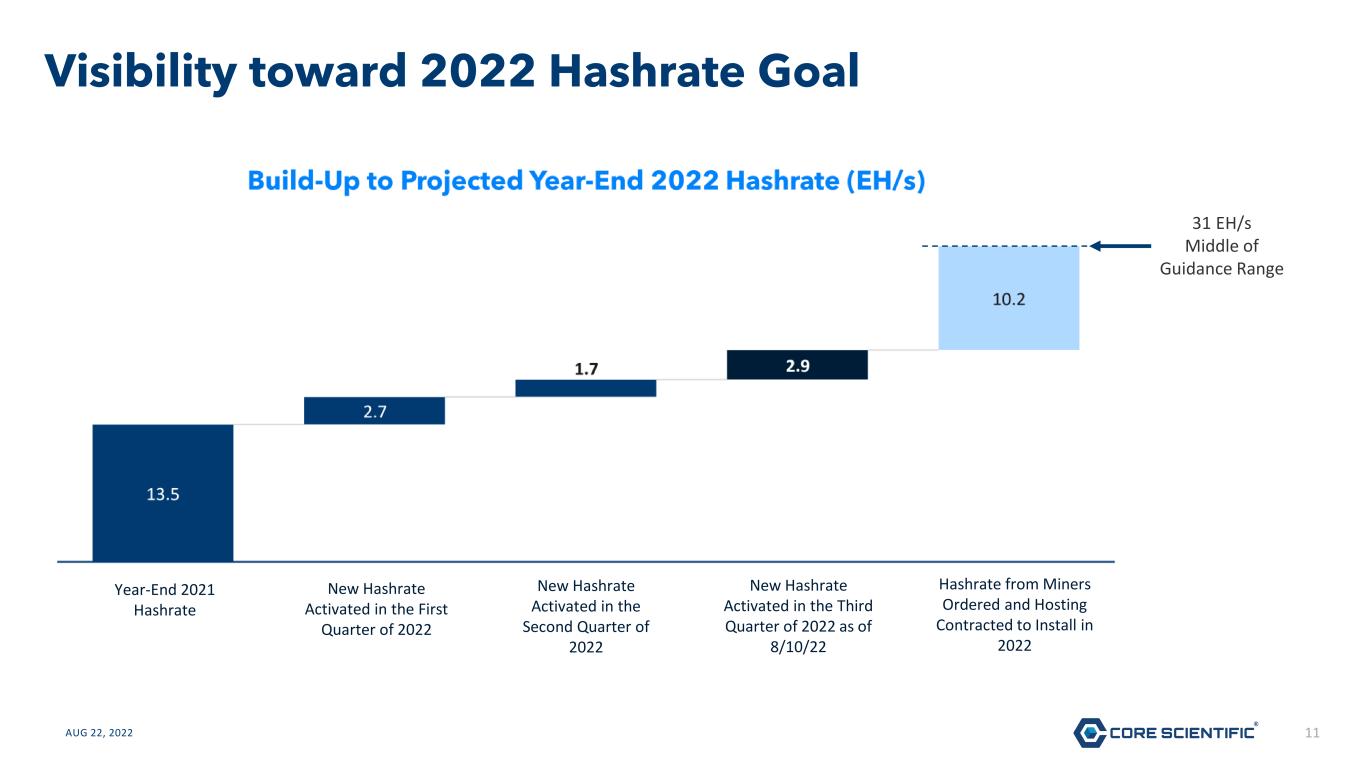

11AUG 22, 2022 Visibility toward 2022 Hashrate Goal 31 EH/s Middle of Guidance Range Year-End 2021 Hashrate Hashrate from Miners Ordered and Hosting Contracted to Install in 2022 New Hashrate Activated in the First Quarter of 2022 New Hashrate Activated in the Second Quarter of 2022 New Hashrate Activated in the Third Quarter of 2022 as of 8/10/22

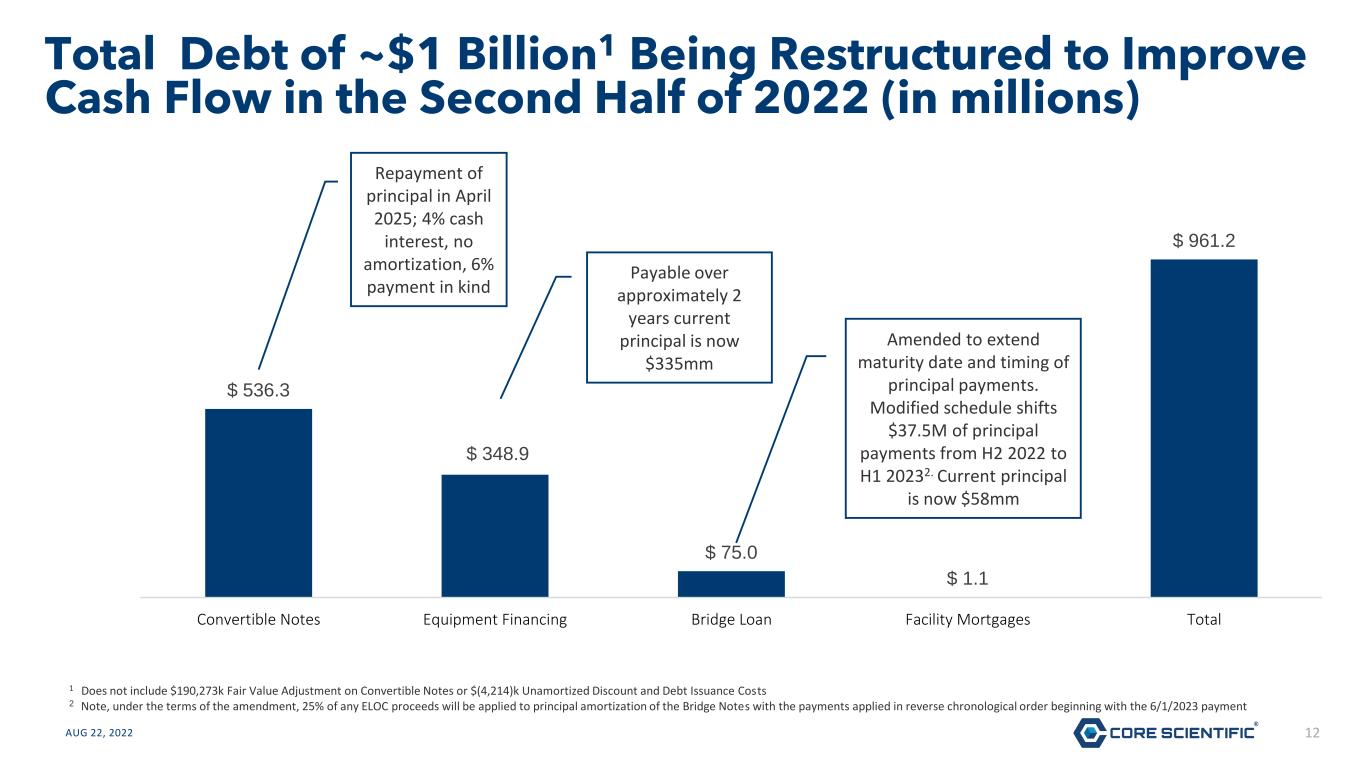

12AUG 22, 2022 $ 536.3 $ 348.9 $ 75.0 $ 1.1 $ 961.2 Convertible Notes Equipment Financing Bridge Loan Facility Mortgages Total Total Debt of ~$1 Billion1 Being Restructured to Improve Cash Flow in the Second Half of 2022 (in millions) Repayment of principal in April 2025; 4% cash interest, no amortization, 6% payment in kind Payable over approximately 2 years current principal is now $335mm Amended to extend maturity date and timing of principal payments. Modified schedule shifts $37.5M of principal payments from H2 2022 to H1 20232. Current principal is now $58mm 1 Does not include $190,273k Fair Value Adjustment on Convertible Notes or $(4,214)k Unamortized Discount and Debt Issuance Costs 2 Note, under the terms of the amendment, 25% of any ELOC proceeds will be applied to principal amortization of the Bridge Notes with the payments applied in reverse chronological order beginning with the 6/1/2023 payment

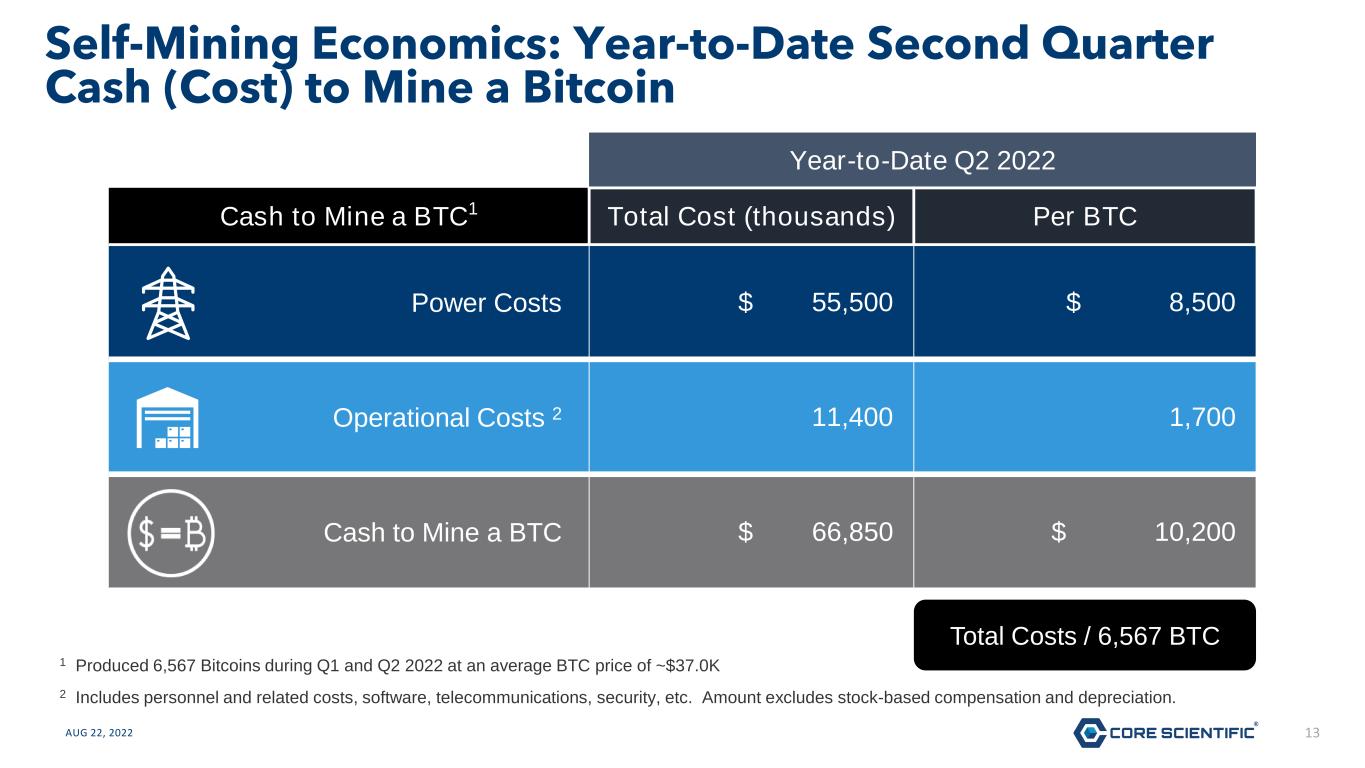

13AUG 22, 2022 Year-to-Date Q2 2022 Cash to Mine a BTC1 Total Cost (thousands) Per BTC Power Costs $ 55,500 $ 8,500 Operational Costs 2 11,400 1,700 Cash to Mine a BTC $ 66,850 $ 10,200 Total Costs / 6,567 BTC Self-Mining Economics: Year-to-Date Second Quarter Cash (Cost) to Mine a Bitcoin 1 Produced 6,567 Bitcoins during Q1 and Q2 2022 at an average BTC price of ~$37.0K 2 Includes personnel and related costs, software, telecommunications, security, etc. Amount excludes stock-based compensation and depreciation.

14AUG 22, 2022 Why Core Scientific? A Blockchain Data Center Developer and Operator at Leading Scale Integrated Data Centers for Self- Mining and Hosting Consistent Growth in Capacity and Capability Deep, Experienced Team Proprietary Technology A MARKET LEADER FULL SPECTRUM TRACK RECORD TEAM IP

15 Blockchain Computing Data Centers for Self-Mining and Colocation Services

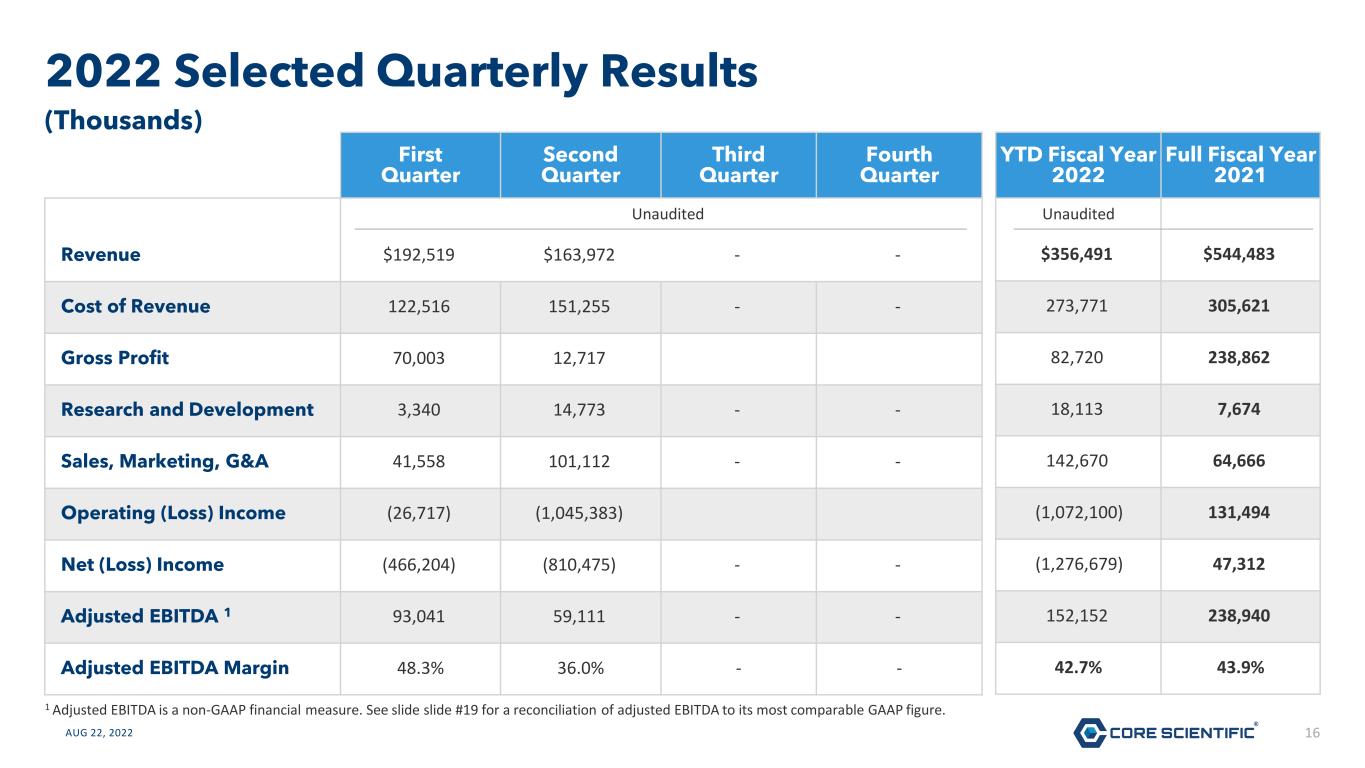

16AUG 22, 2022 First Quarter Second Quarter Third Quarter Fourth Quarter Revenue $192,519 $163,972 - - Cost of Revenue 122,516 151,255 - - Gross Profit 70,003 12,717 Research and Development 3,340 14,773 - - Sales, Marketing, G&A 41,558 101,112 - - Operating (Loss) Income (26,717) (1,045,383) Net (Loss) Income (466,204) (810,475) - - Adjusted EBITDA 1 93,041 59,111 - - Adjusted EBITDA Margin 48.3% 36.0% - - 2022 Selected Quarterly Results 1 Adjusted EBITDA is a non-GAAP financial measure. See slide slide #19 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure. Unaudited (Thousands) YTD Fiscal Year 2022 Full Fiscal Year 2021 $356,491 $544,483 273,771 305,621 82,720 238,862 18,113 7,674 142,670 64,666 (1,072,100) 131,494 (1,276,679) 47,312 152,152 238,940 42.7% 43.9% Unaudited

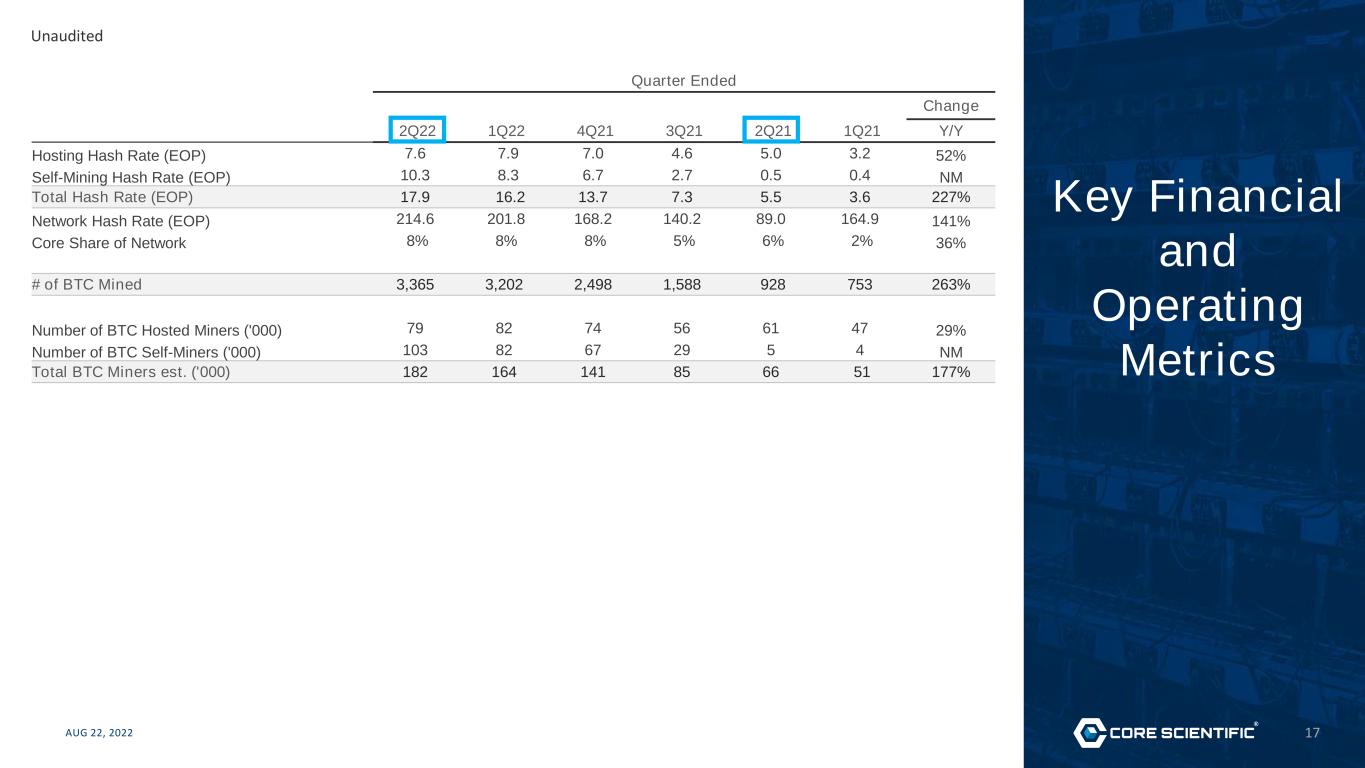

17AUG 22, 2022 Key Financial and Operating Metrics Quarter Ended Change 2Q22 1Q22 4Q21 3Q21 2Q21 1Q21 Y/Y Hosting Hash Rate (EOP) 7.6 7.9 7.0 4.6 5.0 3.2 52% Self-Mining Hash Rate (EOP) 10.3 8.3 6.7 2.7 0.5 0.4 NM Total Hash Rate (EOP) 17.9 16.2 13.7 7.3 5.5 3.6 227% Network Hash Rate (EOP) 214.6 201.8 168.2 140.2 89.0 164.9 141% Core Share of Network 8% 8% 8% 5% 6% 2% 36% # of BTC Mined 3,365 3,202 2,498 1,588 928 753 263% Number of BTC Hosted Miners ('000) 79 82 74 56 61 47 29% Number of BTC Self-Miners ('000) 103 82 67 29 5 4 NM Total BTC Miners est. ('000) 182 164 141 85 66 51 177% Unaudited

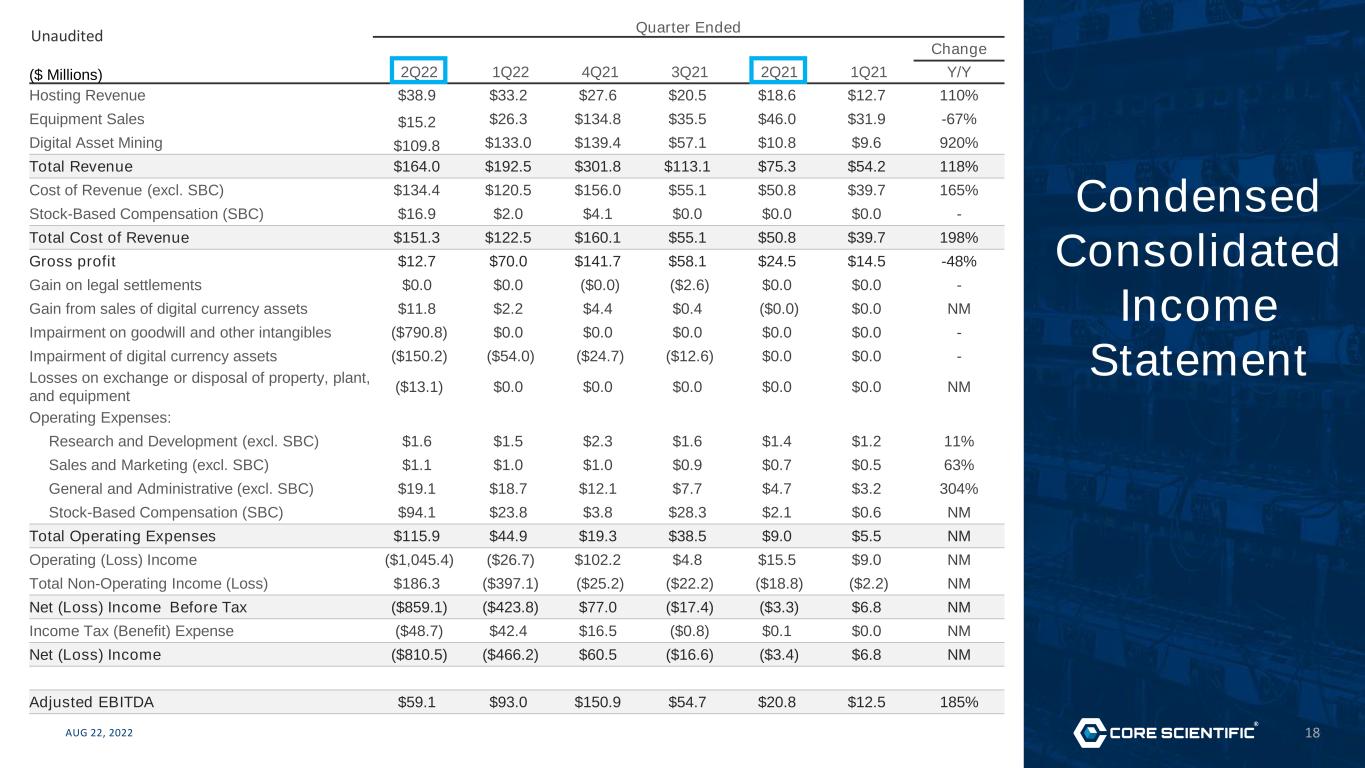

18AUG 22, 2022 Condensed Consolidated Income Statement Quarter Ended Change ($ Millions) 2Q22 1Q22 4Q21 3Q21 2Q21 1Q21 Y/Y Hosting Revenue $38.9 $33.2 $27.6 $20.5 $18.6 $12.7 110% Equipment Sales $15.2 $26.3 $134.8 $35.5 $46.0 $31.9 -67% Digital Asset Mining $109.8 $133.0 $139.4 $57.1 $10.8 $9.6 920% Total Revenue $164.0 $192.5 $301.8 $113.1 $75.3 $54.2 118% Cost of Revenue (excl. SBC) $134.4 $120.5 $156.0 $55.1 $50.8 $39.7 165% Stock-Based Compensation (SBC) $16.9 $2.0 $4.1 $0.0 $0.0 $0.0 - Total Cost of Revenue $151.3 $122.5 $160.1 $55.1 $50.8 $39.7 198% Gross profit $12.7 $70.0 $141.7 $58.1 $24.5 $14.5 -48% Gain on legal settlements $0.0 $0.0 ($0.0) ($2.6) $0.0 $0.0 - Gain from sales of digital currency assets $11.8 $2.2 $4.4 $0.4 ($0.0) $0.0 NM Impairment on goodwill and other intangibles ($790.8) $0.0 $0.0 $0.0 $0.0 $0.0 - Impairment of digital currency assets ($150.2) ($54.0) ($24.7) ($12.6) $0.0 $0.0 - Losses on exchange or disposal of property, plant, and equipment ($13.1) $0.0 $0.0 $0.0 $0.0 $0.0 NM Operating Expenses: Research and Development (excl. SBC) $1.6 $1.5 $2.3 $1.6 $1.4 $1.2 11% Sales and Marketing (excl. SBC) $1.1 $1.0 $1.0 $0.9 $0.7 $0.5 63% General and Administrative (excl. SBC) $19.1 $18.7 $12.1 $7.7 $4.7 $3.2 304% Stock-Based Compensation (SBC) $94.1 $23.8 $3.8 $28.3 $2.1 $0.6 NM Total Operating Expenses $115.9 $44.9 $19.3 $38.5 $9.0 $5.5 NM Operating (Loss) Income ($1,045.4) ($26.7) $102.2 $4.8 $15.5 $9.0 NM Total Non-Operating Income (Loss) $186.3 ($397.1) ($25.2) ($22.2) ($18.8) ($2.2) NM Net (Loss) Income Before Tax ($859.1) ($423.8) $77.0 ($17.4) ($3.3) $6.8 NM Income Tax (Benefit) Expense ($48.7) $42.4 $16.5 ($0.8) $0.1 $0.0 NM Net (Loss) Income ($810.5) ($466.2) $60.5 ($16.6) ($3.4) $6.8 NM Adjusted EBITDA $59.1 $93.0 $150.9 $54.7 $20.8 $12.5 185% Unaudited

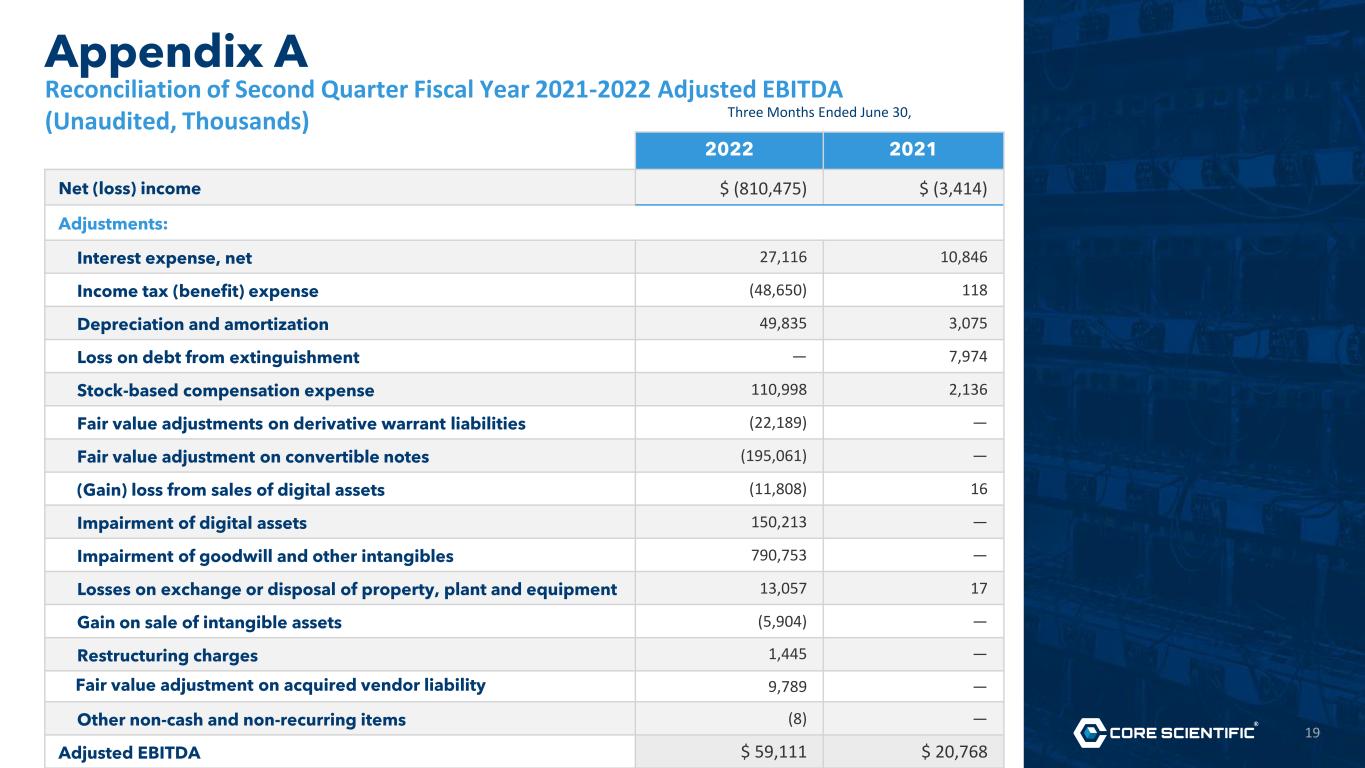

19AUG 22, 2022 Appendix A Three Months Ended June 30, 2022 2021 Net (loss) income $ (810,475) $ (3,414) Adjustments: Interest expense, net 27,116 10,846 Income tax (benefit) expense (48,650) 118 Depreciation and amortization 49,835 3,075 Loss on debt from extinguishment — 7,974 Stock-based compensation expense 110,998 2,136 Fair value adjustments on derivative warrant liabilities (22,189) — Fair value adjustment on convertible notes (195,061) — (Gain) loss from sales of digital assets (11,808) 16 Impairment of digital assets 150,213 — Impairment of goodwill and other intangibles 790,753 — Losses on exchange or disposal of property, plant and equipment 13,057 17 Gain on sale of intangible assets (5,904) — Restructuring charges 1,445 — Fair value adjustment on acquired vendor liability 9,789 — Other non-cash and non-recurring items (8) — Adjusted EBITDA $ 59,111 $ 20,768 Reconciliation of Second Quarter Fiscal Year 2021-2022 Adjusted EBITDA (Unaudited, Thousands)

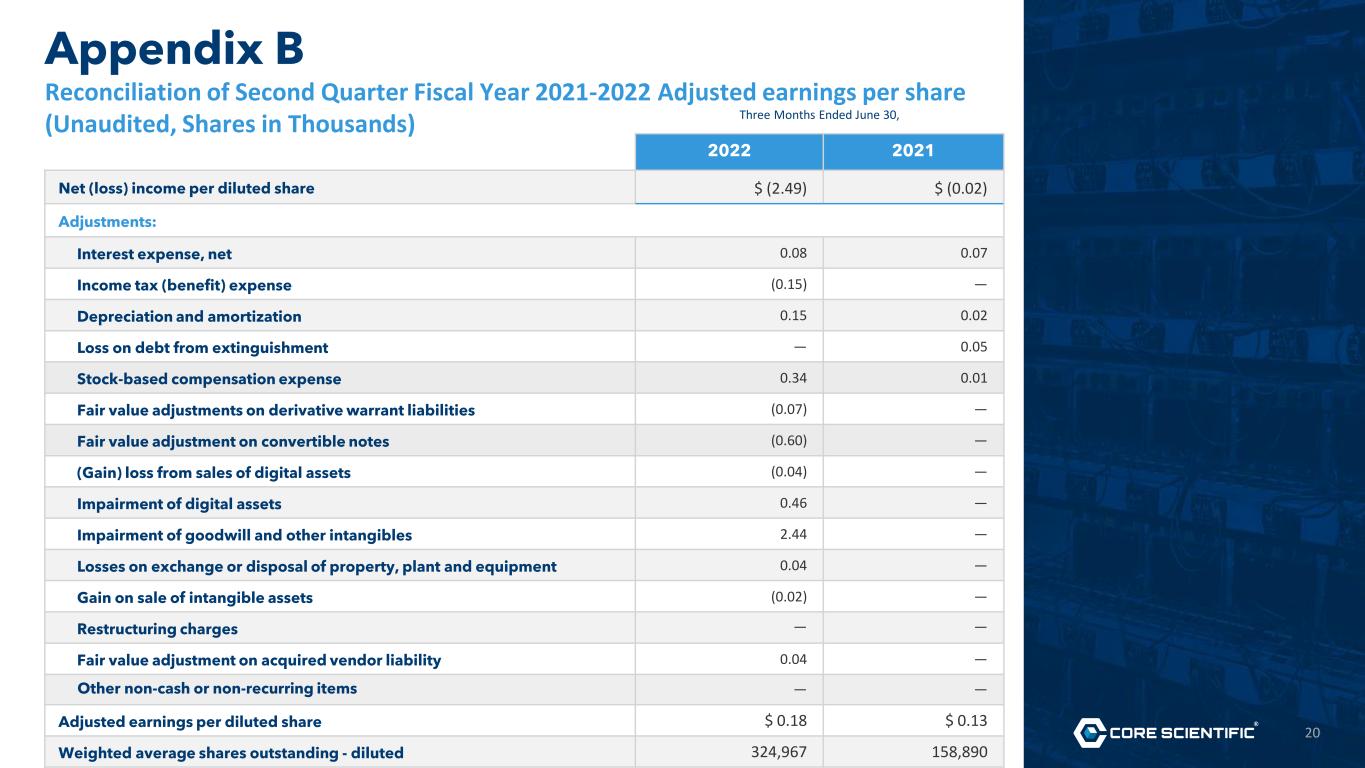

20AUG 22, 2022 Appendix B Three Months Ended June 30, 2022 2021 Net (loss) income per diluted share $ (2.49) $ (0.02) Adjustments: Interest expense, net 0.08 0.07 Income tax (benefit) expense (0.15) — Depreciation and amortization 0.15 0.02 Loss on debt from extinguishment — 0.05 Stock-based compensation expense 0.34 0.01 Fair value adjustments on derivative warrant liabilities (0.07) — Fair value adjustment on convertible notes (0.60) — (Gain) loss from sales of digital assets (0.04) — Impairment of digital assets 0.46 — Impairment of goodwill and other intangibles 2.44 — Losses on exchange or disposal of property, plant and equipment 0.04 — Gain on sale of intangible assets (0.02) — Restructuring charges — — Fair value adjustment on acquired vendor liability 0.04 — Other non-cash or non-recurring items — — Adjusted earnings per diluted share $ 0.18 $ 0.13 Weighted average shares outstanding - diluted 324,967 158,890 Reconciliation of Second Quarter Fiscal Year 2021-2022 Adjusted earnings per share (Unaudited, Shares in Thousands)