INVESTOR PRESENTATION

Published on July 21, 2021

Exhibit 99.2

CORE SCIENTIFIC INVESTOR PRESENTATION July 2021

LEGAL DISCLAIMER ® 2 PROPRIETARY & CONFIDENTIAL CONFIDENTIAL INFORMATION. The information in this presentation is highly confidential. This presentation has been furnished to you solely for your information. The distribution of this presentation by an authorized recipient to any other person is unauthorized. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited. The recipient of this presentation shall keep this presentation and its contents confidential, shall not use this presentation and its contents for any purpose other than as expressly authorized by Core Scientific, Inc. (the “Company”) and Power & Digital Infrastructure Acquisition Corp. (“XPDI”) and shall be required to return or destroy all copies of this presentation or portions thereof in its possession promptly following request for the return or destruction of such copies. By accepting delivery of this presentation, the recipient is deemed to agree to the foregoing confidentiality requirements. Neither the Securities and Exchange Commission (“SEC”) nor any state or territorial securities commission has approved or disapproved of the securities or determined if this presentation is truthful or complete. In connection with the proposed business combination between XPDI and the Company (the “Business Combination”), XPDI intends to file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form S - 4 containing a preliminary proxy statement and a preliminary prospectus of XPDI, and after the registration statement is declared effective, XPDI will mail a definitive proxy statement/p rospectus relating to the proposed Business Combination to its stockholders. This presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. XPDI’s stockholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus and the amendments thereto and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about XPDI, the Company and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of XPDI as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a request to: Power & Digital Infrastructure Acquisition Corp., 321 North Clark Street, Suite 2440, Chicago, IL 60654. XPDI and its directors and executive officers may be deemed participants in the solicitation of proxies from XPDI’s stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in XPDI is contained in XPDI’s final prospectus related to its initial public offering dated February 9, 2021, which was filed with the SEC and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request to: Power & Digital Infrastructure Acquisition Corp., 321 North Clark Street, Suite 2440, Chicago, IL 60654. Additional information regarding the interests of such participants will be contained in the proxy statement/prospectus for the proposed Business Combination when available. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of XPDI in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination will be included in the proxy statement for the proposed Business Combination when available. This presentation contains trademarks, service marks, trade name and copyrights of XPDI, the Company and the other companies identified herein which are property of their respective owners. FORWARD - LOOKING STATEMENTS. This presentation contains forward - looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this presentation are forward - looking statements. Forward - looking statements include, but are not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics, projections of market opportunity and expectations, the estimated implied enterprise value of the combined company, Core Scientific's ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the combined company, the combined company's ability to source and retain talent, the cash position of the combined company following closing, XPDI's and Core Scientific's ability to consummate the Transaction, and expectations related to the terms and timing of the Transaction. You can identify forward - looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “seek,” “plan,” “intend,” “believe,” “will,” “may,” “could,” “continue,” “likely,” “should,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events but not all forward - looking statements contain these identifying words. These forward - looking statements are subject to a number of risks and uncertainties, including risks related to mining equipment supply, the sufficiency of infrastructure, including electricity sources, the price of bitcoin, the global hash rate and other risks identified as “risk factors” later in this presentation, the parties may be unable to successfully or timely consummate the proposed business combination, including the risk that any regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the stockholders of the Company or XPDI is not obtained; failure to realize the anticipated benefits of the proposed business com bination; and those factors discussed in XPDI’s final prospectus filed with the SEC on February 11, 2021 under the heading “Risk Factors” and other documents XPDI has filed, or will file, with the SEC. The forward - looking statements in this presentation are based on assumptions that the Company and XPDI have made in light of their industry experience and their perceptions of historical trends, current conditions, expected future developments and other factors that they believe are appropriate under the circumstances. You should understand that these statements are not guarantees of performance or results. These assumptions and the combined company’s future performance or results involve risks and uncertainties (many of which are beyond the Company’s and XPDI’s control). Additional factors or events that could cause the combined company’s actual performance to differ from these forward - looking statements may emerge from time to time, and it is not possible for the Company or XPDI to predict all of them. Should one or more of these risks or uncertainties materialize, or should any of the assumptions prove incorrect, the combined company’s actual financial condition, results of operations, future performance and business may vary in material respects from the performance projected in these forward - looking statements. This presentation, including any forward - looking statement made by the Company and XPDI within, speaks only as of the date on which it is made. The Company and XPDI undertake no obligation to publicly update this presentation, whether as a result of new information, future developments or otherwise, except as may be required by law. Market data and industry information used throughout this presentation are based on the knowledge of the industry and the good faith estimates of the Company’s management. The Company and XPDI also relied, to the extent available, upon the review of independent industry surveys and other publicly available information prepared by a number of third - party sources. All of the market data and industry information used in this presentation involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although the Company and XPDI believe these sources are reliable, they cannot guarantee the accuracy or completeness of this information, and they have not independently verified this information. This presentation contains the Company’s projected financial and operational information. Such projected financial and operational information is forward - looking and is for illustrative purposes only. The information should not be relied upon as being indicative of future results. Projections, assumptions and estimates of the Company’s future performance and the future performance of the industry in which the Company operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including, among other things, the sufficiency of infrastructure, including electricity sources, the price of bitcoin, the global hash rate and the shipment of manufacturers’ units on a timely basis. The Company’s management believes the projections and underlying assumptions have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected. The inclusion of such projections or historical financial and operational information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved or that historical results will be indicative of future performance. FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES. Certain financial information and data contained in this presentation is unaudited and does not conform to Regulation S - X promulgated under the Securities Act of 1933, as amended. Accordingly, such financial information may be adjusted in or may be presented differently in, the proxy statement/prospectus or registration statement to be filed by XPDI with the SEC. This presentation also includes non - GAAP financial measures, including Adjusted EBITDA. XPDI and the Company believe that these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non - GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. Not all of the information necessary for a quantitative reconciliation of these forward - looking non - GAAP financial measures to the most directly comparable GAAP financial measures is available without unreasonable efforts at this time. Specifically, the Company does not provide such quantitative reconciliation due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. The material has been prepared or is distributed solely for information purposes and is not a proxy statement, an offer to sell, a solicitation or an offer to buy or a recommendation to purchase any security or instrument or to participate in any trading strategy. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. Note 1: Presentation assumes pro forma Core Scientific, including the acquisition of Blockcap, which is expected to close on July 22, 2021, and Blockcap’s acquisition of Radar Relay, which closed on July 2, 2021.

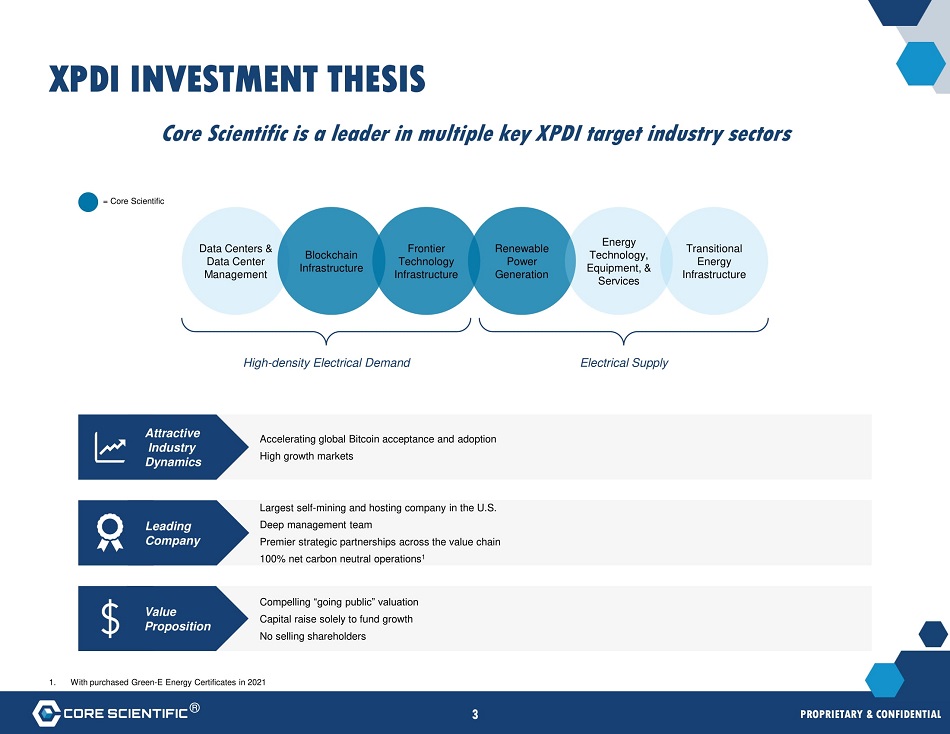

XPDI INVESTMENT THESIS Core Scientific is a leader in multiple key XPDI target industry sectors 1. With purchased Green - E Energy Certificates in 2021 Data Centers & Data Center Management Blockchain Infra s tru c tu re Frontier Technology Infra s tru c tu re Rene w able Power Genera t i on Energy Technology, Equip m en t, & Services Transitional Energy Infra s tru c tu re = Core Scientific Largest self - mining and hosting company in the U.S. Deep management team Premier strategic partnerships across the value chain 100% net carbon neutral operations 1 Leading Company Compelling “going public” valuation Capital raise solely to fund growth No selling shareholders V alue Proposition Accelerating global Bitcoin acceptance and adoption High growth markets Att r a c tive In d ustry Dynamics High - density Electrical Demand ® 3 PROPRIETARY & CONFIDENTIAL Electrical Supply

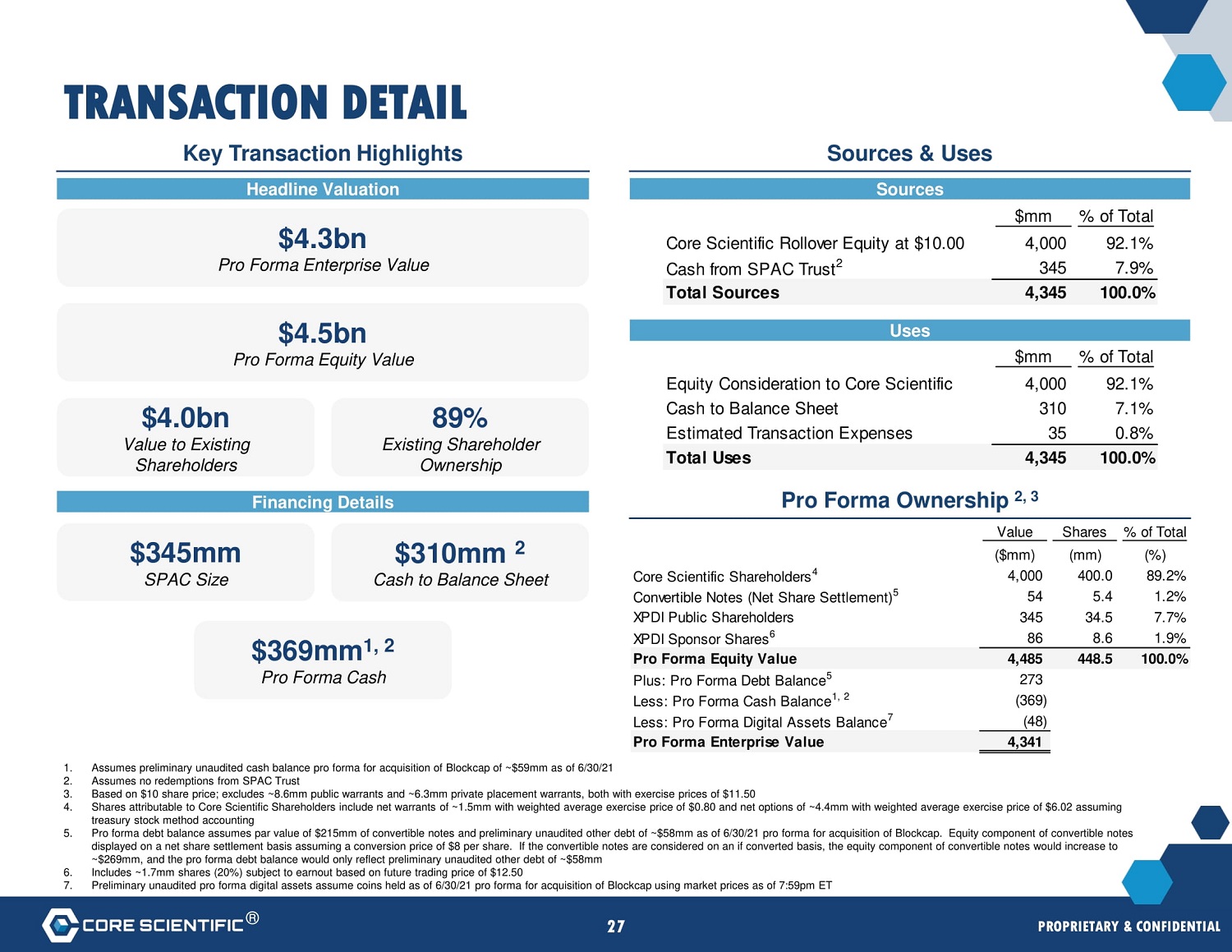

TRANSACTION SUMMARY ® 4 PROPRIETARY & CONFIDENTIAL T ransa c tion Structure • Core Scientific, Inc. (“Core Scientific”) to combine with Power & Digital Infrastructure Acquisition Corp. (“XPDI”), a publicly listed Special Purpose Acquisition Company with ~$345mm cash currently held in trust • Transaction expected to close in Q4 2021 • The post - closing company, Core Scientific, Inc. (“Core”), is expected to be listed on Nasdaq Valuation • Transaction implies a pro forma enterprise value of ~$4.3bn • Significant discount to publicly traded comparable companies Capital Structure • Transaction expected to result in ~$310mm of net proceeds 1 • Existing Core Scientific shareholders rolling 100% of their equity • 100% of proceeds to fund growth 1. Assumes no redemptions from SPAC Trust

SPEAKING TODAY Michael Levitt Co - Founder, Co - Chairman and CEO Michael Trzupek Chief Financial Officer 30+ years in the finance industry, 20+ years investing in TMT, 20+ years managing high growth finance businesses Served as CEO of Kayne Anderson Capital; Vice Chairman and Partner at Apollo Global Management; Founder, Chairman and CEO of Stone Tower Capital; Co - Head of Investment Banking at Smith Barney; and Managing Director at Morgan Stanley 25+ years in finance and engineering Served as CFO for Premera Blue Cross; Divisional CFO for Hardware Operations at Microsoft; and Senior Controller at Intel Alan Curtis Ch i ef Tech n o l o g y Officer S t e v e Gi t li n VP, Investor Relations M i chael Bros VP, Corporate Development Jim Nygaard Ch i ef F i n a nc i al Officer, XPDI Adam Sullivan Managing Director, XMS Capital Partners, LLC ® 5 PROPRIETARY & CONFIDENTIAL

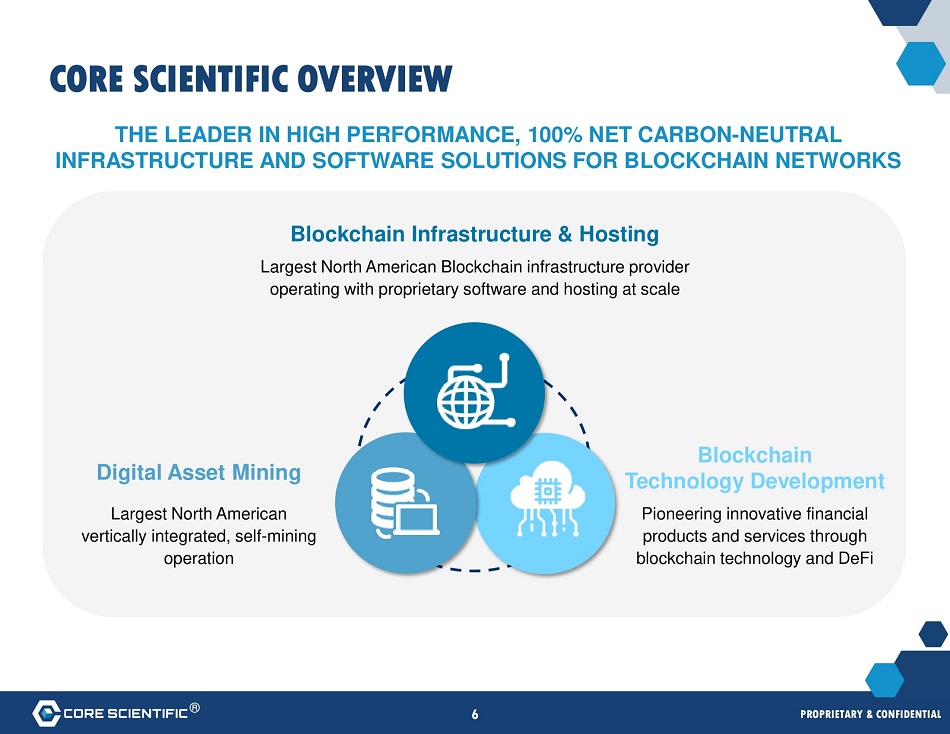

| CORE | SCIENTIFIC OVERVIEW Digital Asset Mining Largest N orth A m erican vertically integrated, self - mining operation Blockchain Technology Development Pioneering innovative financial products and services through blockchain technology and DeFi ® 6 PROPRIETARY & CONFIDENTIAL THE LEADER IN HIGH PERFORMANCE, 100% NET CARBON - NEUTRAL INFRASTRUCTURE AND SOFTWARE SOLUTIONS FOR BLOCKCHAIN NETWORKS Blockchain Infrastructure & Hosting Largest North American Blockchain infrastructure provider operating with proprietary software and hosting at scale |

CORE SCIENTIFIC INVESTMENT THESIS Demonstrated track record of success Experienced management team Strong financial performance with compelling long - term growth opportunities Market leader uniquely positioned to address large, rapidly growing digital assets economy Diversified revenue model and differentiated solutions ® 7 PROPRIETARY & CONFIDENTIAL

MARKET LEADER uniquely positioned to address large, rapidly growing digital assets economy ® 8 PROPRIETARY & CONFIDENTIAL

~$1.4T Total Cryptocurrency Market Cap (Jul. ’21) 1 ~$500B Decentralized Finance (DeFi) Market Size Opportunity 2 LARGE, GROWING MARKET OPPORTUNITY Bitcoin and Dig i tal Asse t s Blockchain Adjacencies 1. Coin Gecko as of 7/12/21 2. Chainlink ® 9 PROPRIETARY & CONFIDENTIAL

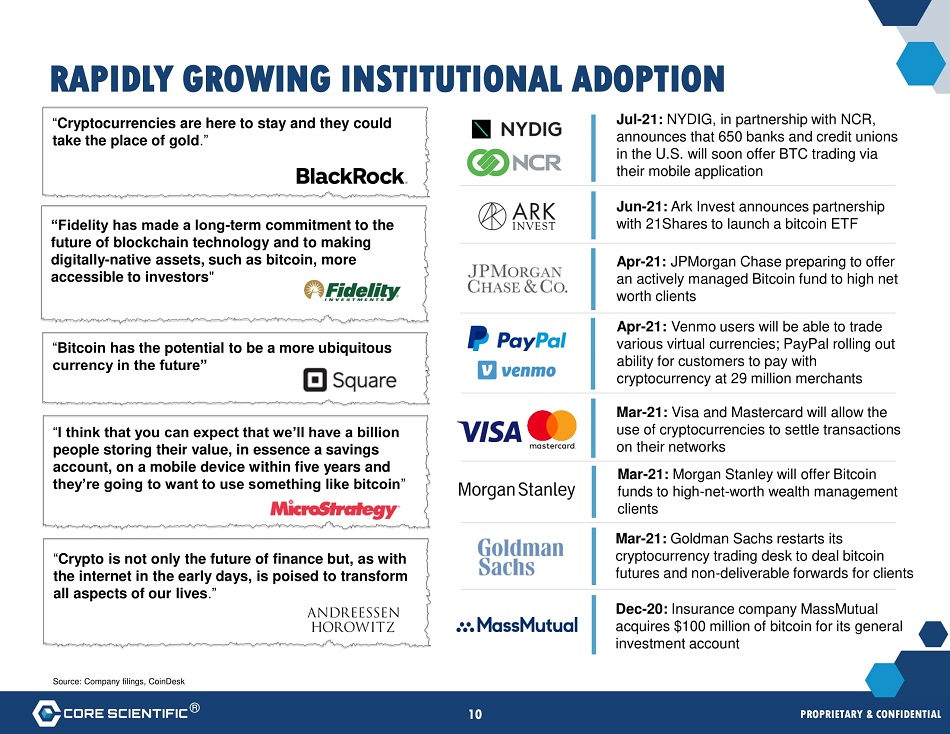

RAPIDLY GROWING INSTITUTIONAL ADOPTION Mar - 21: Morgan Stanley will offer Bitcoin funds to high - net - worth wealth management clients Mar - 21: Goldman Sachs restarts its cryptocurrency trading desk to deal bitcoin futures and non - deliverable forwards for clients Apr - 21: Venmo users will be able to trade various virtual currencies; PayPal rolling out ability for customers to pay with cryptocurrency at 29 million merchants “ Cryptocurrencies are here to stay and they could take the place of gold .” Dec - 20: Insurance company MassMutual acquires $100 million of bitcoin for its general investment account Source: Company filings, CoinDesk Mar - 21: Visa and Mastercard will allow the use of cryptocurrencies to settle transactions on their networks “ I think that you can expect that we’ll have a billion people storing their value, in essence a savings account, on a mobile device within five years and they’re going to want to use something like bitcoin ” “ Bitcoin has the potential to be a more ubiquitous currency in the future” “Fidelity has made a long - term commitment to the future of blockchain technology and to making digitally - native assets, such as bitcoin, more accessible to investors " Apr - 21 : JPMorgan Chase preparing to offer an actively managed Bitcoin fund to high net worth clients “ Crypto is not only the future of finance but, as with the internet in the early days, is poised to transform all aspects of our lives . ” Jun - 21: Ark Invest announces partnership with 21Shares to launch a bitcoin ETF Jul - 21: NYDIG, in partnership with NCR, announces that 650 banks and credit unions in the U.S. will soon offer BTC trading via their mobile application ® 10 PROPRIETARY & CONFIDENTIAL

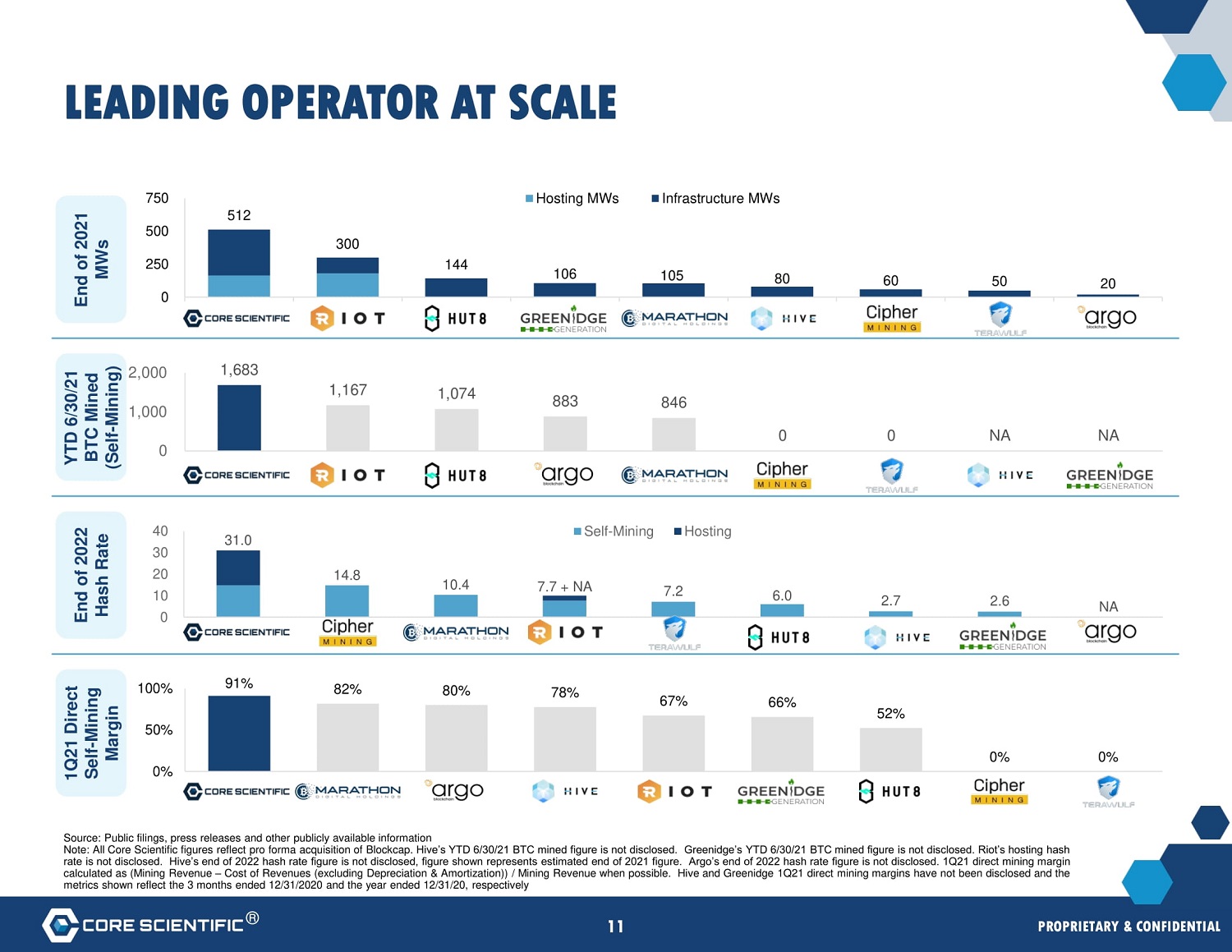

14 .8 10 .4 7.2 6 .0 2 .7 2 .6 NA 31 .0 7.7 + NA 40 30 20 10 0 Self - Mining Hosting 1,683 1,167 1,074 883 846 0 0 NA NA 0 1 , 0 0 0 2 , 00 0 Source : Public filings, press releases and other publicly available information Note : All Core Scientific figures reflect pro forma acquisition of Blockcap . Hive’s YTD 6 / 30 / 21 BTC mined figure is not disclosed . Greenidge’s YTD 6 / 30 / 21 BTC mined figure is not disclosed . Riot’s hosting hash rate is not disclosed . Hive’s end of 2022 hash rate figure is not disclosed, figure shown represents estimated end of 2021 figure . Argo’s end of 2022 hash rate figure is not disclosed . 1 Q 21 direct mining margin calculated as (Mining Revenue – Cost of Revenues (excluding Depreciation & Amortization)) / Mining Revenue when possible . Hive and Greenidge 1 Q 21 direct mining margins have not been disclosed and the metrics shown reflect the 3 months ended 12 / 31 / 2020 and the year ended 12 / 31 / 20 , respectively LEADING OPERATOR AT SCALE 300 144 106 105 80 60 50 20 0 2 5 0 512 500 7 5 0 Hosting MWs Infrastructure MWs End of 2021 MWs YTD 6/30/21 BTC Mined ( S el f - Mi n i n g ) End of 2022 Hash Rate 91% 82% 80% 78% 67% 66% 52% 0% 0% 0% 5 0 % 1 0 0% 1Q21 D irect Self - Mining Margin ® 11 PROPRIETARY & CONFIDENTIAL

DEMONSTRATED TRACK RECORD of success ® 12 PROPRIETARY & CONFIDENTIAL

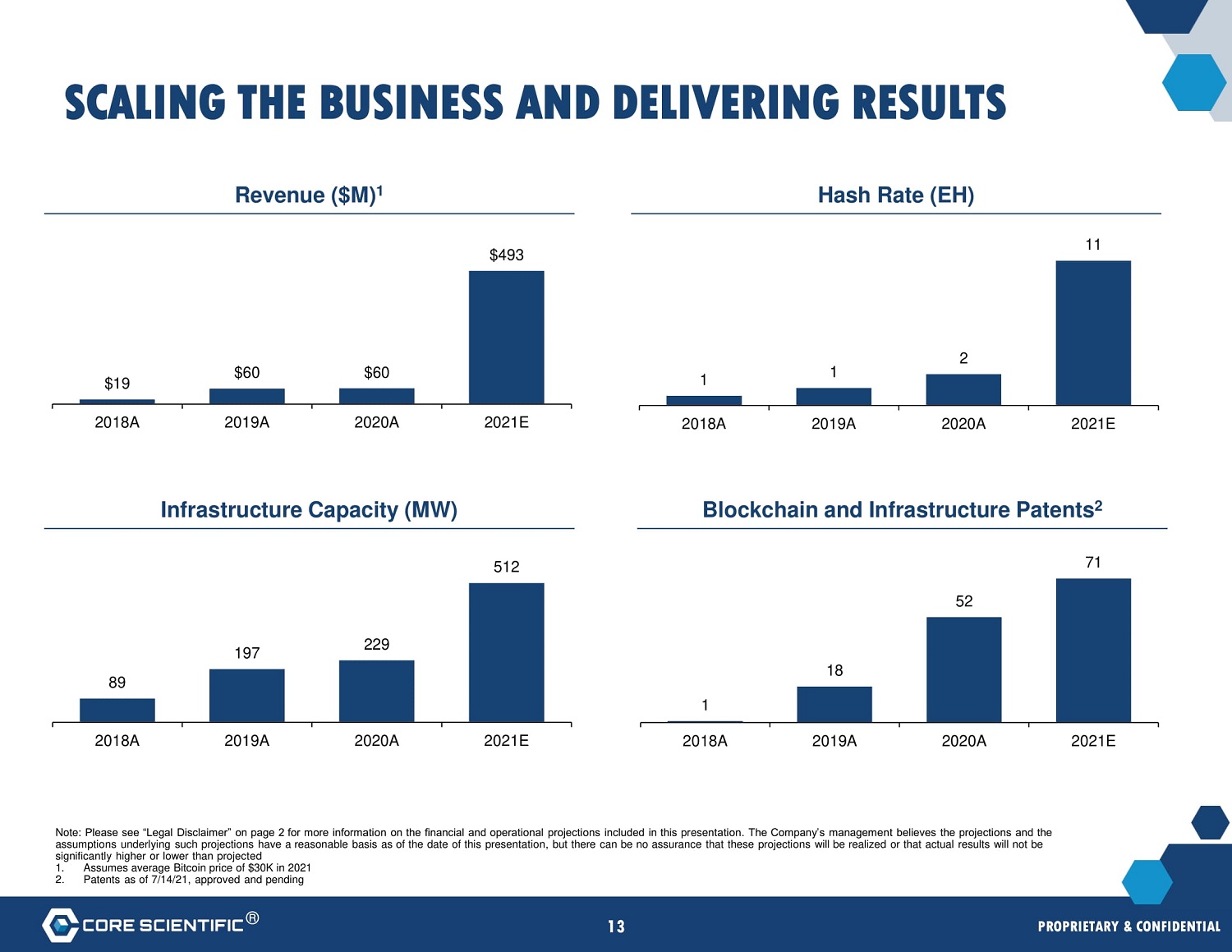

Note: Please see “Legal Disclaimer” on page 2 for more information on the financial and operational projections included in this presentation. The Company’s management believes the projections and the assumptions underlying such projections have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected 1. Assumes average Bitcoin price of $30K in 2021 2. Patents as of 7/14/21, approved and pending SCALING THE BUSINESS AND DELIVERING RESULTS Revenue ($M) 1 Infrastructure Capacity (MW) Hash Rate (EH) Blockchain and Infrastructure Patents 2 $19 $60 $60 $493 2 0 18 A 2 0 19 A 2 0 20 A 2 0 21 E 1 1 2 11 2 0 1 8 A 2 0 1 9 A 2 0 2 0 A 2 0 2 1 E 89 197 229 512 2 0 1 8 A 2 0 1 9 A 2 0 2 0 A 2 0 2 1 E 1 ® 13 PROPRIETARY & CONFIDENTIAL 18 52 71 2 0 18

Diversified revenue model and DIFFERENTIATED SOLUTIONS ® 14 PROPRIETARY & CONFIDENTIAL

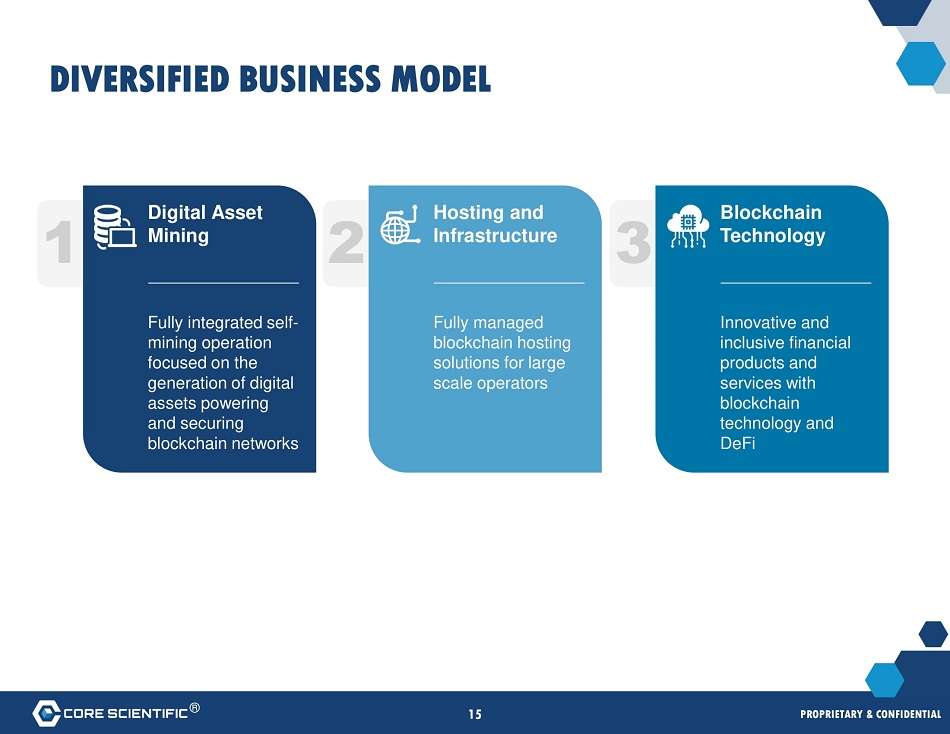

DIVERSIFIED BUSINESS MODEL Digital Asset Mining Fully integrated self - mining operation focused on the generation of digital assets powering and securing blockchain networks 1 Hosting and In f rastruct u re Fully managed blockch a in hosting solutions for large scale operators 2 Blockchain Technology Innovative and inclusive financial products and services with blockchain technology and DeFi 3 ® 15 PROPRIETARY & CONFIDENTIAL

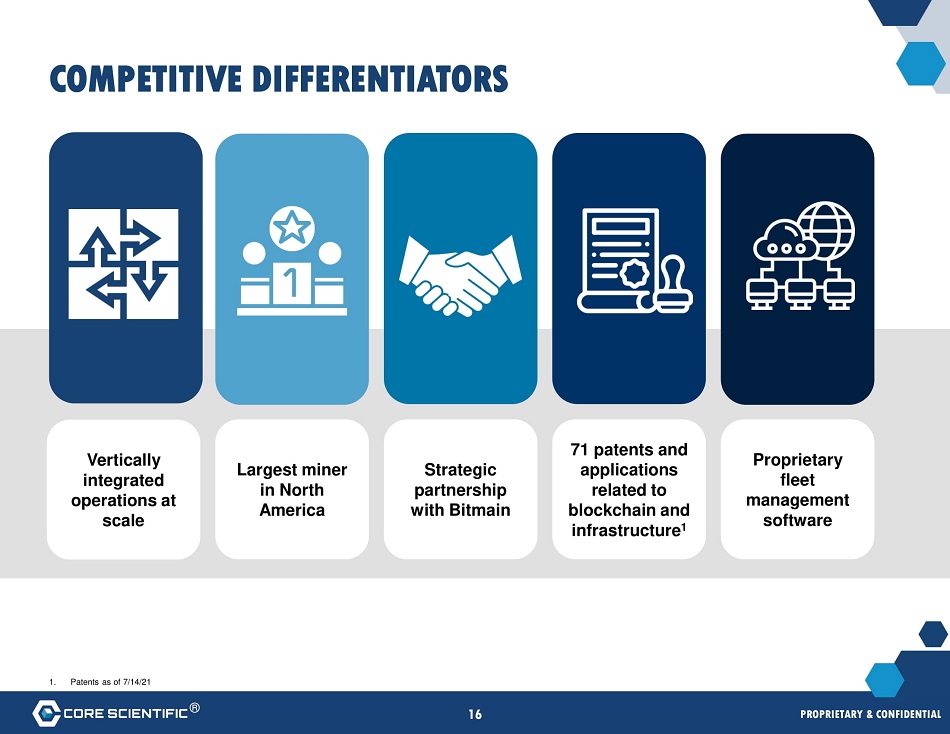

1. Patents as of 7/14/21 COMPETITIVE DIFFERENTIATORS Vertically integrated op erati on s at scale L ar g est mi n er in North America Strategic partnership w i t h B itm a in 71 patents and applications related to b l o ckcha i n a n d infrastructure 1 Proprietary fleet ma n a g eme n t software ® 16 PROPRIETARY & CONFIDENTIAL

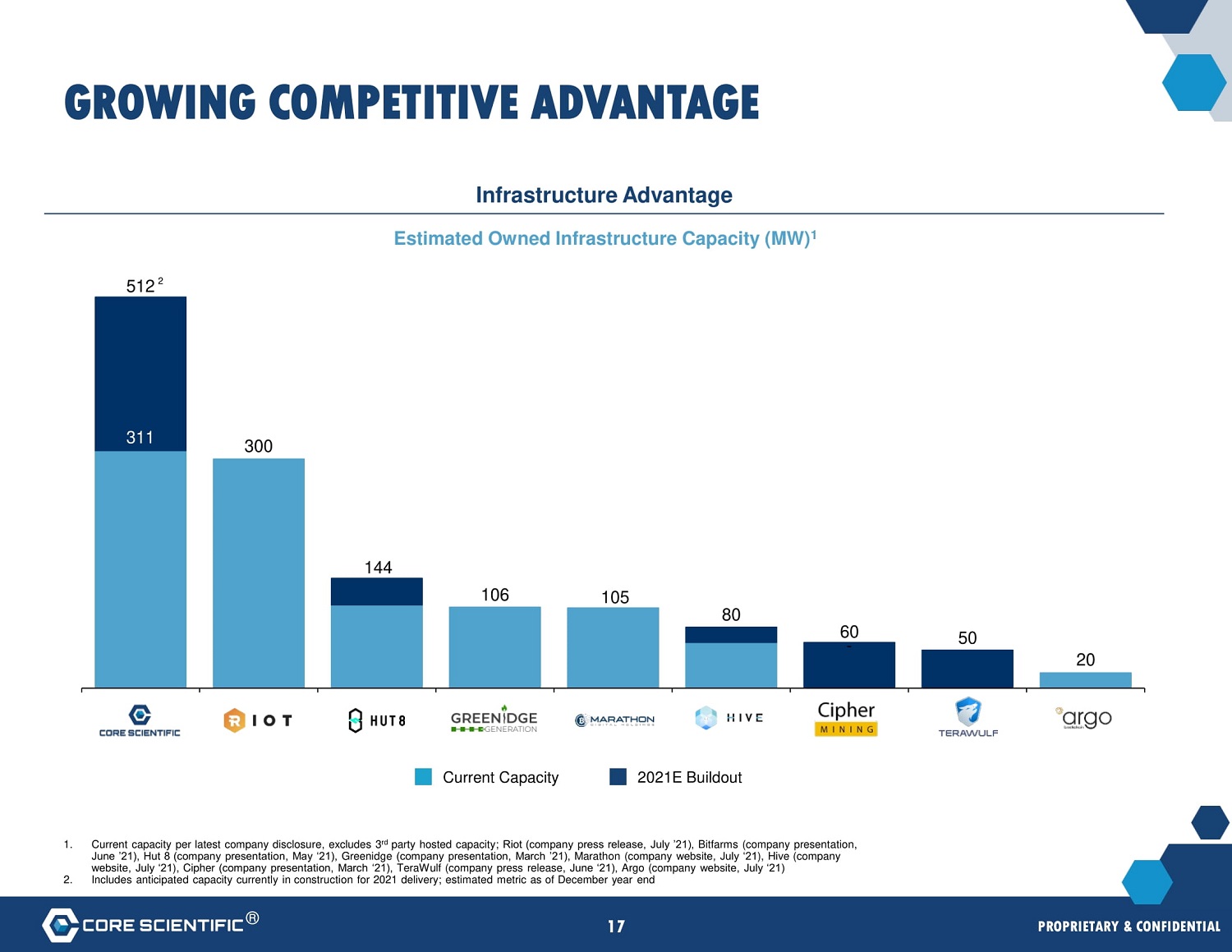

311 106 105 - 20 300 144 80 60 50 51 2 2 1. Current capacity per latest company disclosure, excludes 3 rd party hosted capacity; Riot (company press release, July ’21), Bitfarms (company presentation, June ’21), Hut 8 (company presentation, May ‘21), Greenidge (company presentation, March ’21), Marathon (company website, July ‘21), Hive (company website, July ‘21), Cipher (company presentation, March ‘21), TeraWulf (company press release, June ‘21), Argo (company website, July ‘21) 2. Includes anticipated capacity currently in construction for 2021 delivery; estimated metric as of December year end GROWING COMPETITIVE ADVANTAGE I n frastr u c t u re A d v a n ta g e Estimated Owned Infrastructure Capacity (MW) 1 2 0 2 1 E B u i l d o ut Current Capacity ® 17 PROPRIETARY & CONFIDENTIAL

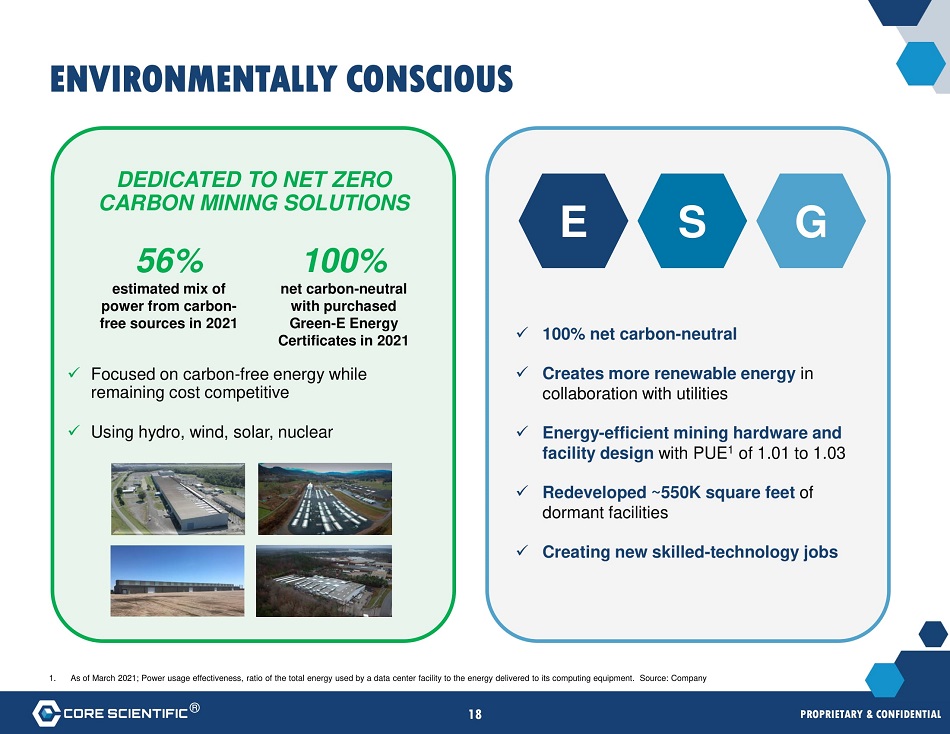

1. As of March 2021; Power usage effectiveness, ratio of the total energy used by a data center facility to the energy delivered to its computing equipment. Source: Company ENVIRONMENTALLY CONSCIOUS x Creates more renewable energy in collaboration with utilities x Energy - efficient mining hardware and facility design with PUE 1 of 1.01 to 1.03 x Redeveloped ~550K square feet of dormant facilities x Creating new skilled - technology jobs x Focused on carbon - free energy while remaining cost competitive x Using hydro, wind, solar, nuclear 100% net carbon - neutral with purchased Green - E Energy Certificates in 2021 56% estimated mix of power from carbon - free sources in 2021 DEDICATED TO NET ZERO CARBON MINING SOLUTIONS E S x 100% net carbon - neutral G ® 18 PROPRIETARY & CONFIDENTIAL

STRONG FINANCIAL PERFORMANCE with compelling long - term growth opportunities ® 19 PROPRIETARY & CONFIDENTIAL

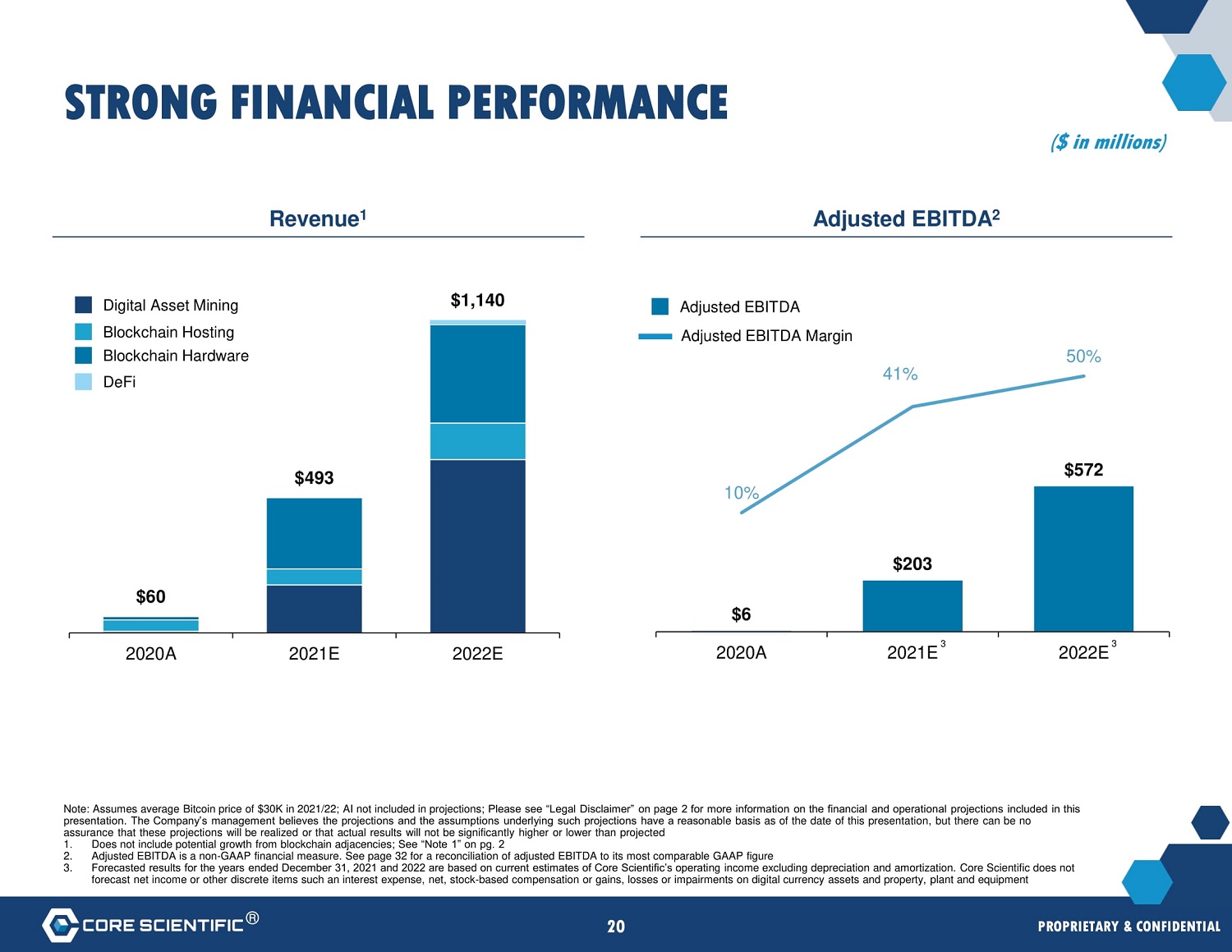

$6 $203 $572 10% 41% 50% 2 0 20A 3 2021E 3 2022E $60 $493 $1 , 1 40 2 0 20 A 2 0 21 E 2 0 22 E Note: Assumes average Bitcoin price of $30K in 2021/22; AI not included in projections; Please see “Legal Disclaimer” on page 2 for more information on the financial and operational projections included in this presentation. The Company’s management believes the projections and the assumptions underlying such projections have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected 1. Does not include potential growth from blockchain adjacencies; See “Note 1” on pg. 2 2. Adjusted EBITDA is a non - GAAP financial measure. See page 32 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure 3. Forecasted results for the years ended December 31, 2021 and 2022 are based on current estimates of Core Scientific’s operating income excluding depreciation and amortization. Core Scientific does not forecast net income or other discrete items such an interest expense, net, stock - based compensation or gains, losses or impairments on digital currency assets and property, plant and equipment STRONG FINANCIAL PERFORMANCE ($ in millions) Revenue 1 Digital Asset Mining Blockchain Hosting Bl oc k c h ai n Hard w are DeFi Adjusted EBITDA 2 Adjusted EBITDA Adjusted EBITDA Margin ® 20 PROPRIETARY & CONFIDENTIAL

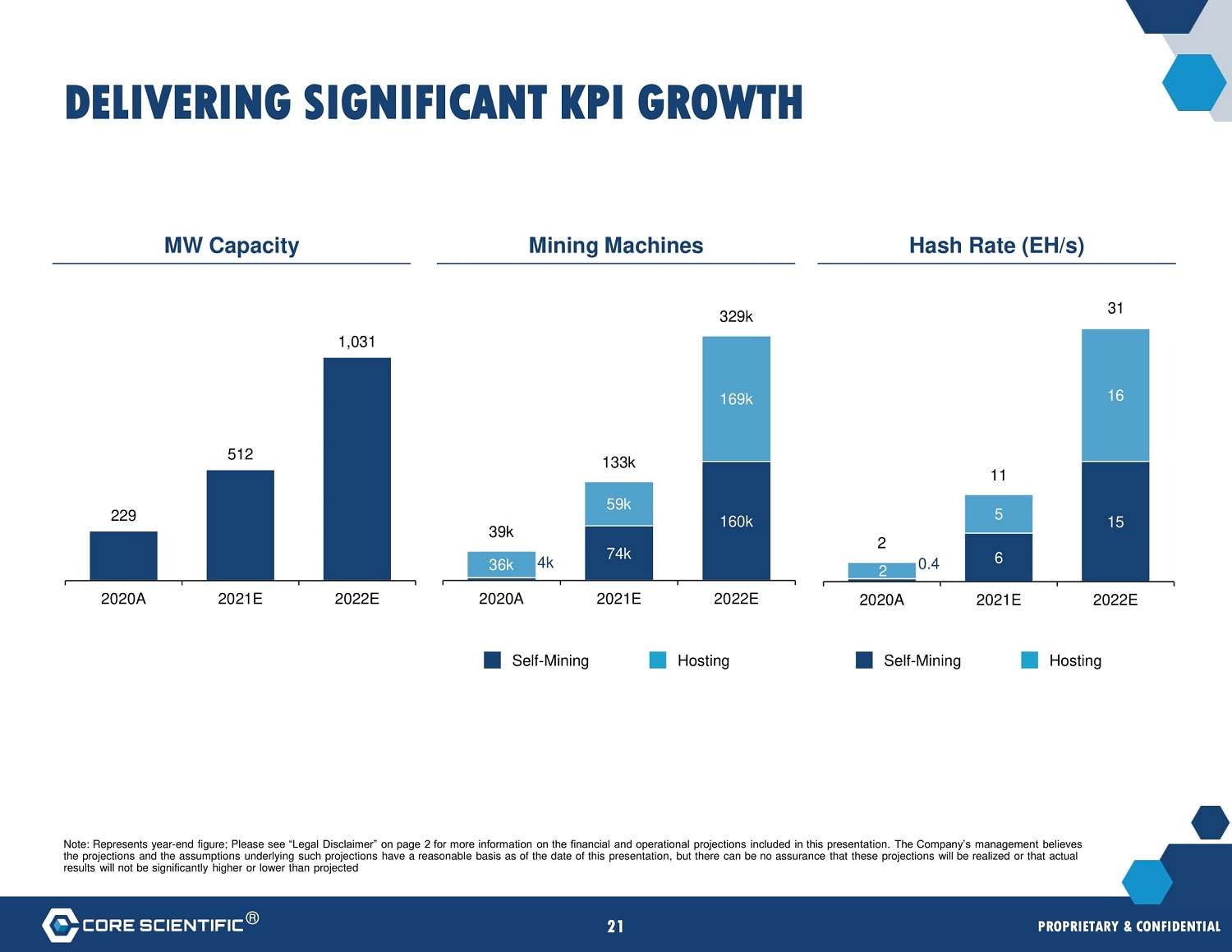

DELIVERING SIGNIFICANT KPI GROWTH Note: Represents year - end figure; Please see “Legal Disclaimer” on page 2 for more information on the financial and operational projections included in this presentation. The Company’s management believes the projections and the assumptions underlying such projections have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected MW Capacity M i nin g M ac hin es Hash Rate (EH/s) Se l f - M i n i ng Host i ng S e l f - M i n i ng Host i ng 4 k 7 4 k 1 6 0k 3 6 k 5 9 k 1 6 9k 3 9 k 1 3 3k 3 2 9k 2 0 2 0 A 2 0 2 1 E 2 0 22E 229 ® 21 PROPRIETARY & CONFIDENTIAL 512 1,031 2 0 2 0 A 2 0 2 1 E 2 0 2 2 E

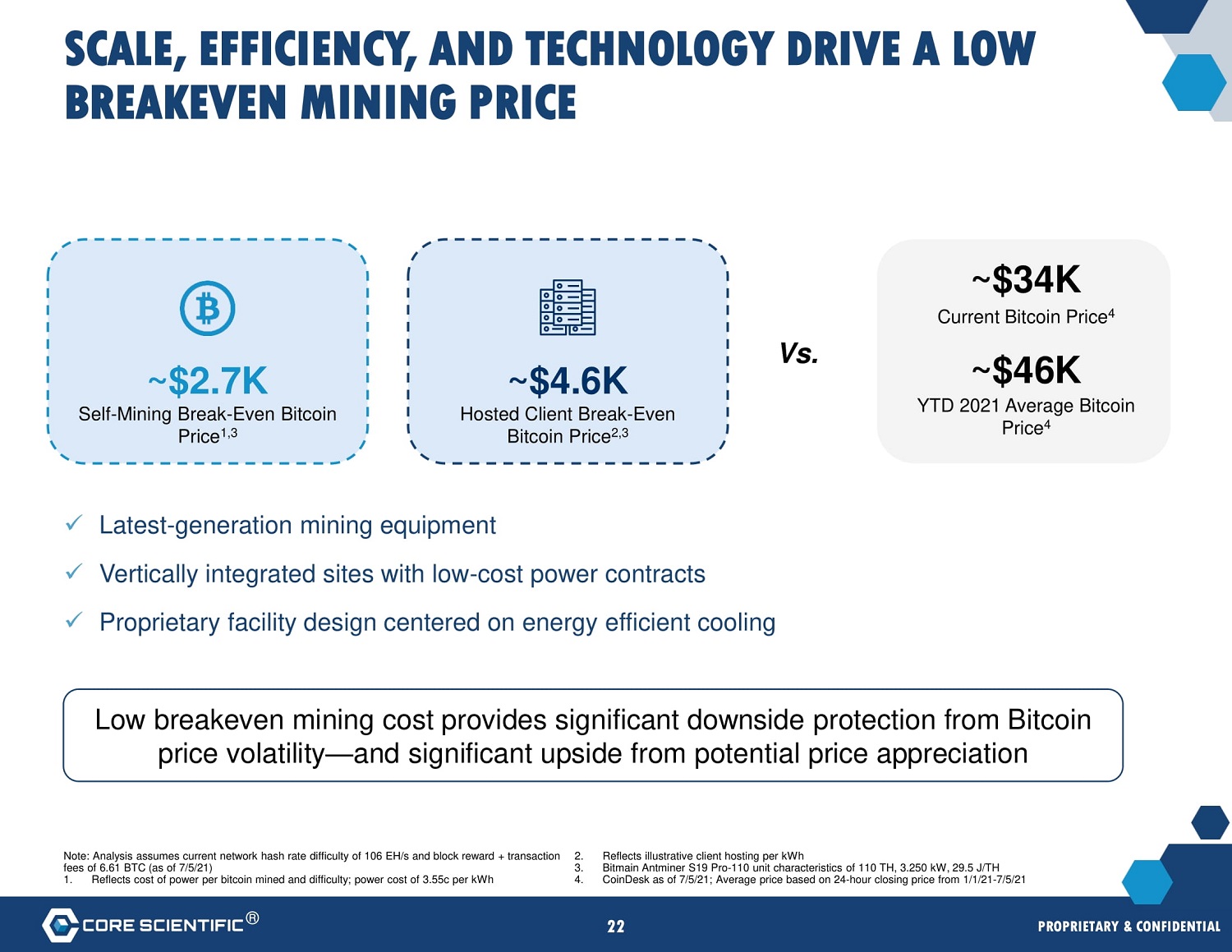

fees of 6.61 BTC (as of 7/5/21) 1. Reflects cost of power per bitcoin mined and difficulty; power cost of 3.55c per kWh Note: Analysis assumes current network hash rate difficulty of 106 EH/s and block reward + transaction 2. Reflects illustrative client hosting per kWh 3. Bitmain Antminer S19 Pro - 110 unit characteristics of 110 TH, 3.250 kW, 29.5 J/TH 4. CoinDesk as of 7/5/21; Average price based on 24 - hour closing price from 1/1/21 - 7/5/21 SCALE, EFFICIENCY, AND TECHNOLOGY DRIVE A LOW BREAKEVEN MINING PRICE ~$4.6K Hosted Client Break - Even Bitcoin Price 2,3 ~$2.7K Self - Mining Break - Even Bitcoin Price 1,3 V s . ~$34K CCuurrrreennttBBititccooininPPrricicee 44 ~~$$4466KK YYTTDD22002211AAvveerraaggeeBBititccooinin PPrricicee 44 x Latest - generation mining equipment x Vertically integrated sites with low - cost power contracts x Proprietary facility design centered on energy efficient cooling Low breakeven mining cost provides significant downside protection from Bitcoin price volatility — and significant upside from potential price appreciation ® 22 PROPRIETARY & CONFIDENTIAL

EXPERIENCED management team ® 23 PROPRIETARY & CONFIDENTIAL

TODD DUCHENE General Counsel EXPERIENCED MANAGEMENT TEAM – EXECUTIVE LEADERSHIP SHARON ORLOPP Chief Human Resources Officer MICHAEL LEVITT Co - Founder, Co - Chairman and CEO MICHAEL TRZUPEK Chief Financial Officer ALAN CURTIS Chief Technology Officer BRETT HARRISON Chief Development Officer WES T ON A D A M S Chie f Co nstructio n Officer KYLE BUCKETT Chief of Staff DARIN FEINSTEIN C o - Fo und e r and Co - Chairman ® 24 PROPRIETARY & CONFIDENTIAL

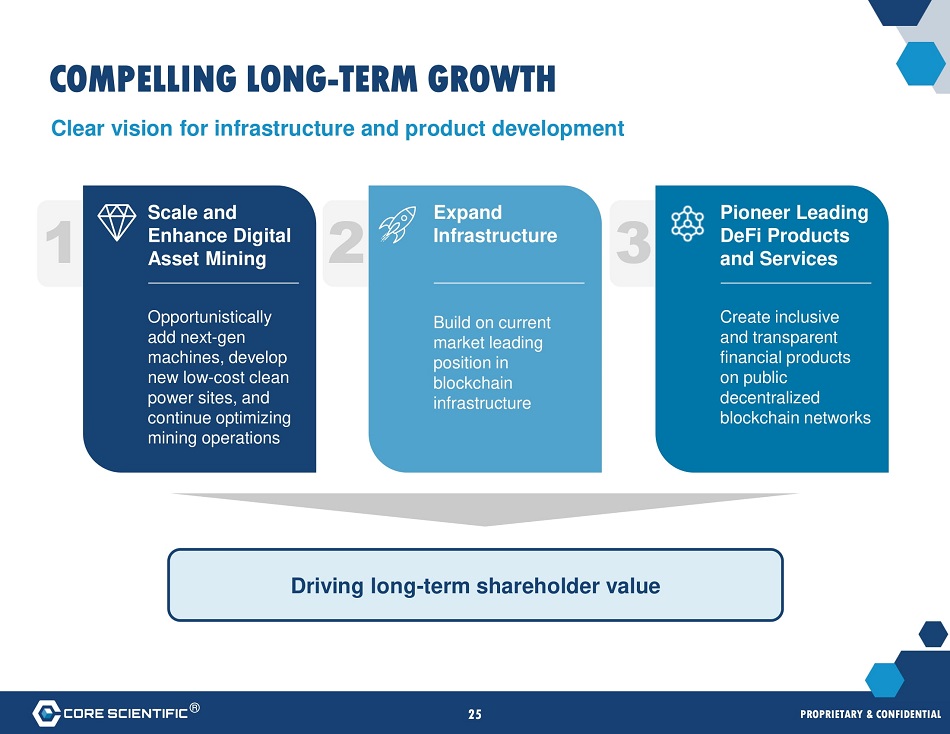

COMPELLING LONG - TERM GROWTH Clear vision for infrastructure and product development Scale and Enhance Digital Asset Mining Opportunistically add next - gen machines, develop new low - cost clean power sites, and continue opti m izing mining operations Expand In f rastruct u re Build on current market leading position in blockchain infrastructure Pioneer Leading DeFi Products and Services Create inclusive and transparent financial products on public decentralized blockchain networks 1 2 3 Driving long - term shareholder value ® 25 PROPRIETARY & CONFIDENTIAL

Transaction Details ® 26 PROPRIETARY & CONFIDENTIAL

($mm) (mm) Core Scientific Shareholders 4 4,000 400.0 Convertible Notes (Net Share Settlement) 5 54 5.4 XPDI Public Shareholders XPDI Sponsor Shares 6 345 86 34.5 8.6 Pro Forma Equity Value 4,485 448.5 100.0% Plus: Pro Forma Debt Balance 5 273 Less: Pro Forma Cash Balance 1, 2 (369) Less: Pro Forma Digital Assets Balance 7 (48) Pro Forma Enterprise Value 4,341 Value Shares % of Total TRANSACTION DETAIL Headline Valuation $4.3bn Pro Forma Enterprise Value $4.5bn Pro Forma Equity Value $4.0bn Value to Existing Shareholders 89% Existing Shareholder Ownership Financing Details $345mm SPAC Size $369mm 1, 2 Pro Forma Cash 1. Assumes preliminary unaudited cash balance pro forma for acquisition of Blockcap of ~$59mm as of 6/30/21 2. Assumes no redemptions from SPAC Trust 3. Based on $10 share price; excludes ~8.6mm public warrants and ~6.3mm private placement warrants, both with exercise prices of $11.50 4. Shares attributable to Core Scientific Shareholders include net warrants of ~1.5mm with weighted average exercise price of $0.80 and net options of ~4.4mm with weighted average exercise price of $6.02 assuming treasury stock method accounting 5. Pro forma debt balance assumes par value of $215mm of convertible notes and preliminary unaudited other debt of ~$58mm as of 6/30/21 pro forma for acquisition of Blockcap. Equity component of convertible notes displayed on a net share settlement basis assuming a conversion price of $8 per share. If the convertible notes are considered on an if converted basis, the equity component of convertible notes would increase to ~$269mm, and the pro forma debt balance would only reflect preliminary unaudited other debt of ~$58mm 6. Includes ~1.7mm shares (20%) subject to earnout based on future trading price of $12.50 7. Preliminary unaudited pro forma digital assets assume coins held as of 6/30/21 pro forma for acquisition of Blockcap using market prices as of 7:59pm ET Key Transaction Highlights Sources & Uses Pro Forma Ownership 2, 3 Sources Uses $310mm 2 Cash to Balance Sheet $mm % o ® 27 PROPRIETARY & CONFIDENTIAL Core Scientific Rollover Equity at $10.00 Cash from SPAC Trust 2 Total S Equity Consideration to Core Scientific 4,000 92.1% Cash to Balance Sheet 310 7.1% Estimated Transaction Expenses 35 0.8% Total Uses 4,345 100.0% $mm % of Total

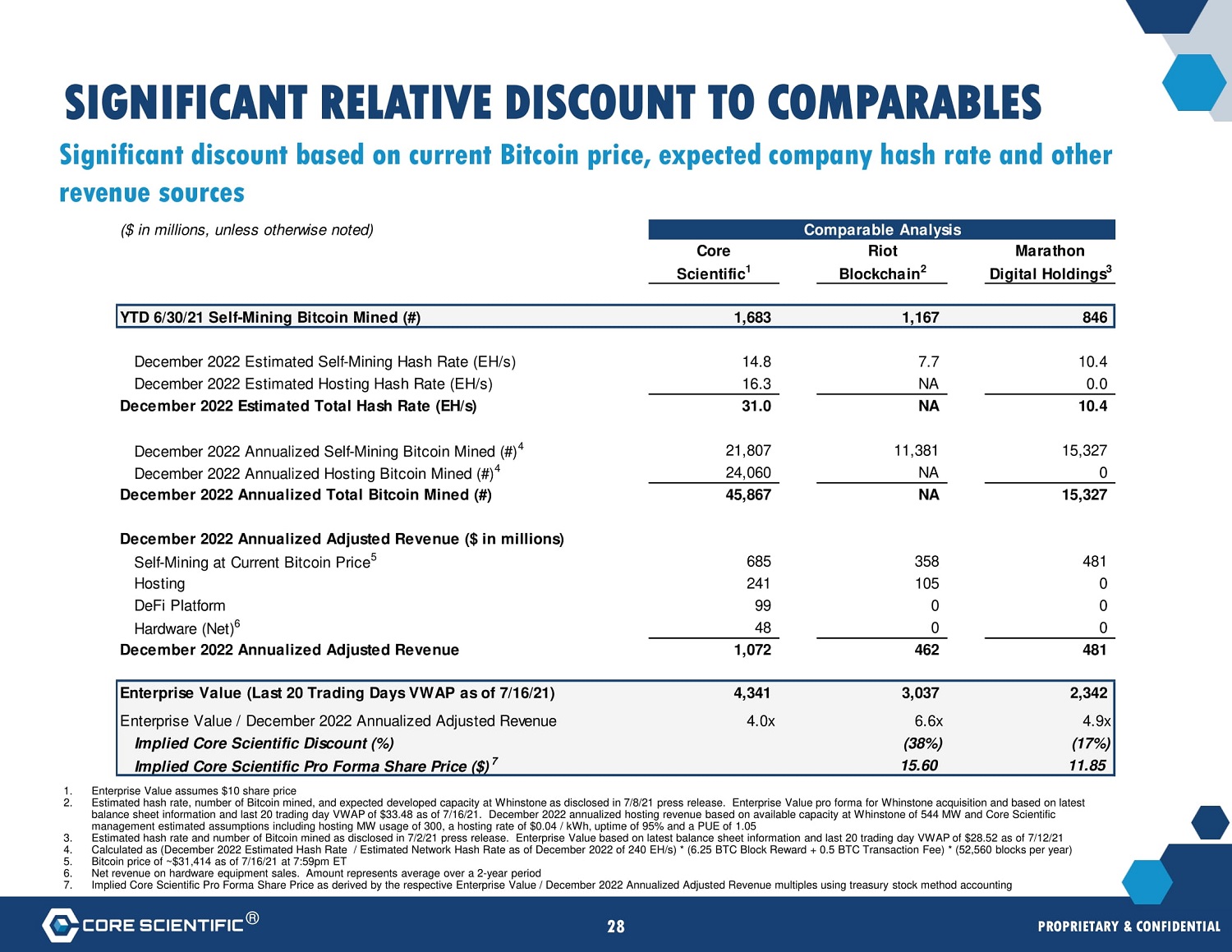

($ in millions, unless otherwise noted) Comparable Analysis Core Riot Marathon Scientific 1 Blockchain 2 Digital Holdings 3 YTD 6/30/21 Self - Mining Bitcoin Mined (#) 1,683 1,167 846 December 2022 Estimated Self - Mining Hash Rate (EH/s) 14.8 7.7 10.4 December 2022 Estimated Hosting Hash Rate (EH/s) 16.3 NA 0.0 December 2022 Estimated Total Hash Rate (EH/s) 31.0 NA 10.4 December 2022 Annualized Self - Mining Bitcoin Mined (#) 4 21,807 11,381 15,327 December 2022 Annualized Hosting Bitcoin Mined (#) 4 24,060 NA 0 December 2022 Annualized Total Bitcoin Mined (#) 45,867 NA 15,327 December 2022 Annualized Adjusted Revenue ($ in millions) Self - Mining at Current Bitcoin Price 5 685 358 481 Hosting 241 105 0 DeFi Platform 99 0 0 Hardware (Net) 6 48 0 0 December 2022 Annualized Adjusted Revenue 1,072 462 481 Enterprise Value (Last 20 Trading Days VWAP as of 7/16/21) 4,341 3,037 2,342 Enterprise Value / December 2022 Annualized Adjusted Revenue 4.0x 6.6x 4.9x Implied Core Scientific Discount (%) (38%) (17%) I m p l i e d C ore S c i e n t i f i c P r o Fo r m a S h a r e P r i c e ( $ ) 7 15.60 11.85 SIGNIFICANT RELATIVE DISCOUNT TO COMPARABLES ® 28 PROPRIETARY & CONFIDENTIAL Significant discount based on current Bitcoin price, expected company hash rate and other revenue sources 1. Enterprise Value assumes $10 share price 2. Estimated hash rate, number of Bitcoin mined, and expected developed capacity at Whinstone as disclosed in 7/8/21 press release. Enterprise Value pro forma for Whinstone acquisition and based on latest balance sheet information and last 20 trading day VWAP of $33.48 as of 7/16/21. December 2022 annualized hosting revenue based on available capacity at Whinstone of 544 MW and Core Scientific management estimated assumptions including hosting MW usage of 300, a hosting rate of $0.04 / kWh, uptime of 95% and a PUE of 1.05 3. Estimated hash rate and number of Bitcoin mined as disclosed in 7/2/21 press release. Enterprise Value based on latest balance sheet information and last 20 trading day VWAP of $28.52 as of 7/12/21 4. Calculated as (December 2022 Estimated Hash Rate / Estimated Network Hash Rate as of December 2022 of 240 EH/s) * (6.25 BTC Block Reward + 0.5 BTC Transaction Fee) * (52,560 blocks per year) 5. Bitcoin price of ~$31,414 as of 7/16/21 at 7:59pm ET 6. Net revenue on hardware equipment sales. Amount represents average over a 2 - year period 7. Implied Core Scientific Pro Forma Share Price as derived by the respective Enterprise Value / December 2022 Annualized Adjusted Revenue multiples using treasury stock method accounting

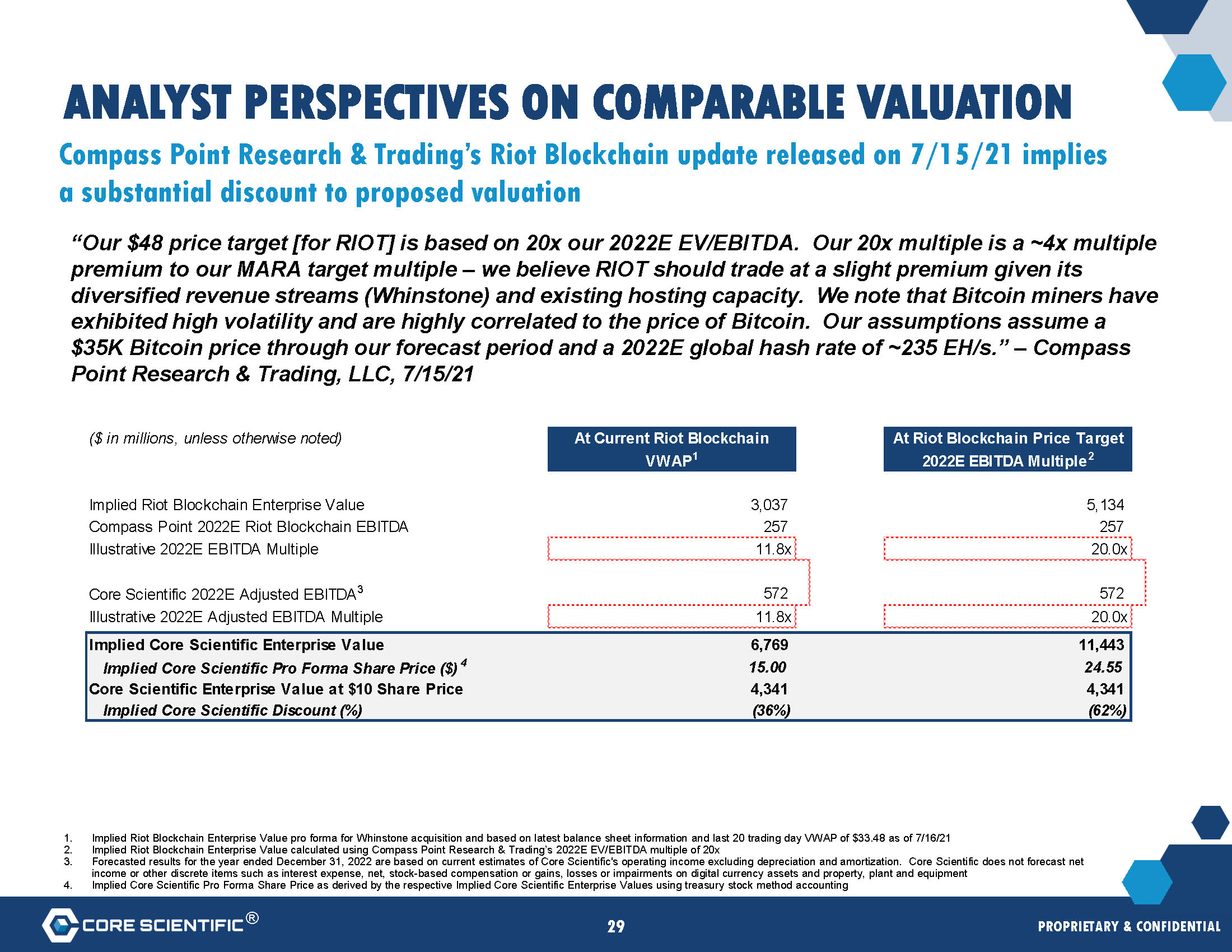

($ in millions, unless otherwise noted) At Current Riot Blockchain VWAP 1 At Riot Blockchain Price Target 2022E EBITDA Multiple 2 Implied Riot Blockchain Enterprise Value 3,037 5,134 Compass Point 2022E Riot Blockchain EBITDA 257 257 Illustrative 2022E EBITDA Multiple 11.8x 20.0x Core Scientific 2022E Adjusted EBITDA 3 572 572 Illustrative 2022E Adjusted EBITDA Multiple 11.8x 20.0x Implied Core Scientific Enterprise Value 6,769 11,443 I m p li e d C o r e S c i e n t i f i c P r o Fo r m a S h a r e P r i c e ( $ ) 4 15.00 24.55 Core Scientific Enterprise Value at $10 Share Price 4,341 4,341 Implied Core Scientific Discount (%) (36%) (62%) ANALYST PERSPECTIVES ON COMPARABLE VALUATION ® 29 PROPRIETARY & CONFIDENTIAL Compass Point Research & Trading’s Riot Blockchain update released on 7/15/21 implies a substantial discount to proposed valuation “Our $48 price target [for RIOT] is based on 20x our 2022E EV/EBITDA. Our 20x multiple is a ~4x multiple premium to our MARA target multiple – we believe RIOT should trade at a slight premium given its diversified revenue streams (Whinstone) and existing hosting capacity. We note that Bitcoin miners have exhibited high volatility and are highly correlated to the price of Bitcoin. Our assumptions assume a $35K Bitcoin price through our forecast period and a 2022E global hash rate of ~235 EH/s.” – Compass Point Research & Trading, LLC, 7/15/21 1. Implied Riot Blockchain Enterprise Value pro forma for Whinstone acquisition and based on latest balance sheet information and last 20 trading day VWAP of $33.48 as of 7/16/21 2. Implied Riot Blockchain Enterprise Value calculated using Compass Point Research & Trading’s 2022E EV/EBITDA multiple of 20x 3. Forecasted results for the year ended December 31, 2022 are based on current estimates of Core Scientific's operating income excluding depreciation and amortization. Core Scientific does not forecast net income or other discrete items such as interest expense, net, stock - based compensation or gains, losses or impairments on digital currency assets and property, plant and equipment 4. Implied Core Scientific Pro Forma Share Price as derived by the respective Implied Core Scientific Enterprise Values using treasury stock method accounting

CORE SCIENTIFIC INVESTMENT THESIS Demonstrated track record of success Experienced management team Strong financial performance with compelling long - term growth opportunities Market leader uniquely positioned to address large, rapidly growing digital assets economy Diversified revenue model and differentiated solutions ® 30 PROPRIETARY & CONFIDENTIAL

APPENDIX ® 31 PROPRIETARY & CONFIDENTIAL

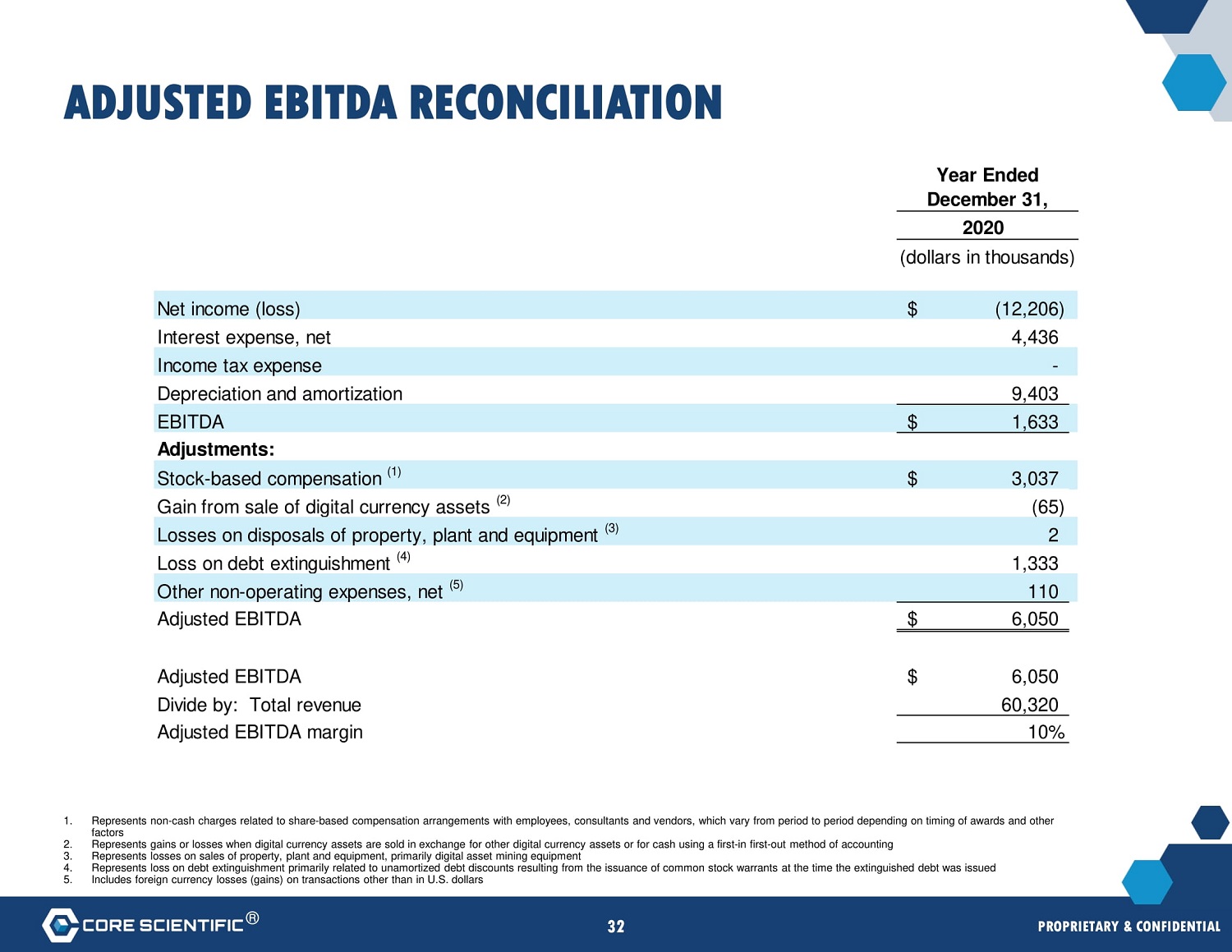

ADJUSTED EBITDA RECONCILIATION ® 32 PROPRIETARY & CONFIDENTIAL 1. Represents non - cash charges related to share - based compensation arrangements with employees, consultants and vendors, which vary from period to period depending on timing of awards and other factors 2. Represents gains or losses when digital currency assets are sold in exchange for other digital currency assets or for cash using a first - in first - out method of accounting 3. Represents losses on sales of property, plant and equipment, primarily digital asset mining equipment 4. Represents loss on debt extinguishment primarily related to unamortized debt discounts resulting from the issuance of common stock warrants at the time the extinguished debt was issued 5. Includes foreign currency losses (gains) on transactions other than in U.S. dollars Net income (loss) $ (12,206) Interest expense, net 4,436 Income tax expense - Depreciation and amortization 9,403 EBITDA $ 1,633 Adjustments: Stock - based compensation (1) $ 3,037 Gain from sale of digital currency assets (2) (65) Losses on disposals of property, plant and equipment (3) 2 Loss on debt extinguishment (4) 1,333 Other non - operating expenses, net (5) 110 Adjusted EBITDA $ 6,050 Adjusted EBITDA $ 6,050 Divide by: Total revenue 60,320 Adjusted EBITDA margin 10% Year Ended December 31, 2020 (dollars in thousands)

RISK FACTORS ® 33 PROPRIETARY & CONFIDENTIAL

RISK FACTORS (1/6) The below list of key risks has been prepared solely for the purposes of potential investors evaluating the the proposed Business Combination, and not for any other purpose. Unless the context otherwise requires, all reference in this subsection to the "Company," "Core Scientific," "we," "us" or "our" refer to the business of Core Scientific and its subsidiaries (including Blockcap, the acquisition of which is expected to be completed on July 22, 2021) prior to the consummation of the Business Combination. The risks presented below are some of the general risks to the business sand operations of Core Scientific following completion of the Business Combination. You should carefully consider these risks and uncertainties and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this Company or XPDI before making an investment decision. Risks relating to the business of Core Scientific will be disclosed in future documents filed or furnished with the U.S. Securities and Exchange Commission (the "SEC"), including documents filed or furnished in connection with the proposed transaction between XPDI and Core Scientific. The risks presented in such filings will be consistent with those that would be required for a public company in SEC filings and may differ significantly from and be more extensive than those presented below. These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of Core Scientific following the completion of the Business Combination. Investors should carefully consider the following risk factors in addition to the information included in the investor presentation. Core Scientific may face additional risks and uncertainties that are not presently known to it, or that it currently deems immaterial, which may also impair Core Scientific's business or financial condition. ® 34 PROPRIETARY & CONFIDENTIAL Risks Related to Core Scientific’s Business and Industry 1. Our business is highly dependent on a small number of digital currency mining equipment suppliers. 2. A slowdown in the demand for blockchain/artificial intelligence (“AI”) technology or blockchain/AI hosting resources and other market and economic conditions could have a material adverse effect on our business, financial condition and results of operations. 3. We have an evolving business model and a limited history of generating revenue from our services. In addition, our evolving business model, and our expansion into new lines of business or derivatives such as DeFi, increases the complexity of our business, which could have a material adverse effect on our business, financial condition and results of operations. 4. Our limited operating history and rapidly evolving industry makes it difficult for us to evaluate our future business prospects and the failure to do so accurately could have a material adverse effect on our business, financial condition and results of operations. 5. Our businesses are capital intensive and failure to obtain the necessary capital when needed may force us to delay, limit or terminate our expansion efforts or other operations, which could have a material adverse effect on our business, financial condition and results of operations.

6. Changes in tariffs, import or export restrictions, Chinese regulations or other trade barriers could have a material adverse effect on our business, financial condition and results of operations. 7. Our historical financial results may not be indicative of our future performance and our inability to obtain adequate funding could have a material adverse effect on our business, financial condition and results of operations. 8. Substantially all of our assets are pledged to our senior secured lender and failure to repay obligations to our senior lender when due will have a material adverse effect on our business and could result in foreclosure on our assets. 9. Our revenue comes from a small number of customers, and the loss of, or significant decrease in business from, any number of these customers or the failure to continually attract new customers could have a material adverse effect on our business, financial condition and results of operations. 10. Delays in the expansion of existing hosting facilities or the construction of new hosting facilities or significant cost overruns could have a material adverse effect on our business, financial condition and results of operations. 11. The coronavirus outbreak has had, and may continue to have, a material adverse impact on our business, liquidity, financial condition and results of operations. 12. We are subject to risks associated with our need for significant electrical power and the limited availability of power resources, which could have a material adverse effect on our business, financial condition and results of operations. 13. Governments and government regulators may potentially restrict the ability of electricity suppliers to provide electricity to hosting and transaction processing operations such as ours, which could have a material adverse effect on our business, financial condition and results of operations. 14. Power outages in our hosting facilities could have a material adverse effect on our business, financial condition and results of operations. 15. Our success depends in large part on our ability to mine for digital assets profitably and to attract customers for our hosting capabilities. Increases in power costs, inability to mine digital assets efficiently and to sell digital assets at favorable prices will reduce our operating margins, impact our ability to attract customers for our services may harm our growth prospects and could have a material adverse effect on our business, financial condition and results of operations. 16. If we do not accurately predict our hosting facility requirements, it could have a material adverse effect on our business, financial condition and results of operations. ® 35 PROPRIETARY & CONFIDENTIAL RISK FACTORS (2/6)

17. We may not be able to compete effectively against our current and future competitors, which could have a material adverse effect on our business, financial condition and results of operations. 18. If the award of digital assets for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending hash rate to solve blocks and confirmations of transactions on the blockchain could be slowed temporarily. A reduction in the hash rate expended by miners on any digital asset network could increase the likelihood of a malicious actor obtaining control in excess of fifty percent (50%) of the aggregate hash rate active on such network or the blockchain, potentially permitting such actor to manipulate the blockchain in a manner that adversely affects our business, financial condition, and results of operations. 19. If we fail to accurately estimate the factors upon which we base our contract pricing, we may generate less profit than expected or incur losses on those contracts, which could have a material adverse effect on our business, financial condition and results of operations. 20. Any failure in the critical systems of our hosting facilities or services we provide could lead to disruptions in our and our customers’ businesses and could harm our reputation and result in financial penalty and legal liabilities, which would reduce our revenue and have a material adverse effect on our business, financial condition and results of operations. 21. We generate significant revenue from a limited number of hosting facilities in Kentucky, Georgia and North Carolina and a significant disruption to operations in these region could have a material adverse effect our business, financial condition and results of operations. 22. Currently, there is relatively small use of digital assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect our business, financial condition, and results of operations. 23. Concerns about greenhouse gas emissions and global climate change may result in environmental taxes, charges, assessments or penalties and could have a material adverse effect on our business, financial condition, and results of operations. 24. If we do not successfully close or integrate acquisitions or strategic partnerships (including the pending acquisition of Blockcap), we may not realize the anticipated benefits of any such acquisitions or partnerships, which could have a material adverse effect on our business, financial condition and results of operations. 25. Latency in confirming transactions on a network could result in a loss of confidence in the network, which could have a material adverse effect on our business, financial condition and results of operations. 26. If we are not able to successfully anticipate, invest in, or adopt technological advances in our industry, it could have a material adverse effect on our business, financial condition and results of operations. ® 36 PROPRIETARY & CONFIDENTIAL RISK FACTORS (3/6)

27. We may not be able to adequately protect our intellectual property rights and other proprietary rights, which could have a material adverse effect on business, financial condition and results of operations. 28. Significant or unexpected changes to our transaction processing operations may have a material adverse effect on our business, financial condition and results of operations. 29. A reduction in the processing power expended by transaction processors on a network could increase the likelihood of a malicious actor or botnet obtaining control, which could have a material adverse effect on our business, financial condition and results of operations. 30. Transaction processing operators may sell a substantial amount of digital assets into the market, which may exert downward pressure on the price of the applicable digital asset, and in turn, could have a material adverse effect on our business, financial condition and results of operations. 31. The “halving” of rewards available on the Bitcoin network, or the reduction of rewards on other networks, has had and in the future could have a negative impact on our ability to generate revenue and could have a material adverse effect on our business, financial condition and results of operations. 32. From time to time we have sold, and we may sell in the future, a portion of our digital assets to pay for costs and expenses, which has reduced, and may continue to reduce, the amount of digital assets we hold and thus prevents us from recognizing any gain from the appreciation in value of the digital assets we have sold and may sell in the future. 33. Digital assets are subject to extreme price volatility. The value of digital assets is dependent on a number of factors, any of which could have a material adverse effect on our business, financial condition and results of operations. 34. The loss or destruction of a private key required to access a digital asset is irreversible, we also may temporarily lose access to our digital assets. 35. Intellectual property rights claims may adversely affect the operation of any or all of the networks. 36. The patent applications we have filed may not result in issued patents, and our issued patents may not provide meaningful protection, may be challenged, and may prove difficult to enforce. 37. A soft or hard fork on a network could have a material adverse effect on our business, financial condition and results of operations. 38. The digital assets held by us may be subject to loss, damage, theft or restriction on access, which could have a material adverse effect on our business, financial condition or results of operations. 39. The digital assets held by us are not subject to FDIC or SIPC protections. ® 37 PROPRIETARY & CONFIDENTIAL RISK FACTORS (4/6)

40. As more processing power is added to a network, our relative percentage of total processing power on that network is expected to decline absent significant capital investment, which has an adverse impact on our ability to generate revenue from processing transactions on that network and could have a material adverse effect on our business, financial condition and results of operations. 41. If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired. 42. We may acquire other businesses or receive offers to be acquired, which could require significant management attention, disrupt our business or dilute stockholder value. 43. An active trading market for our common stock may never develop or be sustained. 44. Our revenue may be negatively impacted by the inability or unwillingness of equipment manufacturers to deliver on our hardware orders in a timely manner. 45. We will incur costs and demands upon management as a result of complying with the laws and regulations affecting public companies in the United States, which may harm our business. 46. Digital assets such as Bitcoin may be regulated as securities or investment securities. 47. Since there has been limited precedent set for financial accounting or taxation of digital assets other than digital securities, it is unclear how we will be required to account for digital asset transactions and the taxation of our businesses. ® 38 PROPRIETARY & CONFIDENTIAL RISK FACTORS (5/6)

Risks Related to the Business Combination and the Combined Entity 48. The financial and operational projections related to the Company may not be realized, which may adversely affect the trading price of our common stock following the closing of the Business Combination. 49. The trading price of our common stock may be volatile, and you could lose all or part of your investment. 50. If you purchase our common stock in this private placement, you will incur immediate and substantial dilution in the book value of your investment. 51. Future sales and issuances of our capital stock or rights to purchase capital stock could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to decline. 52. We will have broad discretion in the use of net proceeds from this private placement and may invest or spend the proceeds in ways with which you do not agree and in ways that may not yield a return. 53. Substantial future sales of shares of our common stock could cause the market price of our common stock to decline. 54. Provisions in our corporate charter documents and under Delaware law may prevent or frustrate attempts by our stockholders to change our management or hinder efforts to acquire a controlling interest in us, and the market price of our common stock may be lower as a result. 55. Our common stock market price and trading volume could decline if securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business. 56. We are an “emerging growth company,” and we intend to comply only with reduced disclosure requirements applicable to emerging growth companies. As a result, our common stock could be less attractive to investors. 57. We do not intend to pay dividends for the foreseeable future. 58. The announcement of the proposed Business Combination could disrupt our relationships with its suppliers or other third parties. 59. We will incur significant transaction and transition costs in connection with the Business Combination. 60. We will be the only principal asset of XPDI following the Business Combination, and accordingly it will depend on distributions from us to pay taxes and expenses. 61. Fluctuations in operating results, quarter to quarter earnings and other factors, including negative media coverage, may result in significant decreases in the price of the combined company's securities. 62. Claims for indemnification by the combined company's directors may reduce its available funds to satisfy successful third - party claims against the combined company and may reduce the amount of money available to the combined company. ® 39 PROPRIETARY & CONFIDENTIAL RISK FACTORS (6/6)