EX-99.2

Published on January 25, 2024

Exhibit 99.2 Core Scientific, Inc. Emergence Update* January 22, 2024 * This is only a summary. All shareholders and creditors should read the Plan and Disclosure Statement for details. 1

Legal Disclaimer This document is solely for informational purposes. You should not rely upon it or use it to form the definitive basis for any decision or action whatsoever, with respect to any proposed transaction or otherwise. This document is “as is” and neither Core Scientific, Inc. (the “Company”) nor any affiliates or agents of the Company, make any representation or warranty, express or implied, in relation to the accuracy or completeness of the information contained in this document or any oral information provided in connection herewith, or any data it generates and expressly disclaim any and all liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information or any errors or omissions therein. All share and warrant numbers in this document are rounded down to the nearest whole share or warrant, as applicable, which reflects that no fractional shares or warrants will be issued in connection with the Company’s Chapter 11 Plan. You are encouraged to read the Company’s Chapter 11 Plan and the related Disclosure Statement, each as amended or supplemented, which are available (i) on the website of Stretto, the Company’s voting and solicitation agent, at https://cases.stretto.com/corescientific/, (ii) by calling Stretto at (949) 404-4152 (in the U.S. and Canada; toll-free) or +1 (888) 765-7875 (outside of the U.S. and Canada), or (iii) by sending an electronic mail message to CoreScientificInquiries@stretto.com. This document does not constitute an offer to sell or the solicitation of an offer to buy any security, nor does it constitute an offer or commitment to lend, syndicate or arrange a financing, underwrite or purchase or act as an agent or advisor or in any other capacity with respect to any transaction, or commit capital, or to participate in any trading strategies, and does not constitute legal, regulatory, accounting or tax advice to the recipient. This document does not constitute and should not be considered as any form of legal or financial opinion or recommendation by the Company or any of its affiliates. This document is not a research report nor should it be construed as such. The document, including any projections and forecasts, was not prepared with a view toward public disclosure or compliance with the published guidelines of the Securities and Exchange Commission (“SEC”) or the guidelines established by the Public Company Accounting Oversight Board and should not be relied upon to make an investment decision with respect to the Company. This document does not purport to present the Company’s financial condition in accordance with GAAP. The Company’s independent registered public accounting firm has not examined, compiled or otherwise applied procedures to this document and, accordingly, does not express an opinion or any other form of assurance with respect to this document. Any projections or forecasts were prepared for internal use, capital budgeting and other management decisions and are subjective in many respects. Any such projections or forecasts reflect numerous assumptions made by management of the Company with respect to financial condition, business and industry performance, general economic, market and financial conditions, and other matters, all of which are difficult to predict, and many of which are beyond the Company’s control. The disclosure of this document should not be regarded as an indication that the Company or its affiliates or representatives consider this document to be a reliable prediction of future events, and this document should not be relied upon as such. The statements in this document speak only as of the date such statements were made, or any earlier date indicated therein. Neither the Company nor any of its affiliates or representatives has made or makes any representation to any person regarding the ultimate outcome of the foregoing, and none of them undertakes any obligation to publicly update this document to reflect circumstances existing after the date when this document was made available to stakeholders or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying this document are shown to be in error. The statements provided in this document are subject to all of the cautionary statements and limitations described herein, therein and under the caption “Forward-Looking Statements” and the risk factors in the Company’s SEC filings. Forward-Looking Statements This document contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited to, statements about plans, expectations and intentions with respect to the future and other statements identified by words such as will likely result, are expected to, will continue, is anticipated, estimated, believe, intend, plan, projection, “forecast,” outlook or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of the management of the Company and are inherently subject to significant contingencies, many of which are difficult to predict and generally beyond the control of the parties. Actual performance or achievements may differ materially, and potentially adversely, from any forward-looking statements and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as such information is based on estimates and assumptions. The forward-looking statements are subject to various risks, uncertainties and other factors, many of which are beyond the Company’s control. 2

Agenda I. Summary II. Post-Emergence Capital Structure III. Stakeholder Recoveries 3

We’ve Made Significant Progress toward Emergence • Paid off DIP financing • Finalized an oversubscribed $55 million Equity Rights Offering • In 2023, self-mined 13,762 bitcoin and ~5,512 bitcoin from hosted miners • Plan of Reorganization confirmed by Court on January 16 • Core expects to emerge from bankruptcy in the next few days 4

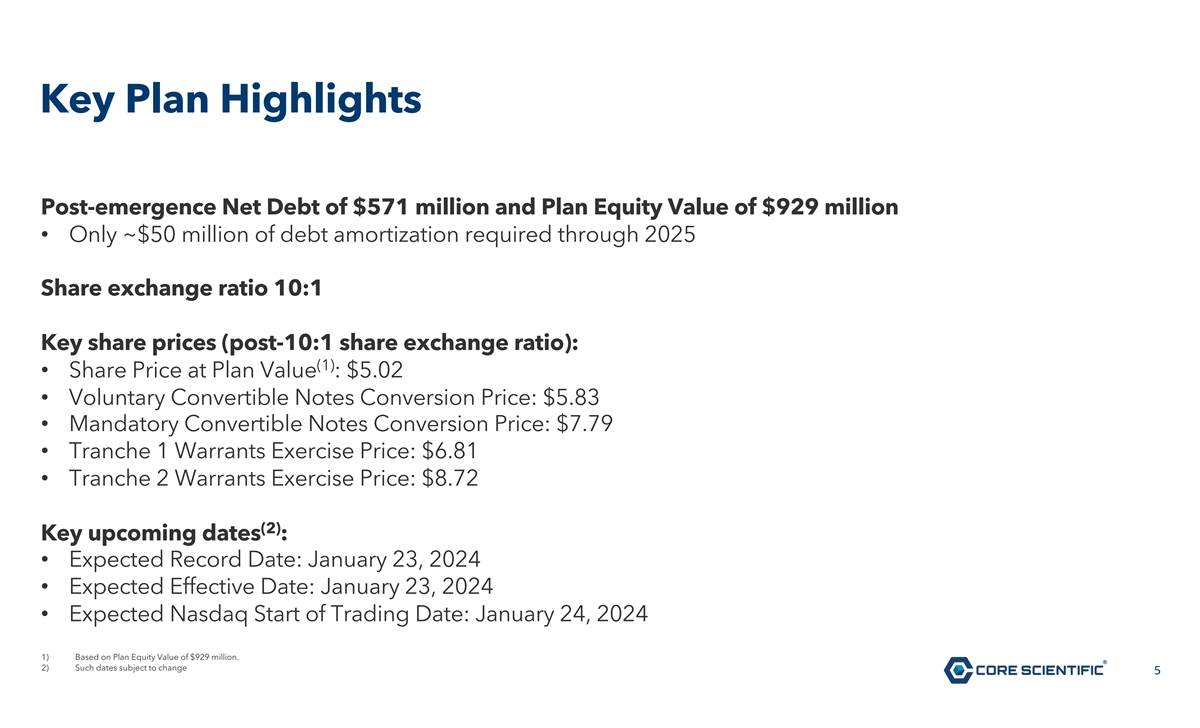

Key Plan Highlights Post-emergence Net Debt of $571 million and Plan Equity Value of $929 million • Only ~$50 million of debt amortization required through 2025 Share exchange ratio 10:1 Key share prices (post-10:1 share exchange ratio): (1) • Share Price at Plan Value : $5.02 • Voluntary Convertible Notes Conversion Price: $5.83 • Mandatory Convertible Notes Conversion Price: $7.79 • Tranche 1 Warrants Exercise Price: $6.81 • Tranche 2 Warrants Exercise Price: $8.72 (2) Key upcoming dates : • Expected Record Date: January 23, 2024 • Expected Effective Date: January 23, 2024 • Expected Nasdaq Start of Trading Date: January 24, 2024 1) Based on Plan Equity Value of $929 million. 2) Such dates subject to change 5

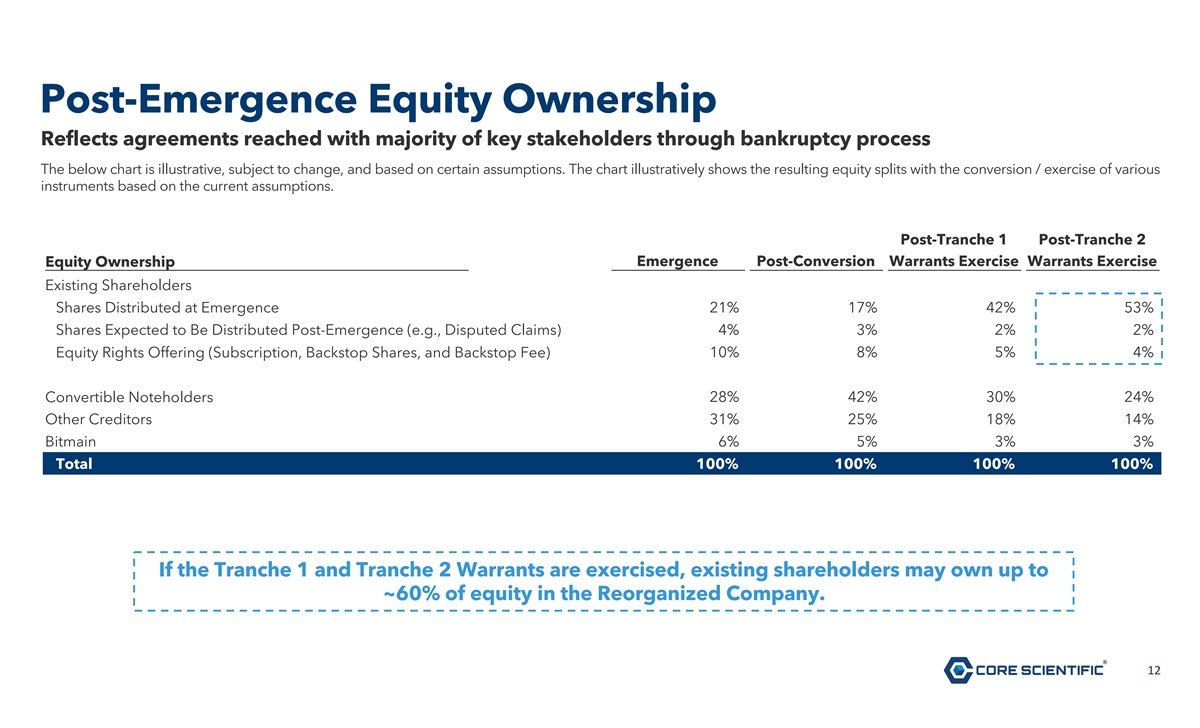

Plan Highlights: Maximizing Value for All Stakeholders Common Shareholders as of the Plan Effective Date (expected to be January 23, 2024) are expected to receive $1.18 per share of pre-exchange value based on current assumptions (see page 22 for assumptions) • Includes non-contingent recovery of ~$1.11 per share and expected additional distributions of ~$0.06 per share • Existing equity to receive new common shares and two tranches of warrants • If the Tranche 1 and 2 Warrants are exercised in full, existing shareholders may own as much as ~60% of equity in the Reorganized Company (including on account of equity issued in connection with equity rights offering) The Convertible Notes are receiving original par plus accrued interest and accretion in the form of New Secured Notes, New Secured Convertible Notes, and New Common Shares Executive • The April Convertible Noteholders are expected to receive $1.631 of value for every $1 original par face amount • The August Convertible Noteholders are expected to receive $1.203 of value for every $1 original par face amount Summary Recapitalized projected Core balance sheet reflects agreements with majority of key stakeholders • $55 million equity rights offering and $80 million exit facility (of which $40 million is new money) provide liquidity upon emergence • Plan results in deleveraging via equitization of claims • New debt schedule reflects just ~$50 million of required paydown through year-end 2025 1) ERO shares are calculated as if such equity distributions are already made. 66

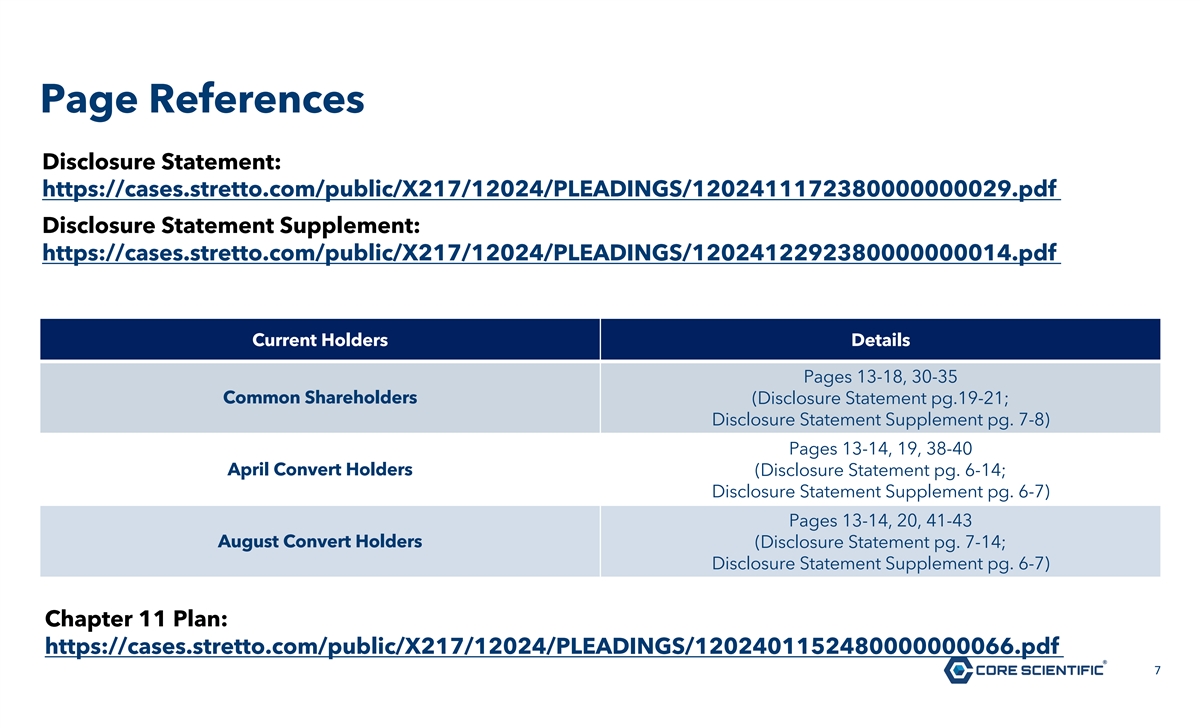

Page References Disclosure Statement: https://cases.stretto.com/public/X217/12024/PLEADINGS/1202411172380000000029.pdf Disclosure Statement Supplement: https://cases.stretto.com/public/X217/12024/PLEADINGS/1202412292380000000014.pdf Current Holders Details Pages 13-18, 30-35 Common Shareholders (Disclosure Statement pg.19-21; Disclosure Statement Supplement pg. 7-8) Pages 13-14, 19, 38-40 April Convert Holders (Disclosure Statement pg. 6-14; Disclosure Statement Supplement pg. 6-7) Pages 13-14, 20, 41-43 August Convert Holders (Disclosure Statement pg. 7-14; Disclosure Statement Supplement pg. 6-7) Chapter 11 Plan: https://cases.stretto.com/public/X217/12024/PLEADINGS/1202401152480000000066.pdf 7

II. Post-Emergence Capital Structure 8

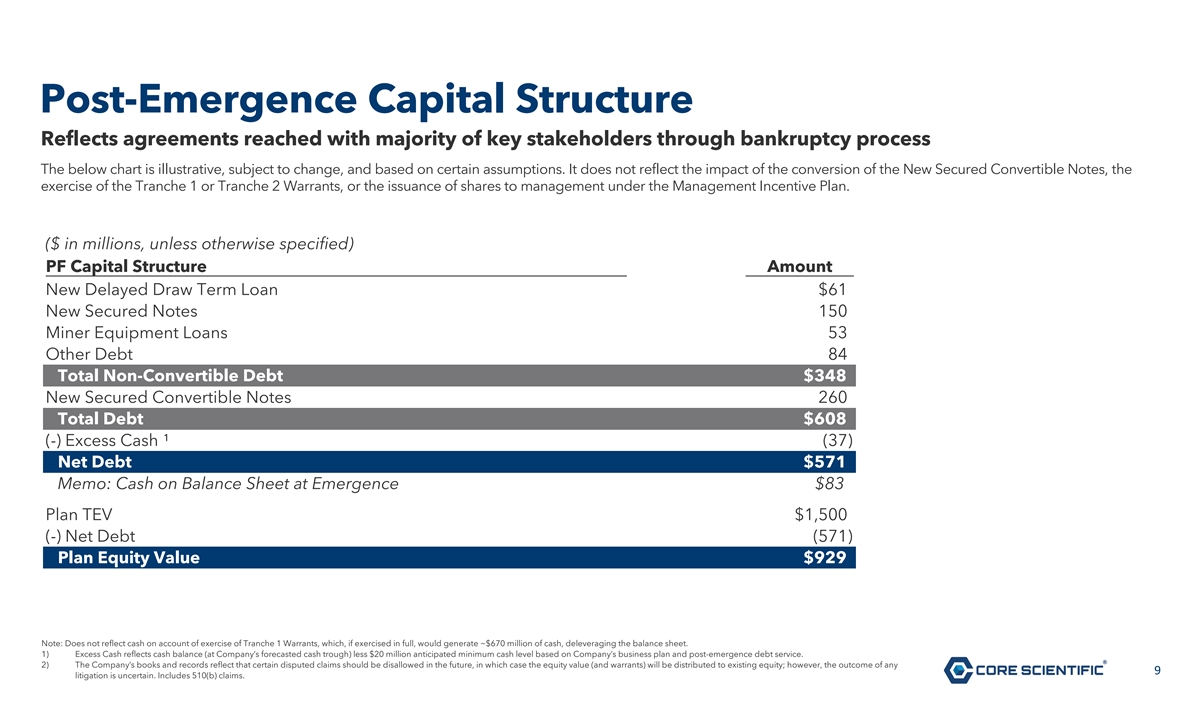

Post-Emergence Capital Structure Reflects agreements reached with majority of key stakeholders through bankruptcy process The below chart is illustrative, subject to change, and based on certain assumptions. It does not reflect the impact of the conversion of the New Secured Convertible Notes, the exercise of the Tranche 1 or Tranche 2 Warrants, or the issuance of shares to management under the Management Incentive Plan. ($ in millions, unless otherwise specified) PF Capital Structure Amount New Delayed Draw Term Loan $61 New Secured Notes 150 Miner Equipment Loans 53 Other Debt 84 Total Non-Convertible Debt $348 New Secured Convertible Notes 260 ⁽ ⁾ Total Debt $608 (-) Excess Cash ¹ (37) Net Debt $571 Memo: Cash on Balance Sheet at Emergence $83 Plan TEV $1,500 (-) Net Debt (571) Plan Equity Value $929 Note: Does not reflect cash on account of exercise of Tranche 1 Warrants, which, if exercised in full, would generate ~$670 million of cash, deleveraging the balance sheet. 1) Excess Cash reflects cash balance (at Company’s forecasted cash trough) less $20 million anticipated minimum cash level based on Company’s business plan and post-emergence debt service. 2) The Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value (and warrants) will be distributed to existing equity; however, the outcome of any 9 litigation is uncertain. Includes 510(b) claims.

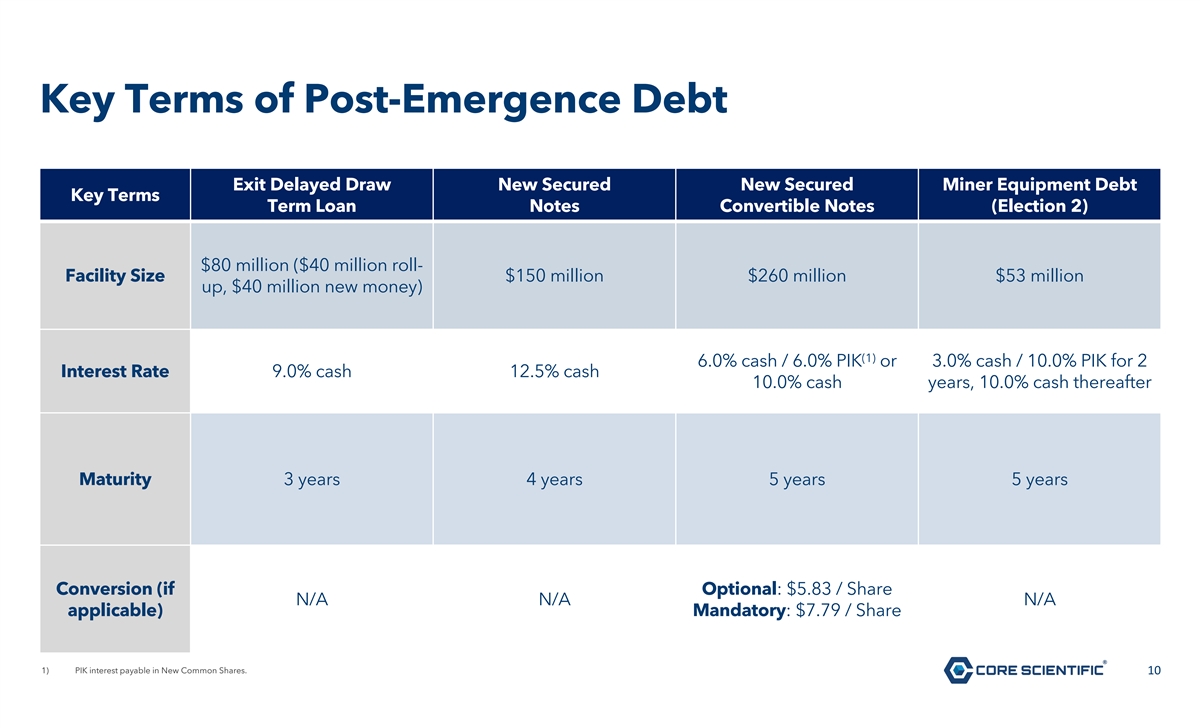

Key Terms of Post-Emergence Debt Exit Delayed Draw New Secured New Secured Miner Equipment Debt Key Terms Term Loan Notes Convertible Notes (Election 2) $80 million ($40 million roll- Facility Size $150 million $260 million $53 million up, $40 million new money) (1) 6.0% cash / 6.0% PIK or 3.0% cash / 10.0% PIK for 2 Interest Rate 9.0% cash 12.5% cash 10.0% cash years, 10.0% cash thereafter Maturity 3 years 4 years 5 years 5 years Conversion (if Optional: $5.83 / Share N/A N/A N/A applicable) Mandatory: $7.79 / Share 1) PIK interest payable in New Common Shares. 10

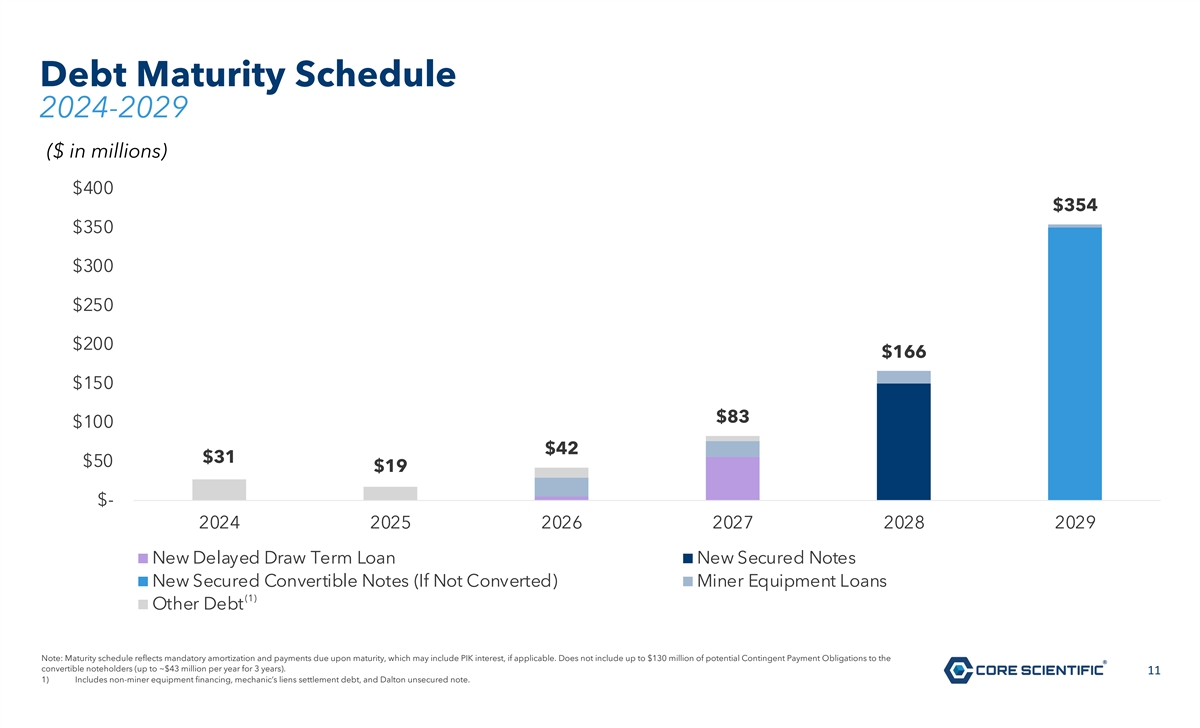

Debt Maturity Schedule 2024-2029 ($ in millions) $400 $354 $350 $300 $250 $200 $166 $150 $83 $100 $42 $31 $50 $19 $- 2024 2025 2026 2027 2028 2029 New Delayed Draw Term Loan New Secured Notes New Secured Convertible Notes (If Not Converted) Miner Equipment Loans (1) Other Debt Total Note: Maturity schedule reflects mandatory amortization and payments due upon maturity, which may include PIK interest, if applicable. Does not include up to $130 million of potential Contingent Payment Obligations to the convertible noteholders (up to ~$43 million per year for 3 years). 11 1) Includes non-miner equipment financing, mechanic’s liens settlement debt, and Dalton unsecured note.

Post-Emergence Equity Ownership Reflects agreements reached with majority of key stakeholders through bankruptcy process The below chart is illustrative, subject to change, and based on certain assumptions. The chart illustratively shows the resulting equity splits with the conversion / exercise of various instruments based on the current assumptions. Post-Tranche 1 Post-Tranche 2 Equity Ownership Emergence Post-Conversion Warrants Exercise Warrants Exercise Existing Shareholders Shares Distributed at Emergence 21% 17% 42% 53% Shares Expected to Be Distributed Post-Emergence (e.g., Disputed Claims) 4% 3% 2% 2% 10% 8% 5% 4% Equity Rights Offering (Subscription, Backstop Shares, and Backstop Fee) Convertible Noteholders 28% 42% 30% 24% Other Creditors 31% 25% 18% 14% Bitmain 6% 5% 3% 3% Total 100% 100% 100% 100% If the Tranche 1 and Tranche 2 Warrants are exercised, existing shareholders may own up to ~60% of equity in the Reorganized Company. 12

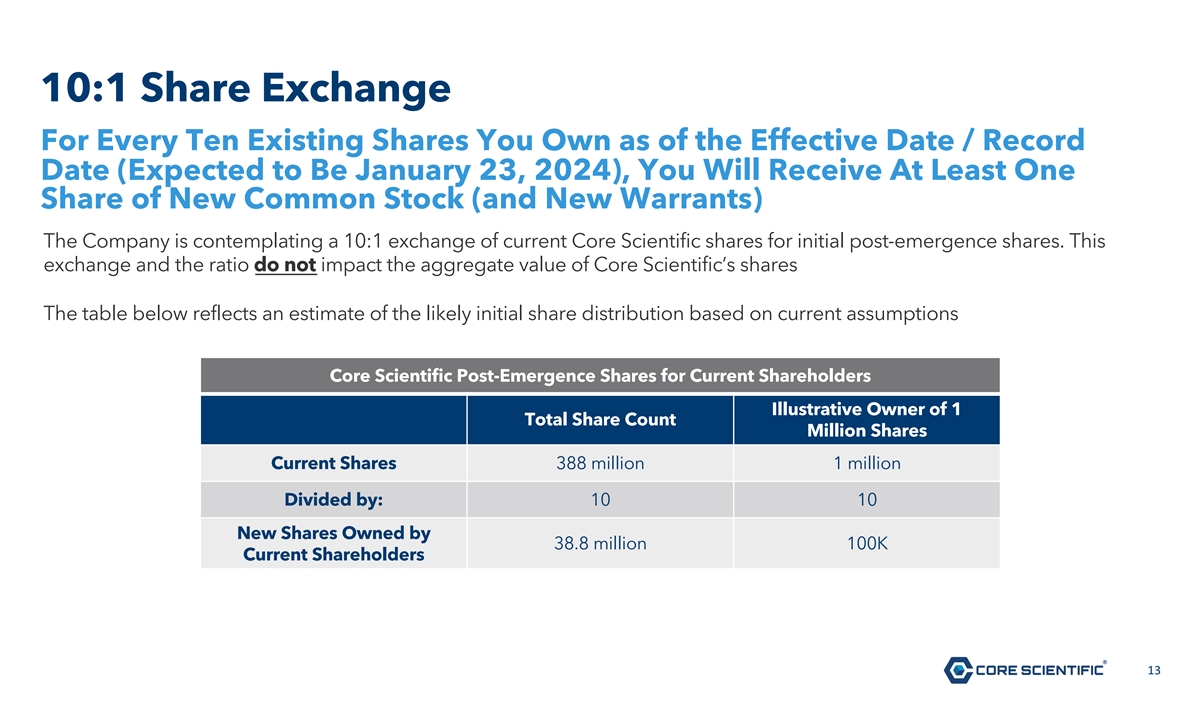

10:1 Share Exchange For Every Ten Existing Shares You Own as of the Effective Date / Record Date (Expected to Be January 23, 2024), You Will Receive At Least One Share of New Common Stock (and New Warrants) The Company is contemplating a 10:1 exchange of current Core Scientific shares for initial post-emergence shares. This exchange and the ratio do not impact the aggregate value of Core Scientific’s shares The table below reflects an estimate of the likely initial share distribution based on current assumptions Core Scientific Post-Emergence Shares for Current Shareholders Illustrative Owner of 1 Total Share Count Million Shares Current Shares 388 million 1 million Divided by: 10 10 New Shares Owned by 38.8 million 100K Current Shareholders 13

III. Stakeholder Recoveries 14

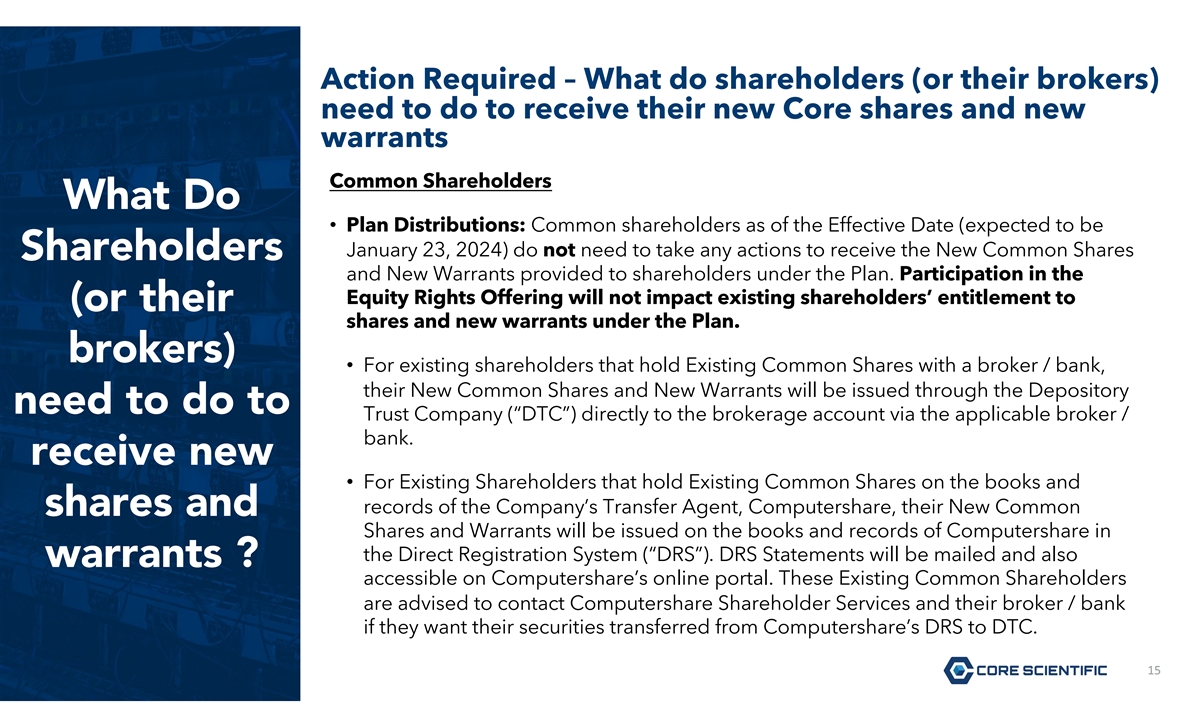

Action Required – What do shareholders (or their brokers) need to do to receive their new Core shares and new warrants Common Shareholders What Do • Plan Distributions: Common shareholders as of the Effective Date (expected to be January 23, 2024) do not need to take any actions to receive the New Common Shares Shareholders and New Warrants provided to shareholders under the Plan. Participation in the Equity Rights Offering will not impact existing shareholders’ entitlement to (or their shares and new warrants under the Plan. brokers) • For existing shareholders that hold Existing Common Shares with a broker / bank, their New Common Shares and New Warrants will be issued through the Depository need to do to Trust Company (“DTC”) directly to the brokerage account via the applicable broker / bank. receive new • For Existing Shareholders that hold Existing Common Shares on the books and records of the Company’s Transfer Agent, Computershare, their New Common shares and Shares and Warrants will be issued on the books and records of Computershare in the Direct Registration System (“DRS”). DRS Statements will be mailed and also warrants ? accessible on Computershare’s online portal. These Existing Common Shareholders are advised to contact Computershare Shareholder Services and their broker / bank if they want their securities transferred from Computershare’s DRS to DTC. 15 15

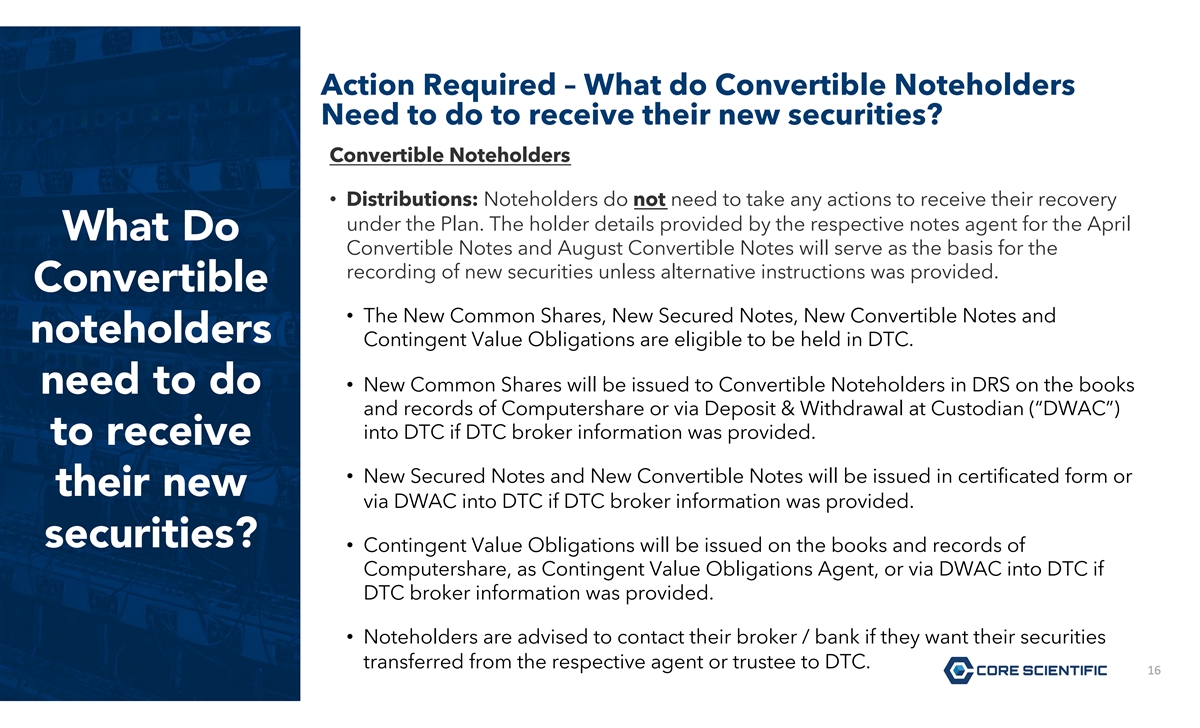

Action Required – What do Convertible Noteholders Need to do to receive their new securities? Convertible Noteholders • Distributions: Noteholders do not need to take any actions to receive their recovery under the Plan. The holder details provided by the respective notes agent for the April What Do Convertible Notes and August Convertible Notes will serve as the basis for the recording of new securities unless alternative instructions was provided. Convertible • The New Common Shares, New Secured Notes, New Convertible Notes and noteholders Contingent Value Obligations are eligible to be held in DTC. • New Common Shares will be issued to Convertible Noteholders in DRS on the books need to do and records of Computershare or via Deposit & Withdrawal at Custodian (“DWAC”) into DTC if DTC broker information was provided. to receive • New Secured Notes and New Convertible Notes will be issued in certificated form or their new via DWAC into DTC if DTC broker information was provided. securities? • Contingent Value Obligations will be issued on the books and records of Computershare, as Contingent Value Obligations Agent, or via DWAC into DTC if DTC broker information was provided. • Noteholders are advised to contact their broker / bank if they want their securities transferred from the respective agent or trustee to DTC. 16 16

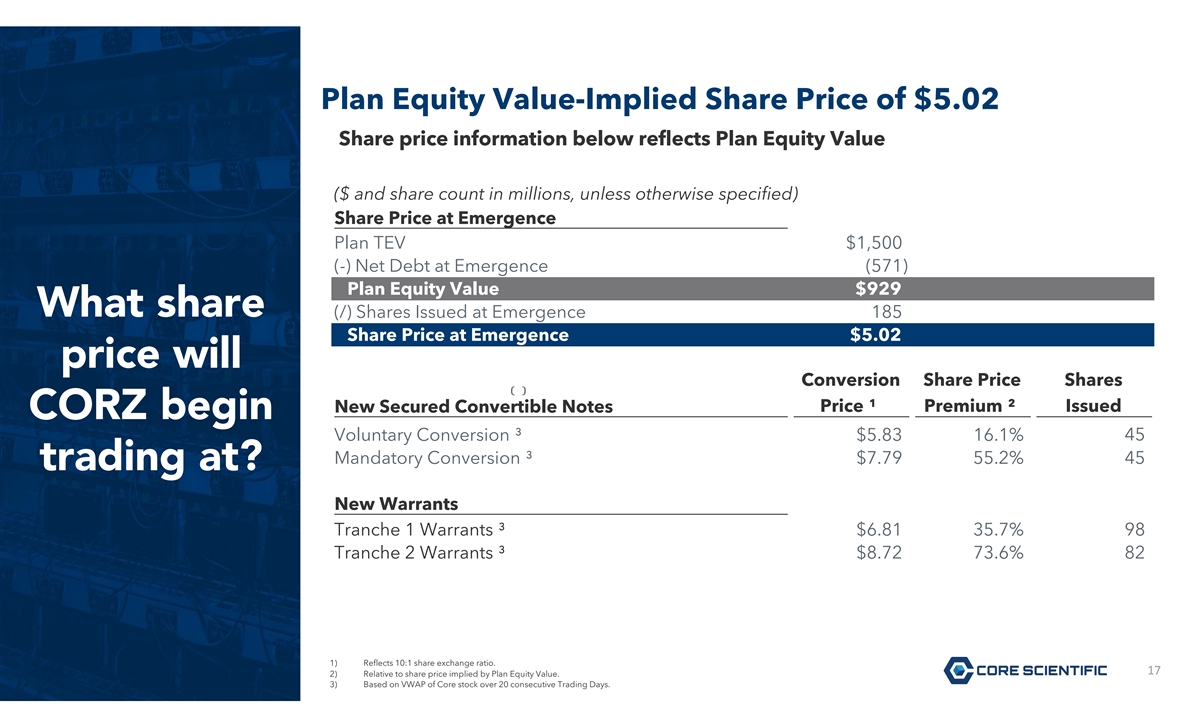

Plan Equity Value-Implied Share Price of $5.02 Share price information below reflects Plan Equity Value ($ and share count in millions, unless otherwise specified) Share Price at Emergence Plan TEV $1,500 (-) Net Debt at Emergence (571) Plan Equity Value $929 What share (/) Shares Issued at Emergence 185 Share Price at Emergence $5.02 price will ⁽ ⁾ ⁽ ⁾ Conversion Share Price Shares ⁽ ⁾ Price ¹ Premium ² Issued New Secured Convertible Notes CORZ begin ⁽ ⁾ 45 Voluntary Conversion ³ $5.83 16.1% Mandatory Conversion ³ $7.79 55.2% 45 trading at? ⁽ ⁾ New Warrants ⁽ ⁾ Tranche 1 Warrants ³ $6.81 35.7% 98 Tranche 2 Warrants ³ $8.72 73.6% 82 1) Reflects 10:1 share exchange ratio. 17 17 2) Relative to share price implied by Plan Equity Value. 3) Based on VWAP of Core stock over 20 consecutive Trading Days.

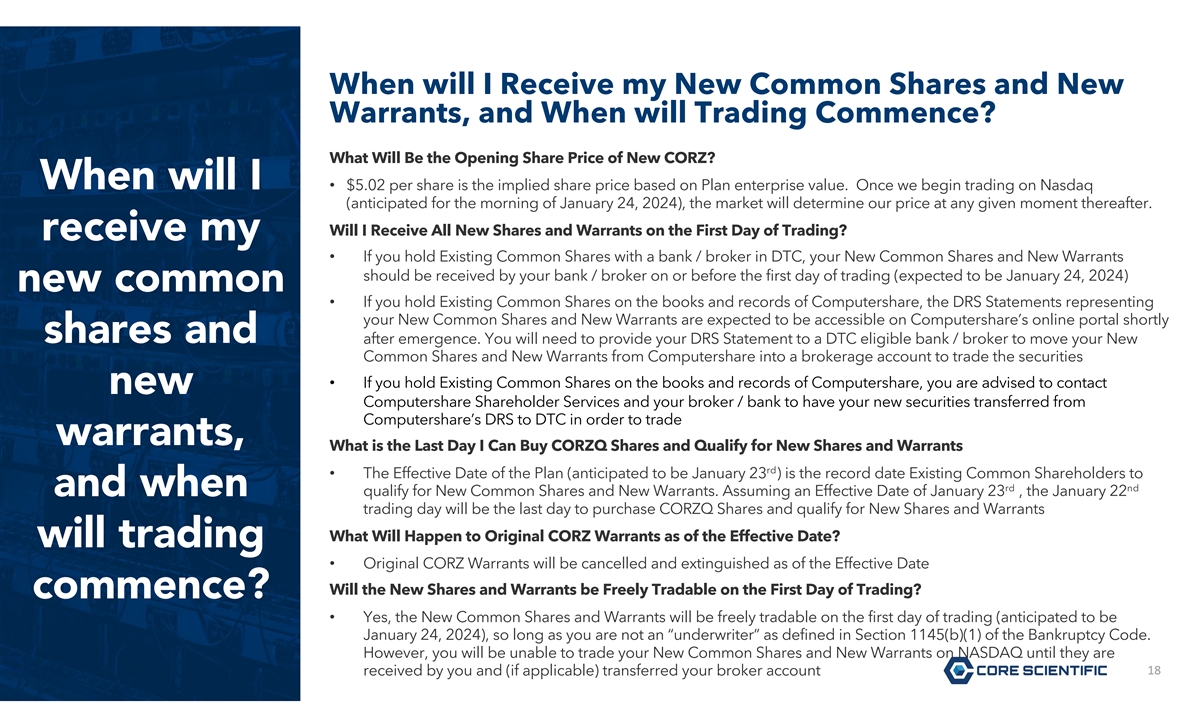

When will I Receive my New Common Shares and New Warrants, and When will Trading Commence? What Will Be the Opening Share Price of New CORZ? When will I • $5.02 per share is the implied share price based on Plan enterprise value. Once we begin trading on Nasdaq (anticipated for the morning of January 24, 2024), the market will determine our price at any given moment thereafter. Will I Receive All New Shares and Warrants on the First Day of Trading? receive my • If you hold Existing Common Shares with a bank / broker in DTC, your New Common Shares and New Warrants should be received by your bank / broker on or before the first day of trading (expected to be January 24, 2024) new common • If you hold Existing Common Shares on the books and records of Computershare, the DRS Statements representing your New Common Shares and New Warrants are expected to be accessible on Computershare’s online portal shortly shares and after emergence. You will need to provide your DRS Statement to a DTC eligible bank / broker to move your New Common Shares and New Warrants from Computershare into a brokerage account to trade the securities • If you hold Existing Common Shares on the books and records of Computershare, you are advised to contact new Computershare Shareholder Services and your broker / bank to have your new securities transferred from Computershare’s DRS to DTC in order to trade warrants, What is the Last Day I Can Buy CORZQ Shares and Qualify for New Shares and Warrants rd • The Effective Date of the Plan (anticipated to be January 23 ) is the record date Existing Common Shareholders to rd nd and when qualify for New Common Shares and New Warrants. Assuming an Effective Date of January 23 , the January 22 trading day will be the last day to purchase CORZQ Shares and qualify for New Shares and Warrants What Will Happen to Original CORZ Warrants as of the Effective Date? will trading • Original CORZ Warrants will be cancelled and extinguished as of the Effective Date Will the New Shares and Warrants be Freely Tradable on the First Day of Trading? commence? • Yes, the New Common Shares and Warrants will be freely tradable on the first day of trading (anticipated to be January 24, 2024), so long as you are not an “underwriter” as defined in Section 1145(b)(1) of the Bankruptcy Code. However, you will be unable to trade your New Common Shares and New Warrants on NASDAQ until they are 18 18 received by you and (if applicable) transferred your broker account

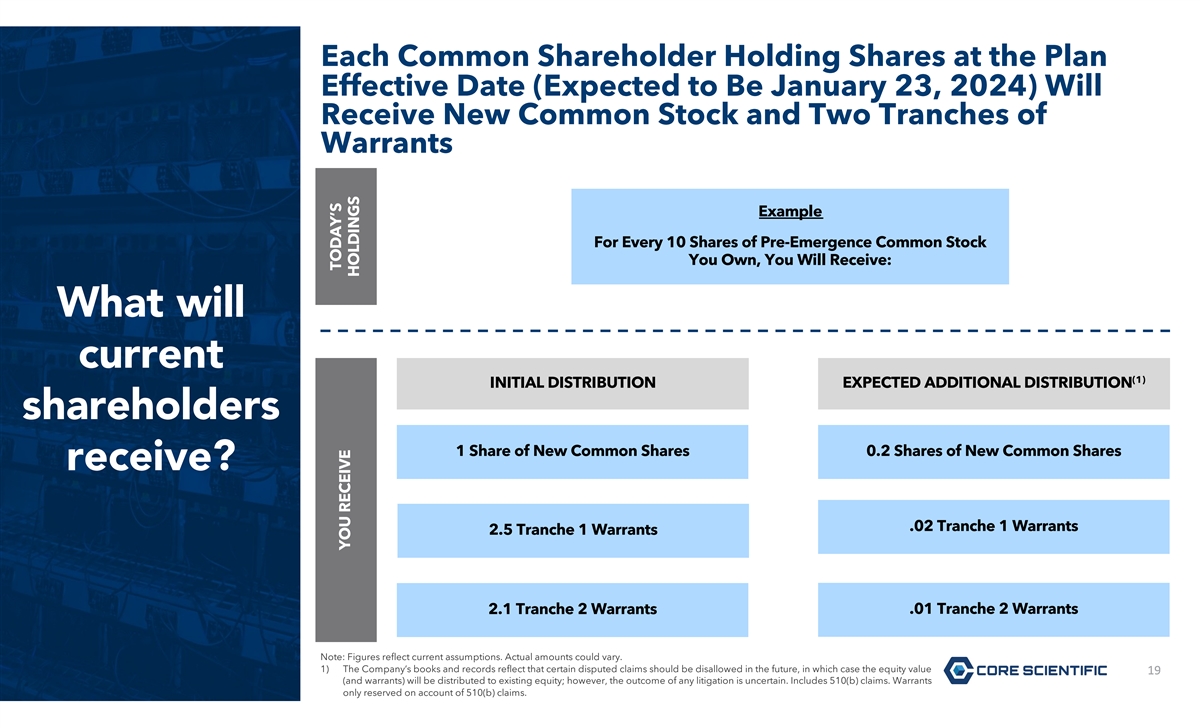

Each Common Shareholder Holding Shares at the Plan Effective Date (Expected to Be January 23, 2024) Will Receive New Common Stock and Two Tranches of Warrants Example For Every 10 Shares of Pre-Emergence Common Stock You Own, You Will Receive: What will current (1) INITIAL DISTRIBUTION EXPECTED ADDITIONAL DISTRIBUTION shareholders 1 Share of New Common Shares 0.2 Shares of New Common Shares receive? .02 Tranche 1 Warrants 2.5 Tranche 1 Warrants 2.1 Tranche 2 Warrants .01 Tranche 2 Warrants Note: Figures reflect current assumptions. Actual amounts could vary. 1) The Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value 19 19 (and warrants) will be distributed to existing equity; however, the outcome of any litigation is uncertain. Includes 510(b) claims. Warrants only reserved on account of 510(b) claims. TODAY’S YOU RECEIVE HOLDINGS

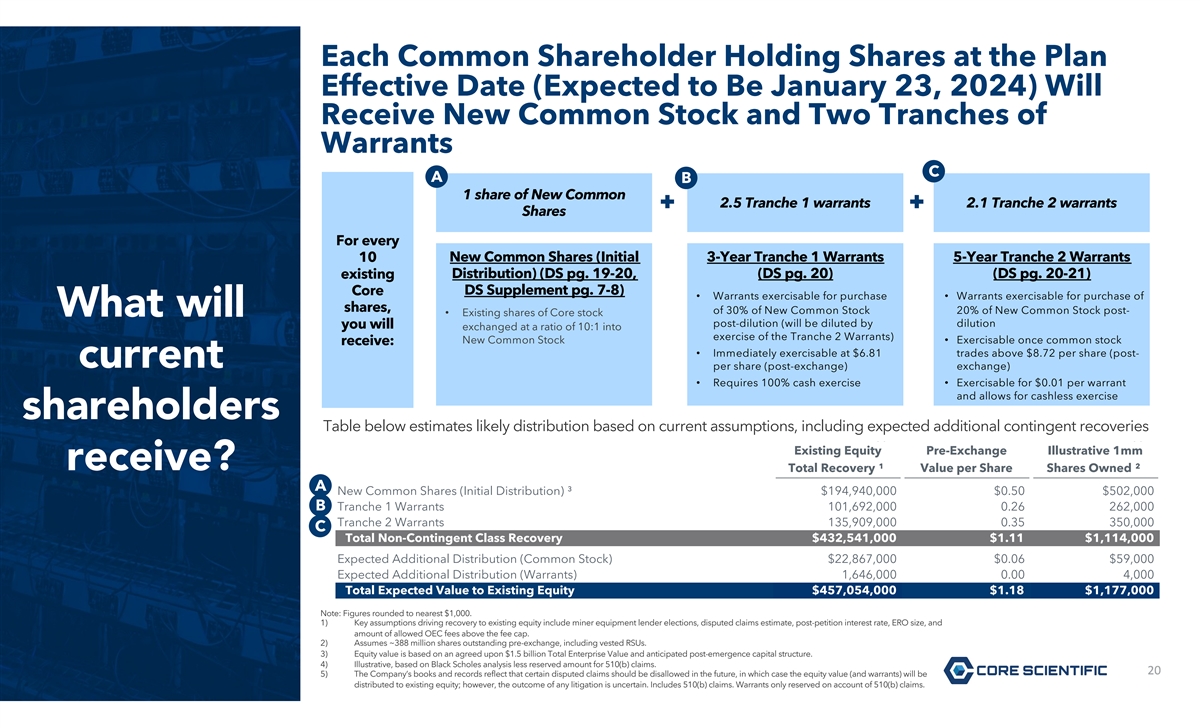

Each Common Shareholder Holding Shares at the Plan Effective Date (Expected to Be January 23, 2024) Will Receive New Common Stock and Two Tranches of Warrants C A B 1 share of New Common 2.5 Tranche 1 warrants 2.1 Tranche 2 warrants Shares For every 10 New Common Shares (Initial 3-Year Tranche 1 Warrants 5-Year Tranche 2 Warrants existing Distribution) (DS pg. 19-20, (DS pg. 20) (DS pg. 20-21) Core DS Supplement pg. 7-8) • Warrants exercisable for purchase • Warrants exercisable for purchase of shares, of 30% of New Common Stock 20% of New Common Stock post- What will • Existing shares of Core stock post-dilution (will be diluted by dilution you will exchanged at a ratio of 10:1 into exercise of the Tranche 2 Warrants) New Common Stock • Exercisable once common stock receive: • Immediately exercisable at $6.81 trades above $8.72 per share (post- current per share (post-exchange) exchange) • Requires 100% cash exercise • Exercisable for $0.01 per warrant and allows for cashless exercise shareholders Table below estimates likely distribution based on current assumptions, including expected additional contingent recoveries ⁽ ⁾ ⁽ ⁾ Existing Equity Pre-Exchange Illustrative 1mm ⁽ ⁾ receive? Total Recovery ¹ Value per Share Shares Owned ² ⁽⁴⁾ A New Common Shares (Initial Distribution) ³ $194,940,000 $0.50 $502,000 ⁽⁴⁾ B Tranche 1 Warrants 101,692,000 0.26 262,000 Tranche 2 Warrants 135,909,000 0.35 350,000 C ⁽⁵⁾ Total Non-Contingent Class Recovery $432,541,000 $1.11 $1,114,000 ⁽⁵⁾ Expected Additional Distribution (Common Stock) $22,867,000 $0.06 $59,000 Expected Additional Distribution (Warrants) 1,646,000 0.00 4,000 Total Expected Value to Existing Equity $457,054,000 $1.18 $1,177,000 Note: Figures rounded to nearest $1,000. 1) Key assumptions driving recovery to existing equity include miner equipment lender elections, disputed claims estimate, post-petition interest rate, ERO size, and amount of allowed OEC fees above the fee cap. 2) Assumes ~388 million shares outstanding pre-exchange, including vested RSUs. 3) Equity value is based on an agreed upon $1.5 billion Total Enterprise Value and anticipated post-emergence capital structure. 4) Illustrative, based on Black Scholes analysis less reserved amount for 510(b) claims. 20 20 5) The Company’s books and records reflect that certain disputed claims should be disallowed in the future, in which case the equity value (and warrants) will be distributed to existing equity; however, the outcome of any litigation is uncertain. Includes 510(b) claims. Warrants only reserved on account of 510(b) claims.

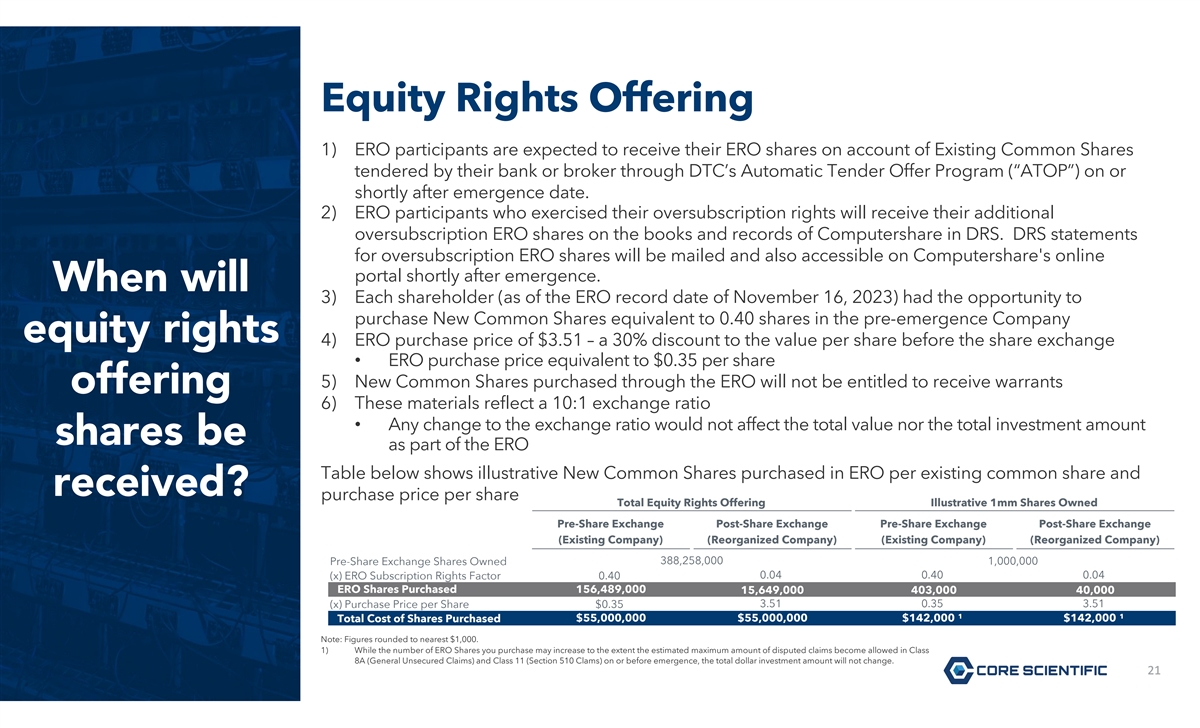

Equity Rights Offering 1) ERO participants are expected to receive their ERO shares on account of Existing Common Shares tendered by their bank or broker through DTC’s Automatic Tender Offer Program (“ATOP”) on or shortly after emergence date. 2) ERO participants who exercised their oversubscription rights will receive their additional oversubscription ERO shares on the books and records of Computershare in DRS. DRS statements for oversubscription ERO shares will be mailed and also accessible on Computershare's online portal shortly after emergence. When will 3) Each shareholder (as of the ERO record date of November 16, 2023) had the opportunity to purchase New Common Shares equivalent to 0.40 shares in the pre-emergence Company equity rights 4) ERO purchase price of $3.51 – a 30% discount to the value per share before the share exchange • ERO purchase price equivalent to $0.35 per share 5) New Common Shares purchased through the ERO will not be entitled to receive warrants offering 6) These materials reflect a 10:1 exchange ratio • Any change to the exchange ratio would not affect the total value nor the total investment amount shares be as part of the ERO Table below shows illustrative New Common Shares purchased in ERO per existing common share and received? purchase price per share Total Equity Rights Offering Illustrative 1mm Shares Owned Pre-Share Exchange Post-Share Exchange Pre-Share Exchange Post-Share Exchange (Existing Company) (Reorganized Company) (Existing Company) (Reorganized Company) 388,258,000 Pre-Share Exchange Shares Owned 1,000,000 (x) ERO Subscription Rights Factor 0.40 0.04 0.40 0.04 ERO Shares Purchased 156,489,000 15,649,000 403,000 40,000 ⁽ ⁾ ⁽ ⁾ (x) Purchase Price per Share $0.35 3.51 0.35 3.51 Total Cost of Shares Purchased $55,000,000 $55,000,000 $142,000 ¹ $142,000 ¹ Note: Figures rounded to nearest $1,000. 1) While the number of ERO Shares you purchase may increase to the extent the estimated maximum amount of disputed claims become allowed in Class 8A (General Unsecured Claims) and Class 11 (Section 510 Clams) on or before emergence, the total dollar investment amount will not change. 21 21

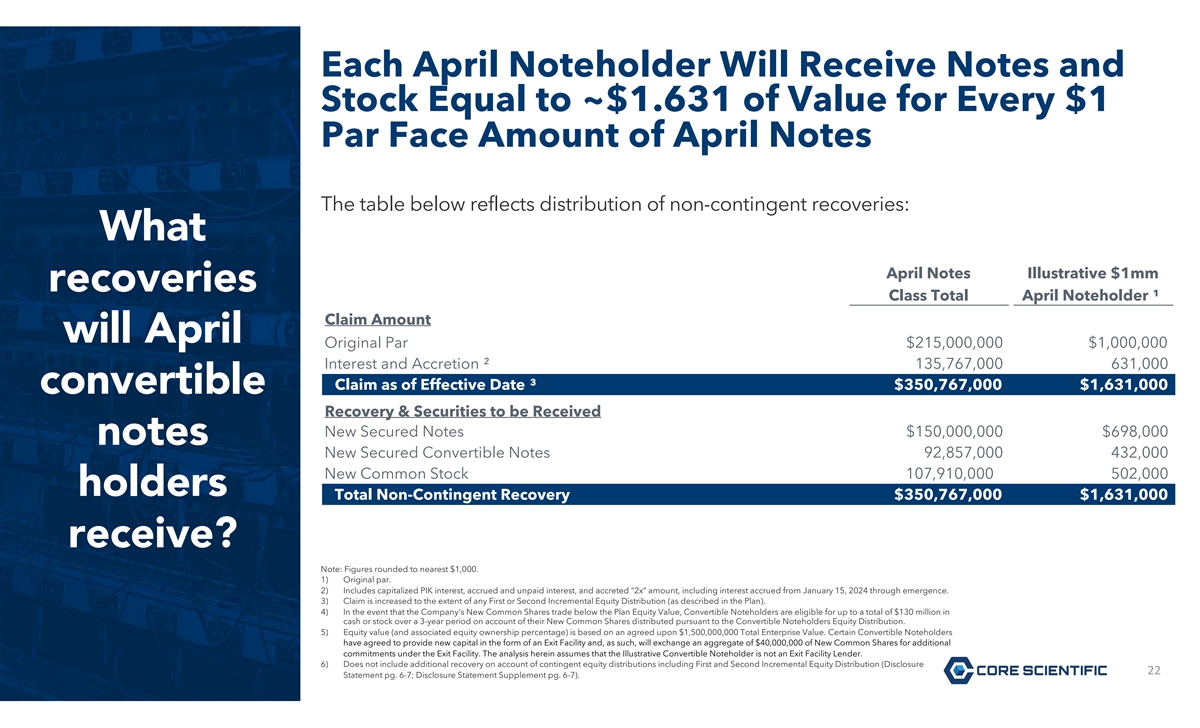

Each April Noteholder Will Receive Notes and Stock Equal to ~$1.631 of Value for Every $1 Par Face Amount of April Notes The table below reflects distribution of non-contingent recoveries: What ⁽ ⁾ April Notes Illustrative $1mm recoveries Class Total April Noteholder ¹ Claim Amount ⁽ ⁾ will April Original Par $215,000,000 $1,000,000 ⁽ ⁾ Interest and Accretion ² 135,767,000 631,000 Claim as of Effective Date ³ $350,767,000 $1,631,000 convertible Recovery & Securities to be Received New Secured Notes $150,000,000 $698,000 notes ⁽⁴⁾ ⁽⁵⁾ New Secured Convertible Notes 92,857,000 432,000 ⁽⁶⁾ New Common Stock 107,910,000 502,000 holders Total Non-Contingent Recovery $350,767,000 $1,631,000 receive? Note: Figures rounded to nearest $1,000. 1) Original par. 2) Includes capitalized PIK interest, accrued and unpaid interest, and accreted “2x” amount, including interest accrued from January 15, 2024 through emergence. 3) Claim is increased to the extent of any First or Second Incremental Equity Distribution (as described in the Plan). 4) In the event that the Company's New Common Shares trade below the Plan Equity Value, Convertible Noteholders are eligible for up to a total of $130 million in cash or stock over a 3-year period on account of their New Common Shares distributed pursuant to the Convertible Noteholders Equity Distribution. 5) Equity value (and associated equity ownership percentage) is based on an agreed upon $1,500,000,000 Total Enterprise Value. Certain Convertible Noteholders have agreed to provide new capital in the form of an Exit Facility and, as such, will exchange an aggregate of $40,000,000 of New Common Shares for additional commitments under the Exit Facility. The analysis herein assumes that the Illustrative Convertible Noteholder is not an Exit Facility Lender. 6) Does not include additional recovery on account of contingent equity distributions including First and Second Incremental Equity Distribution (Disclosure 22 22 Statement pg. 6-7; Disclosure Statement Supplement pg. 6-7).

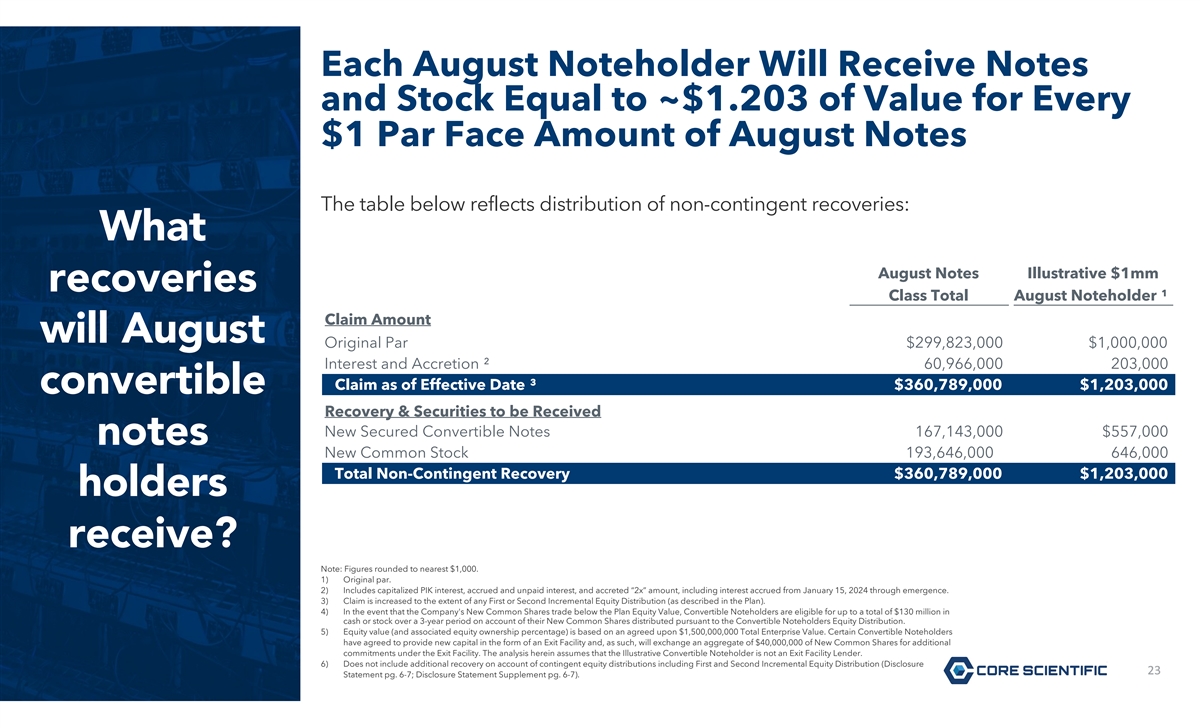

Each August Noteholder Will Receive Notes and Stock Equal to ~$1.203 of Value for Every $1 Par Face Amount of August Notes The table below reflects distribution of non-contingent recoveries: What ⁽ ⁾ August Notes Illustrative $1mm recoveries Class Total August Noteholder ¹ Claim Amount ⁽ ⁾ will August Original Par $299,823,000 $1,000,000 ⁽ ⁾ Interest and Accretion ² 60,966,000 203,000 Claim as of Effective Date ³ $360,789,000 $1,203,000 convertible Recovery & Securities to be Received ⁽⁴⁾ ⁽⁵⁾ New Secured Convertible Notes 167,143,000 $557,000 notes ⁽⁶⁾ New Common Stock 193,646,000 646,000 Total Non-Contingent Recovery $360,789,000 $1,203,000 holders receive? Note: Figures rounded to nearest $1,000. 1) Original par. 2) Includes capitalized PIK interest, accrued and unpaid interest, and accreted “2x” amount, including interest accrued from January 15, 2024 through emergence. 3) Claim is increased to the extent of any First or Second Incremental Equity Distribution (as described in the Plan). 4) In the event that the Company's New Common Shares trade below the Plan Equity Value, Convertible Noteholders are eligible for up to a total of $130 million in cash or stock over a 3-year period on account of their New Common Shares distributed pursuant to the Convertible Noteholders Equity Distribution. 5) Equity value (and associated equity ownership percentage) is based on an agreed upon $1,500,000,000 Total Enterprise Value. Certain Convertible Noteholders have agreed to provide new capital in the form of an Exit Facility and, as such, will exchange an aggregate of $40,000,000 of New Common Shares for additional commitments under the Exit Facility. The analysis herein assumes that the Illustrative Convertible Noteholder is not an Exit Facility Lender. 6) Does not include additional recovery on account of contingent equity distributions including First and Second Incremental Equity Distribution (Disclosure 23 23 Statement pg. 6-7; Disclosure Statement Supplement pg. 6-7).

Thank You. Chapter 11 Hotline: +1 (949) 404-4152, Toll-Free: +1 (888) 765-7875 TeamCoreScientific@stretto.com corescientific.com 24