EX-99.1

Published on December 21, 2022

Exhibit 99.1 Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Core Scientific Creditor Discussion Materials November 30, 2022 Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 1

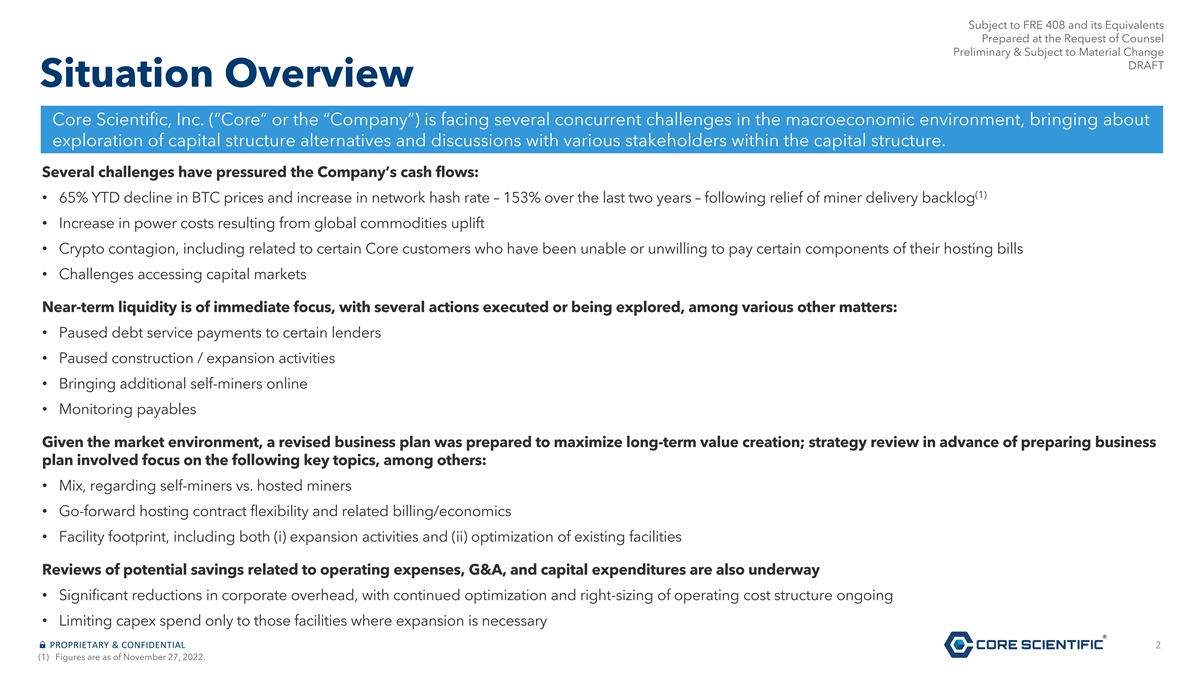

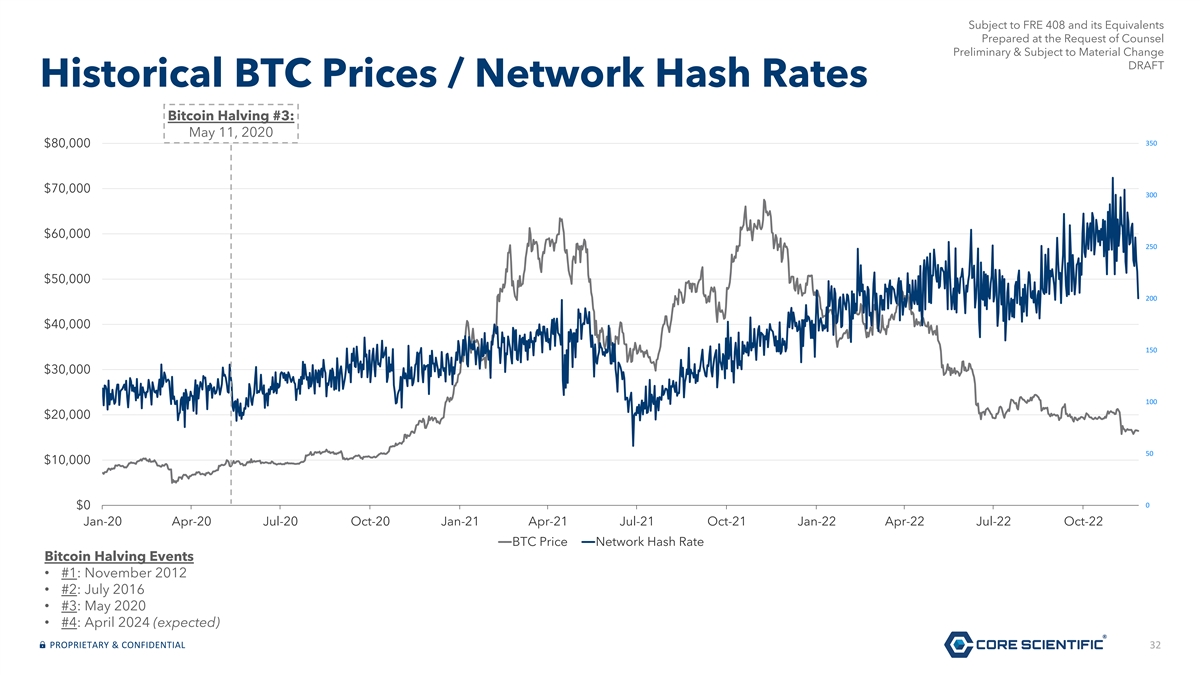

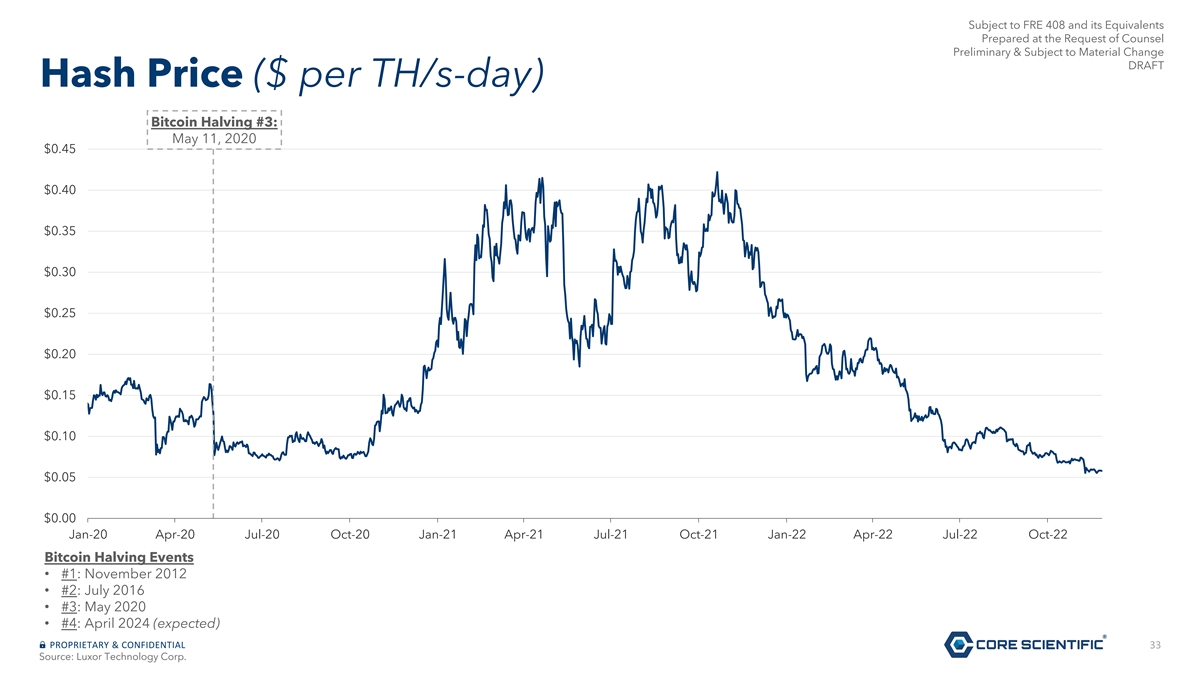

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Situation Overview Core Scientific, Inc. (“Core” or the “Company”) is facing several concurrent challenges in the macroeconomic environment, bringing about exploration of capital structure alternatives and discussions with various stakeholders within the capital structure. Several challenges have pressured the Company’s cash flows: (1) • 65% YTD decline in BTC prices and increase in network hash rate – 153% over the last two years – following relief of miner delivery backlog • Increase in power costs resulting from global commodities uplift • Crypto contagion, including related to certain Core customers who have been unable or unwilling to pay certain components of their hosting bills • Challenges accessing capital markets Near-term liquidity is of immediate focus, with several actions executed or being explored, among various other matters: • Paused debt service payments to certain lenders • Paused construction / expansion activities • Bringing additional self-miners online • Monitoring payables Given the market environment, a revised business plan was prepared to maximize long-term value creation; strategy review in advance of preparing business plan involved focus on the following key topics, among others: • Mix, regarding self-miners vs. hosted miners • Go-forward hosting contract flexibility and related billing/economics • Facility footprint, including both (i) expansion activities and (ii) optimization of existing facilities Reviews of potential savings related to operating expenses, G&A, and capital expenditures are also underway • Significant reductions in corporate overhead, with continued optimization and right-sizing of operating cost structure ongoing • Limiting capex spend only to those facilities where expansion is necessary PROPRIETARY & CONFIDENTIAL 2 (1) Figures are as of November 27, 2022.

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Highly Experienced Management Team MIKE LEVITT TODD DUCHENE MATT BROWN Co-Chairman and CEO President and Chief Legal Officer EVP, Data Center Operations RUSSELL CANN DARIN FEINSTEIN DENISE STERLING EVP, Client Services EVP, Strategy CFO MICHAEL BROS JEFF TAYLOR KATY HALL SVP, Capital Markets and SVP, Chief Information General Counsel Acquisitions Security Officer PROPRIETARY & CONFIDENTIAL 3

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Company Background Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 4

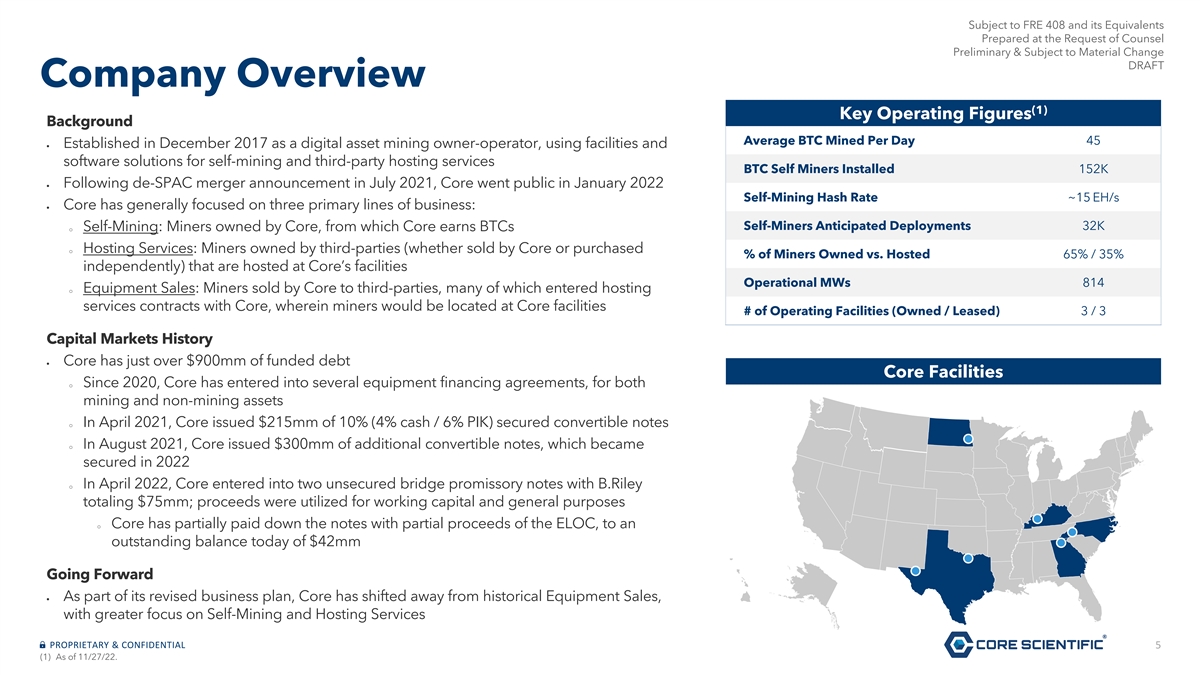

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Company Overview (1) Key Operating Figures Background Average BTC Mined Per Day 45 • Established in December 2017 as a digital asset mining owner-operator, using facilities and software solutions for self-mining and third-party hosting services BTC Self Miners Installed 152K • Following de-SPAC merger announcement in July 2021, Core went public in January 2022 Self-Mining Hash Rate ~15 EH/s • Core has generally focused on three primary lines of business: Self-Miners Anticipated Deployments 32K o Self-Mining: Miners owned by Core, from which Core earns BTCs o Hosting Services: Miners owned by third-parties (whether sold by Core or purchased % of Miners Owned vs. Hosted 65% / 35% independently) that are hosted at Core’s facilities Operational MWs 814 o Equipment Sales: Miners sold by Core to third-parties, many of which entered hosting services contracts with Core, wherein miners would be located at Core facilities # of Operating Facilities (Owned / Leased) 3 / 3 Capital Markets History • Core has just over $900mm of funded debt Core Facilities o Since 2020, Core has entered into several equipment financing agreements, for both mining and non-mining assets o In April 2021, Core issued $215mm of 10% (4% cash / 6% PIK) secured convertible notes o In August 2021, Core issued $300mm of additional convertible notes, which became secured in 2022 o In April 2022, Core entered into two unsecured bridge promissory notes with B.Riley totaling $75mm; proceeds were utilized for working capital and general purposes o Core has partially paid down the notes with partial proceeds of the ELOC, to an outstanding balance today of $42mm Going Forward • As part of its revised business plan, Core has shifted away from historical Equipment Sales, with greater focus on Self-Mining and Hosting Services PROPRIETARY & CONFIDENTIAL 5 (1) As of 11/27/22.

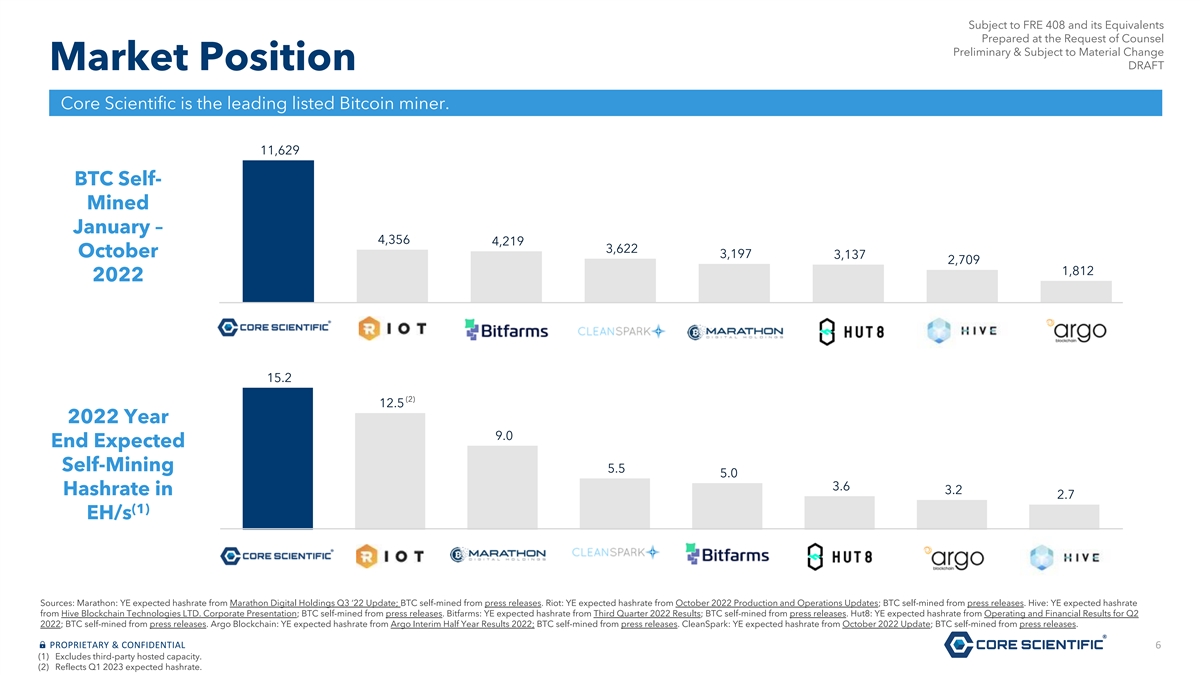

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Market Position Core Scientific is the leading listed Bitcoin miner. 11,629 BTC Self- Mined January – 4,356 4,219 3,622 October 3,197 3,137 2,709 1,812 2022 15.2 (2) 12.5 2022 Year 9.0 End Expected Self-Mining 5.5 5.0 3.6 3.2 Hashrate in 2.7 (1) EH/s Sources: Marathon: YE expected hashrate from Marathon Digital Holdings Q3 ‘22 Update; BTC self-mined from press releases. Riot: YE expected hashrate from October 2022 Production and Operations Updates; BTC self-mined from press releases. Hive: YE expected hashrate from Hive Blockchain Technologies LTD. Corporate Presentation; BTC self-mined from press releases. Bitfarms: YE expected hashrate from Third Quarter 2022 Results; BTC self-mined from press releases. Hut8: YE expected hashrate from Operating and Financial Results for Q2 2022; BTC self-mined from press releases. Argo Blockchain: YE expected hashrate from Argo Interim Half Year Results 2022; BTC self-mined from press releases. CleanSpark: YE expected hashrate from October 2022 Update; BTC self-mined from press releases. PROPRIETARY & CONFIDENTIAL 6 (1) Excludes third-party hosted capacity. (2) Reflects Q1 2023 expected hashrate.

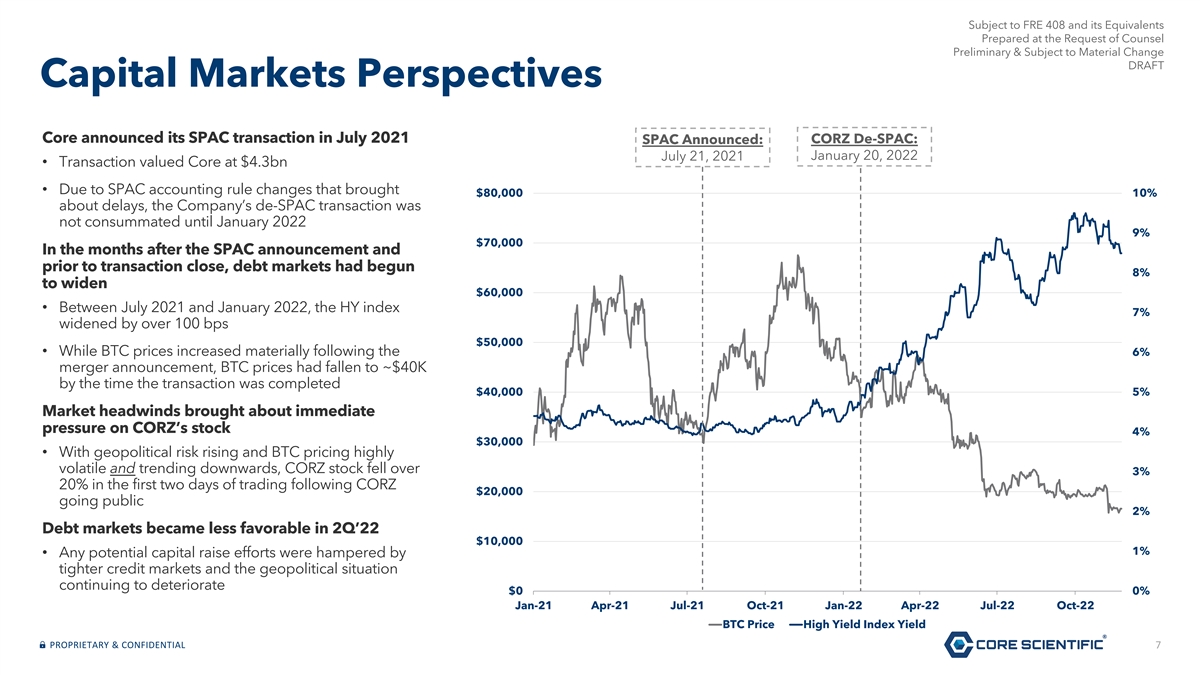

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Capital Markets Perspectives Core announced its SPAC transaction in July 2021 CORZ De-SPAC: SPAC Announced: January 20, 2022 July 21, 2021 • Transaction valued Core at $4.3bn • Due to SPAC accounting rule changes that brought $80,000 10% about delays, the Company’s de-SPAC transaction was not consummated until January 2022 9% $70,000 In the months after the SPAC announcement and prior to transaction close, debt markets had begun 8% to widen $60,000 • Between July 2021 and January 2022, the HY index 7% widened by over 100 bps $50,000 • While BTC prices increased materially following the 6% merger announcement, BTC prices had fallen to ~$40K by the time the transaction was completed $40,000 5% Market headwinds brought about immediate pressure on CORZ’s stock 4% $30,000 • With geopolitical risk rising and BTC pricing highly volatile and trending downwards, CORZ stock fell over 3% 20% in the first two days of trading following CORZ $20,000 going public 2% Debt markets became less favorable in 2Q’22 $10,000 1% • Any potential capital raise efforts were hampered by tighter credit markets and the geopolitical situation continuing to deteriorate $0 0% Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 BTC Price High Yield Index Yield PROPRIETARY & CONFIDENTIAL 7

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Hosting Operations Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 8

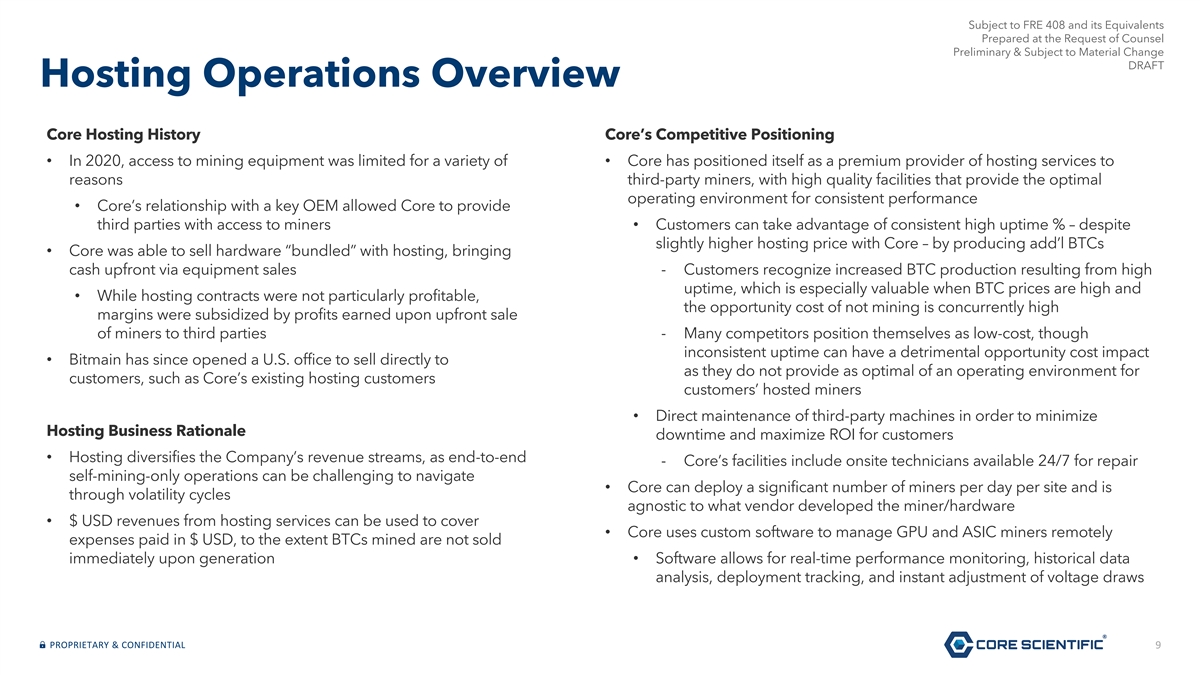

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Hosting Operations Overview Core Hosting History Core’s Competitive Positioning • In 2020, access to mining equipment was limited for a variety of • Core has positioned itself as a premium provider of hosting services to reasons third-party miners, with high quality facilities that provide the optimal operating environment for consistent performance • Core’s relationship with a key OEM allowed Core to provide third parties with access to miners• Customers can take advantage of consistent high uptime % – despite slightly higher hosting price with Core – by producing add’l BTCs • Core was able to sell hardware “bundled” with hosting, bringing cash upfront via equipment sales - Customers recognize increased BTC production resulting from high uptime, which is especially valuable when BTC prices are high and • While hosting contracts were not particularly profitable, the opportunity cost of not mining is concurrently high margins were subsidized by profits earned upon upfront sale of miners to third parties - Many competitors position themselves as low-cost, though inconsistent uptime can have a detrimental opportunity cost impact • Bitmain has since opened a U.S. office to sell directly to as they do not provide as optimal of an operating environment for customers, such as Core’s existing hosting customers customers’ hosted miners • Direct maintenance of third-party machines in order to minimize Hosting Business Rationale downtime and maximize ROI for customers • Hosting diversifies the Company’s revenue streams, as end-to-end - Core’s facilities include onsite technicians available 24/7 for repair self-mining-only operations can be challenging to navigate • Core can deploy a significant number of miners per day per site and is through volatility cycles agnostic to what vendor developed the miner/hardware • $ USD revenues from hosting services can be used to cover • Core uses custom software to manage GPU and ASIC miners remotely expenses paid in $ USD, to the extent BTCs mined are not sold immediately upon generation• Software allows for real-time performance monitoring, historical data analysis, deployment tracking, and instant adjustment of voltage draws PROPRIETARY & CONFIDENTIAL 9

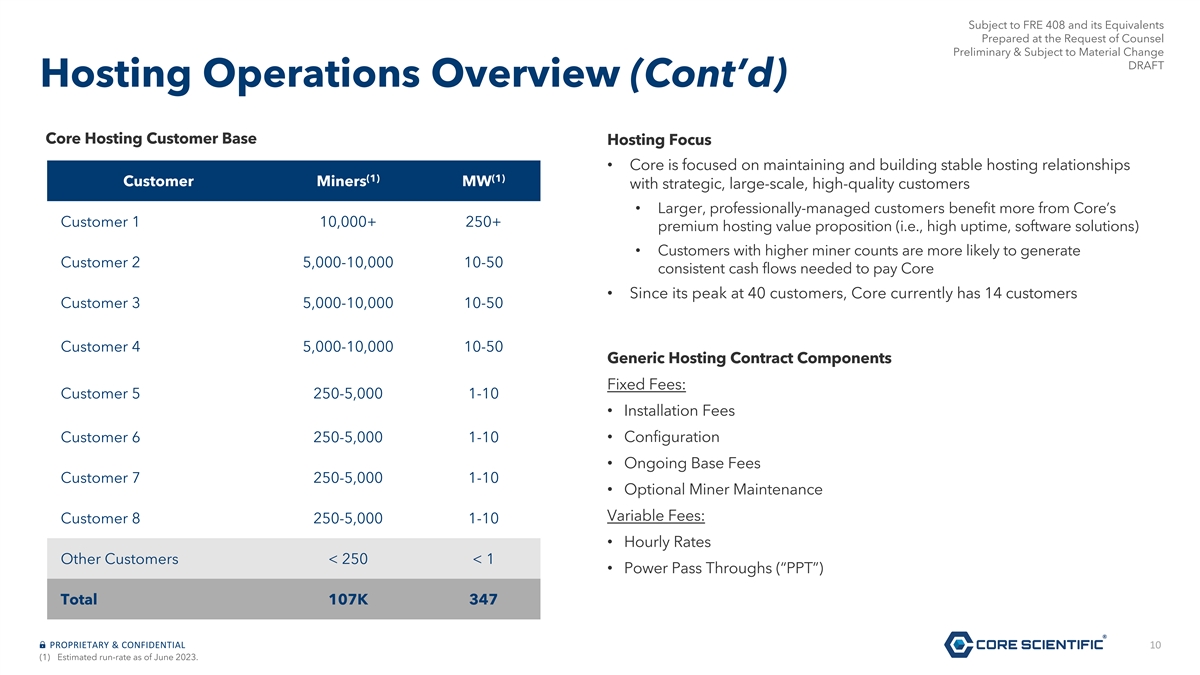

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Hosting Operations Overview (Cont’d) Core Hosting Customer Base Hosting Focus • Core is focused on maintaining and building stable hosting relationships (1) (1) Customer Miners MW with strategic, large-scale, high-quality customers • Larger, professionally-managed customers benefit more from Core’s Customer 1 10,000+ 250+ premium hosting value proposition (i.e., high uptime, software solutions) • Customers with higher miner counts are more likely to generate Customer 2 5,000-10,000 10-50 consistent cash flows needed to pay Core • Since its peak at 40 customers, Core currently has 14 customers Customer 3 5,000-10,000 10-50 Customer 4 5,000-10,000 10-50 Generic Hosting Contract Components Fixed Fees: Customer 5 250-5,000 1-10 • Installation Fees Customer 6 250-5,000 1-10• Configuration • Ongoing Base Fees Customer 7 250-5,000 1-10 • Optional Miner Maintenance Variable Fees: Customer 8 250-5,000 1-10 • Hourly Rates Other Customers < 250 < 1 • Power Pass Throughs (“PPT”) Total 107K 347 PROPRIETARY & CONFIDENTIAL 10 (1) Estimated run-rate as of June 2023.

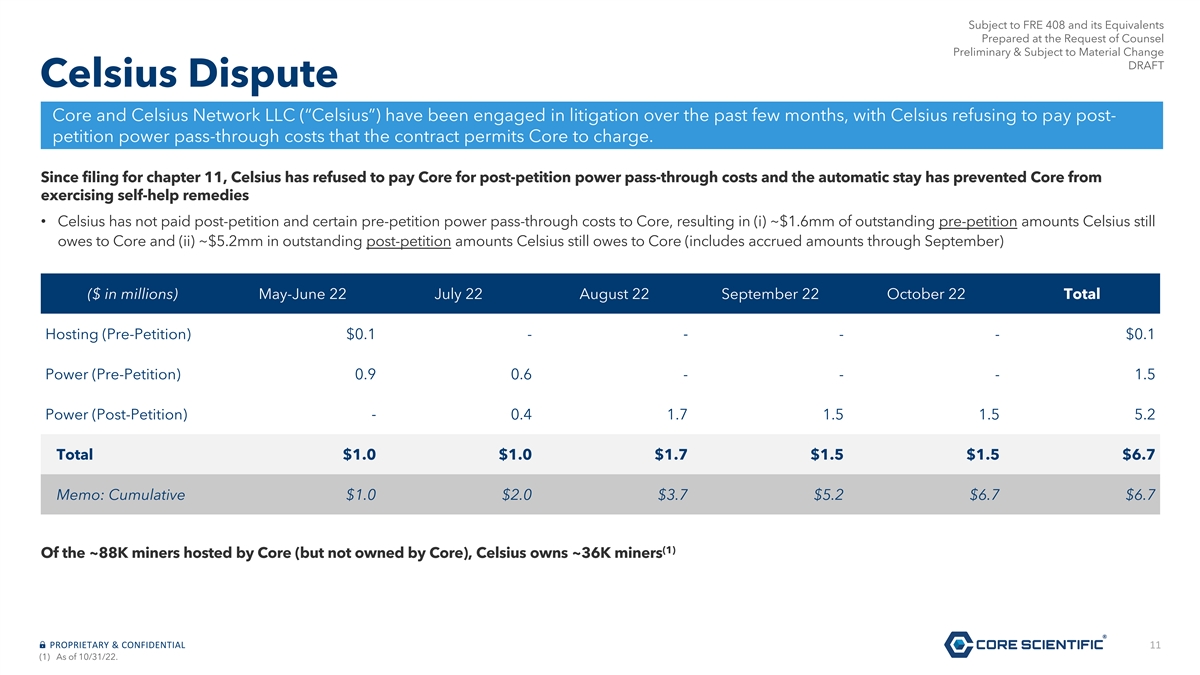

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Celsius Dispute Core and Celsius Network LLC (“Celsius”) have been engaged in litigation over the past few months, with Celsius refusing to pay post- petition power pass-through costs that the contract permits Core to charge. Since filing for chapter 11, Celsius has refused to pay Core for post-petition power pass-through costs and the automatic stay has prevented Core from exercising self-help remedies • Celsius has not paid post-petition and certain pre-petition power pass-through costs to Core, resulting in (i) ~$1.6mm of outstanding pre-petition amounts Celsius still owes to Core and (ii) ~$5.2mm in outstanding post-petition amounts Celsius still owes to Core (includes accrued amounts through September) ($ in millions) May-June 22 July 22 August 22 September 22 October 22 Total Hosting (Pre-Petition) $0.1 - - - - $0.1 Power (Pre-Petition) 0.9 0.6 - - - 1.5 - Power (Post-Petition) 0.4 1.7 1.5 1.5 5.2 Total $1.0 $1.0 $1.7 $1.5 $1.5 $6.7 Memo: Cumulative $1.0 $2.0 $3.7 $5.2 $6.7 $6.7 (1) Of the ~88K miners hosted by Core (but not owned by Core), Celsius owns ~36K miners PROPRIETARY & CONFIDENTIAL 11 (1) As of 10/31/22.

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Self-Mining Operations Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 12

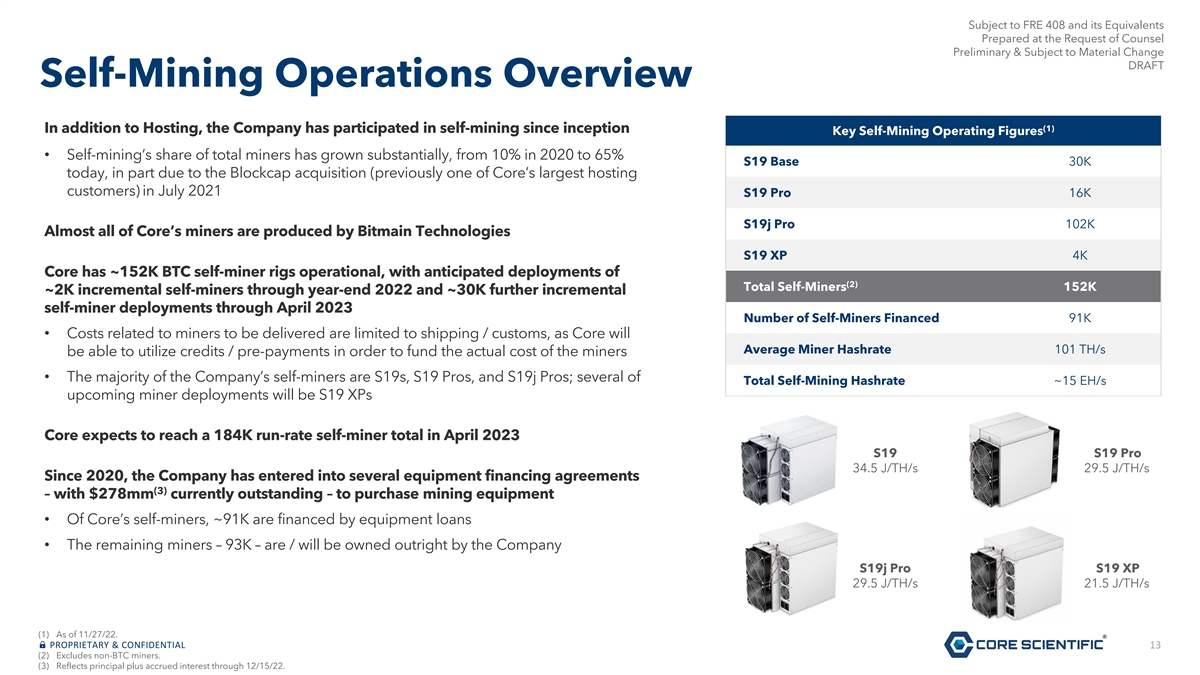

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Self-Mining Operations Overview (1) In addition to Hosting, the Company has participated in self-mining since inception Key Self-Mining Operating Figures • Self-mining’s share of total miners has grown substantially, from 10% in 2020 to 65% S19 Base 30K today, in part due to the Blockcap acquisition (previously one of Core’s largest hosting customers) in July 2021 S19 Pro 16K S19j Pro 102K Almost all of Core’s miners are produced by Bitmain Technologies S19 XP 4K Core has ~152K BTC self-miner rigs operational, with anticipated deployments of (2) Total Self-Miners 152K ~2K incremental self-miners through year-end 2022 and ~30K further incremental self-miner deployments through April 2023 Number of Self-Miners Financed 91K • Costs related to miners to be delivered are limited to shipping / customs, as Core will Average Miner Hashrate 101 TH/s be able to utilize credits / pre-payments in order to fund the actual cost of the miners • The majority of the Company’s self-miners are S19s, S19 Pros, and S19j Pros; several of Total Self-Mining Hashrate ~15 EH/s upcoming miner deployments will be S19 XPs Core expects to reach a 184K run-rate self-miner total in April 2023 S19 S19 Pro 34.5 J/TH/s 29.5 J/TH/s Since 2020, the Company has entered into several equipment financing agreements (3) – with $278mm currently outstanding – to purchase mining equipment • Of Core’s self-miners, ~91K are financed by equipment loans • The remaining miners – 93K – are / will be owned outright by the Company S19j Pro S19 XP 29.5 J/TH/s 21.5 J/TH/s (1) As of 11/27/22. PROPRIETARY & CONFIDENTIAL 13 (2) Excludes non-BTC miners. (3) Reflects principal plus accrued interest through 12/15/22.

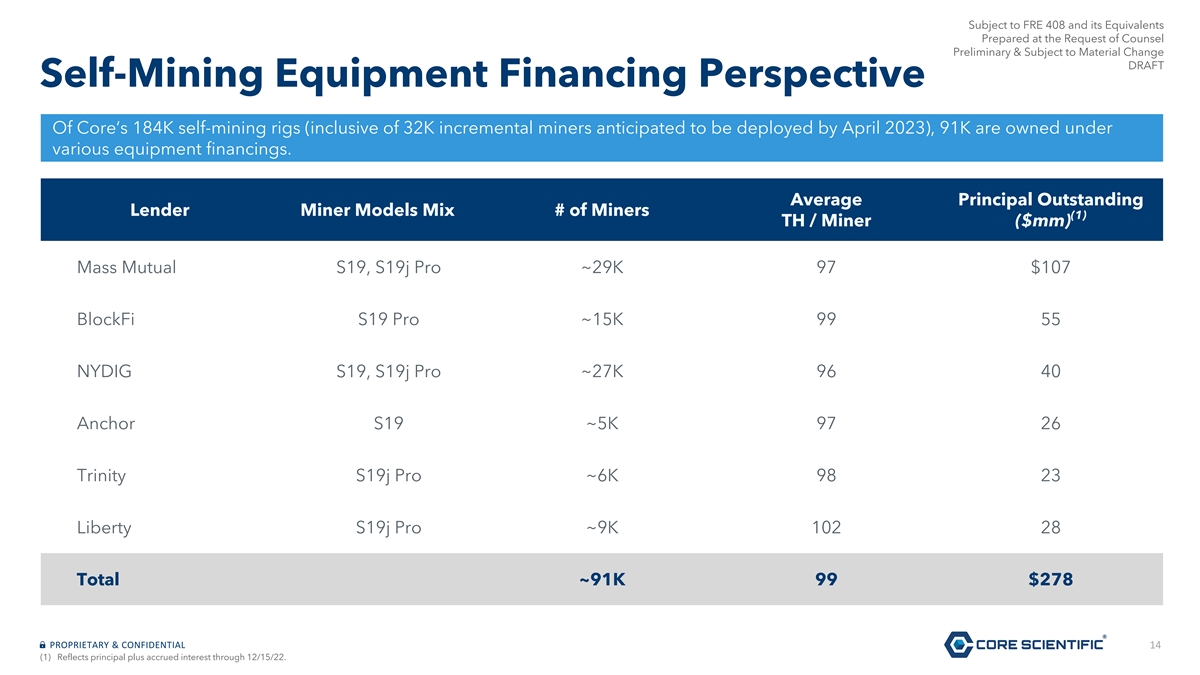

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Self-Mining Equipment Financing Perspective Of Core’s 184K self-mining rigs (inclusive of 32K incremental miners anticipated to be deployed by April 2023), 91K are owned under various equipment financings. Average Principal Outstanding Lender Miner Models Mix # of Miners (1) TH / Miner ($mm) Mass Mutual S19, S19j Pro ~29K 97 $107 BlockFi S19 Pro ~15K 99 55 NYDIG S19, S19j Pro ~27K 96 40 Anchor S19 ~5K 97 26 Trinity S19j Pro ~6K 98 23 Liberty S19j Pro ~9K 102 28 Total ~91K 99 $278 PROPRIETARY & CONFIDENTIAL 14 (1) Reflects principal plus accrued interest through 12/15/22.

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT General Operations Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 15

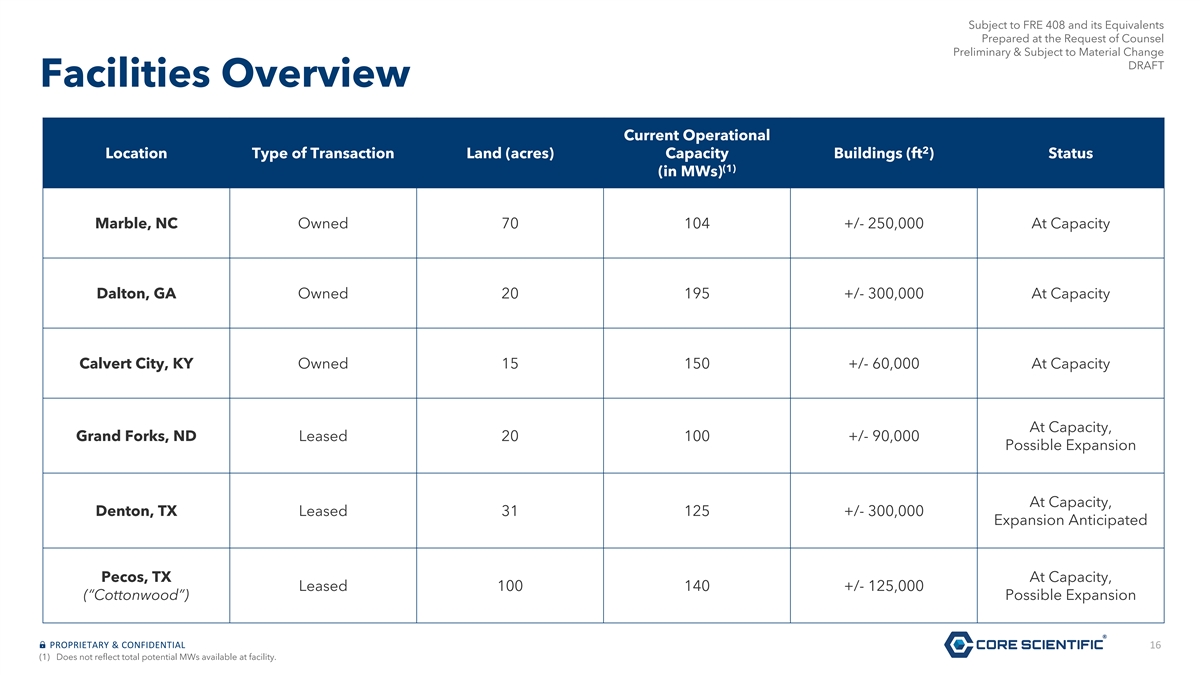

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Facilities Overview Current Operational 2 Location Type of Transaction Land (acres) Capacity Buildings (ft ) Status (1) (in MWs) Marble, NC Owned 70 104 +/- 250,000 At Capacity Dalton, GA Owned 20 195 +/- 300,000 At Capacity Calvert City, KY Owned 15 150 +/- 60,000 At Capacity At Capacity, Grand Forks, ND Leased 20 100 +/- 90,000 Possible Expansion At Capacity, Denton, TX Leased 31 125 +/- 300,000 Expansion Anticipated Pecos, TX At Capacity, Leased 100 140 +/- 125,000 (“Cottonwood”) Possible Expansion PROPRIETARY & CONFIDENTIAL 16 (1) Does not reflect total potential MWs available at facility.

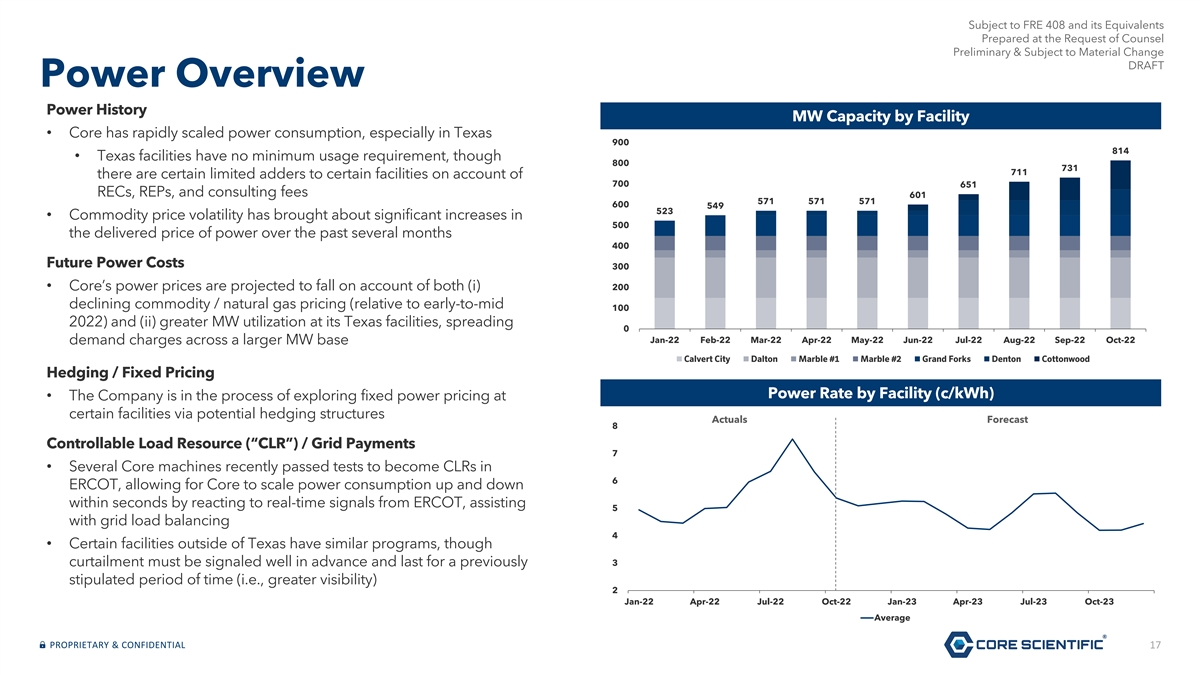

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Power Overview Power History MW Capacity by Facility • Core has rapidly scaled power consumption, especially in Texas 900 814 • Texas facilities have no minimum usage requirement, though 800 731 711 there are certain limited adders to certain facilities on account of 700 651 RECs, REPs, and consulting fees 601 571 571 571 600 549 523 • Commodity price volatility has brought about significant increases in 500 the delivered price of power over the past several months 400 Future Power Costs 300 • Core’s power prices are projected to fall on account of both (i) 200 declining commodity / natural gas pricing (relative to early-to-mid 100 2022) and (ii) greater MW utilization at its Texas facilities, spreading 0 Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 demand charges across a larger MW base Calvert City Dalton Marble #1 Marble #2 Grand Forks Denton Cottonwood Total Hedging / Fixed Pricing Power Rate by Facility (c/kWh) • The Company is in the process of exploring fixed power pricing at certain facilities via potential hedging structures Actuals Forecast 8 Controllable Load Resource (“CLR”) / Grid Payments 7 • Several Core machines recently passed tests to become CLRs in 6 ERCOT, allowing for Core to scale power consumption up and down within seconds by reacting to real-time signals from ERCOT, assisting 5 with grid load balancing 4 • Certain facilities outside of Texas have similar programs, though 3 curtailment must be signaled well in advance and last for a previously stipulated period of time (i.e., greater visibility) 2 Jan-22 Apr-22 Jul-22 Oct-22 Jan-23 Apr-23 Jul-23 Oct-23 Average PROPRIETARY & CONFIDENTIAL 17

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Power Background by Facility Current Operational Total Available Capacity Facility Location Power Company Term / Expiration Capacity (MW) (MW) Marble 1 Marble, NC 35 35 TVA-Murphy Power Auto-renewal Marble 2 Marble, NC 69 69 Duke Carolinas Dec. 2022 Dalton Brown Dalton, GA 53 53 Dalton Utilities Dec. 2022 Dalton Green Dalton, GA 142 142 Dalton Utilities Dec. 2022 TVA Calvert Calvert City, KY 150 150 TVA Direct Apr. 2029 Grand Forks Grand Forks, ND 100 100 Minnkota / NoDak Dec. 2026 ERCOT (Supplier: City of Denton Denton, TX 125 297 Sept. 2028 Denton) Cottonwood Pecos, TX 140 140 ERCOT (Supplier: Shell) 1 month PROPRIETARY & CONFIDENTIAL 18

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Expansion Overview Denton Expansion • Denton build-out in process throughout 2022, with 125MW of current capacity • Core anticipates expanding the Denton site • Denton expansion anticipated to cost an incremental ~$42mm (inclusive of past due invoices and power deposits, subject to continuing review) with payments anticipated between March 2023 and May 2023 • Expansion would add an additional 172MW - Implies cost per incremental MW of ~$200K (excl. power deposits) - Following completion of expansion, Denton capacity will be 297MW • Future Denton expansion predicated on committed hosting demand • Certain hosting customers have expressed a desire to increase their hosting presence with Core • Core’s hosting services are particularly attractive to customers given the Company’s focus on operating the highest quality facilities, which utilize impactful software and result in the high uptime for customers PROPRIETARY & CONFIDENTIAL 19

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Near-Term Liquidity Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 20

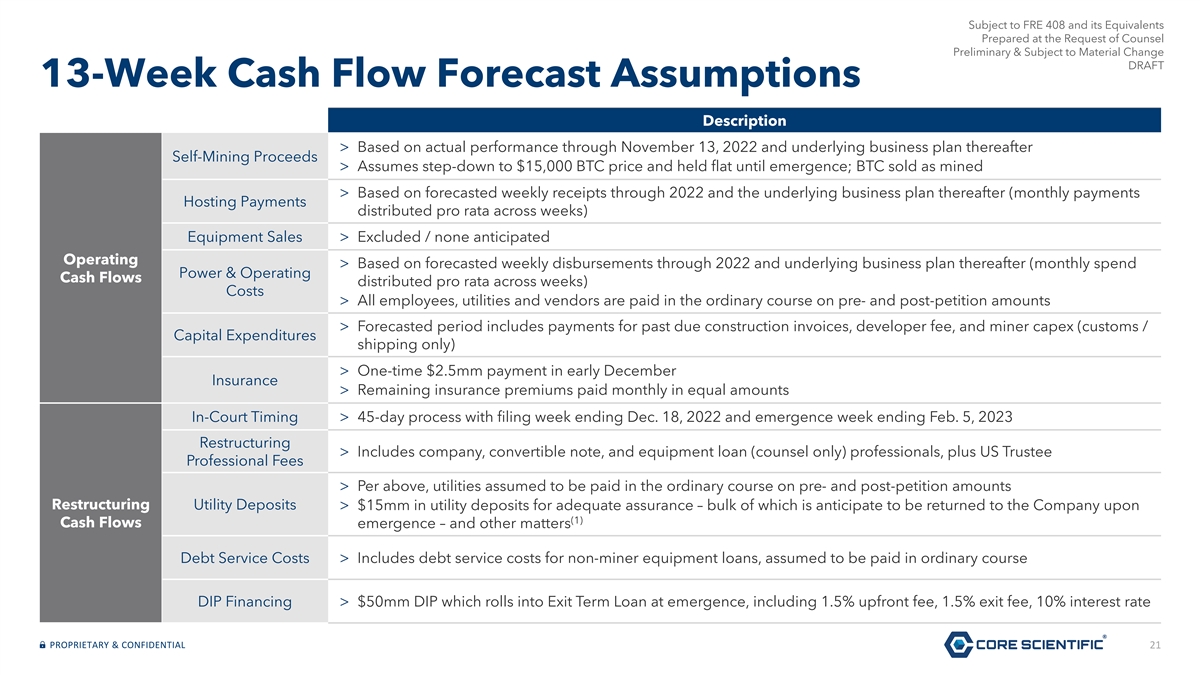

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT 13-Week Cash Flow Forecast Assumptions Description > Based on actual performance through November 13, 2022 and underlying business plan thereafter Self-Mining Proceeds > Assumes step-down to $15,000 BTC price and held flat until emergence; BTC sold as mined > Based on forecasted weekly receipts through 2022 and the underlying business plan thereafter (monthly payments Hosting Payments distributed pro rata across weeks) Equipment Sales > Excluded / none anticipated Operating > Based on forecasted weekly disbursements through 2022 and underlying business plan thereafter (monthly spend Power & Operating Cash Flows distributed pro rata across weeks) Costs > All employees, utilities and vendors are paid in the ordinary course on pre- and post-petition amounts > Forecasted period includes payments for past due construction invoices, developer fee, and miner capex (customs / Capital Expenditures shipping only) > One-time $2.5mm payment in early December Insurance > Remaining insurance premiums paid monthly in equal amounts In-Court Timing > 45-day process with filing week ending Dec. 18, 2022 and emergence week ending Feb. 5, 2023 Restructuring > Includes company, convertible note, and equipment loan (counsel only) professionals, plus US Trustee Professional Fees > Per above, utilities assumed to be paid in the ordinary course on pre- and post-petition amounts Restructuring Utility Deposits > $15mm in utility deposits for adequate assurance – bulk of which is anticipate to be returned to the Company upon (1) Cash Flows emergence – and other matters Debt Service Costs > Includes debt service costs for non-miner equipment loans, assumed to be paid in ordinary course DIP Financing > $50mm DIP which rolls into Exit Term Loan at emergence, including 1.5% upfront fee, 1.5% exit fee, 10% interest rate PROPRIETARY & CONFIDENTIAL 21

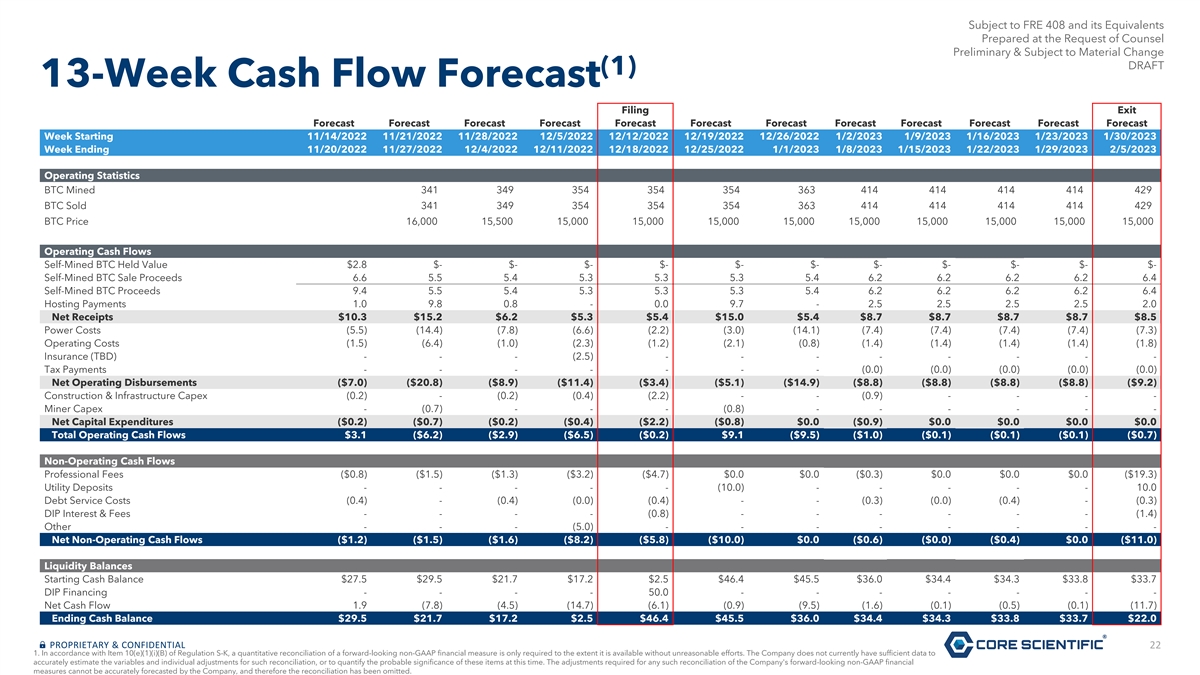

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT (1) 13-Week Cash Flow Forecast Filing Exit Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Forecast Week Starting 11/14/2022 11/21/2022 11/28/2022 12/5/2022 12/12/2022 12/19/2022 12/26/2022 1/2/2023 1/9/2023 1/16/2023 1/23/2023 1/30/2023 Week Ending 11/20/2022 11/27/2022 12/4/2022 12/11/2022 12/18/2022 12/25/2022 1/1/2023 1/8/2023 1/15/2023 1/22/2023 1/29/2023 2/5/2023 Operating Statistics BTC Mined 341 349 354 354 354 363 414 414 414 414 429 BTC Sold 341 349 354 354 354 363 414 414 414 414 429 BTC Price 16,000 15,500 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 15,000 Operating Cash Flows Self-Mined BTC Held Value $2.8 $- $- $- $- $- $- $- $- $- $- $- Self-Mined BTC Sale Proceeds 6.6 5.5 5.4 5.3 5.3 5.3 5.4 6.2 6.2 6.2 6.2 6.4 Self-Mined BTC Proceeds 9.4 5.5 5.4 5.3 5.3 5.3 5.4 6.2 6.2 6.2 6.2 6.4 Hosting Payments 1.0 9.8 0.8 - 0.0 9.7 - 2.5 2.5 2.5 2.5 2.0 Net Receipts $10.3 $15.2 $6.2 $5.3 $5.4 $15.0 $5.4 $8.7 $8.7 $8.7 $8.7 $8.5 Power Costs (5.5) (14.4) (7.8) (6.6) (2.2) (3.0) (14.1) (7.4) (7.4) (7.4) (7.4) (7.3) Operating Costs (1.5) (6.4) (1.0) (2.3) (1.2) (2.1) (0.8) (1.4) (1.4) (1.4) (1.4) (1.8) Insurance (TBD) - - - (2.5) - - - - - - - - Tax Payments - - - - - - - (0.0) (0.0) (0.0) (0.0) (0.0) Net Operating Disbursements ($7.0) ($20.8) ($8.9) ($11.4) ($3.4) ($5.1) ($14.9) ($8.8) ($8.8) ($8.8) ($8.8) ($9.2) Construction & Infrastructure Capex (0.2) - (0.2) (0.4) (2.2) - - (0.9) - - - - Miner Capex - (0.7) - - - (0.8) - - - - - - Net Capital Expenditures ($0.2) ($0.7) ($0.2) ($0.4) ($2.2) ($0.8) $0.0 ($0.9) $0.0 $0.0 $0.0 $0.0 Total Operating Cash Flows $3.1 ($6.2) ($2.9) ($6.5) ($0.2) $9.1 ($9.5) ($1.0) ($0.1) ($0.1) ($0.1) ($0.7) Non-Operating Cash Flows Professional Fees ($0.8) ($1.5) ($1.3) ($3.2) ($4.7) $0.0 $0.0 ($0.3) $0.0 $0.0 $0.0 ($19.3) Utility Deposits - - - - - (10.0) - - - - - 10.0 Debt Service Costs (0.4) - (0.4) (0.0) (0.4) - - (0.3) (0.0) (0.4) - (0.3) DIP Interest & Fees - - - - (0.8) - - - - - - (1.4) Other - - - (5.0) - - - - - - - - Net Non-Operating Cash Flows ($1.2) ($1.5) ($1.6) ($8.2) ($5.8) ($10.0) $0.0 ($0.6) ($0.0) ($0.4) $0.0 ($11.0) Liquidity Balances Starting Cash Balance $27.5 $29.5 $21.7 $17.2 $2.5 $46.4 $45.5 $36.0 $34.4 $34.3 $33.8 $33.7 DIP Financing - - - - 50.0 - - - - - - - Net Cash Flow 1.9 (7.8) (4.5) (14.7) (6.1) (0.9) (9.5) (1.6) (0.1) (0.5) (0.1) (11.7) Ending Cash Balance $29.5 $21.7 $17.2 $2.5 $46.4 $45.5 $36.0 $34.4 $34.3 $33.8 $33.7 $22.0 PROPRIETARY & CONFIDENTIAL 22 1. In accordance with Item 10(e)(1)(i)(B) of Regulation S-K, a quantitative reconciliation of a forward-looking non-GAAP financial measure is only required to the extent it is available without unreasonable efforts. The Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation, or to quantify the probable significance of these items at this time. The adjustments required for any such reconciliation of the Company's forward-looking non-GAAP financial measures cannot be accurately forecasted by the Company, and therefore the reconciliation has been omitted.

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Business Plan Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 23

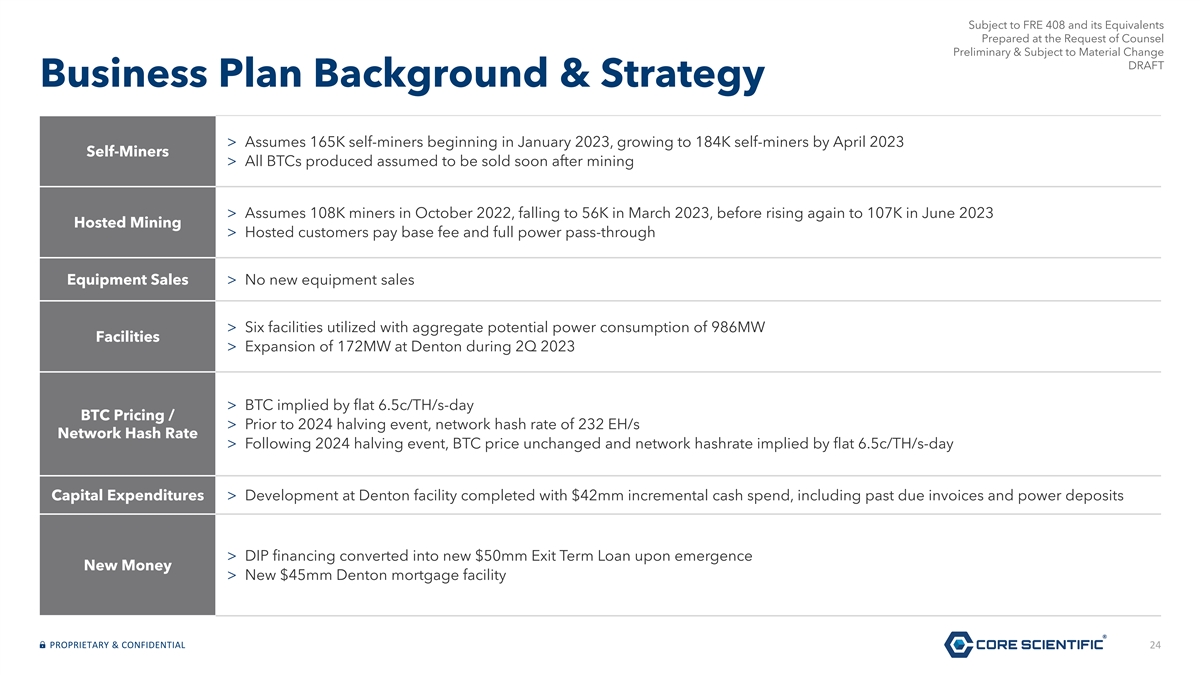

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Business Plan Background & Strategy > Assumes 165K self-miners beginning in January 2023, growing to 184K self-miners by April 2023 Self-Miners > All BTCs produced assumed to be sold soon after mining > Assumes 108K miners in October 2022, falling to 56K in March 2023, before rising again to 107K in June 2023 Hosted Mining > Hosted customers pay base fee and full power pass-through Equipment Sales > No new equipment sales > Six facilities utilized with aggregate potential power consumption of 986MW Facilities > Expansion of 172MW at Denton during 2Q 2023 > BTC implied by flat 6.5c/TH/s-day BTC Pricing / > Prior to 2024 halving event, network hash rate of 232 EH/s Network Hash Rate > Following 2024 halving event, BTC price unchanged and network hashrate implied by flat 6.5c/TH/s-day Capital Expenditures > Development at Denton facility completed with $42mm incremental cash spend, including past due invoices and power deposits > DIP financing converted into new $50mm Exit Term Loan upon emergence New Money > New $45mm Denton mortgage facility PROPRIETARY & CONFIDENTIAL 24

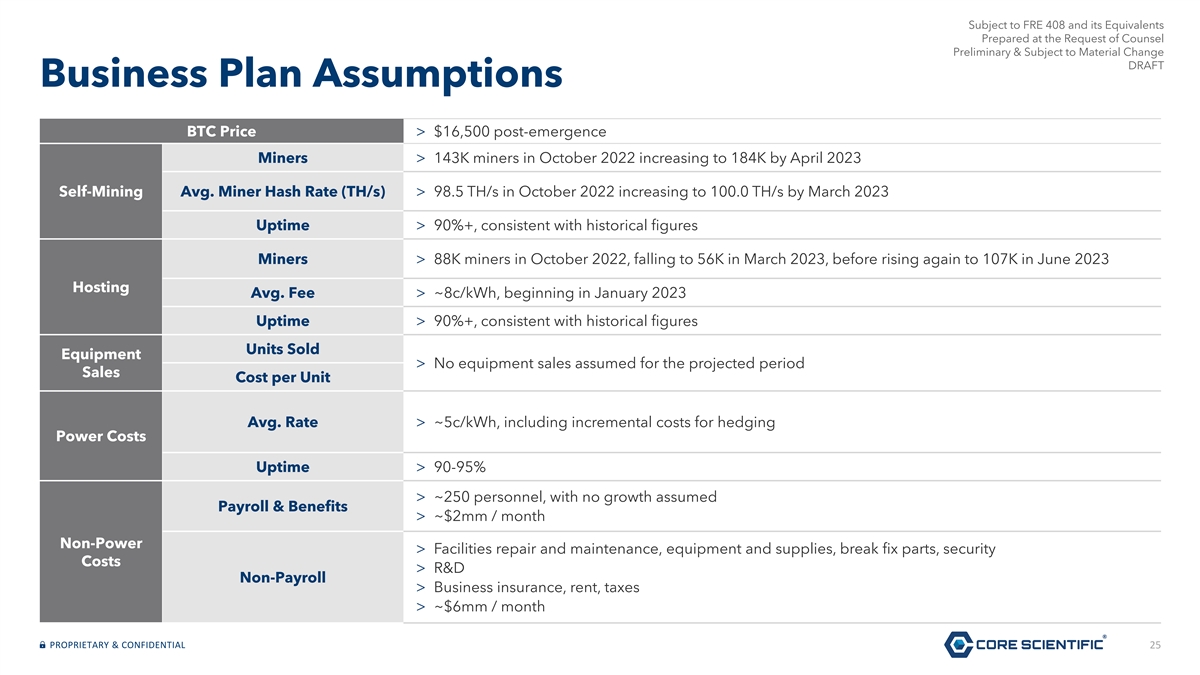

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Business Plan Assumptions BTC Price > $16,500 post-emergence Miners > 143K miners in October 2022 increasing to 184K by April 2023 Self-Mining Avg. Miner Hash Rate (TH/s) > 98.5 TH/s in October 2022 increasing to 100.0 TH/s by March 2023 Uptime > 90%+, consistent with historical figures Miners > 88K miners in October 2022, falling to 56K in March 2023, before rising again to 107K in June 2023 Hosting Avg. Fee > ~8c/kWh, beginning in January 2023 Uptime > 90%+, consistent with historical figures Units Sold Equipment > No equipment sales assumed for the projected period Sales Cost per Unit Avg. Rate > ~5c/kWh, including incremental costs for hedging Power Costs Uptime > 90-95% > ~250 personnel, with no growth assumed Payroll & Benefits > ~$2mm / month Non-Power > Facilities repair and maintenance, equipment and supplies, break fix parts, security Costs > R&D Non-Payroll > Business insurance, rent, taxes > ~$6mm / month PROPRIETARY & CONFIDENTIAL 25

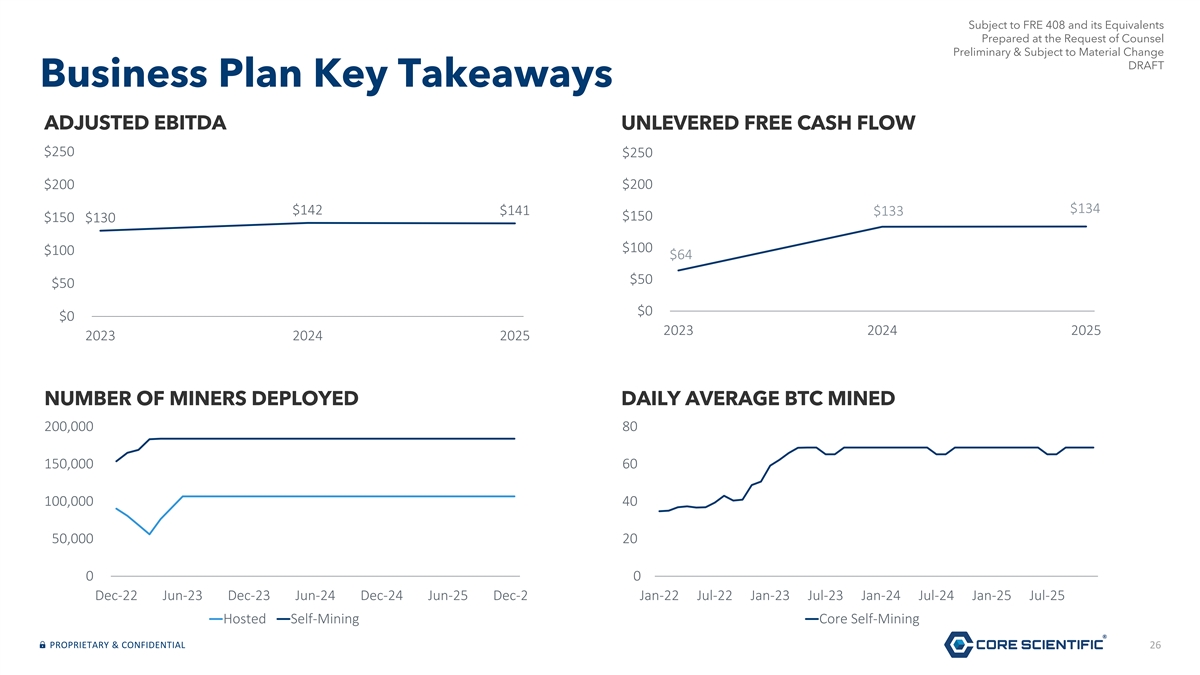

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Business Plan Key Takeaways ADJUSTED EBITDA UNLEVERED FREE CASH FLOW $250 $250 $200 $200 $134 $142 $141 $133 $150 $150 $130 $100 $100 $64 $50 $50 $0 $0 2023 2024 2025 2023 2024 2025 NUMBER OF MINERS DEPLOYED DAILY AVERAGE BTC MINED 200,000 80 150,000 60 100,000 40 50,000 20 0 0 Dec-22 Jun-23 Dec-23 Jun-24 Dec-24 Jun-25 Dec-25 Jan-22 Jul-22 Jan-23 Jul-23 Jan-24 Jul-24 Jan-25 Jul-25 Hosted Self-Mining Core Self-Mining PROPRIETARY & CONFIDENTIAL 26

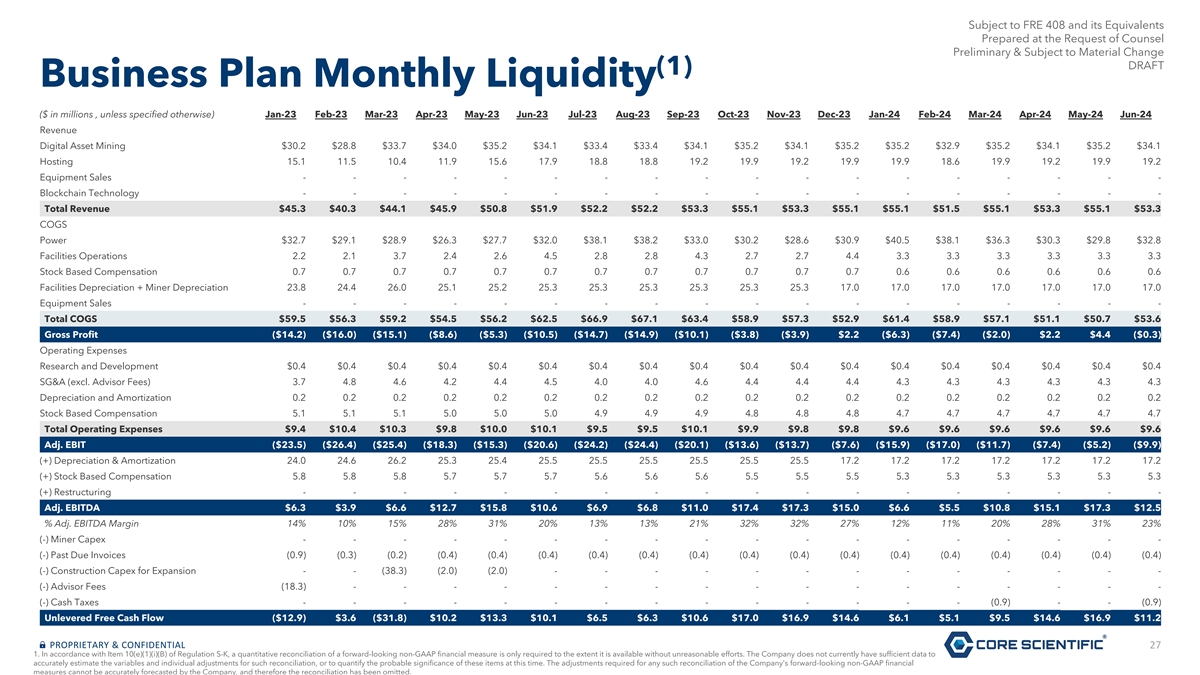

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT (1) Business Plan Monthly Liquidity ($ in millions , unless specified otherwise) Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23 Jul-23 Aug-23 Sep-23 Oct-23 Nov-23 Dec-23 Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Revenue Digital Asset Mining $30.2 $28.8 $33.7 $34.0 $35.2 $34.1 $33.4 $33.4 $34.1 $35.2 $34.1 $35.2 $35.2 $32.9 $35.2 $34.1 $35.2 $34.1 Hosting 15.1 11.5 10.4 11.9 15.6 17.9 18.8 18.8 19.2 19.9 19.2 19.9 19.9 18.6 19.9 19.2 19.9 19.2 Equipment Sales - - - - - - - - - - - - - - - - - - Blockchain Technology - - - - - - - - - - - - - - - - - - Total Revenue $45.3 $40.3 $44.1 $45.9 $50.8 $51.9 $52.2 $52.2 $53.3 $55.1 $53.3 $55.1 $55.1 $51.5 $55.1 $53.3 $55.1 $53.3 COGS Power $32.7 $29.1 $28.9 $26.3 $27.7 $32.0 $38.1 $38.2 $33.0 $30.2 $28.6 $30.9 $40.5 $38.1 $36.3 $30.3 $29.8 $32.8 Facilities Operations 2.2 2.1 3.7 2.4 2.6 4.5 2.8 2.8 4.3 2.7 2.7 4.4 3.3 3.3 3.3 3.3 3.3 3.3 Stock Based Compensation 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.7 0.6 0.6 0.6 0.6 0.6 0.6 Facilities Depreciation + Miner Depreciation 23.8 24.4 26.0 25.1 25.2 25.3 25.3 25.3 25.3 25.3 25.3 17.0 17.0 17.0 17.0 17.0 17.0 17.0 Equipment Sales - - - - - - - - - - - - - - - - - - Total COGS $59.5 $56.3 $59.2 $54.5 $56.2 $62.5 $66.9 $67.1 $63.4 $58.9 $57.3 $52.9 $61.4 $58.9 $57.1 $51.1 $50.7 $53.6 Gross Profit ($14.2) ($16.0) ($15.1) ($8.6) ($5.3) ($10.5) ($14.7) ($14.9) ($10.1) ($3.8) ($3.9) $2.2 ($6.3) ($7.4) ($2.0) $2.2 $4.4 ($0.3) Operating Expenses Research and Development $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 $0.4 SG&A (excl. Advisor Fees) 3.7 4.8 4.6 4.2 4.4 4.5 4.0 4.0 4.6 4.4 4.4 4.4 4.3 4.3 4.3 4.3 4.3 4.3 Depreciation and Amortization 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 0.2 Stock Based Compensation 5.1 5.1 5.1 5.0 5.0 5.0 4.9 4.9 4.9 4.8 4.8 4.8 4.7 4.7 4.7 4.7 4.7 4.7 Total Operating Expenses $9.4 $10.4 $10.3 $9.8 $10.0 $10.1 $9.5 $9.5 $10.1 $9.9 $9.8 $9.8 $9.6 $9.6 $9.6 $9.6 $9.6 $9.6 Adj. EBIT ($23.5) ($26.4) ($25.4) ($18.3) ($15.3) ($20.6) ($24.2) ($24.4) ($20.1) ($13.6) ($13.7) ($7.6) ($15.9) ($17.0) ($11.7) ($7.4) ($5.2) ($9.9) (+) Depreciation & Amortization 24.0 24.6 26.2 25.3 25.4 25.5 25.5 25.5 25.5 25.5 25.5 17.2 17.2 17.2 17.2 17.2 17.2 17.2 (+) Stock Based Compensation 5.8 5.8 5.8 5.7 5.7 5.7 5.6 5.6 5.6 5.5 5.5 5.5 5.3 5.3 5.3 5.3 5.3 5.3 (+) Restructuring - - - - - - - - - - - - - - - - - - Adj. EBITDA $6.3 $3.9 $6.6 $12.7 $15.8 $10.6 $6.9 $6.8 $11.0 $17.4 $17.3 $15.0 $6.6 $5.5 $10.8 $15.1 $17.3 $12.5 % Adj. EBITDA Margin 14% 10% 15% 28% 31% 20% 13% 13% 21% 32% 32% 27% 12% 11% 20% 28% 31% 23% (-) Miner Capex - - - - - - - - - - - - - - - - - - (-) Past Due Invoices (0.9) (0.3) (0.2) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (0.4) (-) Construction Capex for Expansion - - (38.3) (2.0) (2.0) - - - - - - - - - - - - - (-) Advisor Fees (18.3) - - - - - - - - - - - - - - - - - (-) Cash Taxes - - - - - - - - - - - - - - (0.9) - - (0.9) Unlevered Free Cash Flow ($12.9) $3.6 ($31.8) $10.2 $13.3 $10.1 $6.5 $6.3 $10.6 $17.0 $16.9 $14.6 $6.1 $5.1 $9.5 $14.6 $16.9 $11.2 PROPRIETARY & CONFIDENTIAL 27 1. In accordance with Item 10(e)(1)(i)(B) of Regulation S-K, a quantitative reconciliation of a forward-looking non-GAAP financial measure is only required to the extent it is available without unreasonable efforts. The Company does not currently have sufficient data to accurately estimate the variables and individual adjustments for such reconciliation, or to quantify the probable significance of these items at this time. The adjustments required for any such reconciliation of the Company's forward-looking non-GAAP financial measures cannot be accurately forecasted by the Company, and therefore the reconciliation has been omitted.

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Appendix Additional Company Information Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 28

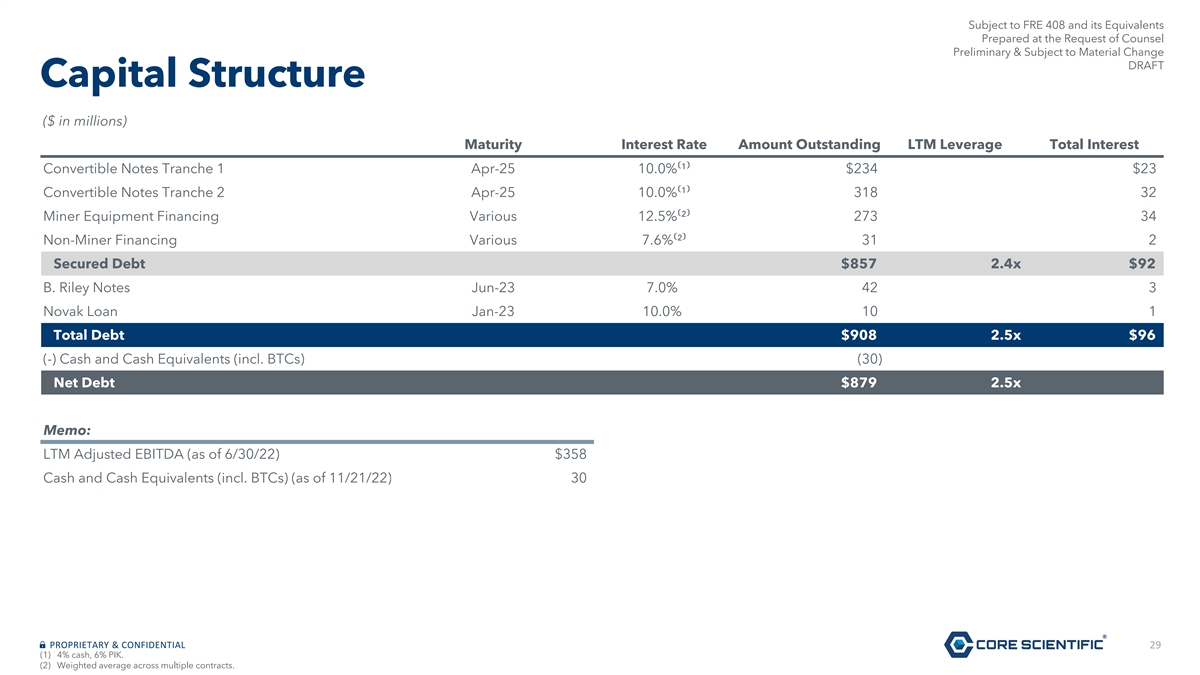

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Capital Structure ($ in millions) Maturity Interest Rate Amount Outstanding LTM Leverage Total Interest Convertible Notes Tranche 1 Apr-25 10.0%⁽¹⁾ $234 $23 Convertible Notes Tranche 2 Apr-25 10.0%⁽¹⁾ 318 32 Miner Equipment Financing Various 12.5%⁽²⁾ 273 34 Non-Miner Financing Various 7.6%⁽²⁾ 31 2 Secured Debt $857 2.4x $92 B. Riley Notes Jun-23 7.0% 42 3 Novak Loan Jan-23 10.0% 10 1 Total Debt $908 2.5x $96 (-) Cash and Cash Equivalents (incl. BTCs) (30) Net Debt $879 2.5x Memo: LTM Adjusted EBITDA (as of 6/30/22) $358 Cash and Cash Equivalents (incl. BTCs) (as of 11/21/22) 30 PROPRIETARY & CONFIDENTIAL 29 (1) 4% cash, 6% PIK. (2) Weighted average across multiple contracts.

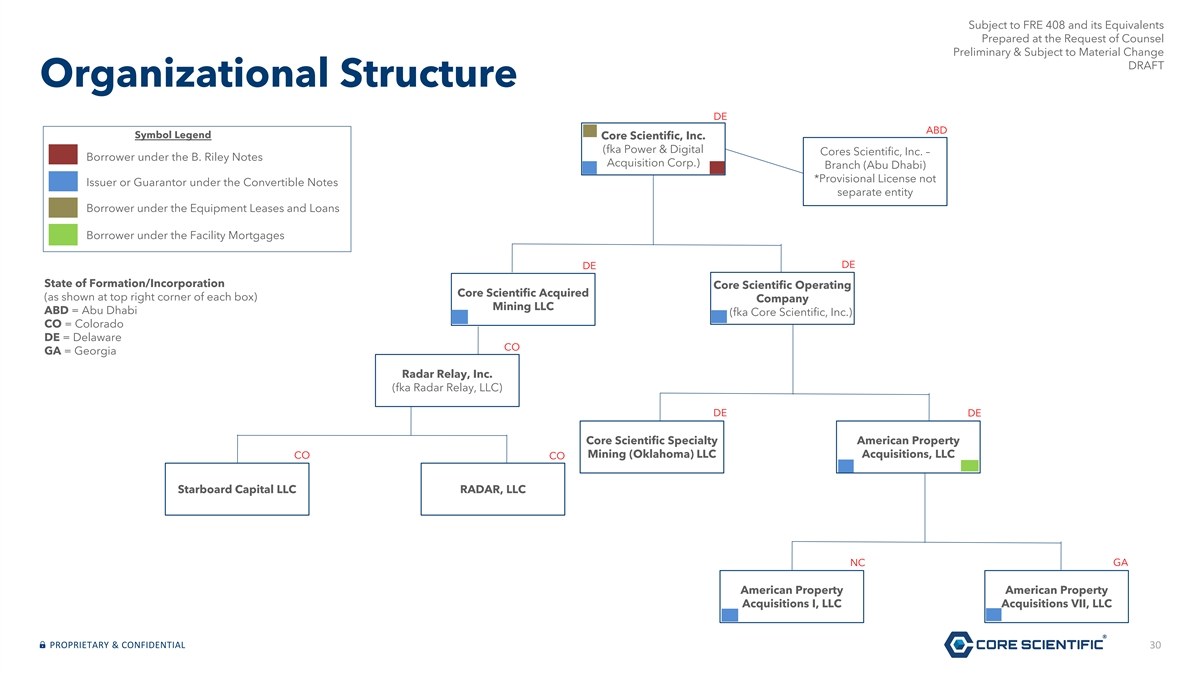

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Organizational Structure DE ABD Symbol Legend Core Scientific, Inc. (fka Power & Digital Cores Scientific, Inc. – Borrower under the B. Riley Notes Acquisition Corp.) Branch (Abu Dhabi) *Provisional License not Issuer or Guarantor under the Convertible Notes separate entity Borrower under the Equipment Leases and Loans Borrower under the Facility Mortgages DE DE State of Formation/Incorporation Core Scientific Operating Core Scientific Acquired (as shown at top right corner of each box) Company Mining LLC ABD = Abu Dhabi (fka Core Scientific, Inc.) CO = Colorado DE = Delaware CO GA = Georgia Radar Relay, Inc. (fka Radar Relay, LLC) DE DE Core Scientific Specialty American Property Mining (Oklahoma) LLC Acquisitions, LLC CO CO Starboard Capital LLC RADAR, LLC NC GA American Property American Property Acquisitions I, LLC Acquisitions VII, LLC PROPRIETARY & CONFIDENTIAL 30

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Appendix Key Market Data & Statistics Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT PROPRIETARY & CONFIDENTIAL 31

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Historical BTC Prices / Network Hash Rates Bitcoin Halving #3: May 11, 2020 350 $80,000 $70,000 300 $60,000 250 $50,000 200 $40,000 150 $30,000 100 $20,000 50 $10,000 0 $0 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 BTC Price Network Hash Rate Bitcoin Halving Events • #1: November 2012 • #2: July 2016 • #3: May 2020 • #4: April 2024 (expected) PROPRIETARY & CONFIDENTIAL 32

Subject to FRE 408 and its Equivalents Prepared at the Request of Counsel Preliminary & Subject to Material Change DRAFT Hash Price ($ per TH/s-day) Bitcoin Halving #3: May 11, 2020 $0.45 $0.40 $0.35 $0.30 $0.25 $0.20 $0.15 $0.10 $0.05 $0.00 Jan-20 Apr-20 Jul-20 Oct-20 Jan-21 Apr-21 Jul-21 Oct-21 Jan-22 Apr-22 Jul-22 Oct-22 Bitcoin Halving Events • #1: November 2012 • #2: July 2016 • #3: May 2020 • #4: April 2024 (expected) PROPRIETARY & CONFIDENTIAL 33 Source: Luxor Technology Corp.