EX-99.2

Published on May 12, 2022

Exhibit 99.2 First Quarter Fiscal Year 2022 Earnings Presentation May 12, 2022 MAY 12, 2022 1

Legal Disclaimer Forward-Looking Statements This presentation includes “forward-looking statements'' within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, those related to the Company’s ability to scale and grow its business, source clean and renewable energy, the advantages and expected growth of the Company, future estimates of revenue, net income and adjusted EBITDA, future estimates of computing capacity and operating power, future demand for hosting capacity, future estimate of hashrate (including mix of self-mining and hosting), operating gigawatts and power, future projects in construction or negotiation and future expectations of operation location, orders for miners and critical infrastructure, future estimates of self-mining capacity, the public float of the Company’s shares, future infrastructure additions and their operational capacity, and operating power and site features of the Company’s operations center in Denton, Texas. These statements are provided for illustrative purposes only and are based on various assumptions and on the current expectations of the Company’s management. These forward-looking statements are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including those identified in the Company’s reports filed with the U.S. Securities and Exchange Commission (”SEC”) from time to time, including the Company’s definitive proxy statement filed with the SEC on January 3, 2022, and other subsequent filings the Company files with the SEC from time to time, including its Annual Report on Form 10-K for the year ended December 31, 2021, and Current Report on Form 8-K filed on January 24, 2022, and Quarterly Report on form 10- Q for the first quarter ended March 31, 2022, to be filed with the SEC on or about May 13, 2022 . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Accordingly, undue reliance should not be placed upon the forward-looking statements. Except as required by law, the Company assumes no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Year over year comparisons are based on the combined results of Core Scientific and its acquired entities. Non-GAAP Financial Measures This presentation also contains non-GAAP financial measures as defined by the SEC rules, including Adjusted EBITDA and adjusted earnings (loss) per diluted share. The Company believes that these non- GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Company's financial condition and results of operations. The Company's management uses certain of these non-GAAP measures to compare the Company's performance to that of prior periods for trend analyses and for budgeting and planning purposes. The Company urges investors not to rely on any single financial measure to evaluate its business. MAY 12, 2022 2

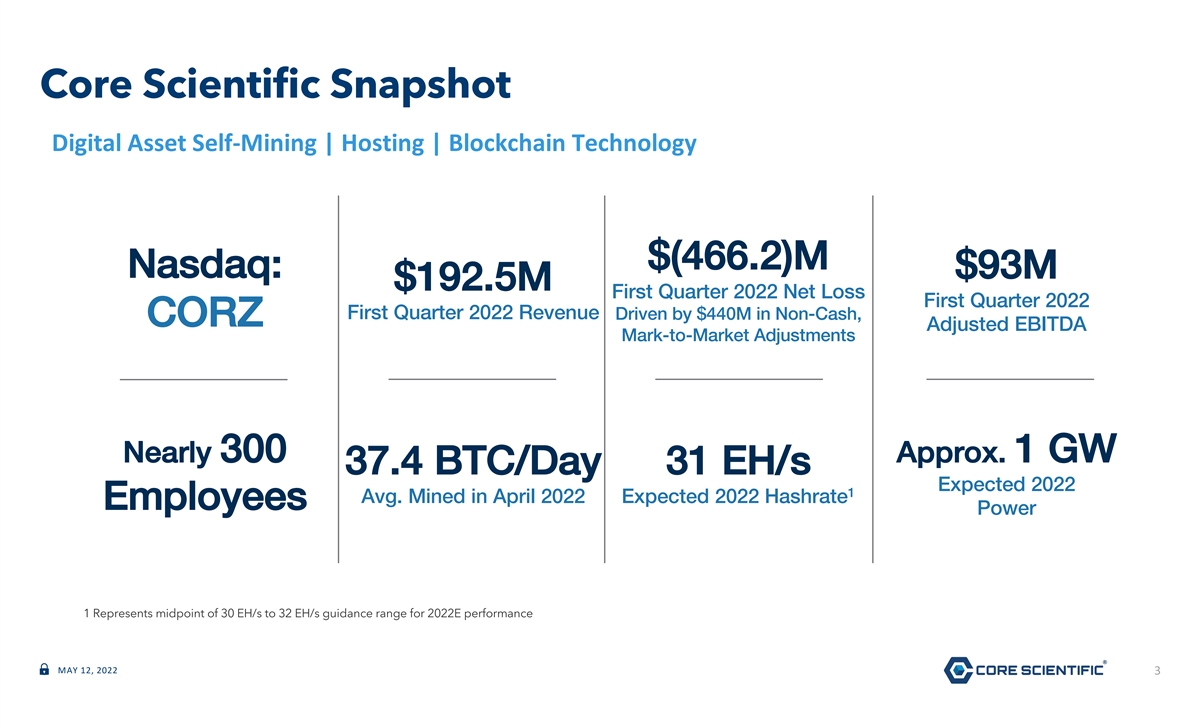

Core Scientific Snapshot Digital Asset Self-Mining | Hosting | Blockchain Technology $(466.2)M Nasdaq: $93M $192.5M First Quarter 2022 Net Loss First Quarter 2022 First Quarter 2022 Revenue Driven by $440M in Non-Cash, CORZ Adjusted EBITDA Mark-to-Market Adjustments Nearly 300 Approx. 1 GW 37.4 BTC/Day 31 EH/s Expected 2022 1 Avg. Mined in April 2022 Expected 2022 Hashrate Employees Power 1 Represents midpoint of 30 EH/s to 32 EH/s guidance range for 2022E performance MAY 12, 2022 3

First Quarter 2022 Key Highlights Strong operational results Market-leading scale Continued progress toward achieving 2022 growth projections Strong market position MA APRYI L1 2 22 , ,2022 2022 4 4

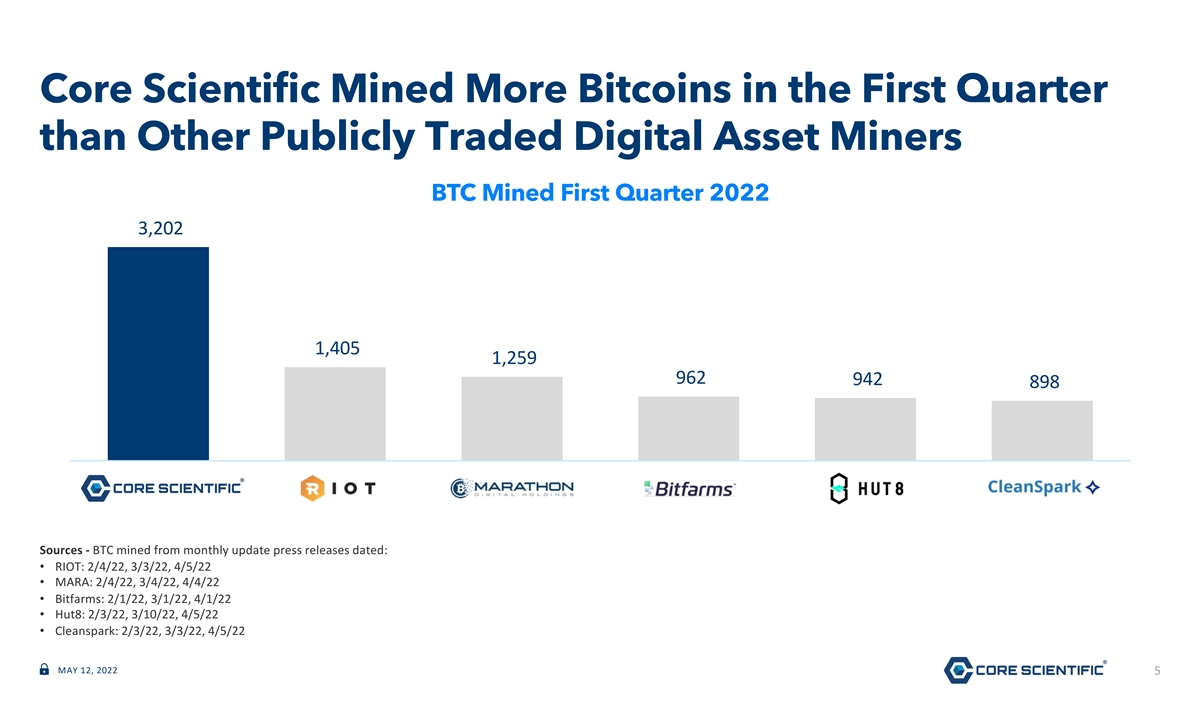

Core Scientific Mined More Bitcoins in the First Quarter than Other Publicly Traded Digital Asset Miners BTC Mined First Quarter 2022 3,202 1,405 1,259 962 942 898 Core Scientific Riot Blockchain Marathon Digital Bitfarms Hut8 Cleanspark Sources - BTC mined from monthly update press releases dated: • RIOT: 2/4/22, 3/3/22, 4/5/22 • MARA: 2/4/22, 3/4/22, 4/4/22 • Bitfarms: 2/1/22, 3/1/22, 4/1/22 • Hut8: 2/3/22, 3/10/22, 4/5/22 • Cleanspark: 2/3/22, 3/3/22, 4/5/22 MAY 12, 2022 5

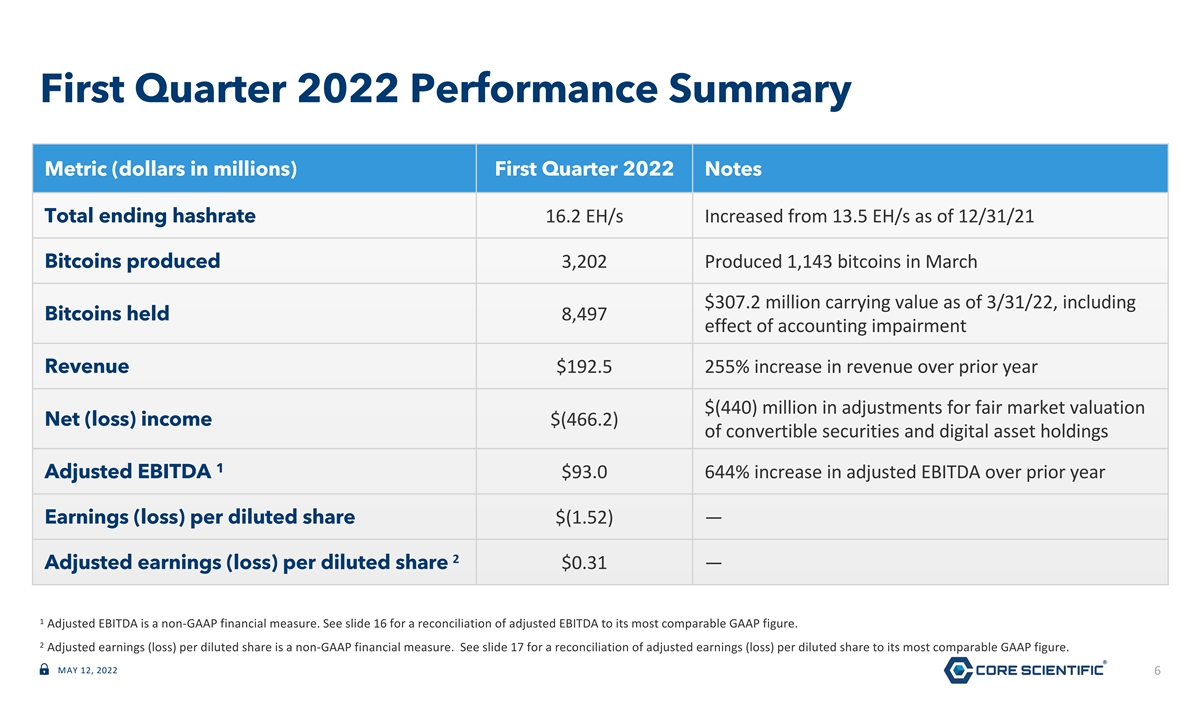

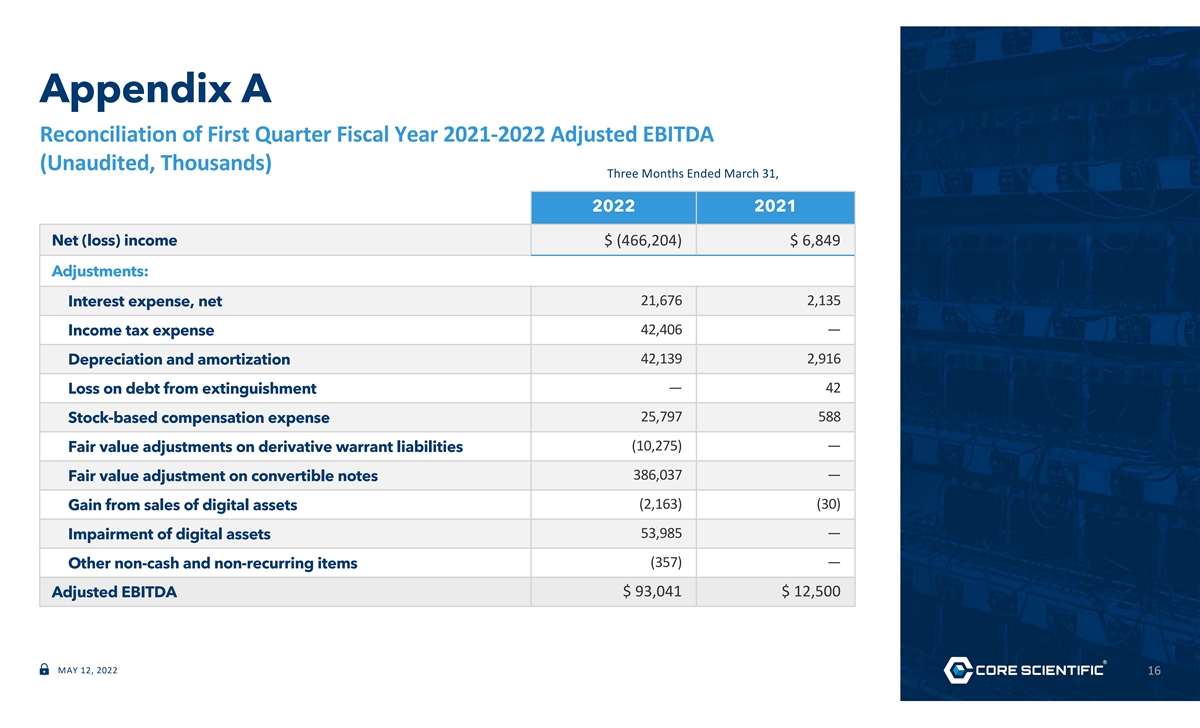

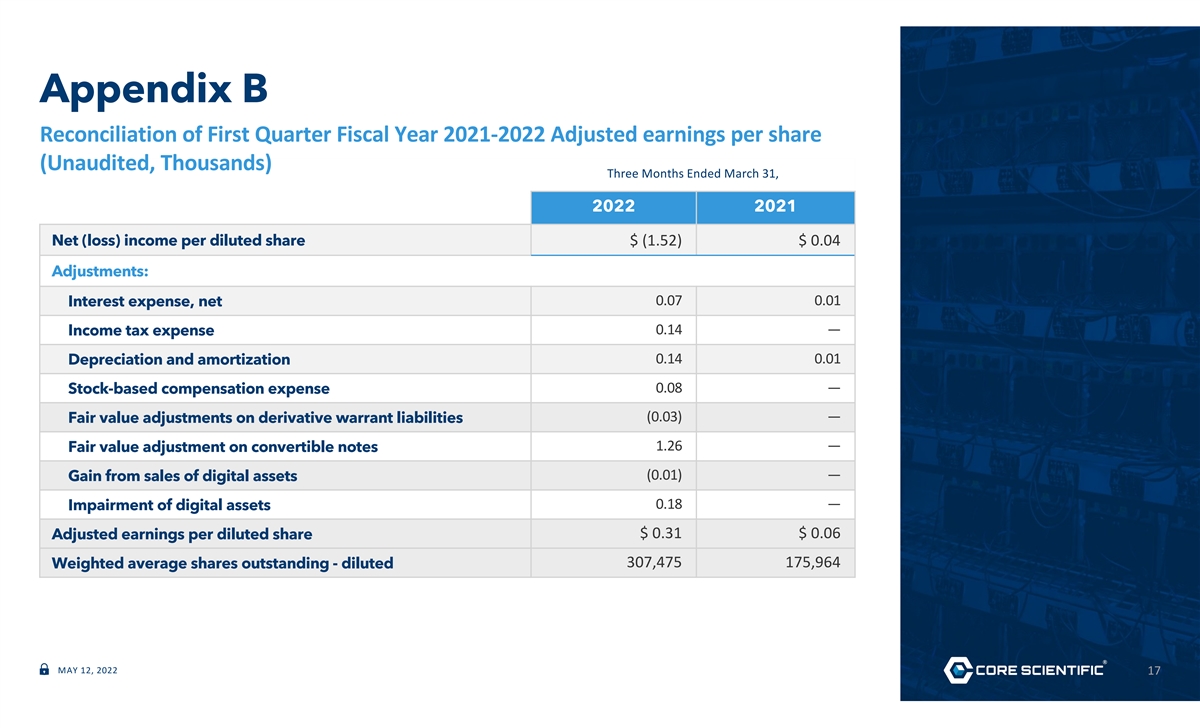

First Quarter 2022 Performance Summary Metric (dollars in millions) First Quarter 2022 Notes Total ending hashrate 16.2 EH/s Increased from 13.5 EH/s as of 12/31/21 Bitcoins produced 3,202 Produced 1,143 bitcoins in March $307.2 million carrying value as of 3/31/22, including Bitcoins held 8,497 effect of accounting impairment Revenue $192.5 255% increase in revenue over prior year $(440) million in adjustments for fair market valuation Net (loss) income $(466.2) of convertible securities and digital asset holdings 1 Adjusted EBITDA $93.0 644% increase in adjusted EBITDA over prior year Earnings (loss) per diluted share $(1.52) — 2 Adjusted earnings (loss) per diluted share $0.31 — 1 Adjusted EBITDA is a non-GAAP financial measure. See slide 16 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure. 2 Adjusted earnings (loss) per diluted share is a non-GAAP financial measure. See slide 17 for a reconciliation of adjusted earnings (loss) per diluted share to its most comparable GAAP figure. MAY 12, 2022 6

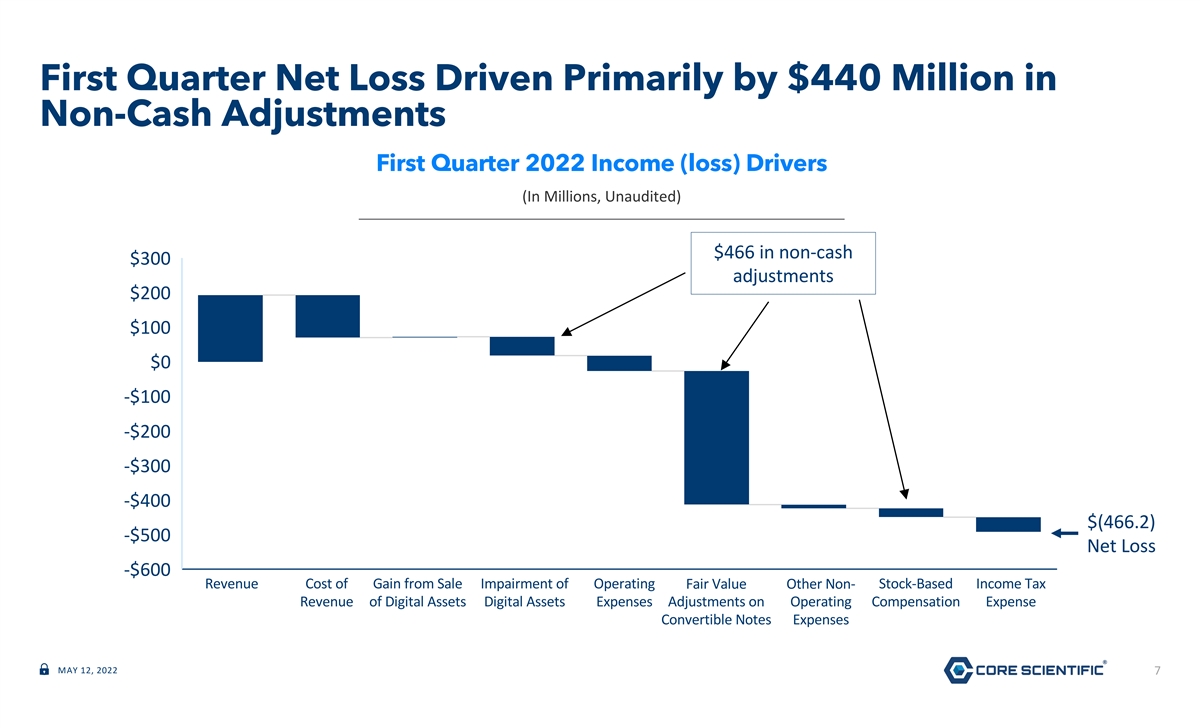

First Quarter Net Loss Driven Primarily by $440 Million in Non-Cash Adjustments First Quarter 2022 Income (loss) Drivers (In Millions, Unaudited) $466 in non-cash $300 adjustments $200 $100 $0 -$100 -$200 -$300 -$400 $(466.2) -$500 Net Loss -$600 Revenue Cost of Gain from Sale Impairment of Operating Fair Value Other Non- Stock-Based Income Tax Cost of Revenue Impairment of … Fair Value … Stock-Based… Revenue of Digital Assets Digital Assets Expenses Adjustments on Operating Compensation Expense Revenue Gain from Sale… Operating… Other Non-… Income Tax… Convertible Notes Expenses MAY 12, 2022 7

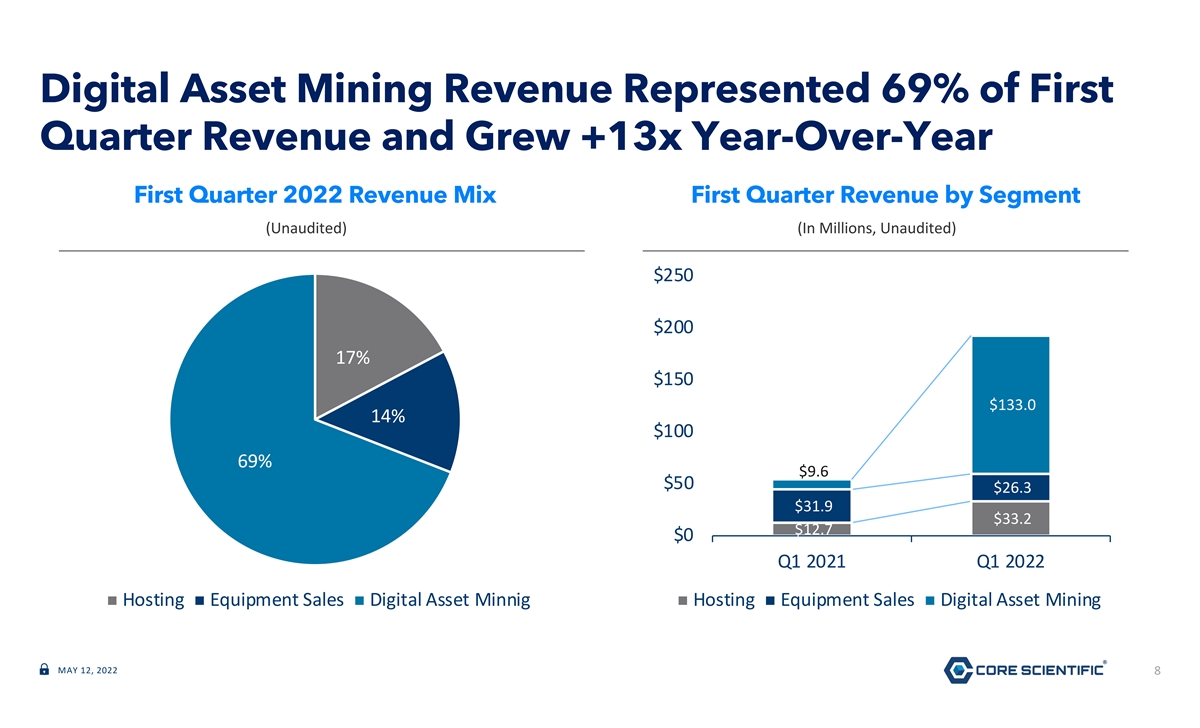

Digital Asset Mining Revenue Represented 69% of First Quarter Revenue and Grew +13x Year-Over-Year First Quarter 2022 Revenue Mix First Quarter Revenue by Segment (Unaudited) (In Millions, Unaudited) $250 $200 17% $150 $133.0 14% $100 69% $9.6 $50 $26.3 $31.9 $33.2 $12.7 $0 Q1 2021 Q1 2022 Hosting Equipment Sales Digital Asset Minnig Hosting Equipment Sales Digital Asset Mining MAY 12, 2022 8

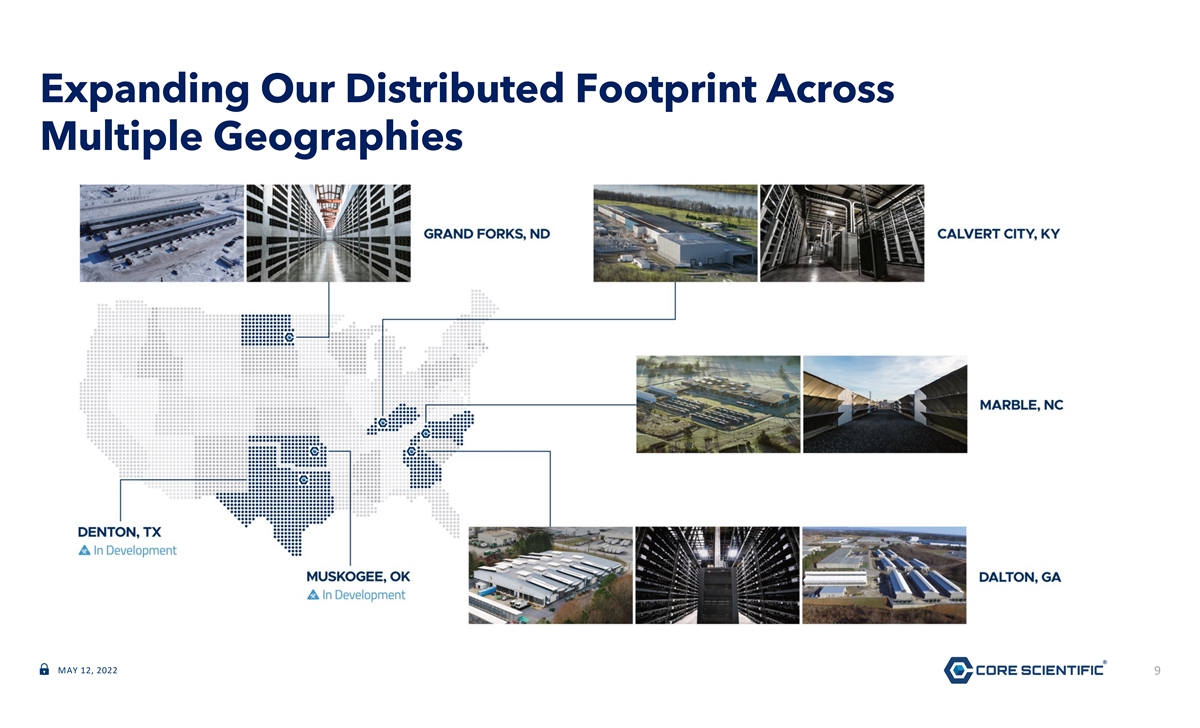

Expanding Our Distributed Footprint Across Multiple Geographies MAY 12, 2022 9

Denton, Texas Data Center Development Progress MAY 12, 2022 10

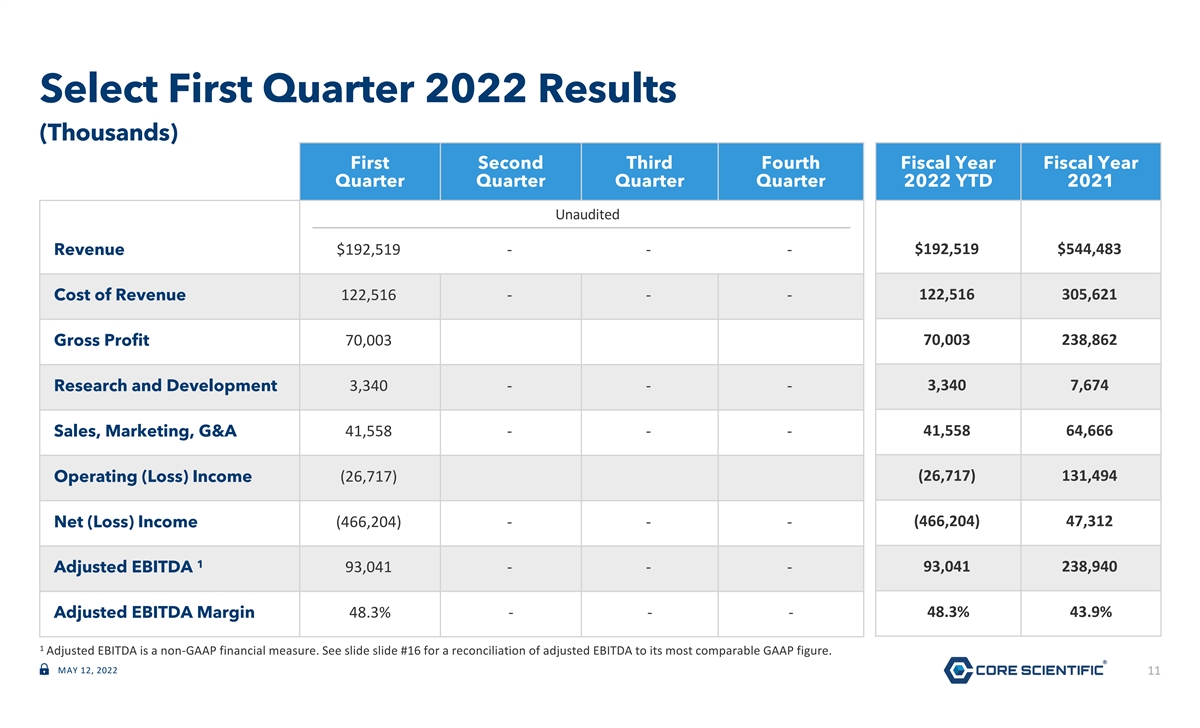

Select First Quarter 2022 Results (Thousands) First Second Third Fourth Fiscal Year Fiscal Year Quarter Quarter Quarter Quarter 2022 YTD 2021 Unaudited Revenue $192,519 - - - $192,519 $544,483 122,516 - - - 122,516 305,621 Cost of Revenue 70,003 238,862 Gross Profit 70,003 3,340 7,674 Research and Development 3,340 - - - 41,558 64,666 Sales, Marketing, G&A 41,558 - - - (26,717) 131,494 Operating (Loss) Income (26,717) Net (Loss) Income (466,204) - - - (466,204) 47,312 1 Adjusted EBITDA 93,041 - - - 93,041 238,940 48.3% - - - 48.3% 43.9% Adjusted EBITDA Margin 1 Adjusted EBITDA is a non-GAAP financial measure. See slide slide #16 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure. MAY 12, 2022 11

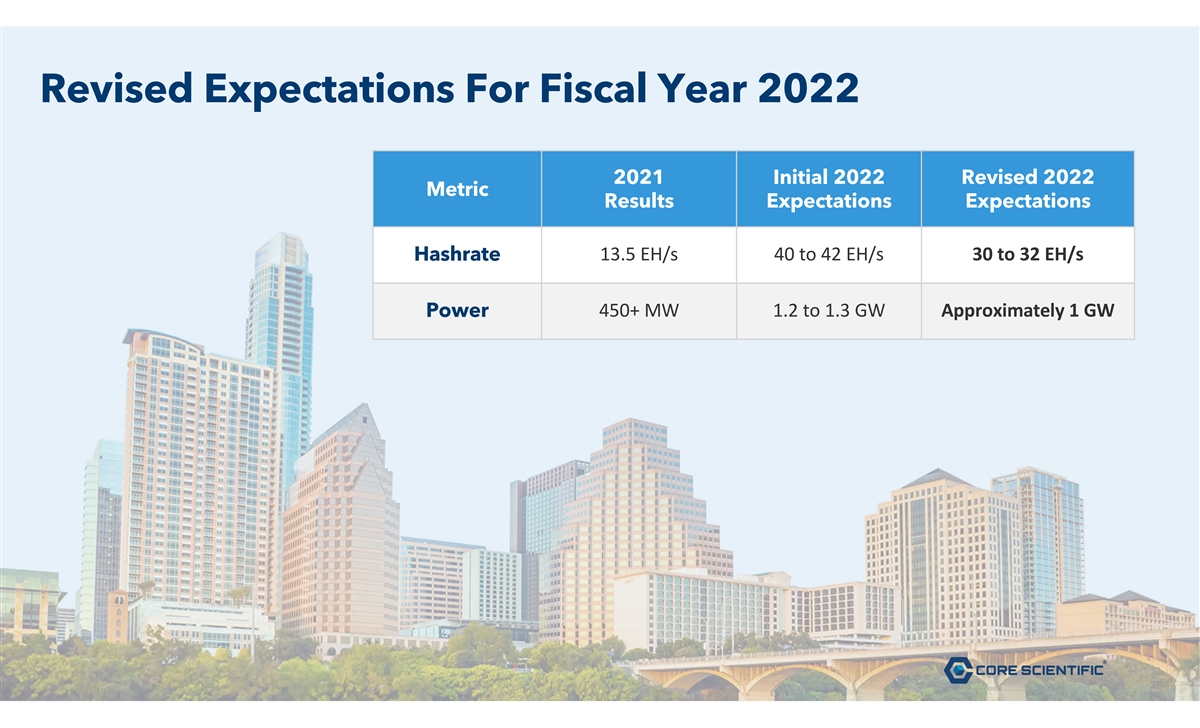

Revised Expectations For Fiscal Year 2022 2021 Initial 2022 Revised 2022 Metric Results Expectations Expectations Hashrate 13.5 EH/s 40 to 42 EH/s 30 to 32 EH/s 450+ MW 1.2 to 1.3 GW Approximately 1 GW Power MAY 12, 2022 12 12

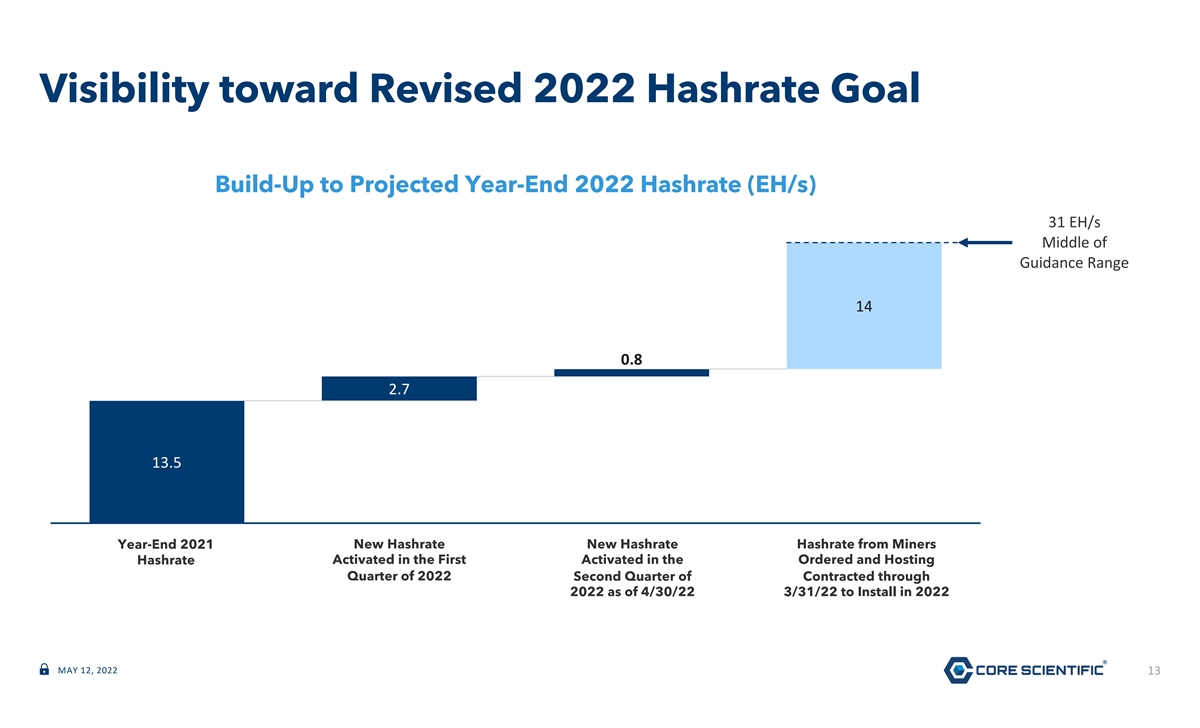

Visibility toward Revised 2022 Hashrate Goal Build-Up to Projected Year-End 2022 Hashrate (EH/s) 31 EH/s Middle of Guidance Range 14 0.8 2.7 13.5 Year-End 2021 New HasNe hra w te Ha As ch tirv aa te te d in Q1 New Hashrate HashrHa ate s h fr ro at m e fMi rom ne Mi rs n O errd s ered Activated in the First Activated in the Ordered and Hosting Hashrate Year-End 2021 Hashrate 2022 New Hashrate Activated in Q2 and Hosting Contracted in 2021 Quarter of 2022 Second Quarter of Contracted through 2022 as of 4/30/22 to Install in 2022 (net of 2022 as of 4/30/22 3/31/22 to Install in 2022 Gryphon's 60-70k miners) MAY 12, 2022 13

Why Core Scientific? A MARKET LEADER FULL SPECTRUM TRACK RECORD TEAM IP A Blockchain Integrated Self- Consistent Deep, Proprietary Infrastructure Mining and Growth in Experienced Technology Developer at Hosting Capacity and Team Leading Scale Capability MAY 12, 2022 14

Infrastructure to Power the World’s New Financial System 15

Appendix A Reconciliation of First Quarter Fiscal Year 2021-2022 Adjusted EBITDA (Unaudited, Thousands) Three Months Ended March 31, 2022 2021 Net (loss) income $ (466,204) $ 6,849 Adjustments: 21,676 2,135 Interest expense, net 42,406 — Income tax expense 42,139 2,916 Depreciation and amortization — 42 Loss on debt from extinguishment 25,797 588 Stock-based compensation expense (10,275) — Fair value adjustments on derivative warrant liabilities 386,037 — Fair value adjustment on convertible notes (2,163) (30) Gain from sales of digital assets 53,985 — Impairment of digital assets (357) — Other non-cash and non-recurring items Adjusted EBITDA $ 93,041 $ 12,500 MAY 12, 2022 16 16

Appendix B Reconciliation of First Quarter Fiscal Year 2021-2022 Adjusted earnings per share (Unaudited, Thousands) Three Months Ended March 31, 2022 2021 Net (loss) income per diluted share $ (1.52) $ 0.04 Adjustments: 0.07 0.01 Interest expense, net 0.14 — Income tax expense 0.14 0.01 Depreciation and amortization 0.08 — Stock-based compensation expense (0.03) — Fair value adjustments on derivative warrant liabilities 1.26 — Fair value adjustment on convertible notes (0.01) — Gain from sales of digital assets 0.18 — Impairment of digital assets $ 0.31 $ 0.06 Adjusted earnings per diluted share 307,475 175,964 Weighted average shares outstanding - diluted MAY 12, 2022 17 17