EX-99.1

Published on October 29, 2021

Exhibit 99.1

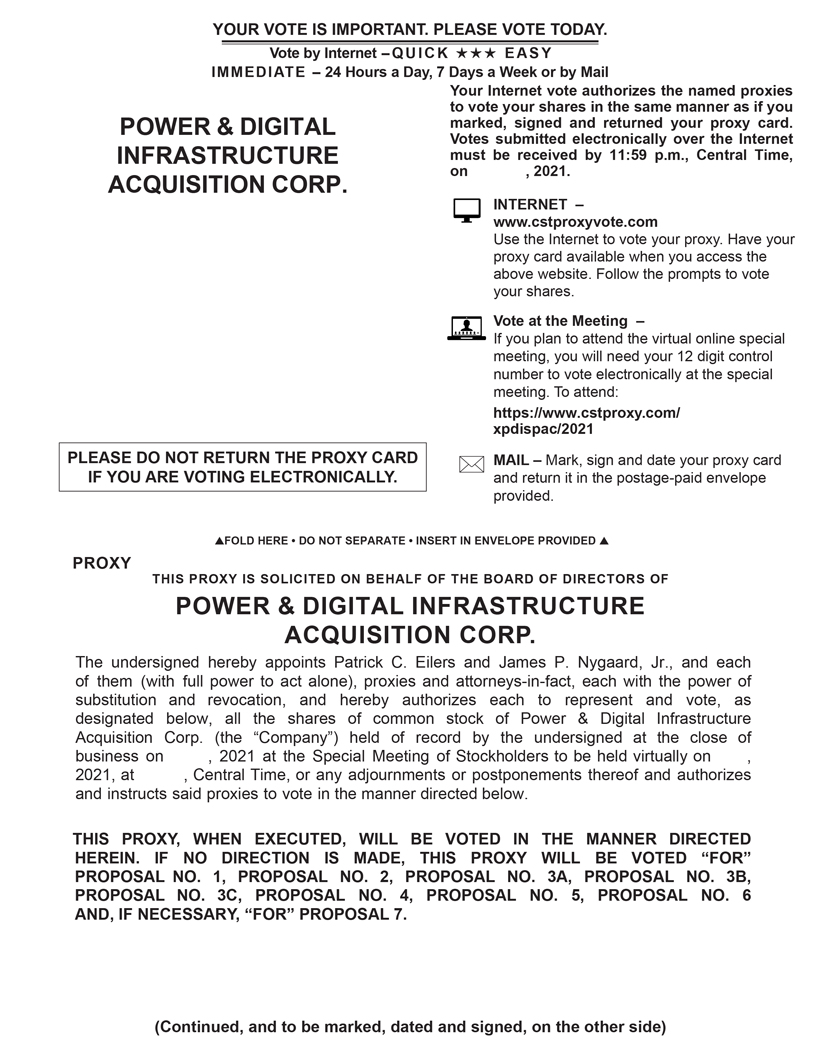

YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY. Vote by InternetQUICK ï^ï^ï^ EASY IMMEDIATE24 Hours a Day, 7 Days a Week or by Mail POWER & DIGITAL INFRASTRUCTURE ACQUISITION CORP. PLEASE DO NOT RETURN THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY. Your Internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card. Votes submitted electronically over the Internet must be received by 11:59 p.m., Central Time, on , 2021. INTERNET www.cstproxyvote.com Use the Internet to vote your proxy. Have your proxy card available when you access the above website. Follow the prompts to vote your shares. Vote at the Meeting If you plan to attend the virtual online special meeting, you will need your 12 digit control number to vote electronically at the special meeting. To attend: https://www xpdispac/2021 .cstproxy.com/ MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope provided. ï³FOLD HERE DO NOT SEPARATE INSERT IN ENVELOPE PROVIDED ï³ PROXY THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF POWER & DIGITAL INFRASTRUCTURE ACQUISITION CORP. The undersigned hereby appoints Patrick C. Eilers and James P. Nygaard, Jr., and each of them (with full power to act alone), proxies and attorneys-in-fact, each with the power of substitution and revocation, and hereby authorizes each to represent and vote, as designated below, all the shares of common stock of Power & Digital Infrastructure Acquisition Corp. (the Company) held of record by the undersigned at the close of business on , 2021 at the Special Meeting of Stockholders to be held virtually on , 2021, at , Central Time, or any adjournments or postponements thereof and authorizes and instructs said proxies to vote in the manner directed below. THIS PROXY, WHEN EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR PROPOSAL NO. 1, PROPOSAL NO. 2, PROPOSAL NO. 3A, PROPOSAL NO. 3B, PROPOSAL NO. 3C, PROPOSAL NO. 4, PROPOSAL NO. 5, PROPOSAL NO. 6 AND, IF NECESSARY, FOR PROPOSAL 7. (Continued, and to be marked, dated and signed, on the other side)

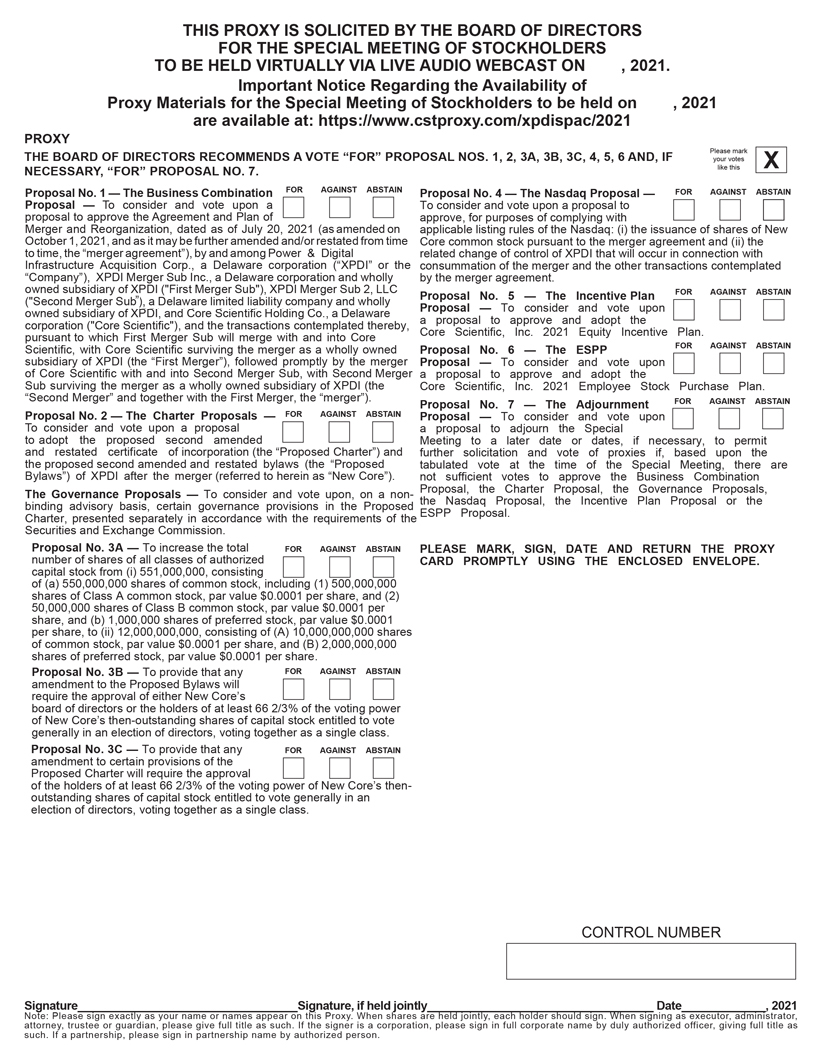

THIS PROXY IS SOLICITED BY THE BOARD OF DIRECTORS FOR THE SPECIAL MEETING OF STOCKHOLDERS TO BE HELD VIRTUALLY VIA LIVE AUDIO WEBCAST ON , 2021. Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on , 2021 are available at: https://www.cstproxy.com/xpdispac/2021 PROXY THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSAL NOS. 1, 2, 3A, 3B, 3C, 4, 5, 6 AND, IF Please mark your votes NECESSARY, FOR PROPOSAL NO. 7. like this Proposal No. 1 The Business Combination FOR AGAINST ABSTAIN Proposal proposal to approve To consider the Agreement and vote and upon Plan of a October Merger and 1, 2021, Reorganization and as it may , dated be further as of amended July 20 ,and/or 2021 restated (as amended from time on Infrastructure to time, the merger Acquisition agreement), Corp., by a and Delaware among Power corporation & Digital (XPDI or the Company), owned subsidiary XPDI of Merger XPDI (First Sub Inc Merger ., a Delaware Sub), XPDI corporation Merger and Sub wholly 2, LLC (Second owned subsidiary Merger Sub), of XPDI, a Delaware and Core limited Scientific liability Holding company Co., a and Delaware wholly corporation pursuant to (Core which Scientific) First Merger , and Sub the will transactions merge with contemplated and into Core thereby, Scientific subsidiary , with of XPDI Core (the Scientific First Merger), surviving followed the merger promptly as a wholly by the owned merger of Sub Core surviving Scientific the with merger and as into a wholly Second owned Merger subsidiary Sub, with of Second XPDI (the Merger Second Merger and together with the First Merger, the merger). Proposal No. 2 The Charter Proposals FOR AGAINST ABSTAIN To to adopt consider the and proposed vote upon second a proposal amended and the proposed restated second certificate amended of incorporation and restated (the bylaws Proposed (the Proposed Charter) and Bylaws) of XPDI after the merger (referred to herein as New Core). binding The Governance advisory basis, Proposals certain governance To consider provisions and vote upon, in the on Proposed a non-Charter, Securities presented and Exchange separately Commission in accordance . with the requirements of the Proposal No. 3A To increase the total FOR AGAINST ABSTAIN number capital stock of shares from (i) of all 551,000,000, classes of authorized consisting of shares (a) 550,000,000 of Class A common shares of stock, common par value stock, $ including 0.0001 per (1) share, 500,000,000 and (2) share, 50,000,000 and (b) shares 1,000,000 of Class shares B common of preferred stock, stock, par value par value $0.0001 $0. 0001 per per of common share, to stock, (ii) 12,000,000,000, par value $0.0001 consisting per share, of (A) and 10,000,000,000 (B) 2,000,000,000 shares shares of preferred stock, par value $0.0001 per share. Proposal No. 3B To provide that any FOR AGAINST ABSTAIN amendment require the approval to the Proposed of either Bylaws New Cores will board of New of Cores directors then or -outstanding the holders shares of at least of capital 66 2/3% stock of the entitled voting to power vote generally in an election of directors, voting together as a single class. Proposal No. 3C To provide that any FOR AGAINST ABSTAIN amendment Proposed Charter to certain will require provisions the of approval the of outstanding the holders shares of at least of capital 66 2/3% stock of entitled the voting to vote power generally of New in Cores an then-election of directors, voting together as a single class. Proposal No. 4 The Nasdaq Proposal FOR AGAINST ABSTAIN approve, To consider for and purposes vote upon of complying a proposal with to Core applicable common listing stock rules pursuant of the Nasdaq: to the merger (i) the agreement issuance of and shares (ii) the of New consummation related change of of the control merger of XPDI and the that other will occur transactions in connection contemplated with by the merger agreement. Proposal No. 5 The Incentive Plan FOR AGAINST ABSTAIN a Proposal proposal to To approve consider and and adopt vote the upon Core Scientific, Inc. 2021 Equity Incentive Plan. Proposal No. 6 The ESPP FOR AGAINST ABSTAIN Proposal To consider and vote upon a Core proposal Scientific, to approve Inc. 2021 and Employee adopt the Stock Purchase Plan. Proposal No. 7 The Adjournment FOR AGAINST ABSTAIN a Proposal proposal to To adjourn consider the and Special vote upon Meeting further solicitation to a later and date vote or of dates, proxies if necessary, if, based to upon permit the tabulated not sufficient vote votes at the to time approve of the the Special Business Meeting, Combination there are Proposal, the Nasdaq the Proposal, Charter Proposal, the Incentive the Plan Governance Proposal Proposals, or the ESPP Proposal. CARD PLEASE PROMPTLY MARK, SIGN, USING DATE THE AND ENCLOSED RETURN ENVELOPE THE PROXY . CONTROL NUMBER Note: Signature Please sign exactly as your name or names appear on Signature, this Proxy. When if held shares jointly are held jointly, each holder should sign. When signing Date as executor, administrator, , 2021 attorney, such. If a trustee partnership, or guardian, please please sign in give partnership full title name as such by .authorized If the signer person is a corporation, . please sign in full corporate name by duly authorized officer, giving full title as such. If a partnership, please sign in partnership name by authorized person.