EXHIBIT 99.1

Published on October 30, 2025

Exhibit 99.1

Adam Sullivan, CEO Jim Nygaard, CFO Matt Brown, COO October 30, 2025 Investor

Presentation

2 FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and

performance metrics, projections of market opportunity and expectations, the Company’s ability to scale, grow its business and execute on its growth plans and contractual commitments, source sufficient energy at attractive rates, the

advantages, expected growth, and anticipated future revenue of the Company, and the Company’s ability to source and retain talent. You can identify forward-looking statements by the fact that they do not relate strictly to historical or

current facts. These statements may include words such as “aim,” “estimate,” “plan,” “project,” “forecast,” “goal,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate

future events or trends or that are not statements of historical facts. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially, including: our ability to attract customers for

our high density colocation capabilities; our ability to perform under our existing colocation agreements, our ability to maintain our competitive position in our existing operating segments; our ability to raise additional capital to continue

our expansion efforts or other operations; our need for significant electric power and the limited availability of power resources; the potential failure in our critical systems, facilities or services we provide; the physical risks and

regulatory changes relating to climate change; our vulnerability to physical security breaches, which could disrupt our operations; a potential slowdown in market and economic conditions, particularly those impacting high density computing;

changing expectations with respect to ESG policies; the effectiveness of our compliance and risk management methods. Any such forward-looking statements represent management’s estimates and beliefs as of the date of this presentation. While we

may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. Although the Company believes that in making such forward-looking

statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the

assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2024, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or

revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Key investment highlights Leadership team brings over of 150-years of combined

experience building data center infrastructure Strong balance sheet provides future financial flexibility to execute on strategic growth opportunities Sales pipeline remains robust and includes a mix of hyperscale and non-hyperscale

customers Colocation contracts deliver compelling economics and strong margins 12-yr contracts with CoreWeave provide >$10 Billion in total contract value and ~$850 Million in avg. annual run rate revenue

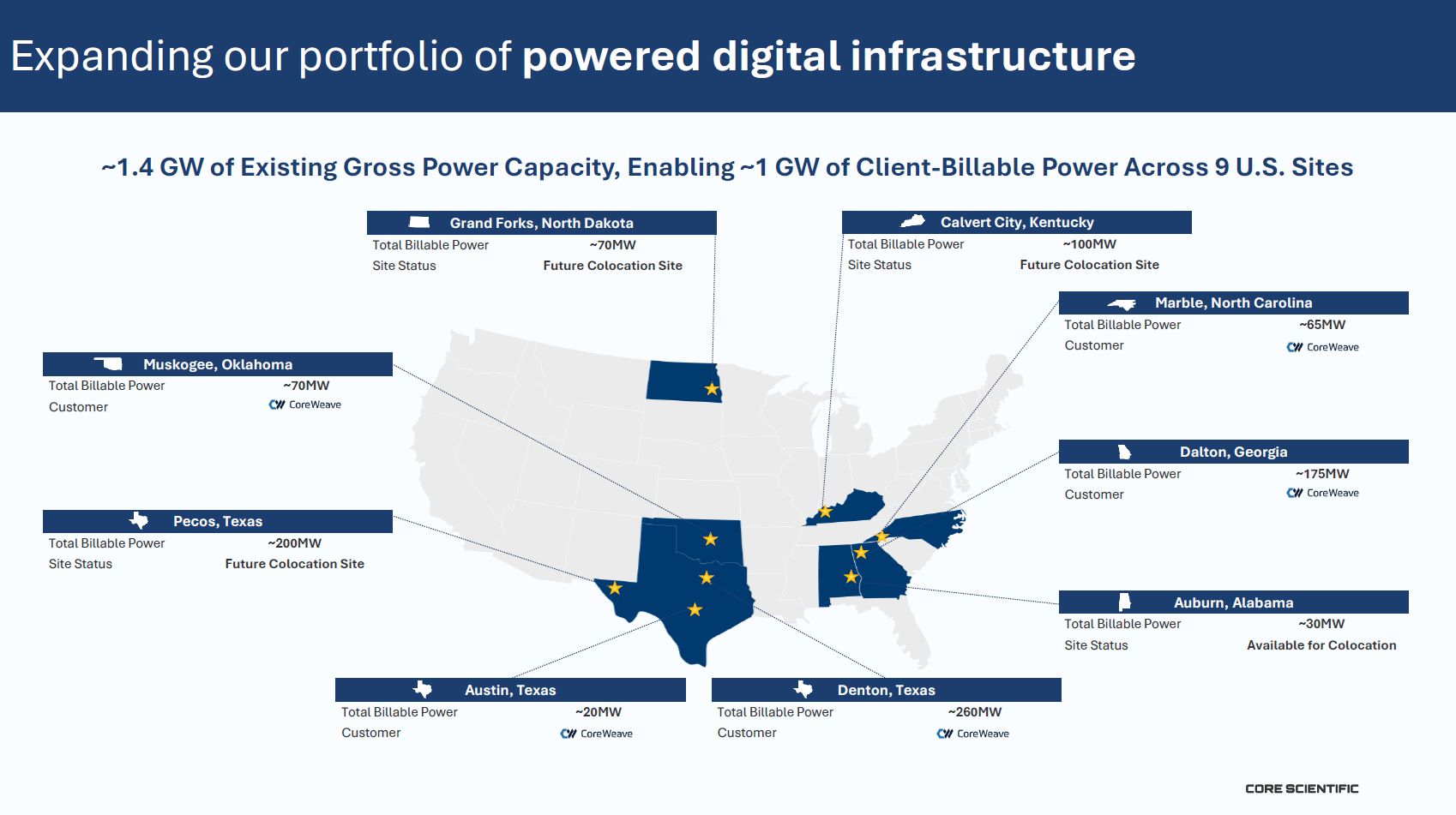

Expanding our portfolio of powered digital infrastructure Denton, Texas Total

Billable Power ~260MW Customer Pecos, Texas Total Billable Power ~200MW Site Status Future Colocation Site Dalton, Georgia Total Billable Power ~175MW Customer Calvert City, Kentucky Total Billable Power ~100MW Site

Status Future Colocation Site Muskogee, Oklahoma Total Billable Power ~70MW Customer Marble, North Carolina Total Billable Power ~65MW Customer Grand Forks, North Dakota Total Billable Power Site Status ~70MW Future Colocation

Site Auburn, Alabama Total Billable Power ~30MW Site Status Available for Colocation Austin, Texas Total Billable Power ~20MW Customer ~1.4 GW of Existing Gross Power Capacity, Enabling ~1 GW of Client-Billable Power Across 9 U.S.

Sites

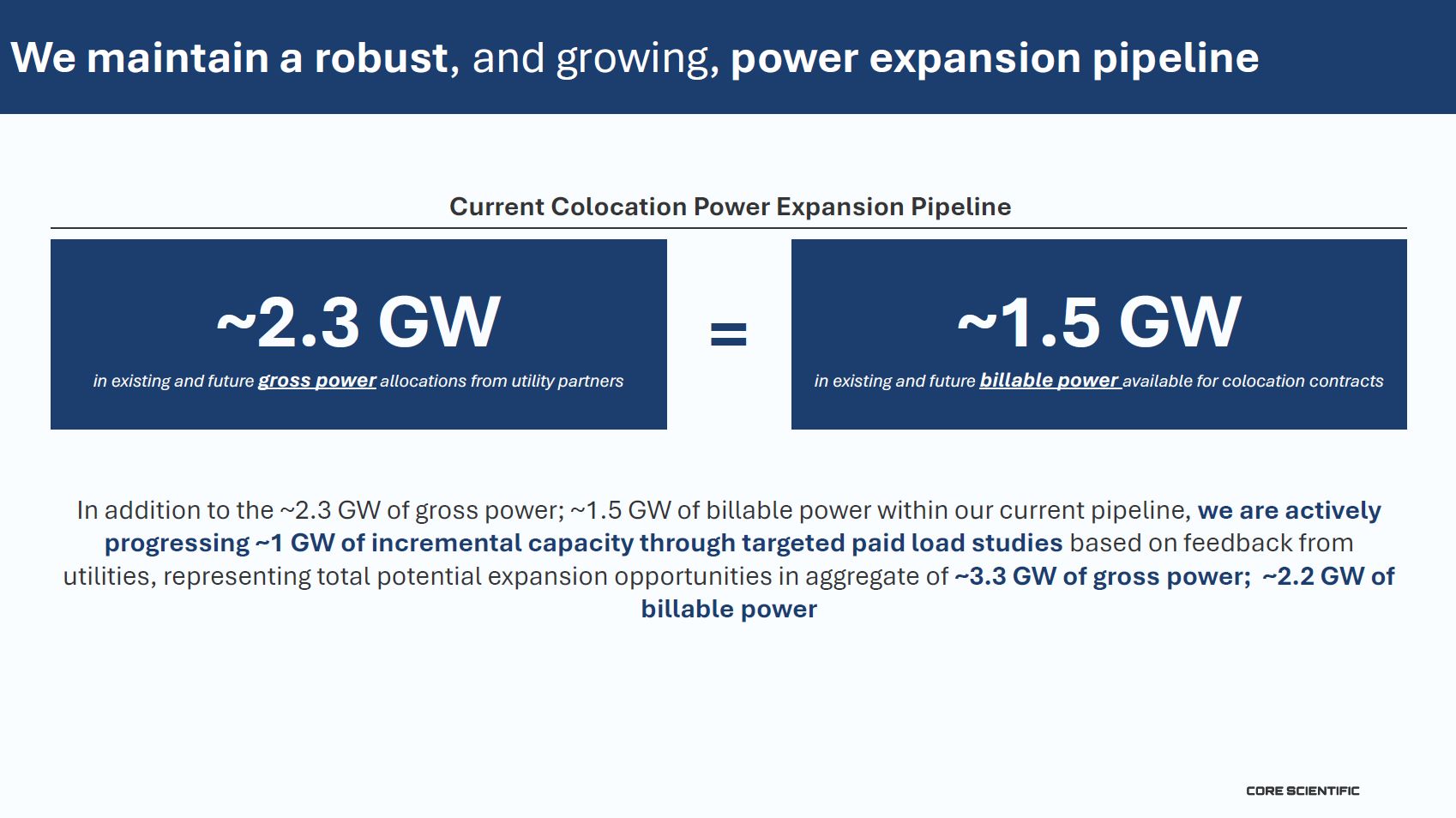

We maintain a robust, and growing, power expansion pipeline Current Colocation

Power Expansion Pipeline ~2.3 GW in existing and future gross power allocations from utility partners ~1.5 GW in existing and future billable power available for colocation contracts = In addition to the ~2.3 GW of gross power; ~1.5 GW of

billable power within our current pipeline, we are actively progressing ~1 GW of incremental capacity through targeted paid load studies based on feedback from utilities, representing total potential expansion opportunities in aggregate of ~3.3

GW of gross power; ~2.2 GW of billable power

~590 MW infrastructure (~800 MW gross) Over $10 Billion In revenue potential

over contracts’ term ~$850 Million avg. annual run rate revenue1 75% to 80% anticipated profit margin2 12-year contracts with two 5-year options3 Client pays for capex4, power and utilities CoreWeave contract summary Represents the

estimated average annual revenue over the 12-year contract periods; Austin, Texas contract term is a 7-year period. Expenses include facilities operations, repairs & maintenance, security, FTEs, insurance, property taxes, etc. Austin,

Texas contract term is 7 years with elective extensions. Up to $1.5 Million per MW (or approximately $750 Million) of data center build out costs are funded by CoreWeave and credited against hosting payments at no more than 50% of monthly fees

until fully repaid. The balance of modification costs relate to items purchased directly by CoreWeave and contributed for use in the facility. For the additional 70 MW expansion, Core Scientific is responsible for funding $104 Million of capex

($1.5M per MW) for the powered core and shell with no capex credit associated with this new agreement. 6

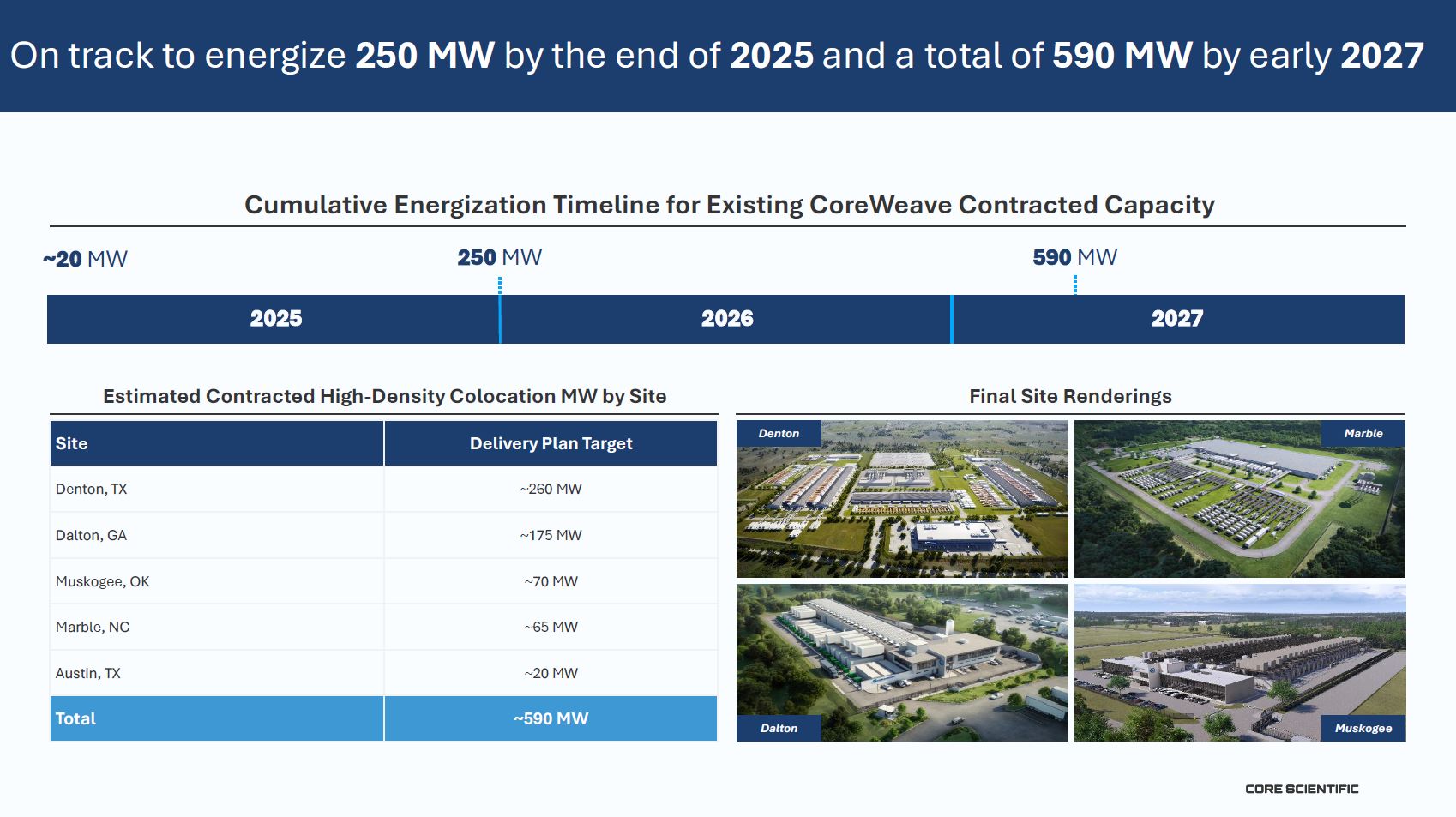

On track to energize 250 MW by the end of 2025 and a total of 590 MW by early

2027 ~20 MW Site Delivery Plan Target Denton, TX ~260 MW Dalton, GA ~175 MW Muskogee, OK ~70 MW Marble, NC ~65 MW Austin, TX ~20 MW Total ~590 MW Estimated Contracted High-Density Colocation MW by Site Final Site

Renderings 2025 2026 2027 Denton Marble Dalton Muskogee Cumulative Energization Timeline for Existing CoreWeave Contracted Capacity 250 MW 590 MW

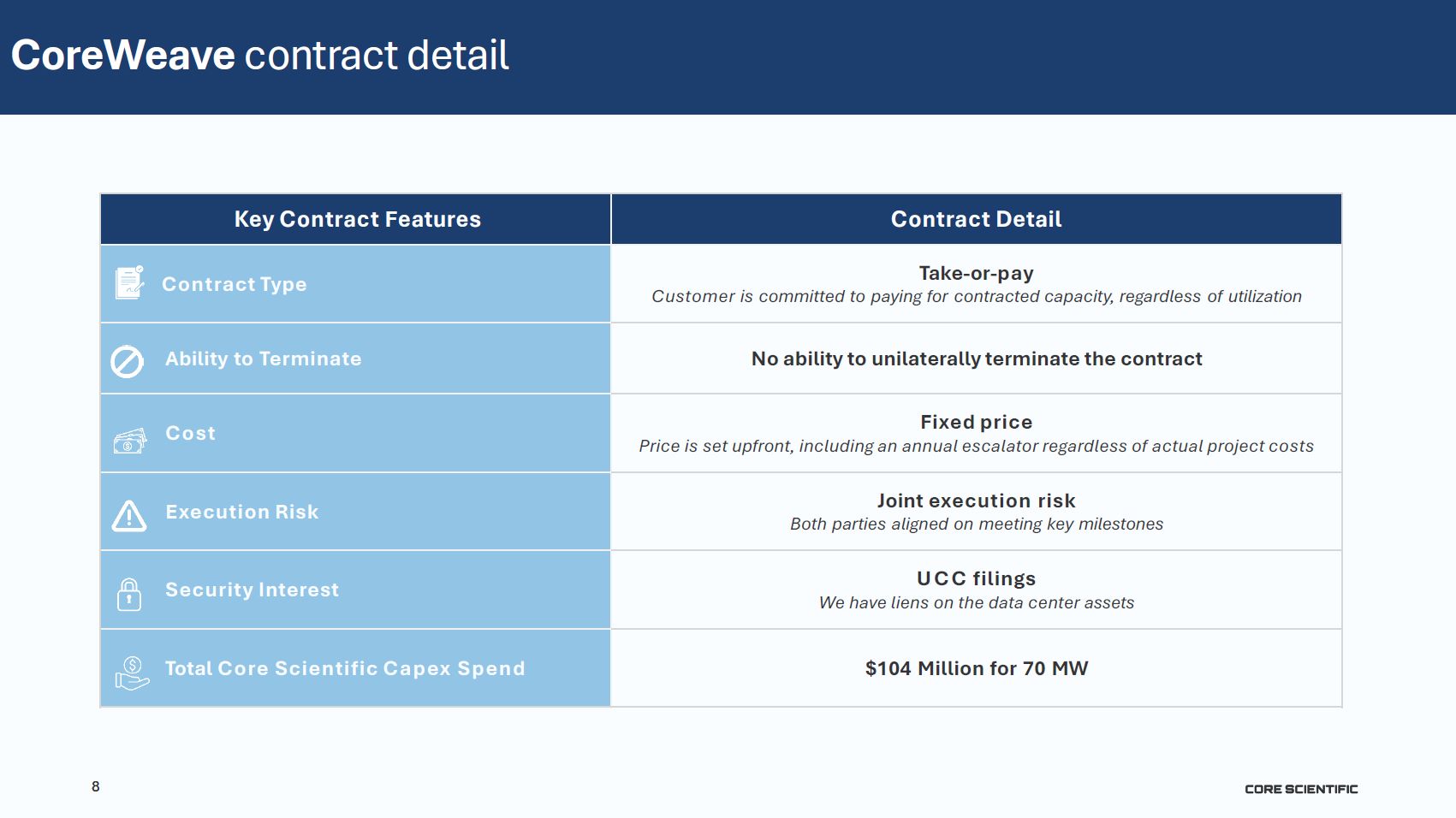

8 Key Contract Features Contract Detail Contract Type Take-or-pay Customer is

committed to paying for contracted capacity, regardless of utilization Ability to Terminate No ability to unilaterally terminate the contract Cost Fixed price Price is set upfront, including an annual escalator regardless of actual project

costs Execution Risk Joint execution risk Both parties aligned on meeting key milestones Security Interest UCC filings We have liens on the data center assets Total Core Scientific Capex Spend $104 Million for 70 MW CoreWeave contract

detail

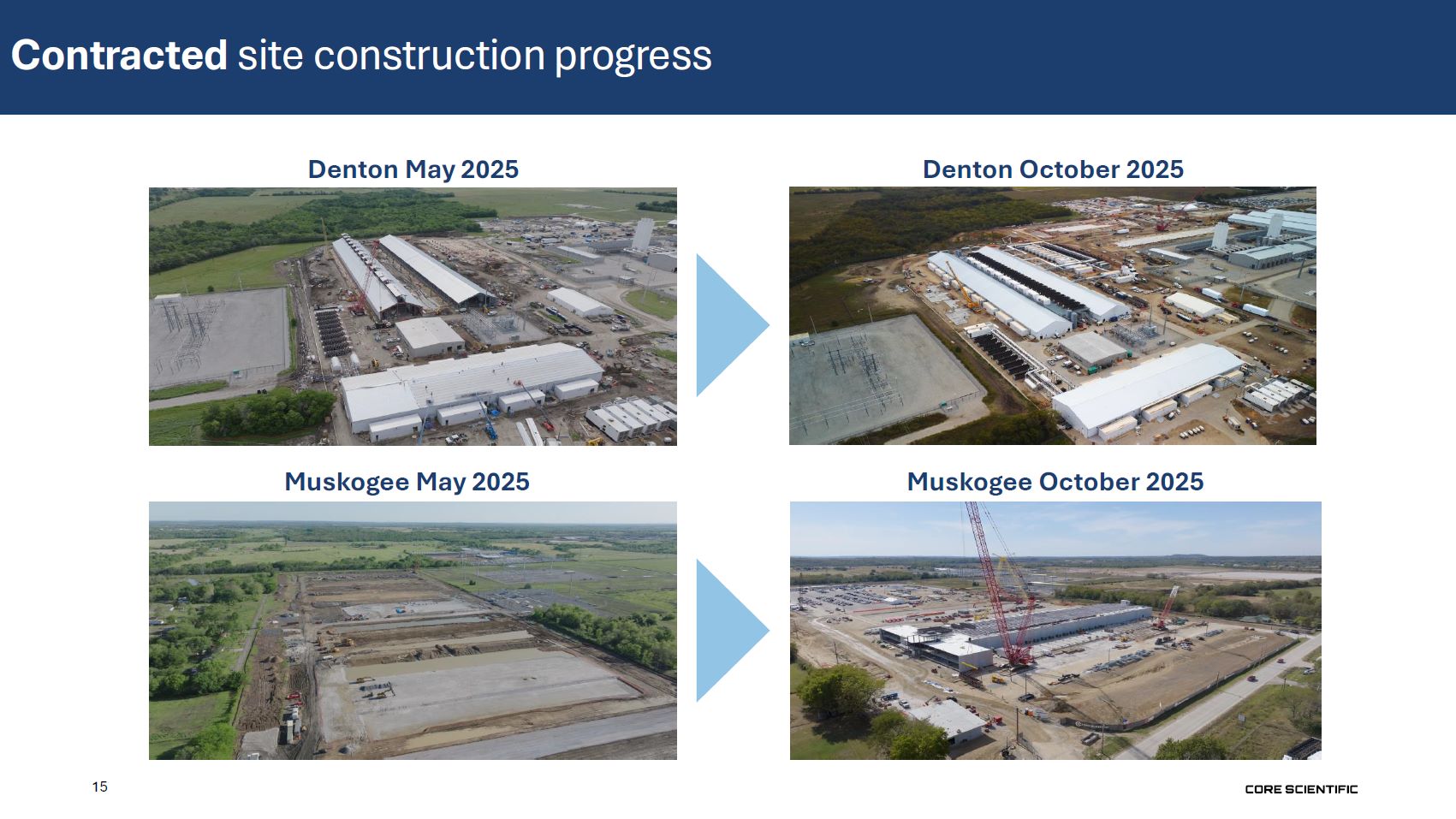

9 ~120+ MW Energized Across Denton & Marble Sites Contracted site

construction progress Precast Building Completed at Dalton 1 & Muskogee Sites Denton Marble Dalton Muskogee

10 Rob Hepler Head of Data Center Operations Matt Tyndall Head of Site

Development Trip Guinan VP of Site Development Chip Scaglione VP of Site Development Kelsey Gallagher VP of Site Development JP Balajadia Sr. Director of Site Dev Jon Gibbs Sr. Director of Site Dev Data center team with 150+ years of

combined experience Matt Brown Chief Operations Officer Data Center team with 150+ years of combined experience

ORE SCIENTIFIC 11 What to expect by Q4 earnings Signing of at least one new

colocation customer 1 One or more new power contract(s) at existing site(s) 2 New major power contract and site in top US market 3 Additional details on scalable financing approach 4

12 Appendix

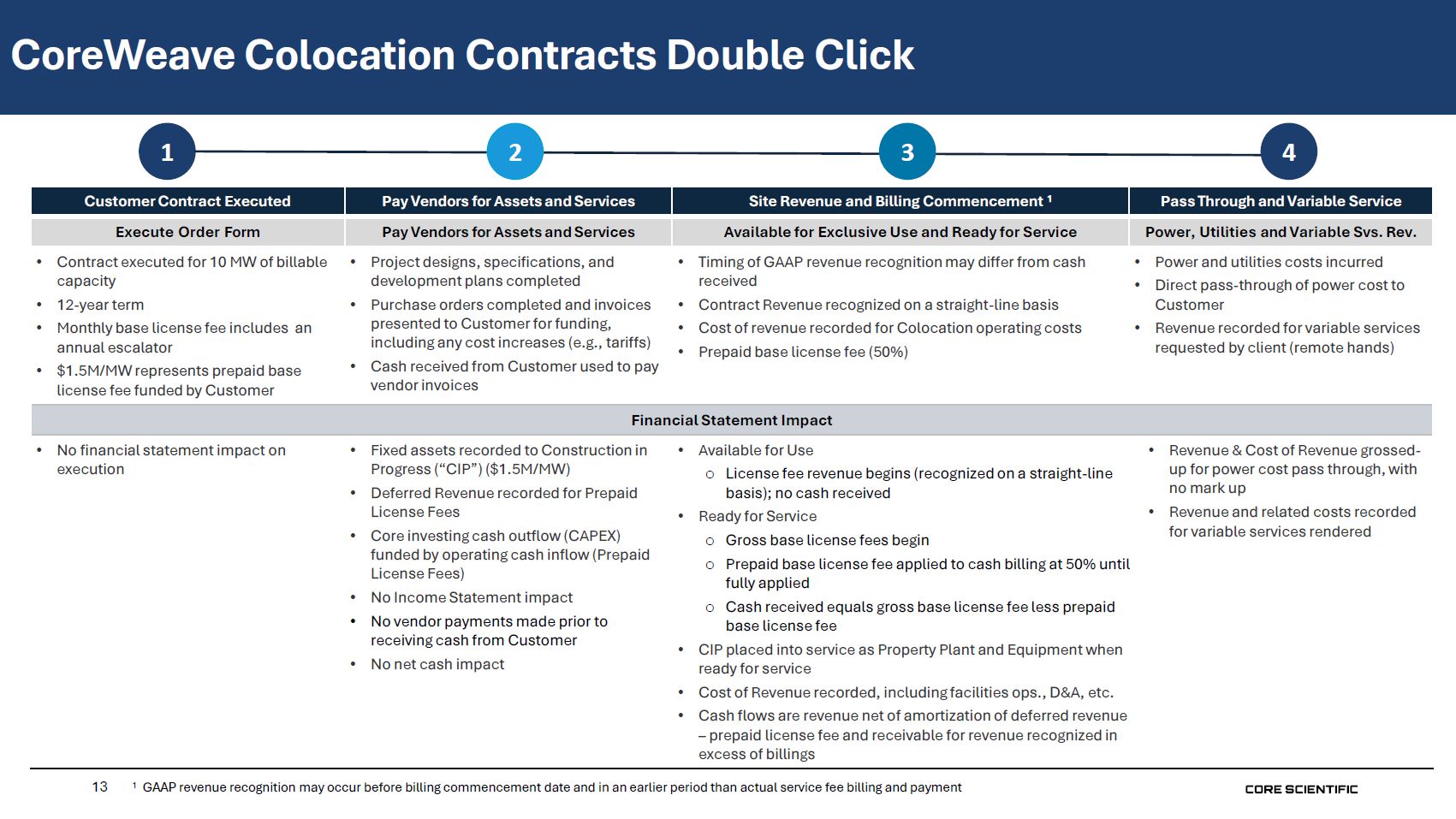

13 Customer Contract Executed Pay Vendors for Assetsand Services Site Revenue

and Billing Commencement 1 Pass Through and Variable Service Execute Order Form Pay Vendors for Assetsand Services Available for Exclusive Use and Ready for Service Power, Utilities and Variable Svs. Rev. Contract executed for 10 MW of

billable capacity 12-year term Monthly base license fee includes an annual escalator $1.5M/MW represents prepaid base license fee funded by Customer Project designs, specifications, and development plans completed Purchase orders completed

and invoices presented to Customer for funding, including any cost increases (e.g., tariffs) Cash received from Customer used to pay vendor invoices Timing of GAAP revenue recognition may differ from cash received Contract Revenue recognized

on a straight-line basis Cost of revenue recorded for Colocation operating costs Prepaid base license fee (50%) Power and utilities costs incurred Direct pass-through of power cost to Customer Revenue recorded for variable services

requested by client (remote hands) Financial Statement Impact No financial statement impact on execution Fixed assets recorded to Construction in Progress (“CIP”) ($1.5M/MW) Deferred Revenue recorded for Prepaid License Fees Core

investing cash outflow (CAPEX) funded by operating cash inflow (Prepaid License Fees) No Income Statement impact No vendor payments made prior to receiving cash from Customer No net cash impact Available for Use License fee revenue begins

(recognized on a straight-line basis); no cash received Ready for Service Gross base license fees begin Prepaid base license fee applied to cash billing at 50% until fully applied Cash received equals gross base license fee less prepaid

base license fee CIP placed into service as Property Plant and Equipment when ready for service Cost of Revenue recorded, including facilities ops., D&A, etc. Cash flows are revenue net of amortization of deferred revenue – prepaid

license fee and receivable for revenue recognized in excess of billings Revenue & Cost of Revenue grossed- up for power cost pass through, with no mark up Revenue and related costs recorded for variable services rendered 1 GAAP revenue

recognition may occur before billing commencement date and in an earlier period than actual service fee billing and payment 1 2 3 4 CoreWeave Colocation Contracts Double Click

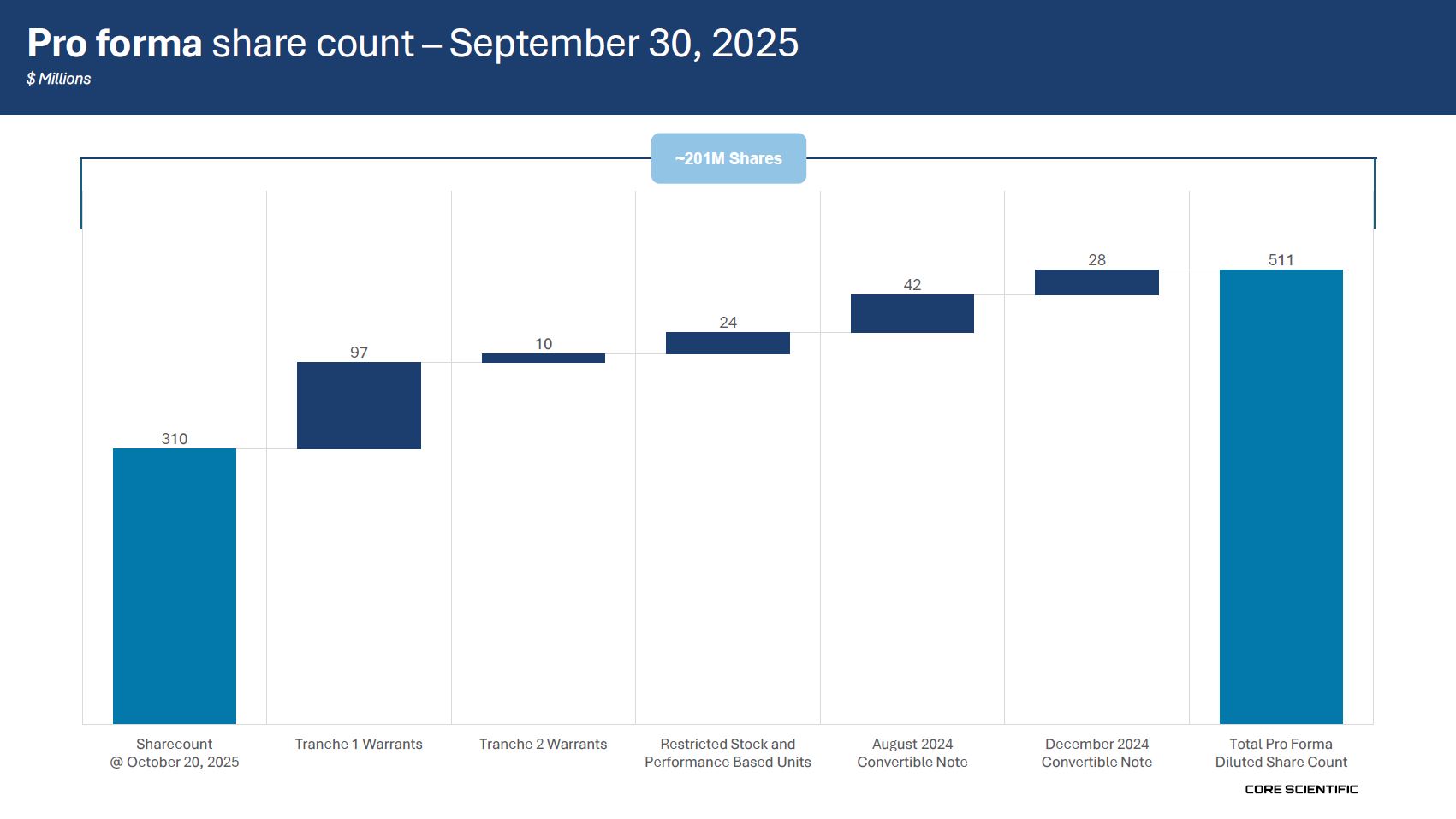

Pro forma share count – September 30, 2025 $

Millions 310 97 10 24 42 28 511 Sharecount Tranche 1 Warrants Tranche 2 Warrants Restricted Stock and August 2024 December 2024 Total Pro Forma @ October 20, 2025 Performance Based Units Convertible Note Convertible

Note Diluted Share Count ~201M Shares

15 Denton May 2025 Denton October 2025 Muskogee May 2025 Muskogee October

2025 Contracted site construction progress

16 Marble May 2025 Marble October 2025 Dalton 1 May 2025 Dalton 1 October

2025 Contracted site construction progress