EXHIBIT 99.1

Published on October 14, 2025

Exhibit 99.1

Proposed Merger between Core Scientific and CoreWeave October 2025

Executive Summary 2 The Core Scientific Board of Directors (the “Board”)

unanimously determined that the proposed transaction with CoreWeave represents the best available alternative for all Core Scientific stockholders and recommends all stockholders vote FOR the transaction 1 The proposed transaction

provides significant pro forma combination benefits; the companies are closely linked which de-risks integration and benefits from combined operations 2 The proposed combination eliminates standalone execution risk on timely delivery

of currently leased data centers and projected future leasing in Core Scientific’s current business plan (the “Standalone Plan”), as well as its ~$7.3 billion financing need 3 The Board oversaw the negotiation of an attractive exchange

ratio that provides meaningful upfront premium and upside opportunity to Core Scientific stockholders 4 The proposed transaction was the result of a thoughtful Board-led evaluation of strategic alternatives

Transaction Summary Transaction Terms Core Scientific stockholders to

receive 0.1235 newly-issued shares of CoreWeave Class A common stock for each share of Core Scientific common stock held Exchange ratio of 0.1235 reflects a ~71% premium to the 10-day VWAP exchange ratio as of June 25, 2025, prior to

media reports regarding a transaction between the parties Through extensive negotiations, Core Scientific obtained an approximately 34% increase in the exchange ratio from CoreWeave's initial offer Core Scientific stockholders will

receive an 8.9% ownership in a leading AI platform with strong momentum Structure provides certainty into required share issuance and ownership for both companies Ensures there is no acquiror walk away right Process Overview Highly

qualified, engaged and independent Board provided direct oversight of negotiations with CoreWeave and met numerous times throughout the process, which led to increased offers from CoreWeave Thoughtfully considered alternatives, including

the tradeoffs between this transaction and Core Scientific’s Standalone Plan Achieved attractive exchange ratio – negotiations with CoreWeave yielded multiple exchange ratio increases that ultimately culminated in the best and final

offer CoreWeave indicated it was unwilling to pursue a fixed value deal (with or without a collar) or include cash in its proposal, as such terms would not be acceptable to its Board1 Engaged two independent financial advisors to provide

fairness opinions who did not believe there would be any alternative potential buyer for Core Scientific Timing and Approvals Transaction has been unanimously approved by the board of directors of each company Expected to close in Q4

2025 Subject to approval by the affirmative vote of a majority of Core Scientific’s outstanding common shares HSR waiting period expired on August 25, 2025 On July 7, 2025, Core Scientific announced it had entered into a definitive

agreement pursuant to which CoreWeave will acquire Core Scientific in an all-stock transaction 3 Source: DealPointData (as of 10/09/2025) 1. Since 2004, only 2% of all stock transactions have included collar provisions. Based on public,

stock only, fixed exchange ratio transactions since 2004, excluding merger-of-equals transactions, withdrawn transactions, and transactions with premiums greater than 150%

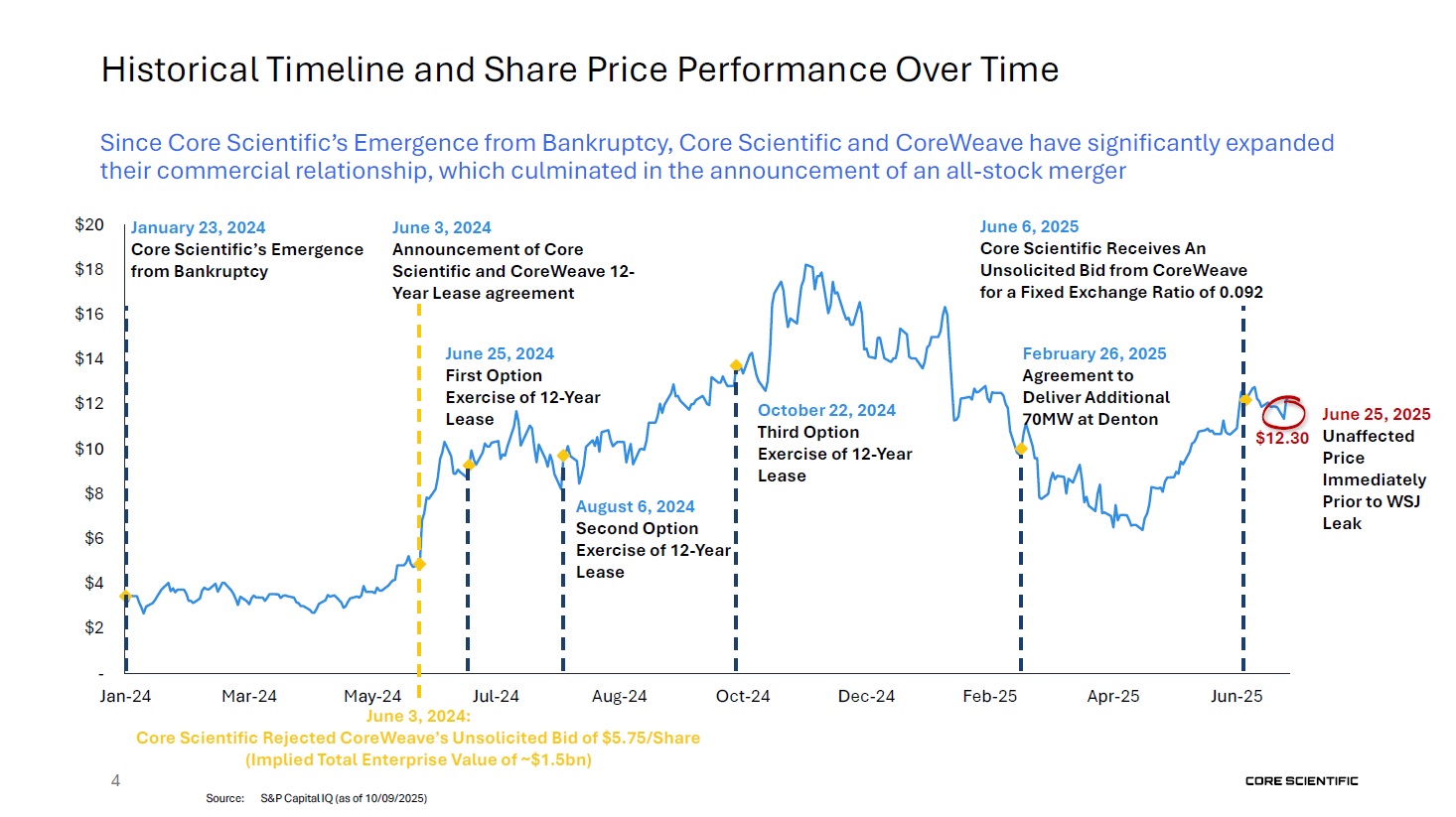

Historical Timeline and Share Price Performance Over Time Since Core

Scientific’s Emergence from Bankruptcy, Core Scientific and CoreWeave have significantly expanded their commercial relationship, which culminated in the announcement of an all-stock merger - Jan-24

Mar-24 $2 $4 $6 $8 $10 $12 $14 $16 $18 $20 May-24 Jul-24 Aug-24 Oct-24 Dec-24 Feb-25 Apr-25 Jun-25 January 23, 2024 Core Scientific’s Emergence from Bankruptcy June 6, 2025 Core Scientific Receives An Unsolicited Bid

from CoreWeave for a Fixed Exchange Ratio of 0.092 June 3, 2024 Announcement of Core Scientific and CoreWeave 12- Year Lease agreement June 3, 2024: Core Scientific Rejected CoreWeave’s Unsolicited Bid of $5.75/Share (Implied Total

Enterprise Value of ~$1.5bn) June 25, 2025 Unaffected Price Immediately Prior to WSJ Leak $12.30 June 25, 2024 First Option Exercise of 12-Year Lease 4 Source: S&P Capital IQ (as of 10/09/2025) August 6, 2024 Second Option

Exercise of 12-Year Lease October 22, 2024 Third Option Exercise of 12-Year Lease February 26, 2025 Agreement to Deliver Additional 70MW at Denton

Significant Potential Pro Forma Combination Benefits 1 5

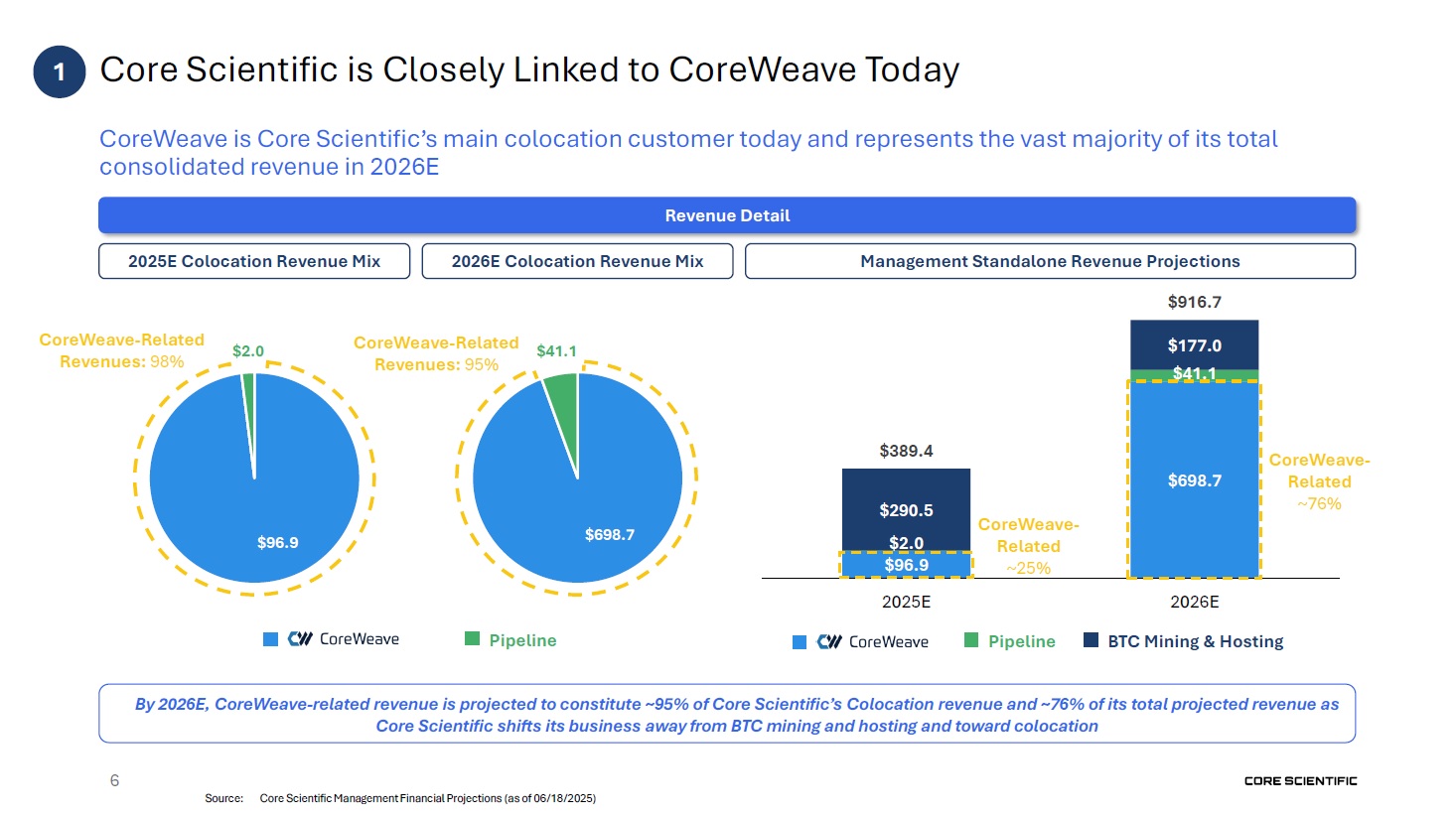

Core Scientific is Closely Linked to CoreWeave Today CoreWeave is Core

Scientific’s main colocation customer today and represents the vast majority of its total consolidated revenue in 2026E Revenue Detail $96.9 $698.7 $290.5 $2.0 $177.0 $41.1 $389.4 $916.7 2025E 2026E BTC Mining &

Hosting Management Standalone Revenue Projections 2025E Colocation Revenue Mix 2026E Colocation Revenue Mix CoreWeave-Related Revenues: 98% CoreWeave-Related Revenues: 95% $698.7 $41.1 $96.9 $2.0 Pipeline Pipeline By 2026E,

CoreWeave-related revenue is projected to constitute ~95% of Core Scientific’s Colocation revenue and ~76% of its total projected revenue as Core Scientific shifts its business away from BTC mining and hosting and toward

colocation CoreWeave- Related ~25% CoreWeave- Related ~76% 1 6 Source: Core Scientific Management Financial Projections (as of 06/18/2025)

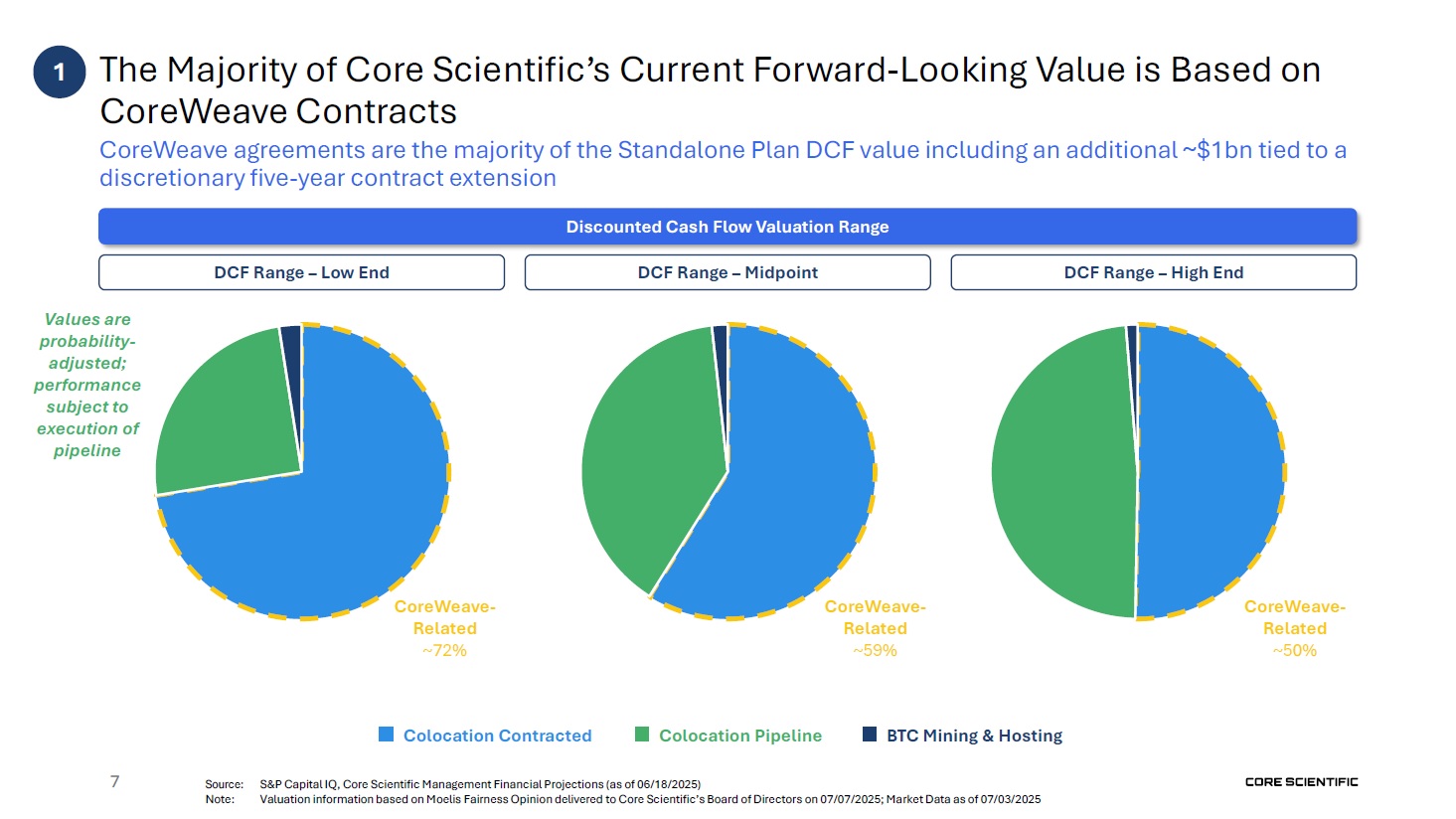

The Majority of Core Scientific’s Current Forward-Looking Value is Based on

CoreWeave Contracts CoreWeave- Related ~72% CoreWeave- Related ~59% CoreWeave- Related ~50% Colocation Contracted Colocation Pipeline BTC Mining & Hosting Source: S&P Capital IQ, Core Scientific Management Financial

Projections (as of 06/18/2025) Note: Valuation information based on Moelis Fairness Opinion delivered to Core Scientific’s Board of Directors on 07/07/2025; Market Data as of 07/03/2025 CoreWeave agreements are the majority of the

Standalone Plan DCF value including an additional ~$1bn tied to a discretionary five-year contract extension Discounted Cash Flow Valuation Range 7 DCF Range – Low End DCF Range – Midpoint DCF Range – High End Values are probability-

adjusted; performance subject to execution of pipeline 1

8 Potential Pro Forma Combination Benefits The combined company will benefit

from a number of potential cost savings and synergies, which will create value for Core Scientific stockholders Source: Management estimates Pro forma ownership in an “up the stack”, high-growth tech stock currently valued at a

significant discount to its publicly-traded peers and relative growth profile Potential for incremental price appreciation via multiple expansion Provides Core Scientific stockholders a premium today and substantial upside in joint value

creation vs. fixed payments over the next 15+ years Accelerates and de-risks path to scale for both companies, with the majority of the asset base already reserved by CoreWeave (making a competing bid unlikely) Verticalization creates

differentiated leading large-cap AI infrastructure player Core Scientific stockholders share in the benefit of the elimination of ~$10bn in contractual payments and lower debt financing costs associated with the combined

company Estimated $500mm+ fully ramped, annual run rate cost savings by the end of 2027E More liquid pro forma trading security, which may reduce volatility of combined company vs. individual standalone companies De-risks Core

Scientific’s ability to secure financing for data center buildout without customer contracts 1

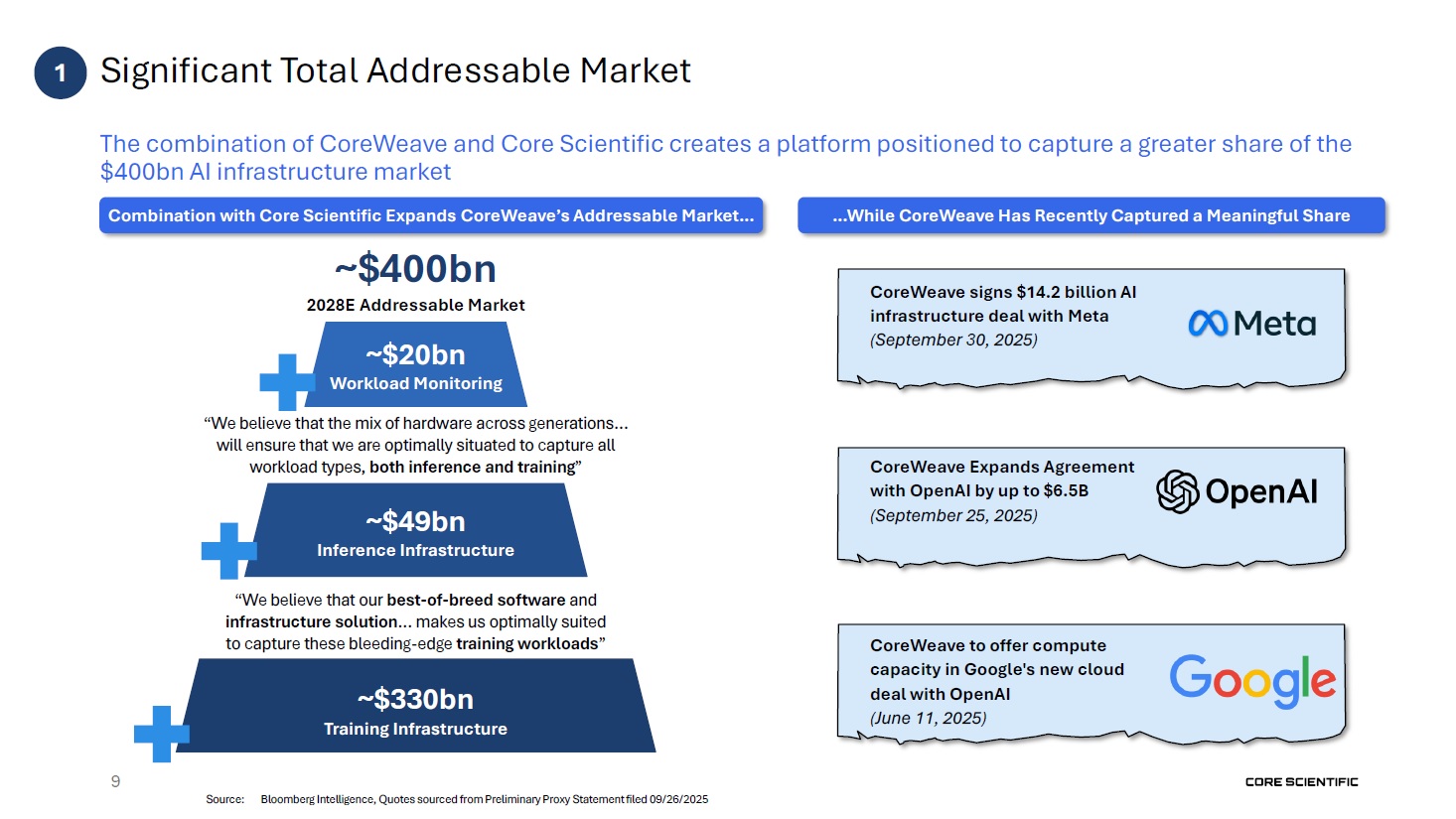

Significant Total Addressable Market 9 ~$400bn 2028E Addressable

Market ~$330bn Training Infrastructure ~$49bn Inference Infrastructure ~$20bn Workload Monitoring The combination of CoreWeave and Core Scientific creates a platform positioned to capture a greater share of the $400bn AI

infrastructure market Combination with Core Scientific Expands CoreWeave’s Addressable Market… …While CoreWeave Has Recently Captured a Meaningful Share CoreWeave Expands Agreement with OpenAI by up to $6.5B (September 25,

2025) CoreWeave signs $14.2 billion AI infrastructure deal with Meta (September 30, 2025) CoreWeave to offer compute capacity in Google's new cloud deal with OpenAI (June 11, 2025) “We believe that our best-of-breed software and

infrastructure solution… makes us optimally suited to capture these bleeding-edge training workloads” “We believe that the mix of hardware across generations… will ensure that we are optimally situated to capture all workload types, both

inference and training” 1 Source: Bloomberg Intelligence, Quotes sourced from Preliminary Proxy Statement filed 09/26/2025

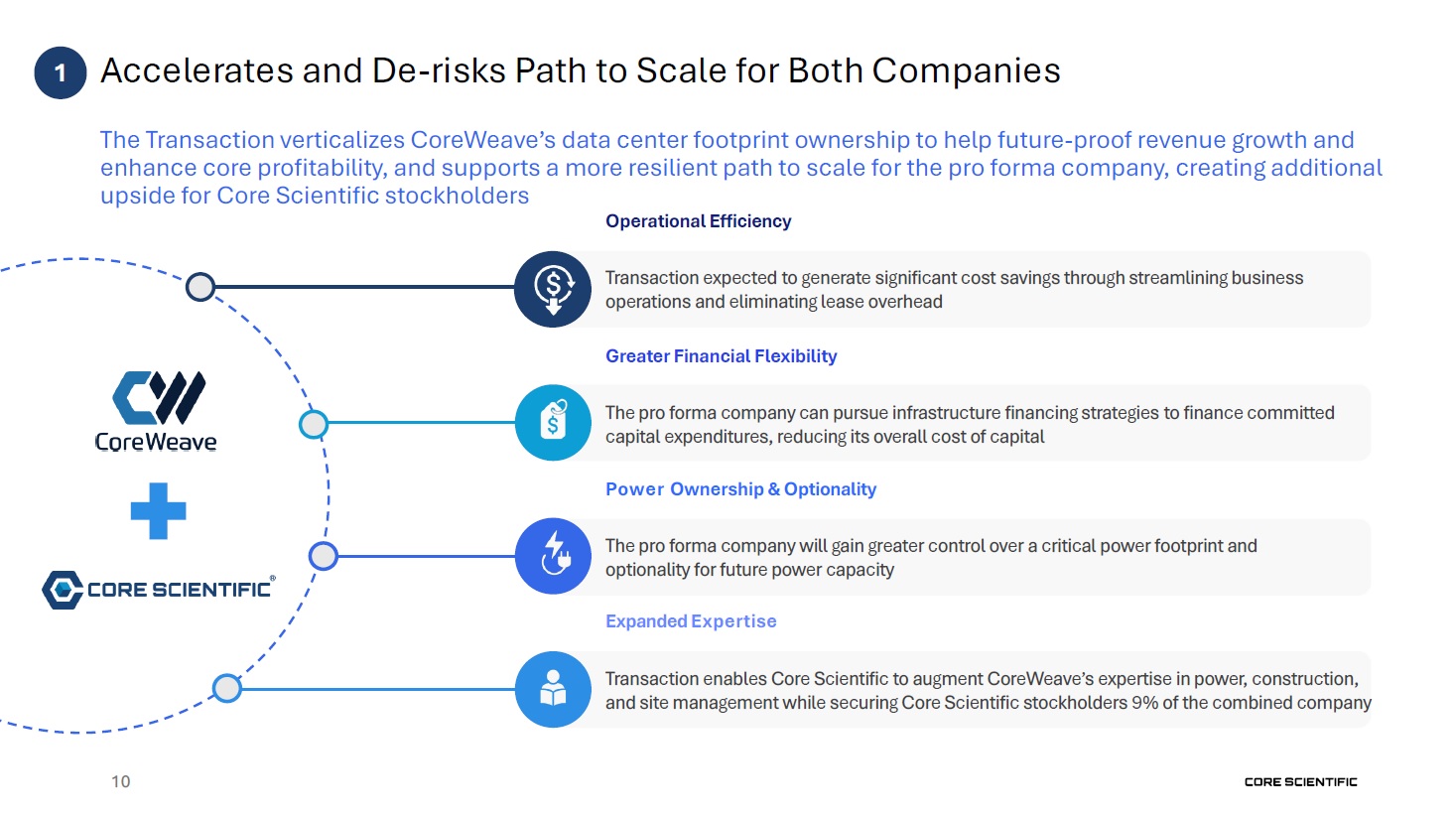

Accelerates and De-risks Path to Scale for Both Companies The Transaction

verticalizes CoreWeave’s data center footprint ownership to help future-proof revenue growth and enhance core profitability, and supports a more resilient path to scale for the pro forma company, creating additional upside for Core

Scientific stockholders Operational Efficiency Transaction expected to generate significant cost savings through streamlining business operations and eliminating lease overhead Greater Financial Flexibility The pro forma company can

pursue infrastructure financing strategies to finance committed capital expenditures, reducing its overall cost of capital Power Ownership & Optionality The pro forma company will gain greater control over a critical power footprint

and optionality for future power capacity Expanded Expertise Transaction enables Core Scientific to augment CoreWeave’s expertise in power, construction, and site management while securing Core Scientific stockholders 9% of the combined

company 1 10

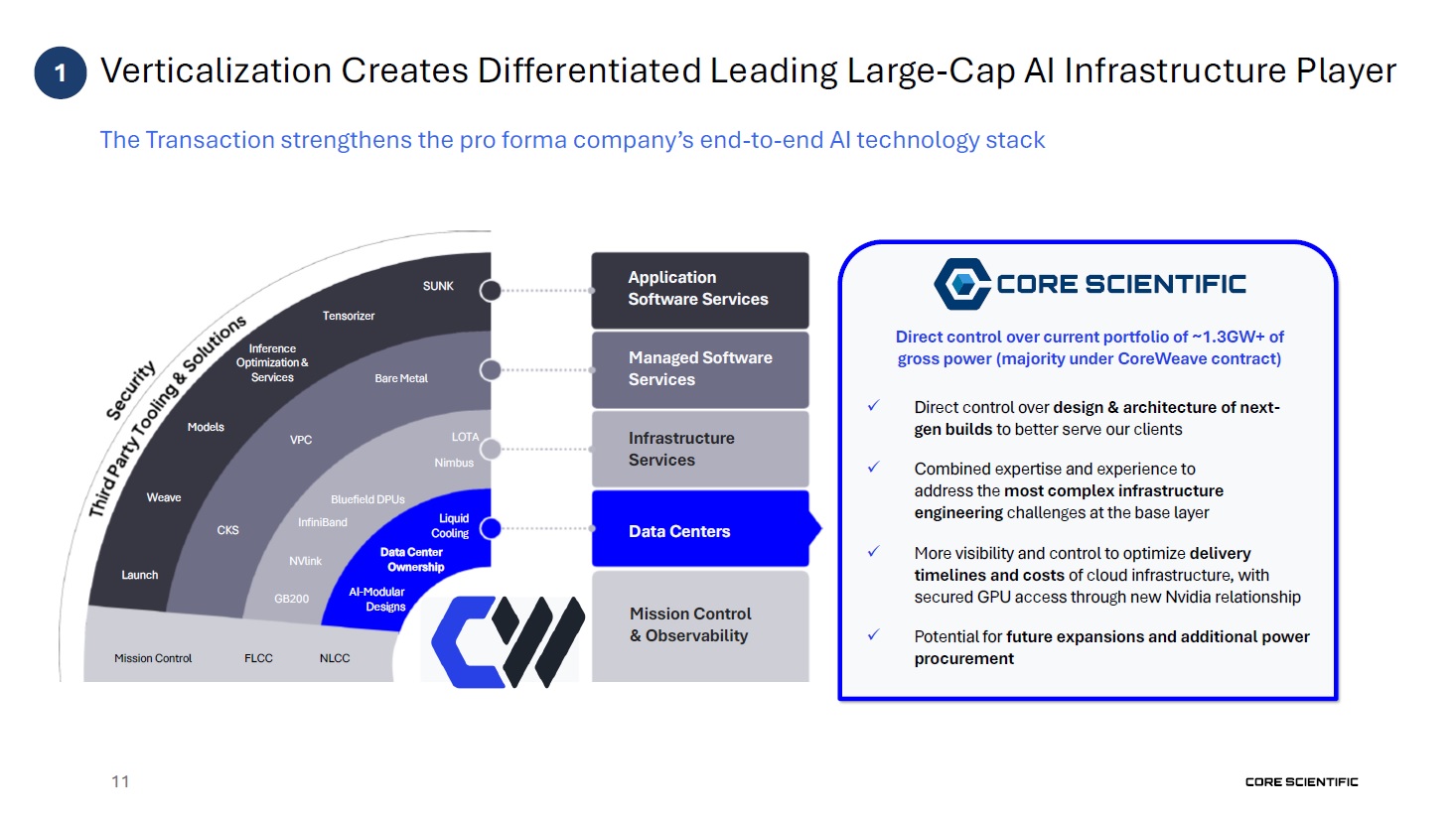

Verticalization Creates Differentiated Leading Large-Cap AI Infrastructure

Player Managed Software Services Infrastructure Services Data Centers Application Software Services Bare Metal VPC CKS LOTA Nimbus Bluefield DPUs InfiniBand NVlink GB200 Mission Control FLCC NLCC Mission Control &

Observability SUNK Inference Optimization & Services Tensorizer Models Weave Launch Liquid Cooling Data Center Ownership AI-Modular Designs Direct control over current portfolio of ~1.3GW+ of gross power (majority under

CoreWeave contract) Direct control over design & architecture of next- gen builds to better serve our clients Combined expertise and experience to address the most complex infrastructure engineering challenges at the base layer More

visibility and control to optimize delivery timelines and costs of cloud infrastructure, with secured GPU access through new Nvidia relationship Potential for future expansions and additional power procurement The Transaction strengthens

the pro forma company’s end-to-end AI technology stack 1 10

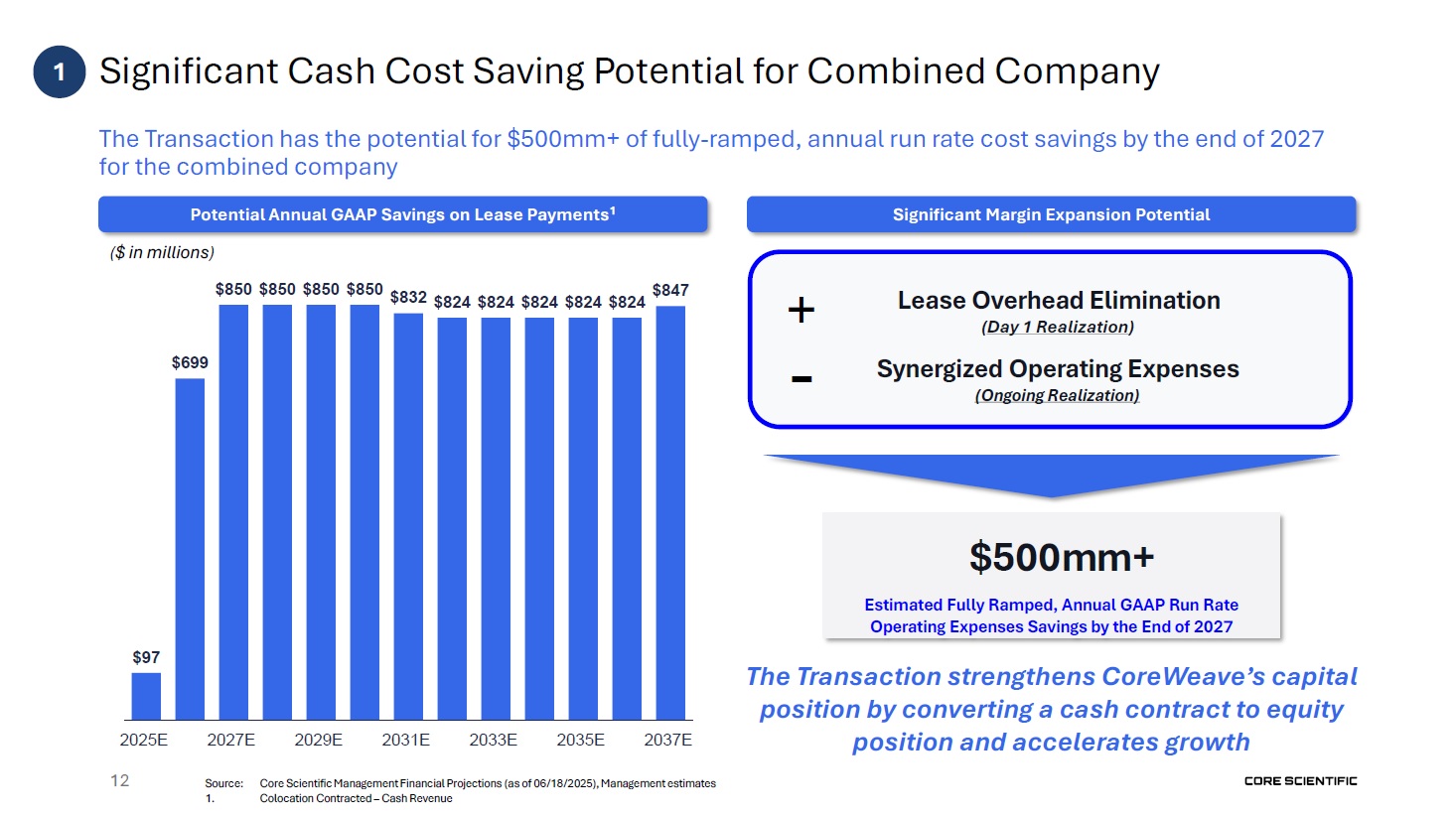

$500mm+ Estimated Fully Ramped, Annual GAAP Run Rate Operating Expenses

Savings by the End of 2027 + Lease Overhead Elimination (Day 1 Realization) - Synergizedngoing(O OperRealization)a ting Expenses Significant Cash Cost Saving Potential for Combined Company The Transaction has the potential for $500mm+

of fully-ramped, annual run rate cost savings by the end of 2027 for the combined company Potential Annual GAAP Savings on Lease Payments1 Significant Margin Expansion Potential ($ in millions) $97 $699 $850 $850 $850 $850 $832 $824

$824 $824 $824 $824 $847 2025E 2027E 2029E 2031E 2033E 2035E 2037E Source: Core Scientific Management Financial Projections (as of 06/18/2025), Management estimates 12 The Transaction strengthens CoreWeave’s capital position by

converting a cash contract to equity position and accelerates growth 1 1. Colocation Contracted – Cash Revenue

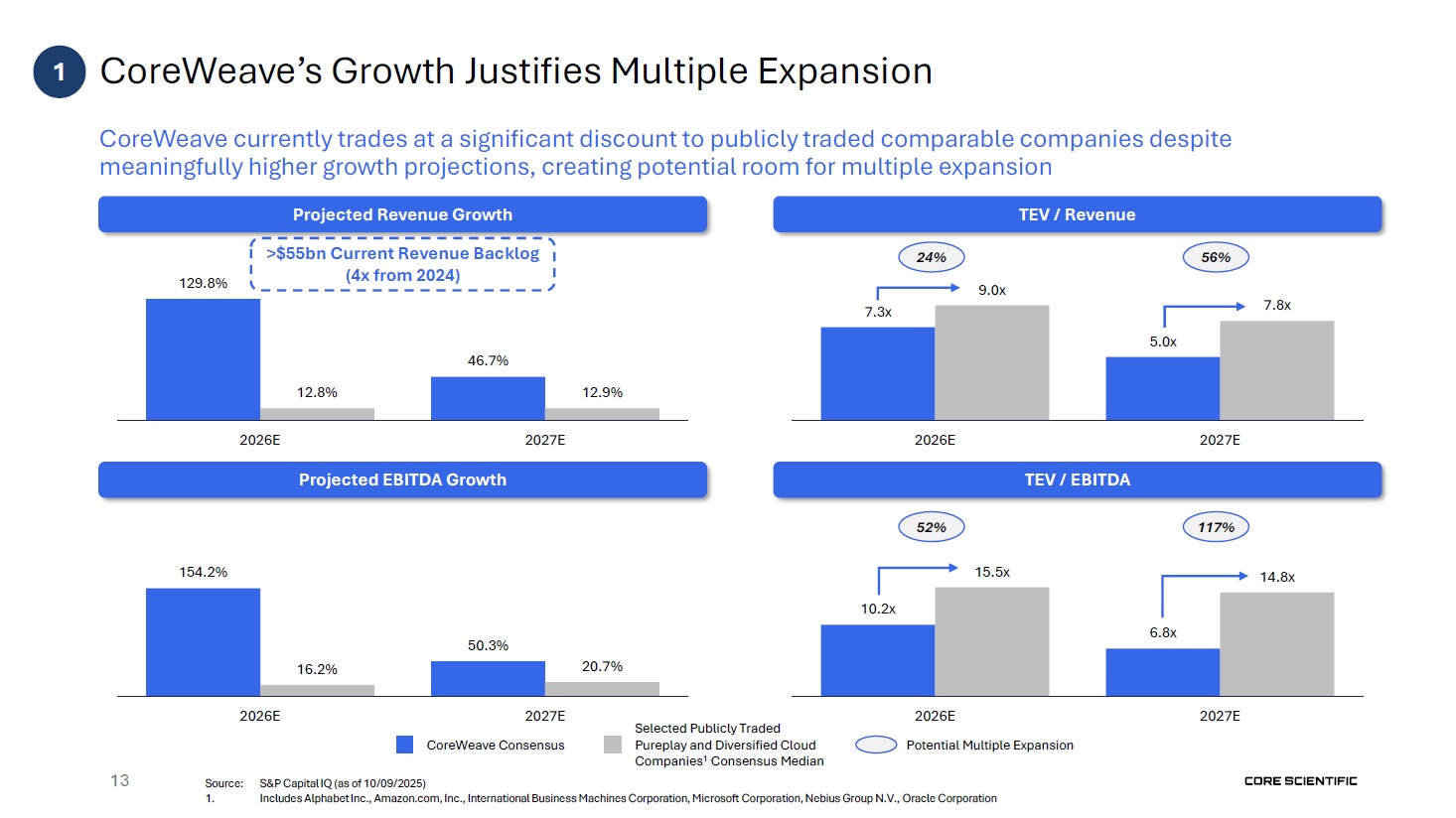

7.3x 5.0x 9.0x 7.8x 2026E 2027E 10.2x 6.8x 15.5x 14.8x 2026E Potential

Multiple Expansion 2027E CoreWeave’s Growth Justifies Multiple Expansion 2027E CoreWeave Consensus Selected Publicly Traded Pureplay and Diversified Cloud Companies1 Consensus Median TEV / EBITDA 13 Source: S&P Capital IQ (as of

10/09/2025) 1. Includes Alphabet Inc., Amazon.com, Inc., International Business Machines Corporation, Microsoft Corporation, Nebius Group N.V., Oracle Corporation CoreWeave currently trades at a significant discount to publicly traded

comparable companies despite meaningfully higher growth projections, creating potential room for multiple expansion Projected Revenue Growth TEV / Revenue Projected EBITDA

Growth 129.8% 46.7% 12.8% 12.9% 2026E 2027E 154.2% 50.3% 16.2% 20.7% 2026E 24% 56% 52% 117% 1 >$55bn Current Revenue Backlog (4x from 2024)

Combination Eliminates Risks of Core Scientific Standalone Execution 2 14

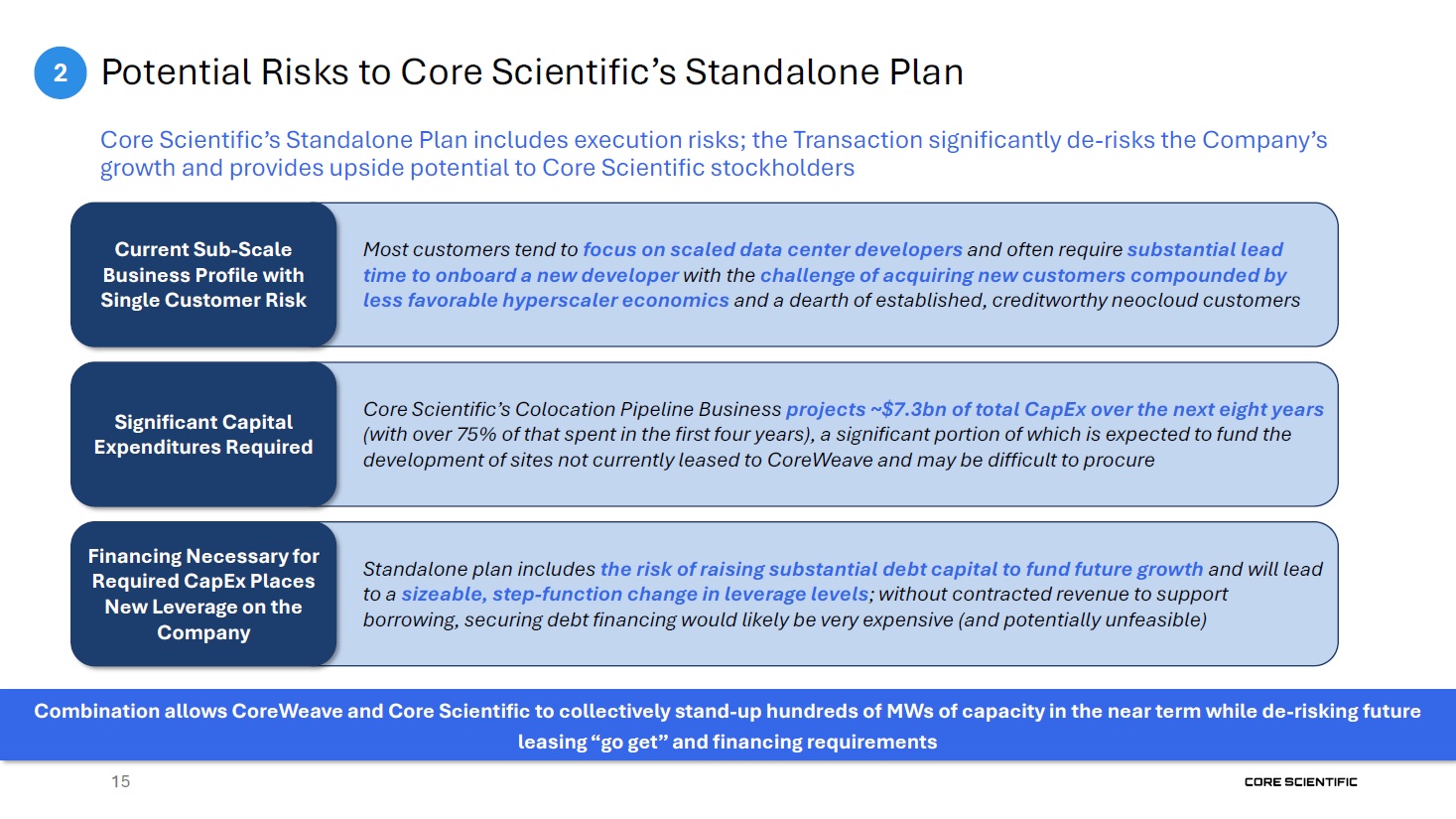

Potential Risks to Core Scientific’s Standalone Plan 2 Core Scientific’s

Standalone Plan includes execution risks; the Transaction significantly de-risks the Company’s growth and provides upside potential to Core Scientific stockholders Core Scientific’s Colocation Pipeline Business projects ~$7.3bn of total

CapEx over the next eight years (with over 75% of that spent in the first four years), a significant portion of which is expected to fund the development of sites not currently leased to CoreWeave and may be difficult to

procure Significant Capital Expenditures Required Standalone plan includes the risk of raising substantial debt capital to fund future growth and will lead to a sizeable, step-function change in leverage levels; without contracted revenue

to support borrowing, securing debt financing would likely be very expensive (and potentially unfeasible) Financing Necessary for Required CapEx Places New Leverage on the Company Most customers tend to focus on scaled data center

developers and often require substantial lead time to onboard a new developer with the challenge of acquiring new customers compounded by less favorable hyperscaler economics and a dearth of established, creditworthy neocloud

customers Current Sub-Scale Business Profile with Single Customer Risk 14 Combination allows CoreWeave and Core Scientific to collectively stand-up hundreds of MWs of capacity in the near term while de-risking future leasing “go get”

and financing requirements

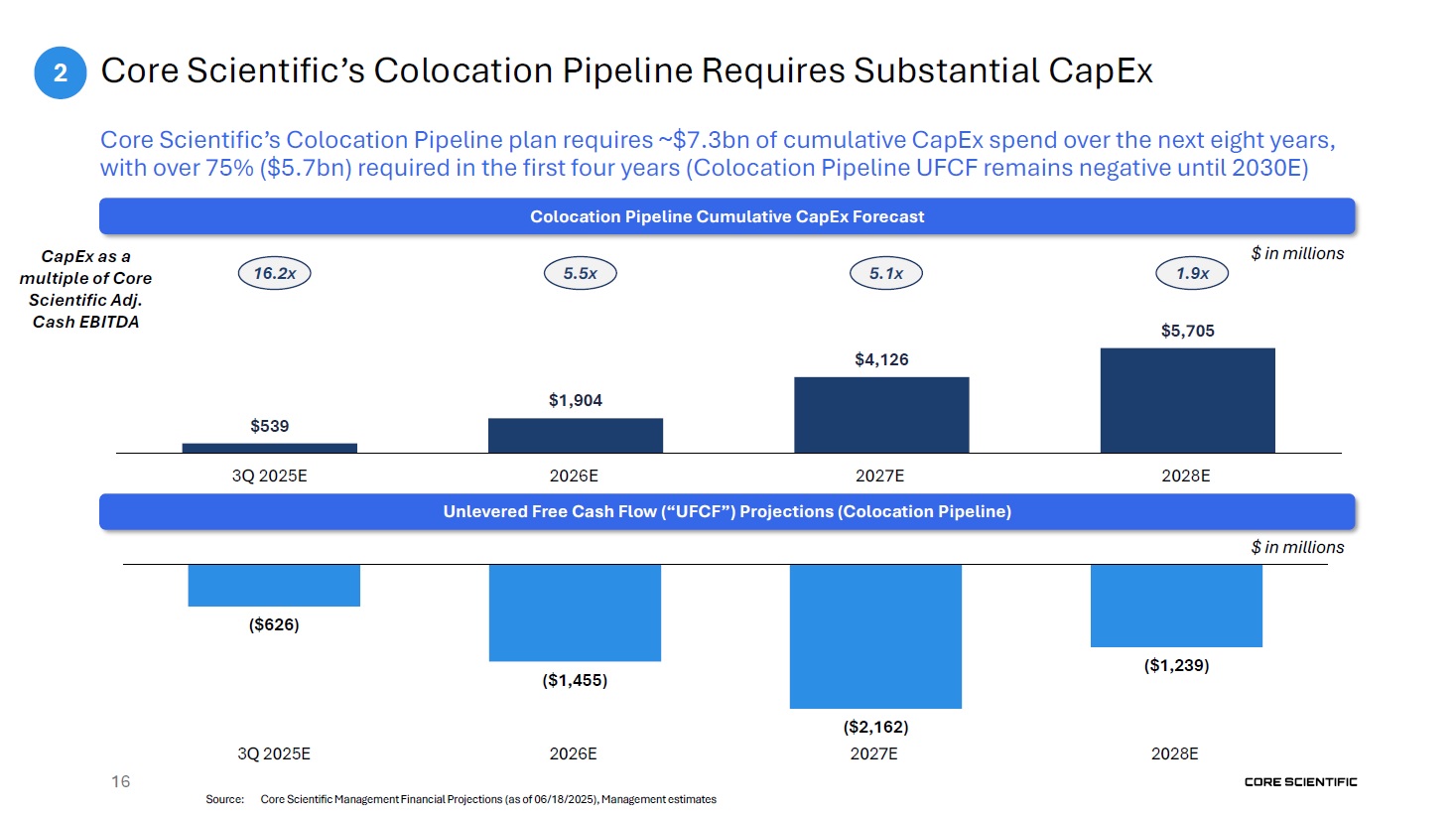

Core Scientific’s Colocation Pipeline Requires Substantial CapEx Core

Scientific’s Colocation Pipeline plan requires ~$7.3bn of cumulative CapEx spend over the next eight years, with over 75% ($5.7bn) required in the first four years (Colocation Pipeline UFCF remains negative until 2030E) Colocation

Pipeline Cumulative CapEx Forecast $539 $1,904 $4,126 $5,705 3Q 2025E 2026E 2027E Unlevered Free Cash Flow (“UFCF”) Projections (Colocation Pipeline) 2028E ($626) ($1,455) ($1,239) ($2,162) 2027E 3Q

2025E 2026E 2028E 16.2x CapEx as a multiple of Core Scientific Adj. Cash EBITDA 5.5x 5.1x 1.9x $ in millions $ in millions 2 16 Source: Core Scientific Management Financial Projections (as of 06/18/2025), Management estimates

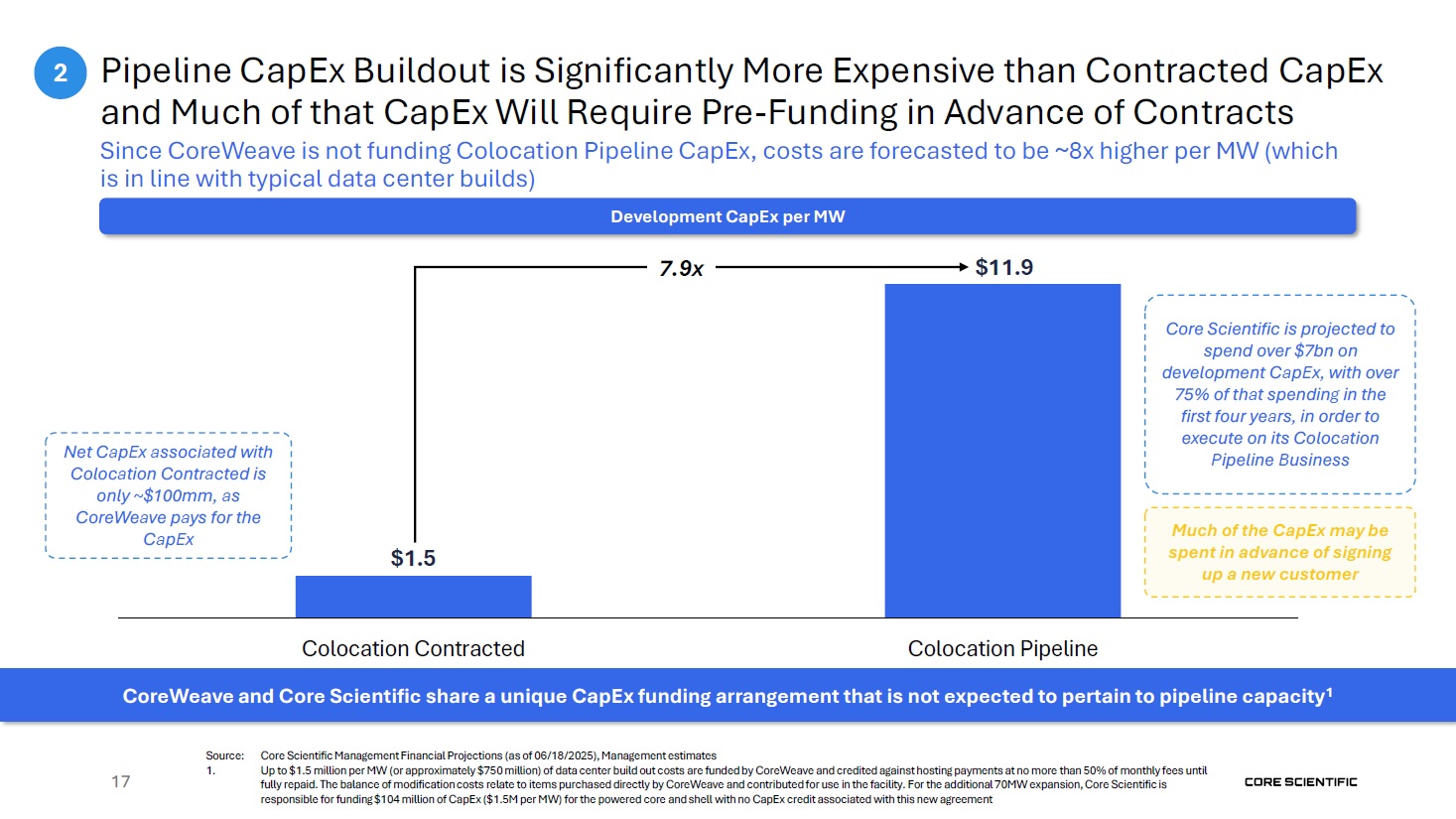

$1.5 $11.9 17 Pipeline CapEx Buildout is Significantly More Expensive than

Contracted CapEx and Much of that CapEx Will Require Pre-Funding in Advance of Contracts 7.9x Source: Core Scientific Management Financial Projections (as of 06/18/2025), Management estimates 1. Up to $1.5 million per MW (or

approximately $750 million) of data center build out costs are funded by CoreWeave and credited against hosting payments at no more than 50% of monthly fees until fully repaid. The balance of modification costs relate to items purchased

directly by CoreWeave and contributed for use in the facility. For the additional 70MW expansion, Core Scientific is responsible for funding $104 million of CapEx ($1.5M per MW) for the powered core and shell with no CapEx credit associated

with this new agreement Since CoreWeave is not funding Colocation Pipeline CapEx, costs are forecasted to be ~8x higher per MW (which is in line with typical data center builds) Development CapEx per MW Core Scientific is projected to

spend over $7bn on development CapEx, with over 75% of that spending in the first four years, in order to execute on its Colocation Pipeline Business Net CapEx associated with Colocation Contracted is only ~$100mm, as CoreWeave pays for

the CapEx Colocation Contracted Colocation Pipeline CoreWeave and Core Scientific share a unique CapEx funding arrangement that is not expected to pertain to pipeline capacity1 2 Much of the CapEx may be spent in advance of signing up a

new customer

Attractive Exchange Ratio 3 18

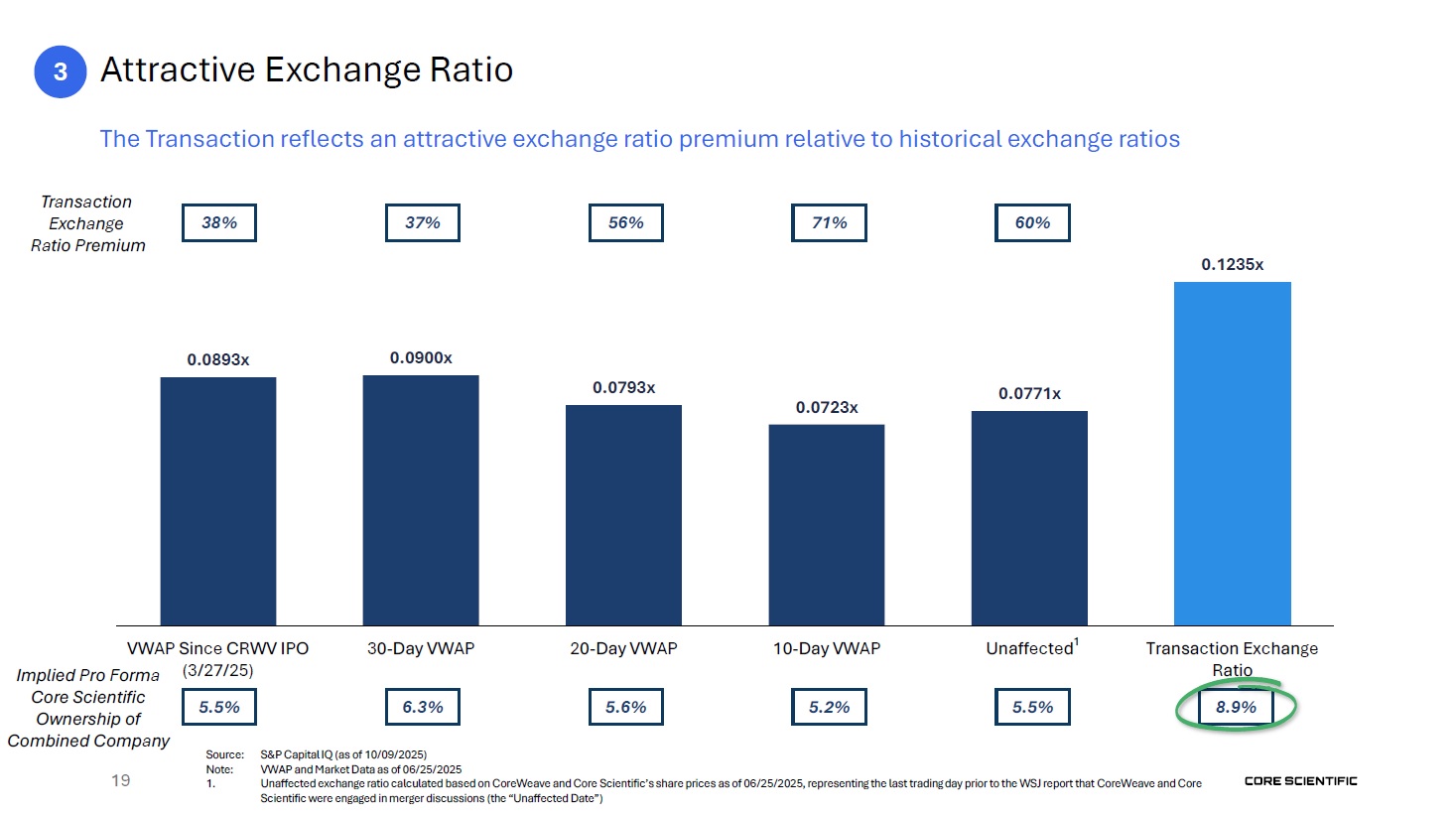

0.0893x 0.0900x 0.0793x 0.0723x 0.0771x 0.1235x VWAP Since CRWV

IPO (3/27/25) 30-Day VWAP 20-Day VWAP 10-Day VWAP Unaffected1 Attractive Exchange Ratio The Transaction reflects an attractive exchange ratio premium relative to historical exchange

ratios 3 60% 71% 56% 37% 38% 5.5% 5.2% 5.6% 6.3% 5.5% Transaction Exchange Ratio 8.9% Implied Pro Forma Core Scientific Ownership of Combined Company 19 Source: S&P Capital IQ (as of 10/09/2025) Note: VWAP and Market

Data as of 06/25/2025 1. Unaffected exchange ratio calculated based on CoreWeave and Core Scientific’s share prices as of 06/25/2025, representing the last trading day prior to the WSJ report that CoreWeave and Core Scientific were

engaged in merger discussions (the “Unaffected Date”) Transaction Exchange Ratio Premium

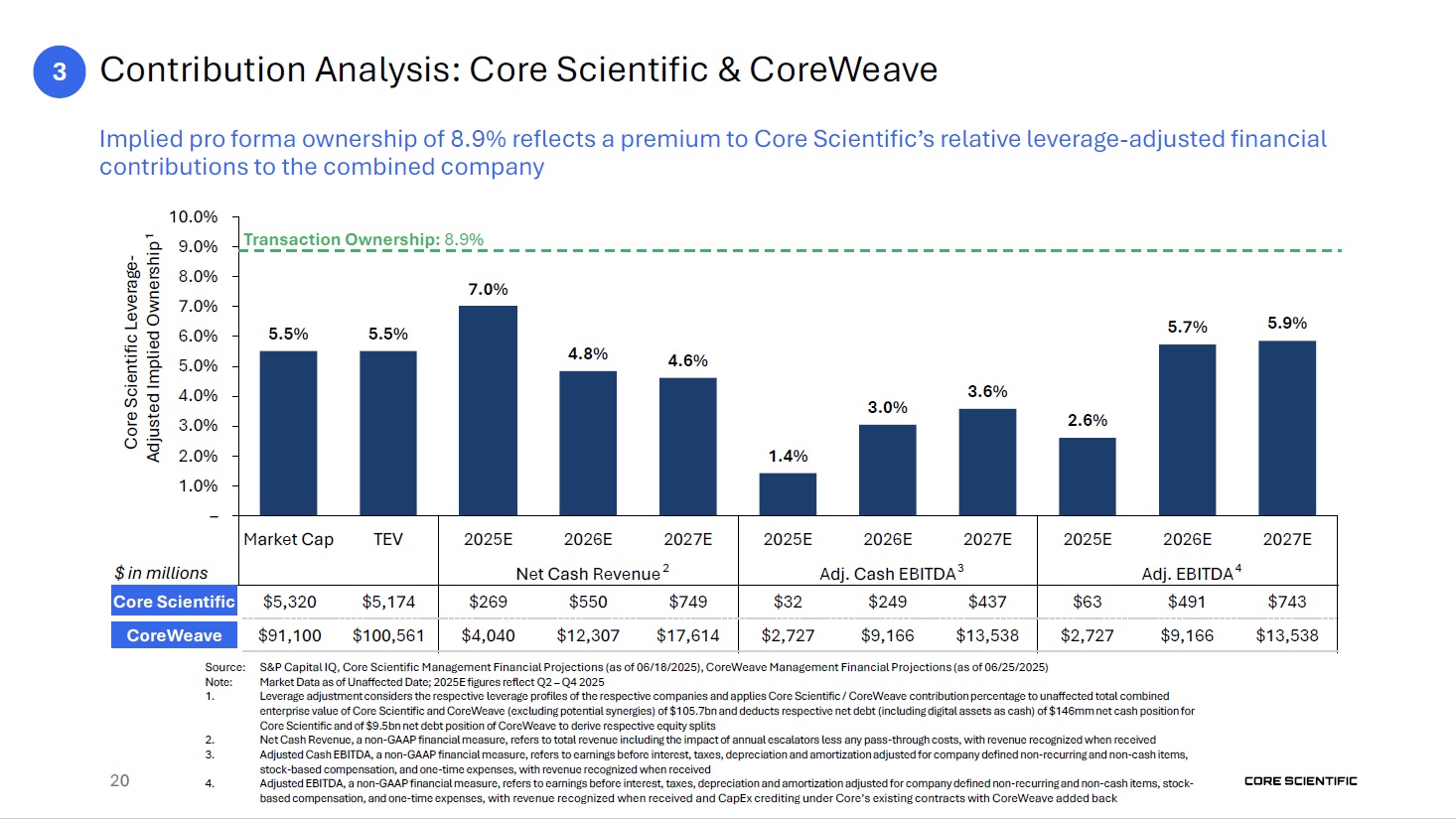

5.5% 5.5% 7.0% 4.8% 4.6% 1.4% 3.0% 3.6% 2.6% 5.7% 5.9% 9.0% 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% Implied

pro forma ownership of 8.9% reflects a premium to Core Scientific’s relative leverage-adjusted financial contributions to the combined company 10.0% Core Scientific Leverage- Adjusted Implied Ownership1 20 Contribution Analysis: Core

Scientific & CoreWeave Transaction Ownership: 8.9% Market Cap TEV 2025E 2026E 2027E Net Cash Revenue 2 2025E 2026E 2027E Adj. Cash EBITDA3 2025E 2026E 2027E Adj. EBITDA4 Core

Scientific $5,320 $5,174 $269 $550 $749 $32 $249 $437 $63 $491 $743 CoreWeave $91,100 $100,561 $4,040 $12,307 $17,614 $2,727 $9,166 $13,538 $2,727 $9,166 $13,538 – $ in millions Source: Note: 1. S&P Capital

IQ, Core Scientific Management Financial Projections (as of 06/18/2025), CoreWeave Management Financial Projections (as of 06/25/2025) Market Data as of Unaffected Date; 2025E figures reflect Q2 – Q4 2025 Leverage adjustment considers the

respective leverage profiles of the respective companies and applies Core Scientific / CoreWeave contribution percentage to unaffected total combined enterprise value of Core Scientific and CoreWeave (excluding potential synergies) of

$105.7bn and deducts respective net debt (including digital assets as cash) of $146mm net cash position for Core Scientific and of $9.5bn net debt position of CoreWeave to derive respective equity splits Net Cash Revenue, a non-GAAP

financial measure, refers to total revenue including the impact of annual escalators less any pass-through costs, with revenue recognized when received Adjusted Cash EBITDA, a non-GAAP financial measure, refers to earnings before interest,

taxes, depreciation and amortization adjusted for company defined non-recurring and non-cash items, stock-based compensation, and one-time expenses, with revenue recognized when received Adjusted EBITDA, a non-GAAP financial measure,

refers to earnings before interest, taxes, depreciation and amortization adjusted for company defined non-recurring and non-cash items, stock- based compensation, and one-time expenses, with revenue recognized when received and CapEx

crediting under Core’s existing contracts with CoreWeave added back 2. 3. 4. 3

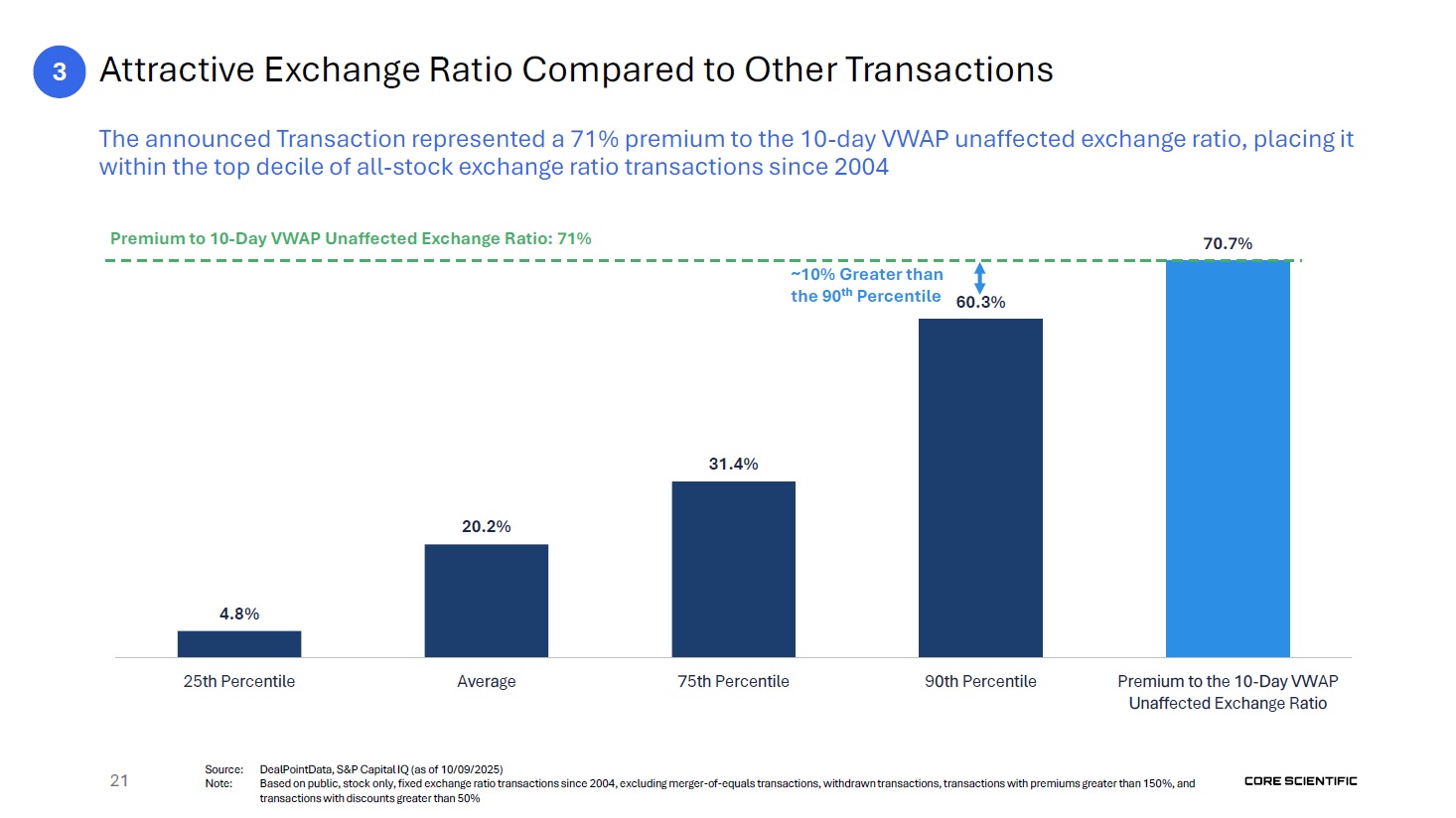

4.8% 20.2% 31.4% 60.3% 70.7% 25th Percentile Average 75th

Percentile 90th Percentile Premium to the 10-Day VWAP Unaffected Exchange Ratio Attractive Exchange Ratio Compared to Other Transactions The announced Transaction represented a 71% premium to the 10-day VWAP unaffected exchange ratio,

placing it within the top decile of all-stock exchange ratio transactions since 2004 21 Source: DealPointData, S&P Capital IQ (as of 10/09/2025) Note: Based on public, stock only, fixed exchange ratio transactions since 2004,

excluding merger-of-equals transactions, withdrawn transactions, transactions with premiums greater than 150%, and transactions with discounts greater than 50% Premium to 10-Day VWAP Unaffected Exchange Ratio: 71% ~10% Greater than the

90th Percentile 3

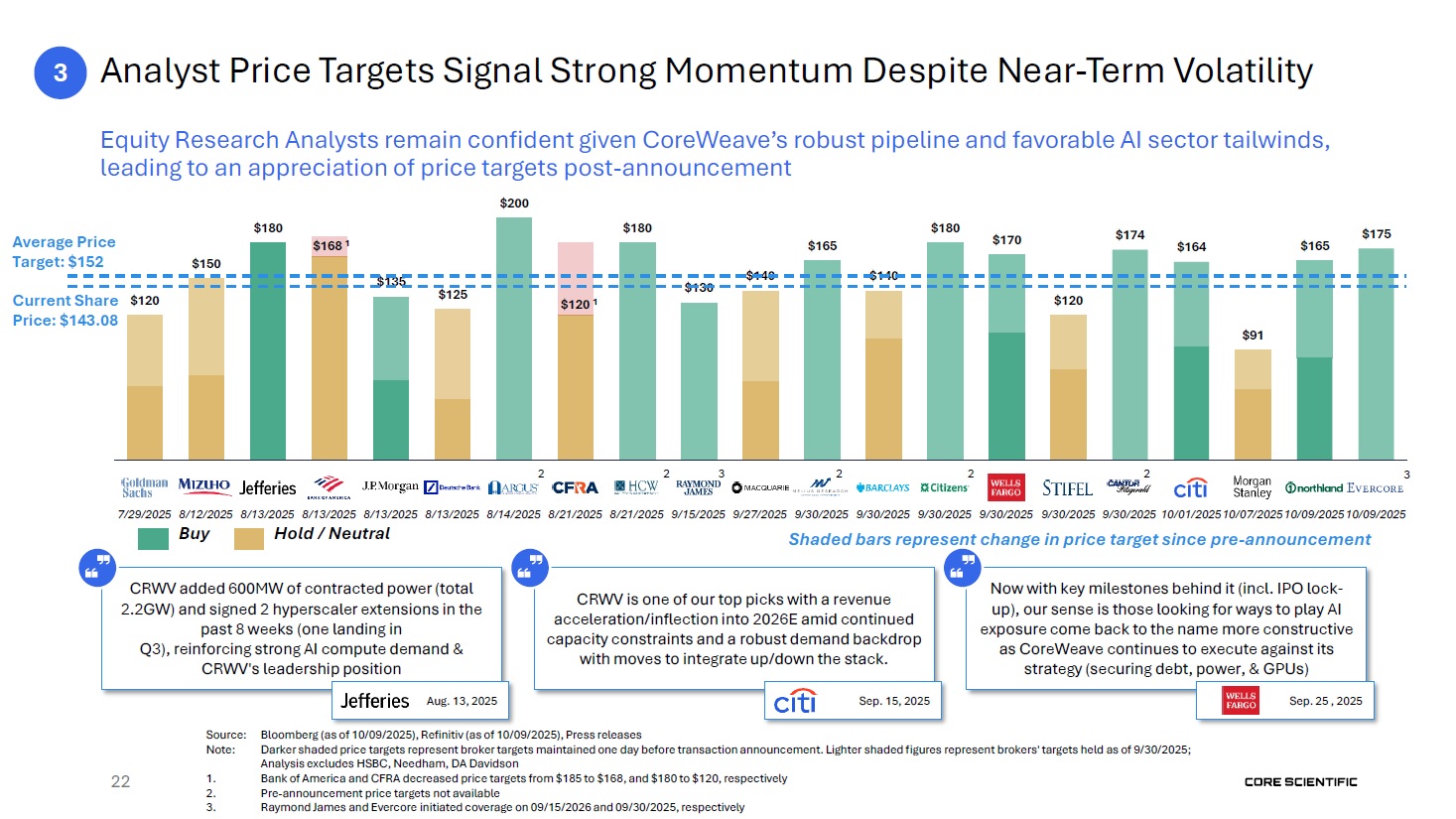

$120 $150 $135 $125 Equity Research Analysts remain confident given

CoreWeave’s robust pipeline and favorable AI sector tailwinds, leading to an appreciation of price targets post-announcement $200 $120 1 $130 $140 $140 $180 $180 $180 $168 1 $165 $170 $120 $174 $91 $164 $165 $175 22 Analyst

Price Targets Signal Strong Momentum Despite Near-Term Volatility Source: Note: Bloomberg (as of 10/09/2025), Refinitiv (as of 10/09/2025), Press releases Darker shaded price targets represent broker targets maintained one day before

transaction announcement. Lighter shaded figures represent brokers' targets held as of 9/30/2025; Analysis excludes HSBC, Needham, DA Davidson Bank of America and CFRA decreased price targets from $185 to $168, and $180 to $120,

respectively Pre-announcement price targets not available Raymond James and Evercore initiated coverage on 09/15/2026 and 09/30/2025, respectively 1. 2. 3. CRWV added 600MW of contracted power (total 2.2GW) and signed 2 hyperscaler

extensions in the past 8 weeks (one landing in Q3), reinforcing strong AI compute demand & CRWV's leadership position Aug. 13, 2025 CRWV is one of our top picks with a revenue acceleration/inflection into 2026E amid continued

capacity constraints and a robust demand backdrop with moves to integrate up/down the stack. Sep. 15, 2025 Now with key milestones behind it (incl. IPO lock- up), our sense is those looking for ways to play AI exposure come back to the

name more constructive as CoreWeave continues to execute against its strategy (securing debt, power, & GPUs) Sep. 25 , 2025 Buy Hold / Neutral Shaded bars represent change in price target since pre-announcement Average

Price Target: $152 Current Share Price: $143.08 2 2 2 3 2 2 7/29/2025 8/12/2025 8/13/2025 8/13/2025 8/13/2025 8/13/2025 8/14/2025 8/21/2025 8/21/2025 9/15/2025 9/27/2025 9/30/2025 9/30/2025 9/30/2025 9/30/2025 9/30/2025 9/30/2025

10/01/202510/07/202510/09/202510/09/2025 3 3

Transaction Resulted from Independent, Board-Led Evaluation of Strategic

Alternatives 4 23

Core Scientific’s highly engaged Board upheld best practices throughout its

oversight of the transaction process Six member Board with five independent directors led by independent Chairman Core Scientific’s directors hold extensive experience in finance, M&A and the Blockchain / Crypto sector Core

Scientific’s Board and management possess deep insight into CoreWeave’s business and growth opportunities Engaged two independent financial advisory firms that advised on the transaction and provided fairness opinions Evaluated all options,

including the Standalone Plan and taking into account views from its financial advisors, the Board determined that it was not likely any potential alternative counterparties would be interested and able to pursue a transaction given the

extensive commercial relationship and unique strategic fit with CoreWeave Robust negotiations, overseen by Board, led to multiple increased offers from CoreWeave, resulting in an increase in exchange ratio of approximately 34% over the

exchange ratio in CoreWeave’s initial offer Final offer was CoreWeave’s best and final – indicated they were not willing to provide additional value or change the structure (i.e., to include cash consideration or a collar) 4 Independent,

Board-Led Review of Strategic Alternatives 23

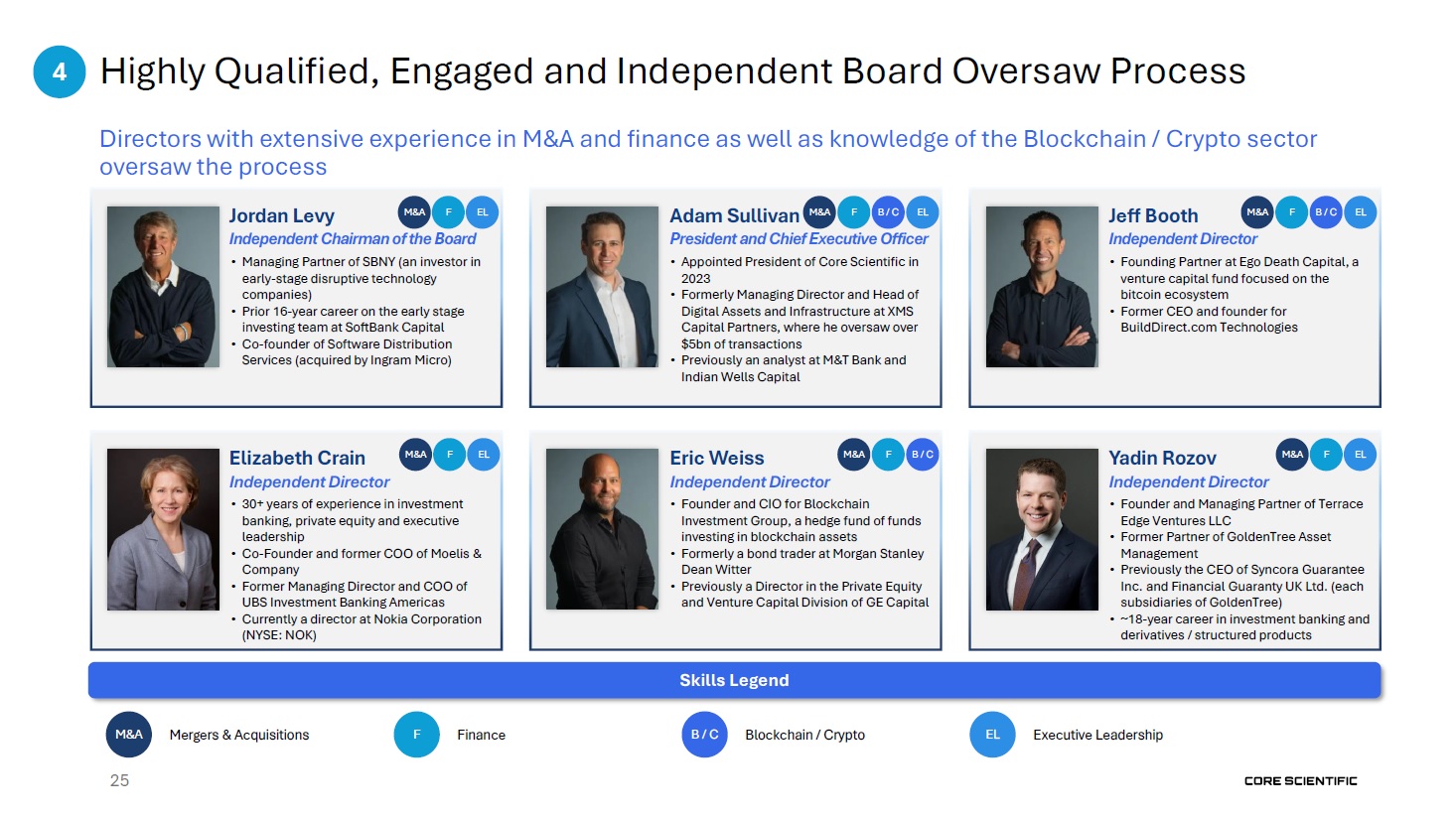

Highly Qualified, Engaged and Independent Board Oversaw Process Independent

Chairman of the Board Managing Partner of SBNY (an investor in early-stage disruptive technology companies) Prior 16-year career on the early stage investing team at SoftBank Capital Co-founder of Software Distribution Services

(acquired by Ingram Micro) President and Chief Executive Officer Appointed President of Core Scientific in 2023 Formerly Managing Director and Head of Digital Assets and Infrastructure at XMS Capital Partners, where he oversaw over $5bn

of transactions Previously an analyst at M&T Bank and Indian Wells Capital Independent Director Founding Partner at Ego Death Capital, a venture capital fund focused on the bitcoin ecosystem Former CEO and founder

for BuildDirect.com Technologies Elizabeth Crain M&A F EL Independent Director 30+ years of experience in investment banking, private equity and executive leadership Co-Founder and former COO of Moelis & Company Former

Managing Director and COO of UBS Investment Banking Americas Currently a director at Nokia Corporation (NYSE: NOK) Eric Weiss M&A F B / C Independent Director Founder and CIO for Blockchain Investment Group, a hedge fund of funds

investing in blockchain assets Formerly a bond trader at Morgan Stanley Dean Witter Previously a Director in the Private Equity and Venture Capital Division of GE Capital Yadin Rozov M&A F EL Independent Director Founder and

Managing Partner of Terrace Edge Ventures LLC Former Partner of GoldenTree Asset Management Previously the CEO of Syncora Guarantee Inc. and Financial Guaranty UK Ltd. (each subsidiaries of GoldenTree) ~18-year career in investment

banking and derivatives / structured products Skills Legend Directors with extensive experience in M&A and finance as well as knowledge of the Blockchain / Crypto sector oversaw the process Mergers & Acquisitions M&A• F •

Finance Blockchain / Crypto B / C• EL • Executive Leadership Jordan Levy Adam Sullivan M&A Jeff Booth M&A F EL F B / C EL M&A F B / C EL 4 23

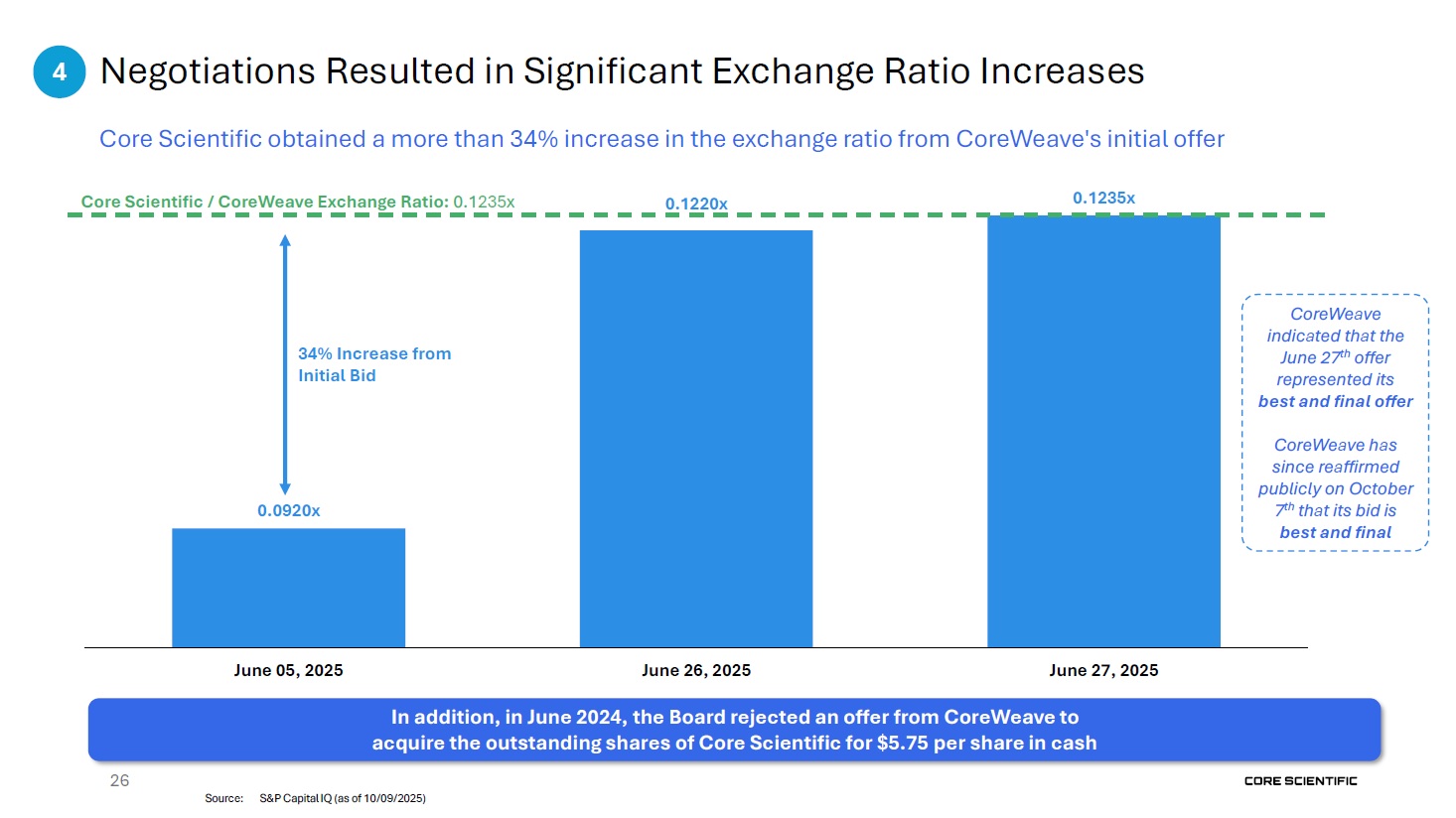

0.0920x 0.1220x 0.1235x June 05, 2025 Negotiations Resulted in Significant

Exchange Ratio Increases Core Scientific / CoreWeave Exchange Ratio: 0.1235x 34% Increase from Initial Bid CoreWeave indicated that the June 27th offer represented its best and final offer CoreWeave has since reaffirmed publicly on

October 7th that its bid is best and final 26 Core Scientific obtained a more than 34% increase in the exchange ratio from CoreWeave's initial offer 4 June 26, 2025 June 27, 2025 In addition, in June 2024, the Board rejected an offer

from CoreWeave to acquire the outstanding shares of Core Scientific for $5.75 per share in cash Source: S&P Capital IQ (as of 10/09/2025)

Conclusion 27

Conclusion The Board unanimously determined that the Transaction with

CoreWeave represents the best available alternative for all Core Scientific stockholders and recommends that all Core Scientific stockholders vote FOR the transaction 1 The proposed transaction provides significant pro forma combination

benefits; the companies are closely linked which de-risks integration and benefits from combined operations 2 The proposed combination eliminates standalone execution risk on timely delivery of currently leased data centers and projected

future leasing in Core Scientific’s current business plan (the “Standalone Plan”), as well as its ~$7.3 billion financing need 3 The Board oversaw the negotiation of an attractive exchange ratio that provides meaningful upfront premium

and upside opportunity to Core Scientific stockholders 4 The proposed transaction was the result of a thoughtful Board-led evaluation of strategic alternatives 27

This communication contains “forward-looking statements” within the meaning of

the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities 27 Exchange Act of 1934, as amended. In this context, forward-looking statements often address future business

and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or

negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the

proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are

beyond the control of Core Scientific, Inc. (“Core Scientific”) and CoreWeave, Inc. (“CoreWeave”) that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that

may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms or at all, and the timing thereof, including obtaining regulatory approvals that may be required on anticipated

terms and the Core Scientific stockholder approval of the proposed transaction; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness,

financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the proposed transaction, including

the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of Core Scientific and CoreWeave to integrate their businesses

successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against Core Scientific, CoreWeave or their respective directors and officers; the

risk that disruptions from the proposed transaction will harm Core Scientific’s or CoreWeave’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues;

potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; rating agency actions and Core Scientific’s and CoreWeave’s ability to access short- and long-term

debt markets on a timely and affordable basis; legislative, regulatory and economic developments and actions targeting public companies in the artificial intelligence, power, data center and crypto mining industries and changes in local,

national or international laws, regulations and policies affecting Core Scientific and CoreWeave; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the

pendency of the proposed transaction that could affect Core Scientific’s and/or CoreWeave’s financial performance and operating results; certain restrictions during the pendency of the proposed transaction that may impact Core Scientific’s

ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against Core Scientific or CoreWeave and other political

or security disturbances; dilution caused by CoreWeave’s issuance of additional shares of its securities in connection with the proposed transaction; the possibility that the transaction may be more expensive to complete than anticipated,

including as a result of unexpected factors or events; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for

power and other market or economic conditions that impact demand and pricing; changes in technical or operating conditions, including unforeseen technical difficulties; development delays at Core Scientific and/or CoreWeave’s data center

sites, including any delays in the conversion of such sites from crypto mining facilities to high-performance computing sites; Core Scientific’s ability to earn digital assets profitably and to attract customers for its high density

colocation capabilities; Core Scientific’s ability to perform under its existing colocation agreements; Core Scientific’s ability to maintain its competitive position in its existing operating segments; the impact of increases in total

network hash rate; Core Scientific’s ability to raise additional capital to continue its expansion efforts or other operations; Core Scientific’s need for significant electric power and the limited availability of power resources; the

potential failure in Core Scientific’s critical systems, facilities or services the Company provides; the physical risks and regulatory changes relating to climate change; potential significant changes to the method of validating

blockchain transactions; Core Scientific’s vulnerability to physical security breaches, which could disrupt operations; a potential slowdown in market and economic conditions, particularly those impacting high density computing, the

blockchain industry and the blockchain hosting market; price volatility of digital assets and bitcoin in particular; potential changes in the interpretive positions of the SEC or its staff with respect to digital asset mining firms; the

likelihood that U.S. federal and state legislatures and regulatory agencies will enact laws and regulations to regulate digital assets and digital asset intermediaries; changing expectations with respect to ESG policies; the effectiveness

of Core Scientific’s compliance and risk management methods; the adequacy of Core Scientific’s sources of recovery if the digital assets held by Core Scientific are lost, stolen or destroyed due to third-party digital asset services; and

those risks described in the section titled “Risk Factors” in CoreWeave’s Prospectus dated March 27, 2025, filed with the SEC on March 31, 2025 pursuant to Rule 424(b) under the Securities Act of 1933, as amended, relating to the

Registration Statement on Form S-1, as amended (File No. 333-285512), Item 1A of CoreWeave’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2025, filed with the SEC on August 13, 2025 and subsequent reports on Forms

10-Q and 8-K; those risks described in Item 1A of Core Scientific’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2025, filed with the SEC on August 8, 2025, Item 1A of Core Scientific’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2024, filed with the SEC on February 27, 2025 and subsequent reports on Forms 10-Q and 8-K. These risks, as well as other risks associated with the proposed transaction, are more fully discussed in

the proxy statement/prospectus that is included in the registration statement on Form S-4 that was initially filed by CoreWeave with the SEC on August 20, 2025, and which was amended on September 17, 2025 and September 25, 2025, in

connection with the proposed transaction. While the list of factors presented here and the list of factors presented in the registration statement on Form S-4 are considered representative, no such list should be considered to be a

complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. You should not place undue reliance on any of these

forward-looking statements as they are not guarantees of future performance or outcomes; actual performance and outcomes, including, without limitation, Core Scientific’s or CoreWeave’s actual results of operations, financial

condition and liquidity, and the development of new markets or market segments in which Core Scientific or CoreWeave operate, may differ materially from those made in or suggested by the forward-looking statements contained in this

communication. Neither Core Scientific nor CoreWeave assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should

circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on Core Scientific’s or

CoreWeave’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date. Cautionary Statement Regarding Forward-Looking Information

Important Information about the Transaction and Where to Find It In

connection with the proposed transaction between Core Scientific and CoreWeave, Core Scientific and CoreWeave filed with the SEC a registration statement on Form S-4 on August 20, 2025, which was amended on September 17, 2025 and September

25, 2025, that includes a proxy statement of Core Scientific that also constitutes a prospectus of CoreWeave. The registration statement on Form S-4 was declared effective on September 26, 2025. CoreWeave filed a prospectus on September 26,

2026, and Core Scientific filed a definitive proxy statement on September 26, 2025. Each of Core Scientific and CoreWeave may also file other relevant documents with the SEC regarding the proposed transaction. This communication is not a

substitute for the registration statement, proxy statement or prospectus or any other document that Core Scientific or CoreWeave (as applicable) has filed or may file with the SEC in connection with the proposed transaction. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF CORE SCIENTIFIC AND COREWEAVE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus, as well as other filings containing important information about Core Scientific or CoreWeave, without charge at

the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by Core Scientific will be available free of charge on Core Scientific’s internet website at

https://investors.corescientific.com/sec-filings/all-sec- filings or by contacting Core Scientific’s investor relations contact at ir@corescientific.com. Copies of the documents filed with the SEC by CoreWeave will be available free of

charge on CoreWeave’s internet website at https://coreweave2025ipo.q4web.com/financials/sec-filings/ or by contacting CoreWeave’s investor relations contact at investor-relations@coreweave.com. The information included on, or accessible

through, Core Scientific or CoreWeave’s website is not incorporated by reference into this communication. Participants in the Solicitation Core Scientific, CoreWeave, their respective directors and certain of their respective executive

officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Core Scientific is set forth in its proxy statement for its 2025

annual meeting of stockholders, which was filed with the SEC on March 28, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1839341/000119312525065652/d925494ddef14a.htm) and in its Form 8-K, which was filed with the

SEC on May 16, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1839341/000162828025026294/core-20250513.htm). Information about the directors and executive officers of CoreWeave is set forth in CoreWeave’s Prospectus

dated March 27, 2025, which was filed with the SEC on March 31, 2025 pursuant to Rule 424(b) under the Securities Act of 1933, as amended, relating to the Registration Statement on Form S-1, as amended (File No. 333-285512) (and which is

available at https://www.sec.gov/Archives/edgar/data/1769628/000119312525067651/d899798d424b4.htm). These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the

proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, is contained in the proxy statement/prospectus and other relevant materials that have been and may be filed with the SEC

regarding the proposed transaction. No Offer or Solicitation This communication is for informational purposes only and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or

a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Non-GAAP Financial Measures This

communication includes certain non-GAAP measures not based on generally accepted accounting principles. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in

accordance with GAAP. The non-GAAP measures used by Core Scientific and/or CoreWeave may differ from the non-GAAP measures used by other companies. 27 Additional Information