PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on March 12, 2025

Table of Contents

☒ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

☐ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

Preliminary Proxy Statement — Subject to Completion

CORE SCIENTIFIC, INC.

2025

Notice of Annual Meeting of Stockholders

and Proxy Statement

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Letter to Stockholders |

LETTER TO STOCKHOLDERS

Dear Core Scientific Stockholders,

As I reflect on 2024, I am filled with immense pride in our transformation. We emerged from Chapter 11 as a Bitcoin mining company and ended 2024 as a leading provider of high-performance computing (HPC) infrastructure and AI-driven data center solutions — while maintaining our strength in digital asset mining. Our success stems from three fundamental advantages: control of 1,300 MW of powered infrastructure in strategic locations, deep operational expertise in managing high-density computing environments, and long-term contracts with industry-leading customers. We believe these strengths uniquely position us in a market experiencing unprecedented demand for reliable, scalable computing infrastructure.

Key Highlights

| 1. | Landmark Customer Partnerships — We secured HPC hosting contracts totaling over 500 MW, representing $8.7 billion in potential revenue over 12 years. These long-term agreements should provide predictable future cash flow and demonstrate customer confidence in our infrastructure capabilities. |

| 2. | Strategic Infrastructure Expansion — We increased our total capacity to 1,300 MW through major expansions at our Denton and Pecos sites. The groundbreaking of our new Oklahoma facility and our Alabama lease agreement with a purchase option will further strengthen our market position in key regions. |

| 3. | Financial Strength — We completed the mandatory conversion of secured debt and raised $1.1 billion in convertible notes, reducing interest rates and enhancing liquidity. We believe our improved capital structure supports growth while maintaining financial discipline. |

Looking Forward

In 2025, we are focusing on three strategic priorities:

| • | Expanding our infrastructure capacity to deploy the first 500 MW of contracted facilities, laying the groundwork for sustained long-term growth. |

| • | Broadening and diversifying our customer base across the HPC spectrum to drive organic growth through new customer acquisition. |

| • | Pursuing strategic acquisitions that complement our existing infrastructure and enhance our competitive position in key markets. |

The convergence of AI, cloud computing, and digital assets is driving record demand for high-performance computing infrastructure. Core Scientific’s unique combination of assets, expertise, and customer relationships positions us to capitalize on this opportunity.

Gratitude

As Chief Executive Officer, I want to express my sincere gratitude to our dedicated team members — the backbone of our success. Their commitment and resilience have been instrumental in propelling Core Scientific forward.

To our stockholders, I, along with the entire leadership team, appreciate your continued confidence and support. We are excited about the future and look forward to driving long-term value together.

| Sincerely,

Adam Sullivan Chief Executive Officer Core Scientific, Inc. |

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Notice of Annual Meeting |

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

|

|

|

| Date and Time: Day, May 12, 2025 10:00 a.m. Eastern Time |

Meeting Place: At www.proxydocs.com/CORZ |

Dear Fellow Stockholder,

It is my pleasure to invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Core Scientific, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held virtually via live webcast available at www.proxydocs.com/CORZ, on Monday, May 12, 2025 at 10:00 a.m. Eastern Time. Stockholders attending the Annual Meeting virtually will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We encourage you to attend online and participate. We recommend that you log in 15 minutes before 10:00 a.m., Eastern Time on May 12, 2025 to ensure you are logged in when the Annual Meeting starts.

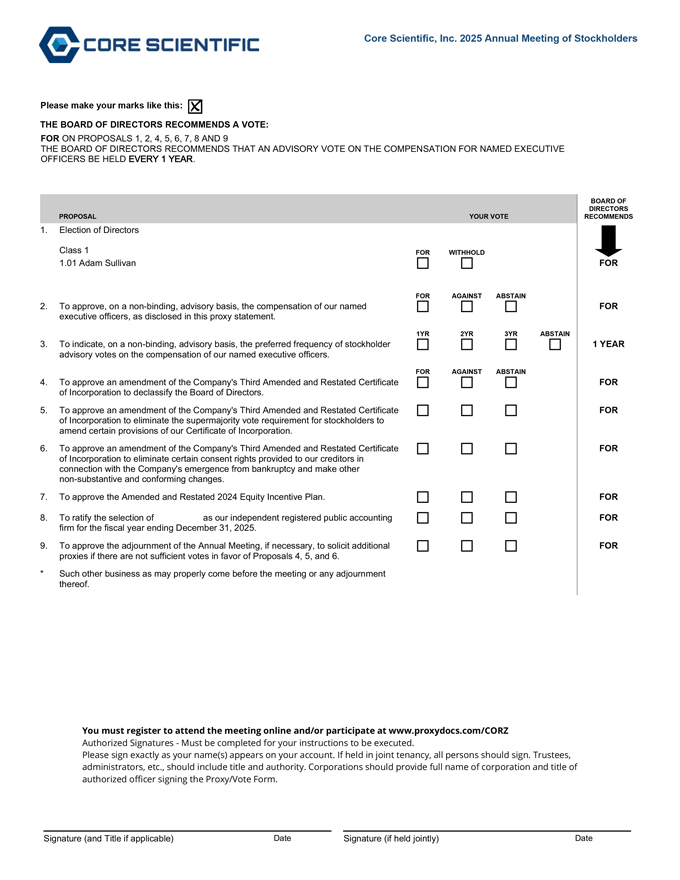

The Annual Meeting will be held for the following purposes:

| 1. | To elect the Board of Directors’ nominee for director identified in the attached proxy statement to hold office until the 2028 Annual Meeting of Stockholders (if Proposal 4 is not approved), or until the 2026 Annual Meeting of Stockholders (if Proposal 4 is approved). |

| 2. | To approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement. |

| 3. | To indicate, on a non-binding, advisory basis, the preferred frequency of stockholder advisory votes to approve the compensation of our named executive officers. |

| 4. | To approve an amendment of the Company’s Third Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to declassify the Board of Directors. |

| 5. | To approve an amendment of the Company’s Certificate of Incorporation to eliminate the supermajority vote requirement for stockholders to amend certain provisions of our Certificate of Incorporation. |

| 6. | To approve an amendment of the Company’s Certificate of Incorporation to eliminate certain consent rights provided to our creditors in connection with the Company’s emergence from bankruptcy and make other non-substantive and conforming changes. |

| 7. | To approve our Amended and Restated 2024 Stock Incentive Plan. |

| 8. | To ratify the selection of Auditor as our independent registered public accounting firm for the fiscal year ending December 31, 2025. |

| 9. | To approve the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 4, 5, and 6. |

In addition, we will transact such other business as may properly come before the Annual Meeting or any adjournment, continuation or postponement thereof. The items of business are more fully described in the accompanying proxy statement.

The record date (the “Record Date”) for the Annual Meeting is March 14, 2025. Only stockholders of record at the close of business on the Record Date are entitled to notice of, and to vote at, the Annual Meeting.

Todd M. DuChene

Chief Legal and Administrative Officer and Secretary

Dover, Delaware

March [18], 2025

| Your vote is important! Please vote. Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 12, 2025. The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at h.t.t.p.s://investors.corescientific.com and w.w.w.proxydocs.com/CORZ It is important that proxies be completed and submitted promptly. Therefore, whether or not you plan to be present at

|

||||

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Table of Contents |

| i |

TABLE OF CONTENTS

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

| 1 |

CORE SCIENTIFIC, INC.

838 Walker Road

Suite 21-2105

Dover, Delaware 19904

PROXY STATEMENT FOR THE 2025 ANNUAL MEETING OF STOCKHOLDERS

May 12, 2025

Questions and answers about these proxy materials and voting

Why did I receive proxy materials?

We have sent you this proxy statement (this “Proxy Statement”) because the board of directors (the “Board of Directors”) of Core Scientific, Inc. (sometimes referred to as “the Company,” “Core,” “we” and “our”) is soliciting, on the Company’s behalf, your proxy to vote at the 2025 Annual Meeting of Stockholders (the “Annual Meeting”), including at any adjournments or postponements of the meeting.

We intend to first mail the Proxy Statement and the form of proxy to stockholders on or about March [18], 2025.

How do I attend the Annual Meeting?

We will be hosting the Annual Meeting via live audio webcast only. Stockholders will not be able to physically attend the Annual Meeting. You are entitled to attend the Annual Meeting if you were a stockholder of record as of the close of business on March 14, 2025 (the “Record Date”), or hold a valid proxy for the meeting. You can attend the annual meeting by visiting www.proxydocs.com/CORZ, where you will be able to listen to the Annual Meeting live, submit questions and vote online.

The meeting will be held on Monday, May 12, 2025 at 10:00 a.m. Eastern Time. We encourage you to access the Annual Meeting 15 minutes prior to the start time to allow time for online check-in. We have worked to offer the same participation opportunities as would be provided at an in-person meeting while further enhancing the online experience available to all stockholders regardless of their location. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

In order to enter the Annual Meeting virtually, you will need the unique 12-digit control number, which is included on your proxy card if you are a common stockholder of record or included with your voting instruction card and voting instructions received from your broker, bank, trustee, or nominee if you are the beneficial owner of the shares held in “street name.”

Can I ask questions at the Annual Meeting?

Stockholders will have the ability to submit questions during the Annual Meeting via the Annual Meeting website at www.virtualshareholdermeeting.com/CORZ2025. Questions may be submitted online shortly prior to, and during, the Annual Meeting by logging in with the 12-digit control number at www.proxydocs.com/CORZ. We will answer questions during the Annual Meeting that are pertinent to the Company as time permits. If we receive substantially similar written questions, we plan to group such questions together and provide a single response to avoid repetition and allow time for additional question topics. For appropriate questions that are not otherwise addressed during the Annual Meeting, we will publish our responses on our Investor Relations site after the meeting or communicate the relevant response directly to the submitting stockholder. Additional information regarding the rules and procedures for participating in the virtual Annual Meeting will be provided in our rules of conduct for the Annual Meeting, which stockholders can view during the meeting at www.proxydocs.com/CORZ.

What if I have technical difficulties or trouble accessing the virtual meeting website?

Technicians will be available to assist you with any technical difficulties you may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the online check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting log in page.

Table of Contents

| 2 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

What if I cannot virtually attend the Annual Meeting?

You may vote your shares electronically before the meeting by internet, by proxy or by telephone as described below. You do not need to access the Annual Meeting audio-only webcast to vote if you submitted your vote via proxy, by internet or by telephone in advance of the Annual Meeting.

Who can vote at the Annual Meeting?

Only common stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. On the Record Date, there were [xxx,xxx,xxx] shares of common stock outstanding and entitled to vote. A list of stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices for examination during ordinary business hours by any stockholder for any purpose germane to the Annual Meeting for a period of ten days prior to the Annual Meeting through the close of the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If on the Record Date, your shares of common stock were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting virtually or vote by proxy prior to the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return your vote by proxy through the Internet or over the telephone or vote by proxy using a proxy card.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on the Record Date, your shares were held not in your name but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the proxy materials should be forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record you may not vote your shares at the Annual Meeting even if you participate virtually unless you request and obtain a valid proxy from your broker, bank or other agent.

How many votes do I have?

Each holder of our common stock will have one vote per share of common stock held as of the Record Date.

What am I voting on?

There are nine matters scheduled for a vote:

| • | The election of the Board of Directors’ nominee for director, Adam Sullivan, to hold office until the 2028 Annual Meeting of Stockholders (if Proposal 4 is not approved) or until the 2026 Annual Meeting of Stockholders (If Proposal 4 is approved) (Proposal 1); |

| • | Approval, on a non-binding, advisory basis, of the compensation of our named executive officers, as disclosed in this Proxy Statement (Proposal 2); |

| • | Indication, on a non-binding, advisory basis, of the preferred frequency of stockholder advisory votes to approve the compensation of our named executive officers (Proposal 3); |

| • | Approval of an amendment of the Company’s Third Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”) to declassify the Board of Directors (Proposal 4); |

| • | Approval of an amendment of the Company’s Certificate of Incorporation to eliminate the supermajority vote requirement for stockholders to amend certain provisions of our Certificate of Incorporation (Proposal 5); |

| • | Approval of an amendment of the Company’s Certificate of Incorporation to eliminate certain consent rights provided to our creditors in connection with the Company’s emergence from bankruptcy and make other non-substantive and conforming changes (Proposal 6); |

| • | Approval of our Amended and Restated 2024 Stock Incentive Plan (Proposal 7); |

| • | Ratification of the selection of Auditor as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal 8); and. |

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

| 3 |

| • | Approval of the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 4, 5 and 6 (Proposal 9). |

What if another matter is properly brought before the Annual Meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. To vote all of your shares by proxy, you must complete, date, sign and return each proxy card and voting instruction form that you receive or vote over the telephone or via the internet the shares represented by each, e-mail, proxy card or voting instruction form that you receive. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

How do I vote?

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote at the Annual Meeting or you may vote by proxy through the Internet, over the telephone or using a proxy card. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote electronically even if you have already voted by proxy.

| • | To vote online at the Annual Meeting, you will need to visit www.proxydocs.com/CORZ during the Annual Meeting while the polls are open and follow the instructions provided. You will be asked to provide the 12-digit control number from the proxy card and follow the instructions. |

| • | To vote in advance of the Annual Meeting through the Internet, go to www.proxypush.com/CORZ to complete an electronic proxy card. You will be asked to provide the 12-digit control number from the proxy card. [Your Internet vote must be received by 11:59 p.m., Eastern Time, on May 11, 2025 to be counted. |

| • | To vote in advance of the Annual Meeting over the telephone, dial toll-free 1-866-240-5213 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the 12-digit control number from the proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time, on May 11, 2025 to be counted. |

| • | To vote in advance of the Annual Meeting using a printed proxy card that may be delivered to you, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a copy of the proxy materials containing voting instructions from that organization rather than from us. You must follow these instructions for your bank, broker or other stockholder of record to vote your shares per your instructions. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank.

| We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from internet access providers and telephone companies.

|

||||

Table of Contents

| 4 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing the proxy card that may be delivered to you, by telephone, through the Internet or electronically at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted in accordance with the recommendations of the Board of Directors:

| • | “FOR” the election of the nominee for director (Proposal 1). If the nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for the nominee will instead be voted for the election of a substitute nominee proposed by us; |

| • | “FOR” the advisory approval of executive compensation (Proposal 2); |

| • | For “ONE YEAR” as the preferred frequency of advisory votes to approve executive compensation (Proposal 3); |

| • | “FOR” the amendment of the Company’s Certificate of Incorporation to declassify the Board of Directors (Proposal 4), |

| • | “FOR” the amendment of the Company’s Certificate of Incorporation to eliminate the supermajority vote requirement for stockholders to amend certain provisions of our Certificate of Incorporation (Proposal 5), |

| • | “FOR” the amendment of the Company’s Certificate of Incorporation to eliminate certain consent rights provided to our creditors in connection with the Company’s emergence from bankruptcy and make other non-substantive and conforming changes (Proposal 6), |

| • | “FOR” the approval of our Amended and Restated 2024 Stock Incentive Plan (Proposal 7), |

| • | “FOR” the selection of Auditor as our independent registered public accounting firm for the fiscal year ending December 31, 2025 (Proposal 8); and |

| • | “FOR” the approval of the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 4, 5 and 6 (Proposal 9). |

If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. Brokers, banks and other securities intermediaries may use their discretion to vote your “uninstructed” shares with respect to matters considered to be “routine,” but not with respect to “non-routine” matters. In this regard, Proposals 1 through 7 and Proposal 9 are considered to be “non-routine,” meaning that your broker may not vote your shares on this proposal in the absence of your voting instructions. However, Proposal 8 is considered to be a “routine” matter, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 8. Accordingly, if you own shares through a nominee, such as a broker, bank or other agent, please be sure to instruct your nominee how to vote to ensure that your vote is counted on all of the proposals.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.” Proposals 1 through 7 and Proposal 9 are considered to be “non-routine,” and we therefore expect broker non-votes to exist in connection with these proposals.

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

| 5 |

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may grant a subsequent proxy by telephone or through the Internet. |

| • | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 838 Walker Road, Suite 21-2105, Dover, Delaware 19904. |

| • | You may attend the Annual Meeting virtually and vote online. Simply attending the Annual Meeting virtually will not, by itself, revoke your proxy. Even if you plan to attend the Annual Meeting virtually, we recommend that you also submit your proxy or voting instructions or vote by telephone or through the Internet so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count, (i) with respect to Proposal 1, votes “FOR,” “WITHHOLD” and broker non-votes; (ii) with respect to Proposals 2, 4, 5, 6, 7, 8 and 9, votes “FOR,” “AGAINST,” abstentions and broker non-votes (although no broker non-votes are expected on Proposal 8); and (iii) with respect to Proposal 3, votes for frequencies of “ONE YEAR,” “TWO YEARS,” “THREE YEARS,” abstentions and broker non-votes.

What vote is required for adoption or approval of each proposal and how will votes be counted?

| Proposal |

Vote Required for Approval | Effect of Abstentions or Withhold Votes, As Applicable |

Effect of Broker Non-Votes |

Board of Directors Recommendation |

||||

| 1. Election of Director named in this Proxy Statement |

Directors are elected by a plurality of the votes cast by the holders of shares present in person or represented by proxy at the Annual Meeting and entitled to vote. In other words, the nominee receiving the most “FOR” votes will be elected. | No Effect | No Effect | “FOR” its nominee | ||||

| 2. Advisory approval of the compensation of the Company’s Named Executive Officers |

The number of votes cast “FOR” the proposal must exceed the number of votes cast “AGAINST” the proposal for the proposal to be approved. Because this proposal is an advisory vote, the result will not be binding on our Board of Directors. | No Effect | No Effect | “FOR” | ||||

| 3. Advisory vote on the frequency of stockholder advisory votes to approve executive compensation |

The frequency receiving the most votes will be considered the preferred frequency of our stockholders. Because this proposal is an advisory vote, the result will not be binding on our Board of Directors. | No Effect | No Effect | “ONE YEAR” |

Table of Contents

| 6 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

| Proposal |

Vote Required for Approval | Effect of Abstentions or Withhold Votes, As Applicable |

Effect of Broker Non-Votes |

Board of Directors Recommendation |

||||

| 4. Approval of amendment of Certificate of Incorporation to declassify the Board of Directors |

The affirmative vote of the holders of at least 66 2/3% of the voting power of all of the outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class, will be required for the proposal to be approved. | Against | Against | “FOR” | ||||

| 5. Approval of amendment of Certificate of Incorporation to eliminate supermajority vote requirement for amendments to Certificate of Incorporation |

The affirmative vote of the holders of at least 66 2/3% of the voting power of all of the outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class, will be required for the proposal to be approved. | Against | Against | “FOR” | ||||

| 6. Approval of amendment of Certificate of Incorporation to eliminate certain consent rights provided to creditors in connection with the Company’s emergence from bankruptcy |

The affirmative vote of the holders of at least 66 2/3% of the voting power of all of the outstanding shares of capital stock entitled to vote generally in the election of directors, voting together as a single class, will be required for the proposal to be approved. | Against | Against | “FOR” | ||||

| 7. Approval of our Amended and Restated 2024 Stock Incentive Plan |

The number of votes cast “FOR” the proposal must exceed the number of votes cast “AGAINST” the proposal for the proposal to be approved. | No Effect | No Effect | “FOR” | ||||

| 8. Ratification of the appointment of Auditor as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025 |

The number of votes cast “FOR” the proposal must exceed the number of votes cast “AGAINST” the proposal for the proposal to be approved. | No Effect | Not applicable | “FOR” | ||||

| 9. Approval of the adjournment of the Annual Meeting, if necessary, to solicit additional proxies if there are not sufficient votes in favor of Proposals 4, 5, and 6. |

The holders of a majority of the voting power of the shares present in person, by remote communication or represented by proxy at the meeting and entitled to vote thereon will be required for the proposal to be approved. | Against | No Effect | “FOR” |

In addition, for approval, Proposals 4, 5 and 6 require the affirmative vote of at least two (2) Class 2 directors and at least two (2) Class 3 directors, because such votes are required to alter, amend or repeal Articles V, VII and VIII of the Certificate of Incorporation, which are implicated in Proposals 4, 5 and 6. As such, these requisite votes have been obtained prior to the filing of this Proxy Statement.

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Proxy Statement for the 2025 Annual Meeting of Stockholders |

| 7 |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the voting power of the outstanding shares entitled to vote are present at the Annual Meeting in person, by remote communication, if applicable, or represented by proxy. On the Record Date, there were [xxx,xxx,xxx] shares outstanding and entitled to vote.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote electronically at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Annual Meeting or the holders of a majority of voting power of the shares present at the Annual Meeting in person, by remote communication or represented by proxy may adjourn the Annual Meeting to another date.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to the proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners. In addition, we have hired MacKenzie Partners to solicit proxies. We expect to pay MacKenzie Partners a fee of $10,000 plus reasonable expenses for these services.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

| Your vote is important! Please vote. Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 12, 2025. The Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K are available at h.t.t.p.s://investors.corescientific.com and w.w.w.proxydocs.com/CORZ. It is important that proxies be completed and submitted promptly. Therefore, whether or not you plan to be present at

|

||||

Table of Contents

| 8 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Proposal 1: Election of Directors |

PROPOSAL 1

ELECTION OF DIRECTOR

General

The Certificate of Incorporation currently provides for a classified Board of Directors of seven directors consisting of three classes of directors, as follows:

| • | Class 1: Adam Sullivan and Jarrod Patten |

| • | Class 2: Jeff Booth and Eric Weiss |

| • | Class 3: Todd Becker, Jordan Levy and Yadin Rozov, |

Our Certificate of Incorporation currently provides that the term of office of the initial Class 1 directors expires at this Annual Meeting; the term of office of the initial Class 2 directors expires at the 2026 Annual Meeting of Stockholders; and the term of office of the initial Class 3 directors expires at the 2027 Annual Meeting of Stockholders. If elected by our stockholders, successors to the class of directors whose term expires at their respective annual meeting will be elected to hold office until the third annual meeting next succeeding his or her election and until his or her respective successor has been duly elected and qualified or, if sooner, until his or her earlier death, resignation or removal Vacancies on the Board of Directors created by the resignation or removal of a director appointed by the Equity Committee or the Ad Hoc Noteholder Group established by the Plan of Reorganization may be filled by a majority vote of the remaining directors from a list submitted by either the Equity Committee or the Ad Hoc Noteholder Group, as the case may be, and newly created directorships on our Board of Directors may be filled by persons elected by a majority of the remaining directors, unless the Board of Directors determines by resolution that any such vacancy or newly created directorship will be filled by the stockholders. Any director elected to fill a vacancy will hold office for the remainder of the full term of the class of the director for which the vacancy was created or occurred and until such director’s successor shall have been elected and qualified or until such director’s earlier death, resignation or removal. Notwithstanding the foregoing, as further explained in Proposal 4, if Proposal 4 is approved by stockholders, our Certificate of Incorporation will be amended to eliminate our classified Board of Directors structure, and all members of our Board of Directors will serve one-year terms beginning with the Company’s 2026 Annual Meeting. Further, if Proposal 6 is approved by stockholders, vacancies on the Board of Directors created by the resignation or removal of a director appointed by the Equity Committee or the Ad Hoc Noteholder Group need not be chosen from a list submitted by either the Equity Committee or the Ad Hoc Noteholder Group, as the case may be.

Mr. Sullivan has been recommended by our Nominating and Corporate Governance Committee and nominated by the Board of Directors for election at the Annual Meeting and, if elected at the Annual Meeting, Mr. Sullivan would serve until our 2028 Annual Meeting of Stockholders (if Proposal 4 is not approved), or until our 2026 Annual Meeting of Stockholders (if Proposal 4 is approved) and until his successor has been duly elected, or if sooner, until the director’s death, resignation or removal. It is our Company’s policy to encourage nominees for directors to attend the Annual Meeting.

Mr. Patten’s term will expire at the conclusion of the Annual Meeting, and the vacancy will not be filled at this time. Proxies cannot be voted for a greater number of persons than the number of nominees named. The Board of Directors may determine, if Proposal 4 is approved, to change the current size of the Board of Directors from seven directors.

Mr. Sullivan has agreed to serve if elected and we have no reason to believe that he will be unable to serve.

| Recommendation of the Board of Directors |

||||||||

| The Board of Directors recommends voting “FOR” the director nominee named above.

|

||||||||

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Information Regarding Director Nominees and Continuing Directors |

| 9 |

INFORMATION REGARDING DIRECTOR NOMINEE AND DIRECTORS

The following is a brief biography of our nominee for director and all other directors and a discussion of the specific experience, qualifications, attributes or skills of the nominee that led us to conclude that such person should serve as a director. We believe that, as a whole, the Board of Directors possesses the requisite skills and characteristics, leadership traits, work ethic, and independence to provide effective oversight.

No director nominee or continuing director is related by blood, marriage, or adoption to any director, executive officer or person chosen to become a director or executive officer. No arrangements or understandings exist between any director nominee or continuing director and any other person pursuant to which such person was selected as a director or nominee. Further, there are no legal proceedings to which any director nominee or continuing director is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

Information Regarding Director Nominee

| Mr. Sullivan has served on our Board of Directors since January 23, 2024. Mr. Sullivan has served as our President since May 15, 2023 and as our Chief Executive Officer as of August 2, 2023. Prior to joining the Company, from 2017 to 2023. Mr. Sullivan served as Managing Director and Head of Digital Assets and Infrastructure Group at XMS Capital Partners (a financial advisory firm) where he oversaw over $5 billion of transactions. While employed at XMS Capital Partners, Mr. Sullivan represented Power and Digital Infrastructure Acquisition Corporation in its acquisition of Core Scientific Holding Co., a predecessor and its subsidiary entities (collectively, “Legacy Core”) in 2021. He received his B.A. in Financial Economics from the University of Rochester.

We believe that Mr. Sullivan’s expertise with respect to the bitcoin mining industry and the operation of our business provide him with the qualifications and skills to serve on our Board of Directors. |

||||||

| Adam Sullivan President and CEO

Age: 33

Director Since: 2024

Committees: N/A

|

||||||

Information Regarding Continuing Directors

Directors with Terms Expiring at the 2026 Annual Meeting of Stockholders

| Mr. Booth has served on our Board of Directors since January 23, 2024. Mr. Booth is currently an entrepreneur and author of The Price of Tomorrow – Why Deflation is Key to an Abundant Future. From 1999 to 2017, Mr. Booth was Chief Executive Officer and Founder of BuildDirect.com Technologies, Inc. (TSX-V: BILD) a company that connects buyers and sellers of building materials and equipment to simplify the home improvement market. Mr. Booth is a Founding Partner of Ego Death Capital, a partnership of entrepreneurs that invest in other entrepreneurs solving world problems. Mr. Booth’s insights and achievements have earned him the BC Technology Industry Association’s Person of the Year in 2015 and in October 2023, he was honored with induction into the BCTIA’s Hall of Fame. Furthermore, in 2016, he gained recognition from Goldman Sachs, who named him one of the 100 Most Intriguing Entrepreneurs. In addition to his work investing and helping entrepreneurs build on the rails of bitcoin, he is a co-founder of Addy and NocNoc. Mr. Booth also actively serves on the Board of Directors of Fedi, and Breez, in addition to several advisory boards. A dedicated member of the Young Presidents Organization since 2004, he further contributes as a Founding Fellow at the Creative Destruction Lab.

We believe Mr. Booth’s entrepreneurial efforts, experience in bitcoin and other technology driven enterprises provide him with the qualifications and skills to serve on our Board of Directors. |

||||||

| Jeff Booth Independent Director

Age: 55

Director Since: 2024

Committees: Compensation Nominating and Corporate Governance

|

||||||

Table of Contents

| 10 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Information Regarding Director Nominees and Continuing Directors |

| Mr. Weiss has served on our Board of Directors since January 23, 2024. Mr. Weiss is the founder and Chief Investment Officer for Blockchain Investment Group LP, a hedge fund of funds investing exclusively in blockchain assets, since February 2018. Mr. Weiss began his career as a US Government bond trader at Morgan Stanley Dean Witter. After earning his MBA from Columbia Business School, Mr. Weiss joined the Private Equity and Venture Capital Division of GE Capital as a Director in the internet business space. While in this role, Mr. Weiss joined a client company, Internet Capital Group (ICG), as a Director of investments in business-to-business internet companies. Mr. Weiss also served as ICG’s Board of Directors representative for a number of portfolio companies. After ICG, Mr. Weiss served as a founding Principal at Stripes Group, identifying and leading investments in the online direct marketing space. Mr. Weiss has also been an active investor of personal capital in hedge funds and hedge fund of funds for over twenty years and purchased his first bitcoin in December 2013.

We believe Mr. Weiss is well suited to serve as a director on our Board of Directors due to his experience with blockchain and digital asset investing and trading markets. |

||||||

| Eric Weiss Independent Director

Age: 54

Director Since: 2024

Committees: Compensation Nominating and Corporate Governance

|

||||||

Directors with Terms Expiring at the 2027 Annual Meeting of Stockholders

| Mr. Becker has served on our Board of Directors since January 23, 2024. Since 2009, Mr. Becker has served as President, Chief Executive Officer and Director of Green Plains, Inc. (Nasdaq: GPRE), a producer of ethanol, grain handling and storage and related services). Mr. Becker has also previously served as Chief Executive Officer and Director of Green Plains Partners since its formation in 2015 and previously served on the board of directors for Hillshire Brands from 2012 to 2014, where he also served on the audit and compensation committees. He also spent ten years with ConAgra Foods in various management positions, including Vice President of International Trading and Marketing for ConAgra Trade Group and President of ConAgra Canada. Mr. Becker has 36 years of extensive experience in executive management, risk management, hedging and derivatives, supply chain management, M&A, and operations in numerous commodity processing and manufacturing businesses, along with significant international experience in agricultural and energy markets. In addition, he has extensive experience in debt and equity market capital raises, as well as a deep understanding and ability in investor relations and what it takes to attract and retain capital. Mr. Becker earned a master’s degree in finance from the Kelley School of Business at Indiana University and a bachelor’s degree in business administration with an emphasis in Finance from the University of Kansas.

We believe that Mr. Becker’s management, finance, and innovation expertise and experience as a director and audit committee member provide him with the qualifications and skills to serve on our Board of Directors. |

||||||

| Todd Becker Independent Director

Age: 59

Director Since: 2024

Committees: Audit

|

||||||

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Information Regarding Director Nominees and Continuing Directors |

| 11 |

| Mr. Levy has served on our Board of Directors since January 23, 2024. Mr. Levy currently serves as Managing Partner of SBNY (an investor in early stage disruptive technology driven companies). Prior to SBNY, Mr. Levy worked as a Partner on the early stage investing team at SoftBank Capital for 16 years. Before SoftBank, Mr. Levy was co-founder and President of ClientLogic and President, co-CEO and co-Chairman of its predecessor companies, UCA (now SITEL Worldwide) and SoftBank Services Group. Mr. Levy was also co-founder of Software Distribution Services (acquired by Ingram Micro, NYSE: INGM) and a founding director at Cobalt Networks (acquired by Sun Microsystems) and GT Interactive (acquired by Atari).

Mr. Levy currently serves on the Boards of Directors of BuzzFeed (Nasdaq: BZFD), JackThreads, RebelMouse, Shareablee, SocialFlow, Spanfeller Media, TalkSpace, WildCard and Work Market. Previously, he served on the Board of Directors of Hyperpublic (acquired by Groupon), KickApps (acquired by KIT Digital), OMGPOP (acquired by Zynga), XO Soft (acquired by CA) and ZipList (acquired by Condé Nast). Mr. Levy invested in Buddy Media (acquired by Salesforce.com) and Huffington Post (acquired by AOL). Mr. Levy is the co-founder of Z80 Labs, a startup incubator in Buffalo, and Chairman of the 43North global business plan competition. He is also non-executive Chairman of Synacor (Nasdaq: SYNC) and serves as a Director of COKeM International Ltd. Mr. Levy also served on the Upstate Regional Advisory Board for the Federal Reserve Bank of New York.

Mr. Levy is past Chairman of the Erie Canal Harbor Development Corporation, the state agency responsible for the redevelopment of Buffalo’s historic waterfront. He is a trustee of the University of Buffalo Foundation. He served for nine years as a trustee of the Albright-Knox Art Gallery and is past President of the Jewish Federation of Greater Buffalo. Mr. Levy holds a B.A. in Political Science from the State University of New York at Buffalo. We believe Mr. Levy’s service on the boards of other public companies gives him a strong understanding of his role as a member of our Board of Directors and enables him to provide essential strategic and corporate governance leadership to our Board of Directors.

Additionally, Mr. Levy’s experience as a venture capital investor, including at the seed stage, enables him to bring to our Board of Directors significant technology experience and insights in evaluating new businesses and products. |

||||||

| Jordan Levy Independent Director

Age: 69

Director Since: 2024

Committees: Nominating and Corporate Governance

|

||||||

| Mr. Rozov has served on our Board of Directors since January 23, 2024. Mr. Rozov is the founder and Managing Partner of Terrace Edge Ventures LLC, a financial advisory firm providing consulting services to public and private companies and institutional investors, since January 2022. From 2019 to 2021, Mr. Rozov was a Partner of GoldenTree Asset Management LLC, a leading global credit asset management firm. From 2019 to 2021, Mr. Rozov also served as the Chief Executive Officer and President of Syncora Guarantee Inc. and from 2020 to 2021, as Chief Executive Officer of Financial Guaranty UK Ltd, each of which is a stand-alone specialty insurance company owned by GoldenTree. From 2009 to 2019, he was a Partner and Managing Director at Moelis & Company where he headed the Financial Institution Advisory group and was on the Management Committee of Moelis Asset Management. From 2014 to 2019, Mr. Rozov helped co-found College Avenue Student Loans LLC and served on its board of directors and co-founded Chamonix Partners Capital Management LLC. From 2007 to 2009, Mr. Rozov was a Managing Director at UBS AG, where he was the Head of the Americas for the Repositioning Group. Mr. Rozov has served on the board of directors of Midwest Holding Inc. (Nasdaq: MDWT) since June 2022, on the board of directors of Neo Performance Materials Inc. since August 2022 and on the board of directors of Oramed Pharmaceuticals (Nasdaq: ORMP) since April 2022. Mr. Rozov holds an M.Sc. in data science from Columbia University and a bachelor’s degree with highest honors in Physics and Materials Engineering from Rutgers University.

We believe Mr. Rozov is well suited to serve as a director on our Board of Directors due to his extensive experience in the financial services industry, both as an executive and a founder. |

||||||

| Yadin Rozov Independent Director

Age: 47

Director Since: 2024

Committees: Audit Compensation

|

||||||

Table of Contents

| 12 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Information Regarding Director Nominees and Continuing Directors |

Director with Term Expiring at the 2025 Annual Meeting of Stockholders

| Mr. Patten has served on our Board of Directors since January 23, 2024. Mr. Patten founded and runs global real estate advisory firm RRG and has served as its president and chief executive officer since inception in 1996. Mr. Patten’s professional career has been dedicated to the development and execution of real estate, technology and technology management solutions that heighten operational controls, lower operating costs and deliver sustainable cost savings to users of space worldwide. Mr. Patten’s leadership, foresight and expertise have been critical drivers in the delivery of billions of dollars in value to diverse, leading-edge organizations globally. Mr. Patten has been a member of the Board of Directors of MicroStrategy Incorporated (“MicroStrategy”) (Nasdaq: MSTR) since November 2004. MicroStrategy is a multi-billion dollar public company headquartered in Tysons Corner, Virginia, in the Washington metropolitan area. MicroStrategy has built a material, digital assets business and is believed currently to be the largest public company holder of bitcoin on its corporate balance sheet. Mr. Patten received a B.S. in Biology and a B.A. in Biological Anthropology and Anatomy from the Trinity College of Arts and Sciences at Duke University.

We believe that Mr. Patten is well-suited to serve on our Board of Directors due to his leadership and management expertise as a chief executive officer, his international business, finance, and corporate compliance experience, and his extensive knowledge of bitcoin, and cost and operational controls. |

||||||

| Jarrod Patten Independent Director

Age: 52

Director Since: 2024

Committees: Audit

|

||||||

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

| 13 |

CORPORATE GOVERNANCE AND RELATED MATTERS

Communications with Directors

Stockholders and other parties interested in communicating directly with the Chairman, any committee chair, or with the non-employee directors as a group may do so by contacting the Chairman of the Board of Directors, c/o Corporate Secretary, Core Scientific, Inc., 838 Walker Road, Suite 21-2105, Dover, Delaware 19904. Concerns relating to accounting, internal controls or auditing matters are promptly brought to the attention of the Audit Committee and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Meetings

During 2024, the Company’s current Board of Directors held thirteen meetings and acted by unanimous written consent ten times. In 2024, each director attended more than 75% of the total Board of Directors and committee meetings (for committees on which he served). Under Core Scientific’s Corporate Governance Principles, each director is expected to commit the time necessary to prepare for and attend all Board of Directors and committee meetings, as well as the Annual Meeting of Stockholders. All members of the Board of Directors are expected to attend the Annual Meeting. We did not hold a 2024 Annual Meeting of Stockholders.

Prior to the Company’s emergence from bankruptcy on January 23, 2024, the Company’s prior Board of Directors met twice and acted by unanimous written consent one time. The Company’s prior Board of Directors consisted of Michael Levitt, Matt Minnis, Darin Feinstein, Neal Goldman, Jarvis Hollingsworth and Kneeland Youngblood.

Board of Directors Independence

As required under the Nasdaq Stock Market, LLC (“Nasdaq”) listing standards, a majority of the members of a listed company’s Board of Directors must qualify as “independent,” as affirmatively determined by the Board of Directors. The Board of Directors consults with its counsel to ensure that the Board of Director’s determinations are consistent with relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant facts and circumstance, including any identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board of Directors has affirmatively determined that each of Messrs. Becker, Booth, Levy, Patten, Rozov and Weiss are “independent” as defined by applicable NASDAQ rules, and each of Messrs. Feinstein, Goldman, Hollingsworth, and Youngblood were “independent” during the period each served on our Board of Directors during 2024.

Board of Directors Leadership Structure

Since January 23, 2024, the Company maintains separate CEO and Chair roles. The Board of Directors has determined this to be the appropriate leadership structure at this time to carry out its roles and responsibilities on behalf of the Company and its stockholders. Our Board of Directors is chaired by Jarrod Patten, who was appointed a director by the Equity Committee established pursuant to the Company’s plan of reorganization (“Plan of Reorganization”) under the jointly administered Chapter 11 cases under the caption CORE SCIENTIFIC, INC. et al Debtors” and set forth in the Fourth Amended Joint Chapter 11 Plan of Core Scientific and its affiliated debtors dated January 15, 2024. The Board will select the Company’s CEO and chairperson of the Board in the manner that it determines to be in the best interests of the Company’s stockholders. The Company does not believe there should be a fixed rule regarding the positions of Chief Executive Officer and chairperson being held by different individuals, or whether the chairperson should be an employee of the Company or should be elected from among the non-employee directors. The needs of the Company and the individuals available to assume these roles may require different outcomes at different times, and the Board believes that retaining flexibility in these decisions is in the best interests of the Company. The Nominating and Corporate Governance Committee will periodically review this matter and make recommendations to the Board.

In the event that the Company does not have an independent chairperson of the Board, the independent directors may designate a lead independent director. The name of the chairperson or lead independent director will be listed in the Company’s Proxy Statement. The lead independent director’s duties shall include: (i) presiding at all meetings of the Board at which the chairperson is not present,

Table of Contents

| 14 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

including executive sessions of the independent directors; (ii) acting as liaison between the independent directors and the Chief Executive Officer and chairperson; (iii) presiding over meetings of the independent directors; (iv) consulting with the chairperson in planning and setting schedules and agendas for Board meetings; and (v) performing such other functions as the Board may delegate.

The Board of Directors will continue to evaluate the separation of the roles of CEO and Chair , as well as the role and responsibilities of the Chair. The Board of Directors intends to act as necessary to ensure that the Board of Directors and management operate with a common purpose and a single, clear chain of command to execute our strategic initiatives and business plans, while facilitating the regular flow of information.

Role of the Board of Directors in Risk Oversight

We face a broad array of risks, including market, operational, strategic, legal, regulatory, reputational, cybersecurity/data security, environmental, social and financial risks. Our management is responsible for establishing and maintaining systems to manage these risks. One of the key functions of our Board of Directors is to exercise informed oversight of our risk management process. Our Board of Directors does not have a standing risk management committee but rather administers this oversight function directly through the Board of Directors as a whole, as well as through various standing committees of our Board of Directors that address risks inherent in their respective areas of oversight. In particular, our Board of Directors is responsible for monitoring and assessing strategic risk exposure and our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also oversees compliance with legal and regulatory requirements. The Board of Directors and committees receive regular reports from Company management with respect to particular risk exposures and the committee chairs provide regular reports to the Board of Directors with respect to relevant areas of oversight as discussed below.

Board of Directors Committees

The Board of Directors has standing Audit, Compensation and Nominating and Corporate Governance Committees.

| Name |

Audit | Nominating Corporate Governance |

Compensation | |||

| Adam Sullivan |

||||||

| Jarrod Patten |

X | |||||

| Todd Becker |

Chair | |||||

| Jeff Booth |

X | X | ||||

| Yadin Rozov |

X | Chair | ||||

| Eric Weiss |

X | X | ||||

| Jordan Levy |

Chair | |||||

Our Board of Directors has adopted a written charter for each of our committees, each of which is available to stockholders on our investor relations website at https://investors.corescientific.com.

Code of Business Conduct and Ethics

We have adopted a code of conduct (the “Code of Conduct”) applicable to all employees, directors and officers, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Conduct is available under the Governance section of our website at https://investors.corescientific.com. If we make any substantive amendments to the Code of Conduct or grant any waiver from a provision of the Code of Conduct to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Insider Trading and Hedging Policy

Our Board of Directors has adopted an insider trading policy, governing the purchase, sale, and/or other dispositions of the Company’s securities by directors, officers, employees, and certain consultants, that are reasonably designed to promote

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

| 15 |

compliance with insider trading laws, rules and regulations and any listing standards applicable to us. The Company’s insider trading policy also prohibits our employees (including officers), directors and certain consultants from engaging in hedging or monetization transactions with respect to our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds. In addition, our insider trading policy prohibits trading in derivative securities related to our securities, which include publicly traded call and put options, engaging in short selling of our common stock, purchasing our common stock on margin or holding it in a margin account and pledging our shares as collateral for a loan. Although we have not formally adopted insider trading policies and procedures governing transactions in our securities by the Company itself, we intend to comply with all applicable securities laws and regulations when engaging in such transactions.

Audit Committee

The Audit Committee of the Board of Directors (the “Audit Committee”) is currently composed of three members: Mr. Becker (Chair), Mr. Patten, and Mr. Rozov. Prior to the Company’s emergence from bankruptcy on January 23, 2024, the Company’s Audit Committee consisted of Neal Goldman, Jarvis Hollingsworth and Kneeland Youngblood. The Audit Committee met eight times in 2024.

Our Board of Directors has determined that each of these individuals meets the independence requirements of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”), Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the applicable listing standards of Nasdaq. Each member of our Audit Committee can read and understand fundamental financial statements in accordance with Nasdaq audit committee requirements. Additionally, our Board of Directors has determined that Mr. Patten, Mr. Becker and Mr. Rozov (as well as Messrs. Goldman, Hollingsworth and Youngblood prior to the Company’s Plan of Reorganization in January 2024) are qualified as audit committee financial experts within the meaning of SEC rules and meet the financial sophistication requirements of the applicable Nasdaq listing rules. In arriving at this determination, the Board of Directors has examined each Audit Committee member’s scope of experience and the nature of their prior and/or current employment and has determined that each Audit Committee member qualifies as a financial expert as defined in Item 407(d) of Regulation S-K. Both our independent registered public accounting firm and management periodically meet privately with our Audit Committee.

The primary purpose of the Audit Committee is to discharge the responsibilities of the Board of Directors with respect to oversight of corporate accounting and financial reporting processes, systems of internal control and financial statement audits, and to oversee our independent registered public accounting firm. Specific responsibilities of the Audit Committee include:

| • | helping the Board of Directors oversee corporate accounting and financial reporting processes; |

| • | managing the selection, engagement, qualifications, independence and performance of a qualified firm to serve as the independent registered public accounting firm to audit the financial statements; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, the interim and year-end operating results; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing related person transactions; |

| • | obtaining and reviewing a report by the independent registered public accounting firm at least annually that describes internal quality control procedures, any material issues with such procedures and any steps taken to deal with such issues when required by applicable law; and |

| • | approving or, as permitted, pre-approving, audit and permissible non-audit services to be performed by the independent registered public accounting firm. |

Report of the Audit Committee of the Board of Directors

The material in this report is not “soliciting material,” is not deemed filed with the Securities and Exchange Commission (the “SEC”) and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2024, with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants’ communications with the Audit Committee concerning independence and has discussed with the independent registered public accounting firm the accounting

Table of Contents

| 16 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

firm’s independence. Based on the foregoing, the Audit Committee has recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

Respectfully submitted,

Todd Becker (Chair)

Jarrod Patten

Yadin Rozov

Compensation Committee

The Compensation Committee of the Board of Directors (the “Compensation Committee”) is currently composed of three directors: Mr. Rozov (Chair), Mr. Booth and Mr. Weiss. Prior to the Company’s emergence from bankruptcy on January 23, 2024, the Compensation Committee consisted of Kneeland Youngblood, Matt Minnis, and Neal Goldman .Our Board of Directors has determined that each of the members of the Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act and is “independent” as defined under the applicable listing standards of Nasdaq, including the standards specific to members of a compensation committee. The Compensation Committee met [ten] times and acted by unanimous written consent seven times in 2024.

The primary purpose of the Compensation Committee is to discharge the responsibilities of the Board of Directors in overseeing the compensation policies, plans and programs and to review and determine the compensation to be paid to executive officers, directors and other members of senior management, as appropriate. Specific responsibilities of the Compensation Committee include:

| • | reviewing and approving the compensation of our Chief Executive Officer, other executive officers and other members of senior management; |

| • | administering the equity incentive plans and other benefit programs; |

| • | reviewing, adopting, amending and terminating incentive compensation and equity plans, employment agreements, severance agreements and similar arrangements, profit sharing plans, bonus plans, change-of-control protections and any other compensatory arrangements for the executive officers, including our Chief Executive Officer, and other members of senior management; and |

| • | reviewing and establishing general policies relating to compensation and benefits of the employees. |

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets quarterly and with greater frequency if necessary. The Compensation Committee also acts periodically by unanimous written consent in lieu of a formal meeting. The agenda for each meeting is usually developed by the chair of the Compensation Committee, in consultation with our Chief Executive Officer and Chief Legal Officer. The Compensation Committee meets regularly in executive session. However, from time to time, the Compensation Committee may invite various members of management and other employees as well as outside advisors or consultants to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer and Chief Legal Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding their compensation. The Charter of the Compensation Committee (referred to as the “Charter” in the following two paragraphs) grants the Compensation Committee full access to all books, records, facilities and personnel of the Company.

In addition, under the Charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Compensation Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms. Under the Charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the Compensation Committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration the factors, prescribed by the SEC, and the applicable listing standards of Nasdaq, that bear upon the adviser’s independence; however, there is no requirement that any adviser be independent.

Further, under the Charter, the Chair of the Compensation Committee has the delegated authority to act on behalf of the Compensation Committee in connection with (1) approval of the retention of advisors and outside service providers (including

Table of Contents

| CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

| 17 |

negotiation and execution of their engagement letters) and (2) as may otherwise be determined by the Compensation Committee. The Compensation Committee also may form and delegate authority to one or more subcommittees consisting of one or more members of the Board of Directors (whether or not he, she or they are on the Compensation Committee) to the extent allowed under applicable law and Nasdaq listing requirements. By delegating an issue to the Chair or a subcommittee, the Compensation Committee does not surrender any authority over that issue. Although the Compensation Committee may act on any issue that has been delegated to the Chair or a subcommittee, doing so will not limit or restrict future action by the Chair or subcommittee on any matters delegated to it. Any action or decision of the Chair or a subcommittee is presented to the Compensation Committee at its next scheduled meeting.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee are currently, or have been at any time, one of our executive officers or employees. None of our executive officers currently serve, or have served during the last year, as a member of the Board of Directors or Compensation Committee of any entity where an executive officer of such other entity serves or served as a member of our Board of Directors or Compensation Committee.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee of the Board of Directors (the “Nominating and Corporate Governance Committee”) is currently composed of three directors: Mr. Levy (Chair), Mr. Booth and Mr. Weiss. Prior to the Company’s emergence from bankruptcy on January 23, 2024, the Company’s Nominating and Corporate Governance Committee consisted of Jarvis Hollingsworth, Kneeland Youngblood, and Matt Minnis. The Nominating and Corporate Governance Committee met three times in 2024. All members of the Nominating and Corporate Governance Committee are independent under the applicable listing standards of Nasdaq.

The Nominating and Corporate Governance Committee of the Board of Directors is responsible for identifying and evaluating candidates, including the nomination of incumbent directors for reelection and nominees recommended by stockholders, to serve on the Board of Directors, considering and making recommendations to the Board of Directors regarding the composition and chairmanship of the committees of the Board of Directors, developing and making recommendations to the Board of Directors regarding corporate governance guidelines and matters, including in relation to corporate social responsibility and overseeing periodic evaluations of the performance of the Board of Directors, including its individual directors and committees subject in all respects to the Company’s Certificate of Incorporation.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including a reputation for integrity, honesty and adherence to high ethical standards; demonstrated business acumen, experience and the ability to exercise sound judgement in matters that relate to the current and long-term objectives of the Company and a willingness and ability to contribute positively to the decision-making process of the Company; a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the Board of Directors and its committees; the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the best interests of all stockholders. The Nominating and Corporate Governance Committee also believes that candidates for director should not have, nor appear to have, a conflict of interest that would impair the candidate’s ability to represent the interests of all the Company’s stockholders and to fulfill the responsibilities of a director. However, the Nominating and Corporate Governance Committee may modify these qualifications from time to time based on evolving needs of the Board of Directors. Candidates for director nominees are reviewed in the context of the current composition of the Board of Directors, the operating requirements of the Company and the long-term interests of stockholders.

Our Nominating and Corporate Governance Committee believes that our Board of Directors, taken as a whole, should embody a wide range of skills, experiences and backgrounds. In this regard, the Nominating and Corporate Governance Committee will strive to achieve a balance of backgrounds, perspectives, and experience on our Board of Directors and its committees.

The Nominating and Corporate Governance Committee appreciates the value of thoughtful Board of Directors refreshment, and regularly identifies and considers qualities, skills and other director attributes that would enhance the composition of the Board of Directors. In the case of incumbent directors whose terms of office are set to expire, the Committee reviews these directors’ overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors’ independence. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent, which determination is

Table of Contents

| 18 | | CORE SCIENTIFIC 2025 PROXY STATEMENT Corporate Governance and Related Matters |

based upon applicable SEC rules and regulations and Nasdaq listing standards. The Nominating and Corporate Governance Committee then compiles a list of potential candidates, and may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the Board of Directors. The Nominating and Corporate Governance Committee meets to discuss and consider each potential candidate’s qualifications and then selects a nominee for recommendation to the Board of Directors by majority vote.