DEF 14A: Definitive proxy statements

Published on April 8, 2022

Table of Contents

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to § 240.14a-12 |

Core Scientific, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Table of Contents

CORE SCIENTIFIC, INC.

210 Barton Springs Road

Suite 300

Austin, Texas 78704

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 11, 2022

Dear Stockholder of Core Scientific, Inc.:

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of Core Scientific, Inc., a Delaware corporation (the Company). The Annual Meeting will be held virtually on Wednesday, May 11, 2022 at 10:00 a.m. Eastern Time. You may attend the virtual meeting, submit questions and vote your shares electronically during the meeting via live webcast by visiting www.virtualshareholdermeeting.com/CORZ2022. You will not be able to attend the Annual Meeting in person. Shareholders attending the Annual Meeting virtually will be afforded the same rights and opportunities to participate as they would at an in-person meeting. We encourage you to attend online and participate. We recommend that you log in 15 minutes before 10:00 a.m., Eastern Time on May 11, 2022 to ensure you are logged in when the Annual Meeting starts.

The Annual Meeting will be held for the following purposes:

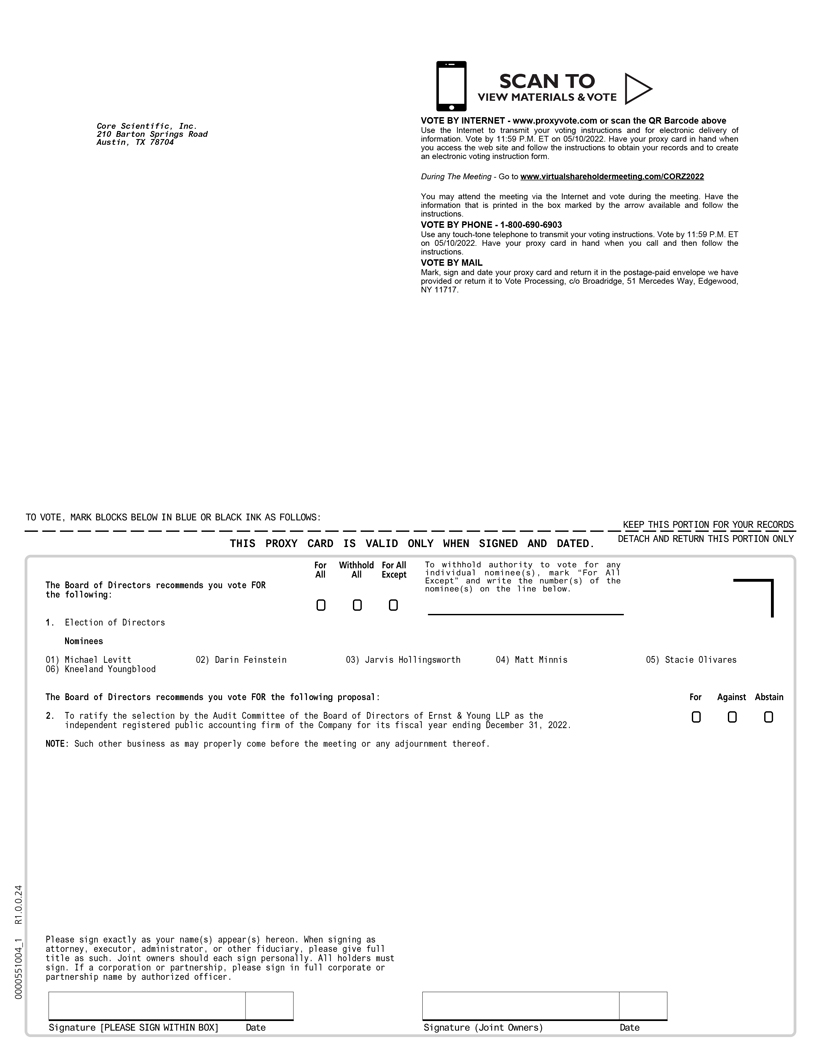

| 1. | To elect the nominees to the Board of Directors (the Board) named in the accompanying proxy statement (the Proxy Statement), Michael Levitt, Darin Feinstein, Jarvis Hollingsworth, Matt Minnis, Stacie Olivares and Kneeland Youngblood, to hold office until the 2023 Annual Meeting of Stockholders and until their successors are duly elected and qualified. |

| 2. | To ratify the selection of Ernst & Young LLP as the independent registered public accounting firm of the Company for its fiscal year ending December 31, 2022. |

| 3. | To conduct any other business properly brought before the Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

You will be able to attend the Annual Meeting, submit questions and vote during the live webcast by visiting www.virtualshareholdermeeting.com/CORZ2022 and entering the 16-digit Control Number included in your proxy card, voting instruction form, or in the instructions that you received via email. Please refer to the additional logistical details and recommendations in the accompanying Proxy Statement.

The record date for the Annual Meeting is March 28, 2022. Only stockholders of record at the close of business on that date may vote at the Annual Meeting or any adjournment or postponement thereof.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders

to Be Held on May 11, 2022 at 10:00 a.m. Eastern Time

The Proxy Statement and Annual Report to stockholders

are available at https://www.proxyvote.com.

By Order of the Board of Directors,

Michael Levitt

Chief Executive Officer and Co-Chair of the Board of Directors

Austin, Texas

April 7, 2022

You are cordially invited to attend the Annual Meeting online. Whether or not you expect to attend the Annual Meeting, please complete, date, sign and return the enclosed proxy, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the Annual Meeting. A return envelope (which is postage prepaid if mailed in the United States) has been provided for your convenience. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain a proxy issued in your name from that record holder.

Table of Contents

i

Table of Contents

CORE SCIENTIFIC, INC.

210 Barton Springs Road

Suite 300

Austin, Texas 78704

PROXY STATEMENT

FOR THE 2022 ANNUAL MEETING OF STOCKHOLDERS

May 11, 2022

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have sent you these proxy materials because the Board of Core Scientific, Inc. (sometimes referred to as the Company or Core) is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders (the Annual Meeting), including at any adjournments or postponements of the meeting. You are invited to attend the Annual Meeting online to vote on the proposals described in this Proxy Statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, or follow the instructions below to submit your proxy over the telephone or through the internet.

We intend to mail these proxy materials on or about April 7, 2022 to all stockholders of record entitled to vote at the Annual Meeting.

Why are you holding a virtual Annual Meeting?

As part of our effort to maintain a safe and healthy environment for our directors, members of management and stockholders who wish to attend the Annual Meeting, in light of the ongoing COVID-19 pandemic we believe that hosting a virtual meeting is in the best interest of the Company and its stockholders and enables increased stockholder attendance and participation because stockholders can participate from any location around the world. Stockholders will have the same rights and opportunities to participate as they would have at an in-person meeting.

How do I attend the Annual Meeting?

You cannot attend the Annual Meeting physically. You can attend the annual meeting by visiting www.virtualshareholdermeeting.com/CORZ2022, where you will be able to listen to the Annual Meeting live, submit questions and vote online.

The meeting will be held on Wednesday, May 11, 2022 at 10:00 a.m. Eastern Time. We encourage you to access the Annual Meeting 15 minutes prior to the start time to allow time for online check-in. We have worked to offer the same participation opportunities as would be provided at an in-person meeting while further enhancing the online experience available to all stockholders regardless of their location. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies. If you experience technical difficulties during the Annual Meeting, you should call the technical support phone number provided when you log in to the Annual Meeting.

In order to enter the Annual Meeting virtually, you will need the unique 16-digit control number, which is included on your proxy card if you are a stockholder of record of the shares, or included with your voting instruction card and voting instructions received from your broker, bank, trustee, or nominee if you are the beneficial owner of the shares held in street name.

1

Table of Contents

What if I cannot virtually attend the Annual Meeting?

You may vote your shares electronically before the meeting by internet, by proxy or by telephone as described below. You do not need to access the Annual Meeting audio-only webcast to vote if you submitted your vote via proxy, by internet or by telephone in advance of the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on March 28, 2022 will be entitled to vote at the Annual Meeting. On this record date, there were 316,243,371 shares of common stock outstanding and entitled to vote. A list of stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices for examination during normal business hours by any stockholder for any purpose germane to the Annual Meeting for a period of ten days prior to the Annual Meeting through the close of the Annual Meeting.

Stockholder of Record: Shares Registered in Your Name

If on March 28, 2022, your shares were registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are a stockholder of record. As a stockholder of record, you may vote at the Annual Meeting virtually or vote by proxy prior to the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to fill out and return the enclosed proxy card, vote by proxy electronically through the Internet or over the telephone to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on March 28, 2022, your shares were held not in your name but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote your shares at the Annual Meeting even if you participate virtually unless you request and obtain a valid proxy from your broker, bank or other agent.

What am I voting on?

There are two matters scheduled for a vote:

| | Election of six (6) directors to hold office until the 2023 Annual Meeting of Stockholders (Proposal 1); and |

| | Ratification of selection of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 (Proposal 2). |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

With respect to Proposal 1, you may either vote FOR all the nominees to the Board or you may WITHHOLD your vote for any nominee you specify. With respect to Proposal 2, you may vote FOR or AGAINST or abstain from voting.

2

Table of Contents

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote electronically over the internet before or during the Annual Meeting, vote by proxy through the Internet, vote by proxy over the telephone, or vote by proxy using the enclosed proxy card. Whether or not you plan to attend the virtual Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting virtually and vote electronically even if you have already voted by proxy.

| | To vote through the Internet before the Annual Meeting, go to www.proxyvote.com to complete an electronic proxy card. You will be asked to provide the 16-digit control number from the proxy card. Your Internet vote must be received by 11:59 p.m., Eastern Time, on May 10, 2022 to be counted. |

| | To vote your shares electronically at the Annual Meeting, you will need to visit www.virtualshareholdermeeting.com/CORZ2022 during the Annual Meeting while the polls are open and follow the instructions provided. You will be asked to provide the control number from the proxy card and follow the instructions. |

| | To vote over the telephone from a location in the United States, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time, on May 10, 2022 to be counted. |

| | To vote using the proxy card, simply complete, sign and date the enclosed proxy card. and return it promptly in the envelope provided. If you return your signed proxy card to us before the Annual Meeting, we will vote your shares as you direct. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from us. To vote prior to the Annual Meeting, simply complete and mail the voting instruction form to ensure that your vote is counted. Alternatively, you may vote by telephone or over the internet as instructed by your broker or bank.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of March 28, 2022.

If I am a stockholder of record and I do not vote, or if I return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record and do not vote by completing a proxy card, by telephone, through the Internet or electronically at the Annual Meeting, your shares will not be voted.

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, FOR the election of all six nominees for director and FOR the ratification of the selection of our independent registered public accounting firm. If any other matter is properly presented at the Annual Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares using his or her best judgment.

3

Table of Contents

If I am a beneficial owner of shares held in street name and I do not provide my broker or bank with voting instructions, what happens?

If you are a beneficial owner of shares held in street name and you do not instruct your broker, bank or other agent how to vote your shares, your broker, bank or other agent may still be able to vote your shares in its discretion. In this regard, under the rules of the New York Stock Exchange (NYSE), brokers, banks and other securities intermediaries that are subject to NYSE rules, including those voting on behalf of beneficial owners of Nasdaq-listed companies, may use their discretion to vote your uninstructed shares with respect to matters considered to be routine under NYSE rules, but not with respect to non-routine matters. In this regard, Proposal 1 is considered to be non-routine under NYSE rules meaning that your broker may not vote your shares on this proposal in the absence of your voting instructions. However, Proposal 2 is considered to be a routine matter under NYSE rules, meaning that if you do not return voting instructions to your broker by its deadline, your shares may be voted by your broker in its discretion on Proposal 2. Accordingly, if you own shares through a nominee, such as a broker, bank or other agent, please be sure to instruct your nominee how to vote to ensure that your vote is counted on all of the proposals.

If you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the proxy cards in the proxy materials to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| | You may grant a subsequent proxy by telephone or through the Internet. |

| | You may send a timely written notice that you are revoking your proxy to our Corporate Secretary at 210 Barton Springs Road, Suite 300, Austin, Texas 78704. |

| | You may attend the Annual Meeting virtually and vote electronically. Simply attending the Annual Meeting virtually will not, by itself, revoke your proxy. Even if you plan to attend the Annual Meeting virtually, we recommend that you also submit your proxy or voting instructions or vote by telephone or through the Internet so that your vote will be counted if you later decide not to attend the Annual Meeting. |

Your most current proxy card or telephone or Internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

4

Table of Contents

When are stockholder proposals and director nominations due for next years annual meeting?

To be considered for inclusion in next years proxy materials, your proposal must be submitted in writing by December 7, 2022, to our Corporate Secretary, c/o Core Scientific, Inc., 210 Barton Springs Road, Suite 300, Austin, Texas 78704.

Our bylaws also establish an advance notice procedure if you wish to present a proposal (including a director nomination) before an annual meeting of stockholders but you are not requesting that your proposal or nomination be included in next years proxy materials. To be timely for our 2023 Annual Meeting of Stockholders, our Corporate Secretary must receive the written notice at our principal executive offices not later than the close of business on February 10, 2023 nor earlier than the close of business on January 11, 2023. However, if we hold our 2023 Annual Meeting of Stockholders more than 30 days before or after May 11, 2023 (the one-year anniversary date of the 2022 Annual Meeting of Stockholders), then timely notice of a stockholder proposal that is not intended to be included in our proxy statement must be received not earlier than the close of business on the 120th day prior to the 2023 Annual Meeting of Stockholders and not later than the close of business on the later of (a) the 90th day prior to the 2023 Annual Meeting of Stockholders and (b) the 10th day following the day on which the one of the following first occurs: (i) mailing of notice of the date of the 2023 Annual Meeting of Stockholders and (ii) the first public announcement of the date of the 2023 Annual Meeting of Stockholders. You are also advised to review our bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

How are votes counted?

Proposal 1: Election of Directors. Directors will be elected by a plurality of votes cast at the Annual Meeting by holders of shares present or represented by proxy and entitled to vote. The nominees receiving the most For votes will be elected as directors. You may not vote your shares cumulatively for the election of directors. Abstentions and broker non-votes will not affect the outcome of the election of directors.

Proposal 2: Ratification of the Selection of the Independent Registered Public Accounting Firm. To be approved, the ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for fiscal year ending December 31, 2022 must receive For votes from the holders of a majority of shares present or represented by proxy and entitled to vote. Abstentions will have the same effect as an Against vote..

What are broker non-votes?

As discussed above, when a beneficial owner of shares held in street name does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed to be non-routine, the broker or nominee cannot vote the shares. These unvoted shares are counted as broker non-votes. Proposal 1 is considered to be non-routine, and we therefore expect broker non-votes to exist in connection with this proposal.

As a reminder, if you are a beneficial owner of shares held in street name, in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from your broker, bank or other agent.

5

Table of Contents

How many votes are needed to approve each proposal?

The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| Proposal Number |

Proposal Description |

Vote Required for Approval |

Effect of |

Effect of

Broker |

||||

| 1 | Election of directors | The nominees receiving the most For votes will be elected as directors; withheld votes will have no effect. | Not applicable | No effect | ||||

|

2 |

Ratification of the selection of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2022 |

For votes from the holders of a majority of shares present in person or by remote communication, if applicable, or represented by proxy and entitled to vote on this proposal. |

Against |

Not applicable(1) |

| (1) | Proposal 2 is considered to be a routine matter. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker, bank or other agent that holds your shares, your broker, bank or other agent has discretionary authority to vote your shares on this proposal. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority in voting power of the outstanding shares entitled to vote are present at the Annual Meeting in person or by remote communication, if applicable, or represented by proxy. On the record date, there were 316,243,371 shares outstanding and entitled to vote. Thus, the holders of 158,121,686 shares must be present in person or by remote communication, if applicable, or represented by proxy at the Annual Meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote electronically the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the Annual Meeting in person or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

What proxy materials are available on the internet?

The proxy statement and annual report to stockholders are available at https://www.proxyvote.com.

6

Table of Contents

Description of the Business Combination Completed in January 2022

Prior to January 19, 2022, we were a blank check company known as Power & Digital Infrastructure Acquisition Corp. (hereinafter referred to as XPDI) and were incorporated for the purpose of effecting a merger, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses.

On July 20, 2021, XPDI entered into that certain Agreement and Plan of Reorganization and Merger (as amended on October 1, 2021, and as further amended on December 29, 2021, the Merger Agreement), by and among XPDI, Core Scientific Holding Co., a Delaware corporation (Legacy Core), XPDI Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of XPDI (Merger Sub). Pursuant to the terms of (a) the Merger Agreement and (b) that certain Agreement and Plan of Merger, dated as of October 1, 2021, as amended on January 14, 2022, by and among XPDI, Legacy Core, XPDI Merger Sub 3, LLC, a Delaware limited liability company and wholly owned subsidiary of XPDI (Merger Sub 3), and Blockcap, Inc., a Nevada corporation and wholly owned subsidiary of Legacy Core (Blockcap), the Business Combination (as defined below) was effected by (i) the merger of Merger Sub with and into Legacy Core (the First Merger), which occurred on January 19, 2022, with Legacy Core surviving the First Merger as a wholly owned subsidiary of XPDI, (ii) the merger of Legacy Core with and into XPDI (the Second Merger), which occurred on January 20, 2022, with XPDI surviving the Second Merger, and (iii) following the closing of the Second Merger on January 20, 2022, the merger of Blockcap with and into Merger Sub 3 (the Third Merger and collectively with the First Merger, the Second Merger and the other transactions described in the Merger Agreement, the Business Combination), with Merger Sub 3 surviving the Third Merger as a wholly owned subsidiary of XPDI under the name Core Scientific Acquired Mining LLC. Immediately prior to the effective time of the First Merger, XPDI filed a Second Amended and Restated Certificate of Incorporation with the Secretary of State of the State of Delaware pursuant to which XPDI changed its name from Power & Digital Infrastructure Acquisition Corp. to Core Scientific, Inc.

Following the Business Combination, we are a best-in-class large-scale operator of dedicated, purpose-built facilities for digital asset mining and a premier provider of blockchain infrastructure, software solutions and services. Our common stock and public warrants began trading on the Nasdaq Global Select Market on January 20, 2022 under the symbols CORZ and CORZW, respectively.

7

Table of Contents

ELECTION OF DIRECTORS

Our Board currently consists of the following six members: Michael Levitt, Darin Feinstein, Jarvis Hollingsworth, Matt Minnis, Stacie Olivares and Kneeland Youngblood. Our certificate of incorporation provides that each member of the Board will serve a one-year term expiring at our next annual meeting of stockholders and until his or her successor is elected, or, if sooner, until the directors death, resignation or removal. Vacancies or newly created directorships on our Board may be filled by persons elected by a majority of the remaining directors, unless the Board determines by resolution that any such vacancy or newly created directorship will be filled by the stockholders. Any director elected to fill a vacancy will hold office for the remainder of the full term of the director for which the vacancy was created or occurred and until such directors successor shall have been elected and qualified or until such directors earlier death, resignation or removal.

Each of the current directors has been nominated by our Nominating and Corporate Governance committee for election at the Annual Meeting and if elected at the Annual Meeting, each of the nominees would serve until our next annual meeting of stockholders to be held in 2023 and until his or her successor has been duly elected, or if sooner, until the directors death, resignation or removal. It is our companys policy to encourage nominees for directors to attend the Annual Meeting.

Directors are elected by a plurality of the votes of the holders of shares present in person or by remote communication, if applicable, or represented by proxy and entitled to vote on the election of directors. Accordingly, the six nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the six nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead be voted for the election of a substitute nominee proposed by us. Each person nominated for election has agreed to serve if elected. We have no reason to believe that any nominee will be unable to serve.

Information Regarding Director Nominees

The following is a brief biography of each nominee for director and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Nominating and Corporate Governance Committee to recommend that person as a nominee for director, as of the date of this Proxy Statement.

Michael Levitt, age 63, has served as our Chief Executive Officer and Co-Chair and a member of the Board since January 2022. Mr. Levitt served as the Chief Executive Officer of Legacy Core from May 2021 until the Business Combination, and as Chairman and a member of Legacy Cores board of directors from June 2018 until the Business Combination. Mr. Levitt has also served as Chairman of Irradiant Partners, LP since October 2021. From July 2016 to July 2021, Mr. Levitt was the Chief Executive Officer of Kayne Anderson Capital Advisors, L.P. Prior to joining Kayne, Mr. Levitt served as a Vice Chairman and Partner of Apollo Global Management, LLC (NYSE: APO) from April 2012 to May 2016. Mr. Levitt joined Apollo following Apollos acquisition of Stone Tower Capital LLC, an investment firm, which he founded in 2001 and where he served as Chairman of the board of directors, Chief Executive Officer and Chief Investment Officer. Prior to that, Mr. Levitt worked as a Partner at Hicks, Muse, Tate & Furst Incorporated, a private equity firm. Earlier in his career, Mr. Levitt served as the Co-Head of the Investment Banking Division of Smith Barney Inc. Mr. Levitt began his investment banking career at Morgan Stanley & Co., Inc. Mr. Levitt has served on the board of directors of The Music Acquisition Corporation (NYSE: TMAC) since December 2020 and served on the board of directors of Kayne Anderson BDC, LLC from May 2018 to October 2021. Mr. Levitt holds a B.B.A. and J.D. from the University of Michigan. We believe that Mr. Levitts significant financial expertise, his knowledge of the corporate credit and investment markets, his business acumen and his leadership as a sitting Chief Executive Officer provide him with the qualifications and skills to serve on our Board.

8

Table of Contents

Darin Feinstein, age 50, has served as our Chief Vision Officer and Co-Chair of the Board since January 2022. Mr. Feinstein is an American entrepreneur who has been involved in many ventures within the digital assets space since 2012. Mr. Feinstein co-founded Legacy Core in 2017 and founded Blockcap in 2020. In addition to these blockchain companies, Mr. Feinstein owns and operates a portfolio of business ventures across a variety of industries including live entertainment, finance, food & beverage, hospitality and technology, among others. Mr. Feinstein is a philanthropist who co-founded The Feinstein Griffin foundation, with Eddie Griffin, and Mr. Feinstein and Mr. Griffin for the past decade have been hosting events and donating to various charities around the United States. Mr. Feinstein is a California Licensed attorney (currently non-practicing) and holds many privileged licenses including a gaming license, liquor licenses and various financial licenses in multiple states across the United States. We believe that Mr. Feinsteins significant experience in the digital asset space and his institutional knowledge of our businesses as a co-founder of Legacy Core and Blockcap provide him with the qualifications and skills to serve on our Board.

Jarvis Hollingsworth, age 59, has served as a member of our Board since January 2022. Mr. Hollingsworth has served as Chairman of the Board of Trustees of the Teacher Retirement System of Texas, a $190 billion pension trust fund for retirees, teachers and employees of education-related institutions since November 2017. Since November 2019, Mr. Hollingsworth has also served on the board of directors of Laredo Petroleum, Inc. (NYSE: LPI), a diversified energy company, and on the finance committee of the Memorial Hermann Hospital System since May 2017. Mr. Hollingsworth has also served as Vice Chairman at Irradiant Partners, LP since September 2021. Mr. Hollingsworth served as General Counsel and a member and executive committee member of the board of directors for Kayne Anderson Capital Advisors, L.P., a leading alternatives investment management firm from May 2019 to July 2021. Mr. Hollingsworth served as a director of Emergent Technologies LP, a fintech company that provides payment services in emerging markets using a gold-backed digital currency from April 2016 to November 2019, and from May 2017 to July 2019 served as a director of Cullen Frost Bankers, Inc. (NYSE: CFR). Mr. Hollingsworth holds a Bachelor of Science from the United States Military Academy at West Point and served for several years on active and reserve duty in the United States Army. Mr. Hollingsworth holds a J.D. from the University of Houston Law Center. We believe that Mr. Hollingsworths knowledge of the digital assets industry and his understanding of public company governance and operations from his service on public company boards of directors provide him with the qualifications and skills to serve on our Board.

Matt Minnis, age 57, has served as a member of our Board since January 2022. Mr. Minnis co-founded Legacy Core in 2017 and served as a member of its board of directors from June 2018 until the Business Combination. Mr. Minnis has also served as Managing Member of BEP 888 and BEP 999 digital asset mining companies, which were founded in 2020. Further, Mr. Minnis has served as Chairman of the board of directors of Pledgling Technologies, Inc., a company focused on charitable donations, which he co-founded in 2014. Mr. Minnis has also served as President and Chief Executive Officer of Minnis Investments LLC, a private investment firm focused on early-stage technology companies, real estate and venture capital investments since 2009. Mr. Minnis holds a B.B.A. in Marketing and M.B.A. in Finance from Texas Christian University. We believe that Mr. Minnis knowledge of Legacy Core and the digital asset mining industry as well as his investment and venture capital expertise provide him with the qualifications and skills to serve on our Board.

Stacie Olivares, age 47, has served as a member of our Board since January 2022. In 2021, Ms. Olivares was nominated by President Biden to the Federal Retirement Thrift Investment Board, a role subject to Senate confirmation. From August 2019 to January 2022, Ms. Olivares served as a trustee of the California Public Employees Retirement System (CalPERS), the largest public pension in the United States with $500 billion AUM and 2 million members. From March 2019 to April 2020, Ms. Olivares served as Chief Investment Officer of Lendistry, a minority-owned CDFI and fintech lender. Prior to Lendistry, from October 2011 to January 2018 Ms. Olivares was the Managing Director and Chief Investment Officer of the California Organized Investment Network (COIN), , a $29 billion ESG investment fund of the insurance industry, which she joined after working at Morgan Stanley from 2008 to 2011. Before Wall Street, she led the State of Californias economic advisory board from 2002 through 2007 as it grew from the 6th to the 4th largest in the world. Ms. Olivares serves on the

9

Table of Contents

corporate boards of Kroll Bond Rating Agency (KBRA) and Mission Advancement Corp (NYSE: MACC), the nonprofit boards of the Latino Community Foundation and Hispanic Heritage Foundation, and the advisory boards of UC Berkeleys College of Letters & Science and the California Emerging Technology Fund. Ms. Olivares earned a Bachelors in economics from University of California at Berkeley and holds a Masters in public policy from Harvard University. We believe that Ms. Olivares financial expertise, her understanding of corporate and board governance, her early-stage investment expertise and experience in matters related to ESG provide her with the qualifications and skills to serve on our Board.

Kneeland Youngblood, age 66, has served as a member of our Board since January 2022. Mr. Youngblood has served as a member of the board of directors of numerous TPG Pace SPAC transactions since 2015. Mr. Youngblood is a director nominee of TPG Pace Beneficial II Corp. Mr. Youngblood has served as a founding partner of Pharos Capital Group, LLC since 1998, a private equity firm that focuses on providing growth and expansion capital/buyouts in the health care service sector. Mr. Youngblood is a director of Mallinckrodt Pharmaceuticals, a director of Scientific Games Corporation and Chairman of the Finance Committee of the Presidents Advisory Board of the UT Southwestern Medical Center. Previously, Mr. Youngblood served as a member of the board of directors of Pace-I from September 2015 through its business combination with Playa in March 2017. Mr. Youngblood has also served as a member of the board of directors of Pace-II from June 2017 through its business combination with Accel. Mr. Youngblood is also a former director of Burger King Corporation, Starwood Hotels and Lodging, Gap Inc. and Energy Future Holdings (formerly TXXU). He also serves on several private company and not-for-profit boards. Mr. Youngblood graduated from Princeton University in 1978 with an A.B in Politics/Science in Human Affairs and earned an M.D. degree from the University of Texas, Southwestern Medical School. We believe that Mr. Youngbloods extensive leadership experience, expertise in growth investing and his service as a board member across a diverse set of industries provide him with the qualifications and skills to serve on our Board.

There are no family relationships between or among any of our directors or nominees. There is no arrangement or understanding between any of our directors or nominees and any other person or persons pursuant to which he or she is to be selected as a director or nominee.

There are no legal proceedings to which any of our directors is a party adverse to us or any of our subsidiaries or in which any such person has a material interest adverse to us or any of our subsidiaries.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Board Diversity

The Board Diversity Matrix below provides the diversity statistics for our Board.

| Board Diversity Matrix (As of April 7, 2022) |

||||||||||||||||||||||||

| Total Number of Directors |

6 | |||||||||||||||||||||||

| Female | Male |

Non- Binary |

Did Not Disclose Gender |

|||||||||||||||||||||

| Part I: Gender Identity |

||||||||||||||||||||||||

| Directors |

1 | 5 | ||||||||||||||||||||||

| Part II: Demographic Background |

||||||||||||||||||||||||

| African American or Black |

2 | |||||||||||||||||||||||

| Alaskan Native or Native American |

||||||||||||||||||||||||

| Asian |

||||||||||||||||||||||||

| Hispanic or Latinx |

1 | |||||||||||||||||||||||

| Native Hawaiian or Pacific Islander |

||||||||||||||||||||||||

| White |

3 | |||||||||||||||||||||||

| Two or More Races or Ethnicities |

||||||||||||||||||||||||

| LGBTQ+ |

||||||||||||||||||||||||

| Did Not Disclose Demographic Background |

||||||||||||||||||||||||

10

Table of Contents

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the Board of Directors

As required under the Nasdaq Stock Market (Nasdaq) listing standards, a majority of the members of a listed companys board of directors must qualify as independent, as affirmatively determined by the board of directors. The Board consults with its counsel to ensure that the Boards determinations are consistent with relevant securities and other laws and regulations regarding the definition of independent, including those set forth in pertinent listing standards of Nasdaq, as in effect from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his or her family members, and the Company, its senior management and its independent auditors, the Board has affirmatively determined that the following four directors are independent directors within the meaning of the applicable Nasdaq listing standards: Mr. Hollingsworth, Mr. Minnis, Ms. Olivares and Mr. Youngblood. In making this determination, the Board found that none of these directors or nominees for director had a material or other disqualifying relationship with the Company. Mr. Levitt and Mr. Feinstein are employed by us and are therefore not independent under Nasdaq listing standards.

Our Board is co-chaired by Mr. Levitt and Mr. Feinstein, who also serve as our Chief Executive Officer and Chief Vision Officer, respectively. We believe that combining the positions of Chief Executive Officer and Co-Chair of the Board will help to ensure that the Board and management will act with a common purpose and provide a single, clear chain of command to execute our strategic initiatives and business plans. In addition, we believe that a combined Chief Executive Officer/Co-Chair is better positioned to act as a bridge between management and the Board, facilitating the regular flow of information.

Our Board has appointed Mr. Hollingsworth as lead independent director in order to help reinforce the independence of the Board as a whole. The position of lead independent director has been structured to serve as an effective balance to Mr. Levitts leadership as the combined Chief Executive Officer and Co-Chair. The lead independent director is empowered to, among other duties and responsibilities, work with the Chief Executive Officer to develop and approve an appropriate board meeting schedule; work with the Chief Executive Officer to develop and approve meeting agendas; provide the Chief Executive Officer feedback on the quality, quantity and timeliness of the information provided to the board; develop the agenda and moderate executive sessions of the independent members of the board; preside over board meetings when the Chief Executive Officer is not present or when such persons performance or compensation is discussed; act as principal liaison between the independent members of the board and the Chief Executive Officer; convene meetings of the independent directors as appropriate; and perform such other duties as may be established or delegated by the board. As a result, we believe that the lead independent director can help ensure the effective independent functioning of the Board in its oversight responsibilities. In addition, we believe that the lead independent director serves as a conduit between the other independent directors and the Co-Chairs, for example, by facilitating the inclusion on meeting agendas of matters of concern to the independent directors.

Role of the Board in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. Our Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various standing committees of our Board that address risks inherent in their respective areas of oversight. In particular, our Board is responsible for monitoring and assessing strategic risk exposure and our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The audit committee also monitors compliance with legal and regulatory requirements.

11

Table of Contents

Meetings of the Board of Directors

Prior to the Business Combination, XPDIs board of directors met four times during the year ended December 31, 2021. XPDI had three standing committees: an Audit Committee, a Corporate Governance and Nominating Committee and a Compensation Committee. These committees met six, one and zero times during the year ended December 31, 2021, respectively. Each member of XPDIs board of directors attended 75% or more of the aggregate number of meetings of the board and of the committees on which he or she served, held during the portion of the last fiscal year for which he or she was a director or committee member.

Information Regarding Committees of the Board of Directors

Following the Business Combination, our Board has three standing committees: an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees has authority to engage legal counsel or other experts or consultants, as it deems appropriate to carry out its responsibilities. Copies of the committee charters are available on the investor relations page of our website, https://investors.corescientific.com, by clicking on the Governance tab. The information on our website is not part of this Proxy Statement and is not deemed incorporated by reference into this Proxy Statement or any other public filing made with the SEC.

The composition and function of each of these committees are described below.

The Audit Committee is currently composed of three members: Ms. Olivares (chair), Mr. Youngblood and Mr. Hollingsworth. Our Board has determined that each of these individuals meets the independence requirements of the Sarbanes-Oxley Act of 2002, as amended (the Sarbanes-Oxley Act), Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the Exchange Act), and the applicable listing standards of Nasdaq. Each member of our audit committee can read and understand fundamental financial statements in accordance with Nasdaq audit committee requirements. In arriving at this determination, the board has examined each audit committee members scope of experience and the nature of their prior and/or current employment. Additionally, our Board has determined that Ms. Olivares qualifies as an audit committee financial expert within the meaning of SEC regulations and meets the financial sophistication requirements of the applicable Nasdaq listing rules. In making this determination, our board has considered Ms. Olivares formal education and previous and current experience in financial and accounting roles. Both our independent registered public accounting firm and management periodically meet privately with our audit committee.

The primary purpose of the Audit Committee is to discharge the responsibilities of the board with respect to corporate accounting and financial reporting processes, systems of internal control and financial statement audits, and to oversee our independent registered public accounting firm. Specific responsibilities of the audit committee include:

| | helping the Board oversee corporate accounting and financial reporting processes; |

| | managing the selection, engagement, qualifications, independence and performance of a qualified firm to serve as the independent registered public accounting firm to audit the financial statements; |

| | discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent accountants, the interim and |

| | year-end operating results; |

| | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| | reviewing related person transactions; |

12

Table of Contents

| | obtaining and reviewing a report by the independent registered public accounting firm at least annually that describes internal quality control procedures, any material issues with such procedures and any steps taken to deal with such issues when required by applicable law; and |

| | approving or, as permitted, pre-approving, audit and permissible non-audit services to be performed by the independent registered public accounting firm. |

Report of the Audit Committee of the Board of Directors

The material in this report is not soliciting material, is not deemed filed with the Securities and Exchange Commission (the SEC) and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.

The Audit Committee has reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2021 with management of the Company. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (PCAOB) and the SEC. The Audit Committee has also received the written disclosures and the letter from the independent registered public accounting firm required by applicable requirements of the PCAOB regarding the independent accountants communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the accounting firms independence. Based on the foregoing, the Audit Committee has recommended to the Board that the audited financial statements be included in the Companys Annual Report on Form 10-K for the fiscal year ended December 31, 2021.

Respectfully submitted,

Stacie Olivares (Chair)

Kneeland Youngblood

Jarvis Hollingsworth

The Compensation Committee is currently composed of three directors: Mr. Youngblood (chair), Ms. Olivares and Mr. Minnis. All members of our Compensation Committee are independent (as independence is currently defined in Rule 5605(d)(2) of the Nasdaq listing standards. Each of the members of the Compensation Committee is a non-employee director, as defined in Rule 16b-3 promulgated under the Exchange Act. Our Board has determined that each of these individuals is independent as defined under the applicable listing standards of Nasdaq, including the standards specific to members of a compensation committee.

The primary purpose of the Compensation Committee is to discharge the responsibilities of the board in overseeing the compensation policies, plans and programs and to review and determine the compensation to be paid to executive officers, directors and other senior management, as appropriate. Specific responsibilities of the compensation committee include:

| | reviewing and approving the compensation of the chief executive officer, other executive officers and senior management; |

| | administering the equity incentive plans and other benefit programs; |

| | reviewing, adopting, amending and terminating incentive compensation and equity plans, severance agreements, profit sharing plans, bonus plans, change-of-control protections and any other compensatory arrangements for the executive officers and other senior management; and |

| | reviewing and establishing general policies relating to compensation and benefits of the employees. |

13

Table of Contents

Compensation Committee Processes and Procedure

Typically, the compensation committee meets quarterly and with greater frequency if necessary. The compensation committee also acts periodically by unanimous written consent in lieu of a formal meeting. The agenda for each meeting is usually developed by the chair of the compensation committee, in consultation with our Chief Executive Officer and General Counsel. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation. The charter of the Compensation Committee grants the Compensation Committee full access to all books, records, facilities and personnel of the Company.

In addition, under the charter, the Compensation Committee has the authority to obtain, at the expense of the Company, advice and assistance from compensation consultants and internal and external legal, accounting or other advisors and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. The Compensation Committee has direct responsibility for the oversight of the work of any consultants or advisers engaged for the purpose of advising the Committee. In particular, the Compensation Committee has the sole authority to retain, in its sole discretion, compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultants reasonable fees and other retention terms. Under the charter, the Compensation Committee may select, or receive advice from, a compensation consultant, legal counsel or other adviser to the compensation committee, other than in-house legal counsel and certain other types of advisers, only after taking into consideration six factors, prescribed by the SEC and Nasdaq, that bear upon the advisers independence; however, there is no requirement that any adviser be independent.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is currently composed of four directors: Mr. Hollingsworth (chair), Mr. Minnis, Mr. Youngblood and Ms. Olivares. All members of the Nominating and Corporate Governance Committee are independent (as independence is currently defined in Rule 5605(a)(2) of the Nasdaq listing standards).

The Nominating and Corporate Governance Committee of the board is responsible for identifying and evaluating candidates, including the nomination of incumbent directors for reelection and nominees recommended by stockholders, to serve on the board, considering and making recommendations to the board regarding the composition and chairmanship of the committees of the board, developing and making recommendations to the Board regarding corporate governance guidelines and matters, including in relation to corporate social responsibility and overseeing periodic evaluations of the performance of the board, including its individual directors and committees.

The Nominating and Corporate Governance Committee believes that candidates for director should have certain minimum qualifications, including a reputation for integrity, honesty and adherence to high ethical standards; demonstrated business acumen, experience and the ability to exercise sound judgements in matters that relate to the current and long-term objectives of the Company and a willingness and ability to contribute positively to the decision-making process of the Company; a commitment to understand the Company and its industry and to regularly attend and participate in meetings of the board and its committees; the interest and ability to understand the sometimes conflicting interests of the various constituencies of the Company, which include stockholders, employees, customers, governmental units, creditors and the general public, and to act in the interests of all stockholders; and the ability to serve for at least three years before reaching the age of 75. The Nominating and Corporate Governance Committee also believes that candidates for director should not have, nor

14

Table of Contents

appear to have, a conflict of interest that would impair the candidates ability to represent the interests of all the Companys stockholders and to fulfill the responsibilities of a director. However, the Nominating and Corporate Governance Committee retains the right to modify these qualifications from time to time. Candidates for director nominees are reviewed in the context of the current composition of the board, the operating requirements of the Company and the long-term interests of stockholders, and the Nominating and Corporate Governance Committee has direct input from the Chairman of the board and the Chief Executive Officer.

Our Nominating and Corporate Governance Committee has not adopted a formal diversity policy in connection with the consideration of director nominations or the selection of nominees but believes that our board, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the Nominating and Corporate Governance Committee will consider issues of diversity among its members in identifying and considering nominees for director and strive where appropriate to achieve a diverse balance of backgrounds, perspectives, experience, age, gender, ethnicity and country of citizenship on our Board and its committees. The Nominating and Corporate Governance Committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

The Nominating and Corporate Governance Committee appreciates the value of thoughtful board refreshment, and regularly identifies and considers qualities, skills and other director attributes that would enhance the composition of the board. In the case of incumbent directors whose terms of office are set to expire, the Committee reviews these directors overall service to the Company during their terms, including the number of meetings attended, level of participation, quality of performance and any other relationships and transactions that might impair the directors independence. The Nominating and Corporate Governance Committee also takes into account the results of the boards self-evaluation, conducted annually on a group and individual basis. In the case of new director candidates, the Nominating and Corporate Governance Committee also determines whether the nominee is independent for Nasdaq purposes, which determination is based upon applicable Nasdaq listing standards, applicable SEC rules and regulations and the advice of counsel, if necessary. The Nominating and Corporate Governance Committee then uses its network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm. The Nominating and Corporate Governance Committee conducts any appropriate and necessary inquiries into the backgrounds and qualifications of possible candidates after considering the function and needs of the board. The Nominating and Corporate Governance Committee meets to discuss and consider the candidates qualifications and then selects a nominee for recommendation to the board by majority vote.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders. The Nominating and Corporate Governance Committee does not intend to alter the manner in which it evaluates candidates, including the minimum criteria set forth above, based on whether or not the candidate was recommended by a stockholder. Stockholders who wish to recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the board may do so by delivering a written recommendation to the Nominating and Corporate Governance Committee at the following address: c/o Core Scientific, Inc., 210 Barton Springs Road, Suite 300, Austin, Texas 78704 at least 120 days prior to the anniversary date of the mailing of our proxy statement for the last Annual Meeting of Stockholders. Submissions must include the full name of the proposed nominee, a description of the proposed nominees business experience for at least the previous five years, complete biographical information, a description of the proposed nominees qualifications as a director and a representation that the nominating stockholder is a beneficial or record holder of our common stock and has been a holder for at least one year. Any such submission must be accompanied by the written consent of the proposed nominee to be named as a nominee and to serve as a director if elected.

15

Table of Contents

Stockholder Communications with the Board of Directors

Stockholders of the Company wishing to communicate with the Board or an individual director may send a written communication to the board or such director c/o Core Scientific, Inc., 210 Barton Springs Road, Suite 300, Austin, Texas 78704, Attn: Secretary. The Secretary will review each communication. The Secretary will forward such communication to the Board or to any individual director to whom the communication is addressed unless the communication contains advertisements or solicitations or is unduly hostile, threatening or similarly inappropriate, in which case the Secretary shall discard the communication or inform the proper authorities, as may be appropriate.

Code of Business Conduct and Ethics

We have adopted a code of conduct (the Code of Conduct) applicable to all employees, directors and officers, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The Code of Conduct is available under the Governance section of our website at https://investors.corescientific.com. If we make any substantive amendments to the Code of Conduct or grants any waiver from a provision of the Code of Conduct to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

Our Board has adopted an insider trading policy, which prohibits our employees, directors and certain consultants from engaging in hedging or monetization transactions with respect to our securities, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars, and exchange funds. In addition, our insider trading policy prohibits trading in derivative securities related to our securities, which include publicly traded call and put options, engaging in short selling of our common stock, purchasing our common stock on margin or holding it in a margin account and pledging our shares as collateral for a loan.

16

Table of Contents

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board has selected Ernst & Young LLP (EY) as our independent registered public accounting firm for the fiscal year ending December 31, 2022 and has further directed that management submit the selection of its independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. EY has been engaged by us since the Auditor Change Effective Date (as defined below), and had been engaged by Legacy Core since 2019. Representatives of EY are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions. Marcum LLP (Marcum) audited XPDIs consolidated financial statements as of and for the year ended December 31, 2021.

Neither our bylaws nor other governing documents or law require stockholder ratification of the selection of EY as our independent registered public accounting firm. However, the Audit Committee of the Board is submitting the selection of EY to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in our best interests and our stockholders.

The affirmative vote of the holders of a majority of the shares present in person or by remote communication, if applicable, or represented by proxy and entitled to vote on the matter at the Annual Meeting, will be required to ratify the selection of EY.

Change in Auditor

In connection with the Business Combination, on January 21, 2022, the Audit Committee approved the dismissal of Marcum as our independent registered public accounting firm, effective upon completion of Marcums audit of XPDIs consolidated financial statements as of and for the year ended December 31, 2021, and the issuance of their report thereon (the Auditor Change Effective Date). The management communicated the Audit Committees decision to Marcum on January 21, 2022.

Marcums report of independent registered public accounting firm dated January 8, 2021, except for the subsequent events disclosed in Note 7, as to which the date is February 11, 2021, on the XPDI consolidated balance sheet as of December 31, 2020, the related consolidated statements of operations, changes in stockholders equity and cash flows for the period from December 29, 2020 (inception) through December 31, 2020, and the related notes to the financial statements did not contain any adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles, except for an explanatory paragraph in such report regarding substantial doubt about XPDIs ability to continue as a going concern.

During the period from December 29, 2020 (XPDIs inception) through December 31, 2020 and the subsequent interim period through January 21, 2022, there were no disagreements (as such term is defined in Item 304(a)(1)(iv) of Regulation S-K) with Marcum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference thereto in its reports on XPDIs financial statements for such periods. During the period from December 29, 2020 (XPDIs inception) through December 31, 2020 and the subsequent interim period through January 21, 2022, there have been no reportable events (as such term is defined in Item 304(a)(1)(v) of Regulation S-K), other than the material weakness in internal controls identified

by management related to the accounting for a portion of the Class A Common Stock in permanent equity rather than temporary equity, which resulted in the restatement of XPDIs financial statements as set forth in XPDIs Forms 10-Q for the quarters ended March 31, 2021, June 30, 2021 and September 30, 2021 as filed with the SEC on May 25, 2021, August 23, 2021 and November 15, 2021, respectively.

17

Table of Contents

We previously provided Marcum with a copy of the disclosures regarding the dismissal reproduced in this Proxy Statement and received a letter from Marcum addressed to the SEC stating that it agrees with the above statements. This letter was filed as Exhibit 16.1 to our Current Report on Form 8-K filed with the SEC on January 24, 2022.

On January 21, 2022, the Audit Committee approved the engagement of EY as our independent registered public accounting firm, effective upon the Auditor Change Effective Date. EY previously served as the independent registered public accounting firm of Legacy Core prior to the Business Combination. During the period from December 29, 2020 (XPDIs inception) through December 31, 2020 and the subsequent interim period through January 21, 2022, neither XPDI or Core, as applicable, nor anyone on behalf of XPDI or Core, as applicable, consulted with EY, on behalf of XPDI or Core, as applicable, regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit opinion that might be rendered on the financial statements of XPDI or Core, as applicable, or any matter that was either the subject of a disagreement, as defined in Item 304(a)(1)(iv) of Regulation S-K, or a reportable event, as defined in Item 304(a)(1)(v) of Regulation S-K.

Principal Accountant Fees and Services

Marcum Fees

The following table represents aggregate fees billed to XPDI for the fiscal years ended December 31, 2021 and 2020 by Marcum.

| Year Ended December 31, | ||||||||

| 2021 | 2020(1) | |||||||

| Audit Fees(2) |

$ | 284,800 | $ | 25,000 | ||||

| Audit-Related Fees(3) |

| | ||||||

| Tax Fees(4) |

| | ||||||

|

|

|

|

|

|||||

| Total Fees |

$ | 284,800 | $ | 25,000 | ||||

| (1) | XPDI incorporated as a blank check company in Delaware on December 29, 2020. |

| (2) | Consists of fees billed for professional services provided to XPDI in connection with the annual audit of XPDIs consolidated financial statements, the review of its quarterly condensed consolidated financial statements, as well as audit services that are normally provided by an independent registered public accounting firm in connection with statutory and regulatory filings or engagements for those fiscal years, such as statutory audits. The audit fees also include fees for professional services provided in connection with XPDIs initial public offering, incurred during the fiscal year ended December 31, 2021, including consents and review of documents filed with the SEC. |

| (3) | We did not incur any audit-related frees with Marcum for the years ended December 31, 2021 or 2020. |

| (4) | We did not incur any audit-related, tax or other fees with Marcum for the years ended December 31, 2021 or 2020. |

All fees described above were pre-approved by the Audit Committee. There were no services that were approved by the Audit Committee pursuant to Rule 2-01(c)(7)(i)(C) (relating to the approval of a de minimis amount of non-audit services after the fact but before completion of the audit).

18

Table of Contents

Ernst & Young Fees

The following table sets forth the fees billed by Ernst & Young LLP for audit and other services rendered:

| Year Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| (In thousands) | ||||||||

| Audit Fees(1) |

$ | 8,770 | $ | 151 | ||||

| Audit-related Fees(2) |

| | ||||||

| Tax Fees(3) |

94 | 31 | ||||||

| Other(4) |

4 | | ||||||

|

|

|

|

|

|||||

| $ | 8,868 | $ | 182 | |||||

|

|

|

|

|

|||||

| (1) | Audit Fees consisted of fees incurred for services rendered for the annual audit and quarterly reviews of the Companys consolidated financial statements, audits required by public company regulation, professional consultations with respect to accounting issues, registration statement filings, including our Registration Statements on Form S-1 and Form S-4 and related to the Business Combination, shares registration, stock incentive plan registration and issuance of consents and similar matters. |

| (2) | Audit-related fees consist of fees incurred for consultation regarding financial accounting and reporting matters. |

| (3) | Tax fees for 2020 consist of tax compliance, tax advice and tax planning services. Tax fees for 2021 consist of tax advice and tax planning services. |

| (4) | All other fees consist of the cost of our subscription to an accounting research tool provided by Ernst & Young LLP. |

Pre-Approval Policies and Procedures

The Audit Committee has adopted a policy and procedures for the pre-approval of audit and non-audit services rendered by the Companys independent registered public accounting firm. The policy generally pre-approves specified services in the defined categories of audit services, audit-related services and tax services and permissible non-audit services subject to a de minimis exception. Pre-approval may also be given as part of the Audit Committees approval of the scope of the engagement of the independent auditor or on an individual, explicit, case-by-case basis before the independent auditor is engaged to provide each service. The pre-approval of services may be delegated to one or more of the Audit Committees members, but the decision must be reported to the full Audit Committee at its next scheduled meeting.

Prior to the Business Combination, all of the services listed in the table above provided by Marcum were pre-approved by XPDI in accordance with its policies then in effect. Following the Business Combination, all of the services listed in the table above provided by EY were pre-approved by Cores Audit Committee. Cores Audit Committee has determined that the rendering of services other than audit services by Ernst & Young LLP is compatible with maintaining the principal accountants independence.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL 2.

19

Table of Contents

The following table sets forth information with respect to our executive officers and their ages as of the date of this Proxy Statement. There are no family relationships between any of our executive officers, and there is no arrangement or understanding between any executive officer and any other person pursuant to which the executive officer was selected.

| Name |

Age | Position |

||

| Michael Levitt |

63 | Chief Executive Officer and Co-Chair of the Board of Directors | ||

| Denise Sterling |

57 | Chief Financial Officer | ||

| Todd M. DuChene |

58 | EVP, General Counsel, Chief Compliance Officer and Secretary |

Michael Levitt. Biographical information for Mr. Levitt is presented above under the caption Information Regarding Director Nominees.

Denise Sterling. Ms. Sterling has served as our Chief Financial Officer since April 2022. Ms. Sterling previously served as the Companys Senior Vice President of Finance from May 2021 to April 2022. Before joining the Company, Ms. Sterling worked for Oportun, a Nasdaq-listed financial services company that leverages its digital platform to provide responsible consumer credit to hardworking people, as Senior Vice President of FP&A and Finance from June 2018 to May 2021. Ms. Sterling served in various tax and finance roles for Visa from 1995 to 2018, including as Senior Vice President of the Global Risk Management team from November 2016 to June 2018. Ms. Sterling holds a bachelors degree in accounting from San Francisco State University and a masters degree in tax from Golden Gate University. She is a Certified Public Accountant.

Todd DuChene. Mr. DuChene has served as our EVP, General Counsel, Chief Compliance Officer and Secretary since January 2022. Mr. DuChene served as the General Counsel and Secretary of Legacy Core from April 2019 until the Business Combination. Prior to joining Legacy Core, Mr. DuChene served as Senior Vice President, General Counsel and Secretary and Chief Compliance Officer for FLIR Systems, Inc., an industrial and military technology company, from September 2014 to April 2019. Prior to joining FLIR, Mr. DuChene served as Executive Vice President, General Counsel and Secretary of Nuance Communications, Inc., a leading provider of speech recognition and related technology to enterprise, healthcare and mobile and consumer customers, where he was responsible for the legal, intellectual property, corporate governance and regulatory activities of the company, from October 2011 to September 2014. Previously, Mr. DuChene served as Senior Vice President, General Counsel and Secretary of National Semiconductor Corporation from January 2008 to October 2011, prior to its acquisition by Texas Instruments Inc. In addition, Mr. DuChene has served as General Counsel to each of Solectron Corporation, Fisher Scientific International Inc. (now ThermoFisher Scientific) and OfficeMax, Inc. Mr. DuChene began his legal career as a corporate lawyer with BakerHostetler in Cleveland, Ohio in 1988. Mr. DuChene holds a B.A. in Political Science from The College of Wooster and a J.D. from the University of Michigan Law School.

20

Table of Contents

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT