425: Filing under Securities Act Rule 425 of certain prospectuses and communications in connection with business combination transactions

Published on October 20, 2021

Filed by Power & Digital Infrastructure Acquisition Corp.

(Commission File No. 001-40046)

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Power & Digital Infrastructure Acquisition Corp.

Form S-4 File No. 333-258720

CORE SCIENTIFIC ANALYST EVENT October 19, 2021

INTRODUCTION Steve Gitlin SVP Investor Relations

LEGAL DISCLAIMER CONFIDENTIAL INFORMATION. The information in this presentation is highly confidential. This presentation has been furnished to you solely for your information. The distribution of this presentation by an authorized recipient to any other person is unauthorized. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any portion of this presentation to any person is prohibited. The recipient of this presentation shall keep this presentation and its contents confidential, shall not use this presentation and its contents for any purpose other than as expressly authorized by Core Scientific, Inc. (the Company) and Power & Digital Infrastructure Acquisition Corp. (XPDI). By accepting delivery of this presentation, the recipient is deemed to agree to the foregoing confidentiality requirements. Neither the Securities and Exchange Commission (SEC) nor any state or territorial securities commission has approved or disapproved of the securities or determined if this presentation is truthful or complete. In connection with the proposed business combination between XPDI and the Company (the Business Combination), XPDI has filed with the SEC a registration statement on Form S-4 containing a preliminary proxy statement and a preliminary prospectus of XPDI, and after the registration statement is declared effective, XPDI will mail a definitive proxy statement/prospectus relating to the proposed Business Combination to its stockholders. This presentation does not contain all the information that should be considered concerning the proposed Business Combination and is not intended to form the basis of any investment decision or any other decision in respect of the Business Combination. XPDIs stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus and the amendments thereto, when available, and the definitive proxy statement/prospectus and other documents filed in connection with the proposed Business Combination, as these materials will contain important information about XPDI, the Company and the Business Combination. When available, the definitive proxy statement/prospectus and other relevant materials for the proposed Business Combination will be mailed to stockholders of XPDI as of a record date to be established for voting on the proposed Business Combination. Stockholders will also be able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus and other documents filed with the SEC, without charge, once available, at the SECs website at www.sec.gov, or by directing a request to: Power & Digital Infrastructure Acquisition Corp., 321 North Clark Street, Suite 2440, Chicago, IL 60654. XPDI and its directors and executive officers may be deemed participants in the solicitation of proxies from XPDIs stockholders with respect to the proposed Business Combination. A list of the names of those directors and executive officers and a description of their interests in XPDI is contained in XPDIs final prospectus related to its initial public offering dated February 9, 2021, which was filed with the SEC and is available free of charge at the SECs web site at www.sec.gov, or by directing a request to: Power & Digital Infrastructure Acquisition Corp., 321 North Clark Street, Suite 2440, Chicago, IL 60654. Additional information regarding the interests of such participants is contained in the proxy statement/prospectus for the proposed Business Combination that has been filed with the SEC. The Company and its directors and executive officers may also be deemed to be participants in the solicitation of proxies from the stockholders of XPDI in connection with the proposed Business Combination. A list of the names of such directors and executive officers and information regarding their interests in the proposed Business Combination is included in the proxy statement/prospectus for the proposed Business Combination. Stockholders, potential investors and other interested persons should read the proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above. This presentation contains trademarks, service marks, trade name and copyrights of XPDI, the Company and the other companies identified herein which are property of their respective owners. FORWARD-LOOKING STATEMENTS. This presentation includes forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as estimate, plan, project, forecast, intend, will, expect, anticipate, believe, seek, target or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. These forward-looking statements are inherently subject to risks, uncertainties and assumptions. Such forward-looking statements include, but are not limited to, statements regarding possible or assumed future actions, business strategies, events or results of operations; projections, estimates and forecasts of revenue and other financial and performance metrics; projections of market opportunity and expectations; the estimated implied enterprise value of the combined company following the Business Combination; the combined companys ability to scale and grow its business and source clean and renewable energy; the advantages and expected growth of the combined company; the combined companys ability to source and retain talent; the cash position of the combined company following closing of the Business Combination; XPDIs and the Companys ability to consummate the Business Combination; expectations related to the terms, timing and benefits of the Business Combination; risks related to the novel coronavirus (COVID-19) pandemic or the emergence of variant strains of COVID-19; the maintenance of key strategic relationships with partners and distributors; and changes in laws and regulations, including tax laws and laws relating to protection of the environment. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of XPDIs and the Companys management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of XPDI and the Company. These forward-looking statements are subject to a number of risks and uncertainties, including the ability of XPDI and the Company to successfully or timely consummate the Business Combination, including the risk that necessary regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business Combination or approval of the stockholders of XPDI; failure to realize the anticipated benefits of the Business Combination; the combined companys ability to execute on its business model, potential business expansion opportunities and growth strategies, retain and expand customers use of its services and attract new customers and source and maintain talent; risks relating to the combined companys sources of cash and cash resources; risks relating to the blockchain and frontier technology infrastructure sectors, including the unregulated nature of the digital asset space and potential future regulations, volatility of the price of digital assets, changes in the award structure for solving digital assets and limited availability of electric power resources; risks relating to the Companys and the combined companys vulnerability to security breaches; risks relating to the uncertainty of the projected financial information with respect to the combined company; the combined companys ability to manage future growth; the effects of competition on the combined companys future business; the amount of redemption requests made by XPDIs public stockholders; the ability of XPDI or the combined company to issue equity or equity-linked securities in connection with the Business Combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; the impact of the COVID-19 pandemic on the Companys or the combined companys business and the global economy; and those factors discussed under Risk Factors later in this presentation, and those factors discussed in XPDIs final prospectus related to its initial public offering dated February 9, 2021 under the heading Risk Factors, in XPDIs Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 under the heading Risk Factors filed with the SEC on May 25, 2021 and other documents of XPDI filed, or to be filed, with the SEC. If any of these risks materialize or XPDIs or the Companys assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither XPDI nor the Company presently know or that XPDI and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect XPDIs and the Companys expectations, plans or forecasts of future events and views as of the date of this presentation. XPDI and the Company anticipate that subsequent events and developments will cause XPDIs and the Companys assessments to change. However, while XPDI and the Company may elect to update these forward-looking statements at some point in the future, XPDI and the Company specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing XPDIs and the Companys assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements. Market data and industry information used throughout this presentation are based on the knowledge of the industry and the good faith estimates of the Companys management. The Company and XPDI also relied, to the extent available, upon the review of independent industry surveys and other publicly available information prepared by a number of third-party sources. All of the market data and industry information used in this presentation involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although the Company and XPDI believe these sources are reliable, they cannot guarantee the accuracy or completeness of this information, and they have not independently verified this information. This presentation contains the Companys projected financial and operational information. Such projected financial and operational information is forward-looking and is for illustrative purposes only. The information should not be relied upon as being indicative of future results. Projections, assumptions and estimates of the Companys future performance and the future performance of the industry in which the Company operates are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including, among other things, the sufficiency of infrastructure, including electricity sources, the price of bitcoin, the global hashrate and the shipment of manufacturers units on a timely basis. The Companys management believes the projections and underlying assumptions have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected. The inclusion of such projections or historical financial and operational information in this presentation should not be regarded as a representation by any person that the results reflected in such projections will be achieved or that historical results will be indicative of future performance. FINANCIAL INFORMATION; NON-GAAP FINANCIAL MEASURES. Certain financial information and data contained in this presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act of 1933, as amended. Accordingly, such financial information may be adjusted in or may be presented differently in, the proxy statement/prospectus or registration statement filed by XPDI with the SEC. This presentation also includes non-GAAP financial measures, including Adjusted EBITDA. XPDI and the Company believe that these non-GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to the Companys financial condition and results of operations. The Companys management uses certain of these non-GAAP measures to compare the Companys performance to that of prior periods for trend analyses and for budgeting and planning purposes. Not all of the information necessary for a quantitative reconciliation of these forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures is available without unreasonable efforts at this time. Specifically, the Company does not provide such quantitative reconciliation due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. The material has been prepared or is distributed solely for information purposes and is not a proxy statement, an offer to sell, a solicitation or an offer to buy or a recommendation to purchase any security or instrument or to participate in any trading strategy. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended. Note 1: Presentation assumes pro forma Company, including the acquisition of Blockcap, Inc. (Blockcap), which closed on July 30, 2021, and Blockcaps acquisition of Radar Relay, Inc., which closed on July 1, 2021.

TODAYS AGENDA Topic Time Presenter Introduction and Security Briefing 8:459:00 Steve Gitlin, SVP IR Scaling and Securing the Blockchain Ecosystem Mike Levitt, Co-Chairman & CEO Scaling Our Data Centers Wes Adams, EVP Construction 9:00 10:00 Key Technology Enablers Alan Curtis, EVP & CTO Operational Excellence Matt Brown, EVP Data Center Operations Tour 10:0011:00 All Goals and Progress 11:0011:15 Michael Trzupek, EVP & CFO Q&A Session 11:1511:35 All Summary 11:3511:45 Mike Levitt Lunch 11:4512:30 All Departures 12:0012:30 All

SCALING AND SECURING THE BLOCKCHAIN ECOSYSTEM Mike Levitt Co-Founder, Co-Chairman, Chief Executive Officer

EXPERIENCED LEADERSHIP TEAM WESTON ADAMS MATT BROWN KYLE BUCKETT LYNN BURGENER EVP, Construction EVP, Data Center Operations SVP, Corporate Operations SVP, Tax & Trade TODD DUCHENE DARIN FEINSTEIN RUSSELL CANN ALAN CURTIS EVP, General Counsel Co-Founder and Co-Chairman EVP, Client Services EVP, Chief Technology Officer STEVEN GITLIN CAROL HAINES BRETT HARRISON TARAS KULYK SVP, Investor Relations SVP, Power and Sustainability SVP, Business Development SVP, Growth MICHAEL LEVITT SHARON ORLOPP JEFF PRATT ALLISON REICHEL Co-Founder, Co-Chairman and CEO EVP, Human Resources SVP, Partnerships VP, Chief Economist DENISE STERLING JEFF TAYLOR MICHAEL TRZUPEK y SVP, Corporate Finance SVP, Chief Information Security Officer EVP, Chief Financial Officer

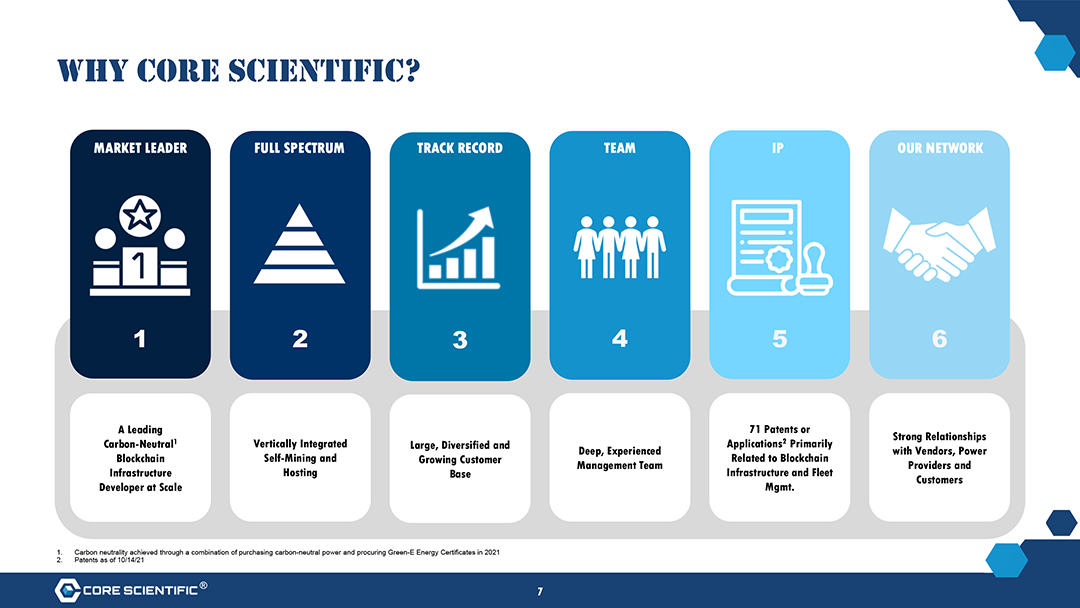

WHY CORE SCIENTIFIC? MARKET LEADER FULL SPECTRUM TRACK RECORD TEAM IP OUR NETWORK 1 2 3 4 5 6 A Leading 71 Patents or Strong Relationships Carbon-Neutral1 Vertically Integrated Large, Diversified and Deep, Experienced Applications2 Primarily with Vendors, Power Blockchain Self-Mining and Growing Customer Related to Blockchain Management Team Providers and Infrastructure Hosting Base Infrastructure and Fleet Customers Developer at Scale Mgmt. 1. Carbon neutrality achieved through a combination of purchasing carbon-neutral power and procuring Green-E Energy Certificates in 2021 2. Patents as of 10/14/21

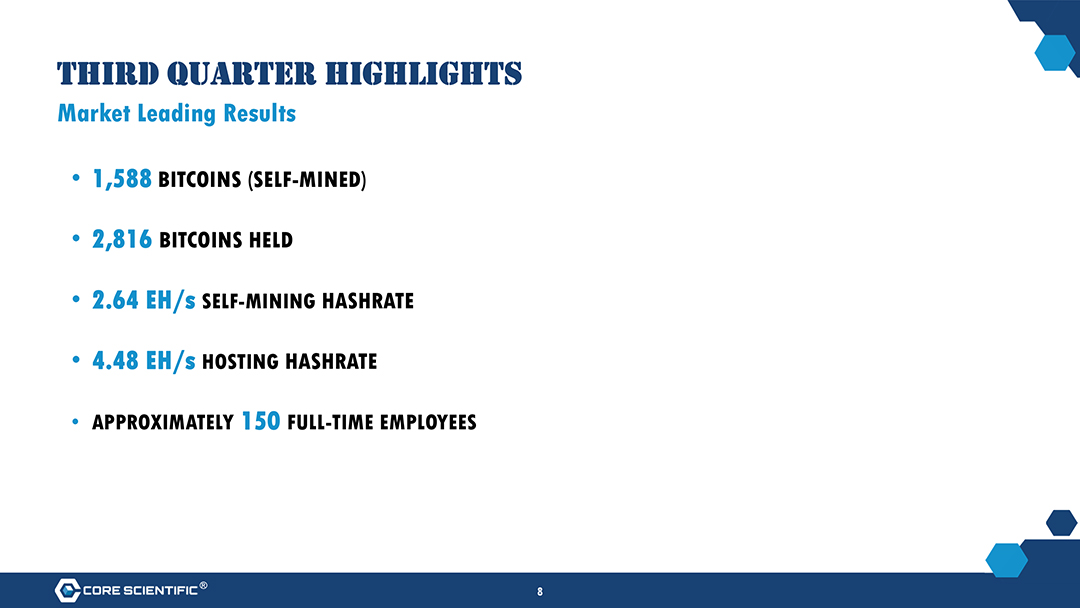

THIRD QUARTER HIGHLIGHTS Market Leading Results 1,588 BITCOINS (SELF-MINED) 2,816 BITCOINS HELD 2.64 EH/s SELF-MINING HASHRATE 4.48 EH/s HOSTING HASHRATE APPROXIMATELY 150 FULL-TIME EMPLOYEES

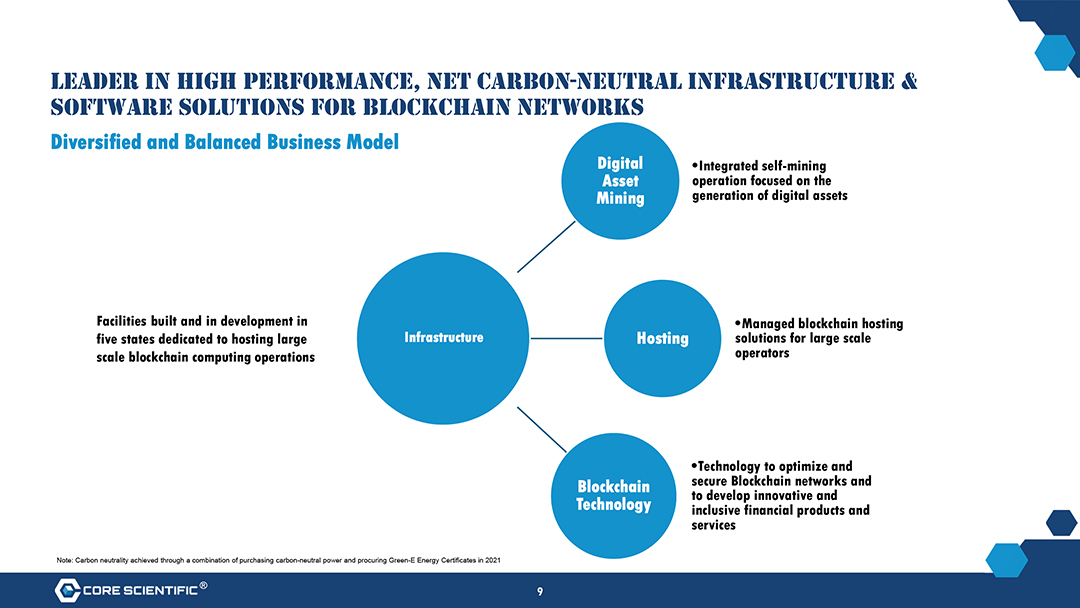

LEADER IN HIGH PERFORMANCE, NET CARBON-NEUTRAL INFRASTRUCTURE & SOFTWARE SOLUTIONS FOR BLOCKCHAIN NETWORKS Diversified and Balanced Business Model Infrastructure Digital Asset Mining Hosting Blockchain Technology Facilities built and in development in five states dedicated to hosting large scale blockchain computing operations Integrated self-mining operation focused on the generation of digital assets Managed blockchain hosting solutions for large scale operators Technology to optimize and secure Blockchain networks and to develop innovative and inclusive financial products and services Note: Carbon neutrality achieved through a combination of purchasing carbon-neutral power and procuring Green-E Energy Certificates in 2021

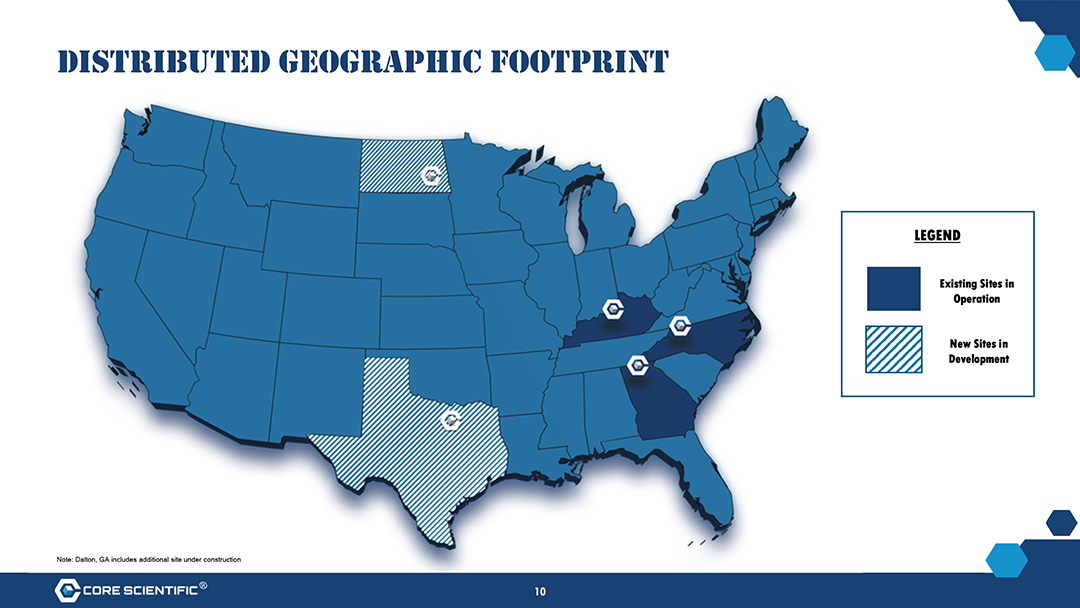

DISTRIBUTED GEOGRAPHIC FOOTPRINT LEGEND Existing Sites in Operation New Sites in Development Note: Dalton, GA includes additional site under construction 10

STRONG IP PORTFOLIO (71 PATENTS*) PROPRIETARY FACILITY DESIGNS PROPRIETARY TECHNOLOGY MINDER Fleet Management Software To Optimize Performance and Uptime

SCALING OUR DATA CENTERS Wes Adams EVP, Construction

DEDICATED CONSTRUCTION, DEVELOPMENT AND POWER TEAM WESTON ADAMS EVP, Construction GARRY FIFE SVP, Electrical and Design LESA LAMBERSON Manager, Purchasing KYLE BUCKETT SVP, Corporate Operations KELSEY GALLAGHER SVP, Facilities Construction HARSH PATEL Mechanical Engineer JIM CLEVELAND SVP, Power Acquisition CAROL HAINES SVP, Power and Sustainability TOM SCHMUHL Director, Power Analytics Power negotiation and contracting Structural engineering Civil engineering Large scale electrical engineering Construction management Supply chain management Local government relations

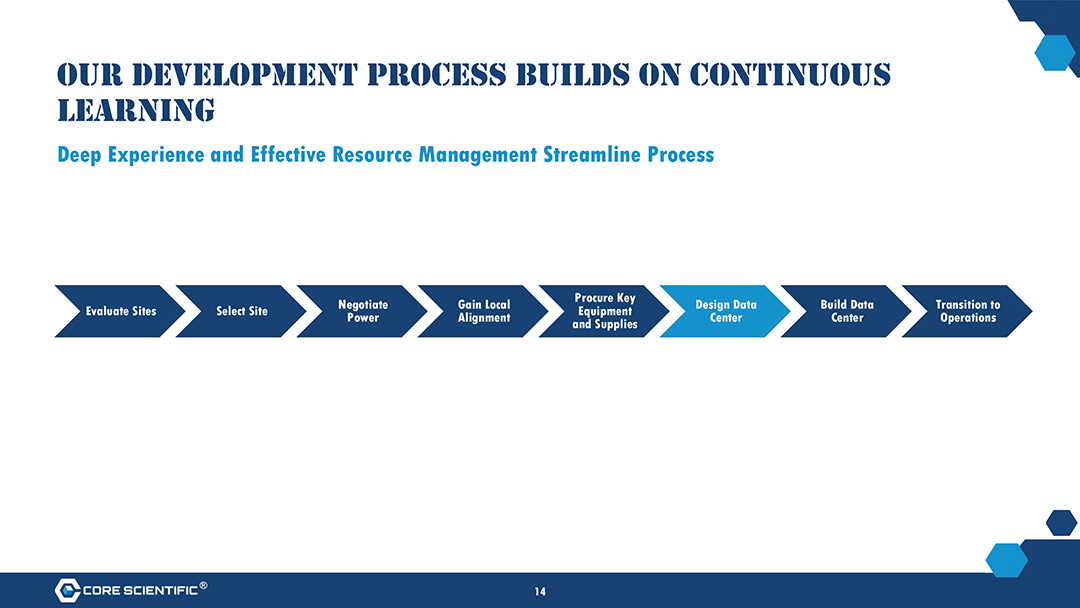

OUR DEVELOPMENT PROCESS BUILDS ON CONTINUOUS LEARNING Deep Experience and Effective Resource Management Streamline Process Evaluate Sites Select Site Negotiate Power Gain Local Alignment Procure Key Equipment and Supplies Design Data Center Build Data Center Transition to Operations

WE DESIGN OUR DATA CENTERS TO DELIVER MAXIMUM UPTIME BLOCKCHAIN INFRASTRUCTURE Airflow and heat evacuation Optimize cost Maintain thermal balance Continuously improve and evaluate alternative technologies (e.g., immersion)

KEY TECHNOLOGY ENABLERS Alan Curtis EVP, Chief Technology Officer

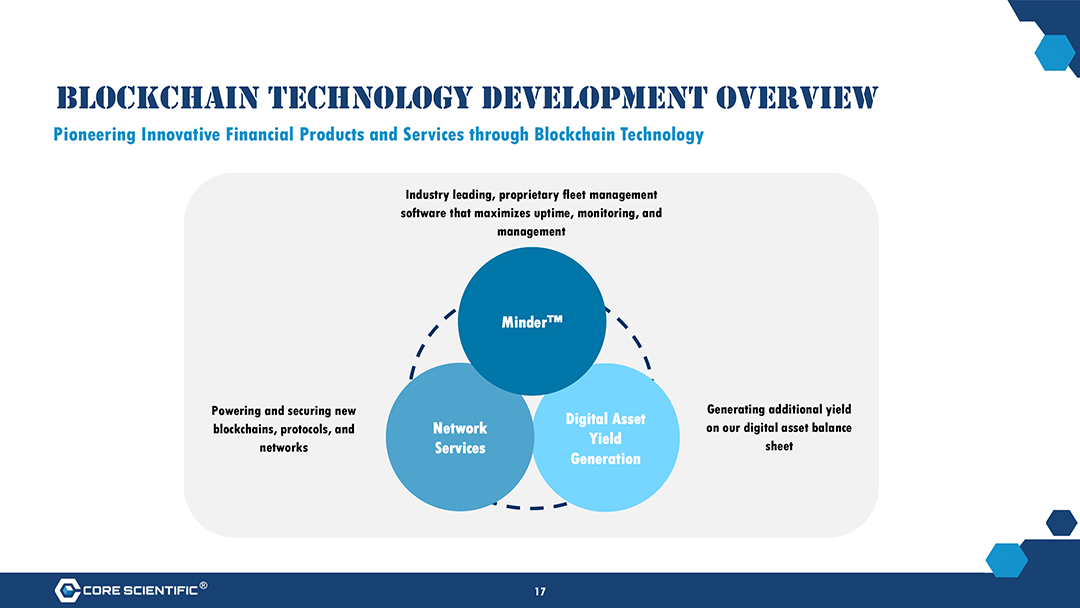

BLOCKCHAIN TECHNOLOGY DEVELOPMENT OVERVIEW Pioneering Innovative Financial Products and Services through Blockchain Technology Industry leading, proprietary fleet management software that maximizes uptime, monitoring, and management Powering and securing new blockchains, protocols, and networks Generating additional yield on our digital asset balance sheet Minder Network Services Digital Asset Yield Generation

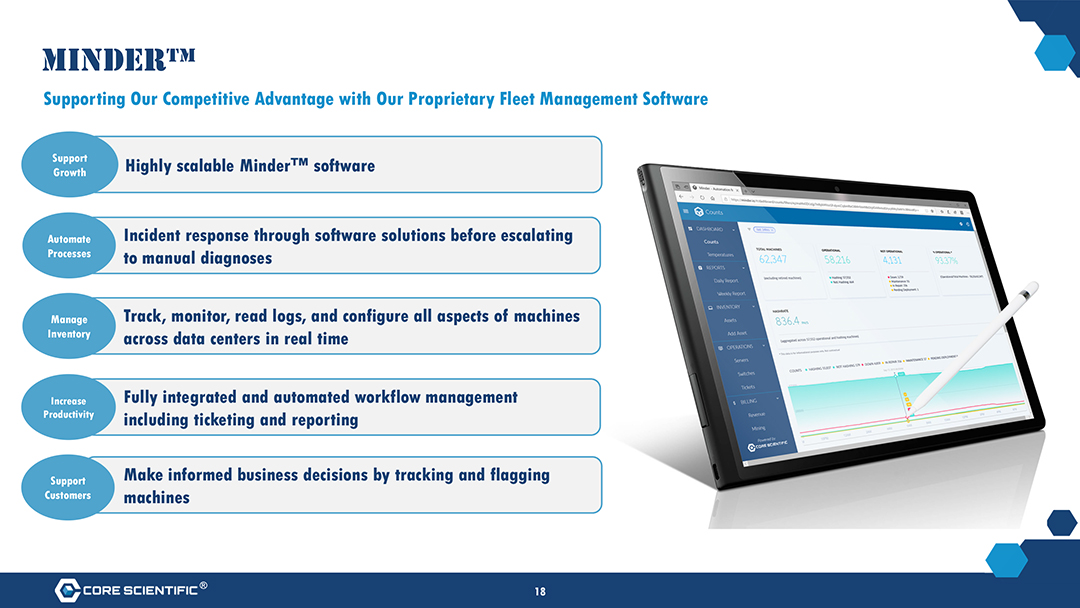

MINDER Supporting Our Competitive Advantage with Our Proprietary Fleet Management Software Support Growth Highly scalable Minder software Automate Processes Incident response through software solutions before escalating to manual diagnoses Manage Inventory Track, monitor, read logs, and configure all aspects of machines across data centers in real time Increase Productivity Fully integrated and automated workflow management including ticketing and reporting Support Customers Make informed business decisions by tracking and flagging machines

OPERATIONAL EXCELLENCE Matt Brown EVP, Data Center Operations

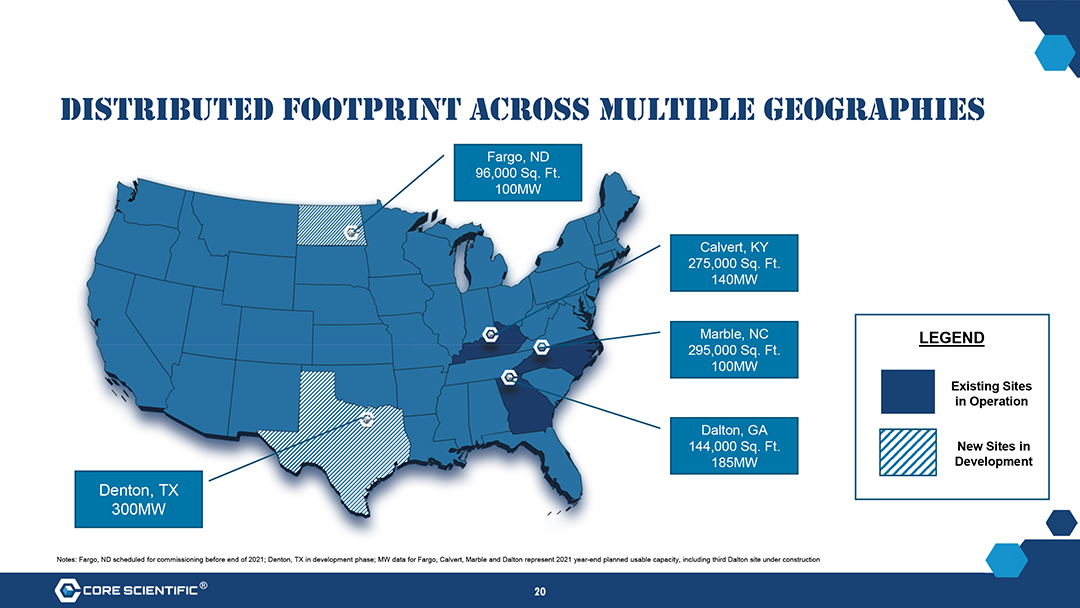

DISTRIBUTED FOOTPRINT ACROSS MULTIPLE GEOGRAPHIES Notes: Fargo, ND scheduled for commissioning before end of 2021; Denton, TX in development phase; MW data for Fargo, Calvert, Marble and Dalton represent 2021 year-end planned usable capacity, including third Dalton site under construction Fargo, ND 96,000 Sq. Ft. 100MW Calvert, KY 275,000 Sq. Ft. 140MW Marble, NC 295,000 Sq. Ft. 100MW Denton, TX 300MW Dalton, GA 144,000 Sq. Ft. 185MW LEGEND Existing Sites in Operation New Sites in Development

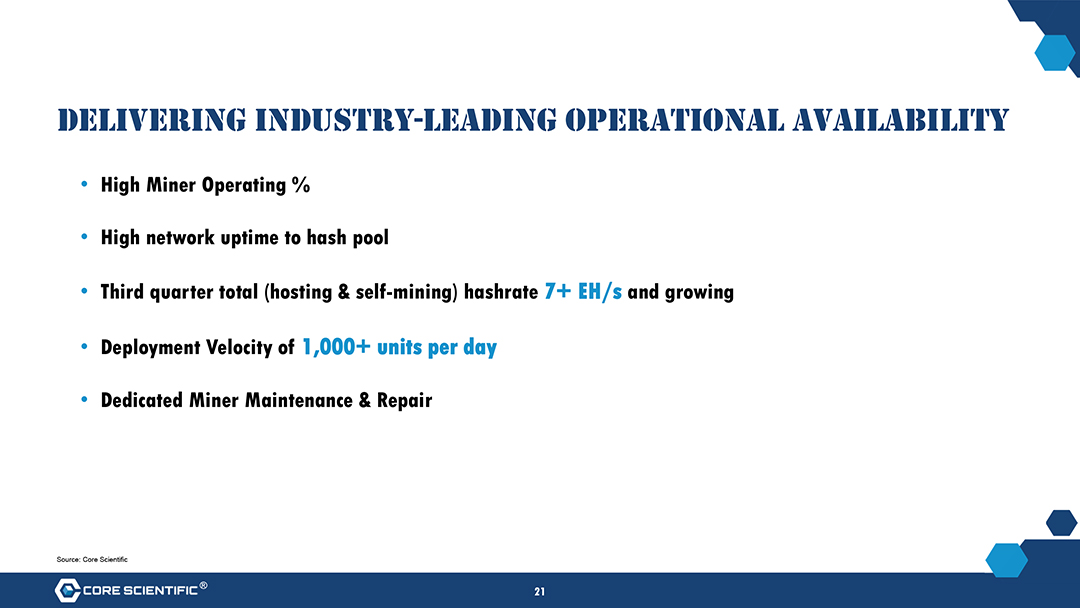

DELIVERING INDUSTRY-LEADING OPERATIONAL AVAILABILITY High Miner Operating % High network uptime to hash pool Third quarter total (hosting & self-mining) hashrate 7+ EH/s and growing Deployment Velocity of 1,000+ units per day Dedicated Miner Maintenance & Repair Source: Core Scientific ® 21

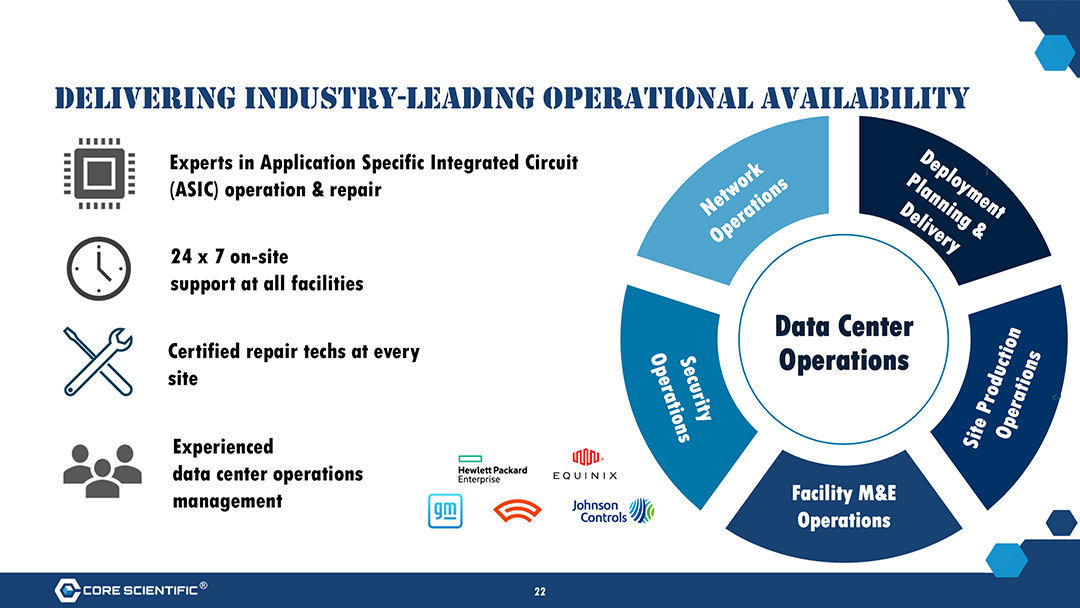

DELIVERING INDUSTRY-LEADING OPERATIONAL AVAILABILITY Experts in Application Specific Integrated Circuit (ASIC) operation & repair 24 x 7 on-site support at all facilities Data Center Certified repair techs at every Operations site Experienced data center operations Facility M&E management Operations ® 22

FACILITY TOUR ® 23

GOALS AND PROGRESS Michael Trzupek EVP, Chief Financial Officer ® 24

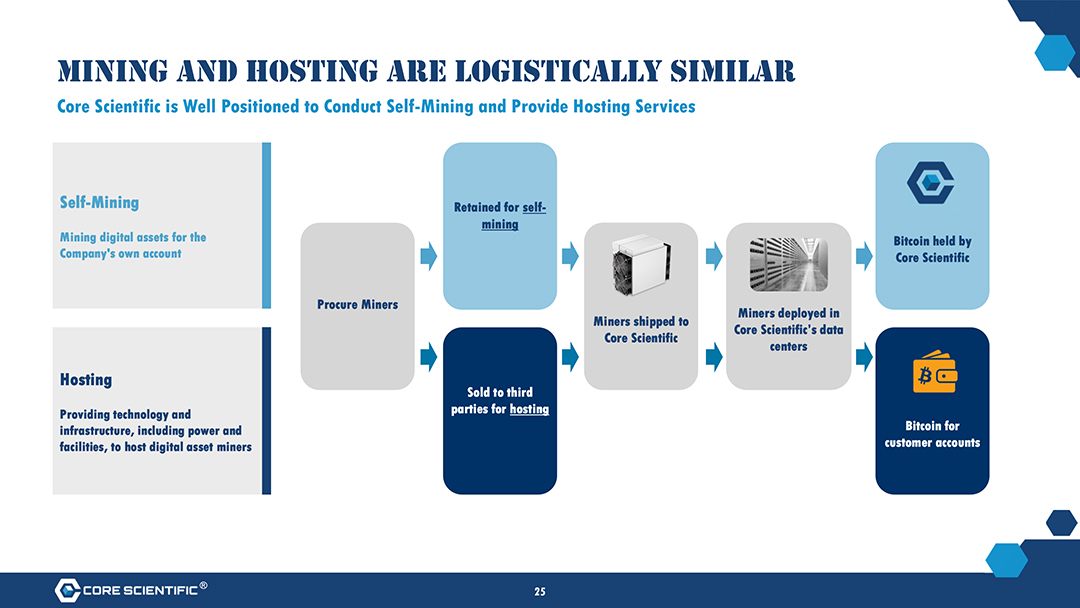

MINING AND HOSTING ARE LOGISTICALLY SIMILAR Core Scientific is Well Positioned to Conduct Self-Mining and Provide Hosting Services Self-Mining Retained for self-mining Mining digital assets for the Bitcoin held by Companys own account Core Scientific Procure Miners Miners deployed in Miners shipped to Core Scientifics data Core Scientific centers Hosting Sold to third Providing technology and parties for hosting infrastructure, including power and Bitcoin for facilities, to host digital asset miners customer accounts ® 25

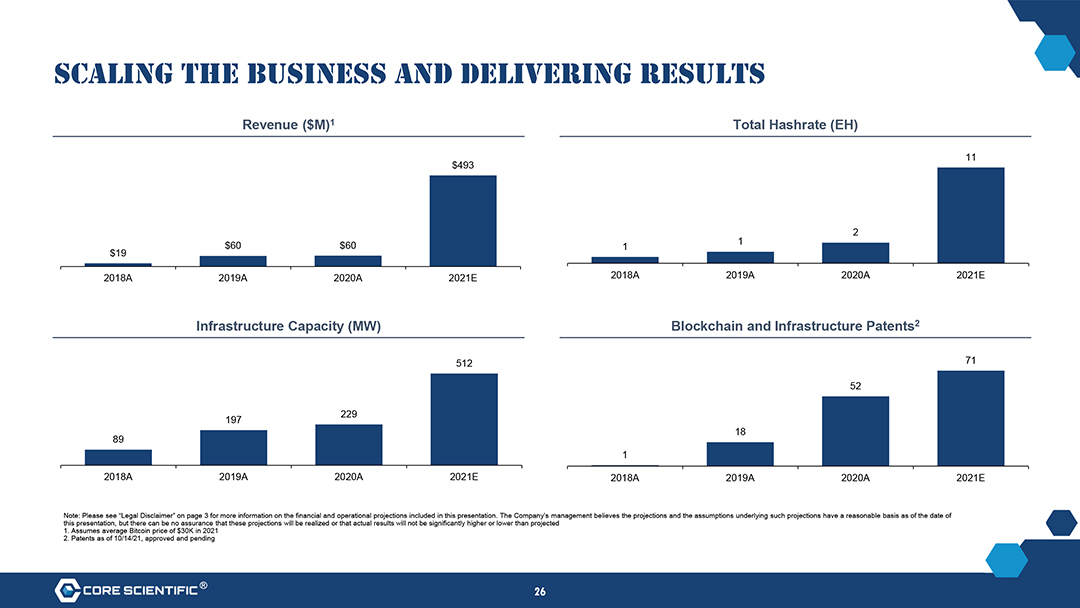

SCALING THE BUSINESS AND DELIVERING RESULTS Revenue ($M)1 Total Hashrate (EH) 11 $493 1 2 $60 $60 1 $19 2018A 2019A 2020A 2021E 2018A 2019A 2020A 2021E Infrastructure Capacity (MW) Blockchain and Infrastructure Patents2 512 71 52 229 197 18 89 1 2018A 2019A 2020A 2021E 2018A 2019A 2020A 2021E Note: Please see Legal Disclaimer on page 3 for more information on the financial and operational projections included in this presentation. The Companys management believes the projections and the assumptions underlying such projections have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected 1. Assumes average Bitcoin price of $30K in 2021 2. Patents as of 10/14/21, approved and pending ® 26

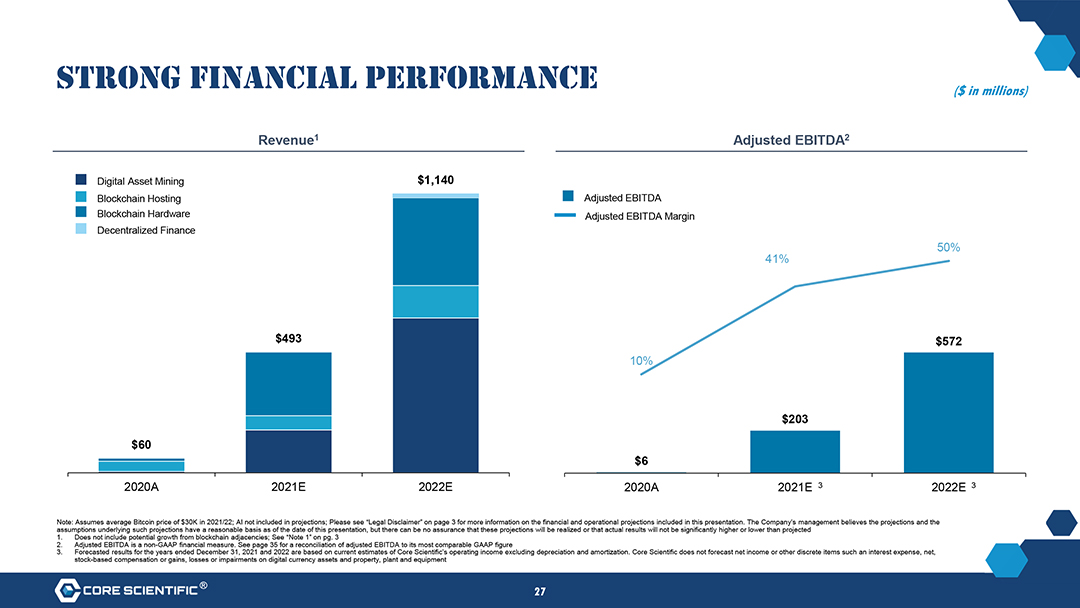

STRONG FINANCIAL PERFORMANCE ($ in millions) Revenue1 Adjusted EBITDA2 Digital Asset Mining $1,140 Blockchain Hosting Adjusted EBITDA Blockchain Hardware Adjusted EBITDA Margin Decentralized Finance 41% 50% $493 $572 10% $203 $60 $6 2020A 2021E 2022E 2020A 2021E 3 2022E 3 Note: Assumes average Bitcoin price of $30K in 2021/22; AI not included in projections; Please see Legal Disclaimer on page 3 for more information on the financial and operational projections included in this presentation. The Companys management believes the projections and the assumptions underlying such projections have a reasonable basis as of the date of this presentation, but there can be no assurance that these projections will be realized or that actual results will not be significantly higher or lower than projected 1. Does not include potential growth from blockchain adjacencies; See Note 1 on pg. 3 2. Adjusted EBITDA is a non-GAAP financial measure. See page 35 for a reconciliation of adjusted EBITDA to its most comparable GAAP figure 3. Forecasted results for the years ended December 31, 2021 and 2022 are based on current estimates of Core Scientifics operating income excluding depreciation and amortization. Core Scientific does not forecast net income or other discrete items such an interest expense, net, stock-based compensation or gains, losses or impairments on digital currency assets and property, plant and equipment ® 27

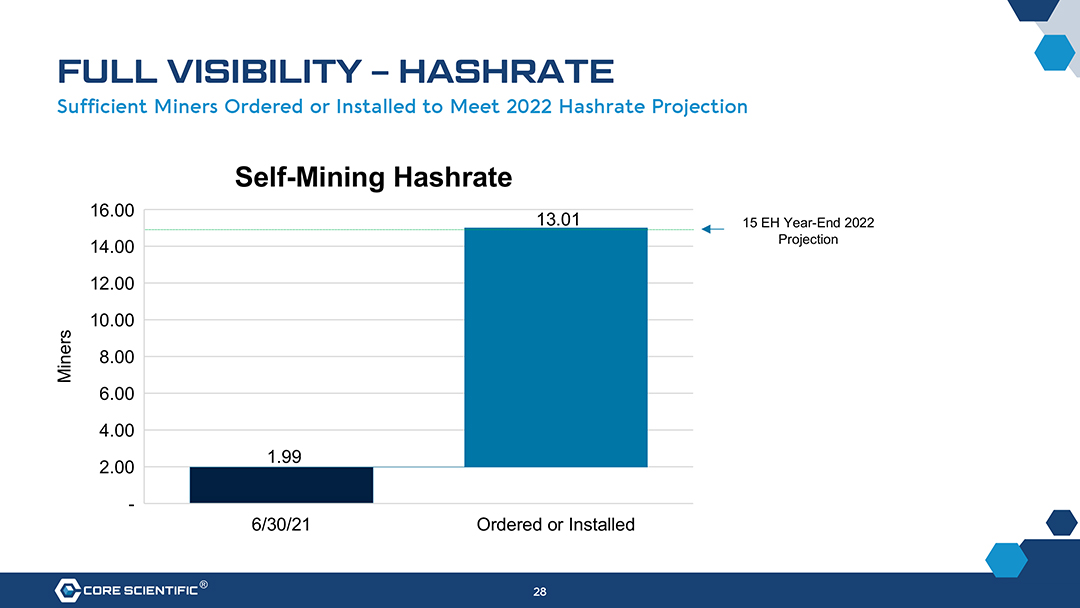

FULL VISIBILITY HASHRATE Sufficient Miners Ordered or Installed to Meet 2022 Hashrate Projection 15 EH Year-End 2022 Projection ® 28 Self-Mining Hashrate

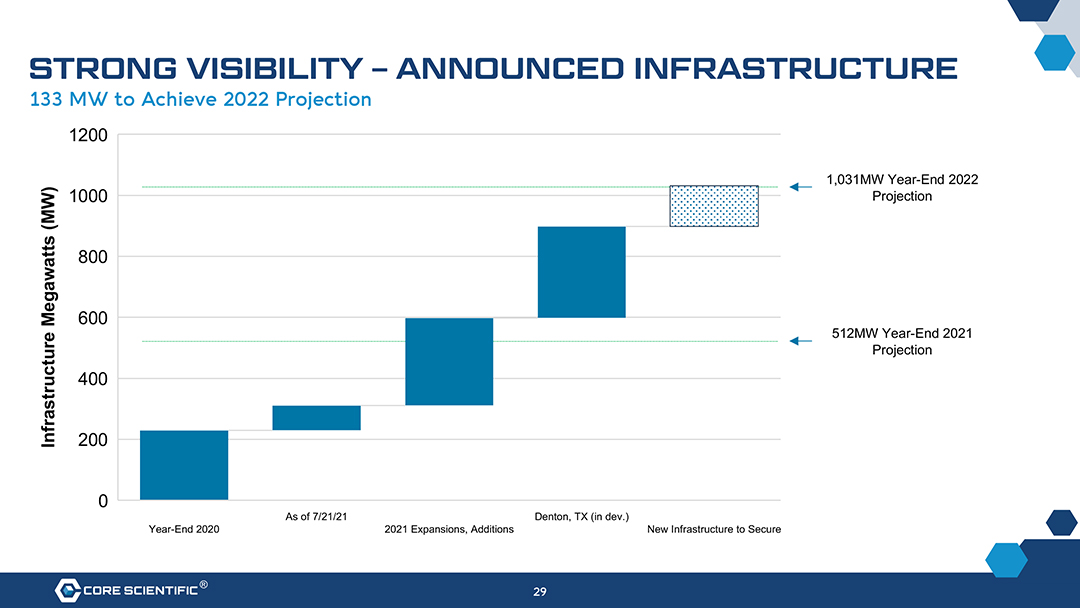

STRONG VISIBILITY ANNOUNCED INFRASTRUCTURE 133 MW to Achieve 2022 Projection 1,031MW Year-End 2022 Projection 512MW Year-End 2021 Projection ® 29 1000 800 600 400 200 Infrastructure Megawatts (MW)

Q&A ® 30

SUMMARY AND CLOSING ® 31

WHY CORE SCIENTIFIC? MARKET LEADER FULL SPECTRUM TRACK RECORD TEAM IP OUR NETWORK 1 2 3 4 5 6 A Leading 71 Patents or Strong Relationships Carbon-Neutral1 Vertically Integrated Large, Diversified and Deep, Experienced Applications2 Primarily with Vendors, Power Blockchain Self-Mining and Growing Customer Related to Blockchain Management Team Providers and Infrastructure Hosting Base Infrastructure and Fleet Customers Developer at Scale Mgmt. 1. Carbon neutrality achieved through a combination of purchasing carbon-neutral power and procuring Green-E Energy Certificates in 2021 2. Patents as of 10/14/21 ® 32

THANK YOU ir@corescientific.com

APPENDIX

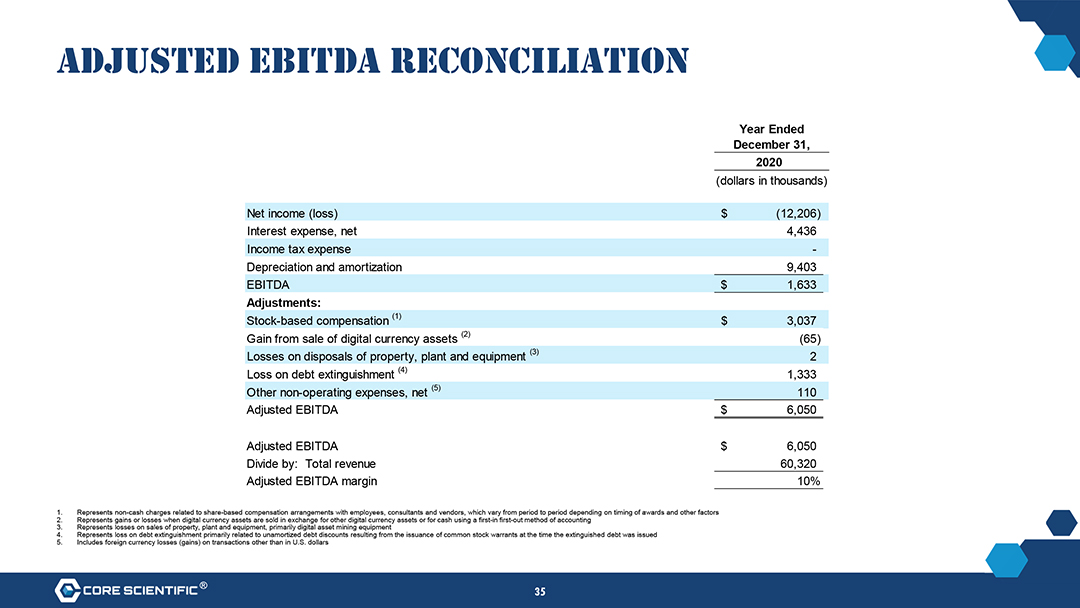

ADJUSTED EBITDA RECONCILIATION Year Ended December 31, 2020 (dollars in thousands) Net income (loss) $ (12,206) Interest expense, net 4,436 Income tax expense -Depreciation and amortization 9,403 EBITDA $ 1,633 Adjustments: Stock-based compensation (1) $ 3,037 Gain from sale of digital currency assets (2) (65) Losses on disposals of property, plant and equipment (3) 2 Loss on debt extinguishment (4) 1,333 Other non-operating expenses, net (5) 110 Adjusted EBITDA $ 6,050 Adjusted EBITDA $ 6,050 Divide by: Total revenue 60,320 Adjusted EBITDA margin 10% 1. Represents non-cash charges related to share-based compensation arrangements with employees, consultants and vendors, which vary from period to period depending on timing of awards and other factors 2. Represents gains or losses when digital currency assets are sold in exchange for other digital currency assets or for cash using a first-in first-out method of accounting 3. Represents losses on sales of property, plant and equipment, primarily digital asset mining equipment 4. Represents loss on debt extinguishment primarily related to unamortized debt discounts resulting from the issuance of common stock warrants at the time the extinguished debt was issued 5. Includes foreign currency losses (gains) on transactions other than in U.S. dollars ® 35

RISK FACTORS

RISK FACTORS (1/5) The below list of key risks has been prepared solely for the purposes of potential investors evaluating the the proposed Business Combination, and not for any other purpose. Unless the context otherwise requires, all references below and in the following risk factors to the Company, Core Scientific, we, us or our refer to the business of Core Scientific and its subsidiaries (including Blockcap, the acquisition of which closed on July 30, 2021) prior to the consummation of the Business Combination. Furthermore, the risks presented below are some of the general risks to the business and operations of the combined company following completion of the Business Combination. You should carefully consider these risks and uncertainties and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in this Company or XPDI before making an investment decision. Risks relating to the business of Core Scientific will be disclosed in future documents filed or furnished with the SEC, including documents filed or furnished in connection with the Business Combination. The risks presented in such filings will be consistent with those that would be required for a public company in SEC filings and may differ significantly from and be more extensive than those presented below. These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to the business, financial condition and prospects of the combined company following the completion of the Business Combination. Investors should carefully consider the following risk factors in addition to the information included in the investor presentation. Core Scientific may face additional risks and uncertainties that are not presently known to it, or that it currently deems immaterial, which may also impair the Companys business or financial condition. Risks Related to Core Scientifics Business and Industry 1. Our business is highly dependent on a small number of digital currency mining equipment suppliers. 2. A slowdown in the demand for blockchain/artificial intelligence (AI) technology or blockchain/AI hosting resources and other market and economic conditions could have a material adverse effect on our business, financial condition and results of operations. 3. We have an evolving business model and a limited history of generating revenue from our services. In addition, our evolving business model, and our expansion into new lines of business or derivatives such as decentralized finance, increases the complexity of our business, which could have a material adverse effect on our business, financial condition and results of operations. 4. Our limited operating history and rapidly evolving industry makes it difficult for us to evaluate our future business prospects and the failure to do so accurately could have a material adverse effect on our business, financial condition and results of operations. 5. Our businesses are capital intensive and failure to obtain the necessary capital when needed may force us to delay, limit or terminate our expansion efforts or other operations, which could have a material adverse effect on our business, financial condition and results of operations. 6. Changes in tariffs, import or export restrictions, Chinese regulations or other trade barriers could have a material adverse effect on our business, financial condition and results of operations. 7. Our historical financial results may not be indicative of our future performance and our inability to obtain adequate funding could have a material adverse effect on our business, financial condition and results of operations. 8. Substantially all of our assets are pledged to our senior secured lender and failure to repay obligations to our senior lender when due will have a material adverse effect on our business and could result in foreclosure on our assets. ® 37

RISK FACTORS (2/5) 9. Our revenue comes from a small number of customers, and the loss of, or significant decrease in business from, any number of these customers or the failure to continually attract new customers could have a material adverse effect on our business, financial condition and results of operations. 10. Delays in the expansion of existing hosting facilities or the construction of new hosting facilities or significant cost overruns could have a material adverse effect on our business, financial condition and results of operations. 11. The coronavirus outbreak has had, and may continue to have, a material adverse impact on our business, liquidity, financial condition and results of operations. 12. We are subject to risks associated with our need for significant electrical power and the limited availability of power resources, which could have a material adverse effect on our business, financial condition and results of operations. 13. Governments and government regulators may potentially restrict the ability of electricity suppliers to provide electricity to hosting and transaction processing operations such as ours, which could have a material adverse effect on our business, financial condition and results of operations. 14. Power outages in our hosting facilities could have a material adverse effect on our business, financial condition and results of operations. 15. Our success depends in large part on our ability to mine for digital assets profitably and to attract customers for our hosting capabilities. Increases in power costs, inability to mine digital assets efficiently and to sell digital assets at favorable prices will reduce our operating margins, impact our ability to attract customers for our services, may harm our growth prospects and could have a material adverse effect on our business, financial condition and results of operations. 16. If we do not accurately predict our hosting facility requirements, it could have a material adverse effect on our business, financial condition and results of operations. 17. We may not be able to compete effectively against our current and future competitors, which could have a material adverse effect on our business, financial condition and results of operations. 18. If the award of digital assets for solving blocks and transaction fees for recording transactions are not sufficiently high to incentivize miners, miners may cease expending hashrate to solve blocks and confirmations of transactions on the blockchain could be slowed temporarily. A reduction in the hashrate expended by miners on any digital asset network could increase the likelihood of a malicious actor obtaining control in excess of fifty percent (50%) of the aggregate hashrate active on such network or the blockchain, potentially permitting such actor to manipulate the blockchain in a manner that adversely affects our business, financial condition and results of operations. 19. If we fail to accurately estimate the factors upon which we base our contract pricing, we may generate less profit than expected or incur losses on those contracts, which could have a material adverse effect on our business, financial condition and results of operations. 20. Any failure in the critical systems of our hosting facilities or services we provide could lead to disruptions in our and our customers businesses and could harm our reputation and result in financial penalty and legal liabilities, which would reduce our revenue and have a material adverse effect on our business, financial condition and results of operations. 21. We generate significant revenue from a limited number of hosting facilities in Kentucky, Georgia and North Carolina and a significant disruption to operations in these region could have a material adverse effect our business, financial condition and results of operations. 22. Currently, there is relatively small use of digital assets in the retail and commercial marketplace in comparison to relatively large use by speculators, thus contributing to price volatility that could adversely affect our business, financial condition and results of operations. ® 38

RISK FACTORS (3/5) 23. financial Concerns condition about greenhouse and results gas of operations. emissions and global climate change may result in environmental taxes, charges, assessments or penalties and could have a material adverse effect on our business, 24. If partnerships, we do not successfully which could close have or a material integrate adverse acquisitions effect or on strategic our business, partnerships financial (including condition the and recent results acquisition of operations. of Blockcap), we may not realize the anticipated benefits of any such acquisitions or 25. operations. Latency in confirming transactions on a network could result in a loss of confidence in the network, which could have a material adverse effect on our business, financial condition and results of 26. If operations. we are not able to successfully anticipate, invest in or adopt technological advances in our industry, it could have a material adverse effect on our business, financial condition and results of 27. We operations. may not be able to adequately protect our intellectual property rights and other proprietary rights, which could have a material adverse effect on business, financial condition and results of 28. Significant or unexpected changes to our transaction processing operations may have a material adverse effect on our business, financial condition and results of operations. 29. A effect reduction on our in business, the processing financial power condition expended and results by transaction of operations. processors on a network could increase the likelihood of a malicious actor or botnet obtaining control, which could have a material adverse 30. a Transaction material adverse processing effect operators on our business, may sell financial a substantial condition amount and of results digital of assets operations. into the market, which may exert downward pressure on the price of the applicable digital asset, and in turn, could have 31. The could halving have a material of rewards adverse available effect on on the our Bitcoin business, network, financial or the condition reduction and of rewards results of on operations. other networks, has had and in the future could have a negative impact on our ability to generate revenue and 32. we From hold time and to thus time prevents, we have sold, and may and in we the may future sell in prevent, the future, us from a portion recognizing of our digital any gain assets from to the pay appreciation for costs and in value expenses, of thewhich digital has assets reduced, we have and sold may and continue may sell to reduce, in the future. the amount of digital assets 33. condition Digital assets and are results subject of operations. to extreme price volatility. The value of digital assets is dependent on a number of factors, any of which could have a material adverse effect on our business, financial 34. The loss or destruction of a private key required to access a digital asset is irreversible. We also may temporarily lose access to our digital assets. 35. Intellectual property rights claims may adversely affect the operation of any or all of the networks. 36. The patent applications we have filed may not result in issued patents, and our issued patents may not provide meaningful protection, may be challenged and may prove difficult to enforce. 37. A soft or hard fork on a network could have a material adverse effect on our business, financial condition and results of operations. 38. The digital assets held by us may be subject to loss, damage, theft or restriction on access, which could have a material adverse effect on our business, financial condition or results of operations. 39. The digital assets held by us are not subject to FDIC or SIPC protections. 40. As impact more on processing our ability power to generate is added revenue to a network, from processing our relative transactions percentage on of that total network processing and could power have on that a material network adverse is expected effectto ondecline our business, absent significant financial condition capital investment, and results which of operations. has an adverse ® 39

RISK FACTORS (4/5) 41. If we fail to maintain an effective system of disclosure controls and internal control over financial reporting, our ability to produce timely and accurate financial statements or comply with applicable regulations could be impaired. 42. We may acquire other businesses or receive offers to be acquired, which could require significant management attention, disrupt our business or dilute stockholder value. 43. An active trading market for our common stock may never develop or be sustained. 44. Our revenue may be negatively impacted by the inability or unwillingness of equipment manufacturers to deliver on our hardware orders in a timely manner. 45. We will incur costs and demands upon management as a result of complying with the laws and regulations affecting public companies in the United States, which may harm our business. 46. Digital assets such as Bitcoin may be regulated as securities or investment securities. 47. Since there has been limited precedent set for financial accounting or taxation of digital assets other than digital securities, it is unclear how we will be required to account for digital asset transactions and the taxation of our businesses. Risks Related to the Business Combination and the Combined Company 48. The financial and operational projections related to the combined company may not be realized, which may adversely affect the trading price of our common stock following the closing of the Business Combination. 49. The trading price of our common stock may be volatile, and you could lose all or part of your investment. 50. Future sales and issuances of our capital stock or rights to purchase capital stock could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price to decline. 51. Substantial future sales of shares of our common stock could cause the market price of our common stock to decline. 52. Provisions in our corporate charter documents and under Delaware law may prevent or frustrate attempts by our stockholders to change our management or hinder efforts to acquire a controlling interest in us, and the market price of our common stock may be lower as a result. 53. Our common stock market price and trading volume could decline if securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business. 54. We are an emerging growth company, and we intend to comply only with reduced disclosure requirements applicable to emerging growth companies. As a result, our common stock could be less attractive to investors. ® 40

RISK FACTORS (5/5) 57. We do not intend to pay dividends for the foreseeable future. 58. The announcement of the proposed Business Combination could disrupt our relationships with our suppliers or other third parties. 59. We will incur significant transaction and transition costs in connection with the Business Combination. 60. Fluctuations in operating results, quarter to quarter earnings and other factors, including negative media coverage, may result in significant decreases in the price of the combined companys securities. 61. Claims for indemnification by the combined companys directors may reduce its available funds to satisfy successful third-party claims against the combined company and may reduce the amount of money available to the combined company. ® 41

Forward Looking Statements

This investor presentation includes forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as estimate, plan, project, forecast, intend, will, expect, anticipate, believe, seek, target or other similar expressions that predict or indicate future events or trends or that are not statements of historical facts. These forward-looking statements are inherently subject to risks, uncertainties and assumptions. Such forward-looking statements include, but are not limited to, statements regarding possible or assumed future actions, business strategies, events or results of operations; projections, estimates and forecasts of revenue and other financial and performance metrics; projections of market opportunity and expectations; the estimated implied enterprise value of the combined company following the Business Combination; the combined companys ability to scale and grow its business and source clean and renewable energy; the advantages and expected growth of the combined company; the combined companys ability to source and retain talent; the cash position of the combined company following closing of the Business Combination; XPDIs and the Companys ability to consummate the Business Combination; expectations related to the terms, timing and benefits of the Business Combination; risks related to COVID-19 pandemic or the emergence of variant strains of COVID-19; the maintenance of key strategic relationships with partners and distributors; and changes in laws and regulations, including tax laws and laws relating to protection of the environment. These statements are based on various assumptions, whether or not identified in this presentation, and on the current expectations of XPDIs and the Companys management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve, and must not be relied on by any investor, as a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of XPDI and the Company. These forward-looking statements are subject to a number of risks and uncertainties, including the ability of XPDI and the Company to successfully or timely consummate the Business Combination, including the risk that necessary regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Business Combination or approval of the stockholders of XPDI; failure to realize the anticipated benefits of the Business Combination; the combined companys ability to execute on its business model, potential business expansion opportunities and growth strategies, retain and expand customers use of its services and attract new customers and source and maintain talent; risks relating to the combined companys sources of cash and cash resources; risks relating to the blockchain and frontier technology infrastructure sectors, including the unregulated nature of the digital asset space and potential future regulations, volatility of the price of digital assets, changes in the award structure for solving digital assets and limited availability of electric power resources; risks relating to the Companys and the combined companys vulnerability to security breaches; risks relating to the uncertainty of the projected financial information with respect to the combined company; the combined companys ability to manage future growth; the effects of competition on the combined companys future business; the amount of redemption requests made by XPDIs public stockholders; the ability of XPDI or the combined company to issue equity or equity-linked securities in connection with the Business Combination or in the future; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; the impact of the COVID-19 pandemic on the Companys or the combined companys business and the global economy; and those factors discussed under Risk Factors in this presentation, and those factors in XPDIs final prospectus related to its initial public offering dated February 9, 2021 under the heading Risk Factors, in XPDIs Quarterly Report on Form 10-Q for the quarter ended March 31, 2021 under the heading Risk Factors filed with the SEC on May 25, 2021 and other documents of XPDI filed, or to be filed, with the SEC. If any of these risks materialize or XPDIs or the Companys assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that neither XPDI nor the Company presently know or that XPDI and the Company currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect XPDIs and the Companys expectations, plans or forecasts of future events and views as of the date of this presentation. XPDI and the Company anticipate that subsequent events and developments will cause XPDIs and the Companys assessments to change. However, while XPDI and the Company may elect to update these forward-looking statements at some point in the future, XPDI and the Company specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing XPDIs and the Companys assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed upon the forward-looking statements.

As of June 30, 2021, over 50% of the power used in the Companys operation was generated from non-carbon emitting sources by local power providers pursuant to long-term power contracts. The Company determines whether power is generated from non-emitting energy sources from dispatch reports or grid generation mix reports provided by the Companys power providers. Based on these reports the Company purchased Green-e certified renewable energy credits (RECs) to offset 100% of its carbon consumption. The Company expects to maintain its 100% net carbon neutrality by increasing its overall use of renewable power and by purchasing RECs when necessary.

Additional Information and Where to Find It

The Business Combination will be submitted to stockholders of XPDI for their approval. The Registration Statement on Form S-4 (the Registration Statement) that XPDI has filed with the SEC includes a proxy statement/prospectus, which will be distributed to XPDIs stockholders in connection with XPDIs solicitation of proxies for the vote on the Business Combination. After the Registration Statement has been declared effective, XPDI will mail the proxy statement/prospectus to XPDI stockholders as of the record date established for voting on the Business Combination and other matters to be presented at the special meeting of XPDI stockholders. XPDIs stockholders and other interested persons are advised to read the preliminary proxy statement/prospectus and any amendments thereto because these documents contain important information about XPDI, the Company and the Business Combination. Stockholders may also obtain a copy of the proxy statement/prospectus, as well as other documents filed with the SEC regarding the Business Combination and other documents filed with the SEC by XPDI, without charge, at the SECs website located at www.sec.gov or by directing a request to 321 North Clark Street, Suite 2440, Chicago, IL 60654.

Participants in the Solicitation

XPDI, the Company and certain of their respective directors, executive officers and other members of management and employees may, under SEC rules, be deemed to be participants in the solicitations of proxies from XPDIs stockholders in connection with the Business Combination. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of XPDIs stockholders in connection with the Business Combination will be set forth in XPDIs proxy statement/prospectus that has been filed with the SEC. You can find more information about XPDIs directors and executive officers in XPDIs final prospectus related to its initial public offering dated February 9, 2021. Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests is included in the proxy statement/prospectus. Stockholders, potential investors and other interested persons should read the proxy statement/prospectus carefully before making any voting or investment decisions. You may obtain free copies of these documents from the sources indicated above.

No Offer or Solicitation

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.