425: Prospectuses and communications, business combinations

Published on July 7, 2025

Filed by CoreWeave, Inc.

pursuant to Rule 425 of the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12 of the Securities Exchange Act of 1934, as amended

Subject Company: Core Scientific, Inc.

(Commission File No.: 001-40046)

Date: July 7, 2025

The following presentation was posted on CoreWeave, Inc.'s website on July 7, 2025 in connection with CoreWeave's proposed acquisition of Core Scientific, Inc.

CoreWeave Acquisition of Core Scientific July 2025 1

2 Safe Harbor Important Information about the Transaction and Where to Find It In connection with the proposed transaction between CoreWeave, Inc . (“CoreWeave”) and Core Scientific, Inc . (“Core Scientific”), CoreWeave and Core Scientific will file relevant materials with the U . S . Securities and Exchange Commission (the “SEC”), including a registration statement on Form S - 4 filed by CoreWeave that will include a proxy statement of Core Scientific that also constitutes a prospectus of CoreWeave . A definitive proxy statement/prospectus will be mailed to stockholders of Core Scientific . This communication is not a substitute for the registration statement, proxy statement or prospectus or any other document that CoreWeave or Core Scientific (as applicable) may file with the SEC in connection with the proposed transaction . BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF COREWEAVE AND CORE SCIENTIFIC ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS . Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing important information about CoreWeave or Core Scientific, without charge at the SEC’s Internet website (http : //www . sec . gov) . Copies of the documents filed with the SEC by CoreWeave will be available free of charge on CoreWeave’s internet website at https : //coreweave 2025 ipo . q 4 web . com/financials/sec - filings/ or by contacting CoreWeave’s investor relations contact at investor - relations@coreweave . com . Copies of the documents filed with the SEC by Core Scientific will be available free of charge on Core Scientific’s internet website at https : //investors . corescientific . com/sec - filings/all - sec - filings . The information included on, or accessible through, CoreWeave’s or Core Scientific’s website is not incorporated by reference into this communication . Participants in the Solicitation /d 899798 d 424 b 4 . htm) . These documents can be obtained free of charge from the sources indicated above . Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available . CoreWeave, Core Scientific, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction . Information about the directors and executive officers of Core Scientific is set forth in its proxy statement for its 2025 annual meeting of stockholders, which was filed with the SEC on March 28 , 2025 (and which is available at https : //www . sec . gov/Archives/edgar/data/ 1839341 / 000119312525065652 /d 925494 ddef 14 a . htm), in its Form 10 - K for the fiscal year ended December 31 , 2024 , which was filed with the SEC on February 27 , 2025 (and which is available at https : //www . sec . gov/Archives/edgar/data/ 1839341 / 000162828025008302 /core - 20241231 . htm) and in its Form 8 - K, which was filed with the SEC on May 16 , 2025 (and which is available at https : //www . sec . gov/Archives/edgar/data/ 1839341 / 000162828025026294 /core - 20250513 . htm) . Information about the directors and executive officers of CoreWeave is set forth in itsCoreWeave's Prospectus dated March 27 , 2025 , which was filed with the SEC on March 31 , 2025 pursuant to Rule 424 (b) under the Securities Act of 1933 , as amended, relating to the Registration Statement on Form S - 1 , as amended, initially filed with the SEC on March 3 , 2025 (File No . 333 - 285512 ) (and which is available at https : //www . sec . gov/Archives/edgar/data/ 1769628 / 000119312525067651 No Offer or Solicitation This communication is for informational purposes only and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U . S . Securities Act of 1933 , as amended . Forward - Looking Statements This communication contains “forward - looking statements” within the meaning of the federal securities laws, including Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . In this context, forward - looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward - looking statements include such words . Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof . All such forward - looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of CoreWeave and Core Scientific, that could cause actual results to differ materially from those expressed in such forward - looking statements . Important risk factors that may cause such a difference include, but are not limited to : the completion of the proposed transaction on anticipated terms, or at all, and timing, or at all of completion, including obtaining regulatory approvals that may be required on anticipated terms and Core Scientific stockholder approval for the proposed transaction ; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the proposed transaction, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period ; the ability of CoreWeave and Core Scientific to integrate the businesstheir businesses successfully and to achieve anticipated synergies and value creation ; potential litigation relating to the proposed transaction that could be instituted against CoreWeave, Core Scientific or their respective directors and officers ; the risk that disruptions from the proposed transaction will harm CoreWeave’s or Core Scientific’s business, including current plans and operations and that management’s time and attention will be diverted on transaction - related issues ; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction ; rating agency actions and CoreWeave’s and Core Scientific’s ability to access short - and long - term debt markets on a timely and affordable basis ; legislative, regulatory and economic developments and actions targeting public companies in the artificial intelligence, power, data center and crypto mining industries and changes in local, national or international laws, regulations and policies affecting CoreWeave and Core Scientific ; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect CoreWeave’s and/or Core Scientific’s financial performance and operating results ; certain restrictions during the pendency of the proposed transaction that may impact Core Scientific’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business ; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against CoreWeave or Core Scientific and other political or security disturbances ; dilution caused by CoreWeave’s issuance of additional shares of its securities in connection with the proposed transaction ; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events ; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies ; global or regional changes in the supply and demand for power and other market or economic conditions that impact demand and pricing ; changes in technical or operating conditions, including unforeseen technical difficulties ; development delays at CoreWeave and/or Core Scientific data center sites, including any delays in the conversion of such sites from crypto mining facilities to high - performance computing sites ; those risks described in the section titled “Risk Factors” in CoreWeave’s Prospectus dated March 27 , 2025 , filed with the SEC on March 31 , 2025 pursuant to Rule 424 (b) under the Securities Act of 1933 , as amended, relating to the Registration Statement on Form S - 1 , as amended (File No . 333 - 285512 ), Item 1 A of CoreWeave’s Quarterly Report on Form 10 - Q for the quarterly period ended March 31 , 2025 , filed with the SEC on May 15 , 2025 and subsequent reports on Forms 10 - Q and 8 - K ; those risks described in Item 1 A of Core Scientific’s Quarterly Report on Form 10 - Q for the quarterly period ended March 31 , 2025 , filed with the SEC on May 7 , 2025 , Item 1 A of Core Scientific’s Annual Report on Form 10 - K for the fiscal year ended December 31 , 2024 , filed with the SEC on February 27 , 2025 and subsequent reports on Forms 10 - Q and 8 - K ; and those risks that will be described in the registration statement on Form S - 4 and accompanying prospectus, available from the sources indicated above . These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S - 4 that will be filed with the SEC in connection with the proposed transaction . While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S - 4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties . Unlisted factors may present significant additional obstacles to the realization of forward - looking statements . You should not place undue reliance on any of these forward - looking statements as they are not guarantees of future performance or outcomes ; actual performance and outcomes, including, without limitation, CoreWeave’s or Core Scientific’s actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which CoreWeave or Core Scientific operate, may differ materially from those made in or suggested by the forward - looking statements contained in this communication . Neither CoreWeave nor Core Scientific assumes any obligation to publicly provide revisions or updates to any forward - looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws . Neither future distribution of this communication nor the continued availability of this communication in archive form on CoreWeave’s or Core Scientific’s website should be deemed to constitute an update or re - affirmation of these statements as of any future date .

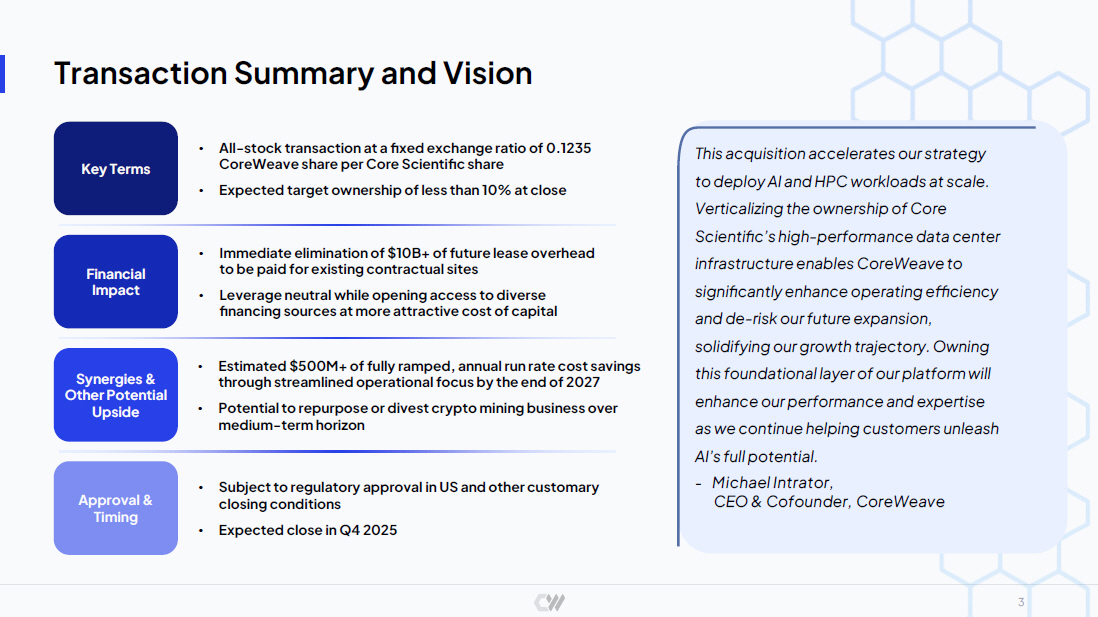

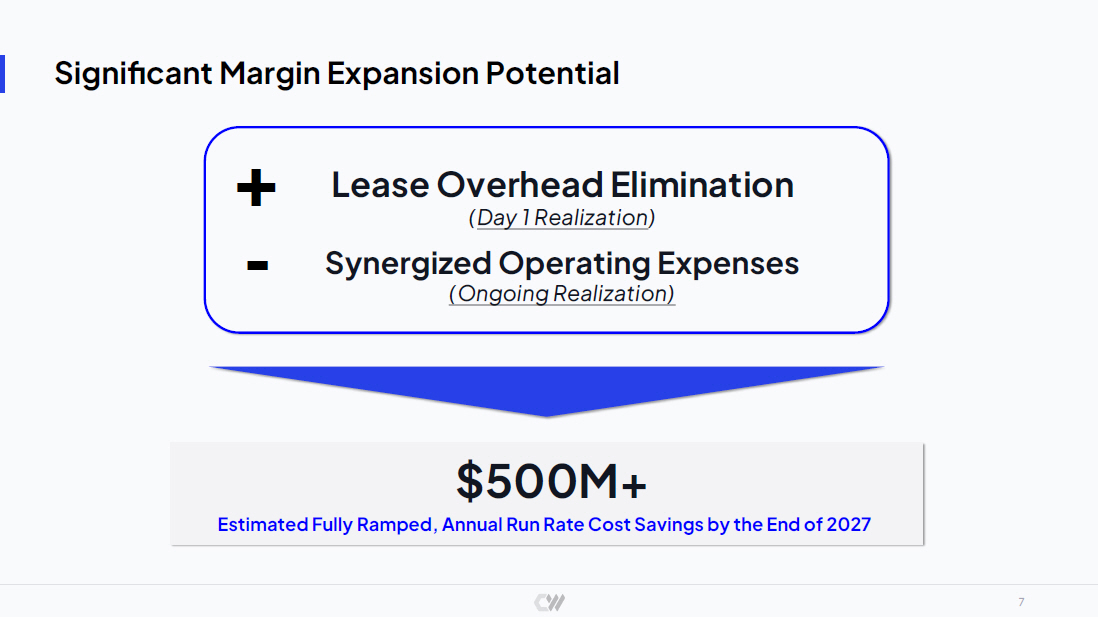

Transaction Summary and Vision 3 Financial Impact • Immediate elimination of $10B+ of future lease overhead to be paid for existing contractual sites • Leverage neutral while opening access to diverse financing sources at more attractive cost of capital Approval & Timing • Subject to regulatory approval in US and other customary closing conditions • Expected close in Q4 2025 Key Terms • All - stock transaction at a fixed exchange ratio of 0.1235 CoreWeave share per Core Scientific share • Expected target ownership of less than 10% at close Synergies & Other Potential Upside • Estimated $500M+ of fully ramped, annual run rate cost savings through streamlined operational focus by the end of 2027 • Potential to repurpose or divest crypto mining business over medium - term horizon This acquisition accelerates our strategy to deploy AI and HPC workloads at scale. Verticalizing the ownership of Core Scientific’s high - performance data center infrastructure enables CoreWeave to significantly enhance operating efficiency and de - risk our future expansion, solidifying our growth trajectory. Owning this foundational layer of our platform will enhance our performance and expertise as we continue helping customers unleash AI’s full potential. - Michael Intrator, CEO & Cofounder, CoreWeave

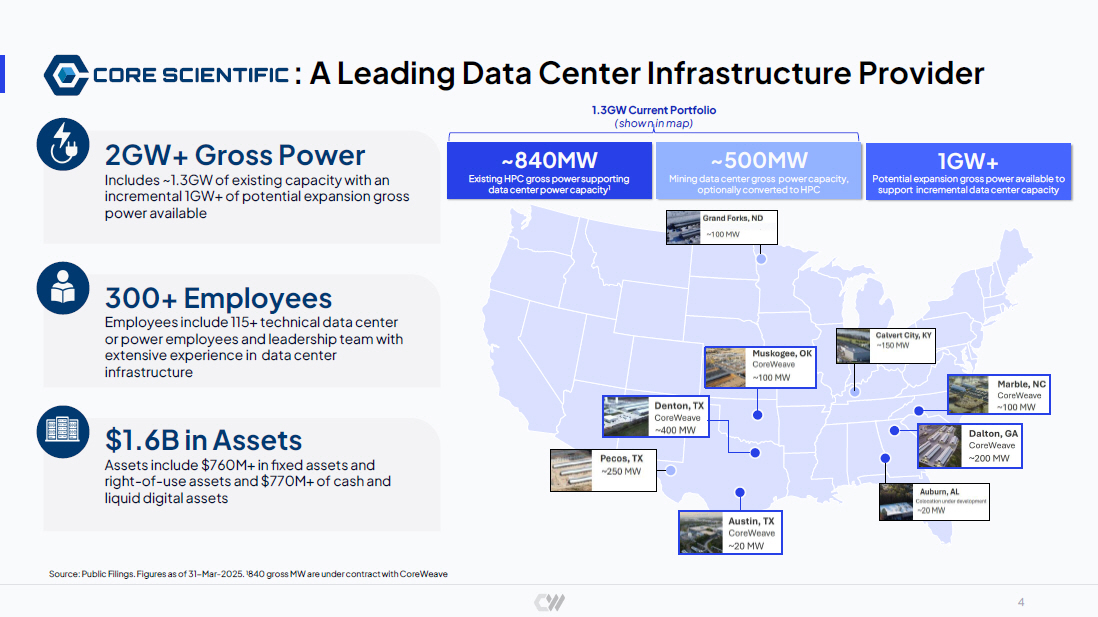

4 ~840MW Existing HPC gross power supporting data center power capacity 1 1GW+ Potential expansion gross power available to support incremental data center capacity 2GW+ Gross Power Includes ~1.3GW of existing capacity with an incremental 1GW+ of potential expansion gross power available 300+ Employees Employees include 115+ technical data center or power employees and leadership team with extensive experience in data center infrastructure $1.6B in Assets Assets include $760M+ in fixed assets and right - of - use assets and $770M+ of cash and liquid digital assets Source: Public Filings. Figures as of 31 - Mar - 2025. 1 840 gross MW are under contract with CoreWeave Co re Scientif : A Leading Data Center Infrastructure Provider ~500MW Mining data center gross power capacity, optionally converted to HPC 1.3GW Current Portfolio (shown in map)

+ Verticalizing Data Center Footprint Ownership to Help Future - Proof Revenue Growth and Enhance Core Profitability Power Ownership & Optionality CoreWeave will gain greater control over a critical power footprint and optionality for future power capacity Expanded Expertise Core Scientific augments CoreWeave’s extensive expertise in power procurement, construction, and site management for infrastructure assets Greater Financing Flexibility CoreWeave can pursue infrastructure financing strategies to finance committed capital expenditures, reducing its overall cost of capital Operational Efficiency Acquisition expects to generate significant cost savings through streamlining business operations and eliminating lease overhead 5

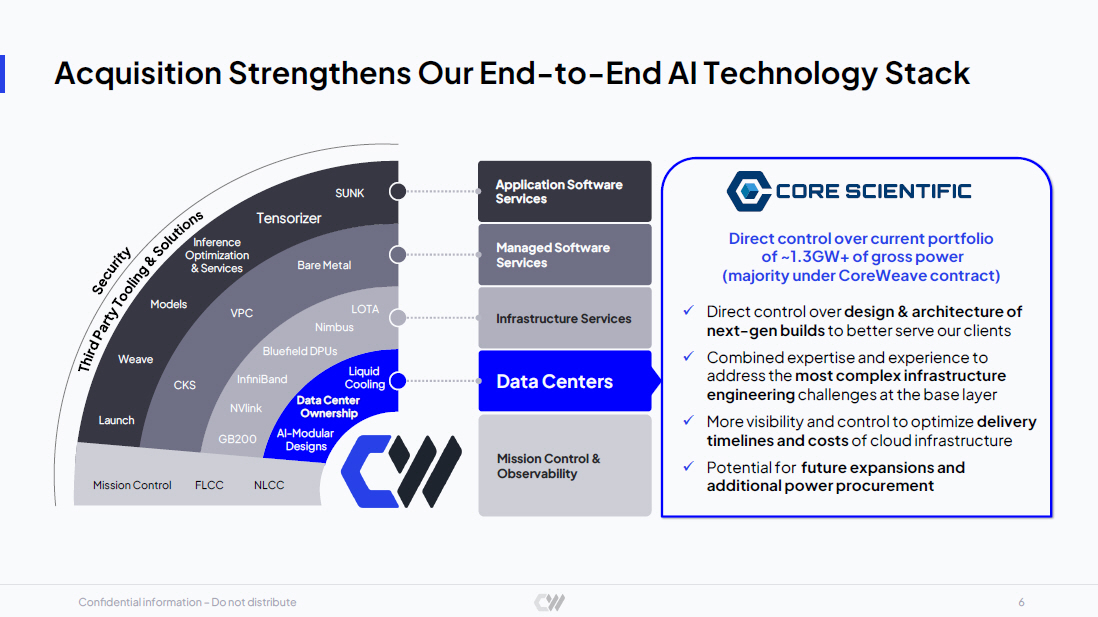

Confidential information – Do not distribute Managed Software Services Infrastructure Services Data Centers Application Software Services Bare Metal VPC CKS LOTA Nimbus Bluefield DPUs InfiniBand NVlink GB200 Liquid Cooling Mission Control FLCC NLCC Mission Control & Observability AI - Modular Designs SUNK Inference Optimization & Services Tensorizer Models Weave Launch 6 Data Center Ownership Direct control over current portfolio of ~1.3GW+ of gross power (majority under CoreWeave contract) x Direct control over design & architecture of next - gen builds to better serve our clients x Combined expertise and experience to address the most complex infrastructure engineering challenges at the base layer x More visibility and control to optimize delivery timelines and costs of cloud infrastructure x Potential for future expansions and additional power procurement Acquisition Strengthens Our End - to - End AI Technology Stack

7 $500M+ Estimated Fully Ramped, Annual Run Rate Cost Savings by the End of 2027 + Lease Overhead Elimination ( Day 1 Realization ) Synergized Operating Expenses (Ongoing Realization) - Significant Margin Expansion Potential

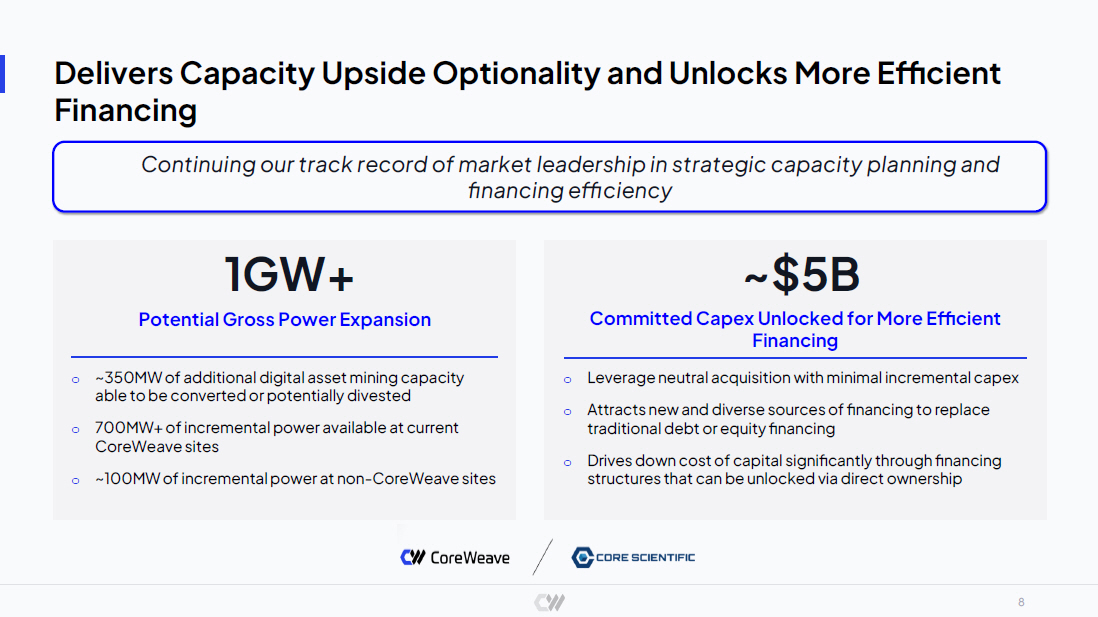

8 1GW+ Potential Gross Power Expansion o ~350MW of additional digital asset mining capacity able to be converted or potentially divested o 700MW+ of incremental power available at current CoreWeave sites o ~100MW of incremental power at non - CoreWeave sites ~$5B Committed Capex Unlocked for More Efficient Financing o Leverage neutral acquisition with minimal incremental capex o Attracts new and diverse sources of financing to replace traditional debt or equity financing o Drives down cost of capital significantly through financing structures that can be unlocked via direct ownership Delivers Capacity Upside Optionality and Unlocks More Efficient Financing Continuing our track record of market leadership in strategic capacity planning and financing efficiency

+++++++

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between CoreWeave, Inc. (“CoreWeave”) and Core Scientific, Inc. (“Core Scientific”), CoreWeave and Core Scientific will file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a registration statement on Form S-4 filed by CoreWeave that will include a proxy statement of Core Scientific that also constitutes a prospectus of CoreWeave. A definitive proxy statement/prospectus will be mailed to stockholders of Core Scientific. This communication is not a substitute for the registration statement, proxy statement or prospectus or any other document that CoreWeave or Core Scientific (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF COREWEAVE AND CORE SCIENTIFIC ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing important information about CoreWeave or Core Scientific, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by CoreWeave will be available free of charge on CoreWeave’s internet website at https://coreweave2025ipo.q4web.com/financials/sec-filings/ or by contacting CoreWeave’s investor relations contact at investor-relations@coreweave.com. Copies of the documents filed with the SEC by Core Scientific will be available free of charge on Core Scientific’s internet website at https://investors.corescientific.com/sec-filings/all-sec-filings. The information included on, or accessible through, CoreWeave’s or Core Scientific’s website is not incorporated by reference into this communication.

Participants in the Solicitation

CoreWeave, Core Scientific, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of Core Scientific is set forth in its proxy statement for its 2025 annual meeting of stockholders, which was filed with the SEC on March 28, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1839341/000119312525065652/d925494ddef14a.htm), in its Form 10-K for the fiscal year ended December 31, 2024, which was filed with the SEC on February 27, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1839341/000162828025008302/core-20241231.htm) and in its Form 8-K, which was filed with the SEC on May 16, 2025 (and which is available at https://www.sec.gov/Archives/edgar/data/1839341/000162828025026294/core-20250513.htm). Information about the directors and executive officers of CoreWeave is set forth in CoreWeave’s Prospectus dated March 27, 2025, which was filed with the SEC on March 31, 2025 pursuant to Rule 424(b) under the Securities Act of 1933, as amended, relating to the Registration Statement on Form S-1, as amended (File No. 333-285512) (and which is available at https://www.sec.gov/Archives/edgar/data/1769628/000119312525067651/d899798d424b4.htm). These documents can be obtained free of charge from the sources indicated above. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes only and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of CoreWeave and Core Scientific, that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms, or at all, and timing of completion, including obtaining regulatory approvals that may be required on anticipated terms and Core Scientific stockholder approval for the proposed transaction; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the proposed transaction, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of CoreWeave and Core Scientific to integrate their businesses successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against CoreWeave, Core Scientific or their respective directors and officers; the risk that disruptions from the proposed transaction will harm CoreWeave’s or Core Scientific’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; rating agency actions and CoreWeave’s and Core Scientific’s ability to access short- and long-term debt markets on a timely and affordable basis; legislative, regulatory and economic developments and actions targeting public companies in the artificial intelligence, power, data center and crypto mining industries and changes in local, national or international laws, regulations and policies affecting CoreWeave and Core Scientific; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect CoreWeave’s and/or Core Scientific’s financial performance and operating results; certain restrictions during the pendency of the proposed transaction that may impact Core Scientific’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against CoreWeave or Core Scientific and other political or security disturbances; dilution caused by CoreWeave’s issuance of additional shares of its securities in connection with the proposed transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for power and other market or economic conditions that impact demand and pricing; changes in technical or operating conditions, including unforeseen technical difficulties; development delays at CoreWeave and/or Core Scientific data center sites, including any delays in the conversion of such sites from crypto mining facilities to high-performance computing sites; those risks described in the section titled “Risk Factors” in CoreWeave’s Prospectus dated March 27, 2025, filed with the SEC on March 31, 2025 pursuant to Rule 424(b) under the Securities Act of 1933, as amended, relating to the Registration Statement on Form S-1, as amended (File No. 333-285512), Item 1A of CoreWeave’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025, filed with the SEC on May 15, 2025 and subsequent reports on Forms 10-Q and 8-K; those risks described in Item 1A of Core Scientific’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2025, filed with the SEC on May 7, 2025, Item 1A of Core Scientific’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 27, 2025 and subsequent reports on Forms 10-Q and 8-K; and those risks that will be described in the registration statement on Form S-4 and accompanying prospectus, available from the sources indicated above.

These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed transaction. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. You should not place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes; actual performance and outcomes, including, without limitation, CoreWeave’s or Core Scientific’s actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which CoreWeave or Core Scientific operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Neither CoreWeave nor Core Scientific assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on CoreWeave’s or Core Scientific’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date.